Certificate on the status of settlements (FORM-39) from the Federal Tax Service

A certificate of the status of settlements is issued by the Russian Federal Tax Service at the place of registration of the legal entity or individual. Here is an approximate list for which an organization or individual may urgently need to order a certificate of open current accounts in Moscow.

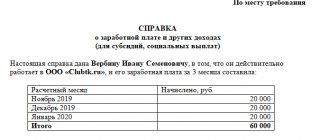

| Name | Deadlines | Prices |

| Standard Receipt | from 10 working days | 2,000 rub. |

| Urgent receipt | 1-3 working days | 4,500 rub. |

Reasons forcing organizations, as well as individuals, to look for channels in order to order a certificate of open current accounts from the tax office:

- to participate in a tender, competition;

- to obtain a license;

- to obtain a loan;

- to receive a subsidy;

- to obtain a visa, etc.

Internal Revenue Service certificate form 39 1 on the status of settlements for individuals who were previously registered for tax purposes as entrepreneurs without forming a legal entity and who have debts on taxes and fees, is formed according to form N 39-1f for one, several or all KBK (with information informational information about debts on taxes and fees existing on the date of issue of the certificate).

Deadlines for issuing a certificate

The period in which the information must be prepared varies from 5 to 12 working days. So, according to paragraphs. 10 p. 1 art. 32 of the Tax Code of the Russian Federation, the period within which the document must be issued cannot exceed 5 days. However, the Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01/ sets other deadlines: up to 10 working days when receiving an application in person, and up to 12 working days when sending a request by mail.

Recent changes in Russian fiscal legislation have required corresponding adjustments to unified forms and forms. Thus, the old tax form 39-1 (a sample is presented below) was canceled due to the transfer of administrative rights for insurance premiums to the Federal Tax Service.

Consequently, the old document did not provide for the reflection of information on the status of settlements for insurance premiums. The new form was approved by Order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17/[email protected] (KND form 1160080).

What is certificate f 39-1 used for: tax

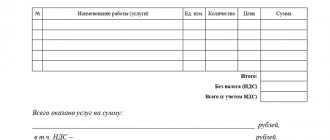

Internal Revenue Service certificate form 39 1 in column 1 contains the name of the tax (fee). Internal Revenue Service certificate form 39 1 in column 2 contains the budget classification code. Column 3 indicates the OKATO code. Column 4 reflects the final balance of tax payments (overpayment “+” or underpayment “-”). Internal Revenue Service certificate form 39 1 in column 5 contains the final balance of settlements for penalties (overpayment “+” or debt “-”). Column 6 indicates the final balance of settlements for tax sanctions (overpayment “+” or debt “-”).

Nuances of self-design

Very often, collecting certificates is a problem because it takes a lot of time and effort. It is especially difficult during the work process to find time to solve all the troubles. Most often, those wishing to obtain this certificate encounter the following difficulties:

- long queues;

- constant shortage of documents;

- constant control over the registration process.

All this not only complicates life, but also causes a lot of problems that affect all areas of life. Therefore, it makes sense to enlist the support of an experienced company in these matters. A modern service will help you solve major problems without your personal participation. Considering this option as one of the most optimal solutions, you know how to request a certificate about the status of settlements with the Pension Fund on time, which will allow you to resolve the issue in a minimum period of time. Such a certificate about the status of tax payments may be necessary in various legal matters, and therefore it makes sense to contact us. For example, if you have already made your first attempts to collect documents, then you have the first reason to contact us.

The tax certificate we receive about the status of settlements will speed up any processes involving the exchange and re-registration of documents. We don’t just help citizens do the work for which they don’t have enough time, but we speed up the process of all procedures. So, we can order a certificate about the status of tax payments without your participation. Legal support is of enormous importance, because we have knowledge in this matter, therefore we always respond to any difficulties in a timely manner. This service is very useful from a profitability point of view, because it is available to everyone. Now there is no point in doubting the validity period of the certificate on the status of settlements with the Social Insurance Fund; we have complete information about all laws and changes in them.

