What is a desk tax audit?

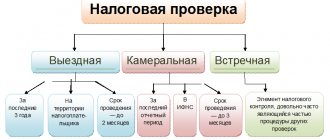

A desk audit is a control event that the Federal Tax Service carries out after receiving any declaration and any settlement.

In general, such an audit does not involve tax officials visiting the taxpayer’s location: all activities are carried out within the premises of the inspectorate. Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

First of all, the received reports are checked to ensure compliance with the deadlines. The Federal Tax Service records that the declaration or calculation was submitted without delay. If the deadline is violated, the payer faces a fine under Article 119 of the Tax Code of the Russian Federation.

IMPORTANT DURING THE QUARANTINE DUE TO CORONAVIRUS. The deadlines for submitting declarations and settlements that fall during the period from March 1 to May 31, 2020 are automatically extended by three months. The exception is the VAT return and insurance settlements for the first quarter of 2020 - they must be submitted no later than May 15 (Resolution of the Government of the Russian Federation dated April 2, 2020 No. 409; see: “Deadlines for payment of taxes and contributions have been postponed” and “When to pay taxes and submit reports: all new deadlines in the table from the Federal Tax Service").

Then controllers check the compliance of the reporting with the rules that are prescribed in the order of filling out a particular declaration (calculation). After this, the fulfillment of the control relations is checked.

Submit all tax returns online for free

In addition, within the framework of the “camera chamber”, data from the declaration or calculation is compared with other information that the tax authorities have at their disposal. In particular, information from the received reports is verified with data from other declarations and calculations of the taxpayer himself, as well as with the reports of his counterparties (clause 2.3 of the Federal Tax Service letter dated July 16, 2013 No. AS-4-2/12705). In addition, the information specified in the declaration or calculation is compared with data from information sources to which the Federal Tax Service has access. This is, in particular, information about licenses, bank accounts, data from the Unified State Register of Legal Entities, the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs (clause 2.5 of the Federal Tax Service letter dated July 16, 2013 No. AS-4-2/12705).

Receive a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the signature of the Federal Tax Service Send an application

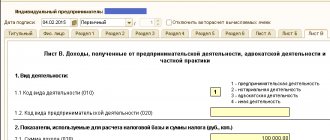

The procedure for submitting “clarifications” is different if the tax is paid by a tax agent

Financiers recalled the special provision of paragraph 6 of Art. 81 of the Tax Code of the Russian Federation, which obliges tax agents, including VAT, to submit updated calculations in the following cases:

- the submitted reports do not reflect (incompletely reflect) any data;

- in case of overstatement or understatement of tax liabilities.

The Ministry of Finance of the Russian Federation clarified that the updated declaration must contain all those sections that were filled out in the primary reporting, even if there are no errors in them.

When compiling a “clarification”, corrections are made to previously completed sections. In this case, new sections are filled in, for example, section 2 “Amount of tax to be paid to the budget, according to the tax agent,” if it was not filled out by mistake in the initial declaration.

Sections that do not require corrections remain unchanged.

Letter of the Federal Tax Service of the Russian Federation dated January 11, 2017 No. AS-4-15/200.

Editor's note:

Thus, for tax agents it does not matter whether the payment is overestimated or underestimated; someone else’s tax must be recalculated in any case.

If the tax agent company detects distortions specified in the letter, the declaration must be clarified.

This also applies to calculations using Form 6-NDFL.

For example, if a March error was noticed at the end of the year after the calculations were submitted based on the results of 9 months, then three “clarifications” will have to be submitted: for the first quarter, half a year and 9 months. After all, section 1 of the form is filled out with a cumulative total, and such an error appears in all calculations submitted for the reporting periods (letter of the Federal Tax Service of the Russian Federation dated July 21, 2017 No. BS-4-11 / [email protected] ).

Distortions in calculations result in a fine of 500 rubles.

A five-day period for filing an updated declaration is established by the Tax Code of the Russian Federation only when issuing a tax demand (to clarify or clarify inconsistencies). In other cases, no deadline is specified. But it is better to submit it early, so that a mistake in underestimating the amount to be paid does not lead to a fine of 20 percent of the arrears (Article 122 of the Tax Code of the Russian Federation). After all, tax officials can be the first to find it, then punishment cannot be avoided.

Before submitting the “clarification”, you must pay the arrears and penalties (clause 4 of Article 81 of the Tax Code of the Russian Federation).

Who conducts the desk audit?

As already noted, a desk audit does not require a mandatory visit to the taxpayer. Therefore, almost all control activities are carried out at the location of the tax authority. For this purpose, the inspectorates have created special departments for desk audits, where submitted declarations and calculations are received.

Employees of these departments (tax inspectors), as part of their daily job duties, with the help of special programs, carry out the above control activities.

REFERENCE. The decision of the head or deputy head of the Federal Tax Service to conduct a desk audit is not required. This is directly stated in paragraph 2 of Article of the Tax Code of the Russian Federation.

Stages of conducting KNI

Conventionally, we can distinguish several stages of conducting KNI:

- Acceptance and registration of the declaration in the AIS “Tax”.

- Arithmetic and desk control of the received declaration.

- Implementation of direct control measures to verify the submitted document.

- Completion of KNP.

- Preparation of a KNP act or other document.

View gallery

Goals and features of the “camera room”

The main purpose of a desk audit is to ensure that tax obligations are formed correctly in a declaration or calculation. In other words, a desk audit can confirm that the taxpayer has correctly calculated the amount of tax, or refute this. Also, during the audit, data from the reporting will be checked with information about the amounts of taxes already transferred in order to establish the presence of arrears or overpayments.

Within the framework of the “camera chamber”, in addition to checking the control ratios and the accuracy of filling out the declaration, other tax control measures can be carried out. Thus, in cases directly specified in the article of the Tax Code of the Russian Federation, additional documents can be requested from the taxpayer confirming the data specified in the declaration. For example, this is allowed when discrepancies are identified between the information in the declaration and the information available to the inspectorate (clause 3 of Art. Tax Code of the Russian Federation).

Receive requests from the Federal Tax Service for free and send the requested documents via the Internet

For more details, see: “The Federal Tax Service requires documents: which requests need to be answered and which can be ignored.”

Also, during a desk audit, the Federal Tax Service may conduct so-called counter audits, that is, request documents and information from third parties (Article 93.1 of the Tax Code of the Russian Federation). They can be both parties to those contracts that the taxpayer himself entered into, and counterparties of the second, third and subsequent links (resolution of the Arbitration Court of the Ural District dated 02.08.18 No. F09-4001/18). For more details, see: “The Federal Tax Service Inspectorate requested data on the counterparty or transaction: when is it legal, and what will happen if you do not respond to the request.”

In addition, when conducting a “camera chamber”, the Federal Tax Service may call the management of the inspected organization or entrepreneur to the inspectorate to give explanations (subclause 4, clause 1, article of the Tax Code of the Russian Federation). Tax authorities also have the right to interrogate any other persons, including taxpayer employees, and seize documents (Articles and Tax Code of the Russian Federation). In some cases, inspections of premises, territories, documents and objects are permissible (clause 1 of Art. Tax Code of the Russian Federation).

IMPORTANT FOR THE PERIOD OF QUARANTINE DUE TO CORONAVIRUS . Until June 1, 2020, any control activities related to direct contact with taxpayers are prohibited. We are talking about interrogations, seizure of documents, inspections, calls to the Federal Tax Service, etc. (letter of the Federal Tax Service dated 04/09/20 No. SD-4-2 / [email protected] ).

In what form should explanations for declarations and calculations be provided?

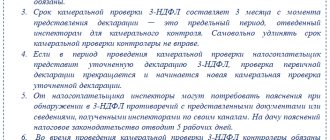

If, during a desk audit, tax officials find errors or inconsistencies in the submitted reports, they have the right to request clarification from the taxpayer. The person being inspected has 5 days to provide explanations or correct previously submitted forms.

If inaccuracies are found by inspectors in the declaration of profit, property or transport, as well as personal income tax reporting, then explanations can be submitted in any form (on paper or according to the TKS). But if the tax office is dissatisfied with the VAT return, then you need to communicate with the Federal Tax Service exclusively in virtual form according to the format established by the Federal Tax Service of the Russian Federation. Otherwise, explanations will be considered not provided and a fine will follow.

Let us recall that the central office of the Federal Tax Service of the Russian Federation, in its decision on a taxpayer’s complaint, argued that the local Federal Tax Service Inspectorate must accept VAT explanations in any electronic form, but they do not necessarily have to comply with the format.

Deadlines for desk checks

As a general rule, a desk audit lasts three months from the date of reporting. VAT returns “by default” must be checked within a shortened period of two months (Clause 2 of Article of the Tax Code of the Russian Federation).

IMPORTANT DURING THE QUARANTINE DUE TO CORONAVIRUS. Despite the fact that the days from March 30 to April 30, 2020 have been declared non-working, tax authorities conduct desk audits within the usual time limits (letter of the Federal Tax Service dated April 10, 2020 No. EA-4-15 / [email protected] ; see “Cameral checks” on VAT and tax refunds will be processed within normal time frames.")

In most cases, it is impossible to extend the period of the “camera chamber”. An exception applies to VAT returns. The tax inspectorate may extend the period for auditing such a report from the reduced two to the standard three months if signs of violation of tax legislation are detected (clause 2 of Article 2 of the Tax Code of the Russian Federation).

Check and submit an electronic VAT return for free

The above inspection periods begin to run from the day the inspection received the declaration or calculation (letter of the Ministry of Finance dated December 22, 2017 No. 03-02-07/1/85955, clause 2.2 of the Federal Tax Service letter dated July 16, 2013 No. AS-4-2/ 12705). The rules for ending the desk audit period are the same as for any other deadlines (Article 6.1 of the Tax Code of the Russian Federation). This means that the “camera room” must end on the corresponding date after three (two) months. If this day falls on a weekend or holiday, the end date is moved to the next business day. And if there is no corresponding date in the month in which the audit is completed, then the audit must end on the last day of that month.

ATTENTION. The Federal Tax Service cannot suspend the period during a desk audit.

The expiration of the “camera chamber” period means that inspectors must stop all “external” inspection activities. That is, they will not be able to send requests for the submission of documents (to both the taxpayer and third parties), conduct interrogations, inspections, seizures, etc. But “internal” events can continue. The fact is that drawing up an inspection report outside its deadline is not a significant violation of the procedure and does not entail the unconditional cancellation of the decision of the Federal Tax Service (clause 14 of article 101 of the Tax Code of the Russian Federation, clause 3 of the letter of the Ministry of Finance dated March 23, 2018 No. 03-02-07/ 1/18400).

ATTENTION. If you submit an updated declaration before the end of the chamber meeting, the verification of the primary reports will immediately stop. And the inspection period will begin to run again (clause 9.1 of Art. Tax Code of the Russian Federation).

What the law says

A desk audit, as mentioned above, is a type of audit of the federal tax service, which is carried out with the support of the current tax code of the Russian Federation. All information concerning the procedure and rules for its implementation are prescribed in Articles 31, 87 and 88 of the Tax Code.

If you have documents that are constantly sent by various companies and enterprises, you can conduct a desk audit. Missing documentation may be requested by tax officials. The amount of this documentation is always large, so quite often situations arise when you need fully certified documentation, and not part of it.

Certified copies of documents must reflect all information data that is on the original of this paper. Tax legislation does not provide for certain conditions for providing certified copies of documents to the Federal Tax Service. It is for this reason that any documents and in any quantity can be certified.

Packages with documents must meet certain requirements:

- the text must be readable;

- when viewing packages there should be no situations with possible mechanical damage;

- it is necessary to ensure simple and unhindered copying from documents;

- all pages must be numbered, and the number of certified copies must be indicated at the end.

Folders with documents are sent to the tax authorities with an attached covering letter.

In cases where, through a desk audit, violations relating to the tax code were identified in the work of a businessman or ordinary employee, tax inspectors have the full right to impose fines, penalties, additional payments, etc. Penalties are issued if:

- the fact of tax evasion in the amount of 20% of the unpaid amounts was recorded;

- a refusal to fill out and submit tax returns and reporting documentation was established;

- other violations of an administrative nature.

If a businessman or the management team of a company hides a large amount of money from the tax inspectorate, then they will be held accountable under the articles of the Criminal Legislation of the Russian Federation.

The procedure for holding a camera room

Desk inspection can be divided into two stages: automated control and in-depth inspection. Automated control of reporting occurs virtually without the participation of tax officials. After the data from the declaration (calculation) is loaded into the inspection information system, the computer itself checks the correctness of filling out the reporting lines and verifies the control ratios.

Also, information from declarations is “run” through special databases - the so-called automatic control systems (ACS). The most famous of them is ASK VAT-2, with the help of which a “cross-check” of the data of all VAT returns is carried out and “gaps” in the value added chains are identified. That is, situations are discovered when tax is accepted for deduction, but at the next stage is not transferred to the budget.

ATTENTION . The risk of additional charges during a desk audit for VAT can be reduced if you check received and issued invoices with counterparties in advance.

Carry out automatic reconciliation of invoices with counterparties Connect to the service

If, based on the results of automated control, errors, discrepancies or inconsistencies are found in reporting, this is a reason for an in-depth check. An extended check is also carried out if the declaration states benefits or the amount of VAT to be refunded. In addition, reporting on taxes related to the use of natural resources is subject to a mandatory in-depth audit (clauses 3, 6, 8 and 9 of Art. Tax Code of the Russian Federation).

In-depth desk audit

At this stage, control measures are carried out by the tax inspector. He must make sure that the taxpayer did not commit any violations when filling out the declaration and calculating the amount of tax.

To do this, the inspector sends requests for the submission of documents and information both to the taxpayer himself and to other persons (including counterparties of the second and subsequent links). If necessary, it is possible to interrogate witnesses, conduct examinations, seize documents or inspect territories, premises, documents and objects.

IMPORTANT DURING THE QUARANTINE DUE TO CORONAVIRUS. Until June 1, 2020, any control measures related to direct contact with taxpayers are prohibited (letter of the Federal Tax Service dated 04/09/20 No. SD-4-2 / [email protected] ).

Also, as part of an in-depth audit, the inspector may send the taxpayer a message about errors identified in the reporting. It may contain a requirement to provide explanations or to submit an updated tax return (Clause 3 of Article of the Tax Code of the Russian Federation).

Receive requirements and send requests to the Federal Tax Service via the Internet for free

IMPORTANT DURING THE QUARANTINE DUE TO CORONAVIRUS. If a request for documents or explanations is received between March 1 and May 31, 2020, the response period is extended by 20 working days. An exception is the case when the demand is sent as part of a desk audit of a VAT return. In this situation, the deadline for submitting documents can be postponed by 10 working days (clause 3 of the Decree of the Government of the Russian Federation dated 04/02/20 No. 409; see: “The deadline for submitting documents at the request of the Federal Tax Service has been extended”).

Desk audit of VAT refund declaration

As already noted, in relation to VAT returns, including those in which the amount of tax to be refunded is declared, a two-month “delay period” has been established. It can be extended for another month if signs of violations are identified (clause 2 of Art. Tax Code of the Russian Federation).

IMPORTANT DURING THE QUARANTINE DUE TO CORONAVIRUS. Declaring the days from March 30 to April 30 as non-working days does not change the timing of desk audits of VAT returns and tax refunds (letter of the Federal Tax Service dated April 10, 2020 No. EA-4-15 / [email protected] ).

It should also be taken into account that when refunding VAT, an in-depth desk audit is always carried out. This means that in addition to the automated reconciliation of control ratios and verification of the declaration under the ASK VAT-2, inspectors will most likely request from the taxpayer invoices and primary documents on applied deductions (clause 8 of Article of the Tax Code of the Russian Federation). In addition, tax authorities will conduct counter-inspections of counterparties to ensure the reality of the transactions and amounts claimed for reimbursement.

Connect to the service for automatic reconciliation of invoices with counterparties

If, as a result, contradictions or discrepancies emerge, then the inspectors may additionally request a sales book, a purchase book, a log of received and issued invoices (clause 8.1 of Article of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated August 10, 2015 No. SD-4-15 / [email protected] ). Also, inspectors have the right to inspect, in the presence of witnesses, the territory and premises of the taxpayer to ensure the availability of resources to carry out the operations declared in the declaration (clause 2 of Art., clauses 1 and 3 of Art. Tax Code of the Russian Federation).

IMPORTANT FOR THE PERIOD OF QUARANTINE DUE TO CORONAVIRUS . If the request for the submission of documents in the “camera chamber” of the VAT declaration is received during the period from March 1 to May 31, 2020, then the response period is extended by 10 working days (clause 3 of the Decree of the Government of the Russian Federation dated April 2, 2020 No. 409). And any “contact” control measures, including inspection of the territories and premises of taxpayers, are prohibited until June 1, 2020 (letter of the Federal Tax Service dated 04/09/20 No. SD-4-2 / [email protected] ).

Check the counterparty for signs of a shell company and the presence of disqualified persons

![Uralsib Bank [CPS] RU](https://fondbiz.ru/wp-content/uploads/uralsib-bank-cps-ru-330x140.jpg)