What details should I use to pay arrears of insurance premiums for 2020?

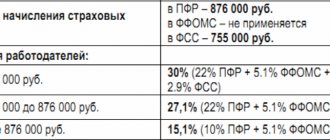

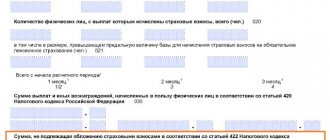

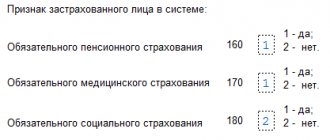

Moreover, for each type of compulsory insurance, an independent payment order should be generated with the transfer of funds in favor of the fund. A monthly mandatory insurance payment is provided for persons paying remuneration to employees and deducting contributions from these amounts for various types of insurance (for employers, which may be foreign or Russian legal entities, individual entrepreneurs, private practitioners).

For those payers who do not have employees, mandatory medical and pension payments are provided, paid to the accounts of the Federal Compulsory Medical Insurance Fund and the Pension Fund of the Russian Federation until the end of the current year. These payments are made for oneself and are mandatory; they are calculated by payers independently, taking into account the current minimum wage and the level of income insofar as it exceeds 300,000 rubles.

in year.

Before 09/14/12 the rate was 8%, after 8.25%. In 2020, the refinancing rate corresponds to the key rate and is 11%. The number of days of delay is counted starting from the 1st day after the deadline for payment of contributions up to and including the day of payment.

Calculation example: The company did not pay contributions to the funds for January 2020 on time; the resulting debt was repaid on May 27, 2016. The last day to transfer insurance payments for January is February 15.

The total amount of employee payments for January amounted to 300,000 rubles. The company calculates contributions according to basic tariffs. It is necessary to calculate the amount of arrears on contributions and the amount of penalties payable.

Name of fund Unpaid contribution for January, rub. Number of days of delay, cal days. Penalty, rub.

In the article we will look at arrears of insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, the Federal Compulsory Medical Insurance Fund: the collection procedure, the deadline, as well as the calculation of penalties. Payers of compulsory insurance premiums bear the obligation to timely pay insurance amounts in full, as well as to submit the appropriate settlement forms with reliable information on compulsory insurance payments.

In case of failure to fulfill these obligations, a debt to the funds arises, called arrears. In such cases, the control body forms a requirement in a regulated form for the debtor to repay the debt forcibly.

Arrears on insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund Arrears arise if the payer does not transfer the required amount of insurance pension, medical and social payments by the 15th day inclusive for the month ended.

Mortgage before the Pension Fund

The employer is obliged to make contributions to non-budgetary organizations from the salary of each employee working at the enterprise.

This applies to pension and health insurance contributions. This procedure is very important, since a pension is formed from these funds. That is, if insurance premiums are not paid for an employee of an enterprise, he may be left without a normal pension. In accordance with Federal Law No. 212, mandatory deadlines for fulfilling payment obligations are established. Contributions must be made by the 15th of the next month for income from the past 30 calendar days.

In addition, the employer must provide timely reports to the PRF. Failure to meet deadlines results in debt formation. The document is filled out according to form RS-B-1. If the data in the report and the actual payments do not match, an overpayment or debt will appear. The first case is not dangerous and does not face fines. But debt must be identified in a timely manner, as this entails penalties.

When is it possible to write off tax arrears?

If a legal entity or individual entrepreneur misses the deadline for paying taxes or insurance premiums, thereby violating tax legislation (paragraph 2, paragraph 1, article 45 of the Tax Code of the Russian Federation), then he will develop a debt to the budget. This is arrears in taxes (insurance contributions), that is, in this case, debt (clause 2 of article 11 of the Tax Code of the Russian Federation).

For information about what violations there is liability for and what its extent is, read the article “Liability for tax violations: grounds and amount of sanctions.”

In addition, there are situations when, while checking a taxpayer, inspectors discover an excessive amount of taxes reimbursed to him from the budget, for example, for VAT. And this is a tax arrears too.