Current regulations

The procedure for applying for information, as well as the rules for issuing documents from the Federal Tax Service, are enshrined in special administrative regulations. This algorithm has been changed several times in recent years. The current standards are enshrined in the Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01/ (as amended on 02/13/2018) and in the Order of the Ministry of Finance of Russia dated 07/02/2012 No. 99n (as amended on 12/26/2013).

Thus, in accordance with established standards, the taxpayer has the right to contact the Federal Tax Service to obtain information, including information on the status of mutual settlements for taxes, fees, insurance premiums and other fiscal payments.

To obtain a certificate, you need to fill out a free-form application, but always in two copies. One copy is handed over to the representative of the Federal Tax Service, and the inspector’s mark of receipt is placed on the second form. If the application is sent by mail, then a second copy is not required. Let us remind you that you can request a document through the taxpayer’s personal account.

Please note that you can use a unified form to obtain information.

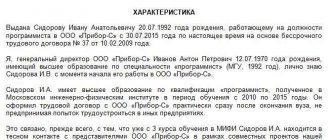

Sample form

We remind you that a certificate on the status of settlements for imprest amounts must be issued within a certain period established by law. Therefore, we support clients at different stages of registration.

If you urgently need a certificate on the status of settlements with the budget or a universal certificate on the status of settlements with the Federal Tax Service, then we can issue each of them for you. The peculiarity of the procedure is that all difficulties are resolved quickly and professionally. Our specialists offer you a service option that is always difficult to perform on your own.

Why us?

The range of services of our law firm is extensive, because our capabilities are unique. By cooperating with us, a certificate from the Internal Revenue Service about the status of settlements will not become a problem for you, but will be a regular legal issue on the way to the result. You will have in your hands a certificate about the status of settlements with the Pension Fund, which was received in accordance with all the rules. If the question concerned other difficulties, then from us you can get a certificate about the status of tax calculations, which will be issued on the basis of existing rules and recommendations. Each such certificate from the Internal Revenue Service on the status of settlements with the budget is an official document that is required to resolve issues of various types.

How to read

The first column contains information about the tax for which the reconciliation occurs. Their positive or negative value is reflected in cells 4, 6 and 8. If the totals show 0, then there are no overpayments or debts.

It should be borne in mind that if an overpayment is detected, this does not always reflect the real picture. An acceptable situation is when an accountant requests a certificate within a year before submitting the annual declaration. Before filing the return, advances for each quarter are also shown as overpayments. After the tax office calculates the tax, this amount will disappear. Often the amount of the overpayment is the same as the amount of advances under the simplified tax system for the reporting year. In order not to run to the tax office for a refund and not get into trouble, you should get an extract and compare the data.

The extract shows the picture for a specific date, and tax reporting is prepared for the period. This must be taken into account. It also consists of 6 blocks.

If the balance is negative, then the final figure will be negative; if it is positive, then this is the amount of overpayment. Penalties and fines are collected in one group, which contains the articles for their accrual.

The picture of mutual settlements with tax authorities is displayed under the “Paid” and “Accrued” items. Charges increase after submitting the declaration.

If a debt is detected that was formed by mistake, you should check the “Paid” item. If there are no previously made payments, then you should take payment documents and contact the tax office for reconciliation. If the error is proven, the document is corrected. If a mistake is made by the company, then you will have to pay off the debts.

Certificate f 39-1 (tax) is an official document that contains information about the state of mutual settlements between the taxpayer and the state budget. Such information can be obtained from the territorial office of the Federal Tax Service or ordered through the taxpayer’s personal account. In this article we will tell you why the document is needed and what procedure for providing information is in effect in 2020.

Certificate on the status of settlements (FORM-39) from the Federal Tax Service

Ordering a certificate on the status of settlements for taxes and fees (39-1)

A certificate on the status of settlements for taxes and fees contains information on accrued taxes, penalties, fees and fines as of the established date. The company can reconcile settlements with the budget using accounting records with data from the Federal Tax Service.

The certificate is issued by the Federal Tax Service of Russia at the place of registration of the legal entity or individual. In order to obtain a certificate, the taxpayer or his representative only needs to write an application to the inspectorate at the place of tax registration of the organization.

The deadline for submitting a certificate is from 10 days to 1 month. These are official deadlines, so it is impossible to urgently obtain a certificate from the tax service.

Purpose of the certificate:

- Confirmation that the organization has no debt to the budget.

- Strict control of budget payments.

- Identification of arrears or overpayments.

- Lending, licensing.

- Participation in the tender.

- The need to confirm the correctness of accounting.

Types of tax authority certificates confirming the absence of debt

LLC "Fresh Wind" received the required certificate (KND 1160080). It reflects the status of settlements for each tax (fee), penalties, fines and interest paid.

For information on which certificates on the status of tax settlements have been issued since July 2020, see the material “The certificate of settlements with the budget has been updated .

If the request had asked for a certificate of fulfillment of the obligation to pay taxes, fees, penalties, fines, interest (KND 1120101), the answer would have been different. Instead of specific numbers, tax officials would use one phrase to reflect the presence or absence of tax debt.

Other publications: Application for deferment of payment of state duty

When requesting from the tax authorities a certificate of no debt , you should remember that if there is the slightest tax debt (even a few kopecks), the wording may be as follows: “Fresh Wind LLC has an unfulfilled obligation to pay taxes.” And such a certificate will not allow the taxpayer to participate in a tender or perform any other actions that require the mandatory absence of debts to the budget.

Thus, one certificate of absence of debt (KND 1160080) will allow you to estimate the size of tax debts, promptly deal with incorrect charges or pay off existing arrears. For another certificate of absence of debt (KND 1120101), it is wise to contact the tax authorities after paying debts: such a certificate will contain wording favorable to the company and will be useful, for example, for participation in the same tender.

A certificate of no debt is issued by tax authorities only upon written request. The request form is not regulated, but it is better to use the form proposed by the tax authorities - it takes into account all the necessary details. The certificate of absence of debt has 2 types: with a general wording about the presence (or absence) of debts and with details of the amounts for unpaid payments. Depending on the purpose for which the certificate is required, you need to specify which form (KND 1120101 or KND 1160080) is required to be generated by the tax office.

How to get a certificate yourself

A balance sheet is a form consisting of several columns that indicate the balance at the beginning and end of a specific period and debit and credit turnover for a certain period for each account and subaccount. Essentially, this is the main accounting document.

To obtain a statement from the tax office, you should make a request in free form or in the form of the Federal Tax Service, if such is provided by this authority.

The request must include the following information:

- Company name (or full name of an individual);

- TIN (applies to legal entities and individual entrepreneurs);

- signature of the manager (or individual);

- printing (for individuals and individual entrepreneurs);

- method of receipt.

If you need a certificate urgently and it is not possible to wait 10-30 days, our company will help you obtain a certificate urgently, for a period of 1 to 3 days.

About form 001-GS/u

When it comes to the civil service, a competition is usually held to fill a vacant position to determine whether applicants meet the requirements and to select the best candidate. As part of the competition, it is established that there are no diseases that prevent a citizen from being hired for service.

What kind of certificate 001-ГС/у for civil servants (you can use the link at the end of the article for free).

Form 001-GS/u was approved by order of the Ministry of Health and Social Development of the Russian Federation No. 984n dated December 14, 2009. The certificate form is Appendix No. 3 to this administrative document; it is issued after undergoing medical examination and examination.

Appendix No. 1, namely the Procedure for undergoing examination (dispensary examination), states that the established procedure applies to:

- for persons already holding positions;

- on persons applying for positions in order to establish the absence of diseases that prevent entry into civil service.

Thus, when submitting documents for a competition, a certificate in form 001-ГС/у is required; a sample of it is approved in the order and is used by healthcare institutions, both public and private.

List of diseases that are not accepted into the army in 2019-2020

Benefits of contacting our company

1. We will help you urgently obtain a certificate from the Federal Tax Service, up to 3 days; 2. The company offers the most favorable prices for a wide range of services provided in comparison with competing companies; 3. We provide documents promptly and legally, certified by seal and signature; 4. We provide for all non-standard situations that may occur; 5. We conclude an agreement, in case of non-compliance with the points of which, we guarantee you a refund.

By contacting, you will receive the necessary document within a maximum of 3 days after sending the request. We will help you save energy and free up time to develop your business.

Return to list