To reflect in accounting the analytical analysis of information about payment and shipment between the client and the contractor, the register “Settlements with buyers and customers” begins to be filled in 62 accounts

.

To systematize and summarize information about business transactions between buyers and suppliers, the accounting department draws up account accounting analytics 62

. Each counterparty undergoes an individual analysis of transactions.

You can trace in detail all transactions performed by all participants:

- goods shipped or works and services provided;

- payment made within the terms specified in the contracts;

- overdue payment (accounts receivable);

- advances received;

- transactions with bills.

Details of settlement transactions with customers-clients are formed on sub-accounts:

- 01

– sales or shipment of products; - 02

– advances received from customers; - 03

– promissory notes received.

These are frequently used subaccounts of account 62 for conducting business activities. Each organization individually creates sub-accounts depending on the company’s work.

Count 62 is active-passive

, which means that the balance can be formed by both debit and credit. It is better to display the opening and closing balances of the reporting period in expanded form on subaccounts.

This is due to the fact that:

- A debit balance

means that the buyer has not yet paid for goods shipped or services rendered (accounts receivable). - The loan balance

shows that an advance has been made, but the goods have not yet been shipped or the work has not been completed.

Analysis of analytical accounting allows you to maintain detailed records of transactions for each client of the enterprise.

The value of the balance sheet

The internal accounting register, which contains information about the movement of turnover and balances for any period of time of mutual settlements with customers, is (SAW). The generated SALT account 62 is used as the basis for providing a statement of reconciliation of settlements with customers.

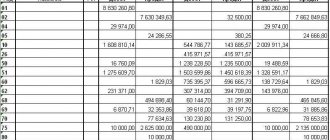

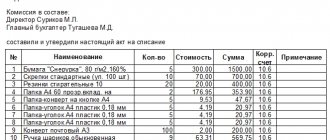

Let's give an example of OCB between the municipal unitary enterprise "Vesna" and the municipal municipality "Mikhailovsky Cultural Center"

: at the beginning of June 2020, sales of goods and payment in the amount of 25,513.18 rubles. was shipped and paid for. The movement by date is indicated in the table. In June 2020, goods worth 12,520 rubles were shipped, but payment for the goods was not received.

Bottom line

: in SALT for June 2020, receivables for the Mikhailovsky Cultural Center MKU accumulated in the amount of RUB 12,520.

| Turnover balance table for account 62 for June 2017 | ||||||

| Total expanded | 25513,18 | 25513,18 | 12520,00 | 38033,18 | 25513,18 | |

| Check | Opening balance | Period transactions | Closing balance | |||

| Counterparties | Dt | CT | Dt | CT | Dt | CT |

| Documents of settlements with the counterparty | ||||||

| 62 | 25513,18 | 25513,18 | 12520,00 | 38033,00 | 25513,18 | |

| Municipal government institution "Mikhailovsky Cultural Center" | 25513,18 | 25513,18 | 12520,00 | 38033,00 | 25513,18 | |

| Sales of goods and services 00000000293 from 04/27/2017 14:18:12 | 3830,18 | 3830,18 | ||||

| Sales of goods and services 00000000459 from 05/18/2017 0:00:09 | 12165,00 | 12165,00 | ||||

| Receipt to the current account 00000000006 from 05/23/2017 12:00:01 | 3830,18 | 3830,18 | ||||

| Sales of goods and services 00000000460 from 05/24/2017 14:49:51 | 9518,00 | 9518,00 | ||||

| Receipt to current account 00000000007 from 05/30/2017 12:00:00 | 9518,00 | 9518,00 | ||||

| Receipt to the current account 00000000008 from 05/30/2017 12:00:01 | 12165,00 | 12165,00 | ||||

| Sales of goods and services 00000000462 from 06/15/2017 13:12:00 | 12520,00 | 12520,00 | ||||

| Total | 12520,00 | 12520,00 | ||||

The final balance of SALT account 62 is displayed in the balance lines. If the loan balance, i.e. debt formed as a result of unshipped goods, then the amount will be in the liability side of the balance sheet. With a debit balance, this is a receivable - it increases the assets of the enterprise and is in the asset balance sheet.

Account 62 is correlated in debit and credit with the following accounts

.

By debit 62

:

- 46

— execution of unfinished work; - 50

— cash payment in cash; - 51

,

52

,

55

— payment to the bank’s personal account; - 62

- 76

— settlement procedure with buyers (debtors and creditors); - — revenue from trade;

- 91

— income and expense transactions not related to the company’s activities.

For loan 62

:

- 50

— advance payment from buyers using the cash method; - 51

,

52

,

55

— advance payment from buyers through a current account; - — settlement transactions with performers;

- 62

— mutual settlements with counterparties; - 63

— doubtful debts in reserve; - — operations on short-term loans;

- 67

— operations on loans and credits for long periods; - 73

— other settlements with employees; - 76

— settlement procedure with clients (debtors and creditors); - 79

— calculations for internal production operations.

In practice, for the economic conduct of commercial activities, the main operations

by count 62 are:

- Movement of settlements with customers-buyers for shipped goods.

- Advance payments from buyers.

- Operations with promissory notes.

General settlement transactions with customers

The supplier Partner LLC concluded an agreement with the client Zarya LLC for the sale of office supplies in the amount of 21,510 rubles, incl. VAT RUB 3,281.19 Payment for goods after shipment.

The accountant of Partner LLC creates the following entries

:

- Dt 62.01 Kt 90.01

– 21,510, revenue from the sale of stationery (based on invoice); - Dt 90.02 Kt 41

– 10,000, cost of office supplies based on calculation; - Dt 90.03 Kt 68

- 3281.19, VAT accrued on the invoice; - Dt 51 Kt 62.01

– 21 510, payment from the customer for stationery according to a payment order; - Dt 90.09 Kt 99

– 8228.81, profit from the sale of stationery.

Accounting for advances received

On June 1, 2020, the supplier Partner LLC entered into an agreement with the buyer Zarya LLC for the supply of stationery in the amount of 21,510 rubles, incl. VAT—RUB 3,281.19 The contract stipulates an advance payment of 30% of the amount of shipped products, which is 6,453 rubles, incl. tax 984.36.

The advance payment was transferred on June 2, 2020 to the current account of Partner LLC. On June 7, 2020, goods were shipped to Zarya LLC in the amount of 21,510.

On June 9, 2020, Zarya LLC transferred the remaining amount in the amount of 15,057 rubles, incl. tax (VAT) 2296.83 rub. Based on primary documents, the accountant creates the following entries:

:

- Dt 51 Kt 62.02

– 6453 rubles, receipt of advance payment to the current account by payment order; - Dt 76 Kt 68

- 984.36 (6453 * 18% / 118%) rubles, VAT on the advance is determined (issued for the amount of the advance, one copy - to the buyer); - Dt 62.01 Kt 90.01

– revenue of 21,510 rubles is reflected, according to the delivery note; - Dt 90 Kt 68

– RUB 3,281.19, VAT on goods shipped; - Dt 68 Kt 76

– 984.36 rubles, VAT accepted for accounting, deduction from advance payment; - Dt 62.02 Kt 62.01

– 6453 rubles, advance payment from Zarya LLC is credited; - Dt 51 Kt 62.01

– 15,057 rubles, funds were credited to the bank account (remaining amount); - Dt 68 Kt 51

– 3281.19 rubles, VAT transferred to the budget.

If the organization has received an advance payment, then after the goods have been shipped, it must be closed by internal posting to subaccounts, otherwise erroneous data will be provided and the organization’s reports will be unreliable. Posting Dt62.02 Kt61.01 closes the advance payment. Advice to accountants: constantly check the movements of transactions on account 62

.

