In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

For this I have my own approach: when giving new knowledge, I strive to ensure that there is a repetition of the previous ones. In other words, we repeat the knowledge that serves us as a support for new ones.

I would like to note that in this series of articles about filling out a balance sheet, I will talk about general ideas, basic rules, and show how it is done. Together with me, you will go all the way to creating a balance sheet based on the OCB of a real enterprise.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet .

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

Here's what we should do now:

- download the balance sheet and open it

- In the “name” column, write the name of the account. No need to look at the chart of accounts. There is no need to achieve some exact match between the name of the account and what it is called in the chart of accounts. Just remember and write. It is enough that your name reflects the essence of the account. For example . I will call the 50th account “Cashier”. And in the chart of accounts it can be called “Enterprise Cash Office”.

- in the “AP” column for each account, indicate what it is, “A – active account”, “P – passive account” or “AP – active-passive account”. Hint : Active accounts are those that store information about what the company has and this is “what” helps the company operate and earn money. Usually “it” can be touched. Active accounts always have a debit balance or zero. Liability accounts are the debts/obligations of our company. This is simply information about the amounts owed. Passive accounts always have a credit balance or zero.

Of course, putting down “A, P and AP” is not an easy task. This requires knowledge and some reflection. I agree that there are invoices where you can issue them right away, and somewhere you can use a hint and enter the required characteristics. In any case, put it where you can do it. And fill in the remaining empty cells according to the chart of accounts. Download the chart of accounts.

Once you solve the problem, compare it with what I did.

Some General Rules and Observations

I assume, reader, that you remember that accounting accounts collect and store information about the activities of a business. All information is separated according to certain criteria. So, the code and name of the accounting account serves as a separation criterion. As a result, OSV shows all the accounting accounts involved in our enterprise. From the OSV we see what information has been collected.

However, the balance sheet collects business information in a different way.

Firstly , the balance sheet divides information into ASSETS and LIABILITIES.

Secondly , within ASSET and LIABILITY, information is divided into certain groups. Each such group is an economic indicator.

Ultimately, SALT is simply regrouped on the balance sheet.

- All debit balances, and these are accounts with characteristic A, go to the “ASSET balance” section

- All credit balances, and these are accounts with characteristic P, go to the “LIABILITY” section of the balance sheet.

- Accounts with the AP characteristic are transferred to the balance sheet as follows: if there is a debit balance, it goes to an ASSET, if there is a credit balance, it goes to a LIABILITY.

The amount received in ASSET or LIABILITY is entered into the specific name of the economic indicator. The basis for including the amount in the economic indicator will be the name of the accounting account, or, when it is not clear, we will use the law on filling out the balance sheet. Well, we will start filling out the balance very soon.

Help me learn how to read a balance sheet{amp}amp;#8230;

Let's calculate the balance sheet currency - 105,000.00 rubles. These data coincide with the data of the Turnover Balance Sheet.

Now let’s fill in the data on the Liability Balance Sheet. Authorized capital – RUB 100,000.00. Let's calculate accounts payable. Let's turn to settlement accounts - 60, 71 and 75. The total credit balance of these accounts is RUB 5,000.00. (amount for account 60).

Balance currency 105,000.00 rub. Please note that the balance sheet currency is the same in both the Asset and the Liability, that is, the total of the Asset is equal to the total of the Liability. This means that the balance sheet in 1C accounting is formed correctly.

Let's, based on the data on the accounting accounts, create a balance sheet in our 1C program, and draw up a Balance Sheet.

The manager should remember that the debit balance on account 99 means the company’s final loss, and the credit balance means net profit.

There are many accounting programs that only require posting transactions. The correctness of accounting is tracked automatically, which is very convenient, especially for novice accountants. As a rule, these programs are linked to primary documents and contracts and are based on Excel. The most popular program is 1C.

If you keep records in the 1C program, then work becomes easy and interesting. Post transactions across accounts, and the program will create the balance for you. You just need to read it correctly, find random errors and correct them in a timely manner.

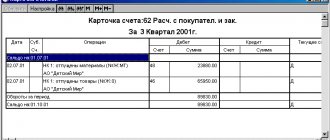

The balance sheet forms the balance sheet and checks the posting of accounts for errors. SALT can be compiled both for analytical accounts (for one specific account) and for the enterprise as a whole (for synthetic accounts). Sample balance sheet for a specific account

SALT on a separate accounting account allows you to see the movement of funds or property according to individual items of costs or income. And also in it you can see the beginning and ending balance of the account as a whole and each item separately.

Sample SALT for balance sheet account 20 “Main production” broken down by costs

How to fill out SALT for an enterprise: example

Example of SALT for a quarter for a specific enterprise

The main and only requirement is a zero balance at the end of the reporting period.

Is this not what we expect to see?

Let's see how our turnover has changed. I'll comment a little. Look, account 26 at the end of the month was “closed” - it became 0. This is good. Here's a log of the wiring showing how it happened.

So, Debit 90 and 91 accounts collect the expenses of our company for the current month.

Important

Now we can calculate the financial result for each of them. Calculating the financial result is some kind of action on 90, 91 accounts. As you remember, accounts 90 and 91 should be equal to 0 after summing up the financial result.

And the final result of financial activities will be in account 99.

Zero balances for accounts 90 and 91 should be for the account as a whole. Sub-accounts of these accounts will have balances until December 31, pending the procedure - balance reformation. But more on that later.

This is how the situation looks in our SALT for accounts 90, 91 and 99.

