Calculation of the effective tax rate for income tax

Your profit: 4,500,000 – 2,700,000 = 1,800,000 rubles.

| Income | 4,500,000 rubles |

| Expenses | 2,700,000 rubles |

| Profit | 1,800,000 rubles |

From the amount of 1,800,000 you need to pay. See below for an example of how to calculate income tax.

The example shows that the amount for receipt of the federal budget does not change - 3% of income ends up there in any case.

Let's look at an example of calculating income tax for dummies to understand how the tax is calculated.

Kolibri LLC produces and sells soft toys. Let's calculate the income tax that the company will pay for 2020 if:

- The LLC received a bank loan for 500,000 rubles;

- sold toys for 1,200,000 rubles including VAT;

- used raw materials for production worth 350,000 rubles;

- paid wages to workers in the amount of 250,000 rubles;

- insurance premiums amounted to 40,000 rubles;

- carried out depreciation in the amount of 30,000 rubles;

- paid interest on the loan in the amount of 25,000 rubles;

- wants to take into account last year’s loss of 120,000 rubles.

Since income is calculated without VAT, it will be 1,000,000 rubles at a VAT rate of 20%. And 200,000 rubles is the amount of VAT that the LLC will transfer to the state. Loan amounts are not subject to income tax; they are simply not included in the tax base according to paragraphs. 10 p. 1 art. 251 Tax Code of the Russian Federation. Therefore, a 500,000 ruble loan is not considered income.

This is income minus expenses and minus last year's loss.

go to the budget of the Russian Federation;

go to the regional budget.

Using simple formulas, we showed how to calculate income tax: we use the example of Kolibri LLC further to show calculations on an online calculator.

You can also automatically calculate taxes in the convenient 1C:BusinessStart application; you do not need to monitor changes in rates, the service is updated automatically, taking into account the latest changes in legislation. The program will warn you about the deadlines for submitting reports and paying taxes, and will tell you what needs to be done and how.

The calculator will help a novice businessman decide which taxation scheme is more profitable to use. Using an online calculator will relieve accountants and managers from difficulties when calculating the amount of money to be paid. Enter data into the lines and watch the result on the screen.

Each taxpayer calculates the amount of income tax at a certain rate taken in accordance with tax legislation.

But if part of the profit is not taxed, or income from different sources has different rates, then a financial instrument such as the effective income tax rate is used to determine the real tax burden in a given period.

But sometimes these 11 months are not so spent. {amp}lt; ... Income tax: the list of expenses has been expanded. A law has been signed that has amended the list of expenses related to wages.

Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children).

In one of the European countries, the tax rate is: Monetary limit Rate size Amount of income less than 15 thousand dollars 20% Amount of income from 15 thousand dollars to 40 thousand dollars 30% Income is more than 40 thousand

dollars 40% The marginal effective rate in this case is 40%. In order to optimize your production and income, you need to understand all the intricacies of tax legislation.

Many of its aspects can significantly reduce the amount required to pay taxes.

Ignorance of current laws leads to various fines, as well as a decrease in the organization’s income and profitability.

Свз Weighted average rate P1 Amount of net profit received P2 Amount of dividends paid C1 Profit tax rate C2 Dividend tax rate Example of comparison of the effective rate with the weighted average: At the end of the reporting period, an enterprise has a profit after tax in the amount of CU 150,000.

- Effective rate: Se = 12,000 / 150,000 x 100% = 8%;

- Weighted average rate: Свз = (138,000 x 20% 12,000 x 13%) / 150,000 x 100% = (27,600 1560) / 150,000 x 100% = 19.4%;

- We determine the bet ratio: CC = 8 / 19.4 x 100% = 41.2%.

Conclusion: the ratio of the effective rate to the weighted average was 41.2%, which is less than 75%.

Add to favoritesSend by email The effective income tax rate is used to determine whether a foreign company is controlled. In this article we will look at what the effective income tax rate is, when it applies and how it is calculated.

What is a controlled foreign company? When does the effective income tax rate apply? How to calculate the effective rate? Conclusions What is a controlled foreign currency appeared in the Tax Code on January 1, 2020.

in connection with the introduction of significant changes to the procedure for taxation of profits of foreign organizations.

Dear readers! Our articles talk about typical ways to solve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form on the right.

The real tax burden is determined using the effective income tax rate. For domestic companies, the indicator allows you to quickly identify deviations from standard taxation and show accounting problems. Applying the settlement rate to foreign companies provides information about the level of control.

The rate is determined as the average ratio of tax to enterprise income. This material will help you understand in more detail what an effective income tax rate is and what conditions exist for its payment.

The effective rate is calculated based on the results of the reporting period, the results of which the company submitted its reports.

It applies if:

- different amounts of income are subject to taxation at different rates (including when applying a progressive tax scale);

- part of the income is not taxed (tax deductions are provided).

Obviously, in such circumstances, the effective tax rate will differ from that established by tax legislation.

Calculation of the effective tax rate A burning issue for most organizations is the effective income tax rate.

It is calculated using the formula: In this case, profit before tax is considered as income reduced by expenses determined according to the rules of RAS or IFRS, and not in accordance with the requirements of the Tax Code of the Russian Federation.

Conclusions The effective income tax rate is not used to calculate income taxes. It is used to determine whether a foreign organization is controlled.

To obtain an exemption, additional conditions must be met: the country of residence of the foreign company must have an agreement with the Russian Federation on the elimination of double taxation and exchange tax information with domestic control authorities. Otherwise, the result of the company’s financial activities will be taxed under the laws of the Russian Federation. Correlation between effective and weighted average rates The weighted average rate affects all categories of profit received by the company.

For example, when receiving profit from dividends, the weighted average rate is calculated according to the algorithm: Svz = (P1 x C1 P2 x C2) / P1 P2.

Important: In such a situation, can an employer count absenteeism to an employee with all the ensuing consequences? {amp}lt; ... A bank’s refusal to carry out an operation can be appealed. The Bank of Russia has developed requirements for an application that a bank client (organization, individual entrepreneur, individual) can send to an interdepartmental commission in the event that the bank refuses to make a payment or enter into a bank account (deposit) agreement. {amp}lt;

… Home → Accounting consultations → General tax issues Current as of: May 10, 2020 In the scientific literature, the effective tax rate in relation to taxes on profit (income) is understood as the average tax rate, reflecting the real share of tax payments from the amount of profit or income received by the taxpayer certain period.

- income between $15,000 and $50,000 is taxed at 25%;

- if the amount of income is in the range from $5,000 to $15,000, then the tax rate will be only 10%;

- Income less than $5,000 is subject to 5% tax.

Let's say a taxable individual received total income in unequal shares, in total it is $95,000. Tax liabilities will be calculated taking into account progressive taxation conditions:

- tax bracket number one is taxed at 50%, thus: $45,000×0.5=22,500%;

- the second category of taxes is calculated as $35,000×0.25=$8,750 (tax rate is 25%);

- third tax category: $10,000×0.1=$1,000 (tax rate 10%);

- fourth tax category: $5000×0.05=$250 (tax rate - 5%).

The received data are summarized: $22,500 $8,750 $1,000 $250=$32,500.

Application of the effective tax rate to the valuation of foreign companies The effective tax rate is used in international financial reporting.

Calculation rules

If this indicator for finished reporting cannot be assessed objectively, then you can use the actual effective rate, which is calculated on the basis of the actual amount of tax from the beginning of the year to the current time. This allows you to more accurately estimate the annual tax rate. The degree of difference in the accounting of expenses and income between accounting and tax accounting is characterized by the size of the effective rate of organizations.

In Russia, there are several ways to calculate the effective income tax rate.

- according to reporting data for the financial year, which is prepared in accordance with the law of the country in which the company is registered;

- according to the rules established by Chapter 25 of the Tax Code of the Russian Federation for taxpayers - Russian organizations (Article 25.13-1 of the Tax Code of the Russian Federation).

An effective income tax rate is an express analysis that allows not only to identify the company’s problems, but also to determine the quality of work of employees responsible for tax accounting.

Determining profit before tax according to RAS is not always effective, since the data obtained may not fully reflect the real situation. In this regard, most companies use profit indicators according to IFRS or management accounting.

Taxpayers

- All Russian legal entities (LLC, JSC, PJSC, etc.)

- Foreign legal entities that operate in Russia through permanent representative offices or simply receive income from a source in the Russian Federation

- Foreign organizations recognized as tax residents of the Russian Federation in accordance with an international treaty on taxation matters - for the purposes of applying this international treaty

- Foreign organizations, the place of actual management of which is the Russian Federation, unless otherwise provided by an international treaty on taxation issues

- Taxpayers who apply special tax regimes (Unified Agricultural Tax, simplified tax system, UTII) or are payers of the gambling business tax

- Participants of the project “Innovative

The obligation to pay tax arises only when there is an object of taxation. If there is no object, there is no reason to pay tax.

For different categories of taxpayers, profit for tax purposes may be different categories of income.

| Taxpayers | Profit for tax purposes | Article of the tax code |

| Russian organizations | Income reduced by expenses | clause 1 art. 247 Tax Code of the Russian Federation |

| Foreign organizations operating in the Russian Federation through a permanent representative office | Income of the representative office reduced by the expenses of the representative office | clause 2 art. 247 Tax Code of the Russian Federation |

| Other foreign organizations | Income received in the Russian Federation | clause 3 art. 247 Tax Code of the Russian Federation |

Region: Russian Federation

An effective income tax rate (ETR) is needed, first of all, for the enterprise itself.

The indicator assesses the quality of work of those responsible for taxation. There is no single legislative concept or formula; Three similar terms used in regulatory and methodological documents are discussed below. C. and, therefore, the tax rates of other countries look low compared to taxes in the United States. In addition, using global and offshore subsidiary earnings as the denominator means that the effects of further changes in earnings are also affected.

Income tax rate, %

This result is not unexpected; it simply confirms our previous evidence. The closure of latency deferrals and earnings smoothing will increase the average corporate income tax rates faced by offshore subsidiaries of U.S. multinationals.

Advance payments

Tax is defined as a percentage of the tax base corresponding to the tax rate. (Article 286 of the Tax Code of the Russian Federation)

- Quarterly advance payments are paid no later than the deadline established for filing tax returns for the corresponding reporting period.

- Payment of tax upon expiration of the tax period no later than the deadline established for filing tax returns for the corresponding tax period.

- Monthly advance payments are paid no later than the 28th day of the month following the previous month.

Basically, all income tax payers pay advance payments monthly (

Clause 2 of Article 286 of the Tax Code of the Russian Federation

)

| Names of payments | Payment deadlines |

| Tax paid at the end of the tax period | No later than March 28 of the year following the expired tax period |

Advance payments at the end of the reporting period:

|

|

| Monthly advance payments | Every month no later than the 28th day of the current month |

| Tax on income from state and municipal securities subject to taxation by the recipient of the income | Within 10 days after the end of the month in which the income was received |

Income tax is paid in advance payments every month or quarter, and then at the end of the year. Those companies whose sales revenues do not exceed 15 million rubles per quarter over the previous 4 quarters have the right to transfer advances quarterly in 2020. Other legal entities pay advances monthly.

Tax inefficiency: assessment and risks

The effective income tax rate is a quick and common way used by auditors to identify problems in a company's taxation. An express assessment shows a deviation from plans or standards, for example, 20% for a general taxation system, 5 or 15% for a simplified one.

An ineffective organization risks overpaying income taxes or losing in litigation. The situation can be improved by changing the accounting policy. At the same time, pay attention to the following:

what expenses are not deductible and how large their volume is;

how the authorized capital is formed and fixed assets are depreciated;

how tax deductions and overpayments are administered;

How large are the reserves for IT?

The effective tax rate is the real tax rate of a particular taxpayer, which is defined as the ratio of the tax actually accrued for the period to the tax base (economic base) for the same period.

The term “Effective Tax Rate” in English is effective tax rate or abbreviated as ETR.

Moment of recognition of income and expenses

Income is your revenue from your main activity (sales, provision of services or performance of work) and from additional sources (bank interest, rental of property). When calculating income tax, income is taken into account without VAT and excise taxes and is confirmed by: invoices, payment orders, entries in the book of income and expenses, and accounting registers.

Expenses are confirmed and justified expenses of the company. They are associated with production activities:

- employee salaries;

- cost of raw materials and equipment;

- depreciation;

- etc.

But there are also those not related to production:

- legal costs;

- difference in exchange rates;

- interest on loans;

- etc.

Accountants pay close attention to documents that confirm income tax expenses, since income can be reduced by expenses only if the following conditions are met:

- expenses must be justified - prove economic feasibility;

- Primary documents (book of income and expenses, tax registers) must be completed correctly.

At the same time, there is a list of costs that cannot be taken into account when reducing the base.

Subtracted from income:

- commercial, transport, production costs (raw materials; wages; depreciation; rent; services of third-party lawyers; representation expenses);

- interest on debts;

- expenses on advertising (with a limitation - only 1% of sales revenue is written off);

- insurance costs;

- spending on research (to improve products);

- expenses for education and training of personnel;

- expenses for the purchase of databases and computer programs.

The list of costs that do not reduce income is given in Article 270 of the Tax Code of the Russian Federation. This:

- remuneration for members of the board of directors;

- contributions to the authorized capital;

- contributions to the securities reserve;

- payments for exceeding the level of emissions into the environment;

- losses associated with economic activities in the communal, housing and socio-cultural spheres;

- penalties and fines;

- money and property transferred to pay for loans and borrowings;

- fees for notary services above the tariff;

- prepayment for a product or service;

- repayment of loans for employee housing;

- voluntary membership contributions to public funds;

- the amount of revaluation of the Central Bank with a negative difference;

- the cost of property that was given free of charge, transfer costs;

- payment for employee travel to work and home, if it is not provided for by production features and contract;

- pension benefits;

- vouchers for treatment and rest of employees;

- payment for vacations that are not provided for by law, but are specified in the contract with the employee;

- payment for sports and cultural events;

- payments for personal consumption goods purchased for employees;

- the cost of subscriptions to newspapers, magazines and other literature not related to production;

- payment for food for employees, unless this is provided for by law or collective agreement.

The moment of recognition is the period of time in which income or expenses are reflected in income tax accounting. There are two such moments. They depend on the method of recognizing income and expenses:

- cash method;

- accrual method.

The company chooses one of the methods, and before December 31 (without waiting for the start of the next tax period) informs the territorial body of the Federal Tax Service of Russia about its choice.

When applying methods, firms take into account amounts at different points in time. Let's look into the nuances.

The cash method assumes that:

- income is taken into account at the time of receipt at the cash desk or in the company's current account, not earlier;

- expenses are taken into account at the time of debiting from the account or paying from the cash register, not earlier;

- When paying tax, amounts are taken into account according to the dates of receipt or write-off.

Accrual method:

- income is taken into account at the time of occurrence (under contracts or payment orders), and not upon direct payment;

- expenses are taken into account at the time of occurrence, and not when funds are written off from accounts;

- When paying tax, amounts are taken into account based on documented dates, even if payment actually occurred later.

All enterprises can use the accrual method. But the use of the cash method is limited:

- Banks are prohibited from using it;

- Firms recognize income and expenses in fact only if revenue does not exceed 1 million rubles. for each of the last four quarters;

- If, when applying the method, the limit is exceeded, then the company is obliged to switch to the accrual method from the beginning of the current year.

What is the tax base if the company suffers a loss?

According to tax accounting rules, the profit of an organization cannot be negative. Even if there is a loss at the end of the year, the tax base is recognized as zero. The tax in this case is also zero. Tax accounting registers must confirm the correctness of the tax base calculation. It is mandatory to submit a declaration, even if the amount is zero.

How to calculate the effective rate

The effective rate is calculated as follows: ESNP = TN / BP,

where TN is the current income tax, taking into account deferred tax assets and liabilities (ONA and ONO); as much as the organization paid in the reporting period; BP – accounting profit, income before tax according to accounting data (not tax). Examples of calculations, monetary units - thousand rubles.

A report from the University of Dublin compares tax rates across countries, whether they are tax-friendly or not. Luxembourg appears alternately, both on the back of the package and on top. A study conducted in Dublin reported income tax rates for Luxembourg companies ranging from 2.4 to 47.7%.

For comparison, in this report, Cyprus has a total tax rate of 22.5%, Ireland - 25.7%, Denmark - 27%. Moreover, among countries still competitive, Switzerland ranks 7th with 29.1%, and the Netherlands ranks 12th with 39.3%. At the bottom of the pack are Belgium, 29th with 57.5% and France with 64.7%.

a) Parameters

LLC "ХХХ", production revenue for January - 120 expenses for January - 110

BP accounting profit: 120 – 110 = 10 NP taxable profit: 120 – 110 = 10 TN current tax: 10 * 20% = 2 SN regulatory rate: 20% ESNP effective rate: 2 / 10 * 100% = 20%

b) Parameters

CJSC "YYY", trade revenue for the first quarter - 300 expenses for the first quarter - 240 commercial expenses in excess of the limit - 8 unpaid repairs in the current quarter - 90 IT for the previous operation - 90 * 20% = 18 depreciation premium for the purchase of equipment - 40 IT for the previous operation – 40 * 20% = 8

To correct this bias, Jim Stewart relies on numbers from the US Bureau of Economic Analysis. There is also a difference in Luxembourg. The rate was 35.9% in France, 20% in Germany, 18.5% in the UK, 6.68% in Switzerland, 3.4% in the Netherlands, and 0.4% in Bermuda.

47.7% when excluding capital

In this table, Ireland appears to be the country with the lowest effective rate at 3.8%. Here Luxembourg is a good last with 47.7% tax! In the report of Fr.

BP accounting profit: 300 – 240 = 60 NP taxable profit: 300 – (240 – = 68 TN current tax: 68 * 20% + 18 – 8 = 23.6 SN regulatory rate: 20% ESNP effective rate: 23.6 / 60 * 100 = 39.3%

= 68 TN current tax: 68 * 20% + 18 – 8 = 23.6 SN regulatory rate: 20% ESNP effective rate: 23.6 / 60 * 100 = 39.3%

Carrying forward losses

Organizations that suffered a loss in the previous tax period have the right to reduce the positive tax base of the current period by the entire amount of the loss they received or by part of this amount. (Article 283 of the Tax Code of the Russian Federation)

Taxpayers are required to keep documents confirming the amount of losses incurred for the entire period when they reduce the tax base of the current tax period by the amounts of previously received losses.

In reporting (tax) periods from January 1, 2020 to December 31, 2020, the tax base for the tax for the corresponding period can be reduced by losses from previous periods by no more than 50%.

The organization Alpha LLC suffered losses for two years in a row:

- based on the results of 2009 - 180,000 rubles.

- based on the results of 2010 - 300,000 rubles.

At the end of 2011, the Company made a profit of 200,000 rubles.

The taxpayer has the right, subject to the conditions of Article 283 of the Tax Code of the Russian Federation, to transfer losses, thereby reducing the tax base, but without exceeding it.

Thus, the organization will be able to carry forward the 2009 loss in the amount of 180,000 rubles to 2011. and part of the 2010 loss in the amount of 20,000 rubles.

In the tax return in Sheet 02:

| Tax return indicator | Line code | Amount (rub.) |

| The tax base | 100 | 200 000 |

| The amount of a loss or part of a loss that reduces the tax base for the reporting (tax) period (page 150 of Appendix 4 to Sheet 02) | 110 | 200 000 |

| Tax base for calculating tax (page 100 - page 110) | 120 | 0 |

Thus, taking into account the transferred losses, the tax base is zero (RUB 200,000-180,000-20,000).

The remaining amount of the loss for 2010 in the amount of RUB 280,000. (300,000 – 20,000) can be taken into account in subsequent periods.

Tax accounting

Tax accounting is a system for summarizing information to determine the tax base for a tax based on data from primary documents. (Article 313 of the Tax Code of the Russian Federation)

Taxpayers calculate the tax base at the end of each reporting (tax) period based on tax accounting data. The tax accounting system is organized by taxpayers independently.

Tax accounting data is confirmed by:

- primary accounting documents (including an accountant’s certificate)

- analytical tax accounting registers

- tax base calculation

Analytical tax accounting registers are consolidated forms of systematization of tax accounting data for the reporting (tax) period.

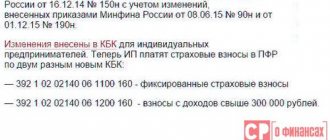

Budget revenue classification codes