A bill is a security

, a promissory note that gives the owner (the holder of the bill) the right to demand payment from the drawer for goods shipped or work performed within a certain period. The issuance of such a bill means a deferred payment.

For transactions on bills of exchange, a subaccount 62.03 “Bills received”

.

Let's give an example with accounting entries

: LLC “Partner” sold stationery to LLC “Zarya” for the amount of 23,500 rubles, incl.

VAT 3584.75. Zarya LLC issued a promissory note to Partner LLC with a nominal amount of 24,000 rubles, the following entries

:

- Dt 62.01 Kt 90.01

– 23,500, stationery shipment completed; - Dt 90.03 Kt 68

– 3584.75, VAT charged; - Dt 62.03 Kt 62.01

– 23,500, receipt of a bill of exchange; - Dt 008

– 24,000, the bill was capitalized on an off-balance sheet account.

When paying for a bill, the postings will be as follows:

:

- Dt 51 Kt 62.03

– 23,500, bill paid; - Dt 51 Kt 91.01

– 500, the difference between the nominal price of the bill and the purchase price (24,000 – 23,500); - Kt 008

– 24,000, writing off the bill from an off-balance sheet account.

If there are overdue obligations on bills of exchange, then this amount relates to accounts receivable.

Account correspondence

Account 62 corresponds with many registers, both debit and credit. This is based on the fact that it, one way or another, correlates with a large number of positions due to the commonality of settlements with counterparties and their interconnectedness with other operations. Among the special accounts with which debit correlation occurs are:

- 46 — Completed stages of unfinished work;

- 50 - Cash desk;

- 51 — Current accounts;

- 52 — Currency accounts;

- 55 – Special bank accounts;

- 57 — Transfers on the way;

- 62 — Settlements with counterparties;

- 76 - Settlements with various debtors and creditors;

- 79 — On-farm calculations;

- 90 - Sales;

- 91 — Other income and expenses.

For the loan, 62 special account is associated with the following accounts:

- 50 - Cashier;

- 51 — Current accounts;

- 52 — Foreign currency accounts;

- 55 – Special bank accounts;

- 57 — Transfers on the way;

- 60 — Settlements with suppliers and contractors;

- 62 — Settlements with buyers and customers;

- 63 — Provisions for doubtful debts;

- 66 — Settlements on short-term loans and borrowings;

- 67 — Settlements on long-term loans and borrowings;

- 73 — Settlements with personnel for other operations;

- 75 — Settlements with founders;

- 76 - Settlements with various debtors and creditors;

- 79 — Calculations within the economic economy.

Analytical card 62 special accounts with turnover and balance for a specific period

Can an account have a credit balance?

Account 62 is an active-passive register, i.e. Depending on the transactions performed, the ending balance can be either a debit or a credit.

The debit balance reflects expenses associated with the sale of products

. Credit balance is the amount of revenue for shipped products transferred to the company's current account.

When compiling a balance sheet, the credit balance on account 62 will be reflected in line 1520 “Short-term accounts payable,” which indicates a decrease in the balance sheet asset.

The balance sheet for account 62 in 1C is presented below.

Account 62 of accounting is an active-passive account “Settlements with buyers and customers”, used to summarize mutual settlements with individuals and legal entities. In this article we will look at the main (standard) transactions for account 62 using the example of selling goods through an online store. Let's study what the balance sheet shows for account 62, as well as what is reflected in the debit and credit of account 62.

Settlements are reflected in correspondence with the account. 90 “Sales” and 91 “Other income and expenses”, for which settlement documents were provided:

Account 62 has two sub-accounts - account 62.01 and 62.02:

- account 62.01 shows the amount of income. Debit turnover reflects the amount of shipped products, goods, and services. Loan turnover is the amount received from customers.

- account 62.02 shows information about advances received from customers. Debit turnover reflects the shipment made against advances. Loan turnover is the amount of advances received from customers.

Turnover - balance sheet for settlements with customers

Allows you to summarize data for all customers to identify debts. As in settlements with suppliers, the balance sheet of 62 accounts makes it possible to analyze indicators for the period in a cross-section.

Structure

The debit balance at the beginning and end of the period indicates the unfulfilled terms of the agreement, i.e., obligations under the contract to customers were fulfilled, however, payment was not received. The credit balance indicates the presence of unshipped goods. Turnovers that record transactions during the selected time: by debit - shipment, by credit - incoming payments.

Filling example

The organization received an advance payment for its goods worth 10,000 rubles. The company shipped half of it. In accounting, movements under the terms of the contract can be represented by the following entries.

- Dt51 Kt 62 - 10000 advance payment received for future delivery

- D62 Kt 41 – 5000 first batch shipped

From the analysis of the statement, we can conclude that further shipment is necessary to close all obligations.

Video on how to create a balance sheet for account 62.

https://youtu.be/dmtkvipu9ok

Postings to account 62 Settlements with buyers and customers using an example

Let's study an example when a product is sold remotely through an online store. Payment for goods purchased through the online store can be made in one of the following ways:

- Bank card (transfer of funds is regulated by law dated June 27, 2011 No. 161-FZ);

- Cash to the courier upon delivery of goods (when selling goods through an online store, OKVED code 52.61.2);

- Through electronic payment systems (regulated by law dated June 27, 2011 No. 161-FZ).

Example

The VESNA organization sells goods through an online store. The organization entered into an Internet acquiring agreement with the bank, on the basis of which the remuneration is 1.5% of the receipt amount. Consequently, the amount of revenue minus remuneration is transferred to the current account.

Buyer Ivanov I.I. in January 2020, I paid for the goods with a bank card in the amount of RUB 50,000.00, incl. VAT 18% - RUB 7,627.12. After receiving the bank statement, the organization ships the paid goods to the buyer.

To carry out the operation, the accountant creates the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 57.03 | 62.02 | 50 000,00 | The buyer made an advance payment by bank card | Payment register |

| 76.AB | 68.02 | 7 627,12 | We charge VAT on the advance received | Invoice issued |

| 51 | 57.03 | 49 250,00 | Receipt of proceeds to the current account | Bank statement |

| 91.02 | 57.03 | 750,00 | Bank remuneration under the agreement | Bank statement |

| 62.R | 90.01.1 | 50 000,00 | Accounting for sales revenue | |

| 90.03 | 68.02 | 7 627,12 | VAT accrual on shipment | |

| 90.02.1 | 41.11 | 50 000,00 | Write-off of shipped goods | |

| 62.02 | 62.R | 50 000,00 | Settlement of advance received | |

| 68.02 | 76.AB | 7 627,12 | Book of purchases |

Buyer Petrov P.P. I ordered goods worth RUB 12,000.00 through an online store, incl. VAT 18% - RUB 1,830.51. The buyer paid the goods in cash to the courier upon delivery of the goods. The delivery cost is 20% of the cost of the goods and is included in the price of the goods. According to the accounting policy, goods are accounted for at sales prices using 42 accounts, the trade margin in the organization is 15%.

Get 267 video lessons on 1C for free:

To reflect the operation, the following transactions are generated:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 50.01 | 90.01.1 | 12 000,00 | We take into account retail revenue | Help - report of the cashier-operator (KM-6) |

| 90.03 | 68.02 | 1 830,51 | We charge VAT on retail sales | |

| 90.02.1 | 41.11 | 12 000,00 | We write off sold goods at sales prices | |

| 50.01 | 90.01.1 | 12 000,00 | Delivery of proceeds to the cashier by courier | Receipt cash order (KO-1) |

| 90.02.1 | 42.01 | — 1 105,38 | Calculation of trade margins on goods sold | Help for calculating the write-off of trade margins on goods sold |

Buyer Sidorov A.P. through electronic payment systems paid for goods in the amount of 95,000.00 rubles, incl. VAT 18% - RUB 14,491.53. The money was first credited to the seller’s “electronic wallet” and then transferred to a bank account minus a commission. The commission is 3.5% of the transfer amount – RUB 3,325.00. The next day the goods were shipped to the buyer.

Postings for the operation:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 55.04 | 62.02 | 95 000,00 | Advance received from buyer using electronic money | Register of payments. |

| 76.AB | 68.02 | 14 491,53 | We charge VAT on the advance payment | Invoice issued |

| 51 | 55.04 | 91 675,00 | Funds were transferred to the current account | Bank statement. |

| 76.09 | 55.04 | 3 325,00 | Bank commission withheld | Bank statement. |

| 44.01 | 76.09 | 2 817,80 | The commission amount is included in expenses | Packing list |

| 19.04 | 76.09 | 507,20 | Input VAT included | |

| 76.09 | 76.09 | 3 325,00 | Advance credited | |

| 68.02 | 19.04 | 507,20 | VAT is accepted for deduction | Invoice received |

| 62.R | 90.01.1 | 95 000,00 | Accounting for sales revenue | Sale of goods and services (act, invoice), Invoice issued |

| 90.03 | 68.02 | 14 491,53 | VAT accrual on shipment | |

| 90.02.1 | 41.11 | 95 000,00 | Write-off of shipped goods | |

| 62.02 | 62.R | 95 000,00 | Settlement of advance received | |

| 68.02 | 76.AB | 14 491,53 | VAT deduction on advance received | Book of purchases |

Account 62 which is reflected in debit and credit

Account 62 in question is active-passive in accounting. Therefore, it can reflect both the organization’s debt to customers (credit balance) and the buyer’s debt to the organization (debit balance). Thus, the debit balance on account 62 indicates that products, goods, services have been shipped and there is a debt from buyers for goods shipped or services provided.

The credit of accounting account 62 displays funds from the sale of products (goods) and for services rendered, as well as prepayments and advances received. But payments and advances are accounted for in different subaccounts:

- Subaccount 62.01 – takes into account payments received in the general manner;

- Subaccount 62.02 – takes into account advances received from customers.

Thus, the credit balance on account 62 means that the enterprise has a debt to customers for advances received.

Formation of SALT according to account 62

The generated balance sheet is a table indicating counterparties and settlements with them:

Balance sheet for account 62

| Check | Balance at the beginning of the period | Period transactions | balance at the end of period | ||||||||

| Counterparties | Debit | Credit | Debit | Credit | Debit | Credit | |||||

| Treaties | |||||||||||

| Documents of settlements with the counterparty | |||||||||||

| Total | |||||||||||

Statement structure:

- Name of counterparties – buyers and customers. All counterparties are displayed here, both under permanent supply contracts and one-time transactions. The balance at the beginning of the formed period determines the amount of the organization's debt for previously made supplies (debit balance) and advance payments received (credit opening balance).

- Settlements with counterparties arising during the period under review are displayed in the turnover column: credit - payments received, debit - shipment of products to customers, provision of services, performance of work (displayed only on the basis of the generated closing documentation - TORG-12, act of provision of services, UPD, etc. .d.).

- The ending balance indicates unfinished settlements with counterparties and allows you to quickly monitor document flow and received payments.

Balance sheet for account 62

It is important before closing the month and drawing up a report on the financial condition of the enterprise to check that the accounting registers are filled out correctly. One of the verification options is the formation of a balance sheet (hereinafter referred to as TSA) for the period under audit:

What the balance sheet shows for account 62 and how to read SALT is shown in the following table.

Account 62 reflects information on settlements with buyers and customers. The balance on it can be either a debit (reflecting the debt of counterparties for payment) or a credit (showing debts on deliveries and orders). Therefore, it is important to correctly define it in the working chart of accounts and correctly organize analytical accounting for it.

Attention! We have prepared documents that will help you properly check any counterparty. Download for free:

It is convenient to work with documents in . It is suitable for organizations and individual entrepreneurs. The program will automatically generate and print all the necessary primary data. It also includes uploading transactions to 1C, automatic generation of any reporting, and much more.

A company or entrepreneur - supplier, seller or contractor - has an account that reflects information about settlements with counterparties:

- with buyers - for goods, products, other property sold to them or for advances received from them on account of sales;

- with customers - on work, services performed for them or on advances received against the future execution of their orders.

Settlements with customers most often occur within the framework of purchase and sale and supply agreements, and settlements with customers - under contract and paid services.

The purpose of accounting account 62 is well illustrated by the following diagram:

Account 62 in accounting is active-passive. At the end of period 62, the account can show either a debit balance or a credit balance. The debit balance of 62 accounts means that buyers and customers remain in debt for the property sold to them or orders completed for them. The balance on the credit of account 62 means debt to counterparties, that is, advances have been received from them, against which the property has not yet been delivered and orders have not yet been completed. The advance may take the form of a commercial loan.

A commercial loan from buyers and customers is the receipt of an advance payment for work, services, goods, products with a deferment in the execution of orders or the supply of property.

Depending on the period for repayment of “payable” and “receivable” debts on account 62, they are divided into:

- long-term debt - if receipt of payment or shipment is planned for a period of more than 12 months;

- short-term debt - if repayment of the debt on delivery or payment is expected earlier than 12 months.

This division of payables and receivables by timing is necessary for their correct reflection in the financial statements, including the Balance Sheet.

Turnover - balance sheet for settlements with suppliers and contractors

Its formation is one of the key elements that makes it possible to control the document flow at the enterprise for further reporting to the tax authorities

Statement structure

In general, it is represented by the following figure:

Balance sheet for account 60

The first column contains the names of all sellers. The opening balance allows you to see debts and advances transferred previously. The debit balance indicates the transfers of funds made, for which there was no delivery of materials or the documents were not submitted to the accounting department on time; for a loan - the sum of all received inventory items, the purchase of which was not paid for.

During the period, current mutual settlements arise. Similarly to the balance, all payments are included in the debit turnover, and receipts are included in the credit turnover. The length of time for analysis is arbitrarily selected (from operations on one specific day to any arbitrarily chosen interval). The ending balance indicates any unresolved issues with supplies and allows you to clearly track document flow and payments.

Advice! When maintaining accounting in specialized software products, you can consider not only the general type of calculations, but also statements separately for advances paid and purchases.

Filling example

The organization purchased a new computer for 20,000 rubles. Under the terms of the agreement, payment can be made in installments of 5,000 rubles per month. In accounting, these actions are reflected in the following entries:

- Dt10 Kt 60 - 20000 received a computer from the supplier

- D60 Kt51 – 5000 transferred the first payment on the computer

Based on the results of checking mutual settlements, we see that the organization’s debt to the counterparty is 15,000 rubles at the end of the period. It is necessary to track debt data so that selling companies are interested in working with the company.

Errors that occur

In the era of active development of technology, the manual method of drawing invoices is almost never used, but various software products are widely used, the leaders of which are 1C developments. Accounting registers can be created in them to better analyze the status of all payments and receipts.

The advantage of using the balance sheet in 1C for control is the ability to analyze not only the general statement, but also to consider separately paid advances (60.02) and the resulting debt for received goods, works, services (60.01). In addition, from the statement you can go to account analysis specifically for transactions with a given counterparty and, if questions arise, immediately see the presence or absence of documents.

There are situations when the same amount falls into circulation at 60.01 and 60.02 and does not overlap. This may be due primarily to a violation of the sequence of documents. If re-execution does not change the situation, then you should pay attention to the possible linking of payments and receipts to various contracts or accounts.

How to create a balance sheet for account 60 in 1C can be seen in the video:

https://youtu.be/LSDssOPHU4o

Account 62 in accounting: correspondence

As can be seen from the list of correspondence, the debit of account 62, which contains the debts of counterparties, interacts with the sales and financial results accounts. And the credit of account 62, where debts to counterparties are reflected, interacts with cash accounts and settlement accounts.

Here are the entries for the most typical operations of a company or entrepreneur - supplier, seller or performer.

| Situation | Debit | Credit |

| Sold products, goods, other property, performed work, services for the counterparty | 62 | 90-1, 91-1 |

| Received payment from buyers and customers | 51, 50 | 62 |

| Received an advance from a counterparty | 51, 50 | |

| The received advance was credited towards payment for products, goods, other property, work, services | 62 subaccount “Settlements on prepayments received” | 62 |

| We wrote off the hopeless “receivables” of buyers and customers | 91-2 | 62 |

| Counted off the counterparty's debt against accounts payable to him | 62 |

Let's illustrate the wiring with numerical examples. To begin with, we will give examples where subaccounts 62 accounts are not used.

Example 1

In May, Symbol LLC provided security services to Vector LLC for the cost of 70,000 rubles.

“Vector” transferred the payment on May 31. Symbol's expenses amounted to 30,000 rubles. “Symbol” applies the simplified tax system, therefore it does not charge VAT on the cost of its assets. It will be reflected in the accounts: Debit 62 Credit 90-1

Debit 90-2 Credit 20Debit 51 Credit 62

— 70,000 rub. – upon receipt of money for services.

The postings are similar if accounting account 62 is used by the seller of the property.

Example 2

In May, Symbol LLC sold its main asset to Vector LLC - a used safe for 70,000 rubles.

“Vector” transferred the payment on May 31. The remaining cost of the safe is 30,000 rubles. “Symbol” applies the simplified tax system, and therefore does not charge VAT on property sales. The accountant of "Symbol" will reflect in the accounting: Debit 62 Credit 91-1

- 70,000 rubles - upon signing the acceptance certificate for the safe;

Debit 91-2 Credit 20

- 30,000 rub.

– for the remaining value of the safe; Debit 51 Credit 62

- 70,000 rub. – upon receipt of money to pay for the safe.

What does the 62nd accounting account contain and how is it maintained - Business Legal Directory

Account 62 in accounting is intended to accumulate information on settlements carried out between buyers and customers. First of all, the 62nd account is necessary to reflect the debt of consumers for work performed or services provided.

In general, this account mirrors the seller’s business activities regulated by the buyer under account 60 (“Settlements with suppliers and contractors”). Work with the account is regulated by Order No. 94-n of the Ministry of Finance of the Russian Federation.

Account 62 is active-passive, that is, account data can appear in the balance sheet as both an asset and a liability.

As soon as the company has accounts receivable, account 62 corresponds with accounts 90 or 91 (“Revenue” or “Other income”). If the work was performed under a long-term contract, then account 46 (“Completed work on unfinished work”) can be credited. If an advance (prepayment) was transferred, accounts payable are formed on account 62.

Analytical accounting by account

Account 62 is used for analytical accounting - a procedure carried out for each invoice provided to customers, and in the case of settlements through scheduled payments - for each buyer and customer.

Analytical accounting should provide access to the following information:

- access to payment documents for which the payment deadline has not yet arrived;

- to undue bills;

- to discounted bills;

- to information about buyers and customers;

- to information about advances received.

In addition, account analytics should allow checking balances for the presence of overdue debts, that is, carried out in the context of counterparties, issued invoices and payment terms for them.

Accounts receivable accounting

Accounts receivable for account 62 are reflected simultaneously with revenue. According to accounting rules, revenue is shown in accounting.

In this case, certain conditions must be met:

- revenue is shown in accounting if there is a legal basis for the right to receive revenue;

- if there is a total revenue value;

- if there is confidence in receiving payment;

- upon transfer of ownership;

- if there is a total value of the relevant expenses that were incurred to obtain the proceeds.

All these conditions must be met - if at least one of them is not met, the funds received by the enterprise must be reflected as accounts payable, and not as repayment of receivables.

Accounting for contracts with trade discounts

In some contracts, the amount of goods or services is not fixed and may decrease depending on the buyer's fulfillment of certain conditions, such as the period for providing the goods, their quantity and delivery times. In these situations we are talking about trade discounts.

https://youtu.be/A7I6qR7sDmA

When providing trade discounts, the amount of receivables should be determined taking into account all bonuses provided to the organization.

The form of discounts can be in kind (that is, the product can be sold free of charge) or monetary (that is, the product can be provided at a reduced price).

If we are talking about in kind, revenue and the total amount of receivables are determined by the contract as a whole (taking into account the price of the goods transferred at a set value other than zero and at a price of zero).

Trade discounts granted for the purchase of goods in sufficiently large quantities or for providing them to the buyer out of season can be taken into account for the assessment of receivables at the time of shipment to the buyer.

At the same time, Account 62 does not provide for the possibility of taking into account discounts provided to consumers in case of payment for goods over a certain period, at the time of shipment.

Accounting for advances received

Often, in order for suppliers to fulfill contractual terms, buyers make advance payments as part of the concluded contracts.

In addition, some contracts provide for the issuance of separate advance invoices and delivery of completed work in installments. In this case, previously paid advances are deducted from the cost of the stages (this is called offset).

The manufacturer's profit is generated as the stages are completed. Advances received in the balance sheet are included in accounts payable, that is, they are reflected in liabilities.

In the case of transferring advances when organizing accounting, several important points must be taken into account:

- the receipt of what property is considered as an advance;

- at what valuation these liabilities should be reflected on the balance sheet.

Value added tax is calculated and payable on advances received.

Accounting for payment by bills of exchange

A fairly common practice when paying for goods supplied or services provided is payment by bills of exchange. Today, two types of bills of exchange are used as payment: financial and commodity.

In this case, we are talking about settlements using intangible means, which means that the amount of receivables is accepted for accounting at the cost of goods or valuables received by the organization (or expected to be received).

Thus, the face value of the bill determines the size of the receivables.

Upon receipt of the bill of exchange, the enterprise is obliged to reflect the amount specified in it in the debit of account 62 “Settlements with buyers and customers.” The valuation of receivables must be equal to the value of the bill (face value).

Source: https://bizjurist.com/buhuchet/62-schet.html

Subaccounts 62 accounts

Since the balance on account 62 can be both debit and credit, then in order to correctly fill out the financial statements, including the Balance Sheet, it is important to correctly organize analytical accounting for account 62. It is necessary, at a minimum, to identify separate sub-accounts (for example, account 62.01 and account 62.02) to reflect:

- sales of works, services, property, for which “receivables” are formed. It could be a score of 62.1;

- receiving advance payments, which form a “creditor”. For example, on the account 62.2.

Subaccounts 62 accounts will have separate balances, as a result of which it will be possible to correctly indicate payables and receivables in the Balance Sheet. After all, it is prohibited to count them against each other on a count of 62.

Example 3

Let's take the condition from example 1 and assume that Vector paid for security services in advance - in April, in full in one payment.

The Symbol accountant will reflect in the accounting: Debit 51 Credit 62.02 subaccount “Settlements on prepayment received”

- 70,000 rubles.

– upon receipt of the advance; Debit 62.01 Credit 90.1

- 70,000 rubles - upon signing the act of services rendered;

Debit 90.2 Credit 20

- 30,000 rub.

– the amount of costs for maintaining security; Debit 62.02 subaccount “Settlements on prepayment received” Credit 62.01

- 70,000 rubles. – offset of the advance against payment for services.

Analytical accounting

For ease of accounting, the analysis of 62 special accounts is carried out in the context of each individual invoice that was sent to the buyer or customer, as well as for each individual counterparty or under an agreement with him. Moreover, the classification of operations may have the following criteria:

- Payment methods (availability of advance payment, payment upon shipment or provision of services);

- Payment terms (whether the due date is overdue or not yet due);

- Is there a bill of exchange (is it accounted for in the bank, is it due or is the bill of exchange overdue).

Important! An accountant can independently select the criteria by which an analytical report of 62 accounting accounts at an enterprise or organization will be built, and include in the conditions his own methods for selecting the necessary positions for their analytics.

Invoice as a document formalizing and confirming the payment transaction

It is also worth remembering that for each operation a legal entity is required to draw up documents confirming it. These can be invoices or invoices, checks and receipts, and other papers. Without this, calculations are not made.

The construction of an analytical report for this special account should provide the ability to obtain all the necessary data on buyers and other counterparties, on payment documents, on payment terms, and so on. Accounting for mutual settlements with counterparties within a bunch of organizations, about whose work consolidated financial statements are formed, is carried out separately in 62 positions.

Sample balance sheet for account 62 for a specific reporting period

Thus, account 62 is an important accounting register, showing all mutual settlements with buyers and customers (counterparties) for goods sold, services provided or work performed. The register has the ability to detail the information by creating additional sub-accounts that reflect settlements with counterparties in foreign currency, using valuable bills of exchange and with pre-agreed advances.

https://youtu.be/R8qZeO5QQE4

Attached files

- Instructions for using account 62.doc

We've dealt with suppliers, now let's move on to buyers. How is customer accounting kept, what are the features of settlements with them, what entries in account 62 reflect mutual settlements with customers in the general case, when receiving advances or bills from them.

Buyers are individuals or legal entities to whom an organization sells goods, products and other tangible assets and assets. Accounting for settlements with customers is kept on account 62. On account 62, analytical accounting can be kept for each individual buyer. The same account may reflect services provided and work performed.

Account 62 is active-passive, that is, accounting is kept on it. This account was analyzed in more detail in, read.

Several sub-accounts can be opened on account 62:

- Subaccount 1 – for accounting for calculations in the general case;

- Subaccount 2 – for accounting for advances received;

- Subaccount 3 – for accounting for bills received.

Postings on 62 accounts for beginners

In the previous article we dealt with suppliers, now let's move on to buyers. How is customer accounting kept, what are the features of settlements with them, what entries in account 62 reflect mutual settlements with customers in the general case, when receiving advances or bills from them.

Buyers are individuals or legal entities to whom an organization sells goods, products and other tangible assets and assets. Accounting for settlements with customers is kept on account 62. On account 62, analytical accounting can be kept for each individual buyer. The same account may reflect services provided and work performed.

Account 62 is active-passive, that is, it records assets and liabilities. This account was analyzed in more detail in this article, read it.

Attention The repayment of the principal amount of the debt is reflected by posting Dt account 51 (for foreign currency accounts Dt 52) and Kt 62. For the convenience of the accountant, analytics for account 62 are carried out in the context of each invoice sent to the buyer, as well as separately for each counterparty and agreement with him.

In addition, operations can be classified according to the following criteria:

- payment method (availability of advance payment or payment upon shipment, provision of services);

- payment deadline (payment is overdue or not due);

- presence of a bill of exchange (the bill of exchange has been accounted for in the bank, its maturity has not yet come, or payment on the bill of exchange is overdue).

The accountant has the right to independently choose the criteria on which the analytical accounting of account 62 at the enterprise will be based.

Settlements with customers (account 62)

But payments and advances are accounted for in different subaccounts:

- Subaccount 62.01 – takes into account payments received in the general manner;

- Subaccount 62.02 – takes into account advances received from customers.

Thus, the credit balance on account 62 means that the enterprise has a debt to customers for advances received.

Accounting for settlements with customers (account 62)

Thus, account 62 reflects settlements with customers and 3 sub-accounts can be opened on it:

- subaccount 1 - to reflect settlements for regular sales;

- subaccount 2 - to account for the advance received;

- subaccount 3 - for accounting for bills received.

In the next article we will look at how to carry out accounting of accounts payable: “Accounting for short-term and long-term loans and borrowings (accounts 66 and 67).” -lesson “Settlements with buyers and customers.

Account 62" This video lesson examines accounting account 62 "Settlements with buyers and customers", discusses standard postings and examples.

The lesson is taught by chief accountant N.V. Gandeva. (teacher, expert of the site “Accounting for Dummies”). Click to watch the video ⇓ Download the presentation “Accounting for settlements with buyers and customers on account 62” in PDF format Evaluate the quality of the article.

Of course, the organization will not pay it in double amount, so it is necessary to deduct VAT from the advance payment; for this purpose, posting D68/VAT K76/VAT from advances is performed. In case of receiving an advance payment from the buyer, invoice.

62 will behave as a passive one: accounts payable (liability) are formed on the loan, debt repayment is formed on the debit (liability reduction). That is why the account.

62 is an active-passive account because it can behave as a passive or an active account.

Features of accounting for settlements with customers (account 62)

Sales" and 91 "Other income and expenses", for which settlement documents are provided: Accounting account 62 has two sub-accounts - account 62.01 and 62.02:

- account 62.01 shows the amount of income. Debit turnover reflects the amount of shipped products, goods, and services.

Loan turnover is the amount received from customers.

- account 62.02 shows information about advances received from customers. Debit turnover reflects the shipment made against advances. Loan turnover is the amount of advances received from customers.

- By bank card (transfer of funds is regulated by law dated June 27, 2011.

Postings to the account 62 Settlements with buyers and customers using an example Let's study an example when a product is sold remotely through an online store. Payment for goods purchased through the online store can be made in one of the following ways:

Account 62 “settlements with buyers and customers” postings and examples

VAT is charged on advances received. Further, when goods, works or services are transferred to the buyer, VAT is charged again, this time on the proceeds. The accrued amount of VAT on the advance received is restored, then an entry is made to offset the advance.

https://youtu.be/YYW8_wGPqpU

Debit Credit Name of transaction 51 62.2 Advance received An advance was received from the buyer to the current account 76. VAT on advances received 68 VAT accrued on the advance received 62.1 90.1 Revenue from the sale of goods is reflected 90.3 68 VAT accrued on goods sold 62.2 Advance received 62.

1 Offset of advance payment against debt repayment 68 76 VAT on advances received Accepted for deduction of VAT in connection with the sale of goods paid in advance. . Example 1. Reflection of settlements with customers in the general manner Kalina LLC entered into an agreement with the buyer for the supply of inventory and materials in the amount of 50,000 rubles.

, VAT 7,627 rub.

The cost of the goods is 23,000 rubles.

Typical wiring

Important Bank statement, delivery note Postings to account 62 “Bills received” If the buyer does not agree to make an advance payment, and also does not have the opportunity to pay for the goods upon shipment, then in this case the supplier receives a bill of exchange from the customer, which acts as security for the receivables.

Let’s imagine that Nova LLC is the supplier, and Antika LLC is the buyer under a furniture supply agreement. Contract amount 114,000 rubles, VAT 17,390 rubles. As security for the debt, Antika LLC issues a promissory note to Nova LLC.

Nova LLC will reflect the following transactions in accounting: Dt Kt Description Amount Document 62 90/1 Revenue from the sale of furniture is reflected 114,000 rubles.

Consignment note 90/3 68 VAT VAT charged 18% of revenue RUB 17,390. Consignment note 62/3 62/1 A promissory note for 114,000 rubles was received from Antika LLC.

Postings debit 62 and credit 62, 91, 76, 90 (nuances)

Add to favoritesSend by email Debit 62 Credit 62 - posting is usually used for settlements with buyers (customers) for the main activities of the enterprise. We will analyze the nuances of correspondence of the 62nd account for various operations in this material.

Purpose of account 62 Nuances of using subaccounts using the example: Dt 62.1 Kt 62.

2 What does the posting Debit 62 Credit 62 mean? Postings Dt 62 Kt 90 and Dt 62 Kt 91 Posting Dt 62 Kt 76 Totals Purpose of account 62 The account is intended to record information about transactions with counterparties purchasing its goods (work, services) from the organization. As a general rule, account 62 reflects transactions on those products of the organization that relate to its main activities.

To record one-time or atypical transactions for an organization, account 76 of the chart of accounts is intended (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n).

Account 62 of accounting is an active-passive account “Settlements with buyers and customers”, used to summarize mutual settlements with individuals and legal entities. In this article we will look at the main (standard) transactions for account 62 using the example of selling goods through an online store.

Let's study what the balance sheet shows for account 62, as well as what is reflected in the debit and credit of account 62. Table of contents

- 1 Account 62 in accounting

- 2 Postings to the account 62 Settlements with buyers and customers using an example

- 3 Account 62 which is reflected in debit and credit

- 4 Balance sheet for account 62

Account 62 in accounting Calculations are reflected in correspondence with the account.

Accounting and postings for bills received If an organization has shipped goods or products to a buyer and received a bill of exchange from him to secure the debt, then it must be accounted for in a separate subaccount 62.3 “Bills received”.

Upon receipt of the bill of exchange, posting D62.3 K62.1 is performed. After the arrival of a certain period specified in the contract, the buyer pays the bill, and posting D51 K62 is reflected.

3, which will mean that the bill has been repaid.

Source: https://agnbotulinum.com/provodki-po-62-schetu-dlya-nachinayushhih/

Accounting for settlements with customers

Debit account 62 reflects the cost of shipped inventory items, that is, the buyer’s receivables to the organization are formed here (proceeds from the sale).

The debit of account 62 corresponds with the credit of accounts for sales or other income and expenses. used when selling goods or products to a buyer, when this is a normal activity of the organization. used for one-time sales of assets: fixed assets, materials, intangible assets, when this is not the usual activity of the enterprise - postings D62 K90/1 or D62 K91/1.

Credit account 62 reflects receipt of payment from the buyer, that is, repayment of existing debt. The credit to account 62 corresponds with the debit of cash accounting accounts (accounts 50, 51, 52, 55) - postings D50 (51, 52, 55) K62.

The cost of sold inventory items is reflected in the debit of account 62, taking into account VAT.

If an organization is a payer of this tax, then it must be calculated in accordance with the applicable rate and paid to the budget. The accrual of value added tax is reflected using entry D90/3 (91/2) K68/VAT (depending on what is sold). Tax payment is reflected using entry D68/VAT K51.

These postings are reflected during a regular sale, when the organization ships inventory items, and the buyer then pays for them.

In this case, account 62 behaves as active: the debit reflects the receivables (asset), and the credit reflects the repayment of debt (reduction of the asset).

Accounting entries for account 62 in the general case:

Accounting for advances received

Another option for settlements with customers is possible, when the organization first receives an advance payment from the buyer (advance payment), after which it makes the shipment. Accounting for settlements will be conducted slightly differently.

First of all, an additional subaccount 2 “Advances received” is opened. In this case, the first subaccount records calculations in the general case.

Receipt of an advance payment is reflected using posting D51 K62/2, and the seller’s accounts payable to the buyer is formed.

If an organization is a VAT payer, then it must allocate tax from the advance received to pay it to the budget. To do this, you can use additional account 76, on which a sub-account “VAT on advances received” is opened. The posting for calculating tax payable on an advance received has the form: D76/VAT on advances K68/VAT, posting is made on the day the advance is received.

On goods sold, VAT must also be charged for payment by posting D90/3 K68.VAT, posting is carried out on the day of shipment.

After the shipment has been made, it is necessary to offset the advance received as payment for the shipped valuables using posting D62/2 K62/1.

As for VAT, we see that the tax is assessed for payment twice: on the advance payment and on the sale. Of course, the organization will not pay it in double amount, so it is necessary to deduct VAT from the advance payment; for this purpose, posting D68/VAT K76/VAT from advances is performed.

If an advance payment is received from the buyer, account 62 will behave as a passive account: accounts payable (liability) are formed on the loan, and debt is repaid on the debit (reduction of liability).

That is why account 62 is active-passive, since it can behave as a passive and as an active account.

Postings for accounting for advances received:

Accounting for bills received

Another way to receive payment from the buyer for shipped valuables is to receive a bill of exchange from him to secure the resulting receivables. The bills received are reflected in subaccount 3, account 62.

Account 62 is intended to summarize information about settlements with buyers and customers in accounting. Find out what transactions are reflected in the debit and credit of this account.

This is an analytical account that reflects the supplier’s transactions with the buyer. It records the debt to the buyer (credit), as well as the buyer's debt (debit). In the balance sheet, an account can be included in both an Asset and a Liability. More details below.

Basic operations on the account. 60

D 08,10,41,K6 receiving inventory from the supplier

D20,25,26,44 K60 - execution of work by a contractor

D19, K60 - accounting for VAT in the item of purchased goods and materials from the supplier

D60, K51 - transfer of funds in favor of the supplier (contractor)

D60 K60/bills issued – own bill issued in payment to the supplier.

D60/veks. issue K51 - own bill repaid

D60 K91.1 – applies in case of expiration of the statute of limitations (3 years from the date of occurrence of accounts payable).

To summarize information about settlements with buyers and customers, an account is used. 62. This account is active and passive, balance sheet. Balance – debt receivable or payable on the part of the buyer or customer. OD - the amount for which settlement documents have been presented. OK – amount of received payments. Analytical accounting is carried out for each buyer and customer separately.

D62 K90.1 – shipment of goods and materials to the buyer or customer after ownership of this goods and materials has transferred to them.

D62 K91.1 – applied if the customer accepted the work performed

D51 K62 - acceptance of funds from a buyer or customer

D91.2 K62 - applies if the statute of limitations has expired from the moment the buyer’s debt arose.

If the organization has performed work (services) for the customer and shipped goods (products) to the buyer, then after the ownership of them has passed to the buyer, an entry is made in accounting according to Dt account 62:

Dt 62 Kt 90-1 (91-1) - reflects the buyer’s debt for shipped goods (products, works, services).

When receiving DS or property from the buyer (customer) in payment of the debt, posting according to Kt account 62:

Dt 50 (51, 52, 10, etc.) Kt 62 funds were received from the buyer (customer) in payment for products, goods, work, services.

If the buyer is also a supplier of goods (works, services) for your organization, you can offset the debts.

If, on account of the upcoming delivery of material assets (performance of work, provision of services), the organization receives advances from buyers (customers), then to account for such amounts, a subaccount is opened to account 62 “Calculations for advances received”:

Dt 50 (51, 52, etc.) Kt 62 subaccount “Calculations for advances received.”

If an advance is received for the upcoming delivery of goods (performance of work, provision of services) subject to added tax, then the amount of the advance is also subject to this tax. Reflect the accrual of VAT on the advance payment by posting:

Dt 62 subaccount “Settlements on advances received”

Kt 68 subaccount “Calculations for VAT” - VAT is charged on the advance received.