- technical;

- brain teaser;

- methodological.

To identify technical errors, it is necessary to check the following relationships:

- compliance of the account balance at the beginning of the reporting period with the end of the previous period - during this check it is necessary to ensure that the initial data is correctly transferred from the SALT of the previous reporting period;

- compliance of data with analytical accounting registers for the corresponding accounts - for each account it is necessary to compare the initial amounts, turnover and final balance with the register data for the corresponding account.

The presence of methodological errors can be determined using the following indicators:

- The equality of the amounts of assets and liabilities at the beginning and end of the reporting period, as well as the equality of the amount of turnover on the asset to the amount of turnover on the liability for the reporting period.

Capital and reserves Authorized capital Retained earnings Profit of the reporting year 200 70 23 Current assets Inventories: - goods Accounts receivable Cash: - in cash - on current account5 Short-term liabilities Loans and credits: - bank loan Accounts payable: - for wages - for taxes - suppliers5 Total asset 945 Total liability 945

OSV clearly shows the movement on each account. Methodological negligence is manifested in the inconsistency of balances with the type of account and the economic nature of the transaction. For example, when there is a loan balance on the active account.

Modern accounting programs allow you to generate a balance sheet automatically

Errors when posting transactions are immediately visible: if you fill out the “turnover” incorrectly, the debit and credit balances will not converge, this is what makes the incorrect statement different from the correct one. Correct preparation of the SALT requires compliance with a number of requirements.

- The balance on the active account is found according to the algorithm: you need to add income to the initial balance and subtract expenses for the month. Calculate the final result and enter it in debit.

- The balance on the passive account is credit. It is calculated according to the algorithm: the initial credit balance is added to the credit turnover and minus the debit turnover.

- In analytical accounting there should not be negative values for some positions and positive for others, so that the result is 0. All accountants need to understand this rule.

- The company's revenue, as well as the final result of its activities (profit or loss), will be formed after the closure of direct and indirect costs.

- Profit is reflected in the credit of account 99 “Profits and losses” and accumulates throughout the year.

- The debit of account 99 shows a loss. On the last day of the year, you need to look at the resulting financial result and close account 99.

- Profit is transferred to the credit of account 84 “Retained earnings”. The loss is debited to account 84 “Uncovered loss”.

The final “turnovers” should show the manager a picture of the life of the enterprise: cash balances in the cash register and in the current account, the amount of profit, the amount of VAT and other taxes payable, etc. Further management decisions should be based on the figures and indicators of SALT. Using the SALT data, the entrepreneur receives a tool for financial control and adjustment of plans and tasks. Generalized and detailed OCB indicators are a reliable way to check the state of the enterprise and see the picture of the business.

Fixed assets and intangible assets when filling out the balance sheet

Fixed assets are inextricably linked with such a concept as depreciation (accounted for in account 02). Depreciation is a gradual decrease in the initial cost of an asset associated with the operation of the asset. The depreciation process for fixed assets occurs over a certain period of time, but more than a year. As a result, everything will come to the point that the amount of depreciation will be equal to the original cost of the operating system.

Look at SALT . Account 01 records the amounts of all fixed assets at their original costs. Account 02 takes into account the depreciation amounts of these fixed assets. Now you are asking yourself, what does this have to do with the balance sheet?

It would seem that according to the rules for posting amounts from SALT to the balance sheet, we must send the amounts from the 01st account to the ASSET, and send the amounts from the 02nd account to the LIABILITY of the balance sheet. However, there is an exception for Fixed Assets.

Its essence is that before sending the amount to the balance sheet, we take the amounts from 01, subtract the amounts from 02 and send the resulting amount to where????

IN THE ASSET balance. Because depreciation can never be more than the original cost of the asset, and therefore the difference between 01-02 will always be a debit. 01 account (A) > 02 account (P). Well, in extreme cases, it will be 0.

Exactly the same situation with accounts 04 and 05. This takes into account the assets of an enterprise that do not have a physical object, like a machine or a machine. Account 04 takes into account such assets of the enterprise as licenses, the exclusive right to a patent, the exclusive right to software, etc. Their period of use is also more than 12 months and they are not intended for resale. Everything is the same as with the OS. Depreciation of Intangible Assets (IMA) is accounted for on account 05.

To finish this article, I propose to do a practical task. We'll work a little with the numbers from the OS. The task is:

- divide your sheet in a notebook or notepad into two columns: “Asset” and “Passive”

- from SALT we will work with the column “Balance at the beginning of the period”

- according to all the rules studied in this article - write out the accounting accounts and amounts, what can be classified as “Asset” and what can be classified as “Liability”

- In each column, calculate the total of all amounts

- compare the total amount of “Asset” and the total amount of “Liability”

To complete the task, you already have previously downloaded OSV. If you haven't downloaded it yet, download it here.

Perhaps now we are ready to fill out the balance sheet. We will do this in the next article. I invite you.

Filling example

Let's look at an example of filling out 71 accounts. One of the company’s employees, for example Ivanov, received funds in the amount of 200,000 rubles for business needs. And Petrov, an employee of the same organization, received 20,000 rubles for business trips.

Accordingly, both employees will need to report on their expenses and provide relevant documents.

A week later, employee Ivanov, confirming his actions, brought an advance report containing 9,000 rubles. Petrov brought the same document, but only for 19,000 rubles.

This raises the question - how to compile SALT for account 71, where business transactions will be indicated?

Such a document will be compiled in the form of a table, where the columns will be designated as follows :

| Account (sub-account) / Analytical characteristics of a sub-account | Balance at the beginning of the period | Period transactions | balance at the end of period | ||

| Debit | Credit | Debit | Credit | Debit | Credit |

Moreover, in the first column will be recorded:

- Synthetic account.

- A subaccount on which transactions were also carried out, but only if it is included in the chart of accounts that will be used by the organization.

- Analytical features by which this subaccount can be determined. Here the signs can be anything, but most often they represent the initials of those employees to whom the cash was entrusted.

Next, you should record in the document the fact that two employees were actually given funds in the specified amount. Such transactions will correspond to the following transactions :

- Dt.71.01 Kt.50 - 10000;

- Dt.71.01 Kt.50 - 20000.

The following data should be reflected in the SALT:

- First, we enter two amounts in the Debit column opposite the corresponding account characteristics (in this case, these will be the names of employees).

- Next, we sum up the two numbers that will help form a debit, and indicate the resulting figure of 30,000 rubles in the Debit column opposite the account.

- If there were no other transactions on the account, then the resulting amount is duplicated again opposite the 71 account.

When employees present checks and reports, the following entries :

- Dt.10 Kt.71.01 - 9000;

- Dt.26 Kt.71.01 - 19000.

In the OCB we additionally indicate the following data :

- We enter checks for 9000 and 19000 opposite the initials of the employees in the Credit column.

- We sum up the data on credit transactions to get the amount of 28,000.

If the initial balance is zero, then in order to calculate the balance at the end of the month and duplicate it in SALT, you need to subtract smaller amounts from the large amounts listed in the columns under the Turnover cell at the end of the month.

If the former are recorded in the Debit section, and the latter in the Credit section, then the results of the calculations are indicated in the Debit section, located under the Balance cell at the end of the month. Here it will consist of:

- 1000 rubles according to the reports of employee Ivanov (this amount will be written opposite his last name);

- 1000 rubles according to the reports of employee Petrov (also recorded opposite the corresponding surname).

After entering the data in the Debit column, located under the End of Period Balance cell, opposite the account itself, you should sum up all the analytical characteristics of the account (in this example, it is 2000 rubles). The same value should be duplicated opposite account 71 under the Balance at the end of the month cell.

As a result, based on the results of operations, a debit balance calculated for 71 accounts is recorded in the SALT. And the total amount of such balance will be 2000 rubles.

And here is an example of what the result of all the above operations will look like:

| Account (sub-account) / Analytical characteristics of a sub-account | Balance at the beginning of the period | Period transactions | balance at the end of period | ||

| Debit | Credit | Debit | Credit | Debit | Credit |

| 71 | 30000 | 28000 | 2000 | ||

| 71.01 | 30000 | 28000 | 2000 | ||

| Ivanov | 10000 | 9000 | 1000 | ||

| Petrov | 20000 | 19000 | 1000 |

We fill out the balance sheet according to the turnover balance sheet

The goal is clear - to lead you, the reader, to filling out the balance. Make sure you are as prepared as possible for this action. And, although I have to try to make the explanation understandable, there is still something missing in this article.

I understand that there will still be questions, but I want to keep them to a minimum. I think that I will answer some of these questions in advance. Before we start filling out the balance sheet form , I suggest working a little more with SALT.

This is what we need to do.

- we continue to work with the first column of SALT - “opening balance”

- write down the invoices that you believe collect information about our company's debts. You can immediately start writing out those bills that you know are in SALT. You can go the opposite way - cross out those accounts that are responsible for the company’s property, for what you can touch. The remaining bills are what you need.

- Issued invoices have amounts in “Debit” or “Credit”, or even both. Write out the invoice, each amount, and write what kind of debt it is - “Should our

- Remember what is called “Our Debt” in accounting. In parentheses for these names, write accounting terms for each amount. For tips, read this article.

Once you do it, compare it with what I got.

How to make a balance sheet from SALT

In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

For this I have my own approach: when giving new knowledge, I strive to ensure that there is a repetition of the previous ones. In other words, we repeat the knowledge that serves us as a support for new ones.

I would like to note that in this series of articles about filling out a balance sheet, I will talk about general ideas, basic rules, and show how it is done. Together with me, you will go all the way to creating a balance sheet based on the OCB of a real enterprise.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet.

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet.

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

So, let's go...

So, let's go...

So, let's go...

So, let's go...

Methodology for preparing a balance sheet

Preparing a balance sheet is the most important element of the work of any accountant. A completed balance sheet of an enterprise is not only a document for reporting to the Federal Tax Service. It is also a source of data for analyzing the current activities of the enterprise and making forecasts. Let's consider what rules determine the procedure for filling out the balance sheet .

To be presented as official reporting, the balance sheet has a specific form. For the internal needs of an organization, it can have many modifications depending on the purpose and the type of data for its compilation:

· data can be taken either on specific dates (balance sheet) or by turnover for a period (turnover balance);

· source data can be either only accounting, or only inventory, or accounting that is confirmed by inventory results;

· data can be taken into account either with the inclusion of regulatory items (depreciation, reserves, markup) or without them;

· a balance sheet can be drawn up in relation to only one of the types of activities of the enterprise;

· the balance sheet can have either a full or abbreviated form;

· the balance sheet can be drawn up in the form of equality between assets and the sum of capital and liabilities, or it can be in the form of equality between capital and the difference between assets and liabilities;

· a balance sheet can be made for one organization or include data for several enterprises (consolidated and consolidated balance sheets);

· in relation to an event, there may be opening, liquidation, separation, and unification balance sheets;

· the balance can be preliminary, forecast, interim, final.

And this is not a complete list of possible options for drawing up a balance sheet for an organization to solve its internal problems.

Line-item filling of the balance sheet with explanation

You should start filling out the balance sheet by drawing up a balance sheet for all accounts for the past year. The basis for filling out the balance will be the balances of these accounts. If any of the balance sheet indicators is missing in the balance sheet, then it is necessary to put a dash.

Let's look at how the most important balance lines are filled out:

- Line 1110 “Intangible assets” is filled out using the formula:

- The following data is entered into line 1150 “Fixed assets” using the following calculation procedure:

- line 1170 “Financial investments” indicates investments for a period of up to 12 months. These include stocks, bills, bonds. The following formula is used to fill in:

- line 1210 “Inventories” is formed from the balance of accounts: 10, 15, 20, 21, 23, 29, 41, 43, 44, 45, 97 minus the balance of accounts 14 and 42;

- line 1230 “Accounts receivable” is calculated based on the account balances: 60, 62, 68, 69, 70, 71, 73, 75, 76. The exception is account 63;

- line 1240 “Financial investments” are calculated using the formula:

- line 1250 “Cash” is determined using the formula:

line 1370 – “Retained earnings (uncovered loss)” is filled in based on the account indicator 84.

After all significant lines of the balance sheet are filled in, the results are summed up and the report is checked. The balance sheet must be completed while maintaining the principle of equality. The results obtained in the asset must be equal to the results generated in the liability. If equality is not observed, then an error was made in drawing up the balance sheet.

Formation of a balance sheet is a responsible and important event, since the report is the main source of information for further analytical research at the enterprise. Only if the report is filled out correctly and accurately can the indicators calculated in the future be considered reliable.

Add a comment Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Find out how your comment data is processed.

How to collect a balance from a turnover balance sheet

However, the fundamental approaches to filling out this form remain the same regardless of the way the source data is reflected in it.

Recommended reporting forms for submission to the Federal Tax Service were approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

The full form of the balance sheet contains the entire list of items that are recommended to be highlighted in the appropriate sections of the balance sheet. However, an enterprise can exclude items from the balance sheet for which it does not have data, and, conversely, include additional items in it if this increases the reliability of the reports prepared.

The full form has a box to display notes for each article. The enterprise decides for itself whether it needs to use this column. Obviously, it becomes necessary for any deviation from the standard recommended form.

The basic rules governing the procedure for drawing up a balance sheet for official reporting purposes are contained in PBU 4/99, approved by Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n. They boil down to the following:

· the source of information for drawing up the balance sheet is accounting data;

· accounting data must be generated according to the rules of the current accounting regulations and in accordance with the accounting policies adopted by the enterprise;

· credentials must meet the requirements of completeness and reliability;

· an enterprise that has branches draws up a single balance sheet for the organization;

· data reflected in the balance sheet must be neutral and correlated with data from previous periods;

· the allocation of items in the balance sheet sections is carried out according to the principle of materiality;

· the reporting period for the balance sheet is a calendar year;

· assets and liabilities reflected in the balance sheet should be divided into short-term and long-term (existing for less than and more than 12 months, respectively);

· offset between items of assets and liabilities is not made if it is not provided for by the PBU;

· property is valued at its “net” value (less regulatory items);

· accounting data of the annual report must be confirmed by inventory.

The balance sheet is filled out on the basis of information about the balances in the accounting accounts as of the reporting date. These balances are reflected in the balance sheet in accordance with the objectives assigned to a specific report.

In relation to data on the financial result (retained earnings/uncovered loss), the current balance sheet is prepared, as a rule, by including in the reporting period the full number of months of the year for which it is formed. This is due to the fact that financial results accounts are generally closed on a monthly basis.

Data in the balance sheet are most often shown in thousands, less often in millions of rubles.

The division of assets and liabilities into long-term and short-term is provided for by the structure of the balance sheet. In his assets, two sections are allocated for this: non-current assets (long-term) and current assets (short-term). The liability is divided into three sections, two of which are sections on obligations, divided by the time of circulation (long-term and short-term). The third liability section reflects data on equity, which occupies a special position in the structure of the balance sheet.

Reflecting information on specific balance lines has its own characteristics:

· data on the cost of fixed assets (including those intended for rental) and intangible assets are shown, as a rule, minus depreciation;

· information on R&D, tangible and intangible exploration assets is filled in only if such assets are available, while exploration assets are reflected net of depreciation;

· data on financial investments, which are loans issued, cash investments in banks (deposits), deposits in other organizations, in securities, are divided depending on their maturity into long-term and short-term and are shown, respectively, in different sections of the asset, when in this case, the amounts are reflected minus the created reserve for depreciation of financial investments;

· information about deferred tax assets and liabilities present in the asset (non-current assets) and liability (long-term liabilities) lines of the balance sheet is filled out only by those organizations that apply PBU 18/02;

· data on inventories, including balances on accounts for materials (with inventory items), goods, finished products, work in progress, RBP, are reduced by the amount of created reserves for depreciation of goods and materials and the amount of trade margin, if goods are accounted for with it;

· accounts receivable and payable, which are amounts that someone owes the company and that the company owes to someone (counterparties, budget, funds, employees), are shown in detail and are reflected, respectively, in the assets and liabilities of the balance sheet as part of short-term liabilities; in this case, accounts receivable are reduced by the amount of created reserves for doubtful debts and data recorded on other balance sheet lines (financial investments);

