continues to pay close attention to the problems of calculating income tax and organizing tax accounting. Release 7.70.432 of the standard configuration (version 4.2) of the 1C: Accounting 7.7 and 1C: Accounting 7.7 (basic) programs, released in early October 2002, included a new report in the configuration: “Analysis of the state of tax accounting.” Now, before preparing a profit tax return, users will be able to check whether tax accounting data is correctly generated. This verification is carried out by comparing accounting and tax accounting data. I.A. talks about this method. Berko, methodologist of the standard solutions (configurations) development department.

The tax accounting system, implemented in standard accounting solutions for "1C: Enterprise 7.7", allows you to automatically generate tax accounting data for most business transactions encountered in practice, and then, based on them, again automatically create tax accounting registers and fill out a tax return for tax on profit. However, before filling out the declaration, you would like to know how correctly the tax accounting data is formed? What is the fastest and best way to check this? In our opinion, in this sense, checking tax accounting data by comparing them with accounting data deserves attention.

What applies to fixed assets

Property of an organization with a useful life of more than 12 months, worth more than 100,000 rubles, used as means of labor for the production and sale of goods (works, services), or for management purposes.

In most cases, fixed assets in tax accounting are recognized as the same objects as in accounting. Land, water, subsoil and other natural resources are non-depreciable fixed assets in both tax and accounting.

Maintain tax and accounting records of fixed assets for free according to the new rules

Why comparison with accounting?

Many accountants currently still experience difficulties with tax accounting. A comparison of accounting and tax accounting data helps to understand to what extent the difference that has arisen is an objective consequence of differences in regulations on accounting and taxation, and where there are obvious errors and blunders of the accountant.

By comparing tax and accounting data, and then analyzing the similarities and differences, you can better learn both the features of tax legislation and the features of the tax accounting system in standard configurations of “1C: Enterprise 7.7”.

What are not fixed assets

Goods, inventories, securities, derivatives instruments and unfinished capital construction projects. According to accounting rules, such property also does not apply to fixed assets.

Also, for tax accounting purposes, expensive publications (books, brochures, etc.) and works of art are not recognized as fixed assets. In accounting, provided that all criteria are met, such items can be taken into account as fixed assets. Finally, fixed assets are not property received as part of targeted financing (there is no such exception in accounting).

Main differences between accounting and tax accounting

In this section, we will consider the following differences between accounting and tax accounting:

Differences in income recognition in accounting and tax accounting

Conclusion when comparing income generated in accounting and tax accounting : in the general case, tax accounting data will coincide with accounting data. And yet, it would be more correct to emphasize that the coincidence of the considered types of income occurs “in the general case.” Therefore, when maintaining accounting and tax accounting, we must not forget about private cases: when recognizing income in tax accounting, there are several features. Later in the article we will consider them in order.

Features of income recognition in tax and accounting

The classification of income in accounting in some cases differs from the classification of income generated in tax accounting

For example, income generated in accounting can include income from participation in the capital of other organizations, in accordance with clauses 5 and 7 of PBU 9/99, as in income from ordinary activities, provided that for the organization this is the subject of its activities, as well as in other income, if this is not the subject of activity.

But in tax accounting, income from equity participation in other organizations (with the exception of income allocated to pay for additional shares (stakes) placed among the organization’s shareholders (participants) should always be classified as non-operating income. This is the requirement of paragraph 1 of Art. 250 Tax Code of the Russian Federation.

The list of income that is not generated when determining the tax base for income tax is somewhat broader than the list of income that should not be taken into account in accounting

For example, receipt in the form of property with a monetary value, which was received in the form of a contribution (contribution) to the authorized capital (fund) of an organization (including income in the form of an excess of price over the nominal value (initial amount)) is not considered income (clause 3 p. 1 Article 251 of the Tax Code of the Russian Federation). This type of income is not on the list of income that should not be taken into account in accounting.

The date of recognition of income for accounting purposes may differ from the date of recognition for tax accounting purposes.

In some cases, you can keep track of income not only using the accrual method, but also the cash method. In general, organizations can maintain accounting only on an accrual basis, with the exception of small businesses. But tax accounting of income can be carried out using either the cash method or the accrual method. This is where you should understand that if in the two types of accounting under consideration income is recognized using different methods, this will lead to a difference in the date of recognition of this income.

