Consequences of mistakes made

Payment orders must be drawn up carefully. Even if the error does not lead to the loss of funds, it will still take a lot of time to correct it. Let's look at the consequences of the error:

- Not paid taxes on time. Consequences: accrual of penalties, fines, risk of repaying the full amount of tax.

- The tax is considered unpaid. Consequences: penalties, fines.

- The payment went to another fund. There is no offsetting of amounts between different funds. Therefore, you will have to pay the tax in full again.

The error will have to be corrected. And this entails separation from employees’ activities, the need to draw up additional documents, and legal proceedings.

Two groups of errors

The current version of Article 45 of the Tax Code of the Russian Federation divides all errors in filling out payment orders into two large groups. The first includes errors that lead to non-payment of taxes to the budget. Let's call them “fatal”. And secondly, those that do not lead to such consequences.

Only two errors are included in the “fatal” group. In order for the tax to be considered unpaid, you must make a mistake either in the Federal Treasury account number or in the name of the recipient bank. Accordingly, if such errors are not corrected in time, the taxpayer will experience arrears with all the ensuing consequences (penalties, possible fines, blocking of the account and the need to repay the tax).

If a “fatal” error is discovered after the bank has executed the order, there is only one way to correct it: re-transfer the money using the correct details. The original amount will need to be returned as overpaid. To do this, you need to write a corresponding application to the tax office and wait 10 days (Article 78 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated 09/06/13 No. ZN-3-1/3228 and the Ministry of Finance of Russia dated 11/02/11 No. 02-04-10/4819 - cm. " "). In a similar manner, you can ask for an offset of this amount.

Possible errors when making payments to a counterparty

The value of the list of the most common errors makes it easier to check and identify shortcomings in specific payment orders. These mistakes are very often made:

- Incorrect TIN. If in all other respects the order is completed correctly, then the regulatory authorities do not have the right to demand clarification of the details.

- The basis for payment is incorrectly specified. This is also a minor error. The funds will be sent to the recipient. In this case, it makes sense to contact the recipient. His response clarifying the basis for the payment is attached to the order. This must be done, as otherwise there may be confusion. It can lead to difficulties in the work of accountants and tax representatives.

- Allocation of VAT if the order concerns counterparties under a special tax regime. For example, the counterparty may use the simplified tax system. In this case, he does not need to pay VAT. Accordingly, there is no need to highlight VAT in the payment order. If this is done, you need to send a clarifying letter to your bank. The latter sends a notification to the bank servicing the counterparty. The error must be corrected. Otherwise, the counterparty will have to pay tax at an increased rate.

- Incorrect designation of payment purposes. For example, the funds were actually transferred as an advance for the service. However, the order specifies a loan as the purpose. In this case, you also need to notify the bank about the error. If this is not done, the company will not receive a deduction for the advance payment.

- Incorrect information about the counterparty. The counterparty's details may be changed. However, the company does not always send out notifications about this. That is, the payment is sent using the old details. In this case, the transferred funds will be kept in the banking institution until the information is clarified. On the sixth day, the funds are returned to their sender. When making such an error, the company has two courses of action: submitting updated information to the bank or receiving funds back on the sixth day and then re-issuing the order.

Even if the error seems insignificant, in most cases it still needs to be corrected.

Errors that can be fixed

Let's look at correctable errors and the procedure for eliminating them:

- The purpose of the funds is incorrectly indicated. You need to perform a tax reconciliation with the Federal Tax Service, and then fill out a reconciliation report. It is signed by an accountant, as well as a representative of the Federal Tax Service.

- Inflated payment amount. There are several ways to proceed. First: redirection of funds. The overpaid money will be used to pay the next payments. Second: processing a refund of payment to the company’s bank account.

The listed errors are considered insignificant. They are relatively easy to fix.

Errors that cannot be corrected

Let's consider significant errors that cannot be corrected:

- Indication of the wrong BCC. For example, the code numbers are indicated incorrectly or the old KBK is taken. In this case, the payment is considered unclassified. The tax will be considered unpaid. That is, the payer will have to pay penalties and fines for late payment. To correct the situation, you need to send an application to the Federal Tax Service. It specifies a request to offset the transferred funds. A copy of the incorrect order and a bank statement are attached to the application.

- Underpayment. The tax is also not considered paid. To correct the situation, you need to add the missing amount to the budget.

- Indication of the BCC, which relates to another tax. In this case, you can act in several ways. This is, firstly, a return of funds to the payer’s bank account. Secondly, this is a repeated payment of the payment. What will happen to the old payment? It is credited under another tax, to which the KBK applies. An overpayment is created for this tax, which will be offset against the next payment.

- Invalid recipient account. This is the most difficult mistake. The money will have to be sent again. A penalty will be charged for late payments.

- The name of the banking institution is incorrect. Also an irreversible error.

- Indication of a non-existent BCC. A refund is being issued. The payment is sent again.

There is a big difference between a significant and an insignificant error. In case of correctable errors, the payer only needs to send a clarification. In this case, the payment will be considered paid. Errors that cannot be corrected mean that taxes or payments to counterparties are not considered paid. That is, fines and penalties will be imposed on the payer.

The court's position regarding errors

Judicial practice confirms that the tax, as well as penalties and fines, are considered paid if the following errors are made in the payment order:

- Invalid KBK:

- AS of the Far Eastern District dated November 19, 2015 No. F03-4782/2015;

- AS of the North Caucasus District dated December 4, 2014 No. F08-8670/2014;

- FAS East Siberian District dated May 14, 2013 No. A33-8935/2012;

- FAS North-Western District dated December 22, 2010 No. A42-2893/2010;

- FAS Moscow District dated January 23, 2013 No. A40-12057/12-90-57, dated December 8, 2011 No. A40-36137/11-140-159;

- FAS Central District dated January 31, 2013 No. A64-5684/2012;

- Federal Antimonopoly Service of the West Siberian District dated June 30, 2011 No. A67-5567/2010;

To learn about the consequences of incorrectly indicating the KBK in the document for the payment of “accidental” insurance premiums transferred to the Social Insurance Fund, read the article “KBK in the payment order in 2020 - 2020” .

- Incorrect TIN, KPP, name of tax authority:

- Incorrect OKATO:

- Errors in the basis of payment:

- FAS of the West Siberian District dated 04/09/2010 No. A27-25035/2009;

- FAS Moscow District dated October 26, 2009 No. KA-A41/10427-09;

- FAS of the North Caucasus District dated 02/06/2008 No. F08-180/2008-68A;

- Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 784/13;

- AS of the North Caucasus District dated March 22, 2016 No. F08-1378/2016;

- AS of the Moscow District dated October 6, 2015 No. F05-13213/2015;

- FAS of the Ural District dated October 10, 2012 No. F09-9057/12;

- FAS of the East Siberian District dated December 6, 2011 No. A33-17476/2010, dated September 1, 2011 No. A33-3885/2010;

- FAS North-Western District dated 07/04/2011 No. A05-5601/2010;

- FAS Moscow District dated January 23, 2013 No. A40-12057/12-90-57, dated June 30, 2011 No. KA-A40/6142-11-2;

- Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 31, 2010 No. A29-1642/2010.

To find out whether the error in the “Tax period” field is critical, read the article “Indicating the tax period in the payment order - 2020 - 2020”.

Features of filling out an application for clarification of tax payment

If the accountant made a minor mistake, the details need to be clarified. To do this, a statement is drawn up containing the information:

- Full name of the head of the Federal Tax Service.

- Company details: name, INN, KPP, OGRN, address.

- Date of.

- Title of the application.

- Request to clarify the payment with reference to regulations (clauses 7-8 of Article 45 of the Tax Code of the Russian Federation).

- Information about the payment (amount, specification of the error committed, corrected version).

- List of attached documents.

IMPORTANT! It makes sense to attach a copy of the order, as well as a copy of the bank statement, to the application.

Errors when sending payments to the budget

A payment order for payments to the budget has many fields, which is prone to errors. However, among these fields there are those that control structures pay little attention to. Specifically, these are the following lines:

- Taxable period.

- Tax payer status.

- Order number and date.

- Reason for payment and its type.

If errors are made in these lines, it is not necessary to correct them. The line “priority of payment” is also unimportant. An exception is that orders are sent by companies whose activities involve financial difficulties: restrictions on expense transactions, insufficient funds in a bank account. If these circumstances are present, the “priority” line is checked first.

The checkpoint indicated on the payment slip is incorrect. What errors in payment orders prevent taxes and contributions from reaching the budget?

Every day, companies send dozens or even hundreds of payment orders.

And although the process is automated, mistakes still happen. What to do if the money went to the wrong place? Calculate and recalculate Let's say a larger amount is transferred to the supplier than provided for under the contract. Most often, it is enough to write a letter to the supplier with a request to return the funds transferred in excess. If the supplier refuses to voluntarily return the excess money, for example, under the pretext of offset against further deliveries under a long-term contract, then first of all it is necessary to study the contract with this supplier. Sometimes an excessively transferred amount may be regarded by the supplier as early fulfillment of the buyer’s obligations. But if such a possibility is not stipulated in the contract, then the supplier has no reason to independently offset the extra money (Article 315 of the Civil Code of the Russian Federation). As a rule, contracts specify the amount that the buyer must pay for a certain quantity of goods supplied and its delivery, that is, it must stipulate the cost per shipment of goods. In this case, neither the supplier nor the buyer can independently (without a prior agreement in writing) change the price either up or down. Therefore, when the buyer transferred “extra” money under the contract, but not on the basis of the terms of the contract, but erroneously, it follows that the funds were received by the supplier unreasonably. A good argument in a dispute with a counterparty may be a mention that interest is paid on the amount of unjust monetary enrichment at the refinancing rate from the moment the acquirer became aware of the unfoundedness of what was received (clause 2 of Article 1107 of the Civil Code), as well as a reference to judicial practice ( clauses 4, 5 of the Information Letter of the Presidium of the Supreme Arbitration Court dated January 11, 2000 No. 49) and the Regulations of the Civil Code on unjust enrichment (Chapter 60). All arguments must be submitted in writing.

Check everything Errors in the details of the counterparty, for example, in the recipient's name, TIN, current account number, make it impossible to credit money to the recipient's account. The transferred amounts “hang”, as a rule, for five banking days, on “unclarified payments”, in the correspondent account of the recipient bank (account No. 47416 “Amounts received in correspondent accounts before clarification”). But if the specified parameters are clarified in a timely manner, funds can be credited. According to the Regulation of the Central Bank of October 3, 2002 No. 2-P “On non-cash payments in the Russian Federation” (clause 6 of Appendix 28) “The credit organization (branch) of the recipient takes prompt measures to obtain supporting documents and ensure that funds are credited for their intended purpose by sending through the Bank of Russia, a request to the credit institution (branch) of the payer with a request to confirm the correctness of the details.” In practice, banks often do not take such prompt measures themselves. Therefore, in the event of an erroneous indication of the details of the counterparty, incorrect data in the name, TIN, current account number, the paying organization must write a letter to its servicing bank specifying the details. The payer's bank, in turn, must forward this letter to the payee's bank. If the letter was not written, the recipient’s bank must return the amount transferred with erroneous details to the payer’s bank after five days. And he, in turn, credits the money to your current account (clause 8 of Appendix 28 of the Central Bank Regulations of October 3, 2002 No. 2-P “On non-cash payments in the Russian Federation”).

Inattentiveness of the clerk It happens that the bank credits the transferred funds to the current account of another company. For example, if the current account is incorrectly indicated in the payment order or simply in case of a typo by the operator. Alas, this is no longer possible without official correspondence with banks. First, you need to contact your financial institution with a request to clarify where the money was credited. Having received the answer, you need to write a claim requesting the return of the erroneously transferred funds. If the Bank Account Agreement between the recipient's bank and the organization that erroneously received the money contains a clause on direct debiting of funds in the event of bank errors, then the likelihood that the money will be returned to you is quite high (this depends only on the recipient's bank). If there is no such clause, then you will have to write a letter to the organization that erroneously received the money, demanding that the amount be returned, as well as calculating interest for the delay in returning the funds received unjustifiably (clause 2 of Article 1107 of the Civil Code). If nothing helps, you will have to resolve the issue in court. There are cases when the payment is transferred to an already closed account. Funds received by the client after termination of the bank account agreement must be returned to the sender. If this does not happen, then the payer organization has the right to request money from the bank in which the recipient’s closed current account was located (clause 8.2 of the Instruction of the Central Bank of the Russian Federation dated September 14, 2006 No. 28-I “On opening and closing bank accounts, deposit accounts (deposits)"). Based on paragraph 6 of Appendix 28 to the Regulations of the Central Bank of the Russian Federation of October 3, 2002 No. 2-P “On non-cash payments in the Russian Federation,” we can conclude that the erroneously transferred funds, before they are credited to the recipient’s account, are the property of the sender of the funds, and The bank does not have ownership rights over them. The obligation to return this amount relates to the current obligations of the bank, therefore, even if a financial institution’s license to carry out banking operations is revoked and a temporary administration is appointed, the return of money must be made in an extraordinary manner, that is, outside of competitive procedures (Resolution of the Federal Antimonopoly Service of the Moscow Region dated May 20, 2009 No. No. KG-A40/3691-09).

Write correctly Error in the purpose of the payment, such as: the basis for the payment, agreement number, account number are incorrectly indicated; the name of the work or product for which payment is being made is incorrectly indicated, VAT is incorrectly allocated - this is not a significant indicator. As a rule, the amount for such a “payment” reaches the recipient safely. If the VAT amount is not indicated in the payment purpose, the bank has the right to refuse to accept the payment order. The Bank of Russia Regulation “On Non-Cash Payments in the Russian Federation” does not regulate the procedure for an organization’s actions when correcting an error made in the purpose of payment when filling out a payment order. Most often, it is sufficient to send a letter indicating the correct purpose of the payment to the accounting department of the recipient organization; it is not necessary to inform the bank. However, you can send a similar letter to your servicing bank. True, not all credit institutions accept such letters, citing the fact that the purpose of settlements concerns only the relationship between the supplier and the buyer. However, there are also banks that refuse to process a payment based on an existing error in the purpose of the transfer. As a rule, in this case we are talking about grammatical errors.

Svetlana Bukharina, chief accountant, and Tatyana Mulikova, general director of Consulting LLC

POPULAR NEWS

To tax or not to tax – no more questions!

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

Tax officials are against changing the procedure for paying personal income tax by employers

In recent years, information has repeatedly appeared about the development of bills, the authors of which wanted to force employers to pay personal income tax on the income of their employees not at the place of registration of the employer-tax agent, but at the place of residence of each employee. Recently, the Federal Tax Service spoke out sharply against such ideas.

The same invoice can be both paper and electronic

The Tax Service allowed sellers who issued a paper invoice to the buyer not to print a second copy of the document, which they keep, but to store it electronically. But at the same time, it must be signed by a strengthened qualified electronic signature of the manager/chief accountant/authorized persons.

Invoice: the line “state contract identifier” can be left blank

From July 1, 2017, a new line 8 “Identifier of the government contract, agreement (agreement)” appeared in invoices. Naturally, you only need to fill out this information if it is available. Otherwise, this line can simply be left blank.

Based on what document should money be issued on account?

The issuance of accountable amounts can be made either on the basis of a written application of the accountable person, or according to an administrative document of the legal entity itself.

Contents of the magazine No. 6 for 2012

N.G. Bugaeva, economist

You specified the wrong details in the payment: what to do?

- Current account Starting a business, Opening a current account, Solution for retail business, Tariffs and terms of service,... Starting a business Starting a business with Sberbank Prepare documents for registering LLCs and individual entrepreneurs Register a business and open an account online Online opening an individual entrepreneur account Open a current account Solution for retail business Tariffs and terms of service Special bank accounts Salary project Promotions and offers Catalog of franchises Catalog of ready-made businesses

- Loans for businessBusiness credit cardLeasingBank guaranteeFactoringOnline loan for businessCredit holidays

- Acquiring - accepting payments by cardsPay QR - accepting payments without a terminalOnline cash register and acquiring in one deviceOnline cash register "Evotor"Billing for housing and communal services companiesAccepting payments from individualsAccepting payments from legal entities

- Business cardsDigitalDebitCreditPremium MastercardPremium VisaInstantFor business trips› Select and order a cardOnline transfers from business cardsBusiness cashback programBusiness credit card partners

- Foreign trade and currency control Option "Foreign trade rubles" Package Cash deposit Collection Self-collection Investments Brokerage services Currency exchange transactions Deposits and bills Depository services Sberbank Business Online Business services Accounting Trade and warehouse management Counterparty verification Lawyer for business Electronic document management Electronic signature › All services for business Certification center PJSC Sberbank

- Instructions and trainingHelp for Sberbank Business OnlineOpening a current accountCredits for businessBusiness cardsAcquiring - accepting payments by cardsOnline cash desk "Evotor"Self-collection› All materialsUp-to-date information about the work of Sberbank for legal entities and individual entrepreneursMeasures of state support for small businessesUsefulHow to avoid restrictions on transactions on the accountOnline check of the status of an executive documentArrests and collectionsCustomer surveysBlog “Simply about business”Contact the bank

- Just about businessStarting a businessClients and profitTaxesBy lawBusiness lessonsCasesSelf-employed

Choose a RKO tariff that is convenient for you

I made a mistake in the details when transferring money. What to do?

Even experienced accountants sometimes make mistakes when filling out payment slips, let alone ordinary citizens making transfers. One wrong number in the card number or details - and the recipient does not receive the money. Where to go in this case - to your bank or to which you transferred? What are the chances of getting your money back?

Correcting the situation is quite possible; the procedure depends on the method of translation and the recipient.

What happens if you make a mistake when writing a checkpoint?

You must understand that all lines of the document must be filled out in compliance with all rules. If you enter the data incorrectly or write something else, this will mean an error and the transfer may not be completed.

In this case, it is usually indicated that the checkpoint is erroneous and the entire amount is sent to the group of outstanding receipts. When the issue is resolved, the funds will be sent to their destination.

Thus, filling out the checkpoint is mandatory for everyone who makes a transfer. If you ignore this, the translation will be impossible. The transferred funds will hang up unclear where, but the bank itself admits that the funds were not sent.

Error in intercard transfer

Suppose a person makes an intercard transfer: he enters the card number and amount on the computer. By clicking the “Translate” button, he confirms the correctness of all entered data. It is always easier to prevent an error than to correct it, so it is advisable to check the entered numbers before sending.

If an error does occur and the recipient’s card number is incorrect, you should contact the receiving bank. Before doing this, you need to request a certificate of unsuccessful operation from your credit institution. To do this, it is not necessary to visit a bank branch; you can use remote communication channels with employees of a financial institution: email or chat. The certificate will contain the first 6 and last 4 digits of the recipient's card number; with their help, the transfer will be found at the receiving bank.