· VAT on advances may be reflected in the balance sheet differently, depending on the accounting policy adopted by the enterprise;

· cash (cash, non-cash, foreign currency) are shown in the total amount minus deposits accounted for in the lines of financial investments;

· the amount of additional capital, if present in accounting, is divided into two lines, depending on whether it is related to the revaluation of property;

· financial result (retained earnings or uncovered loss) in the annual balance sheet represents the result of activities for a finite number of years (after balance sheet reform), and in interim reporting it consists of two figures (financial result of previous years and financial result of the current period), while outside depending on the reporting period, it may be a negative value;

· data on borrowed funds are divided into long-term and short-term liabilities according to the remaining period of their repayment and are shown in different sections of liabilities, while accrued interest on long-term loans is included in short-term debt;

· in a similar manner, depending on the remaining period of use, estimated liabilities are divided into long-term and short-term liabilities reflected in different sections of liabilities, which correspond to the amounts of created reserves for future expenses;

· data on future income additionally includes information on the amounts of targeted financing;

· all sections of the balance sheet, with the exception of the “Capital and Reserves” section, have a line for reflecting other assets or liabilities, intended for entering into it data that does not find a place in other lines of the corresponding section, or for those data that the organization decided to show separately .

· To fill out balance sheet items, data on balances formed as of the reporting date is taken from specific accounting accounts. In relation to the current version of the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, when filling out the full balance sheet form, the balances on the following accounts are used:

· for the article “Intangible assets” - the final balance on account 04 minus the total on account 05, while for account 04 the data falling in the line “Results of research and development” is not taken into account, and for account 05 – figures related to intangible search results assets;

· for the article “Results of research and development”, data on R&D costs reflected in the balance on account 04 is selected;

· for the articles “Intangible exploration assets” and “Tangible exploration assets”, data on the costs of developing natural resources is taken from account 08 minus depreciation related to these assets, taken into account, respectively, on accounts 02 and 05;

· for the item “Fixed assets”, the data is determined as the difference between the balances of accounts 01 and 02 (account 02 does not take into account figures related to material exploration assets and profitable investments in tangible assets), to which is added the amount of capital investment costs accounted for accounts 07 and 08 (except for the figures included in the lines “Intangible search assets” and “Tangible search assets”);

· for the article “Profitable investments in assets”, the difference between the balances of accounts 03 and 02 in relation to the same objects is taken;

· for the item “Financial investments” in non-current assets, data on long-term amounts (with a repayment period of more than 12 months) in accounts 55 (for deposits), 58, 73 (for loans issued to employees) is selected, which are reduced by the amount of reserves for long-term investments (account 59);

· for the item “Deferred tax assets” the balance of account 09 is taken;

· for the item “Inventories”, the amount is formed by adding the balances on accounts 10, 11 (both accounts minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting of goods is carried out with a markup), 43, 44, 45, 46, 97;

· for the article “Value added tax on acquired assets”, the balance of account 19 is taken;

· for the item “Accounts receivable”, the debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus the data recorded under the item “ Financial investments"), 75, 76;

· for the article “Financial investments (except for cash equivalents)” in current assets, data on short-term amounts (with a repayment period of less than 12 months) in accounts 55 (for deposits), 58, 73 (for loans issued to employees) is selected, which reduced by the amount of reserves for short-term investments (account 59);

· for the item “Cash and cash equivalents” the amount is obtained by adding the balances of accounts 50, 51, 52, 55 (except for deposits), 57;

· for the article “Authorized capital (share capital, authorized capital, contributions of partners)” the data is taken as the balance of account 80;

· for the item “Own shares purchased from shareholders”, the balance of account 81 is taken;

· for the article “Revaluation of non-current assets”, data on balances on account 83 related to fixed assets and intangible assets are selected.

· for the item “Additional capital (without revaluation)” the data is formed as balances on account 83 minus data relating to fixed assets and intangible assets;

· for the item “Reserve capital”, the balance of account 82 is taken;

· for the article “Retained earnings (uncovered loss)”, the balance of account 84 is included in the annual balance sheet, and when preparing interim reporting, two balances are added up: account 84 (financial result of previous years) and 99 (financial result of the current period of the reporting year), in this case, the sum can be formed both by addition and by subtraction;

· for the item “Borrowed funds” in the section “Long-term liabilities”, long-term (with a remaining maturity of more than 12 months) debt on loans and borrowings is selected from the balances on account 67, while interest on long-term borrowed funds must be taken into account as part of short-term accounts payable ;

· for the item “Deferred tax liabilities”, the balance of account 77 is taken;

· for the article “Estimated Liabilities” in the “Long-Term Liabilities” section, from the balances on account 96, data on long-term reserves, the useful life of which exceeds 12 months, is selected;

· for the item “Borrowed funds” in the section “Short-term liabilities”, the balances on account 66, interest on long-term borrowed funds taken into account in the balances on account 67, and that debt on long-term loans and borrowings (account 67), which at the time of drawing up the report, are summed up has become short-term (less than 12 months left until its maturity);

· for the item “Accounts payable”, credit balances on accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 are summed up;

· for the item “Deferred income”, the balances of accounts 86 and 98 are added up;

· for the article “Estimated Liabilities” in the “Short-Term Liabilities” section, from the balances on account 96, data on short-term reserves, the useful life of which is less than 12 months, is selected.

Fill out your balance online for free

Dt account 55 subaccount “Deposit accounts” - Balance Kt on account 59 (only long-term investments) + balance on Dt account 73 subaccount “Settlements with personnel for other operations” (long-term interest-bearing loans issued to employees) Deferred tax assets 1180 Balance on Dt account 09 Other non-current assets 1190 Other non-current assets that were not reflected in the asset Total for section 1 1100 Sum of all lines from 1110 to 1190 Inventories 1210 Balance on Dt accounts 10, 11, 41, 43, etc. Value added tax on acquired assets 1220 Balance on account 19 Accounts receivable 1230 Balance on account 60, 60, 76, etc.

Balance sheet (form No. 1). Instructions, rules and filling procedure

Balance sheet

- this is a way of generalizing and grouping the assets of the economy and the sources of their formation - liabilities - at a certain date in monetary value. Balance sheet indicators characterize the financial position of the organization as of the reporting date.

The main task of the balance sheet

– show the owner what he owns or what capital is under his control. The balance sheet allows you to get an idea of material assets, the amount of reserves, the state of payments, and investments.

Analytical and synthetic accounting: filling out the “chessboard”

There are 3 types of turnover for accounting:

- across the entire set of synthetic accounts;

- on a separate synthetic account or subaccount;

- chess statements - they reflect all the entries from the operations log.

The form of the first type of statements is the same for all enterprises, since the list of synthetic accounts is the same for all and is fixed by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

The second type of turnover can vary greatly between companies, since each of them conducts unique business transactions.

We will show how in a particular case the turnover sheet is filled out, choosing for demonstration the synthetic 62nd account and subaccount 62.01 “Settlements with customers for shipped products.”

When preparing a turnover sheet, a table consisting of 7 columns is created. They contain the following information and indicators:

- The 1st contains the account numbers for which the statement is generated.

- In the 2nd and 3rd, the opening balance is given - by debit and credit, determined at the beginning of the reporting period.

- The 4th and 5th indicate the debit and credit turnovers carried out over the past reporting period.

- The 6th and 7th sections show the debit and credit balances determined at the end of the reporting period.

The initial data is as follows: there is a company that supplied its partner with products worth 140 thousand rubles. The funds from the buyer were not received in full - only 80 thousand rubles. The companies had not previously collaborated. Task: to prepare a turnover sheet for account 62 and the accompanying sub-account 62.01.

Dt 62.01 Kt 90 - 140 thousand rubles.

Dt 51 Kt 62.01 - 80 thousand rubles.

| Account name | Opening balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT | |

| 62 | – | – | 140 | 80 | 60 | – |

| 62.01 | – | – | 140 | 80 | 60 | – |

Let's explain the posting:

- The 2nd and 3rd columns are not filled in, since there was no relationship between the companies, which means that no debts were formed at the beginning of the reporting period.

- The amount of 140 thousand rubles is entered in the 4th column, since such a volume of products in monetary terms was delivered to the buyer.

- The amount of 40 thousand rubles is entered in the 5th column. These funds were received as partial payment for the products.

- In the 6th column, the final debit balance is recorded, and the amount of the buyer's debt to the company is entered. This indicator is calculated by subtracting credit turnover from debit turnover in subaccount 62.01 (140,000 – 40,000 = 100,000 rubles).

In our case, the balance and turnover in account 62 coincide with the balance and turnover in subaccount 62.01. In practice, this, of course, is rare, since subaccount 62.02 “Calculations for advances received” is usually used.

Not all accounting rules are regulated by regulations. Most operations are based on primary accounting documents: acts, certificates, invoices, checks, orders, etc. For primary documents, unified forms and recommended samples are provided. The form of the unified document is approved by the relevant instructions and can only be changed by entering additional details. A list of most of these forms with design examples can be found at this link.

Ordinary documents can be modified taking into account the specifics of the enterprise or filled out in any form. Unified forms cannot be changed. This is regulated by Federal Law No. 402-FZ “On Accounting” dated December 6, 2011, which came into force on January 1, 2013, and Russian Government Decree No. 835 dated July 8, 1996. The forms of primary documents are included in the “Album of unified forms of primary documents”, agreed upon by the Ministry of Finance and approved by the State Statistics Committee of the Russian Federation.

Correct accounting in an organization begins with studying regulatory documents

The beauty of the operation is that the term “turnover balance sheet” does not exist in nature, but all accountants know about it. More precisely, the term appeared in legislative acts and instructions sometime before 1990, after which it was lost. In the order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, two concepts are used: the turnover sheet and the balance sheet, the difference between which lies in recording the receipt and consumption of goods and materials.

Local compilation option

In practice, tax authorities, referring to orders No. ММВ -7–6/465 dated June 29, 2012 (as amended on November 28, 2016) and the Federal Tax Service No. ММВ-7 – 6/643 dated November 28, 2016, often, along with primary accounting documents, require exactly turnover balance sheets (SAS), the structure of which is established and has adopted generally accepted formats.

What does OSV show?

The balance sheet should be understood as an accounting document (in the form of a table) that contains the balances of funds and assets in monetary terms. Debit is a credit movement item by item, for a certain period and balances at the end of the period of time (usually a month, quarter, year). The balance sheet forms the balance sheet and checks the posting of accounts for errors. SALT can be compiled both for analytical accounts (for one specific account) and for the enterprise as a whole (for synthetic accounts).

