Girls, please explain, who knows how to read the balance sheet correctly? Using 1C as an example: open the accounting database, select the “Account balance sheet” item in the “Reports” menu. Ask your accountant to bring you a balance sheet for account 28 (goods). But I don’t understand your question. The balance sheet is the balances and turnover of accounts. Start by checking the basic rules for preparing a balance sheet.

Report.Account Analysis (in 1C you will find the report in the menu.Reports - Account Analysis). The report allows you to see changes in the accounting account in the context of corresponding accounts. Konstantin, please tell me about the account card 41. In general, everything is clear to me. The general director works part-time and has not gone on vacation since 2008. The pay in the company where he works part-time will be the same as in a regular full-time company.

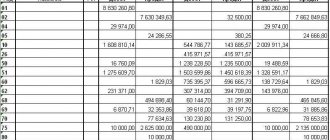

The information on the accounts contained in the SALT is reflected in our table. It will help analyze the SALT for any account and identify doubtful points. Check the consistency and consistency of balances and turnover on interconnected accounts.

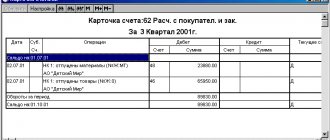

Even if the accountant made a mistake and entered data into the wrong accounts, in any case, we will not lose this operation. Information on any accounting account in the 1C program is obtained using a report. A useful report when you need to see the movements in an accounting account by date (in chronology), how what happened. In our version, account 41 “Goods” had one receipt of goods and two sales of goods.

Each product remained in stock at the end of the reporting period. But these small ones? -5, 3, 5 - what is this? I don’t know if my question is clear. Thank you for the material, I read it in one sitting and really wanted to read and learn more!!! I work at the Pension Fund, I haven’t worked closely with accounting, but I need to develop. Request an explanation of the tax credit from the accountant and check the availability of tax invoices for the amount of the tax credit declared in the reporting.

No matter how much I fight, I can’t understand. But I need it. I’m already ashamed in front of the director and in general in front of my colleagues. The totality of active account balances is the tangible and intangible assets (resources) of the organization.

And active-passive accounts - settlement accounts - can form both an asset and a liability on the balance sheet. IMPORTANT! In the chart of accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, accounts are grouped by sections, and not by asset or liability. There are accounts that should not have a balance at all. Novice accountants sometimes confuse the type of accounts and subaccounts (active, passive, active-passive). How about we display this information as an additional field directly in the back?

Control of cash flow at the enterprise (accounts 51 and 50)

The availability and flow of funds is an assessment of the operation of the enterprise as a whole. To break down cash receipts and expenses incurred, the company uses the following accounts:

- 51 – bank transactions.

- 50 – cash transactions.

The formation of balance sheets for them will allow you to track expenses, check the effectiveness of activities for making further management decisions.

51 counts

An organization's current account is the main instrument of its activities. Everyday necessary actions are carried out through it:

- settlements with buyers and suppliers;

- transfer of wages;

- paying taxes and much more.

Every day, banks provide statements of balances to their customers. It is necessary that the information provided coincides with the assessment of the current account status reflected in the organization.

Attention! Account 51 is active, that is, only a debit balance can be displayed at the beginning and end of periods.

For reliable reporting and accounting at the enterprise, a balance sheet is generated daily after receiving the statement.

For Dt, various cash receipts are indicated, for example, from customers, for Kt - expenses incurred for the selected period. Checking the end of the period consists of reconciling the balances with the bank statement.

This example indicates that during the analyzed period of time the organization received good revenue from paying customers, and this made it possible to cover existing expenses and increase cash reserves.

Advice! Many businesses have multiple checking accounts. It is better to create a statement for each individual bank for prompt reconciliation of balances.

50 count

Many organizations make payments through the cash register. Its presence is necessary, for example, in public places (shops, restaurants). Various business transactions are carried out through the cash register. However, the law establishes the obligation to have a limit on the cash balance and the amount in excess of the limit is transferred to the bank. Therefore, at present, the main use of the cash register is receiving payments and issuing salaries.

Accounting for the movement of money at the cash desk is recorded on account 50. All reflection of receipts and expenditures occurs in the same way as accounting 51. In turn, the analysis of turnover through the balance sheet of account 50 serves as a check on account 51 in order to avoid distortion of information about the financial condition. In addition, the balance of money in the cash register allows you to check compliance with limits. The final balance of 50 together with 51 is a reflection of the company’s work in the market.

Help me learn how to read a balance sheet...

Finally, we can save all the settings we have made so that we can always return to them in the future. This can be useful if there are suspicions that someone has processed documents from closed periods and the turnover has begun. In general, I advise everyone to save its turnover in an electronic archive after the period is closed. How to help the site: tell (share buttons below) about it to your friends and colleagues. Do this once and you will make a significant contribution to the development of the site. There are no ads on the site, but the more people use it, the more energy I have to support it.

Equipment accounting (account 01)

Any work process requires the necessary equipment. This can be not only machines, but also buildings, structures, and expensive office equipment. In accounting, this should be reflected in account 01.

01 account

According to current legislation, in tax accounting, fixed assets (i.e., equipment necessary to support the organization’s activities) include everything costing more than 100,000 and having a service life of more than a year. Equipment and office equipment are used in daily activities and are not purchased for sale. The balance sheet for 01 serves not only to check the availability of fixed assets at the enterprise and their movement, but is also a necessary tool for the formation of property tax.

The commissioning of new fixed assets is reflected by turnover on the debit side, write-off (moral, physical wear and tear or otherwise) - on the credit side.

Attention! For proper control over all available equipment, it is necessary to inextricably analyze two balance sheets: both by the presence and movement of the assets themselves, and by accrued depreciation for the period (account 02).

An example of creating a statement of fixed assets in practice

The company is engaged in renting out offices. The organization's balance sheet includes a building, cars and various office equipment. For her activities, she bought a computer worth 120,000 for the legal department. Since the cost of new equipment is over 100,000, it is durable and will be used to carry out the main activity, this computer is put into operation as a main tool. The generated balance sheet will be presented as follows:

Control of wage payments (account 70)

The company's settlements with personnel regarding wages are recorded on account 70. Account 70 reflects the accrual of salaries, vacation pay, and other payments. Assessing the beginning and ending balances for a period allows you to track wage arrears on time, because personnel are the main link in any enterprise. The balance sheet in this case clearly demonstrates payments and accruals of funds. Debit 70 reflects amounts paid to employees, credit 70 reflects accrued wages. To check account 70, it is convenient to generate payroll sheets in any form for payroll and compare them with the created sheet. This will provide deeper analysis and control.

Characteristic

Movement on account 51 begins immediately as soon as this account was opened at the bank. Funds entering the account will create debit turnover, and the expenditure of funds will be reflected in credit transactions.

Account 51 is active. This means that the opening and closing balances can only be debit. The results of account 51 are reflected in the asset balance sheet of the organization, since it is active.

Operations carried out on account 51 must be carried out only in ruble currency. REFERENCE! Each movement of funds through account 51 must be accompanied by supporting documentation.

Such documents include:

- Bank statements for any open account. Account 51 refers to synthetic accounts, so it is logical to open subaccounts on it. They separately reflect movements for each open account and each bank.

- Outgoing payment requests or instructions that served as the basis for carrying out debit transactions. Credit 51 accounts show not only money transfers, but also cash withdrawals. Then the basis is the counterfoil of the check.

- The debit of account 51 reflects the receipt of revenue when it was deposited by representatives of the organization. This fact is recorded in the bank order.

- Account 51 in the accounting department is debited when money arrives from buyers and other debtors. In this case, the basis is an incoming payment order from the counterparty.

https://youtu.be/7yBU31LBY9Q

Control of settlements for short-term loans and borrowings (account 66)

Almost any organization uses borrowed funds to carry out its current activities and expand its business. In accounting they are divided into the following categories:

- Long-term loans and borrowings (account 67 for liabilities over a year).

- Short-term loans and borrowings (66 account for liabilities up to a year).

The balance sheet for account 66 allows you to see the flow of funds to pay off debts: payment of debt is reflected in the debit of account 66. All transactions are carried out in correspondence with 51 or 50 accounts. All loans issued during the period of analysis of the statement are taken into account in the turnover of 66 loan accounts. The final balance allows, along with cash statements, to make a decision on attracting additional borrowed funds or switching to own collateral.

Control of production costs (account 20)

Any production process has direct and indirect costs. Direct costs are reflected in account 20 (“Main production”). In large enterprises that are not involved in production, account 20 is used for costs directly for the implementation of core activities. For example, landlord organizations can reflect on it all the costs of maintaining the building and rented premises.

When considering the turnover balance sheet of account 20, it is necessary to take into account the following: all production costs are reflected in turnover for Dt:

- remuneration for workers of main production (Dt 20 Kt 70);

- transfer of materials to production (D20 Kt70)

- arising obligations, for example, for the cost of repair work.

Attention! When closing the month, expenses from account 20 should be written off to other accounts. The final balance in the turnover balance sheet of account 20 can only be if there is work in progress.

Materials accounting (account 10)

Account 10 in accounting allows you to group all purchased materials. There are several sub-accounts to it, the main ones being:

- materials for main activities;

- household equipment;

- general household materials (auxiliary supplies purchased for work, for example, office supplies)

Materials from the 10th account are written off to production using requirements - invoices. Credit turnover reflects the quantity and amount of materials used; debit turnover shows the purchase of new materials. The reverse balance sheet for account 10 allows you to control the process of purchasing materials and the result of their use for current activities; the balance of materials in warehouses is also displayed, which provides a good opportunity to make the right decisions about making new purchases.

When taking into account materials, there are some nuances. Depending on the chosen accounting policy, they can be written off at the average cost of all purchases or using the FIFO method (the cost of the first purchases is written off first).

The balance sheet of account 10 must be especially carefully controlled. Situations often arise when documents are processed inconsistently. In this case, the closing balance can show negative amounts of materials written off, and this entails distortion of income tax reporting.

An example of generating a statement for a materials account:

Balance sheet: its importance in accounting

4) from this report you can see all our assets in total terms and liabilities in total terms, i.e. this report is analogous to a balance sheet.

In one case, the company owes all its assets to its shareholders, in the other case, the company owes 90% of its assets to the bank and 10% of its assets to its shareholders. Therefore, when you invest in a company, that is, become its shareholder, it is important for you to know how much the company owes to other persons (not shareholders). I didn't waste my time in vain, because... I love and believe in miracles, for me you are a Wizard.

Thank you! Well, now we’ll study the same material in full detail again to consolidate it, and the unknown planet will become much closer and clearer! This report is from 1C, specifically for account 41, these are the balances of the quantity of goods, these are not AMOUNTS!! Or rather, 58,000, 55,000, 50,000 is clear. how it was formed.

Unfortunately, in 1C, each configuration has now become increasingly different from each other, and having studied one version, there is no guarantee that everything will work out correctly in another configuration.

Do you have any more material? I would like something on balance analysis, it’s very necessary! I realized that only you can help me! Excellent material, in terms of presentation. I would like another lesson about off-balance sheet accounts, although this is excellent. When we compile the turnover, we entered the account numbers, filled out the debit turnover... where do the credit turnover come from?

Sales control (account 90)

The most complete result of the company’s activities is visible on account 90 (“Sales”). Account 90 is a reflection of the main operations by type of activity of the organization.

Account 90 contains several sub-accounts that reflect revenue, cost, VAT, and financial results of activities in a selected period of time.

Attention! When closing the month, all subaccounts 90 must have a zero balance (exception 90.09 - profits and losses from sales). 90.09 should also be closed at the end of the year.

The formation of a turnover balance sheet for account 90 allows you to check the situation in the enterprise as a whole: sales revenue is reflected in the turnover credit of account 90, and cost is reflected in the debit.

Indicators

“Turnover” allows you to conduct a detailed analysis of the information collected on accounting accounts in the shortest possible time. Before starting to consider SALT, you need to study the structure of the accounting (NU) accounts.

There are three groups of accounts: active, passive and active-passive. The procedure for collecting and systematizing for a particular group is individual. To correctly understand the information from the statement, you need to know the parameters for maintaining accounts, which of them may have a balance, and which must certainly be closed within a certain period. For example, account 20 must be closed monthly, accounts 90 and 91 do not require this procedure in the context of subaccounts, and, meanwhile, the final balance is not formed for them.

Timely verification of the correctness of the reflection of information makes it possible to eliminate errors and create a balance sheet that reflects the real picture of the organization’s financial position.

The main benefit of OSV is to speed up the reporting process, as well as to quickly provide information to external users.

Control of payments for taxes and fees (account 68)

The main obligation of all organizations is to pay all necessary taxes and fees. Opening 68 accounts in the accounting department makes it possible to group taxes and track debts. In addition, account 68 allows you to reconcile balances with regulatory authorities using statements of taxes and fees.

Analysis of account 68 is of great importance; only timely control of taxes is the key to successful business and the absence of additional costs for fines and penalties.

In its composition, account 68 has many sub-accounts that reflect all the taxes necessary for payment. It is most convenient to create a balance sheet for account 68 by grouping it into subaccounts to display not just the total debt, but also for each specific tax. 68 account can be checked with statements on the transfer of monetary assets (sometimes incorrect entries may be made to sub-accounts)

Control of settlements with various debtors and creditors (account 76)

In order to reflect general information on mutual settlements with other legal entities not included in the breakdown of 60-75 accounts, 76 is used. It analyzes mutual settlements associated with the following situations:

- property and personal insurance;

- claim settlements;

- dividends, etc.

Example: reverse - balance sheet 76 can reflect insurance payments required for payment on a credit basis, and the transfer of these amounts on a debit basis. The final balance of account 76 allows you to track debts and make decisions on the redistribution of funds for various payments.

The generated balance sheets for the main accounts allow you to clearly and accurately assess not only the efficiency of the enterprise, but also check the correctness of business transactions in accounting.

Post Views: 4,222

Application

It was previously noted that the statement is a register of information about the facts of quantitative and qualitative changes in aspects of the company’s economic activities. Let us note several main functions of OSV:

- identifying inaccuracies and distortions in accounting;

- bringing together information about the state of the enterprise;

- source for assessing profitability;

- factor determining development paths;

- monitoring the correctness of accounting and accounting records;

- assessment of the company's profitability by external users;

- control over the distribution of cost indicators.

The statement can be compiled at any required time (per day, month, quarter, year), for a specific account or for a combination of several.