Correcting errors in accounting and reporting

Correction of errors in accounting and reporting is carried out depending on their nature and moment of detection. Let's consider the procedure for correcting accounting errors. According to the law, errors in accounting and accounting (financial) reporting (hereinafter referred to as reporting) of an organization (clause 2 of PBU 22/2010, approved by order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n (hereinafter referred to as PBU 22/2010)) are recognized as incorrect reflection (failure to reflect) facts of economic activity, due, in particular:

- incorrect application of the legislation of the Russian Federation on accounting and (or) regulatory legal acts on accounting;

- incorrect application by the organization of its accounting policies;

- inaccuracies in calculations;

- incorrect classification or assessment of facts of economic activity;

- incorrect use of information available on the date of signing the statements;

- unfair actions of officials of the organization.

Inaccuracies or omissions identified as a result of obtaining new information that was not available at the time of reflection (non-reflection) of facts of economic activity are not considered errors in accounting and reporting (clause 2 of PBU 22/2010). The rules of PBU 22/2010 do not apply in this case, and income (expenses) of previous years identified in the current period, which were not reflected in accounting for objective reasons (not due to an error), are entered in the records of the period of their discovery, and there is no need to adjust accounting records of previous periods.

IFRS and the reliability of financial statements

The concept of reporting reliability. In regulatory documents, the criterion of reliability is compliance with any requirements, i.e. reporting is considered reliable if it is prepared in accordance with one or another system of rules (RAP, IFRS, etc.).

Thus, the Russian regulatory framework stipulates the following: “Accounting statements generated on the basis of the rules established by regulatory acts on accounting are considered reliable and complete.” (PBU 4/99 “Accounting statements of an organization”, clause 6). Similar norms are contained in international standards. The concept of reliability in the IFRS document system is disclosed in the Principles of preparation and presentation and financial reporting (true and fair view / fair presentation) and in IAS 1 “Presentation of financial statements” (fair presentation and compliance with IFRSs).

The idea behind IFRS is that financial statements should provide a “true and faire view”. The proper application of basic quality characteristics, relevant principles and standards is the key to a reliable and impartial picture of the state of affairs. Thus, compliance with international standards is a criterion for the reliability of reporting. Compliance with IFRS means that the financial statements comply with all applicable standards and interpretations and the Financial Reporting Principles. However, in the extremely rare circumstances where management concludes that compliance with the requirements of a standard would be misleading and therefore departure from a requirement is necessary to achieve a fair representation, the entity must disclose that fact, justify its point of view by fully disclosing the nature of the derogation and the impact on the financial statements.

Does the application of IFRS guarantee the reliability of financial statements? According to the ideas laid down by IFRS, reporting prepared in accordance with these standards should give a reliable representation of reality and reflect the real state of affairs. However, it should be understood that reporting that reflects the real state of affairs is unattainable, only due to the fact that accounting is a model of financial and economic activity, and therefore it inevitably involves a simplification of the properties of the modeled process. ON THE. Blatov (1875-1942) proposed to separate the concepts of “reliability” and “reality” of reporting: reliability is the compliance of reporting with any norms and rules, and reality is compliance with the real state of affairs (Blatov, 1930).

So, speaking about the reliability of financial statements, you need to take into account the following:

— “reliable reporting” is reporting compiled in accordance with certain rules for reflecting the facts of economic life, i.e. reflecting the true state of affairs, the concept is rather theoretical, because reality is too multifaceted to be reflected through symbols (letters and numbers); in practice, these concepts are combined: it is believed that reporting prepared according to the rules (for example, IFRS) should give a true and impartial picture of the state of affairs;

- there are many “reliable statements” of the same business entity, each of which will present its own financial result, its own amount of assets and liabilities and other indicators, since there are many accounting and reporting rules (IFRS, RAP, etc.), which is due to the diversity of accounting methodology;

— the reliability (rather, we are talking about reality) of reporting is limited by the accounting rules by which it is compiled; accounting rules change - reliability changes, i.e. Any reliability of reporting is conditional.

Conventionality of the concept of “reliability of reporting” prepared according to IFRS. As noted above, the limitation on the reliability of reporting prepared in accordance with IFRS is due to the very methodology of these standards, namely those methods and techniques of accounting that are accepted and recorded in the texts of international standards. In our opinion, two key reasons influence the reliability of reporting prepared in accordance with IFRS.

The first reason is the accountant's professional judgment. The definition of the term “professional judgment” is not provided in the IFRS document system, and it is also absent in Russian documents in the field of accounting. Let us give the definition of this term formulated by Ya.V. Sokolov: “professional judgment should be understood as an opinion expressed in good faith by a professional accountant about an economic situation, useful both for its description and for making effective management decisions” (Sokolov Y.V., 2005, p. 78).

Identification of a fact of economic life includes: classification, evaluation, determination of the time and method of recognition, generation of information reflected in financial statements. The opinion of a professional is necessary in situations where the system of accounting rules (in this case we are talking about IFRS) does not establish a specific procedure for accounting and reporting, and also when the accountant did not agree with these rules and decided to reflect reality according to other rules, than is written in regulatory documents (deviation from IFRS).

In other cases, the accountant's professional judgment is already written into the accounting rules. There are three types of situations where an accountant must exercise professional judgment:

1) the accounting procedure is not regulated in regulatory documents - the absence of specific regulatory instructions (for example, in the IFRS system there is no standard defining the accounting of mining operations);

2) all aspects of a business transaction have not been determined - a situation of uncertainty (for example, legal proceedings pending at the reporting date);

3) the norm provided for by regulatory documents does not allow one to reliably reflect the fact of economic life - a situation of disagreement with specific regulatory instructions.

Thus, in our opinion, professional judgment can be considered in a broad and narrow sense. In a broad sense, professional judgment consists of the accountant’s identification of all the facts of economic life; in a narrow sense - facts of economic life in the absence of specific regulatory instructions, in conditions of uncertainty and in case of disagreement with specific regulatory instructions.

Application of the concept of professional judgment presupposes an understanding of the following key points: professional judgment is objective, since it is based on an analysis of accomplished facts of the economic life of the organization; professional judgment is subjective in nature, since it is an opinion based on the knowledge, skills and experience of a particular specialist; the “correctness criterion” of professional judgment is the reliability of financial statements; the “guarantee of correctness” of professional judgment should be an audit of financial statements; professional judgment is not static, it is subject to change due to the emergence of new information; professional judgment needs to be regulated at the regulatory level (state or professional), since the boundary between professional judgment and veiling, and even falsification, of reporting is blurred.

When preparing financial statements under IFRS, the accountant must inevitably make his subjective opinion when qualifying the facts of economic life: establishing useful lives, choosing a depreciation method for fixed assets and intangible assets, recognizing estimated liabilities, determining the amount of impairment loss, choosing a discount rate, determining reportable segments, assessing the amount of doubtful accounts receivable and in many other cases (Generalova, 2005).

Let's give an example. If at the end of the reporting period the company is involved as a defendant in legal proceedings the outcome of which is not yet known, the accountant must decide how to account for this event. Having studied all the circumstances, he can make diametrically opposed decisions: recognize the obligation to the plaintiff while simultaneously reflecting the expenses of the reporting period, if, in his judgment, the likelihood of payment of the claim is high, or not make any entries in the accounting, based on the fact that the outcome of the case will be in favor the company and it most likely will not have to pay. Practice shows that both decisions can be reasoned and, accordingly, legal. The fact is that international standards operate in many cases with qualitative recognition criteria, the assessment of which by a particular accountant may vary. Thus, according to the standard IAS 37 “Provisions, Contingent Liabilities and Contingent Assets” that regulates this issue, the recognition of a provision is carried out when the following conditions are simultaneously met: the company has an obligation (legal or traditional) existing at the reporting date, caused by the event an event in the past; it is likely that an outflow of resources embodying economic benefits will be required to settle the liability; and the amount of the liability can be reliably estimated. Obviously, the analysis of the fulfillment of these three conditions requires inference. This is just one example of a situation where her qualifications are determined by professional judgment.

The second reason affecting the reliability of reporting generated according to international standards is due to the fact that IFRS are based on the economic doctrine of qualifying the facts of economic life, which corresponds to the purpose of financial reporting - meeting the information needs of users, mainly investors. Hence the priority of content over form, taking into account the time value of money, depreciation, fair value, consolidation and many other ideas that sometimes have nothing to do with the legal component of the transactions performed. We are talking about the theory of multilayered fact of economic life, according to which the fact of economic life consists of several layers (Sokolov, 2000, p. 92). One of the classifications of layers of facts of economic life is their division into economic and legal. And according to the principle of complementarity, the more accurately one indicator (the economic nature of the business situation) is reflected, the less accurately the other (the legal aspect of transactions) associated with it is represented. In international standards, when qualifying events and operations, the economic layer prevails, and as a result, the legal layer takes a back seat.

For example, a company's balance sheet compiled according to IFRS rules may reflect objects to which the company does not have legal rights (and may never have rights). We are talking about a financial lease agreement, which, according to international standards, should be considered as a financial agreement and taken into account not depending on the transfer of ownership of the leased item, but on the basis of the transfer of risks and benefits from the lessor to the lessee, i.e. the starting point is the economics of the case, not its legal component. Taking into account the time value of money will lead to the fact that receivables and payables are presented on the balance sheet not at the amount specified in the contract, but at a discounted value.