The following taxes can be reimbursed from the budget:

- VAT, when the amount of deductions exceeds the amount of calculated tax, including taking into account the amounts of tax subject to restoration (clause 2 of Article 173 of the Tax Code of the Russian Federation);

- excise taxes, when the amount of tax deductions is greater than the amount of excise tax calculated on transactions with excisable goods - objects of taxation under Art. 182 of the Tax Code of the Russian Federation (clause 1 of Article 203 of the Tax Code of the Russian Federation).

About illegal VAT refunds and subsequent liability for this, read the material “What is an illegal VAT refund and what is the liability for it?”

Tax arrears arise the very next day after the violation of the deadline established by law for paying taxes to the budget.

If an excessively refunded amount of tax is recognized as arrears, then the day of its formation will be (paragraph 4, paragraph 8, article 101 of the Tax Code of the Russian Federation):

- the day on which the taxpayer actually received the refunded amount of tax from the budget, in the case of transferring funds from the budget to the current account;

- the day on which the decision was made to offset the tax amount, in the event of a tax offset.

Read about the refund procedure in the article “How is VAT refunded: return (refund) scheme?”

Let's consider the procedure for collecting debt to the budget from a taxpayer step by step.

Step 1. If a tax arrears are detected, the tax authority must issue a demand to the debtor to pay taxes, penalties, fines, and interest within the following terms:

- If a tax arrears are identified during a tax audit, then no later than 20 working days from the moment when the decision made based on the results of the audit came into force (clause 6 of article 6.1, clauses 2, 3 of article 70, clause 1 Article 87, paragraphs 7, 9 of Article 101 of the Tax Code of the Russian Federation).

- If the arrears are identified outside the scope of the taxpayer’s audits, then the deadline for sending the demand will depend on the amount of the debt (clauses 1, 3, article 70, clause 10, article 101.4 of the Tax Code of the Russian Federation). So, with a debt of 500 rubles. or more, the demand must be sent within 3 months from the date of discovery of the arrears, and if the debt is less than 500 rubles. - within 1 year from the date of discovery of the arrears.

Step 2. The taxpayer must fulfill the requirement within the period specified therein (clause 6 of article 6.1, paragraph 4 of clause 4 of article 69 of the Tax Code of the Russian Federation). The minimum period within which he must meet the repayment of arrears on taxes, penalties, etc. is 8 working days from the date of receipt. If the debtor does not fulfill the demand, then:

- According to paragraph 3 of Art. 46 of the Tax Code of the Russian Federation, no later than 2 months after the deadline for fulfilling the requirement, the tax authority makes a decision to collect the debt from the debtor’s accounts opened with banking and credit institutions. Let us note that if we are talking about a consolidated group of taxpayers, then the period for making this decision by the tax authority is extended to 6 months from the moment when the deadline for fulfilling the requirement sent to the responsible member of the group has expired (subclause 5, clause 11, article 46 of the Tax Code of the Russian Federation). The procedure for collecting debt from taxpayer accounts is regulated by Art. 46 Tax Code of the Russian Federation. If there are no funds in bank accounts or there are not enough funds to pay off the debt, you must proceed to step 3.

To learn about from which taxpayer accounts debts on taxes and fees can be collected, read the material “From which accounts can tax authorities collect?”

- After 2, but no later than 6 months after the expiration of the deadline for fulfilling the demand for payment of arrears, penalties, fines, etc., the tax authority has the right to submit an application to the arbitration court in order to recover the required amount of debt from the taxpayer. The deadline for filing an application regarding the collection of debt from members of a consolidated group of taxpayers is extended to 6 months after the expiration of the 6-month period for indisputable collection of debt from the bank accounts of these persons (subclause 5, clause 11, article 46 of the Tax Code of the Russian Federation). Please note that if the inspectorate, for good reason, missed the deadline for filing this application, the court can reinstate it (paragraph 1, paragraph 3, subparagraph 5, paragraph 11, article 46 of the Tax Code of the Russian Federation, article 117 of the Arbitration Procedure Code of the Russian Federation).