If the receiving bank does not cooperate and refuses to return the payment, then you can try to return the sent funds forcibly. The police or court will help you deal with the fact of unjust enrichment. In this case, it is advisable to seek the help of a lawyer who understands the nuances of such cases. To compensate for expenses and time, it makes sense to try to collect a penalty from the bank.

Why checkpoint must be indicated in the payment order

If the checkpoint is incorrectly indicated in the payment order, the paying company may not have problems making the payment at the bank. Troubles may arise when the payment is credited to the recipient's bank, and their scale depends on the type of payment and the category of the recipient.

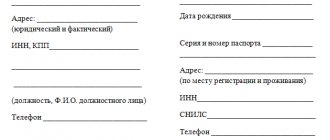

The checkpoint consists of 9 digits and is indicated only in relation to legal entities and budgetary institutions. The first 4 digits are the code of the tax office with which the taxpayer is currently registered, the next 2 digits are the registration code and the remaining 3 are the registration order number on the appropriate basis.

The checkpoint payment order indicates:

- for the sender of the payment - in field 102;

- for the payee - in field 103.

When sending a payment, individual entrepreneurs enter 0 in the sender’s checkpoint column or leave this field empty.

There are 2 main types of payment orders:

- Payments for taxes, fees, etc. to the Federal Tax Service and funds, when the recipient is the Federal Treasury Department (UFK) in a particular region.

- Payments to commercial and non-commercial companies, suppliers, buyers, other counterparties, including individuals.

For budget payments, additional fields are provided. Incorrectly indicating the checkpoint when generating budget payments is fraught with much greater trouble than when sending payments to other counterparties. Let's consider the consequences for each type of bank documents drawn up and the algorithm for subsequent actions.

Error in interbank transfer

Such transfers take longer because both banks and the Central Bank take part in them.

If, due to an error in the details, the money did not reach the recipient, it is added to the account of unrecognized payments. Surely, in this case, a bank specialist will contact the sender of the transfer. After specifying the details, he will credit the money to the desired account.

However, not all banks pay attention to a detailed analysis of transfers. If you find an error in the details, you can contact the sending bank. After this, the clerks will send a letter to the receiving bank with a request to credit the transfer, taking into account the specified details. In theory, this could work, especially if the receiving bank has loyal internal policies.

The second option is to contact the receiving bank with this question, obtaining a payment order. If the sent funds are not credited to the addressee's account within 5 business days, the money must be returned.

You can also try to return the unsuccessful payment back by sending a refund request to the sending bank. However, this procedure is not implemented in all financial institutions.

How to return an incorrect payment

Finding the culprits, of course, is an exciting activity, but let's discuss how to get the money back. And here everything is very bad for the client. The fact is that if the money is written off, then formally the document has passed all checks and is considered correct. That is, his current account number is correctly filled in, and it correlates with the bank’s BIC (the control key of the current account number is calculated taking into account the BIC). If the payment is tax, duty or commission, then in this case the additional fields are filled in correctly. That is, the numbers can be any, but their quantity satisfies the program.

Can the bank send a letter to the recipient in order to determine the fate of the payment?

Maybe. But in practice it is almost useless. Existing electronic banking formats for exchanging information do not provide for sending a message with a “catch-up” correction. That is, there is nothing to send and there is no way to do it. The operator can send a letter in a simple free form, but it is unlikely to be taken into account by the receiving party. Simply because the regulations for the exchange of electronic payment documents do not provide for this method of communication. It’s another matter if the receiving bank itself faces difficulties. For example, not all details are filled out correctly from his point of view. And, for example, the recipient has a different TIN than the one indicated on the payment. Then he himself must send the request and in his response you can send the correct details.

What to do if incorrect tax and budget data are indicated - KBK, OKTMO, etc.

In this case, the money goes to the accounts of the Federal Treasury. They will not be sent back on their own, nor will any requests be received in connection with them. The only correct course of action is to write an official letter on behalf of the payer to the Treasury, with a request to consider a payment with some details as a payment with other details. In this case, Treasury employees will transfer it from the account of unclear payments, where it can theoretically remain indefinitely, to an account with the correct details. You can try and get your money back. But knowing the prospects for this process and the rather lengthy circumstances surrounding it, the operator and bank employees will try to place all responsibility for it entirely on the client. Moreover, according to their conviction, he is already responsible.

How to return money if the wrong recipient is indicated (recipient details are incorrect)

At the same time the simplest and most difficult path.

The simplest one: if the recipient’s details are indicated incorrectly (name, TIN, KPP, etc.), then the recipient’s bank is obliged to issue a clarifying request to the sender. At the same time, set the payment to “unclarified”. If no explanation is received, send it back within 5 days. In this case, the client will receive his money.

The most difficult: the recipient is indicated correctly, along with all the details. But not the one you need. For example, incorrectly selected from the database. In this case, the money will go directly to the client’s current account. And neither the sender’s bank nor the recipient’s credit institution will have the right to seize them. In this case, the payer must already contact the recipient with a letter. That is, to the organization or individual to whose account the money was credited. And they will already consider this letter, determining whether it is worth sending the money back. Credited incorrectly due to an error by the bank operator.

The details in the personal income tax declaration 3 are filled in incorrectly, what is this?

After submitting the personal income tax return 3-NDFL, the responsible specialist may receive a response from the tax office, which states that the sent report had “incorrectly filled in details” and also “identified shortcomings (errors) in the tax return.” What is this? The reasons for this error can be different, ranging from incorrect data indicated in the reporting, and ending with a failure on the tax service servers. Below we will analyze the factors of the dysfunction that has arisen, and also find out how to correct it.

Common mistakes

Error No. 1 : An enterprise using the simplified tax system accepts payment orders without checking them for VAT information.

Comment : Companies using the simplified tax system must carefully check payment orders; they need to make sure that they are marked “Without VAT”.

Error No. 2 : The counterparty received an overpaid amount from the company and refused to return the overpayment. The sending company, based on the fact that it was its mistake, did not demand any more money.

Comment : Despite the fact that the mistake was made by the sender of the payment, a claim can be made against the counterparty who refused to pay the excess money and the funds can be returned through the court.

Error No. 3 : The company’s accountant mistakenly sent money to a counterparty with whom the company no longer works, leaving another counterparty without payment. The one who received the payment in error refused to return the money for a long period of time until he was threatened with legal action. After this, the company issued a refund of the erroneously accepted money.

Comment : In the event that an organization that has accepted erroneously sent money is in no hurry to return it and is deliberately stalling for time, the sender of the payment may demand not only the entire amount of money transferred, but also interest on the use of the funds. The court will be on the side of the sender of the payment, since receiving funds by mistake is considered unjust enrichment, and failure to return funds implies illegal use of them, so you can demand interest at the refinancing rate on the day the money is returned.

Features of filling out the 3-NDFL declaration

As you know, the 3-NDFL report is the main declaration with which the taxpayer notifies the tax authorities about the personal income tax paid to them. Such a declaration is filled out and submitted by individuals who work officially and pay income tax in amounts up to 35% of their income. The declaration is intended to confirm the legality of the income received by an individual and demonstrate the appropriate tax payments from it.

Declaration form 3-NDFL

Filing a tax return 3-NDFL is required for the following categories of citizens:

- Individual entrepreneurs working on the main tax system;

- Lawyers and notaries;

- Persons who received income abroad;

- Persons who received income from real estate or the sale of a car;

- Persons who receive income from lottery winnings or rental property.

The Tax Code of the Russian Federation interprets in what cases 3-NDFL is provided

The 3-NDFL declaration is submitted to the tax authorities before April 30 of the year following the reporting year.

Submit your declaration within the specified deadlines

Errors in KBK: a special approach

With errors in the KBK, not everything is so simple. On the one hand, this is a critical mistake, leading to the accrual of penalties and even a fine if the non-payment is discovered by the fund. On the other hand, if an error in the BCC did not prevent the receipt of contributions to the budget of the corresponding fund, then the organization has grounds to insist on clarification of the payment. A dispute is, of course, very likely. But ultimately, you will be able to avoid both penalties and liability and Resolution of the Federal Antimonopoly Service of the Central Election Commission dated 10/07/2011 No. A14-11622/2010, dated 01/24/2012 No. A14-1357/2011.

As you can see, in certain cases, an error in the KBK can be corrected. By the way, in the application form for clarification developed by the Pension Fund, the KBK is also named among the details to be clarified. So, indirectly, the Pension Fund itself admits that an error in this code does not always lead to money being transferred to the wrong place.

Immediately after the new year, a large number of payments intended for the Federal Compulsory Compulsory Medical Insurance were stuck in unexplained receipts precisely because of the confusion with the KBKP Treasury letter dated 02/17/2012 No. 42-7.4-05/2.0-93. In this regard, the Treasury of Russia and the Pension Fund of the Russian Federation decided to independently clarify payments, without waiting for applications from the policyholder. Letter of the Treasury No. 42-7.4-05/5.4-53, Pension Fund of the Russian Federation No. KA-30-24/1165 dated 02.02.2012. This is perhaps good news.

On the PFR website you can find a reminder on how to correctly fill out payment orders for payment of contributions

Extra-budgetary funds are also interested in ensuring that payments for insurance premiums reach them on time. Therefore, regional branches have posted on their pages samples of filling out payment slips separately for each contribution.

We have a separate division in the Moscow region. We have always transferred personal income tax for the employees of this unit to the inspectorate where it is registered. But last year several times they mistakenly put checkpoints for the head office and not the division on their paychecks. During an on-site inspection, tax officials discovered that these payments were not on the company’s personal card, considered the tax unpaid, and charged us a penalty and a fine under Art. 123 Tax Code of the Russian Federation. Are the actions of the auditors legal? M. Klenova, Moscow

You should not worry about the fact that the accountant indicated in the payment order that personal income tax should be transferred to a separate division of the checkpoint of the head office. If you submit an application to the tax office to clarify the payment, you will not face penalties or interest. Let's explain in more detail.

