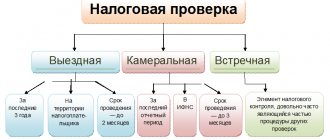

In the article we will look at how a desk audit of 3-NDFL is carried out, its timing, and also how to find out its result. A desk audit is carried out by the supervising tax specialist of the desk department at the location of the tax office based on the provided tax and primary documentation. This type of inspection is carried out on an ongoing basis by a department specially designed for this purpose.

A desk audit will be carried out if the personal income tax payer applies to the tax office:

- For receiving deductions of various nature (property, social);

- For a refund of overpaid tax due to incorrect use of deductions;

- When declaring income received in the past year.

Any appeal to the Federal Tax Service with 3-NDFL is a reason for conducting a desk audit.

When checking 3-NDFL, the clerk will need the declaration itself, as well as documentation justifying the application of the specified rate and deductions. If necessary, the necessary primary documentation is requested from the taxpayer. If the inspection specialist does not understand any points, he will ask the taxpayer for clarification in writing. If anything in the documentation being checked appears suspicious, the matter will be transferred to the department performing on-site inspections. Read in more detail about the verification of entrepreneurs in the article: → “How the desk verification of individual entrepreneurs is carried out on the simplified tax system, PSN, UTII and at closure.”

The desk audit procedure is carried out by tax specialists; the procedure for organizing it is determined by Article 88 of the Tax Code of the Russian Federation.

Deadlines for conducting a desk audit of 3-NDFL

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Paragraph 2 of this article determines that a desk audit must be carried out no later than three months from the date of transfer of 3-NDFL to the tax office .

The starting point for the specified three months is the moment of submission of 3-NDFL. This declaration can be submitted by an individual in several ways:

- personal delivery to a tax specialist;

- electronic transmission;

- mailing.

Date of submission of 3-NDFL depending on the method of submission:

| Feeding method | The date of submission from which the period for the desk audit will begin |

| Personally | The actual day the documents are handed over to the tax specialist. |

| Electronically | The moment of sending the electronic form 3-NDFL to tax specialists. |

| By mail | The actual date of dispatch of the mail with attached documentation. |

Thus, the moment the desk audit begins is the date of transfer of 3-NDFL to the tax office; within 3 months from this date, the desk clerks must check the declaration.

If the taxpayer is required to provide an updated or adjusted 3-NDFL, then the three-month period will be recalculated from the date of submission of the last document or explanation.

How does the verification period affect the deduction of personal income tax?

The verification period does not affect the amount of the deduction. The Federal Tax Service is not intended to have a punitive role in the tax return audit process. Its task is to check, control the correctness, and not punish for shortcomings.

Speaking of the inspector, of course, he is not interested in failure to fulfill his obligations - and his task is timely, competent financial control. Otherwise, this is a disciplinary violation for the employee with subsequent sanctions.

If we are talking about obtaining a tax deduction, the taxpayer is of course interested in receiving this benefit more quickly. It is also worth noting that in addition to the three-month established audit period, the tax authorities are also given a month to pay. Thus, the total period of the desk audit is 4 months.

Progress of desk audit

The verification is carried out on the basis of the provided declaration and accompanying supporting documentation, and there is no connection with any events or grounds. No written notice is sent to the taxpayer about the start of a desk audit.

A written decision or other document is not required to begin a desk inspection; inspectors conduct it independently without any order from above.

If the inspector establishes any violations, a desk audit is carried out and primary documentation is requested from the payer. Within 5 days, the individual is asked to explain the identified inconsistencies, provide additional information, and make adjustments. The clerk can contact the taxpayer using the telephone number specified in 3-NDFL or send a written request for any additional information.

The procedure itself is partially automated - the received 3-NDFL form is checked by a specialized program, which, based on the testing, identifies arithmetic errors, contradictions in indicators and data inconsistencies. The machine cannot identify all possible errors in the declaration indicators; its capabilities have their limits, and therefore, after the machine check, cameramen get down to business.