The two above circumstances are interconnected, but at the same time have an independent character.

Results. To summarize the above, we note that within the framework of IFRS, the reliability of accounting information and the implementation of the role of financial reporting in the economic life of society as a reliable basis for making management decisions is based on professional judgment and on the economic interpretation of the facts of the economic life of business entities. This is precisely what the entire ideology of international standards is aimed at (accounting for the time value of money, applying fair value, accounting for impairment, etc.). Such an approach will provide a “different reliability” than an approach based on a legal interpretation of the facts of economic life and based on strict regulation.

1. Reliability according to IFRS is “one of the reliability” of reporting, based on the Anglo-American model, with its inherent attributes: professional judgment, economic approach, etc.

2. Reflection of the facts of economic life according to IFRS can give rise to even greater variability in financial reporting indicators compared to national accounting standards.

3. The use of accounting information generated in accordance with IFRS (or on their principles - RAS) should occur in conditions of a deep understanding of the formation of this data.

4. Are IFRS necessary? This question is asked by many specialists who are “disillusioned” with the methodology of international standards. Thus, Professor Pankov harshly criticizes the fundamental principles of international standards, such as the accrual method, focusing mainly on the interests of owners (Pankov, 2009, pp. 32-34).

The information generated by any organization that prepares financial statements influences, and sometimes completely determines, the decisions of participants in financial and economic activities, which in turn shape the reality, the economic reality in which we live.

Factors for correcting errors in accounting and reporting

The procedure for correcting errors in accounting and reporting is influenced by two factors:

- the nature of the error (significant or insignificant);

- the moment the error was detected (before or after the end of the reporting period).

An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the reporting of this period (clause 3 of PBU 22/2010).

Let us recall that the reporting period for annual reporting is the calendar year (Part 3 of Article 13, Part 1 of Article 15 of Federal Law No. 402-FZ dated December 6, 2011 (hereinafter referred to as Law No. 402-FZ)), that is, the period from 1 January to December 31st. The exception is cases of creation, reorganization and liquidation of a legal entity (Part 1 of Article 15 of Law No. 402-FZ).

The first reporting year for a newly created commercial non-credit organization is the period from the date of state registration to December 31 of the same calendar year inclusive (Part 2 of Article 15 of Law No. 402-FZ). If state registration was carried out after September 30, then the first reporting year, as a rule, is the period from the date of its state registration to December 31 of the calendar year following the year of registration, inclusive (Part 3 of Article 15 of Law No. 402-FZ).

The organization independently determines the level of materiality of the error based on both the size and nature of the relevant reporting item(s) (clause 3 of PBU 22/2010).

In this case, one should take into account the impact of the error on all indicators presented in the reporting for the period in which it was identified (including indicators of the reporting year and comparative indicators of all previous periods presented in the reporting) (clause 3 of PBU 22/2010; letter Ministry of Finance of Russia dated January 24, 2011 No. 07-02-18/01).

The criterion for assessing an error in order to recognize it as a significant organization must be fixed in the accounting policy. You can set both a general materiality criterion and individual criteria for individual (most significant for the organization) balance sheet items.

One of the options for determining the materiality of an error may be to establish a certain percentage ratio of the value of the distorted balance sheet item to a group of items (total for a section) of the balance sheet or the sum (total) of all components of the balance sheet accounts (balance sheet currency).

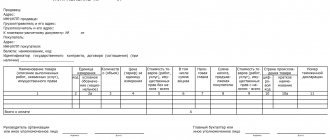

The table below shows the procedure for correcting errors in accounting and reporting, depending on the factors discussed above.

The procedure for correcting errors in accounting and reporting

Verification of the accuracy of accounting data and financial statements [p.192] The correctness of the reflection of business transactions in the accounting accounts is periodically checked using an inventory, which is a way of checking the availability of funds, their sources, as well as the status of settlements with debtors and creditors.

In other words, to ensure the reliability of accounting data and financial statements, enterprises are required to conduct an inventory of property and liabilities, during which their presence, condition and valuation are checked and documented. [p.433] In addition to the powers of the audit commission established by the Law on JSC, in the charter and internal document of the company regulating the procedure for its activities (for example, in the regulations on the audit commission), it is advisable to consolidate the rights and procedures of the audit commission (auditor) of the joint-stock company when control over accounting and reporting, incl. when checking the accuracy of the data contained in accounting documents, in particular, when checking the results of the inventory of property and financial obligations of the company, when auditing the cash register and monitoring compliance with cash discipline, etc. In this case, one must be guided by the general rules established in the Federal Law “On Accounting”, which are developed in other legislative acts.