Tax agent organizations that have separate divisions transfer the personal income tax calculated and withheld from the income of individuals both to the inspectorate at the location of their location and to the inspectorate at the location of each division (clause 7 of Article 226 of the Tax Code of the Russian Federation). In this case, the payment slip must include the details of the inspection office with which the unit is registered, OKATO of the municipality in which this unit is located, as well as its checkpoint. The Ministry of Finance of Russia draws attention to this in letter dated July 3, 2009 No. 03-04-06-01/153.

Thus, such details of the payment order as the department checkpoint must be present in the document. But an error in filling it out will not lead to negative consequences. The fact is that, even if you made a mistake in indicating the checkpoint, you still fulfilled your obligation to pay personal income tax.

The obligation to pay tax is considered fulfilled from the moment the taxpayer presents to the bank a payment order for the transfer of funds to the budget from the organization's current account. At the same time, there must be sufficient funds in the organization’s current account on the day of payment (subclause 1, clause 3, article 45 of the Tax Code of the Russian Federation).

The list of situations in which the taxpayer’s obligation to pay tax is considered unfulfilled is contained in subparagraph. 4 p. 4 art. 45 of the Tax Code of the Russian Federation, and this list is closed. It mentions the following reasons:

- withdrawal by the taxpayer or return by the bank to the taxpayer of an unexecuted order;

- withdrawal by the taxpayer-organization for which the personal account was opened, or return by the Federal Treasury body to the taxpayer of an unexecuted order;

- return by the local administration or federal postal organization to an individual of cash accepted for transfer to the budget;

- incorrect indication by the taxpayer in the order to transfer the tax amount of the Federal Treasury account number and the name of the recipient bank, which resulted in the non-transfer of this amount to the budget;

- if on the day the taxpayer submits an order to the bank to transfer funds to pay tax, this taxpayer has other unfulfilled demands that are presented to his account (personal account) and, in accordance with civil legislation, are fulfilled as a matter of priority, and if on this account (personal account) account) there is not enough balance to satisfy all requirements.

These rules apply not only to taxpayers, but also to tax agents (Clause 8, Article 45 of the Tax Code of the Russian Federation). Therefore, an incorrect checkpoint for a separate division of your organization in a payment order does not indicate non-payment of personal income tax. And if your company paid the tax in full and on time, then the tax authorities have no grounds for charging penalties and fines (Articles 75, 123 of the Tax Code of the Russian Federation).

Arbitration practice on the issue under consideration is in favor of taxpayers. Thus, in the resolution of the Federal Antimonopoly Service of the Moscow District dated March 18, 2009 No. KA-A40/11099-08, the arbitrators came to the conclusion that the incorrect indication of the organization’s checkpoint in the payment order cannot be the basis for considering the obligation to pay tax not fulfilled. The judges noted that the erroneous indication of the checkpoint number in the payment order did not lead to non-payment of tax to the budget, since the payment documents were accepted for execution by the bank and the funds were received into the budget.

True, in this case the issue was considered related to the incorrect indication of the organization’s checkpoint in the payment order for the transfer of income tax. But this does not affect the essence of our question.

To avoid misunderstandings with tax authorities, we advise you to clarify the purpose of the payment. Clause 1 of Art. allows you to do this. 45 Tax Code of the Russian Federation. This provision of the Code states that if an error is detected in the execution of a payment order for the transfer of tax, the taxpayer has the right to submit to the tax authority at the place of his registration an application about the mistake made with a request to clarify the basis, type and identity of the payment, the tax period or the status of the payer. The application must be accompanied by documents confirming payment of the tax and its transfer to the budget to the appropriate account of the Federal Treasury.

Based on this application, the tax authority makes a decision to clarify the payment on the day the taxpayer actually pays the tax to the budget to the appropriate account of the Federal Treasury. In this case, tax authorities must recalculate the amount of penalties accrued on the amount of tax for the period from the date of its actual payment to the day the tax authority makes a decision to clarify the payment.

The recent replacement of OKATO codes with OKTMO codes in payment orders for taxes (see " ") has raised many questions and will certainly lead to a huge number of errors. What consequences can errors in payments lead to and how can they be corrected? BukhOnline tax lawyer Alexey Krainev answered these questions.

Reasons for the error of incorrectly filled in details

Soon after submitting the specified declaration to the Federal Tax Service, you may receive a response about incorrectly filled out report details, with the corresponding values given. Also, the said notice may contain a proposal to make the necessary corrections within five days, or to provide the necessary explanations for any discrepancies that have arisen.

The error is usually caused by the following.

| Reason for error | Details |

| You entered the declarant's details incorrectly | The details you submitted do not match the information available in the Federal Tax Service databases. This is the most common factor in the appearance of this error. The declarant's details were incorrectly indicated in the reporting. |

| There are problems on the servers of the tax service itself | A fairly common cause of the problem is the unstable operation of the Federal Tax Service servers, on which the relevant reports are stored. A common cause of problems is the failure of the Federal Tax Service servers. |

| Failure of the software responsible for sending and receiving tax reporting | Sometimes, as they say, the software package itself, which is responsible for receiving and checking reports, is “buggy” |

What to do in this situation, and how to correct the error “The details of 3 personal income tax were filled in incorrectly”? Let's figure it out.

Errors in payment slips for payment of contributions: what are they and how to correct them

When the payer himself is to blame for the incorrect transfer of funds Ekaterina Gutgarts, editor-in-chief of Prostopravo. According to the latter, an unscrupulous owner is obliged to immediately return the property to the person who has ownership or other right to it in accordance with the contract or law, or who is the bona fide owner of this property. If an unscrupulous owner fails to fulfill this obligation, the interested party has the right to file a claim to recover this property. If the improper recipient refuses to return the funds, they can be claimed in court, and at the same time interest for the use of other people’s funds in accordance with Art. Elena Frankovskaya, First Deputy Chairman of the Board of Forward Bank The recipient bank credits funds to the accounts of its clients only after checking the details and, most importantly, if they match. That is, the recipient’s bank is obliged to check the correspondence of the client’s account number and its code, which are indicated in the electronic document. In case of discrepancy, the bank has the right to withhold the transfer amount for up to four working days to determine the proper recipient of these funds. Elena Derkach, Project Manager of the Department of Savings and Transactional Products of OTP Bank The sending bank must accept the completed document from the client or fill out the document independently and certify it with the payer’s signature. With his signature, the payer confirms the correctness of all specified details, amount, and purpose of payment. The sending bank can influence the payment only within the framework of current legislation, namely: control compliance with existing restrictions on amounts and account modes.

The accountant may be faced with a set-off or refund of insurance premiums. From May 14 this year, you need to use updated application forms approved by order of the Russian Ministry of Labor dated

In particular, you must enter the following data: purpose and purpose of payment; information about the payer who is transferring the money, along with his checkpoint; the addressee who will receive the corresponding amounts, with his checkpoint displayed on the payment slip. These same positions must be filled when money is transferred to private companies. That is, which are not related to the budget system of the Russian Federation.

How to correct incorrect data

To solve the problem you need to do the following:

- Carefully check the correctness of the details you entered.

If errors are made in the declaration, then in accordance with Article 81 of the Tax Code, an updated (corrected) declaration must be submitted. By default, you are given five days for all this. Correct the incorrect data, indicate correction number 1 (“updated”), and resubmit your declaration; Specify the adjustment number 1 - updated - Call your tax office for clarification.

Another effective way to get rid of the error “the details in the 3rd personal income tax return are filled out incorrectly” is to call the tax service. Call the Federal Tax Service hotline, they will offer to switch you to your Federal Tax Service, and then select the department for working with individual taxpayers. Ask for appropriate clarification, and it is quite possible that you will soon resolve the issue; Call your tax office for clarification. - Contact technical support. Write a corresponding letter to the technical support service and wait for a response. In some cases, it was a call to technical support that helped eliminate the error “3-NDFL details were filled in incorrectly” and accept tax reporting.

Send a letter to technical support

This is useful to know: there is an error in the sequence of providing personal income tax information.

In our article, we looked at what the error “The details in the 3-NDFL declaration were incorrectly filled out” is and how to fix it. If you have made a mechanical inaccuracy in your reporting, we recommend correcting it and submitting it to the tax office with correction number 1. If there are no formal errors, we recommend contacting the tax office and technical support service, who will help resolve the problem you are experiencing.

Who and in what cases draws up a notification to clarify the details of the payment order?

A letter of clarification is drawn up and sent by the person who transferred the funds. After all, only the payer has the right to dispose of his funds.

If the recipient of the money believes that there is an error in the payment order, he needs to contact the payer and request a correction. The recipient of the money cannot independently take into account the funds at his own discretion without the permission of the payer.

| Error | Do I need to fix it? | Why |

| Wrong contract | Yes | The supplier may consider the payment as an advance under an erroneous contract and not pay the actual debt for goods and services. In this case:

|

| Incorrect name of product or service | Not necessary | If there are frequent errors or a large transfer amount, the discrepancy between the specified product or service and the recipient’s activity may raise questions from the bank, including blocking the account. It is better to indicate the correct name of the product or service, but in case of widespread errors, they still need to be clarified. |

| VAT rate | No | There are no legal or tax risks. Here, problems may arise for the payer when offsetting VAT from the supplier's advance payment by the Federal Tax Service if the inaccuracy flows into the advance invoice. |