Information about exactly how a desk audit is carried out is confidential. The tax office does not disclose any precise information about the methods and techniques used by cameramen during this procedure.

During the procedure, inspectors identify cases of understatement of the base for calculating tax by logically checking the specified digital indicators in the fields of the declaration. Information from the declaration is compared with other information obtained from previous reports and external sources.

Based on the fact of the desk audit, a list of payers is formed for whom an on-site audit will be carried out.

In the process of desk audit of 3-NDFL, the following stages can be distinguished: (click to expand)

- It is determined whether all documentation has been submitted by the payer;

- The deadline for filing the declaration is compared with the approved deadline;

- Visually inspect the filled fields and the degree of compliance of their design with the established rules;

- The correctness of accounting operations is checked;

- The correct application of the specified tax benefits in the form of deductions of various nature is determined;

- The correct application of rates is checked;

- The correct calculation of the base for personal income tax is monitored.

It is important to indicate a valid telephone number in the declaration so that the controlling inspector can contact the taxpayer as soon as possible to obtain additional information and notify him of identified violations and inaccuracies.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to check your tax return? Step-by-step instruction

This section will tell you in detail how to check your personal income tax-3 declaration.

The moment the procedure begins is considered to be the moment the tax authority specialist is provided with the reporting form with the relevant documents confirming the data contained in it. No special notifications are sent to the taxpayer about the start of the audit.

Also, no instructions or orders are required to conduct a desk audit; the responsible person of the tax inspectorate conducts it without instructions from management.

The responsible specialist checks the data contained in the declaration and, in case of identified inconsistencies, obliges the taxpayer to eliminate the violations found in no more than 5 working days. To do this, the inspector contacts the citizen who submitted the declaration, either by telephone or in writing.

The search for errors and inconsistencies in data in the declaration is carried out partially in an automated mode, since it is checked by a special program. The procedure is then carried out manually by logical data verification.

If in the process of establishing the correctness of the data, shortcomings are discovered, then a decision may be made to conduct an on-site inspection.

Therefore, at the end of the desk audit, a list of persons in respect of whom such a decision was made is drawn up.

Thus, the algorithm for desk verification of personal income tax reporting form 3 is the following sequence:

- determining the completeness of the provided package of documents;

- comparison of the deadline for submitting the declaration with the last deadline for its submission established at the legislative level;

- checking compliance with legal design standards;

- identification of calculation errors;

- clarifying the correct application of various deductions;

- determining the correct application of tax rates;

- determining the correctness of the tax base calculation.

In order for the citizen who filed the declaration to track the status of its verification, he can:

This way, a citizen will be able to find out at any time what stage the desk audit of the reports he or she has submitted is at.

Status of desk audit of 3-NDFL. How to check?

If the taxpayer wishes to personally control the desk audit procedure and monitor its current status, then the following actions can be taken:

- Check the telephone number of the department involved in desk audits of income declarations of individuals, and then monitor the status of the audit using periodic calls;

- Register your personal account on the tax service website.

These actions allow the taxpayer to monitor the actions of cameramen, clarify the necessary questions, deadlines for completing the audit, and its progress, which is especially important when receiving personal income tax deductions.

Legislative regulation of the verification procedure

Let's name 7 basic principles for conducting a desk audit of the 3-NDFL declaration:

We will tell you more about the desk audit of 3-NDFL in the following sections.

Note! Form 3-NDFL was approved by order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected] . Starting with reporting for 2020, the document is filled out using an updated form (taking into account the changes made by order of the Federal Tax Service of Russia dated October 7, 2019 No. ММВ-7-11 / [email protected] ).

Find out how non-tax audits are carried out in different situations:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- “Checking OBEP - grounds and what is being checked?”;

- “Coordination of an unscheduled inspection with the prosecutor’s office”;

- “2020 Audits: Find Your Organization.”

Result of desk audit 3-NDFL

You can find out the result using the above methods. You can also send an official written request to the tax office. It is most convenient to view the result in your personal account; if incomprehensible situations arise, it is recommended to contact directly the office tax department located at the place of filing 3-NDFL, that is, at the place of residence of the individual.

Upon completion of the check, the following result can be established: (click to expand)

- Identification of an error - a request is sent to the taxpayer to provide the necessary documents or correct inaccuracies by submitting a corrective 3-NDFL (the deadline for the desk audit begins to count anew);

- No errors - a receipt is sent for payment of the personal income tax amount specified in the declaration, or a decision is made to reimburse the previously transferred excess tax, or a decision is drawn up to provide a deduction;

- Refusal to provide a deduction or tax refund.

If the result is a refusal, then the reasons for this should be clarified; as a rule, such decisions are made due to a lack of necessary supporting documentation. If the taxpayer does not agree with the conclusions of the tax specialist, he may file a written objection.

If the result of the desk audit is a decision to grant a deduction, then within one month from the end of the audit the funds are transferred to the taxpayer’s account specified in the application submitted along with 3-NDFL as part of the attached documentation. Violation of the specified period is the reason for a written demand for the accrual of interest for each day of delay due to the illegal use of other people's funds.

Also read the article about VAT refund from the budget based on the results of a desk audit.

What exactly is checked and for how long?

The check takes place in several stages and the purpose of each of them is to study:

- The reality of all specified assets. For example, if the payer indicated in the “income” section a salary of 50 thousand rubles, then all documentation with the indicated amounts will be carefully read;

- The legality of all assets specified in the declaration: grounds for accrual of money, verification of transfer recipients, etc.;

- Study of tax violations limited by law - for example, concealment of income from the Federal Tax Service.

The law requires all inspectors to make do with only those sections specified in 3-NDFL, so a large-scale study of all possible violations of the law during an inspection is impossible. Accordingly, only the reporting year is checked . The Federal Tax Service spends serious resources on a detailed study of all income only if there are compelling reasons: if violations lead to a criminal case or a thorough check is required by law (we are talking about studying the declarations of politicians before sending their candidacy for elections).

When answering the question of how long a desk audit of 3-NDFL lasts, we must turn to clause 2 of Art. 88 of the Tax Code of the Russian Federation: the legal act specifies a basic period of 3 months, the extension of which is permissible only in exceptional situations. The law establishes only a maximum period for studying documents, but not a minimum. Accordingly, a desk audit can take a very short period of time, several weeks, or even 3 months.

An example of obtaining a personal income tax deduction

Potapenko A.A. On April 18, 2016, I submitted 3-NDFL to the tax office at my place of residence to receive a property deduction when purchasing an apartment. He accompanied the declaration with a statement and documentation confirming the costs of purchasing housing. In what time frame can he expect the required deduction?

The deadline for conducting a desk audit in this situation is 3 months from the date of submission (until July 18, 2016). If the specialist of the office department does not identify any inaccuracies or errors, all the documentation is available, then after the end of the inspection period, Potapenko will receive the deduction amount within one month, the last date for receiving the money is 08/18/2016.

If Potapenko does not receive the money by August 18, then he should write a complaint, sending it to the head of the tax office.

Normative base

The definition, procedure for conducting, and the possibility of appealing a desk audit of individuals is determined by Article 88 of the Tax Code of the Russian Federation. The content of the legal act, among other things, also: defines the goals of the enterprise, establishes who has the right to check 3-NDFL and within what time frame the check must be completed.

Explanations of the Ministry of Finance of Russia dated June 19, 2012 No. 03-02-08/52 further clarify the deadline for the desk audit of 3-NDFL, namely, the day when the countdown begins in accordance with clause 2 of Art. 88 Tax Code of the Russian Federation.

In a general sense, the Federal Law of 06/08/2015 N 140-FZ (as amended on 12/02/2019) on the procedure for declaring funds is also very useful: it contains a link to the 3-NDFL form that is current in 2020, general rules for filling out, mandatory and voluntary reasons for submitting a document, as well as the procedure for verifying the data set out in 3-NDFL.