Some accountants prefer the so-called checkerboard sheet to the turnover sheet. This is a type of OSV, which differs in the form of filling. All credit accounts are drawn vertically, and debit accounts horizontally. Transaction amounts are indicated at the intersection of rows and columns.

The goal of "chess" is the same as that of a regular OSV. This structure allows you to analyze the income and expense parts of the balance sheet and determine the tax base for any period of time. An example of determining the corresponding account for any of the transactions is given below.

The chess sheet allows you to present information about account balances in a visual form

Sometimes drawing up a balance sheet is preceded by filling out an account card (the so-called drawing of airplanes). For each account, debits and credits are calculated. It looks like the wings of an airplane: debit on the left, credit on the right. In theory, such a drawing makes it easier to fill out the OSV and find errors.

SALT is compiled at the end of each month based on data for each synthetic account. All of them are reflected in the document. A separate line is used to record each account.

It states:

- opening balance;

- loan turnover;

- debit turnover;

- ending balance.

The document must be filled out without errors. The accountant who prepared the statement must check it.

When carrying out manipulation, you must be guided by the following rules:

- the result of calculating initial debit balances must coincide with the result of determining similar credit balances;

- the result of debit turnover must be equal to credit;

- the result of determining the final balances must coincide with the final credit balance.

The preparation of the paper is based on the use of dual notation. Manipulation allows you to control the correctness of recording business transactions. If there is no equality, an error has been made. The calculations must be done again.

The check is carried out after the completion of the statement. The totals of balances and turnover for credit and debit must match. It should be remembered that the balances at the end and beginning of the year must be identical.

For interconnected accounts, balances and turnovers must correspond. In addition, it is necessary to ensure that the indicators are logical. To perform the check, you need to make a calculation that will confirm the correctness of the data entered.

To avoid mistakes, you must carefully study clause 34 of PBU 4/99. It says that offsetting items of liabilities and assets in the financial statements is prohibited.

However, there are exceptions to the rule. These can be found by reviewing the relevant accounting provisions. The statement is considered completed correctly only if all the rules are followed and the final data agrees.

In accounting theory, there are 3 types of accounts:

- active;

- passive;

- active-passive.

The totality of active account balances is the tangible and intangible assets (resources) of the organization. The balance of passive accounts shows the sources of formation of the organization's assets. And active-passive accounts - settlement accounts - can form both an asset and a liability on the balance sheet.

IMPORTANT! In the chart of accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, accounts are grouped by sections, and not by asset or liability.

Analysis of SALT can help identify accounting errors. For example, it is necessary to carefully understand the situation if there is a credit balance on active accounts or, conversely, a debit balance on passive accounts. There are accounts that should not have a balance at all.

The information on the accounts contained in the SALT is reflected in our table. It will help analyze the SALT for any account and identify doubtful points.

There is a joke that an accountant, like a sapper, makes one mistake. This is partly true. If an accountant fails to check himself once, a technical inaccuracy or error entails unreliable reporting, clarification of tax return data and additional payment of taxes. Therefore, it is important for an accountant to check himself in a timely manner.

It is better to check the correctness of filling out the primary accounting documents immediately upon receipt. Having received the primary document, it is necessary to check the completion of the required details, the presence of signatures and seals, as well as the arithmetic of the document. If you have any comments, you can make a copy of the documents, mark the incorrect details with a red pen and return this copy to the counterparty for correction.

How to fill out a balance sheet example

Balance sheet data is widely used for subsequent analysis by the organization's management, tax authorities, banks, suppliers and other creditors.

The balance sheet consists of 2 main parts - assets

and

passive

. The asset represents the organization's resources, and the liability represents the sources of their formation. A distinctive feature of the balance sheet is the equality of the totals of assets and liabilities. This is due to the double entry principle used in accounting.

Assets

The balance sheet contains 2 sections:

- I. Non-current assets;

- II. Current assets.

Passive

The balance sheet consists of 3 sections:

- III. Capital and reserves;

- IV. Long term duties;

- V. Short-term liabilities.

Each asset and liability element of the balance sheet is called a balance sheet item

. Asset items reveal the nature of resources, their use and magnitude. Liability items characterize the sources of resource formation, namely: from what source this part of the assets was created, for what purpose they are intended and their value.

When preparing a balance sheet, keep the following in mind:

- the balance sheet data at the beginning of the year must correspond to the data at the end of last year (taking into account the reorganization);

- offset between items of assets and liabilities, items of profit and loss is not allowed, except in cases where such offset is provided for by the relevant Accounting Regulations;

- the corresponding balance sheet items must be confirmed by inventory data of property, liabilities and settlements.

The standard form of the balance sheet is regulated by the Ministry of Finance (order No. 67n dated July 22, 2003). However, organizations can independently develop a balance sheet form, using the standard one as a template. In this case, the general requirements for accounting reporting must be observed.

When developing and adopting the balance sheet form (Form No. 1), it is recommended to use the total line codes and line codes of sections and groups of items given in the sample balance sheet form. If a transcript is provided for any indicator in a balance sheet developed by an organization independently, then the articles in this transcript are coded by the organization itself.

The balance sheet contains the following mandatory details

:

- the reporting date as of which the balance sheet is presented;

- full name of the organization in accordance with the constituent documents;

- taxpayer identification number (TIN);

- the main type of activity of the enterprise with the OKVED code;

- organizational and legal form/form of ownership (according to the OKOPF and OKFS classifiers);

- unit of measurement - thousand rubles. (OKEY code 384) or million rubles. (OKEY code 385);

- location (address);

- date of approval (indicates the established date for the annual financial statements);

- date of sending/acceptance (the specific date of postal, electronic and other sending of financial statements or the date of their actual transfer according to ownership is indicated).

Total figures for balance sheet items are given in thousands of rubles without decimal places. Organizations with significant sales turnover, liabilities, etc. can provide data in millions of rubles (without decimal places).

Indicators on certain types of assets, liabilities, income, expenses and business transactions may be presented in the balance sheet as a total amount with disclosure in the notes to the balance sheet, if each of these indicators individually is not significant for the assessment by interested users of the financial position of the organization or the financial results of its activities.

Let's consider the procedure for filling out Form 1 “Balance Sheet”

.

In the column “ At the beginning of the reporting year

» shows data at the beginning of the year (opening balance sheet), which must correspond to the data in the column “At the end of the reporting period” of the previous year (closing balance sheet), taking into account the reorganization carried out at the beginning of the reporting year, as well as changes in the assessment of financial reporting indicators associated with the application of the Regulations on accounting and financial reporting in the Russian Federation and the Accounting Regulations “Accounting Policy of the Organization” PBU 1/98.

In the column “ At the end of the reporting period

» shows data on the value of assets, capital, reserves and liabilities at the end of the reporting period (month, quarter, year).

You can form No. 1 in the following formats:

Sample balance sheet form 1

Hint: Active accounts are those that store information about what the company has and this is “what” helps the company operate and earn money. Usually “it” can be touched. Active accounts always have a debit balance or zero. However, the fundamental approaches to filling out this form remain the same regardless of the way the source data is reflected in it.

Based on the balances of accounting accounts (subaccounts) from the balance sheet, we create balance sheet lines. If in the balance sheet you do not have data to fill out any lines of the balance sheet (for example, line 1130 “Intangible exploration assets”, line 1140 “Tangible exploration assets”), then put a dash (Letter of the Ministry of Finance dated 01/09/2013 N 07- 02-18/01).

When generating it in the 1C Accounting program, the accountant does not have any difficulties, because the report is generated automatically. The program also allows you to test yourself using the “Decipher” button.

If you did not keep analytical accounting during the year, then from the total balance of account 58 (59, 63) you will have to manually select the amounts of long-term financial investments. Having determined the amount of long-term financial investments, calculate the line indicator using the formula: Calculate the line indicator 1210 “Inventories” as follows. 1.

The Turnover Balance Sheet reflects balances at the beginning of the period, turnover and balance at the end of the period, that is, the statement is formed for a certain period (for example, month, quarter, year). We will not have an opening balance, since the conduct of activities is considered from scratch, immediately from the moment of formation of the authorized capital. We will sequentially transfer the turnover and balance for each accounting account.

It can be compiled separately for synthetic or analytical accounts. In this case, data for turnover sheets, as a rule, is taken from accounting accounts, where turnover is calculated and new balances are displayed.

Mini-instructions for calculating the balance sheet

Fill out the header of Form 1 , or enter the data into a computer accounting program.

Fill out the first section of the asset - non-current assets . This takes into account: fixed assets of the enterprise that can be invested in construction, whether it is completed or not, in material assets, and various assets. This data is entered into the corresponding lines of the finished balance sheet form.

Complete the second asset section – current assets. This takes into account: various inventories of the enterprise, amounts of VAT not yet accepted for deduction, accounts receivable, investments of the enterprise invested for a short period, free finance and other assets.

Complete the third liability section – capital and reserves. Here, such types of capital as authorized and additional capital are taken into account. Data on reserve capital is indicated, for example, set aside for future planned expenses. Retained earnings should also be indicated in this paragraph.

Complete the fourth liability section - long-term liabilities. This takes into account: long-term loans, for example, loans. At this stage, obligations to the tax authorities are indicated that have been deferred for a number of reasons, as well as other obligations for payments on behalf of the enterprise.

Complete the fifth liability section - short-term liabilities . This takes into account: loans and credits taken out for a short period of time, debt on such, debt to the founders. Planned incomes are included in the balance sheet, as well as expenses and finances that are reserved for them. Short-term liabilities must also be indicated.

The balance is considered consolidated when the total amount for assets fully matches the total amount for liabilities.

The easiest way to prepare a balance sheet is to use specialized accounting software.

How to fill out a balance sheet for 2020

Any professional activity within an organization presupposes that the performer is vested with official responsibilities for his position (or workplace), corresponding rights and responsibility for the results of his work...

Get qualified help right now! Our lawyers will advise you on any issues out of turn.

We will fill out the balance sheet step by step, starting with the first item, Inventories. This article displays materials, goods, finished products, work in progress.

To be honest, I did not want to write an article on such a topic, since if the program works correctly, this knowledge is not necessary, but nevertheless, I am periodically asked questions of this kind. Situations are different; sometimes you actually have to additionally check the reports filled out by the program if the accounting in it was not kept very carefully.

Uncheck the “Table with headers” item -Ok: Immediately go to the Data tab (or to the Power Query tab) -Load and transform group -From table The query editor window will appear: Now we perform data transformations to bring this table to normal, like this called "flat".

Do not include the value of cash equivalents here—show them along with cash on line 1250. Line 1260, Other Current Assets, is usually left blank. It reflects assets that are not named in the standard balance sheet, for example, the debit balance on account 94.

ON If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link. We will also calculate the total turnover and the final balance of all accounts for Debit and Credit. From this table it can be seen that the total turnover for the Debit and Credit accounts is the same.