- No later than 6 months after the end of the deadline for fulfilling the requirement, the tax authority submits an application to the arbitration court in order to recover from the taxpayer the necessary amount of debt in those cases that are provided for in subsection. 1–4 p. 2 tbsp. 45 of the Tax Code of the Russian Federation. In accordance with the provisions of sub-clause. 2 p. 2 art. 45 of the Tax Code of the Russian Federation in this case, tax authorities have the right to go to court only if the arrears are identified during a tax audit and are registered with the debtor for more than 3 months. Indisputable collection of arrears in such situations is impossible.

Step 3. If it is not possible to collect the debt at the expense of the debtor’s funds, then:

- The inspectorate, no later than 1 year after the end of the deadline for fulfilling the requirement to pay the debt, makes a decision on its collection at the expense of the taxpayer’s property (clause 7 of article 46, clause 1 of article 47 of the Tax Code of the Russian Federation). Collection of arrears, penalties, etc. at the expense of property is carried out in the manner prescribed by Art. 47 Tax Code of the Russian Federation.

- In the period from 1 to 2 years after the expiration of the deadline for fulfilling the requirement, tax authorities apply to the court with an application to collect the required debt from the taxpayer. If the inspection, for good reason, misses the deadline for filing the said application, then the court can reinstate it (paragraph 3, paragraph 1, article 47 of the Tax Code of the Russian Federation, article 117 of the Arbitration Procedure Code of the Russian Federation).

Read more about the collection procedure here.

If the statute of limitations for debt to the budget has expired, then the tax authorities will not be able to oblige the debtor to pay the arrears, despite the fact that the debt will still be registered with him. However, if such a debt is deemed uncollectible, it may be excluded from the card for settlements with the budget.

According to sub. 1–4.1 clause 1 art. 59 of the Tax Code of the Russian Federation, a debt is recognized as uncollectible in the following cases:

- upon liquidation of the company;

- when an individual entrepreneur is declared bankrupt;

- in the event of the death of an individual, if he was a debtor for taxes and fees;

- if there is a court decision, according to which the tax authorities do not have the right to demand payment of arrears of taxes, penalties, etc. from the debtor;

- when a bailiff makes a decision to complete proceedings on an executive document with the return of such a document to the claimant (clauses 3, 4, part 1, article 46 of the federal law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”), provided that a this debt is more than 5 years ago, in the following cases:

- the amount of debt is equal to or lower than the amount of claims against the debtor established by the legislation of the Russian Federation on insolvency (bankruptcy) for initiating bankruptcy proceedings;

- the court returns the application for declaring the debtor bankrupt or terminates the bankruptcy proceedings due to the lack of funds necessary to compensate for legal costs for the procedures applied in the bankruptcy case.

For information on liquidating an LLC with tax debts, read the article “Liquidation of an LLC with tax debts.”

Contributions as of January 1: arrears and overpayments – Just about technology

So you submitted a new report to the Federal Tax Service for the 1st quarter, you decided to relax and go about business. But no. The tax office has not yet fully dealt with the contributions that were transferred to its jurisdiction. If you overpaid to the Social Insurance Fund or Pension Fund last year, the Federal Tax Service may not know about it and charge penalties for the arrears.

If you received a letter with arrears, it is better to pay it and apply for a refund of the overpayment for periods before January 1, 2020. Based on your application, the Federal Tax Service, Social Insurance Fund or Pension Fund of the Russian Federation will find out whether there was an error in the transmitted data and independently adjust the balances at the beginning of the year. After this, the Federal Tax Service will return the overpayment. Penalties do not have to be paid, and if they have already been paid, they will be returned upon application.

What are these overpayments?

Entrepreneur Nikodim paid sick leave to his employee Peter in December 2020. Peter was sick for a week, Nikodim paid him 7,000 rubles: 3,000 from profits and reduced contributions to the Social Insurance Fund for December by 4,000.

In December, Peter earned 125,000 rubles. This is the basis for calculating monthly contributions; it includes salaries, bonuses and other taxable payments. In the Social Insurance Fund, the entrepreneur pays 2.9% of this base monthly:

125,000 × 2.9% = 3,625 rubles.

Peter received a payment of 4,000 rubles towards his contributions. The difference between the insurance payment received by the employee and the amount of the accrued contribution is an overpayment. In December this overpayment amounted to

note

4000 - 3,625 = 375 rubles.

When transferring contributions to the Social Insurance Fund for January, Nikodim reduced them by 375 rubles. And at the beginning of May 2020, when the first quarter ended, the tax office received a demand to pay an arrear of 375 rubles and a penalty for this amount of penalties for all four months of delay.

How does the law understand overpayments?

Benefits due to maternity or temporary disability are reimbursed by the Social Insurance Fund. Contributions for the current month are reduced by the amount of these benefits (clause 2 of Article 431 of the Tax Code of the Russian Federation and Article 4.6 of Law No. 255-FZ of December 29, 2006).

Paragraph 9 of Article 431 of the Tax Code allows for overpayment of insurance premiums to be taken into account in two ways:

- To be counted towards the payment of insurance premiums in the following months.

- Reimburse from the Fund to the current account of an individual entrepreneur or organization.

- statement;

- reference-calculation;

- breakdown of expenses incurred;

- documents confirming the employee’s right to this benefit.

What to do with overpayments for last year

Overpayments for last year must be proven and returned. It will no longer be possible to offset the overpayment against future payments: Federal Law No. 212-FZ has become invalid since January.

To return the overpayment, submit an application for the return of the overpayment amount to the Social Insurance Fund, Compulsory Medical Insurance Fund or Pension Fund. You will need:

Application forms, certificates and transcripts are in the letter of the FSS of Russia No. 02-09-11/04-03-27029 dated December 7, 2020.

The FSS contributions were transferred to the tax office, but the correctness and completeness of the calculation of insurance payments is still checked by the Social Insurance Fund. Therefore, an application for the return of overpayments on insurance payments for the previous year must be submitted to the Social Insurance Fund.

The application is considered for three days, after which a desk audit begins. If the payer does not have overdue debts for other tax periods that expired before January 2020, a refund decision is made.

After making a decision, employees of the Social Insurance Fund, the Compulsory Medical Insurance Fund or the Pension Fund send it to the Federal Tax Service. The tax office generates consolidated applications for refund of overpayments for the Federal Treasury. After making the payment, the Treasury provides the Federal Tax Service with an extract with settlement documents confirming payments. All this takes 10 calendar days.

Reconciliation with the tax office: how to understand the statement ٩(͡๏̯͡๏)۶ — Elba

To reconcile with the tax office, you will need two documents:

- A statement of the status of settlements shows only the debt or overpayment of taxes and contributions on a specific date. But to figure out where they came from, you will need another document - an extract of transactions for settlements with the budget.

- The statement of transactions for settlements with the budget shows the history of payments and accrued taxes and contributions for the selected period. Based on the statement, you will understand when the debt or overpayment arose and find out the reason for the discrepancies.

You can order them through Elba - no need to go to the tax office.

Try Elba - 30 days free

Information about the status of settlements

Using the certificate of payment status, you will check whether there is any debt or overpayment at all.

The first column shows the name of the tax you are reconciling against. Information on debts and overpayments is contained in columns 4 - for taxes, 6 - for penalties, 8 - for fines:

- 0 - no one owes anyone, you can breathe easy.

- A plus amount means you have overpaid.

- The amount with a minus - you owe the tax authorities.

Why does the certificate include an overpayment?

If you see incomprehensible debts or overpayments in the certificate, you will need an extract of transactions with the budget to find out the reason for their occurrence.

Extracting transactions for settlements with the budget

Unlike a certificate, an extract does not show the situation on a specific date, but the history of your relationship with the tax office for the period. For example, from the beginning of the year to today.

Statements of budget transactions can come in different formats. Let's look at both - find yours using the screenshot.

To make it easier to understand the statement, we will divide it into 7 blocks:

“Paid” – your payments to the tax office. “Accrued by calculation” is the tax you must pay. Most often, charges appear after submitting the declaration.

Using it, the tax office finds out when and how much you must pay, and enters this information into the database.

If you have an overpayment of 30,000 rubles, then after calculating the tax of 5,000 rubles, an overpayment of 25,000 rubles remains. “Balance of payments” is divided into two columns: “By type of payment” and “By card payments to the budget.” In the first, you see a debt or overpayment for a specific payment - only tax, penalty or fine. In the second - the total total for all payments. For example, the tax overpayment is 30,000 rubles, and the debt for penalties is 1,000 rubles. Therefore, at the beginning of the year, the tax overpayment is 30,000 rubles, and the total overpayment for all payments is 29,000 rubles.

For example, you submitted a declaration under the simplified tax system in February. The tax office immediately entered into the database the tax that needs to be paid on this declaration. But the deadline for paying tax for the year comes later - March 31 for an LLC and April 30 for an individual entrepreneur. Therefore, the accrued tax falls into a separate section “Calculations for future periods”. As soon as the tax payment deadline arrives, the accrued amount from this section will appear in the general list of transactions.

Here you can see on the basis of which document the entry appeared in the tax office or, more simply, the line in the statement. RnalP is the primary tax calculation, that is, a declaration according to the simplified tax system. Based on the declaration, you are charged tax - the amount you must pay to the budget. PlPor is a payment order, a bank document stating that you transferred money to the tax office.

If you have a debt, the first thing to do is check that all of your payments (transactions with the “Paid” type) are included in the statement. If you find that there are not enough payments, although everything was paid on time, take the tax payments and take them to the tax office to sort it out. If there are no errors, but you still owe the state, you will have to pay additional tax.

New form

In 2020, the tax office unsuccessfully updated its software and statements began to arrive in a new, unusual format.

In the old statement, payments and accruals for taxes, penalties and fines were conditionally divided into 3 blocks. In the new one they are mixed in chronological order.

https://youtu.be/ULTgZhR1rxc

How debts/overpayments increased or decreased can be seen in column 13. A positive number is an overpayment, a negative number is a debt. Abbreviations in column 6 will help separate calculations for penalties from calculations for taxes - there will be something with the word “penalty” there.

Now let’s figure out how these overpayments and debts are formed.

The data in column 10 goes to your “minus” - these are tax charges. And at 11, on the contrary, it’s “plus”, these are your payments.

Example

This is an extract from the simplified tax system. The entrepreneur had an overpayment at the beginning of the year, then:

- in April he pays 6,996 rubles, the total overpayment is 71,805 rubles.

- On May 3, he submits a declaration and charges appear in the statement that reduce the overpayment: 71,805 – 4,017 – 28,062 – 8,190 = 31,536 rubles.

- An operation with the description “reduced by declaration” appears. This means that the entrepreneur incurred the main expenses at the end of the year, so during the year he was charged too much tax. Therefore, the accrual is reduced by RUB 10,995. That rare case when a declaration does not add obligations, but vice versa.

- in July, he pays an advance payment for the first half of 2020 and the overpayment at the time of requesting an extract from him is 52,603 rubles.

Conduct regular reconciliation with the tax office to keep payments with the state under control and to immediately find out if something goes wrong.

The article is current as of 02/26/2019

If there is a debt on insurance premiums until 2020

Where should the policyholder turn if, according to the tax office, he has a debt on contributions as of January 1, 2017, which in fact does not exist?

Source: https://freshgeek.ru/vznosy-na-1-ianvaria-nedoimka-i-pereplata/

Arrears on insurance contributions to the Pension Fund, FSS, FFOMS: calculation of penalties

Important

In January 2020, the payment recipient and budget classification codes should be changed in payment orders for the payment of insurance premiums. And in February, the BCC will change again. If you send money to the Pension Fund or Social Insurance Fund details in 2020, the payment will not go through! I hope it’s no secret that starting from 2020, we will transfer insurance contributions to the Pension Fund and the Social Insurance Fund (with the exception of contributions from “NS and PZ”) not to the funds, but to the tax office.

This applies to both employers and individual entrepreneurs paying contributions for themselves. Therefore, starting from 2020, we indicate the Federal Tax Service (including INN and KPP) as the payee on payment orders.

Even if it is a payment for 2020, or arrears for other past years. For example, in my case, in the instructions for insurance premiums, I will indicate - UFK for the Kirov region (MRI Federal Tax Service No. 13 for the Kirov region"), INN 4329002305, KPP 432901001.

Statute of limitations for collection

You must always remit taxes on time, otherwise there may be consequences - tax arrears, as well as the accrual of penalties.

The arrears can be repaid by the taxpayer voluntarily. However, in addition to the tax itself, you will also need to transfer penalties to the budget, calculated taking into account the number of days of late payment.

If the taxpayer does not independently pay off his debt in the form of tax arrears and penalties to the budget, then the tax authorities will collect these amounts by force.

If it is impossible to collect arrears of taxes and penalties from the taxpayer, the tax authorities may write off this debt as bad.

Forcible collection occurs if the debtor refuses to pay them voluntarily.

The creditor himself does not have the right to take coercive measures against the debtor. This is done exclusively through the court.

You cannot go straight to the judiciary. You must first try to solve the problem out of court. To do this, the debtor is first sent a demand for voluntary payment of the debt, which includes the accrued penalty. The requirement is drawn up in the prescribed form. It is sent within 3 months from the date the debt arose. The demand is delivered in person. It can also be sent by registered mail. The document must indicate the following points:

- The time frame within which the arrears must be covered.

- The reasons on which the debt arose.

- The consequences that will be applied to the debtor if he does not pay the debt.

- Information from relevant laws.

The requirement may also not indicate deadlines. In this case, the debtor needs to repay the debt within 10 days.

If the debtor does not make any payments, the creditor has the right to go to court. After receiving the writ of execution, the production process begins. In the process, coercive measures are implemented:

- Write-off of funds from bank accounts in the amount of debt.

- Seizure of property.

- Ban on traveling abroad.

If a debt is not paid for a long time, it is considered uncollectible and is cancelled.

The penalty is calculated daily. Its size is determined as a percentage of the debt. For example, a person’s debt to the tax office is 1000 rubles. The penalty is set at 0.1%. The delay was 10 days. That is, the penalty will be 10 rubles. The arrears are determined based on the current Central Bank refinancing rate.

Accounting for penalties

How to record a penalty in accounting? There is no need to take into account the penalty in expenses, since it is unreasonable. Postings are used to reflect penalties in documents. To track penalties, you can create auxiliary subaccounts “Peni”. The amount of penalties is indicated in the “Losses” account.

When paying a penalty, two payment orders are issued. The documents are marked with different budget classification codes. These codes include 12 characters.

The statute of limitations is not specified in the Tax Code. The deadlines specified in the Civil Code do not apply to arrears. On what basis is the time for collection determined? The Tax Code specifies the time limits for collecting the amount through the court. The structure must apply to a judicial institution within three years. This is the statute of limitations. Collection occurs within the following time:

- 9 months from the date the organization applied to the court.

- 2 years if recovery occurs through seizure of property.

IMPORTANT! It must be said that judicial collection is a lengthy process. It is easier for the creditor to collect the debt out of court. However, this applies to debts of legal entities or individuals. If debts arose to government agencies (tax authorities, Pension Fund, insurance companies), then collection usually occurs quickly.

Online magazine for accountants

In this case, the funds must carry out reconciliation activities and send corrected information on balances to the tax authorities within 3 days. The scheme of your actions in this case is simple: if, when contacting the tax authorities, in order to obtain a certificate of fulfillment of the obligation, the fact of the presence of arrears in contributions for reporting periods before 01.01 is established.

2017 and with which you do not agree, you must: 1. Submit a written request to the funds to conduct a reconciliation and confirm the presence/absence of arrears in contributions; 2. If the fact of the existence of debt is not confirmed, submit to the tax authority an information letter from the funds about the absence of debt for reporting periods before 01/01/2017.

Where to pay arrears on pension contributions

All arrears of Pension Fund contributions, penalties and fines are now transferred to the tax authorities. Whether the arrears in insurance contributions to the Pension Fund relate to 2020, or 2020 and earlier periods - in any case, it must be paid to the Federal Tax Service, and not to the Pension Fund.

For insurance premiums, new BCCs apply, which must be selected depending on the period for which the debt is paid: until 01/01/2017, or from 01/01/2017.

| KBK | Decoding |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions for periods expired before January 1, 2020 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions for periods starting from January 1, 2020 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions in a fixed amount, credited to the PFR budget for the payment of an insurance pension (calculated from the amount of the payer’s income within 300 thousand rubles) for periods expired before January 1, 2020 |

| 182 1 0200 160 | Insurance contributions in a fixed amount, credited to the PFR budget for the payment of an insurance pension (calculated from the amount of the payer’s income over 300 thousand rubles) for periods expired before January 1, 2017 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions in a fixed amount, credited to the Pension Fund budget for the payment of insurance pensions, for periods starting from January 1, 2017 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions in a fixed amount, credited to the Pension Fund budget for the payment of a funded pension |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | Fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund budget for the payment of an insurance pension (not dependent on the results of a special assessment of working conditions (class of working conditions) (list 1) |

| 182 1 0220 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the PFR budget for the payment of an insurance pension (depending on the results of a special assessment of working conditions (class of working conditions) (list 1) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund budget for the payment of an insurance pension (not dependent on the results special assessment of working conditions (class of working conditions) (list 2) |

| 182 1 0220 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund budget for the payment of an insurance pension (depending on the results of a special assessment of working conditions (class of working conditions) (list 2) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | fines |

Debts of the organization to the Pension Fund of Russia

If you don’t want to trust electronic sources, you can find out about the debt by going directly to the pension center in your area. There you need to ask for a reconciliation of calculations and establish the amount of debt, if any.

If a person has good computer skills, then it is recommended to go to the official website of the fund and get all the necessary information about the presence of debt in your personal account. Thanks to this service, you can find out all the information you need without contacting the Pension Fund. But, of course, first you should make a quick registration on the site.

Debt from an individual entrepreneur may arise for the following reasons:

- when he does not pay required insurance premiums, taxes and other fees, ignoring the law;

- pays late. It is extremely important to know exactly the acceptable time limits;

- having repaid the debt, leaves the penalty unpaid;

- incorrectly calculates taxes and insurance premiums;

- makes mistakes in payment documents;

- bankruptcy. In this case, debts are repaid after the sale of commercial assets.

Legal entities, as a rule, always monitor the status of their personal account with the Pension Fund. They have an obligation not only to pay insurance premiums, but also to submit quarterly reports, so it is difficult for them not to notice the formation of debt to the Fund.

Moreover, in this regard, their responsibility is much greater, because, unlike individual entrepreneurs, they pay contributions not only for themselves, but also for their employees.

Enterprises and organizations can obtain information about debt on insurance premiums in one of the following ways:

- make a written request to the local Pension Fund authority and receive a certificate of the status of settlements after 5 working days;

- submit an application through the electronic reporting program for any date and receive a response electronically;

- send an application for a certificate via TKS;

- visit your personal account on the Pension Fund website.

Thus, legal entities have the same opportunities to track the status of pension accruals via the Internet as individual entrepreneurs. You just need to register a personal account, where all the necessary information will be received.

The need to find out about existing debts to pay insurance premiums arises among different groups of citizens. Depending on this, there are various ways to obtain information about timely payment and occurrence of debt. Both companies and entrepreneurs paying contributions, and individuals who are subject to pension and health insurance requirements may be interested in the timeliness of money transfers.

Payers of contributions to obtain information about paid contributions and debts, if any, can do the following:

- personal visit;

- receiving a notification from the Federal Tax Service;

- providing information through the taxpayer’s personal account.

Insured persons are interested in obtaining information about whether the employer transfers the required insurance contributions.