When transferring material assets to the buyer (performing work, providing services), for which an advance was received, the accrued amount of VAT must be restored:

Dt 68 subaccount “Calculations for VAT” Kt 62 subaccount “Calculations for advances received” - the amount of VAT previously accrued on the advance received is restored, and the amount previously taken into account as an advance is reflected directly on account 62:

Dt 62 subaccount “Calculations for advances received” Kt 62 - advances received from customers are credited.

Account 62 in accounting

- credited in correspondence with cash accounts, settlement accounts for the amounts of payments received (including the amounts of advances received), etc. In this case, the amounts of advances received and prepayments are taken into account separately.

- debited in correspondence with accounts 90 “Sales”, 91 “Other income and expenses” for the amounts for which settlement documents were presented.

Analytical accounting is maintained for each invoice presented to buyers (customers), and for settlements using scheduled payments - for each buyer and customer. At the same time, it should show data on:

- buyers and customers on payment documents for which the payment deadline has not yet arrived;

- buyers and customers on payment documents not paid on time;

- advances received;

- bills for which the due date for receipt of funds has not yet arrived;

- bills discounted (discounted) in banks;

- bills for which funds were not received on time.

Accounting when paying with bills of exchange requires reflecting the debt to the counterparty on the credit of account 62 “Settlements with buyers and customers”.

If interest is provided on the received bill of exchange securing the debt of the buyer (customer), then as this debt is repaid, an entry is made in the debit of account 51 “Currency accounts” or 52 “Currency accounts” and the credit of account 62 of accounting (for the amount of debt repayment) and 91 “Other income and expenses” (percentage).

Accounting for settlements with buyers and customers within a group of interrelated organizations, about the activities of which consolidated financial statements are prepared, is kept separately on account 62.

Instructions 52 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000

Account 52 “Currency accounts” is intended to summarize information on the availability and movement of funds in foreign currencies in the organization’s foreign currency accounts opened with credit institutions in the Russian Federation and abroad.

The debit of account 52 “Currency accounts” reflects the receipt of funds to the organization’s foreign currency accounts. The credit of account 52 “Currency accounts” reflects the write-off of funds from the organization’s foreign currency accounts. Amounts erroneously credited or debited to the organization’s foreign currency accounts and discovered when checking statements of a credit institution are reflected in account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”).

Transactions on foreign currency accounts are reflected in accounting on the basis of statements from the credit institution and monetary settlement documents attached to them.

Sub-accounts can be opened for account 52 “Currency accounts”:

- 52-1 “Currency accounts within the country”,

- 52-2 “Currency accounts abroad.”

Analytical accounting for account 52 “Currency accounts” is maintained for each account opened for storing funds in foreign currency.

Subaccounts of account 62

You can open six sub-accounts for account 62:

- 62-1 “Settlements under government contracts”;

- 62-2 “Settlements with procurement and processing organizations of the agro-industrial complex”;

- 62-3 “Settlements on bills received”;

- 62-4 “Calculations for advances received”;

- 62-5 “Intra-group settlements of interrelated organizations”;

- 62-6 “Settlements with other buyers and customers.”

Subaccount 62-1 - to summarize data on settlements with government agencies for sold products and livestock. As sales are recognized for the fulfillment of government orders, the debt of authorized bodies is reflected in the debit of this subaccount in correspondence with account 90 “Sales”. If the shipment of agricultural products was made to repay a previously received commodity loan, then at the same time an entry is made in the debit of accounts 66 “Settlements for short-term loans and borrowings”, 67 “Settlements for long-term loans and borrowings” and the credit of subaccount 62-1 “Settlements for government contracts."

Subaccount 62-2 - to summarize information on payments for sold agricultural products, animals and services provided for their delivery, in the order of fulfillment of contracts. As sales to procurement organizations are recognized, the debt is reflected in the debit of this subaccount in correspondence with account 90 “Sales”, subaccount 1 “Revenue”. If an agricultural organization and a procurement organization are part of an interrelated group, then such settlements should be taken into account in subaccount 62-6 “Intra-group settlements of interrelated organizations.”

Subaccount 62-3 reflects information about the debt of buyers and customers, secured by bills received. If interest is provided on the received bill of exchange securing the debt of the buyer (customer), then as this debt is repaid, an entry is made to the debit of account 51 “Currency accounts” or 52 “Currency accounts” and the credit of account 62 “Settlements with buyers and customers” (on amount of debt repayment) and 91 “Other income and expenses” (by the amount of interest).

Subaccount 62-4 is used to reflect information on settlements for advances received in accordance with contracts for the supply of inventories or for the performance of work performed for customers on partial completion. The amounts of advances and prepayments received are reflected on the credit account 62-4 in correspondence with the cash accounts. Funds received in advances and prepayments, offset upon presentation by the buyer or customer of payment documents for delivered products, are reflected in the debit of subaccount 62-4 and the credit of subaccounts 62-2 and 62-6.

Subaccount 62-5 reflects information on settlements of interrelated organizations (holdings, financial and industrial groups, etc.) for products sold, animals, work performed and services provided. The information from this sub-account is used to determine the adjustments necessary for the preparation of summary (consolidated) statements.

Subaccount 62-6 reflects information with other buyers and customers (legal entities and individuals) on transactions for the sale of finished products, goods, animals, as well as the performance of work and provision of services not provided for in other subaccounts of account 62. In particular, on the specified subaccount The following calculations may be reflected:

- with an individual entrepreneur without forming a legal entity for the products sold by him and the work performed;

- with agricultural organizations for services provided (processing of customer-supplied raw materials, work performed by auxiliary production, etc.).

When shipping products, animals, materials; For the execution of work and provision of services, the corresponding primary documents are drawn up: invoices, acceptance certificates for completed work, etc. The main documents for the emergence of settlement relationships between agricultural and procurement organizations are acceptance receipts. The form of receipts depends on the type of products sold: grain, milk, livestock, etc. In accordance with tax legislation, the information reflected in the listed documents is subject to registration in invoices of the established form. When receiving funds in the form of advances or other payments for upcoming deliveries of animal products (performance of work, provision of services), the organization also draws up an invoice.

Formation of SALT 62 accounts in 1C

When maintaining accounting records in specialized 1C software products, it is possible to generate a detailed statement that will separately display all advance payments received, customer debt for shipped goods, and settlements in foreign currency.

Note from the author! In accounting programs, situations arise when, when generating a report on subaccounts, the same amount is displayed on different subaccounts. This error can be corrected by re-entering the documents in the correct sequence. If the restoration did not lead to the correction of the error, then you should pay attention to the established settlement rules according to the agreement: automatic offset of payments or linking payments to specific documentation. This error must be corrected, since the information affects the reliability of the financial statements (lines 1230, 1520).

The period for the formation of the balance sheet for settlements with buyers and customers is determined in an arbitrary interval depending on the purposes of monitoring (from one business day to several years), therefore SALT is one of the most convenient ways to check mutual settlements with counterparties (it is possible to create an interim report on to a specific buyer repeating the data of the reconciliation report).

The procedure for creating a report in 1C:

- In the menu, select Reports – Account balance sheet;

- Determine the period of interest and select the account for which the report will be generated (it is possible to generate a statement separately for each subaccount);

- Select report detailing: analysis of individual buyers and customers or detailed monitoring of all settlement documents for each counterparty;

- Create a statement and analyze the results.

Something to keep in mind! The SALT data for account 62 must fully correspond to the card for this account and the general SALT for all accounting accounts of the organization.

Account 62 correspondence

| by debit | on loan | ||

| 46 | Completed stages of unfinished work | 50 | Cash register |

| 50 | Cash register | 51 | Current accounts |

| 51 | Current accounts | 52 | Currency accounts |

| 52 | Currency accounts | 55 | Special bank accounts |

| 55 | Special bank accounts | 57 | Transfers on the way |

| 57 | Transfers on the way | 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers | 62 | Settlements with buyers and customers |

| 76 | 63 | Provisions for doubtful debts | |

| 79 | On-farm settlements | 66 | Calculations for short-term loans and borrowings |

| 90 | Sales | 67 | Calculations for long-term loans and borrowings |

| 91 | Other income and expenses | 73 | Settlements with personnel for other operations |

| 75 | Settlements with founders | ||

| 76 | Settlements with various debtors and creditors | ||

| 79 | On-farm settlements | ||

Score 62

All settlements with buyers and customers are formed on this account, namely:

- sold products of own production;

- goods sold;

- services provided;

- receiving advances against future deliveries;

- payment from buyers.

For a detailed consideration of settlements with customers, a balance sheet can also be used.

Account 62 postings

| Debit | Credit | Operation |

| 62 | 46 | Write-off of the cost of completed stages of work. The cost must be paid by the customer and all work on the project is completed. |

| 62 | 50 | Return from the cash register to the buyer of overpaid funds |

| 62 | 50 | Refund from the cash register to the buyer of the advance payment |

| 62 | 51 | Return of overpaid funds from the current account to the buyer |

| 62 | 51 | Refund from the current account to the buyer of the advance payment |

| 62 | 52 | Return from a foreign currency account to the buyer of overpaid funds |

| 62 | 52 | Refund from a foreign currency account to the buyer of the advance payment |

| 62 | 55 | Return from a special account to the buyer of overpaid funds |

| 62 | 55 | Return from a special account to the advance buyer |

| 62 | 57 | Postal order to the buyer |

| 62 | 62 | Advance from the buyer is offset against debt repayment |

| 62 | 76 | |

| 62 | 90 | Reflection of revenue from the sale of goods (services) |

| 62 | 91 | Inclusion of the amount of advance payment from the buyer into other income due to the expiration of the statute of limitations |

| 62 | 91 | Inclusion of positive exchange rate differences in foreign currency in other income |

| 62 | 91 | Reflection of proceeds from the sale of fixed assets and other property |

| Debit | Credit | Operation |

| 50 | 62 | Posting of proceeds - cash received from the buyer - to the organization's cash desk |

| 50 | 62 | Depositing an advance payment from the buyer to the cash register |

| 51 | 62 | Crediting cash from the buyer to the organization's current account |

| 51 | 62 | Transfer of advance payment by the buyer to the organization's bank account |

| 52 | 62 | Crediting funds from the buyer to the organization's foreign currency account |

| 52 | 62 | Transfer by the buyer of an advance payment to the organization’s foreign currency account |

| 55 | 62 | Transferring funds from the buyer to a special account of the organization |

| 55 | 62 | Transfer by the buyer of an advance payment to a special account of the organization |

| 57 | 62 | Transfer of funds by the buyer through a post office or savings bank |

| 60 | 62 | Settlement of counterclaims of the same type |

| 63 | 62 | Debt write-off from the reserve for doubtful debts upon expiration of the statute of limitations |

| 66 | 62 | Repayment of debt on a short-term loan through offset of similar counterclaims |

| 67 | 62 | Repayment of debt on a long-term loan through offset of counter similar claims |

| 73 | 62 | Debt of the organization's employees for products sold to them |

| 75 | 62 | Offsetting the claims of the founders for the payment of income to them through the repayment of debt for the products supplied to them |

| 76 | 62 | Settlement of counterclaims of the same type |

| 91 | 62 | Inclusion of negative exchange rate differences in foreign currency as part of other expenses |

Typical transactions for 51 accounts

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Cash foreign currency deposited into a foreign currency account | 52 | 50 |

| The purchased foreign currency is credited to the foreign currency account | 52 | 51 |

| Funds were transferred from one currency account to another | 52 | 52 |

| Funds are transferred to a foreign currency account from a special bank account | 52 | 55 |

| The purchased foreign currency is credited to the foreign currency account | 52 | 57 |

| Cash in foreign currency received to repay a previously issued loan | 52 | 58-3 |

| Amounts overpaid to the supplier were returned to the foreign exchange account | 52 | 60 |

| Advance payment in foreign currency from the supplier was returned | 52 | 60 |

| Foreign currency received from the buyer | 52 | 62 |

| The buyer made an advance payment in foreign currency | 52 | 62 |

| Received a short-term loan in foreign currency | 52 | 66 |

| Received a long-term loan in foreign currency | 52 | 67 |

| Unused foreign currency issued for reporting was returned to the foreign exchange account | 52 | 71 |

| A loan in foreign currency was returned to the foreign currency account | 52 | 73-1 |

| The amount of compensation for material damage caused by the employee is credited to the foreign currency account | 52 | 73-2 |

| Funds were transferred to the foreign currency account as a contribution to the authorized capital | 52 | 75-1 |

| Received insurance compensation in foreign currency from an insurance company | 52 | 76-1 |

| Funds in foreign currency are credited to a foreign currency account for a recognized (awarded) claim | 52 | 76-2 |

| Funds in foreign currency are credited to a foreign currency account on account of dividends (income) due to the organization from participation in other organizations | 52 | 76-3 |

| Targeted funding has been transferred to the foreign currency account | 52 | 86 |

| Received payment for products sold (goods, works, services) | 52 | 90-1 |

| Funds from the sale of other property, as well as additional income received in foreign currency, are reflected in other income | 52 | 91-1 |

| The positive exchange rate difference on the foreign currency account is included in other expenses | 52 | 91-1 |

| Foreign currency received into a foreign currency account as a result of extraordinary events is included in other income | 52 | 91-1 |

| Foreign currency received free of charge | 52 | 91-1 |

| Cash received into a foreign currency account to be included in deferred income | 52 | 98-1 |

By account credit

| Contents of a business transaction | Debit | Credit |

| The cash desk received foreign currency from a foreign currency account | 50 | 52 |

| Foreign currency transferred to a special bank account | 55 | 52 |

| Foreign currency listed for sale (conversion into rubles) | 57 | 52 |

| Shares paid from foreign currency account | 58-1 | 52 |

| Loan transferred from foreign currency account | 58-3 | 52 |

| Funds were transferred from a foreign currency account under a joint activity agreement | 58-4 | 52 |

| Debt in foreign currency to the supplier was repaid | 60 | 52 |

| An advance in foreign currency was transferred to the supplier | 60 | 52 |

| The amount overpaid by the buyer is returned | 62 | 52 |

| The advance payment was returned to the buyer from a foreign currency account | 62 | 52 |

| A short-term loan or interest on it in foreign currency has been repaid | 66 | 52 |

| A long-term loan or interest on it in foreign currency has been repaid | 67 | 52 |

| Salaries (dividends) to employees were transferred from a foreign currency account | 70 | 52 |

| Cash issued in foreign currency on account | 71 | 52 |

| A loan was provided to an employee in foreign currency | 73-1 | 52 |

| Dividends were paid from the foreign currency account to the founders (participants) | 75-2 | 52 |

| Deposited wages paid | 76-4 | 52 |

| Own shares purchased from shareholders were paid from a foreign currency account | 81 | 52 |

| Expenses were paid from the current account using retained earnings (by decision of the founders (participants) of the organization) | 84 | 52 |

| Negative exchange rate difference on the foreign currency account is included in other expenses | 91-2 | 52 |

| Foreign currency lost as a result of emergency circumstances is included in other expenses | 91-2 | 52 |

| Expenses related to eliminating the consequences of emergency situations were paid from a foreign currency account | 91-2 | 52 |

| Various expenses were paid from a foreign currency account using a previously created reserve. | 96 | 52 |