Inventory is a check of the actual availability of property and obligations of an organization in order to ensure the reliability of accounting and reporting data. Inventory of property and liabilities is determined by the Federal Law on Accounting, Regulations on Accounting and Financial Reporting in the Russian Federation. [p.9]

However, the economic activities of economic entities show that even in the conditions of clearly established control over the registration of business transactions, it is not possible to fully solve this problem. A number of business transactions cannot be documented at the time of their completion. For example, some commodity-material assets, due to their physical and chemical properties, tend to dry out, disperse, volatilize, and break. This is an inevitable natural decline. For such valuables, loss norms are approved in accordance with the established procedure. In other cases, losses and shortages arise due to negligence in the work of financially responsible and other persons, negligence, the presence of intentional and unintentional errors, deception, and sometimes outright fraud. It becomes possible to identify and document such facts, to establish the size of deviations in relation to the information recorded in the primary documents and reflected in the accounting only when these facts are discovered during the inventory process by checking funds in kind, as well as the status of settlements with other organizations. At the same time, the task of checking and documenting the actual availability of property is solved. Therefore, inventory is a continuation of documentation. It complements and clarifies the reliability of current accounting data and annual financial statements. With its help, the organization of more precise control over the availability and movement of property and the sources of its formation, and the work of financially responsible persons is ensured. [p.53]

When the chief accountant is dismissed, the affairs are handed over to the newly appointed one, during which the state of accounting and the reliability of the reporting data are checked with the drawing up of a corresponding act approved by the director. [p.421]

A distinctive feature of this section is the combination of legal and economic approaches to conducting tax audits. Indeed, tax audits, on the one hand, are regulated by legal acts. Their results are legally significant and may entail legal consequences for the person in respect of whom a specific check is being carried out. On the other hand, their essence is to establish, by one means or another (tax control methods or other methods not prohibited by law), the correspondence of the available data on the financial and economic activities of the person being inspected, aimed at generating income, to the actual data. This process is impossible without analyzing accounting and reporting data (i.e. information of a purely economic nature) about the economic activities of the person being audited. Checking the correctness of the arithmetic calculation performed by the taxpayer and presented in the form of tax reporting, checking the legality of the application of tax rates and benefits, checking the correctness of calculation of the tax base, as well as implementing methods for checking the accounting documentation of the person being audited, analyzing the reliability of accounting data, the correctness of calculation and payment to the budget various types of taxes imply the need for the inspector to have appropriate economic training. [p.15]

Verification of the reliability of accounting and reporting data is carried out in the reverse order of the formation of financial statements from the final summary data to the primary accounting documents reflecting individual financial and economic transactions. [p.193]

Audit is the most common form of financial control, which is an interconnected set of checks of the financial and economic activities of enterprises, institutions and organizations, carried out using certain methods of actual and documentary control. The audit is carried out to establish the feasibility, validity, economic efficiency of completed business transactions, to verify compliance with financial discipline, the reliability of accounting and reporting data - to identify violations and shortcomings in the activities of the audited entity. [p.61]

When the chief accountant (accountant) is released, the cases are handed over to the newly appointed chief accountant, accountant (and in the absence of the latter - to an employee appointed by order of the head of the enterprise), during which the status of accounting and the reliability of reporting data is checked with the drawing up of a corresponding act approved by the head enterprises. [p.441]

For failure to fulfill or dishonest performance of his duties, the chief (senior) accountant is liable in accordance with the law. The official salary of the chief accountant is set, as a rule, at the level of the salary of the deputy head of the organization. Upon dismissal from the position of the chief accountant, the cases are handed over to the newly appointed chief accountant (and in the absence of the latter, to an employee appointed by order of the head of the organization), in which the state of accounting and the reliability of the reporting data are checked [p.60]

In order to control the movement of fixed assets, verify the accuracy and completeness of accounting data and their compliance with the actual state of various objects, enterprises periodically conduct inventories. An inventory of fixed assets is carried out, as a rule, once a year, but not earlier than November 1 of the reporting year. [p.65]

In banks, accounting records are carried out by a special audit apparatus, which, unlike the apparatus of other departments, is not part of the accounting bodies, but is an independent structural part of the board and offices of the bank. This feature is due to the fact that in banks R. covers not only accounting and business operations of banks, but also their cash and credit-settlement work. In the process of R., the implementation of party and government directives, as well as instructions from the bank’s Board of Directors, the safety of money and other valuables, the legality of completed banking operations, the establishment of accounting and internal bank control, the correctness of accounting records, the reliability of accounting and statistical data are checked. reporting, quality of customer service, compliance with budgetary staffing discipline, correctness and legality of spending material and monetary resources. At the same time, the staff of the bank being audited is instructed and assistance is provided in eliminating the identified deficiencies. The areas of work scheduled for inspection are provided for in the audit assignment. The scope of the audit and the time periods during which banking transactions are documented are established on the spot by the head of the audit team. R.'s methods are determined by a special instruction of the bank's Board; the results of R. are documented by the bank, in which the main performance indicators of this institution and identified shortcomings in its [p.281] are given.

ACCOUNTING CHECKING reports and balance sheets is a set of techniques for monitoring the reliability of reporting data characterizing the work of an enterprise or organization. Basically, these techniques come down to checking the correctness of reporting and the compliance of its indicators with accounting data. Verification is primarily carried out by studying and comparing individual indicators. Some of them are included in different reporting forms and must match (for example, the amount of profit on the balance sheet and on the income statement). Sometimes the sum or difference of indicators of some forms must be equal to the corresponding indicators of others (the output of marketable products according to the report on their cost must coincide with the indicator of the report on sales of products, increased or decreased by the difference in its balances at the beginning and end of the reporting period on the balance sheet). Such consistency of indicators is determined by the methodology and established procedure for reflecting business transactions in accounting and reporting. However, comparison of reporting data is not an exhaustive way to verify the reliability of reports on the enterprise’s implementation of planned targets and the results of its work. A more in-depth, complete or partial inspection is carried out directly at the enterprise according to analytical data. and synthetic accounting. [p.405]

Acceptance and delivery of cases upon appointment and dismissal of the chief accountant are formalized by an act after checking the state of accounting and the reliability of the reporting data. The act is approved by the head of the enterprise. [p.137]

Preparation and planning of the audit are carried out in accordance with current legislation and the terms of the contract with the client. The auditor must obtain a sufficient understanding of all aspects of the financial and economic activities of the audited entity and assess its accounting and internal control systems in order to determine the likelihood of errors affecting the reliability of financial statements and audit risk. Based on this assessment, the content, scope and number of audit procedures are determined. This information is reflected in the overall audit plan and program. At this stage, the issue of attracting experts and the composition of the audit team is also decided. [p.46]

Inventory as an element of the accounting method allows, through physical verification of material assets, cash and financial obligations, to identify their actual condition. It either confirms accounting data or identifies unaccounted for values and incurred losses, thefts, and shortages. Therefore, with the help of inventory, the safety of material assets and funds is monitored, and the completeness and reliability of accounting and reporting data is checked. [p.9]

Upon dismissal, the chief accountant hands over the files to the newly appointed chief accountant. In the process of submitting cases, the status of accounting and the reliability of reporting data is checked, about which an act is drawn up, approved by the head of the enterprise. [p.52]

Sources of A. x. d.s. p.p. are indicators of the plan, all types of households. accounting (accounting, statistical and operational-technical), reporting arising from it, as well as information obtained independently of accounting. Accounting and reporting data are of particular importance. Planned, reporting and other indicators used for analysis are carefully checked in terms of their reliability and completeness. In the higher org-tspn, which the enterprise is subordinated to, in the bank institution servicing it and in the financial institution. organs analysis of household activity is based primarily on the study of reporting. In the bank, where all settlements and loans are carried out - [p.47]

Inventory is a method of checking whether the actual availability of funds in kind corresponds to accounting data. It is carried out to ensure the reliability of accounting indicators and the safety of socialist property. I. are subject to fixed assets inventory assets work in progress and semi-finished products of own production unfinished capital construction and unfinished production of construction and installation works capital repairs deferred expenses animals for growing and fattening goods and containers of trading enterprises cash documents of strict reporting funds in calculations. I. are also subject to those values that do not belong to the given enterprise (leased fixed assets, valuables in safekeeping or accepted for processing). [p.54]

The purpose of inventory is to check the accuracy of accounting data, reporting and the actual availability of valuables. [p.276]

When the chief accountant is relieved of his position, the state of accounting and the reliability of reporting data is checked, and a corresponding act is drawn up, approved by the head of the organization. [p.209]

Familiarization with the auditor's report. The auditor acts as an external, independent and highly professional expert-controller. Let us remind you that according to Art. 1 of the Federal Law on Auditing Activity No. 119-FZ of August 7, 2001, audit activity (audit) is a business activity involving independent verification of accounting and financial (accounting) statements of organizations and individual entrepreneurs (audited entities). The purpose of the audit is to express an opinion on the reliability of the financial (accounting) statements of the audited entities and the compliance of the accounting procedure with the legislation of the Russian Federation. In the Law, reliability is understood as the degree of accuracy of financial (accounting) reporting data, which allows the user of these reporting, based on its data, to make correct conclusions about the re- [p.222]

In our country, the official birth date of audit is March 1991, when the Constituent Assembly of the Audit Chamber approved its charter. At first, the charter provided only the definition of audit, its organizational forms and its media. Thus, the charter states that an audit is a check carried out on a contractual basis by an independent auditor or audit organization of the correctness of accounting, the reliability and completeness of financial statements and its compliance in an enterprise (of any form of ownership) with the requirements of the current legislation, that the auditor is an individual who has a certain qualifications, the necessary work experience and has received a standard license for the right to engage in auditing; that an audit organization is an enterprise uniting auditors whose subject of activity is auditing. [p.40]

Small businesses that do not apply a simplified system of taxation, accounting and reporting and are required to conduct an independent audit of the reliability of their financial statements have the right not to submit a Statement of Changes in Capital (Form No. 3) and a Statement of Cash Flows (Form No. 3) as part of their annual financial statements. . No. 4), Appendix to accounting (form No. 5), if the relevant data is missing. [p.8]

Small businesses that do not apply the simplified system of taxation, accounting and reporting in accordance with the legislation of the Russian Federation and are required to conduct an independent audit of the reliability of financial statements in accordance with the legislation of the Russian Federation have the right not to submit a Statement of Changes in Capital (form) as part of the annual financial statements No. 3), Cash Flow Statement (Form No. 4), Appendix to the Balance Sheet (Form No. 5), if the relevant data is missing. [p.305]

Audit evidence. During the audit, the auditor must obtain a sufficient amount of high-quality audit evidence to form an opinion on the reliability of the financial statements of the economic entity. However, the types of audit evidence, sources and methods for obtaining them may be different. When collecting audit evidence, the auditor must follow the requirements established by the Rule (standard) Audit Evidence [26]. Obtaining audit evidence from a client using an AIS greatly simplifies the process of obtaining it. When obtaining evidence, the auditor can rely on the processing system itself, making maximum use of its capabilities to obtain the information he needs. He actively uses methods such as data testing, continuous or selective recalculation, tracking the movement of a business transaction from its registration in a document to its reflection on accounting accounts, analytical procedures for analyzing and evaluating the information received, researching the most important financial and economic indicators of the work of the audited entity, drawing up alternative balances, etc. At the same time, the more automatically generated reports the client's ICE-BU allows you to receive, the more different consistency tests there are [p.346]

The use of documentary methodological techniques in financial and economic control makes it possible to give a quantitative and qualitative assessment of identified deficiencies, identify the persons responsible for them and determine the amount of their financial liability. When an audit at an enterprise is carried out for the first time, it is important to first carefully study the constituent documents, the charter of the enterprise, the subject of activity, as well as the accounting policies of the enterprise. It is necessary to subject all monetary and settlement documents, as well as advance reports of accountable persons, to a complete check. When checking the reliability of financial statements, you need to compare data from financial statements, balance sheets, synthetic and analytical accounting registers. [p.86]

AUDIT EVIDENCE - information received by the auditor during the audit from the economic entity being audited and third parties, or the result of its analysis, allowing one to draw conclusions and express the auditor’s own opinion on the reliability of the financial statements. Audit evidence includes documentary sources of data, accounting documentation, expert opinions, and information from other sources. [p.86]

The law determines the need to conduct an inventory of assets and liabilities to ensure verification of the accuracy of accounting and financial reporting data, and it is during the inventory that the presence, condition and assessment of the assets and liabilities of the enterprise are documented. The objects and frequency of inventory are determined by the owner (manager of the enterprise), except for cases when its implementation is mandatory by law. [p.7]

AUDIT OF BUDGET EXECUTION - a documentary check on the spot - in the republic, territory, region, district, city, district, town or village Council - of the legality, correctness and appropriateness of the use of budget funds, the safety of state monetary and material resources, the completeness and timeliness of budget receipts income. In the process of R. and. b. compliance with laws, regulations and orders of the government, decisions of government bodies, rules for drawing up and executing the budget, the reliability of accounting data and reporting on budget execution is checked. The main tasks of the audit are the protection of socialism. property from embezzlers and plunderers of people's property, identifying on-farm reserves and developing measures to eliminate discovered violations and shortcomings. R. and. b. is the most effective and efficient form of subsequent control over budget execution. It is produced in the finance ministries of the union republics by the Control and Audit Directorate of the Ministry of Finance of the USSR, in the finance ministries of the Autonomous Soviet Socialist Republic, regional, regional, district, city and district financial departments - by the control and audit departments of the finance ministries of the union republics and their local authorities. Specialists from other levels of the apparatus of financial authorities participate in audits. In the township and village councils of R. and. b. are carried out by controllers-auditors and the apparatus of the district financial departments. The control and audit departments of the Ministry of Finance check the cash execution of the budget in the offices and branches of the State Bank of the USSR. Budget execution is also audited in budgetary institutions, enterprises and organizations. Representatives of the public are involved in conducting audits - party, Komsomol, trade union organizations of audited enterprises and institutions, as well as various groups of social activists created under the executive committees of local Councils of Workers' Deputies, under financial authorities to participate in measures to improve financial work. [p.281]

Correction of accounting and reporting errors

Corrections of errors in accounting registers must contain (Part 8 of Article 10 of Law No. 402-FZ):

- date of correction;

- signatures of the persons responsible for maintaining this register and authorizing the introduction of corrections (indicating their surnames and initials or other details necessary for identification).

Correction of an error is completed by means of an accounting certificate (Part 1, Article 9 of Law No. 402-FZ), which must reflect all necessary entries (corrective, additional entries, events that caused the error, etc.). The certificate is drawn up on the basis of documents confirming newly identified circumstances or the presence of an error, in any form, indicating the mandatory details provided for in Part 2 of Art. 9 of Law No. 402-FZ.

Depending on the situation, corrections can be made:

- by reversal (for example, in cases of unfounded accounting entries, overstatement of transaction amounts, etc.);

- by making additional entries in the event of additional accrual of amounts not previously taken into account.

Information about significant accounting errors of previous reporting periods, corrected in the current one, must be disclosed in the notes to the annual reports (clause 15 of PBU 22/2010). The explanation provides information:

- about the nature of the error;

- on the amount of adjustment for each reporting item (for each previous reporting period to the extent practicable);

- on the amount of adjustment based on data on basic and diluted earnings (loss) per share (if the organization is required to disclose information on earnings per share);

- on the amount of adjustment to the opening balance of the earliest reporting period presented.

If it is impossible to determine the impact of a significant accounting error on one or more previous reporting periods presented in the financial statements, then the explanations must disclose the reasons for this, as well as provide a description of the method of reflecting the correction of the significant error and indicate the period from which the corrections were made (clause. 16 PBU 22/2010).

Accounting and reporting errors: corrective entries

In accounting, the profit of previous years, identified in the reporting year, is reflected as part of other income under the credit of account 91 sub-account “Other income” on the date of its identification (clauses 8, 16 PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n; Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

Losses from previous years identified in the reporting year are reflected as other expenses in the debit of account 91 subaccount “Other expenses” as of the date of their discovery (clause 12 of PBU 10/99, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

According to Regulation No. 34n (clause 80 of the Regulations on accounting and reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n), such income and expenses are included in the financial result of the organization for the reporting year in which they were identified.

In the form of the income statement, other income is reflected in line 2340 “Other income”. Losses from previous years identified in the reporting period are reflected in line 2350 “Other expenses”.

If the records of the current year correct a significant error of the previous period, identified after the approval of the financial statements, then the amount of the identified income (loss) is not indicated in the financial results statement, but the amount of retained earnings is changed (line 1370 of the balance sheet) (clause 9 of PBU 22/2010 ).

Olga Volkova , expert of the Legal Consulting Service GARANT

Reliability and its essence

Auditing standards define the reliability of financial statements.

Note 1

That degree of accuracy of accounting data that allows a competent user to draw correct conclusions on its basis about the performance of economic entities and make decisions based on these conclusions.

Accounting information collected, compiled and compiled in accordance with the regulations of the system of legislative regulation of accounting in the Russian Federation is considered reliable.

The reliability of accounting data can be achieved if all business transactions are confirmed by correctly executed documents, correctly conducted inventories and assessments of the company’s liabilities and assets. Documentation means that all transactions must be supported by primary documents, as a sign of adherence to the principle of registration. If it is discovered that documents do not correspond to actual events, then the reliability of the information is called into question.

Finished works on a similar topic

- Coursework Reliability of accounting information 440 rub.

- Abstract Reliability of accounting information 220 rub.

- Test work Reliability of accounting information 200 rub.

Receive completed work or specialist advice on your educational project Find out the cost

How to determine the materiality of an error in financial statements

Anyone can make a mistake when preparing financial statements. The main thing is to correct the mistake. And the procedure for correcting it depends on two points: whether the error is significant and in what period it was discovered and paragraphs. 3, 5—11, 14 PBU 22/2010.

A significant error is an error that, individually or together with other errors for the same period, can affect the economic decisions of users made on the basis of the accounting records of this period and paragraphs. 3, 5—11, 14 PBU 22/2010.

What is the materiality of an error?

You determine and establish the criterion for the materiality of an error yourself by registering it in the accounting policy, clause 3 of PBU 22/2010; clause 4 PBU 1/2008. It must be justified.

OPTION 1. You can rely on the same rules for determining the materiality of an indicator as contained in PBU 9/99 on income and PBU 10/99 on expenses. Let us recall that it says that income (expense) for a certain type of activity is shown separately in the reporting if it amounts to 5% or more of the total amount of income (expenses) for the reporting period, clause 18.1 of PBU 9/99; clause 21.1 PBU 10/99. By analogy, it can be stated in the accounting policy that an error is significant if it distorts the indicator for the reporting period by more than 5%.

OPTION 2. You can assess the significance of the error based on the share of the balance sheet item in the reflection of which the error was made in the balance sheet currency. For example, the useful life of the OS is incorrectly determined. Its price does not exceed hundreds of thousands of rubles. And the value of all the company’s assets is in the millions. It is clear that the mistake made will not affect the decisions made by the company's owners on this accounting. It’s another matter if the company bought real estate, but did not timely reflect its value on the balance sheet, and the company does not have other fixed assets. Such an error must already be recognized as significant.

OPTION 3. A qualitative indicator such as type of activity can be used. For example, your main activity is trade, your non-main activity is renting. It can be established that errors made in lease accounting are always insignificant.

OPTION 4. It can be stated that the materiality of the error will be assessed for each specific case separately based on the impact of this error on the financial result and property position of the organization. That is, no single criterion should be established.

OPTION 5. If you are preparing reports solely for submission to the inspection (the owners are not interested in them), then you can rely on the norm of the Code of Administrative Offenses: if the indicator of any article (line) of the accounting records is distorted as a result of an error of 10% or more, then this is a gross violation accounting rules, for which the manager faces a fine of 2 thousand to 3 thousand rubles. Art. 15.11 Code of Administrative Offenses of the Russian Federation That is, it can be established that a significant error will be one that distorts the indicator of the accounting line by at least 10%.

Example. Determining the type of error made

/ condition / The organization erroneously accrued depreciation in the amount of 200,000 rubles for December 2011. instead of 250,000 rubles.

Moreover, before the error was detected, the indicators affected by this error were as follows:

- residual value of fixed assets (from the balance sheet) - 900,000 rubles;

- profit from sales (from the profit and loss statement) - 1,000,000 rubles;

- profit before tax (from the profit and loss statement) - 270,000 rubles;

- net profit (from the profit and loss statement) - 216,000 rubles;

- cost of sales (from the profit and loss statement) - 700,000 rubles;

- the amount of income tax (from the profit and loss statement) - 54,000 rubles.

The same mistake was made in tax accounting - there are no differences.

In its accounting policy, the organization has established that a significant error is one that leads to a distortion of any accounting line by at least 10%.

/ solution / Let's see if the error is significant.

STEP 1. Calculate the amount of the error: 250,000 rubles. – 200,000 rub. = 50,000 rub.

Materiality criteria. Errors in preparing financial statements

x 20%)

22.73 ((RUB 54,000 - RUB 44,000) / RUB 44,000 x 100%) Net profit (loss) 216,000 176,000 (RUB 220,000 - RUB 44,000) 22.73 ((216 000 rub. - 176,000 rub.) / 176,000 rub. x 100%)Step 3. Compare the maximum percentage of distortion with the criterion for the significance of the error: 22.73% > 10%. Thus, the mistake made is significant.

* * *

The main difficulty in correcting errors is the need to make a retrospective recalculation if a significant error is discovered after the participants have approved the statements (Subclause 2 of clause 9 of PBU 22/2010). And only small businesses can establish in their accounting policies that they will correct all their mistakes in the current period.

March 2012

Determining the significance of an error in the financial statements

Anyone can make a mistake when preparing financial statements. The main thing is to correct the mistake. And the procedure for correcting it depends on two points: whether the error is significant and in what period it was discovered.

Note A significant error is an error that, individually or together with other errors for the same period, can affect the economic decisions of users made on the basis of the accounting records of this period (Clause 3, 5 - 11, 14 PBU 22/2010).

How to make accounting corrections

Error detection period

Until December 31 of the reporting year inclusive

In the month of discovery

After the end of the reporting year, but before the date of signing of the reports by the manager

December 31 of the reporting year

After the report is signed by the manager, but before it is presented to the company’s participants

December 31 of the reporting year. If the reporting was submitted to other users (for example, to the Federal Tax Service), then it must be replaced

In the month of discovery - if the error affected the financial result, the adjustment is reflected in account 91 “Other income and expenses”

After the reporting is submitted to the participants, but before it is approved by them

December 31 of the reporting year. Users are sent revised statements with information about the replacement of the original statements and with justification for its revision

After the reporting is approved by the participants

In the discovery quarter, the results of the adjustment are reflected in account 84 “Retained earnings (uncovered loss)”

In the month of discovery - the result of the adjustment is reflected in account 91