In the process of conducting business, organizations and individual entrepreneurs are often faced with the need to return goods to the supplier. The current legislation of the Russian Federation assigns this right to business entities. In addition, the conditions for returning products and the procedure for carrying out the procedure can be specified in the contract.

The procedure must be properly formalized so that the supplier and regulatory authorities do not have any claims against the business entity in the future. To do this, a return invoice to the supplier is drawn up; a sample of it can be found at the end of the article.

When do you need a return label?

A return invoice to the supplier is necessary to document the fact of transfer of goods and materials back to the individual entrepreneur or the company that supplied it to the buyer. It is necessary to prepare two copies of the document. The buyer takes one of them and subsequently uses it to display the return transaction in accounting, and the second must be transferred to the supplier.

This document regulates mutual settlements between suppliers and buyers; it is drawn up only if there are compelling reasons for a return. Based on the invoice, you can make a claim to the supplier and demand compensation for money. If an entrepreneur has never encountered filling out this document before, he should use the return invoice and use it, or use it to draw up a similar document for his company.

https://youtu.be/tFeod1Q4uuY

Invoice for return note

The return of defective products is a business transaction that must be reflected in the accounting accounts. Moreover, each operation must be accompanied by a supporting document.

In addition to the return label, a return invoice may also be issued. When registering a return, the product is returned to the supplier either of proper or inadequate quality. In this case, the return occurs either before the invoice is signed or after it is signed.

When registering the return of goods between organizations on OSNO, quality products can be returned only if there is mutual agreement of all parties, and this condition must be provided for in the agreement. If ownership of the goods has passed to the buyer, and the goods have already been accepted for accounting, then the return will be processed as a reverse sale. In this case, the buyer will have to issue an invoice to the counterparty for the cost of the returned goods. This invoice must be recorded in the sales ledger.

Important! Reverse sales must be made for the same amount as the purchase of the goods.

When registering the return of low-quality goods not accepted for accounting between organizations on the OSN, the buyer does not have to issue an invoice for the return, nor do they have to calculate VAT. The supplier issues an adjustment invoice on its own behalf, which is not entered into the sales book by the buyer. This is due to the fact that there is no input VAT on this purchase. If it turns out that the goods are defective after they have been accepted for accounting, the buyer unilaterally terminates the contract and formalizes this with special documents. An adjustment invoice is issued by the supplier and such a return is not recognized by the sale. In case of a partial return, the buyer does not need to issue an invoice on his own, since part of the goods has already been accepted for accounting. An adjustment invoice is issued by the seller for the balance of the goods that remains after the return. The seller enters the invoice into the purchase book, after which he makes a VAT adjustment to the budget. The buyer, in turn, registers in the purchase book that part of the goods that he accepts for accounting.

The legislative framework

In the Civil Code, the buyer’s right to return goods received is provided for by the following rules: clause 2 of Art. 475; clause 3 art. 468; clause 2 art. 480; clause 3 art. 482. The Civil Code of the Russian Federation provides only some reasons for the return, but it does not prohibit the return of goods and materials for other reasons. In particular, you can return even high-quality goods, the delivery of which was paid for by the buyer. But such a condition must be provided for in the contract.

At the end of this article, anyone can download the return invoice form for free.

In what situations is it compiled?

Possible reasons for returning products are given in the Civil Code of the Russian Federation (for example, Articles 468 and 482) and are specified in the supply agreement.

Examples of common reasons for issuing a VN are:

- The quality of the delivered products is lower than stated.

- The quantity or range of goods does not correspond to the order.

- Broken or missing packaging.

- Incomplete set of accompanying documentation.

- Delay in delivery or payment.

- It is impossible to continue selling products due to the market situation.

- Detection of defects and deficiencies.

- Expiration of expiration date or service life for durable items.

The agreement between the organizations may provide for other situations in which the supplier agrees to accept back the supplied products.

What form of invoice to use

There is no single form of invoice for all organizations; each business entity has the right to develop a return invoice form independently and use it to formalize business transactions. It is important that the form meets all the requirements for primary documentation specified in Art. 9 of Law No. 402-FZ “On Accounting”.

For a return invoice, you can take the unified form TORG-12 as a sample - it was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. It is this that entrepreneurs most often take as the basis for developing a return invoice form.

In addition, when returning in case of discrepancies in the quantity or quality of goods, acts can be drawn up in the following forms:

- TORG-2 – used only for domestically produced goods.

- TORG-3 – used for imported products.

Forms TORG-2 and TORG-3 are drawn up before the goods are accepted for accounting.

The buyer has the right to refuse to accept the goods during acceptance if non-compliance with the terms of the contract is discovered at that moment. In this case, a return invoice in the TORG-12 form is not needed; it is enough to draw up an act in the TORG-2 or TORG-3 form.

A sample of the return invoice TORG-12 and its form will be given below.

Registration of goods return to the supplier

If the customer, upon acceptance of the goods, even before registering it, discovers discrepancies, then the parties must sign a statement of discrepancies. This act is the return invoice TORG-12. If the customer has already accepted the goods for accounting, and only then discovered discrepancies, then a return invoice is drawn up, to which the grounds for return are indicated (inconsistency in quantity, inadequate quality or hidden defects). The return invoice is accompanied by supporting documents, which are acts, claims and letters. All information about discrepancies must be indicated in the return documentation (

Filling out the invoice

Let's look at how to make a return invoice and what needs to be taken into account when filling out individual lines. The sequence of actions will be as follows:

- First you need to fill out the introductory part. Here you indicate information about the sending organization (name, address, bank details, telephone, fax, OKPO and OKDP code). An important point: in the top line “shipper organization” you should enter the buyer’s data.

- Below are lines in which you need to indicate information about the Consignee, Supplier, and Payer. When returning, the supplier and consignor are considered to be the buyer, and the consignee is the seller. The “Payer” line is filled out if the buyer must receive funds upon return, otherwise it is left empty.

- Next, you need to indicate the reason for returning the product. Details of all invoices, contracts and other documents are listed here.

- It is necessary to indicate the bill of lading number and the date of its preparation.

- Below is a tabular section that displays data about the products being shipped: name, characteristics, quantity, price and other information. The information specified in the table must completely coincide with the data on the delivery note drawn up upon acceptance of the goods. The data may not match if only part of the received inventory items is returned.

- Return invoice TORG-12 (download below) is signed by the head of the company or his deputy, the chief accountant and the official who returned the goods. Signatures must be accompanied by a transcript.

Responsible persons must ensure that all fields of the document are filled out properly and sealed by the parties. This is important, because otherwise, the Federal Tax Service may question the buyer’s right to display their expenses for purchasing products and receive a VAT deduction.

Sample of filling out the return invoice (TORG-12).

Return invoice bargaining 12: download sample

- Product acceptance certificate. It reflects information about the product at the time of receipt. It must be certified by the recipient’s signature indicating the date of acceptance. When returning it, it is attached to prove the absence of claims at the time of delivery.

- Claim in free form. It specifies the reasons for sending goods back - defects, mismatch of parameters, sale of goods with an expiring expiration date, violation of the integrity of the packaging, etc.

- Invoice. Issued for goods already accepted for accounting purposes.

How to issue a consignment note (TORG-12)

- The columns “Supplier” and “Consignor” are filled in indicating the address and bank phone details of the buyer under the contract.

- In the line “Consignee” you should indicate the details of the supplier (seller) under the concluded agreement.

- The “Payer” line is filled in if, when returning products, the buyer intends to receive a sum of money from the supplier for the returned goods. If there are no such intentions, the specified line can be left blank.

- The line “Base” is one of the most important. All documents on the basis of which the return is made must be written down:

- details of the agreement concluded between the enterprises;

- numbers and dates of invoices according to which the products were received;

- numbers, dates of documents such as defective statements, letters, etc.

- The numbering of the specified document is assigned in the order accepted at the enterprise, however, it may contain differences, such as the presence of the letter “B” - indicating a return.

- The tabular part is filled out in strict accordance with the data specified in the technical specification that was included when accepting the goods. It is very important to correctly indicate the name, article, type of goods, and their price. It will be important to write down the total amount, as well as the amount of accrued VAT.

How to issue a return in case of defect

The right of the parties to a transaction to return goods may be based on law or contract.

Civil legislation provides for the buyer’s right to return goods to the supplier if they do not comply with the requirements for quality (clause 2, article 475 of the Civil Code of the Russian Federation), assortment (clause 3, article 468 of the Civil Code of the Russian Federation), and packaging (clause 2, article 480 of the Civil Code of the Russian Federation). RF), packaging (clause 3 of Article 482 of the Civil Code of the Russian Federation).

The common belief that there are no other reasons for a return is incorrect: civil law does not prohibit the return of quality goods delivered in whole or in part, even if the delivery was paid for by the buyer.

- expiration date;

- impossibility of implementation;

- delay of payment;

- inconsistency of a quality product with the production goals of the buyer;

- updating the assortment, etc.

Here is a list of what documents to fill out to return goods to the supplier due to defects:

- An act on identified deficiencies, on the basis of which a claim is made to the supplier (a self-developed form containing all the mandatory details of the primary document). This form is applicable when rejecting inventory items already accepted for accounting. When returning at the acceptance stage, you can use the TORG-12 consignment note (marked “return”).

- Return note.

- A letter (claim) to the seller demanding to accept the goods and materials back and return the amount paid for it.

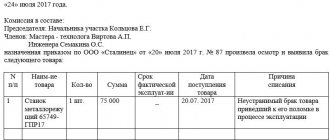

Sample act

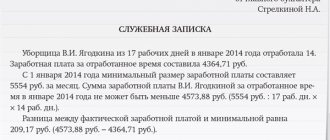

Sample letter of claim

When registering unaccepted goods and materials, no sale occurs (no transfer of ownership). No transactions are reflected in the buyer's accounting. In the seller's accounting, such a transaction is reflected by records of reversal of transactions recorded for the sale of returned goods.

| From the seller | From the buyer | ||

| Dt 62 Kt 90-1 reversal | for the amount of income from the sale of inventory items | Dt 76-2 Kt 41 | for the returned value |

| Dt 90-3 Kt 68 reversal | for the amount of accrued VAT | Dt 76-2 Kt 68 | for the amount of VAT on returned inventory items previously accepted for deduction |

| Dt 90-2 Kt 41 (43) reversal | reversal for the amount of expenses for the purchase of inventory items (production of finished products) | Dt 51 Kt 76-2 | money refunded for poor quality delivery |

| Dt 62 Kt 51 | money was returned to the buyer | ||

How to draw up and sign a delivery note

Paper

Primary documents are signed by the manager and chief accountant or authorized persons. The list of persons authorized to sign primary documents is approved by the manager in agreement with the chief accountant. Thus, the manager can transfer the right to sign the delivery note and formalizes this right with a power of attorney or order.

The consignment note is issued in two copies. The first copy remains with the seller (the organization that hands over inventory items) and is the basis for their write-off. The second copy is transferred to the buyer and is the basis for the recording of these valuables. TORG-12 can have 5 signatures:

- three from the seller’s side: (manager, accountant, responsible for shipment). In some large organizations, one person signs the delivery note upon shipment. Usually this is a certain “operator” who, based on information received from the accounting department and warehouse, generates a document and signs it with his signature. This operating procedure is legally established either in an order, or in a power of attorney, or in the job descriptions of the “operator”;

- one from the buyer’s side (responsible for receiving the goods) - in the line “The cargo was received by the consignee.” This line must contain the signature of an officially authorized representative of the buyer - this can be a person under a power of attorney or under the Charter. Therefore, either the head of the consignee organization (buyer) or an authorized person with a power of attorney for the right to sign the primary documents must sign.

- another signature - in the line “Cargo accepted” - is placed by any financially responsible person who actually accepts the cargo (data on the power of attorney for the transportation of goods and materials is filled in in the same line). This can be either a carrier of a third-party transport organization or a representative of the purchasing organization. The head of the enterprise can accept the goods without a power of attorney - in this case, he signs in the line “Cargo accepted” and does not fill in the lines indicating the details of the power of attorney.

Of course, in both lines “The cargo was received by the consignee” and “The cargo was accepted” the same person can sign (if he has both a power of attorney for goods and materials and the right to sign primary documents). And in this case, more often the signature is placed only in the line “Cargo received”, based on business practice, as well as arbitration judicial practice (Resolution of the Federal Antimonopoly Service of the North-West District of March 1, 2006 N A13-5001/2005-05).

Electronic

The form and procedure for compiling an electronic invoice are no different from the form and procedure for compiling its paper counterpart, with the exception that the electronic document is compiled in one copy, which consists of two files. One of them is formed on the seller’s side, and the second, when sending a document, on the buyer’s side. To sign electronic invoices, instead of a handwritten signature, use an electronic signature (ES), and in accordance with the recommended format TORG-12 (approved by Order of the Federal Tax Service of Russia dated March 21, 2012 No. ММВ-7-6 / [email protected] ), as well as court materials (in in particular, according to the resolution of the Supreme Arbitration Court of the Supreme Higher Military District dated 08/11/2010 in case No. A43-5226/2010), the electronic consignment note is signed with one electronic signature on the part of the seller, and one on the part of the buyer. Total of two signatures.

At the same time, in the lines “Vacation authorized”, “Chief (senior) accountant”, “Cargo released”, “Cargo accepted” and “Cargo received by consignee” the full names and positions of the relevant persons are indicated, and in the line “By power of attorney No.” - information on the power of attorney of the authorized person.

Partly, the ability to sign TORG-12 with one ES is due to the fact that affixing an ES on a document does not mean filling out the signer’s line, but means protecting information and identifying the signatory (No. 63-FZ “On ES”). And one electronic signature is enough to fulfill these conditions.

How to fill out and sample form

The return invoice is a special document in the TORG-12 form, drawn up with all the required details and in accordance with the regulations established by law.

Important! The Federal Tax Service may request invoices from an organization during a special audit.

Return invoice in form TORG-12

A return invoice is issued if the product is found to be defective or does not meet quality standards. It confirms the shipment of goods and materials from the supplier’s warehouse and its receipt by another organization.

With the help of TN, the balance of goods in the warehouse is kept track of, and the final data is entered into the financial statements.

Detailed instructions for processing TORG-12 for return:

- “Invoice” is written at the top of the document. Next, put the serial number of the invoice number and indicate the date of preparation;

- The supplier details are entered below. You must provide all the details: name of the organization, INN/KPP, legal address, name of the counterparty bank, BIC, correspondent and current account;

- Next, you need to indicate the data in the “Consignor” column. Fill in the required details similar to “Supplier”;

- Information about the buyer of the products is entered in the “Payer” column. Fill in the necessary details of the organization and the details of the payer’s bank;

- Next comes the “Consignee” column. The line reflects the details and name of the organization. Often the data on the lines “Payer” and “Consignee” coincide. In this case, it is allowed to indicate “he” in the “Consignee” column;

- Write what will be the basis for returning goods and materials. For example, a supply contract, an agreement. Immediately put the date of the basis document;

- Provide a description of the item that is being returned. Write down the name of the product, its quantity and price. Please indicate below the full cost of the product based on the quantity ordered;

- Sign the management of the above companies - the shipper and the consignee. On the finished TORG-12 form, put the seals of the organizations and the date of drawing up the return invoice.

Note! The return invoice is issued in two copies - one the buyer keeps for himself, and the other gives to the seller.

Filling out TORG-12 is automated thanks to the use of special accounting systems, for example, 1C, SBIS. Filling out manually is allowed, without amendments or typos.

Invoice form according to TORG form - 12

Instructions for processing TORG-12 for return

- The invoice for returning goods to the supplier has its own unique number and date of preparation.

- At the top of the document, the details of the shipper’s organization carrying out the return of the goods are indicated. Mandatory details are TIN/KPP, legal address, bank details of the organization (BIC, correspondent and current account).

- In the “Consignee” column, you must indicate the details of the organization that supplied the goods.

- The “Delivery Address” column indicates the unloading point at the supplier’s territory; this address may differ from the legal address of the organization.

- The “Supplier” column is filled in by analogy with the “Consignee” column, indicating all the necessary details. The supplier in this case will be the organization that returns the goods.

- The “Payer” column often coincides with the “Consignee” line. The line also reflects the details and name of the organization.

- The column “Base” serves to reflect the reason for the return of inventory items. For example, this could be a supply agreement or an additional agreement. When filling out this column, you must indicate the date and number of the basis document.

- In the tabular part of the return invoice, the supplier should indicate a description of the product that is to be returned. Mandatory details to fill out are:

- Name, characteristics, type of product;

- Unit of measurement;

- Type of packaging;

- Quantity;

- Price.

The last column of the column shows the total amount by quantity and price.

At the end of the tabular section, the total quantity and amount of the returned goods are indicated.

- The invoice for returning goods to the supplier is certified by the signatures of authorized persons of the consignor and consignee organizations.

The form in form TORG-12 allows the acceptance of inventory items by power of attorney, indicating the details of the principal organization, as well as the full name and position of the person who received the power of attorney.

- The finished form according to the TORG-12 form is affixed with the organization’s seal and the date of drawing up the invoice for returning the goods to the supplier.

The return invoice is one of the main documents appearing in the document flow between the buyer and supplier upon termination or partial adjustment of the transaction for the purchased goods.

The acquisition and sale of inventory items occurs in accordance with the Civil Code of the Russian Federation. The supplier enters into an agreement with the buyer, on the basis of which he is obliged to provide the required quantity of the goods sold. The additional agreement to the contract specifies the detailed characteristics of the product.

How to issue a return invoice to a supplier

A separate organization must act as a supplier or shipper during the procedure for returning goods. This will make a difference in completing each item on the return invoice.

Operation sequence:

1. The name of the supplier or shipper is entered in the form.

2. The company address and bank transfer details are indicated in the paragraphs below.

3. When filling out the “Consignee” item, you must indicate the name and details of the supplier itself, which were previously stated under the contract. (Since he does not act as the person paying for all procedures for taxes and duties, because the buyer returns the previously paid products and all invested funds will be returned to him).

4. In the event that the payment has not been made, there is no need to fill in the “Payer” column.

5. Next comes the column “Base”. It will be the basis and the most important point. Here it is necessary to describe in detail the reasons for returning the products, indicating all the accompanying documentation for the batch or individual products:

- numbers and dates of invoices, specifically returned goods and materials;

- number and date of the contract drawn up for this product or batch;

- a list of details of acts, defective statements, relevant letters and other documentation, taking into account the legislation or the existing contract.

For the compiled return invoice, a number is set, taking into account the existing numbering of this type of document in the company that compiled the acts. Additionally, if the return shipment is made by road, it is necessary to indicate the number and required date of the accompanying invoice. After which an invoice will be issued for transportation costs for the return transportation of the products.

It is also worth noting that:

- The specified product section is filled out taking into account the data on the invoices, which indicate defective consignments of goods that are already included in the buyer’s records. (Thus, the invoice should allow you to make up the percentage of previously delivered products and those that will be returned. All units of measurement and price for the product must be identical to what is in the invoice. Since the product will be returned under the same conditions as it was sent to the buyer ).

- After which the company representative and chief. accountant checks shipment. Recording compliance with signatures. There is also a need to record the process of receiving products by representatives of the transport organization.

Correct preparation of the invoice

The document has a unified form that contains the relevant information:

- It is necessary to enter the invoice number and the date of generation in the appropriate field;

- At the top of the form you need to indicate the basic details of the shipper - checkpoint, INN, ORGNO, legal address, bank information;

- In the consignee field, you must specify all information regarding the supplier in the same way;

- Where it is necessary to indicate the delivery address, the address where the shipment will actually take place is indicated; the warehouse address in many cases differs from the office address;

- In the supplier column, you must indicate all the information similar to the consignee; in this case, the supplier will be the organization that received low-quality materials or products;

- In the payer column, you must indicate the details of the consignee;

- In the “Grounds” column, you must indicate all the information regarding the implementation of the return measure, its shortcomings, and make complaints;

After this, you need to fill out the tabular part regarding returnable products:

- Name;

- Unit of measurement;

- Type of packaging;

- Total amount;

- Price.

- The last column is for summary information.

This document must be certified by the signatures of authorized persons.

Important: in the basis column you must indicate the details of all documents that are the basis for the supply of products.

In addition, when sending products by transport, it is necessary to record the details of the delivery note in the invoice.

If, during a retail purchase, the goods are returned before the end of the shift, it is necessary to give the buyer funds from the cash register in accordance with the product acceptance certificate. For the amount issued from the cash register, it is necessary to create an act on the issuance of refunds to the buyer according to unused cash receipts in the KM-3 form.

This document is generated in one copy and signed by the manager, and then submitted to the accounting department.

The buyer has the right to return products of inadequate quality or quantity according to the law; it can be returned during the acceptance process only with a discrepancy report.

If the goods are received, it is necessary to generate return documentation in the same way as upon delivery, a delivery note and an invoice.

How to return goods in the 1C program - watch this video: