In order to correctly calculate the bonus in 1C PEG 3.1, you must first configure this function depending on the type of payment. There are production and non-production sources, for which different sources are provided (the first are included in salary expenses, transfers for holidays are taken into account as part of other income and are paid from the company’s net profit).

Non-production bonuses

As an additional payment to stimulate employees, many companies provide non-production incentives - for anniversaries, holidays, etc. They are carried out from the company's net profit.

Step-by-step instruction:

- Create a new accrual, indicate the payment for a separate document.

- Select the income code for personal income tax - 2003 and exclude the payment from the salary costs of employees.

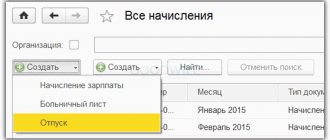

- In the “Salary” section, go to the “Bonuses” documents and create an accrual.

- Fill in the lines by entering information about the employee, the amount, and checking the accrual period.

- At the bottom of the page, indicate the payment: at the time of salary transfer or interpayment period. Check all data and carry out.

Note! From the bonus creation document, you can print an order to reward employees (or for each employee separately).Screenshot of the bonus order

Calculation of bonuses in 1C: Salary and personnel management 8

Published 01.10.2019 07:40 Author: Administrator Finding a good employee who meets all the requirements of the vacancy, has the necessary work experience, knowledge of the specifics of the activity and the desire to conquer heights is quite difficult. But it is even more difficult to retain such an employee, which is why the management of many companies is increasingly resorting to calculating salaries taking into account incentive payments. In this article we will talk about the calculation of various types of bonuses in the 1C program: Salaries and personnel management 8 edition 3.

Incentive payments are enshrined in Article 129 of the Labor Code of the Russian Federation and are part of wages. The legislation does not provide for a specific list of incentive payments, but they can be conditionally divided into:

• bonuses based on the results of the completed period,

• payments for achieving set goals,

• bonuses for training performance,

• bonuses for exceeding the plan,

• bonuses for length of service,

• rewarding the best employees based on the results of the period and others.

The document establishing regular incentive payments in an organization can be the “Regulations on remuneration and bonuses” or, if this is an individual one-time accrual, the “Order on employee incentives”. Incentive payments can be calculated as a percentage of some indicator, for example, output or salary, or set at a fixed amount.

Let's look at how you can automate the calculation of bonuses in the 1C: Salary and Personnel Management program. Let's start by creating new accruals in the "Settings" - "Accruals" section.

Monthly bonus percentage

The first motivational payment that we will consider is a monthly bonus calculated as a percentage. We indicate the appropriate name, select the purpose of the accrual “Premium”. The autofill of other bookmarks will depend on this indicator.

In the “Accrual is carried out” column, select “Monthly”, but if the bonus in your organization is accrued annually or quarterly, then, accordingly, select “In the listed months” and mark December - in the case of an annual bonus, or March, June, September and December - in case of quarterly.

We check the “Include in payroll” and “Result is calculated” flags, after which we proceed to editing the formula. Let's create a new indicator “Percentage of monthly premium” with the assignment of the indicator “Numerical”, used in all months after entering the value.

We save the indicator using the “Save and close” button and add it to the formula. Place the cursor in the “Formula” field and enter “/100*”, find “Calculation base” among the indicators and add it. After clicking “OK”, it should look like this:

If your formula contains such an indicator as the calculation base, this means that you must adjust the tab with the appropriate name. On it you can choose which period you consider to be the base period for calculating the allowance, as well as the types of accruals on the basis of which the calculation will be made (here there can be only a salary or a whole list of basic accruals).

The “Time Tracking” tab is filled in automatically, based on the settings of the “Basic” tab.

On the “Dependencies” tab, we can select accruals and deductions, the calculation base of which includes the current accrual. For example, if you specify “Deduction according to an executive document” in the dependencies, then the accrual of “Monthly bonus as a percentage” will be added to this deduction on the “Calculation base” tab.

As a rule, the “Priority” tab is filled in automatically by the program based on the results of an analysis of the main accrual parameters. But if necessary, you can edit it by indicating accruals whose priority is higher or lower than this accrual.

On the “Average Earnings” tab, you can only edit the indexation of this accrual and which accrual base it is included in. This field is typically completed as “Full Accounted Premium.”

Let’s move on to the last tab “Taxes, fees, accounting”. Here it is important to track the personal income tax code; it should be 2002, and the income category should be “Wages”. Some users are faced with the problem that when choosing code 2002, the income categories offered by the program are limited to the types “Other income” and “Other income from labor activities”.

If you select the income category - “Other income from employment”, then the date of receipt of income will be considered the date of payment of the bonus. And in the letter of the Federal Tax Service dated 10.10.2017 No. GD-4-11/ [email protected] , dated 14.09.2017 No. BS-4-11/18391 it is said that the date of actual receipt of income in the form of a monthly bonus, which is included in the remuneration system , is the last day of the month for which it is calculated. Therefore, we will edit this register; to do this, go to the section “Taxes and Contributions” - “Types of Personal Income Tax”. Let's find the type of income with code 2002 and edit it by setting the flag “Complies with wages”.

After this setup, we can specify the income category we need.

This accrual is included in income tax expenses as an accrual of an incentive nature, therefore we indicate paragraphs. 2, art. 255 Tax Code of the Russian Federation. The completed tab is shown in the figure below:

We save the accrual using the “Record and close” button. Now you can use this accrual in the documents “Hiring”, “Personnel transfer”, “Staffing table”, “Assignment of planned accruals”, “Change of planned accruals”, “Change of wages” and other documents that allow you to assign planned accruals to employees organizations. For example, we will show the completed document “Change in wages”, which was created in the section “Salary” - “Change in employee pay”.

Fixed amount bonus

Now let's move on to considering the calculation of bonuses in a fixed amount, depending on the time worked. I propose to add it by copying the newly created accrual “Monthly Bonus Percentage”.

In the created accrual, change the name to “Monthly bonus amount”. If this payment is planned on a regular basis, then the “Accrual in progress” field is left unchanged. If you specify the value “By a separate document”, then this accrual cannot be used as a planned accrual, and it will be carried out using a separate “Bonus” document.

If the size of the bonus should not depend on the time worked, in the “Calculation and Indicators” section the flag “Result is entered as a fixed amount” is set. In our case, we leave the “Result is calculated” flag and edit the formula. Let's add a new indicator:

Let's insert it into the formula. Using the keyboard and the “Add indicator” button, we will enter the data for calculating the bonus.

The tabs, starting with “Base calculation” and ending with “Taxes, contributions, accounting”, will be left filled in by default.

You can use this accrual, like the previous one, when assigning planned wage amounts using various program documents. As an example, I will show you the completed “Employment Order”, which I created in the “Personnel” section - “Hires, transfers, dismissals.”

Once assigned to employees, the considered bonuses will be calculated monthly in the Payroll document.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Our training courses and webinars

Reviews from our clients

Add a comment

JComments

Pay

Monthly bonuses are paid simultaneously with employee salaries or separately. They can be made in cash or to the employee’s bank card. All statements are generated in a special section “Payments”.

When creating them, you must select the accrual month, the current date of document generation, and the type (salary or separate bonus). Click “Fill” to automatically enter information into the statement.

After checking the information, click “Check”. Based on the created document, generate payment confirmation.

If the bonus is issued separately and paid during the inter-payment period, it is possible to create a statement directly from the accrual document.

Calculation document Premium

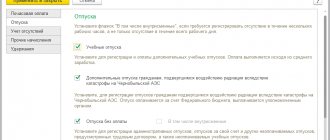

Let's look at an example of payment within a month. Let's check the accrual type settings. Go to the menu “Settings” - “Accruals”.

Purpose – quarterly bonus, select the document “Bonus”, composition of accruals – for the previous quarter.

Next, we create the “Bonus” document, indicate the accrual month of April 2020, the document date is April 25, 2020, select “Quarterly Bonus”, the period is automatically displayed from March 1 to March 31, 2020. Select the employee and fill in the bonus percentage. Payment in the middle of the month on April 25, 2020. The program itself will calculate the base, the amount of the premium and the amount of personal income tax.

The premium can be paid in a separate document, in cash or by bank transfer. The non-cash method can be through a salary project or to each employee’s own account. We choose April 2020, “Award” type. Or you can create a statement directly from the “Bonuses” document by clicking on the “Pay” button and the program will automatically create a payment document.

Accounting

The order in which incentive payments are displayed in company accounting depends on their source. Bonuses are calculated on credit 70 of account, on which all settlements with employees regarding salary are made in the following correspondence:

- Dt 20 (23,25,26,28,44) Kt70 – for production payments;

- Dt 91.02 Kt70 – other expenses of the company (non-production);

- Dt84 Kt70 – transfers are made from the company’s net profit.

Reflection in accounting, postings

Reflection of the accrual of bonus payments should be based on its type and basis for accrual. In which account the bonus is reflected depends on whether it is related to the performance of labor functions or not.

In accordance with the chart of accounts (Order of the Ministry of Finance 94n dated October 31, 2000), settlements with personnel for wages are reflected in account 70. Analytical accounts are opened for each employee.

The bonus is part of the salary. Therefore, their accrual is reflected in the credit of account 70, and the payment in the debit. Remunerations for production indicators are attributed, as a rule, to the same cost accounts where the salary part also belongs: