What exactly is an objection to a tax audit report used for?

An objection drawn up on behalf of the company allows its management to appeal any actions, results and conclusions of the tax authorities who carried out the tax audit.

There are two main types of violations committed by tax authorities:

- procedural (i.e. errors in the order of the event);

- violations related to substantive law (i.e. incorrect interpretation of any documents, incomplete accounting of provided papers, etc.).

The tax office is obliged to respond to a written objection, regardless of which of these types of violations it is written about.

On-site inspections of the Social Insurance Fund: refusal to accept expenses on sick leave for offset

Based on the results of a desk audit, fund employees came to the conclusion that the organization did not violate the legislation on insurance premiums. In this case, they will not draw up any documents based on its results.

The Pension Fund of the Russian Federation together with the Social Insurance Fund can conduct inspections in any organizations. Representatives of the pension fund are studying information related to compulsory insurance, and representatives of the Social Insurance Fund are studying issues related to insurance of temporary disability and in connection with maternity. The following points attract special attention from the Pension Fund of Russia, the Social Insurance Fund, and currently the Federal Tax Service:

- expenses financed by the Social Insurance Fund;

- late submission of reports;

- non-taxable amounts of payments;

- reduced insurance rates;

- inconsistency of calculations with inspection results;

- debt on insurance payments;

- frequent reporting adjustments;

- other violations.

Please note that currently the forms of the on-site inspection report, as well as the requirements for issuing an on-site inspection report, are approved. by order of the FSS of the Russian Federation dated January 25, 2017 No. 9. If you received an act that does not meet these requirements, then this is a reason to appeal it and recognize it as drawn up in violation of the requirements of the law.

What you shouldn't complain about

Everything related to the company’s activities in terms of documents, finance, accounting and taxes can and should be appealed in case of disagreement.

But there are some points against which it is not advisable to file an objection with the tax office. This:

- timing of the verification procedure (start and end dates),

- inaccuracies in the preparation of the protocol,

- minor procedural violations.

All these minor details should be ignored at this stage, focusing on the essence of the claim. Here the mark “at this stage” means that they should be reserved for the court, where, if something happens, they can try to discredit the act (i.e., declare it illegal).

In addition, it should be borne in mind that an objection drawn up in accordance with all the rules, with all the necessary papers attached, regarding the audit procedure may well lead to additional control measures on the part of the tax authorities. And their results, in turn, can easily reveal more serious errors and violations in the activities of the enterprise.

Grounds for disagreement with the act

Well-written objections and well-founded arguments contribute to making a decision to cancel or reduce sanctions. A taxpayer can express disagreement with the act or part of it in relation to:

- Inconsistencies between the actual data of the enterprise and those specified in the act from the point of view of the provisions of tax legislation. In a number of cases, the facts of economic activity are misinterpreted by the inspection inspector.

- Inspection procedures. Violations of procedural order occur, but are extremely rare. Violation of the procedure does not affect the decision making. Cancellation of the decision is carried out in court.

- Data inconsistencies. The materials of the act sometimes contain incomplete information.

- Arithmetic of inspectors' calculations. Errors may occur when calculating penalties, fines and when determining the amount of arrears taking into account overpayments.

The taxpayer is not required to support the arguments put forward with documents. In the form of evidence, documents restored or received from counterparties may be attached confirming the information specified in the objections.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to justify an objection

Before “starting a discussion” with the tax authorities, it is advisable to stock up on one hundred percent arguments and a set of convincing documents certifying the correctness of the organization, which must be added to the objection. To do this, it is necessary to carefully study the tax audit report, and recheck all identified controversial points several times.

If, at the time of writing the tax audit report, the company for some reason lacked some documents, but it managed to restore them as soon as possible or was able to correct minor inaccuracies in the existing papers, this must be reflected in the objection.

This will reduce the amount of additional tax assessed, if any, and also avoid all kinds of fines and penalties.

All your arguments must be carefully and thoroughly explained, indicating the circumstances that led to this or that shortcoming and referring to the legislation of the Russian Federation in the field of taxes, civil law, judicial practice and company regulations.

It will be difficult for tax authorities to argue with well-founded arguments; moreover, if something happens, they will become the evidence base when the company goes to court (if, of course, it comes to that). It should also be noted here that in court it will be possible to raise only those points of the tax audit report that were previously appealed to a higher tax office.

What is the timeframe for consideration?

The tax audit report, other materials of the tax audit, during which violations of the legislation on taxes and fees were revealed, as well as written objections to the said act submitted by the person being inspected (his representative) must be considered by the head (deputy head) of the tax authority that conducted the tax audit. Based on the results of their consideration, the head (deputy head) of the tax authority, within 10 days from the date of expiration of the period specified in paragraph 6 of Article 100 of this Code, makes one of the decisions provided for in paragraph 7 of this article, or a decision to carry out additional tax control measures. The period for reviewing tax audit materials and making an appropriate decision may be extended, but not more than by one month.

Tax Code of the Russian Federation

paragraph 1 of article 101

From the above quote it follows that timely submitted objections will be considered no later than 1 month and 10 days from the end of the deadline for their submission.

Review is scheduled within the first ten days after the submission deadline. The specific date is set by the head of the tax office.

Example: objections were received by the tax office within a month after delivery of the act, for example, February 9, 2020. The review will be scheduled from February 10 to February 27 (11, 12, 18, 19, 23, 25, 26 are weekends).

If a person whose appearance is necessary for the manager does not appear for the review, or during the review it becomes necessary to involve a witness, expert, or specialist, then the director postpones the review for up to one month.

While awaiting the outcome of the objections, consider arguments that will strengthen your position in a possible trial.

Procedure after filing an objection

After filing objections, you should wait for a notification from the tax office setting a date and time for consideration of the case materials. Such a notice is drawn up in the form approved by order of the Federal Tax Service of Russia dated 05/08/2015 T MMV-7–2/ [email protected] (Appendix No. 25 Form for KND 1160076).

All further events regarding the consideration of objections will take place on the initiative of the head of the tax office. As far as the person being inspected is concerned, he will be informed about their occurrence in writing.

If, as a result of newly discovered circumstances, the taxpayer decides to withdraw his objections to the audit report, he has the right to do so. Before the head of the Federal Tax Service makes a decision, he can withdraw his objections in whole or in part; to do this, it is enough to fill out a new form of objections to the act and submit it to the tax office.

Submitting objections to a tax audit report is the beginning of challenging its results set out in the report. The result of an audit sometimes depends on the quality of document preparation. The head of the inspection, based on the objections raised, can cancel the penalties proposed in the act.

Where and how to file an objection

The objection should be submitted to the address of the territorial tax service, whose specialists carried out the audit. The document can be transferred:

- personally “hand to hand”,

- by sending it by registered mail with return receipt requested.

Both of these methods ensure that tax authorities receive the objection in a timely manner.

Today, another proven option for document delivery has become widespread: through electronic services , but only on condition that the organization has an officially registered digital signature.

How are checks carried out?

The Fund's division may conduct an inspection no later than three months from the date of submission of reports. No special order from management is needed for this. The algorithm is like this:

- In the policyholder's documents, inspectors look for discrepancies between the information provided to the Fund and those available to the Social Insurance Fund itself. As well as errors in the calculation of contributions.

- If such violations are found, the inspectors report this to the company or entrepreneur.

- The policyholder must provide explanations within 5 days , and, if necessary, correct errors. If the policyholder believes that there are no errors on his side, he can submit accounting documents that will confirm this.

- Further explanations are considered by the inspectors. As a result, a conclusion must be made as to whether there is a violation by the policyholder of the rules for calculating and paying premiums.

- If it is recognized that there is a violation, or if the policyholder does not provide an explanation, the inspector draws up an inspection report.

- If the FSS has no complaints, then the company or individual entrepreneur is not notified of the control event. In this case, an inspection report is not drawn up.

Main nuances in drawing up an objection

To date, there is no strictly established sample of an objection to a tax audit report. Employees of enterprises and organizations can draw up a document in any form, based on their understanding of it.

In this case, it is advisable to take into account some office work norms and rules for writing business documentation. In particular, the objection must indicate:

- addressee, i.e. the name, number and address of the exact tax office to which the objection is sent,

- sender information (company name and address),

- number of the objection and the date of its preparation.

In the main part it should be indicated

- the act in respect of which an objection is being drawn up,

- describe in detail the essence of the claim, including all available reasons and arguments.

The document must refer to the laws that confirm the correctness of the author of the objection and indicate all additional papers attached to it (marking them as a separate attachment).

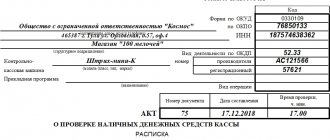

Sample objection to FSS inspection report

The insurance premium payer has the right to attach documents (their certified copies) confirming the validity of the objections to written objections or, within the agreed period, to transfer them to the body monitoring the payment of insurance premiums.

Objections can also be sent by mail (with a description of the attachment and a receipt, so that there is confirmation of the fact that they were sent and received by the addressee). In this case, you should take into account the time required for delivery of the postal item.

N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” presents its objections to the inspection report.

The deadline for filing objections during an on-site inspection is 1 month. During this period of time, documentation with explanations may be drawn up.

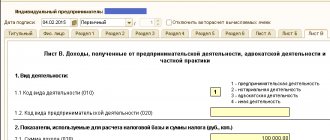

The circumstance, an objection to the report of a desk audit of the FSS sample liability, is recognized as the punishment of a tax offense by the person previously. Augusta submitted documents for reimbursement of expenses for OSS in connection with maternity to the Social Insurance Fund, only today they sent an act, c. Next, the payer must evaluate the disagreement regarding the report of the desk audit of the Social Insurance Fund with an impartial one.

What to pay attention to when preparing a document

Neither the Federal Tax Service in its acts nor the law regulates the filing of an objection in any way. That is, it can be written by hand or printed on a computer on an ordinary A4 sheet or on company letterhead.

It is strictly important to comply with only one condition: the objection must be signed by the head of the enterprise or an employee authorized to create such documents. If the form is endorsed by a proxy, it must also indicate the number and date of the power of attorney.

Today it is not necessary to certify an objection with a stamp, since since 2020, enterprises and organizations have every right not to use stamped products in their work (unless this norm is prescribed in the local regulations of the company).

The document should be drawn up in two copies , one of which should be submitted to the tax office, the second, after the tax specialist has marked the acceptance of the document, should be kept.