Differences in recognition of expenses in accounting and tax accounting

The procedure for accounting for expenses in accounting is regulated by PBU 10/99 “Expenses of an organization,” approved. by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n.

Expenses of an organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property) (clause 2 of PBU 10/99 ).

The disposal of assets is not recognized as an expense of the organization (clause 3 of PBU 10/99):

- in connection with the acquisition (creation) of non-current assets (fixed assets, construction in progress, intangible assets, etc.);

- contributions to the authorized capitals of other organizations, acquisition of shares of joint-stock companies and other securities not for the purpose of resale (sale);

- under commission agreements, agency and other similar agreements in favor of the principal, principal, etc.;

- in the order of advance payment of inventories and other valuables, works, services;

- in the form of advances, deposits to pay for inventories and other valuables, works, services;

- to repay a loan received by the organization.

Let’s compare what is the difference in recognizing expenses in tax accounting.

Expenses are recognized as justified and documented expenses incurred by the taxpayer (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

That is, in order to recognize an expense in tax accounting, the following conditions must be met:

- the costs are justified;

- costs are documented;

- expenses are incurred to carry out activities aimed at generating income.

In accounting, expenses are recognized if the conditions specified in clause 16 of PBU 10/99 are met:

- the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

- the amount of expenditure can be determined;

- there is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization. There is certainty that a particular transaction will result in a reduction in the entity's economic benefits when the entity has transferred an asset or there is no uncertainty about the transfer of the asset.

If at least one of the above conditions is not met in relation to any expenses incurred by the organization, then receivables are recognized in the organization’s accounting records.

Based on the above: in general, at the stage of recognizing expenses, tax accounting and accounting data will coincide

How to determine the initial cost of an OS

The initial cost of a fixed asset includes all costs of acquisition, construction, manufacturing, delivery and bringing it to a condition in which the OS is suitable for use.

Please note: in general, the original cost does not include VAT. For example, a fixed asset cost the company 240,000 rubles, including 20% VAT (40,000 rubles). Only 200,000 rubles should be included in the initial cost. (240,000 - 40,000). And the VAT amount is not reflected in tax accounting.

An exception is provided only for a situation where the company is exempt from paying VAT, or if the fixed asset is used in operations for which value added tax is not charged. In these cases, VAT is also included in the initial cost.

In general, the initial cost is fixed once and is not revised in the future. But there are exceptions to this rule: changes are possible in the case of completion, additional equipment, reconstruction, modernization, partial liquidation and for other similar reasons.

What is bonus depreciation

Each organization has the right to apply the so-called depreciation premium to all fixed assets, except those received free of charge. The bonus allows you to immediately write off part of the money spent on the purchase or construction of an object as current expenses. The maximum premium amount is determined as a percentage of the original cost and depends on the depreciation group (we will discuss these groups in detail below). For fixed assets belonging to the third to seventh depreciation groups, the premium cannot exceed 30%, for all other groups - 10%.

Also, a depreciation bonus can be applied to the costs of completion, additional equipment, reconstruction, modernization, technical re-equipment and partial liquidation. The maximum size here is determined in the same way as in the case of the acquisition or construction of a fixed asset.

If, before the expiration of five years from the date of commissioning, the company sells the fixed asset to a related party, the depreciation bonus must be restored, that is, included in taxable income. In this case, the financial result from the sale should be reduced by the amount of the depreciation bonus. In a situation where an object is sold to a person who is not interdependent, the depreciation bonus is not restored and does not reduce the financial result.

We would like to add that the use of bonus depreciation can be waived. In this case, all costs associated with the fixed asset will be included in its initial cost.

In accounting, bonus depreciation is not provided.

Get a sample accounting policy for a small LLC Get it for free

Features that arise when determining revenue

- When the price is not determined. Sales of products, provision of services and other activities for which the company receives revenue occur on the basis of an agreement between the buyer and the customer. In this case, the contract, as a rule, provides for the establishment of a price. However, there are also contracts where the price is not provided and is determined based on the prices charged for similar types of goods. Revenue in this case is also determined by the price of similar goods.

- Transfer of ownership after receipt of funds. Revenue under this type of contract is determined on the date of receipt of money.

- When providing a commercial loan. When the buyer is granted a deferred payment, the proceeds are accepted in the full amount of the debt. The term of the so-called loan does not matter.

- When paying not in cash. The Civil Code of the Russian Federation allows the option of non-monetary payment only under an exchange agreement. Revenue under such contracts is taken into account at the cost of the goods that the organization receives. In this case, the cost of the goods is determined based on the cost of similar goods (works, services). When the cost of the goods received cannot be determined for some reason, the organization will determine revenue based on the cost of the goods transferred in exchange. The cost of your goods should be similar to the cost of usually shipped goods.

- When the obligation under the contract changes, when a discount is provided. There are situations when the price changes after the contract has been concluded. For example, it is possible to provide a discount. If the goods are transferred to the buyer already taking into account the discount, then there will be no need to adjust the revenue in this case. And if the discount is provided after the shipment has taken place and after the relevant documents have been issued, then the selling company will need to adjust the revenue by creating the posting: D62 K90-1 – REVERSE! Sales revenue is adjusted by the discount amount.

- When returning an item. If a situation arises when the buyer returns the goods, then an adjustment must be made in accounting for revenue, otherwise at the end of the period it will reflect an incorrect result. When the sale of goods and the return of goods occur in the same tax period, then it is necessary to adjust the 90 “Sales” account. But if the return occurs only next year, then the cost of this product will be reflected in non-operating expenses in the form of a loss from previous years and taken into account in account 91 “Other income and expenses.”

- When setting the price in USD There are also situations when settlement under an agreement occurs in rubles, but is equivalent to an amount in the currency of another country or in conventionally accepted units. In this case, the parties to the contract set the date for recalculating the price either from the foreign exchange rate at the time of payment or on the day of shipment. The peculiarity of such an agreement is that the final price is formed only after calculation. That is, the final cost of goods in Russian currency is determined at the time of final settlement and consists of partial payment for future deliveries, as well as other amounts transferred for the goods. The moment of determining revenue will be an earlier date, either the date of shipment or the moment of payment.

- When creating a reserve for doubtful debts. When creating a reserve for debts, the amount of revenue should not change.

Revenue recognition example

Continent LLC ships goods to the Counterparty on prepayment. On the date of transfer of the goods, ownership rights also pass. Revenue is accordingly recognized on the date of shipment. Let's reflect these transactions in accounting with the appropriate entries:

- D51 K62 – Prepayment received for future shipment

- D62 K68 – VAT accrued (as of the date the tax base was determined)

- D62 K90-1 – Products shipped

- D90-3 K68 – VAT charged

- D68 K62 – VAT calculated at the time of shipment is accepted for deduction

How to accept an OS object for accounting

The fixed asset is accepted for accounting at its original cost minus the depreciation bonus (if the company used it). So, if the initial cost of the object is 200,000 rubles. (excluding VAT), and the depreciation premium is 20,000 rubles, then the fixed asset is taken into account at a cost equal to 180,000 rubles. (200,000 - 20,000).

When registering a fixed asset for tax purposes, no special actions need to be taken. In essence, registration means that the accountant has determined the useful life of the asset, included the object in one or another depreciation group, and began to calculate depreciation.

Depreciation in accounting

In accounting, equipment depreciation implies the monthly transfer of the monetary equivalent of items, equipment, and buildings to present-day costs. In simple words, this process allows you to pay off the purchase price of a particular property. According to the accounting methodology clause 49, the prices of property are transferred, which:

- Owned.

- Lives in the economic management of the enterprise.

- Rented by the institution.

Who pays for depreciation?

- Enterprises.

- Landlord or tenant.

- Lessee or lessor.

Accrual is not made for objects not used in the operation of the institution, as well as for owners of non-profit organizations. This does not include houses in which people live, land, dormitory buildings, and museum values.

Enterprise assets are subject to depreciation over their useful life. Typically, an enterprise assumes its duration at its own discretion, using paragraph 20 of PBU 6/01 . The duration may depend on the rate of wear of the equipment, on how powerful and productive it is. The deadline is set once and cannot be changed.

There are 4 methods of calculating depreciation: linear, the method of writing off the cost by the sum of the SPI numbers, the reducing balance method, writing off the cost according to the quantity of production.

The enterprise prescribes for itself some method of calculation. The method, as well as the useful life, cannot be changed during the entire life of the objects.

It doesn’t matter how the company prefers to calculate this indicator, one way or another, for each month it must deduct 1/12 of the annual cost separately for all objects. In turn, the annual cost can be calculated using a formula that must correspond to one of the accrual methods.

Useful life and depreciation groups

According to the Tax Code of the Russian Federation, the useful life is the period during which the fixed asset serves to fulfill the taxpayer’s goals. Despite the difference in wording, in essence this definition coincides with that in accounting.

The useful life is set by the company itself on the date when the OS is put into operation. However, you cannot be completely independent when setting a deadline. Taxpayers must adhere to the classification approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. In it, all fixed assets are distributed into ten depreciation groups, and for each group a lower and upper limit on the useful life is specified. For example, computer technology is classified in the second group with a useful life of 2 to 3 years inclusive.

For tax accounting purposes, the organization is required to adhere to this classification. Derogation from it is possible only if the main means is not mentioned in the classification. Then the useful life must be determined based on the technical conditions and recommendations of the manufacturer.

After reconstruction, modernization and technical re-equipment, the useful life can be increased. But even the extended period must fit within the framework established for the depreciation group to which the object originally belonged.

If a company receives a used OS (including during reorganization or as a contribution to the authorized capital), the accountant should request a certificate from the previous owner. The certificate must indicate what useful life was established by the previous owner and how long he operated the object. The new owner must take this information into account when calculating depreciation. A used fixed asset must be included in the same depreciation group to which it belonged to the previous owner.

Differences between accounting and tax accounting

The main difference between both types of accounting is the purpose of summarizing information and its users. If in tax accounting information is generated to determine the tax base and is used by regulatory authorities and qualified tax consultants, then accounting is needed to generate the most complete information about the state of affairs of the company, which takes into account all factors and includes all completed transactions. The main users of accounting information are the founders and managers of the enterprise.

The differences come from the different documents on which they are based. For tax accounting, the main document is the Tax Code of the Russian Federation and its regulations. Accounting - regulated by the Federal Law “On Accounting”, accounting regulations (PBU) and other legislative acts. When conducting a comparative analysis, differences can be identified in the following categories: recognition of income and expenses, calculation of depreciation, creation of reserves, assessment of inventories, direct and indirect expenses.

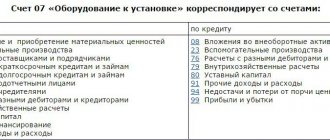

Differences between accounts

Differences in income recognition in accounting and tax accounting

The income of an enterprise in accounting is regulated by PBU 9/99 “Income of the Organization”, in tax accounting - Article 41 of the Tax Code of the Russian Federation “Principles of Determining Income”, Chapters 23 and 25 of the Tax Code of the Russian Federation (part two).

Brief classification of income in both types of accounting:

Revenue recognition

Differences in recognition of expenses in accounting and tax accounting

An organization's expenses for accounting are regulated by PBU 10/99 “Organization's Expenses”, for tax purposes - clause 1 of Article 252 of the Tax Code of the Russian Federation.

The classification of expenses in both types is as follows:

- validity;

- documentary confirmation;

- formed as a result of activities aimed at generating income.

Differences in the recognition of expenses can be not only in their various types, but also in the following cases:

- Some expenses are standardized in tax accounting. This means that the amount of such expenses is not accepted in full, but in the amount determined by the standards by law. In accounting, if an amount is recognized as an expense, it is accepted in its entirety.

- Also, as with the recognition of income, the moment of accepting expenses for accounting and tax accounting may differ. This depends on the method used for calculating the taxable base - the accrual method or the cash method.

Due to differences in the recognition of income and expenses, accounting profit and tax profit may differ from each other. This difference is called a time difference.

Temporary differences are income and expenses in accounting that form accounting profit in one period and tax profit in another.

Recognition of expenses

Differences in depreciation in accounting and tax accounting

The calculation of depreciation on fixed assets in accounting is regulated by PBU 6/01, and in tax accounting - by Article 259 of the Tax Code of the Russian Federation. For accounting purposes, the following methods of calculating depreciation are recognized:

- linear;

- reducing balance method;

- method of writing off cost by the sum of numbers of years of useful life;

- method of writing off cost in proportion to the volume of products (works).

In tax accounting, it is allowed to use only two methods of depreciation of fixed assets: linear and non-linear. Thus, if the management of an enterprise chooses different methods for calculating depreciation amounts, then a difference arises in these indicators.

Differences are also possible when determining the useful life of a fixed asset. For accounting purposes, the useful life of an object is determined independently based on the characteristics of the fixed asset.

In tax terms, the useful life of an object is established on the basis of the Classification of fixed assets, where such a period is established by law. Also in this accounting, it is possible to apply increasing or decreasing coefficients to the depreciation rate, which either accelerate the disposal of the object (when it operates in conditions of increased shifts) or reduce the expenses of the current period. Such coefficients can also be applied when calculating depreciation on leased property. The depreciation bonus (expenses for capital investments) is applied exclusively in tax accounting conditions and reduces taxable profit.

Differences between accounting and tax accounting when creating reserves

Reserves are resources that are created at the enterprise, from which current expenses are subsequently written off. When planning and creating reserves, it is necessary to take into account that in accounting there are mandatory reserves (taking into account exceptions) and reserves that are not required to be formed.

Reserves

Tax accounting does not provide for the creation of mandatory reserves. All reserves are created voluntarily; this is the right of the organization, which must be enshrined in its accounting policies. Only those enterprises that use the accrual method for tax purposes have the right to create reserves for this type of accounting.

Depreciation

Starting from the 1st day of the month following the month the OS was put into operation, the accountant should begin to calculate depreciation, that is, regularly write off part of the cost of the object as current expenses. Depreciation is temporarily suspended in the case of transfer of an object for free use, conservation lasting more than 3 months, as well as reconstruction and modernization lasting more than 12 months.

Tax accounting provides two methods for calculating depreciation: linear and non-linear. For objects belonging to the first to seventh depreciation groups, an organization can choose any of the two methods and apply it to all objects without exception, regardless of the date of their acquisition. For objects of the eighth to tenth groups there is no choice; for them the linear method is required.

According to tax accounting rules, a company has the right to change the method from the beginning of the new year. At the same time, you can switch from a linear method to a nonlinear one, as well as from a nonlinear to linear one, no more than once every five years.

The linear method is applied to each object separately, and the non-linear method is applied to the entire depreciation group.

Regardless of the method, taxpayers may apply increasing factors to the depreciation rate if certain conditions are met. In particular, if fixed assets are operated in a hostile environment or with increased shifts, the depreciation rate can be multiplied by a factor not exceeding 2 (see “How to apply increasing factors: litigation on fixed assets in a hostile environment”).

The difference between the original cost and accrued depreciation is called the residual value of the object.

By the way, in accounting there are not two, but four depreciation methods, and increasing coefficients are generally not provided.

Keep records of depreciable property for free according to the new rules

Linear method in tax accounting

To use it, you need to calculate the depreciation rate for the fixed asset. This rate is equal to one divided by the useful life (expressed in months) and multiplied by 100%.

The monthly depreciation amount is equal to the original cost multiplied by the depreciation rate.

Example

Let's say the useful life is 5 years (which corresponds to 60 months), the initial cost is 200,000 rubles. Then the depreciation rate will be 1.67% (1: 60 months x 100%), and monthly depreciation will be 3,340 rubles (200,000 rubles x 1.67%).

Depreciation must be stopped on the 1st day of the month following the month when the cost of the fixed asset was completely written off, or when the fixed asset left the organization.

Nonlinear method in tax accounting

To use it, it is necessary to determine the total balance for each depreciation group. To find it, you need to add up the residual value of all objects included in this group. The total balance must be determined on the 1st day of the month for which depreciation is calculated. If a company has put into operation a new facility, then from the next month its cost will be included in the total balance of the corresponding group. When an object is disposed of, the total balance is reduced by its residual value.

The amount of monthly depreciation for a group is equal to the total balance multiplied by the depreciation rate for this group and divided by 100. Depreciation rates are established by the Tax Code: for the first group 14.3; for the second - 8.8; for the third - 5.6, etc.

Example

Let's say the total balance for the first depreciation group is 1,000,000 rubles. Then depreciation will be 143,000 rubles (1,000,000 rubles x 14.3: 100). If the total balance of a depreciation group reaches zero, such a group is liquidated. If the total balance is less than 20,000 rubles, the company also has the right to liquidate the group and write off the balance value as non-operating expenses.

Differences in depreciation

- The presence in accounting of 4 methods of deduction of funds for depreciation, in contrast to 2 in tax accounting. At the same time, depreciation will be equal in both cases if the methods coincide. But, today, this is a rather rare situation, since institutions try not to limit themselves to the choice of value transfer methods, but use all kinds of permitted ones.

- premiums in tax depreciation that benefit businesses. They allow you to reduce tax costs. The bonus begins to apply as soon as the equipment is put into operation and can amount to up to 30% of its cost.

- Accounting depreciation involves transferring the cost of objects for each of them separately . In the tax service, if a non-linear method is used, then depreciation is deducted for objects collected in groups.

- In Tax accounting, you do not have to calculate the amount of equipment depreciation for each month separately. There are already certain deduction norms here. This means that the amount of deductions decreases monthly.

Thus, the differences between tax and accounting depreciation are much greater than the similarities. Knowing these features will help you avoid confusing these two seemingly similar concepts.

How to take into account the costs of maintaining and repairing fixed assets

Amounts spent by the company on current or major repairs of fixed assets are written off as other expenses for the period in which they were made. Another option is possible: create a reserve for upcoming OS repairs.

In practice, difficulties arise due to the fact that inspectors regard current repairs as modernization (reconstruction, technical re-equipment, completion or additional equipment). The cost of such work is not considered current expenses, but is included in the initial cost. And this, in turn, increases the tax base and the amount of income tax. Therefore, it is very important for an accountant to prove and document that repairs written off as expenses are not modernization, additions, etc.

Write-off of fixed assets

When selling fixed assets, the company receives income in the amount of revenue (excluding VAT) and expenses equal to the residual value of the object. The difference between income and expenses is the taxable base on which you need to pay income tax. If this difference is negative, the organization experiences a loss. It must be written off as other costs in equal shares over a certain period of time. This segment represents the useful life of the fixed asset, reduced by its service life until the moment of sale.

If an object is disposed of due to unsuitability, liquidation costs can be classified as non-operating expenses. With the straight-line depreciation method, depreciation that has not been accrued in accordance with its useful life can also be included as expenses.

Depreciation of fixed assets upon disposal during sale, reorganization

Disposal of property is carried out during sale to third parties, reorganization of the enterprise, write-off due to loss of properties. When property is disposed of in connection with the sale, amounts in the form of underaccrued depreciation are included in other expenses of the enterprise.

Example of transactions upon disposal of property due to sale

The company entered into an agreement for the sale of equipment with an initial cost of 138,300 rubles. At the time of registration of the sale, the fixed asset has accrued linear depreciation in the amount of 25,500 rubles. In enterprise accounting:

- The write-off of the initial cost of equipment is reflected: Dt 01/ 9 Kt 01/1 in the amount of 138,300 rubles;

- Depreciation was written off: Dt 02 Kt 01/9 in the amount of 25,500 rubles;

- The residual value is taken into account in expenses: Dt 91/2 Kt 01/9 in the amount of 112,800 rubles.

Depreciation of property during structural changes in an organization has the following features:

- When reorganizing an enterprise, depreciation is accrued in the month of the structural change;

- After the transfer of the fixed assets, the start of deductions is made by the legal successor from the month following the registration of the reorganization;

- When liquidating an enterprise, underaccrued depreciation is included in non-operating expenses using the straight-line accrual method;

- If the liquidated organization uses the non-linear method, the remaining amount is written off in the previously established manner as part of the group.

The nonlinear method involves decommissioning property and groups without changing the cost balance.

Analytical accounting of fixed assets

Analytical accounting of income and expenses for fixed assets must be kept separately for each object. The exception is fixed assets, which use a non-linear method - here depreciation can be taken into account for the group as a whole.

Analytical accounting must contain the following information:

- about the initial cost of an object sold (disposed of) in the reporting (tax) period;

- on changes in the initial cost during completion, additional equipment, reconstruction, partial liquidation;

- about the adopted depreciation method;

- about the useful life;

- on the amount of accrued depreciation for the period from the start date of depreciation accrual to the end of the month in which such property was sold (disposed of) - using the linear method;

- on the amount of accrued depreciation and the total balance of each depreciation group - with the non-linear method;

- on the residual value of objects upon disposal;

- on the selling price of the fixed asset;

- on the date of acquisition and date of disposal;

- on the date of transfer into operation, on the start date of conservation, reconstruction, modernization and transfer for free use;

- on costs associated with the sale (disposal) of the object.