Photo from the site moscow-city.online The agreement between the seller (supplier) and the buyer very often does not clearly state the conditions under which the goods are returned - for example, if they were not sold. As a result, the so-called “reverse implementation”, and both parties will overpay taxes. Elena Sapego, head of tax practice, partner at the Stepanovsky, Papakul and Partners Law Office, and assistant lawyer Alexey Korol, tell us how to avoid the problem.

— Adapting to the current state of the market, suppliers and buyers often write the well-known phrase in contracts as a carbon copy: “Delivery is carried out on deferred payment terms until the goods are sold to end consumers, with the buyer having the right to return the delivered goods, if within the period established by the contract , the goods were not sold."

Elena Sapego Head of Tax Practice, Partner at the Law Office "Stepanovsky, Papakul and Partners" Alexey Korol Assistant Attorney at the Law Office "Stepanovsky, Papakul and Partners"

Yes, such a procedure for the relationship between the parties and the direct return of goods is possible - from the point of view of civil law. However, by including such a condition for the return of goods in the contract, companies do not take into account the possible tax consequences. And they forget to include in the contract rules that will ensure optimization of the relationship from the point of view of paying taxes.

“Reverse implementation”: what is it and how to avoid negative consequences

The answer to the last question is that it is necessary to correctly formulate the conditions for the transfer of ownership (not only for delivery, but also in case of return of goods - Note “About business.” ), the rights and obligations of the parties already at the stage of drawing up the contract. However, many companies do not pay much attention to this or completely overlook it.

What is the problem? Of course, the product can still be returned to the seller. But! The sale (delivery) of goods is, firstly, the transfer of goods and, secondly, the transfer of ownership of the goods. In cases of return of goods, the same transfer of goods occurs and again - a transfer of ownership, but from the buyer to the seller.

That is why regulatory authorities regard returns made on grounds not directly provided for by law (for example, the return of a quality product) as another contract for the sale of goods. With all the ensuing tax consequences.

This is the so-called “reverse sale” of goods. In this case, the seller becomes a buyer, and the buyer, accordingly, becomes a seller.

Photo from ssi-schaefer.in

Adjustment VAT, reverse sales - process the return of goods correctly

Until the beginning of the second quarter of 2021, taxpayers, at their discretion, returned goods in two ways: reverse sales or issuance of an adjustment invoice.

That is, the legislation made it possible to choose the most convenient way to conduct a business transaction.

From April 1, 2021 the rules have changed

By Decree of the Government of the Russian Federation of January 19, 2019 No. 15 from the first paragraph of paragraph three of Section II of Appendix No. 5 of the Rules for maintaining a sales book used in calculations of value added tax (approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137), the phrase “ ,...return of goods accepted for registration,....” This means that from 04/01/2019, when returning goods to the seller, the buyer cannot issue an invoice and register it in his sales book. Now the seller, who has shipped/transferred the goods to the buyer, must issue an adjustment invoice indicating the reduced amount of the goods shipped.

Despite the legislative enshrinement of this option for processing the return of goods only from the second quarter of 2021, the Federal Tax Service of Russia, in last year’s letters, strongly recommended using exactly this method from January 1, 2021 (letters of the Federal Tax Service of the Russian Federation dated October 23, 2018 No. SD-4-3 / [email protected ] and dated December 13, 2018 No. ED-4-20/ [email protected] ). It was on the basis of the adjustment invoice that the seller was asked to adjust the VAT amounts previously calculated when transferring the goods to the buyer.

It is noteworthy that just before the entry into force of the amended norm regulating the rules for issuing invoices when returning goods, a “landmark” judicial act appeared - the Determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated March 14, 2019 No. 301-KG18-20421 in case No. A79-12226/2017, where the panel of judges, among other interesting conclusions, makes the following: Return of goods to the seller due to termination of the sales contract due to violation of its terms by the buyer means returning the parties to the contract to their original position.

In this case, the sale of the goods is considered failed and the tax cannot be presented to the buyer for payment, that is, there is no object of taxation. Consequently, the taxpayer has the right to demand adjustment of the VAT amounts previously calculated when transferring the goods to the buyer, taking into account the right guaranteed by subparagraph 5 of paragraph 1 of Article 21 of the Tax Code to the refund of tax amounts contributed to the budget in excess - in the absence of an object of taxation. In the case, which was considered by the court of almost all instances, the actions of the tax inspectorate were challenged for charging additional VAT to the real estate seller.

The seller independently issued an adjustment invoice for the amount of the failed transaction and submitted for deduction the amount of VAT previously calculated upon the sale of the building of the dispensary-sanatorium and the land plot. As a result, the taxpayer defended his right to deduct VAT when returning goods, provided for by the norms of the Tax Code of the Russian Federation - clause 4 of Art. 172 and paragraph 5 of Article 171. It is obvious that the conclusions of the Supreme Court of the Russian Federation, set out in the Determination, can also be extended to partial return of goods.

As already mentioned, the amended norm applies from 04/01/19. However, in May 2021 letters, the Ministry of Finance of the Russian Federation (dated May 15, 2021 N 03-07-09/34582, dated May 15, 2021 N 03-07-09/34591) said: In the event that goods previously purchased and registered by the buyer are subsequently sold on the basis of a purchase and sale agreement (supply agreement), under which the buyer acts as a seller of goods, and the former seller acts as a buyer, then in respect of such goods invoices are issued in the manner prescribed by paragraph 3 of the article 168 of the Tax Code of the Russian Federation. That is, it turns out that “reverse implementation” is possible?

So, after all, how to properly process the return of goods so as not to violate tax laws, comply with the explanations of the Ministry of Finance of the Russian Federation and exercise the legal right to deduct VAT when returning goods from the buyer?

It is recommended to adhere to the following rules:

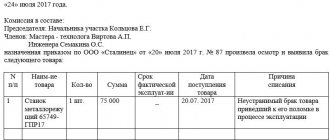

1. If the return of goods occurs due to a violation of contractual obligations: non-compliance with the conditions for quality, completeness, assortment, etc., the supplier issues an adjustment invoice and registers it in its purchase book on the basis of clause 10 of Art. 172 of the Tax Code of the Russian Federation.

In this case, claim documents must be drawn up (claims from the buyer, acts of non-compliance of the goods with the contractual terms, letters from the supplier accepting these claims and agreeing to reduce the price, an additional agreement to the contract on changing the quantity and amount of delivery, a court decision if such a change occurs on the basis of a judicial dispute, etc.).

2. If the goods are returned for another reason (for example, the seller buys back unsold goods from the buyer), the parties can draw up a purchase and sale or delivery agreement, where the former seller will be the buyer, and the former buyer will be the seller.

In this case, the documents are drawn up as in an independent full-fledged transaction: an agreement, an invoice, an invoice, etc. It is advisable to stipulate in the initial agreement that in the event of the return of unsold goods, the parties will formalize their return in a separate agreement.

3. If an ambiguous economic situation arises in the activities of an organization that is not directly regulated by the norms of the Tax Code of the Russian Federation, the company always has the opportunity to “ask” the tax inspectorate what norms of tax legislation should be followed in certain circumstances. To do this, the company sends a written request on the basis of subclause 4 of clause 1 of Art. 32 of the Tax Code of the Russian Federation to the tax authority at the place of registration, sets out the essence of his question (outlines the terms of the operation) and asks the question of what regulatory documents, articles and points to be guided by when calculating taxes, reflecting the operation in tax accounting, establishing the obligations of the taxpayer, etc. .

Regardless of whether the tax inspectorate responded or not, the organization still has the fact of contacting the tax authority for clarification of tax legislation, that is, the organization, as a bona fide taxpayer, has taken comprehensive measures to determine its lawful behavior in conditions of legal uncertainty.

Find out more current information in the Glavbukh System

What are the consequences of “reverse implementation”

Many entrepreneurs believe that since the legislation makes no mention of reverse sales as such, there is no reason to be concerned. But in practice, everything turns out completely opposite.

The consequences of such a “reverse implementation” do not look optimistic for either side. The buyer has turnover for the sale of goods and a tax base for income tax. And the seller can no longer reduce the initial sales turnover and the initial sales proceeds.

The result is that the goods remained with the seller (returned to his warehouse). In this case, both the seller and the buyer calculate VAT twice and take into account the proceeds from sales.

Registration of reverse sales

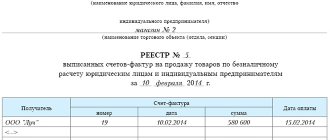

The reverse sale procedure does not require the execution of an act (form TORG-1). The buyer sends the supplier an invoice for the amount of the goods being transferred back. The specified document is registered in the sales book (letters of the Ministry of Finance of the Russian Federation No. 03-07-09/17 (03/02/2012), 03-07-11/79 (03/23/2012)).

According to the accounting records of the seller, proceeds from the sale are recognized as receipts from ordinary types of activities, and expenses (in the form of cost) are recognized as expenses for ordinary types of activities (Order of the Ministry of Finance of the Russian Federation No. 32N, 33N, 05/06/1999).

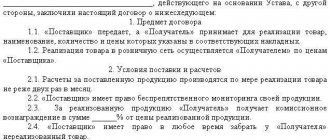

The counterparty completes the sale in a standard manner, and the supplier makes the following transactions (debit/credit):

- 62 / 90.1 – reflection of revenue from sales (Settlements with buyers and customers/Sales (revenue));

- 90.3 / 68 – calculation of VAT on sales (Sales (VAT)/Calculations for taxes and duties (VAT));

- 90.2 / 41 – write-off of production costs (Sales (cost of sales)/Goods);

- 41 / 60 – transfer of the object to the warehouse (return);

- 19 / 60 – allocation of VAT on the product;

- 68 / 19 – direction of VAT for deduction;

- 60/62 – mutual settlement of the parties (with the drawing up of an act).

By the way! When returning, the seller can set off the VAT accrued upon sale as a deduction (Article 171 of the Tax Code of the Russian Federation), which can be applied in full after all adjustments have been made in the accounting, but no later than 12 months from the date of return (Article 172 of the Tax Code of the Russian Federation).

Registration in the case when the buyer is not a VAT payer

During the reverse sale, the original buyer, and now the seller, who is not registered as a VAT payer due to working under the simplified taxation system, can nevertheless deduct VAT on returned goods (letter of the Ministry of Finance of the Russian Federation No. 03-07-15-29, 07.03 .2007).

The original seller makes adjustments to the invoice it previously issued to the purchaser. The specified document is subject to registration in the purchase log (for the amount of the amount to be returned). Therefore, it turns out that the failed seller will be able to offset VAT on the returned items. The reason for the return of the product and the fact that it was accepted or not registered by the counterparty who did not pay VAT at the time of return do not matter.

If the purchased item is returned by an individual, when transferring money from the cash register, it is recommended to register the details of the issued cash order (expenditure) in the purchase log. After the newly received object is capitalized, the seller has the opportunity to accept VAT (deductible).

By the way! Some accountants believe that upon return, the former acquirer must transfer VAT to the seller through a payment order, since this transaction is identical to the offset of claims and commodity exchange transactions, when the amount of tax is transferred to the partner in money (Article 168 of the Tax Code of the Russian Federation). But according to the clarification of the Ministry of Finance of the Russian Federation (letter No. 03-07-11/128, 04/27/2007), if the purchase is returned to the supplier, then the amount of tax must be deducted and cannot be compensated at the expense of the purchaser. Therefore, when transferring back, the buyer does not have to send the tax amount separately.

How to avoid overpaying taxes

An option to solve this problem, in our opinion, is a delayed transfer of ownership. What explains this conclusion?

As a general rule, ownership of the goods passes to the buyer from the moment he receives it (Article 224 of the Civil Code). An exception to the general rule is Article 461 of the Civil Code. It provides for this possibility: the seller retains ownership of the goods - even if it has been shipped to the buyer - until certain circumstances occur.

And if such circumstances do not occur within a certain period of time, the seller, as the owner who has the right to determine the fate of this product, has the right to demand that the buyer return the product to him.

Photo from the site megapolis-real.by

But, as we have repeatedly repeated, the procedure for transferring ownership, which differs from that established by the general rule, must be determined in the contract itself!

Consequently, the return of even high-quality goods, without negative consequences, under a sales contract is possible. But only on condition that in this agreement:

1. Circumstances are provided for until the occurrence of which ownership rights remain with the seller (clause of deferred transfer of ownership rights).

2. At the time of returning the goods, such circumstances had not occurred.

Thus, the parties can be guided by the procedure for transferring ownership rights expressly agreed upon by the parties in the contract. For example, the transfer of ownership when certain conditions are met - when selling goods to third parties, paying for goods.

The seller can and must determine the conditions for the possible return of the goods transferred to the buyer. For example, usually the seller explicitly states in the contract that he allows the sale of such goods to third parties. In addition, the parties agree on the procedure for action when the seller makes a request to return the goods. It is advisable to directly indicate in the contract the right of the owner (seller) to demand the return of the goods, as well as the buyer’s obligation to return the goods within a certain time frame.

Conclusion

Thus, Belarusian entrepreneurs often either do not include in the contract a condition on the moment of transfer of ownership rights at all, or duplicate the provisions of the already mentioned article. 224 Civil Code.

And even if there is a clause about the delayed transfer of ownership, it is not clear how the parties should proceed with this.

Therefore, if there is an understanding that there will be a return of the goods, it is necessary to correctly formulate the conditions for the transfer of ownership. In the future, this will save both time and money: in this case, when returning goods, the seller reduces sales turnover and adjusts taxes accordingly (in the reporting period in which the return was made). The buyer has no sales turnover and no income tax base.