The monthly payment for the first and second child under 3 years of age in the Tula region in 2021 is

11 032 ₽

and is equal to the cost of living for children in the Tula region for the 2nd quarter of the year preceding the year of application for the specified monthly payment

These payments are also called Putin’s and they are paid independently of other payments, without canceling or replacing the latter.

You can count on payment if:

- You are a citizen of the Russian Federation and permanently reside on the territory of the Russian Federation;

- You are a parent, adoptive parent or guardian of a child;

- Your child was born or adopted starting from January 1, 2021, is a citizen of the Russian Federation and is not yet 3 years old;

- The average per capita income of your family does not exceed two times the subsistence level of the working-age population established in the Tula region for the 2nd quarter of the year preceding the year of application for the specified payment - 23,844 ₽

(2nd quarter of 2021);

There is no payment for children born in 2021. If the child is the third, fourth or subsequent, this option of state support also does not apply.

First child benefit

is paid to the woman who gave birth (adopted) the first child, or to the father (adoptive parent) or guardian of the child in the event of the death of the woman and father (adoptive parent), their declaration of death, deprivation of their parental rights, or in the event of cancellation of the adoption of the child.

Benefit in connection with the birth (adoption) of a second child

is carried out to a citizen who has received a state certificate for maternity (family) capital in accordance with Federal Law N 256-FZ “On additional measures of state support for families with children” (12/22/2020).

Thus, for the first child, benefits are paid from the federal budget, for the second - from your maternity capital.

But don’t worry - if you don’t want to spend maternity capital funds on monthly payments, then just don’t apply for payment. Money will not be debited automatically.

Where and when to apply

To receive payment for the first child

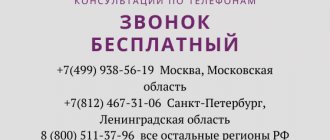

The application is submitted to the social protection department (directly or through the MFC) at the place of residence (stay) or your actual residence.

To receive payment for a second child

The application is submitted to the branch of the Pension Fund of the Russian Federation (directly or through the MFC) at the place of residence (stay) or your actual residence. An application for payment can be submitted simultaneously with an application for a state certificate for maternity (family) capital.

Note! Payment for the first time is assigned until the child turns one year old. Then the application for payment must be submitted again and so on every year until the child turns three years old.

If you first applied for payment within 6 months of the child’s birth, you will receive payment for the past few months at once. Otherwise, benefits will only be paid from the date of application.

Who isn't a single mother?

Single mothers also have preferences when they get a job. The fact is that employers cannot refuse to hire them due to the presence of minor children. And if the candidacy is nevertheless rejected, single mothers must clearly explain the reason for the refusal.

How to apply for benefits for single mothers?

- A single parent who is raising a child under 14 years of age cannot be laid off, fired when there is a change in management, or deprived of a position due to disciplinary sanctions;

- In the event of bankruptcy or liquidation of the organization, the single parent must be provided with another place of employment. Responsibility for this lies with the hiring organization that is about to lay off its employee;

- All parents pay for caring for a sick child. At the same time, the amount of benefit for a single mother depends on the type of treatment. If a child requires hospital stay, payments will be determined by length of service. For outpatient treatment, the benefit is paid in full for the first 10 days, then half;

- For parents with children under 7 years of age, sick leave is paid without restrictions, with children older - the first 15 days are paid;

- A single parent has the right to take leave at his own expense at any time. The maximum duration of such leave is 14 days;

- A single parent with a child under 5 years of age cannot be required to work on weekends and holidays, overtime or night work;

- A mother raising a child under 14 years of age has the right to switch to part-time work at any time.

—>

Also, regardless of employment, support is paid for children 3-7 years old . It was established by Decree No. 199 of March 20, 2020 and Decree No. 384 of March 31, 2020, and applies to those women whose income is below the norm. The amount of assistance is 50% of the cost of living , current for the second quarter of the previous year, established in your region of residence.

- Temporary subsidies for children under 16 years of age caused by the pandemic.

- Regional subsidies for those who care for a daughter or son under one and a half (three) years old . Not available in all constituent entities of the Russian Federation.

- Subsidies and compensation guaranteed by local authorities once a month only for the third and subsequent children (usually equal to the subsistence level).

For non-working people

The amount cannot be lower than the minimum accepted ( RUB 6,752 ), even if the mother’s income turns out to be small. He also does not have the right to exceed the maximum permissible value; for 2021 it is equal to 27,984.66 rubles .

In addition, to receive benefits, you can contact the Federal Tax Inspectorate, the Pension Fund of the Russian Federation, as well as your employer. If there is an MFC in the city, you can apply there immediately for most benefits.

The Labor Code outlines the employer's obligation to provide four additional days off, which are paid. At the initiative of management, a clause on 14 days of unpaid leave can also be included in the collective agreement, in which case women are required to provide it upon request.

Payment for housing and communal services

You can obtain the status of a single mother when registering a child, if the mother is not officially married. In this case, a dash is placed in the Father column. If the mother wants to indicate some data in the father column, then she writes a statement to include information about the father from her words. In this case, the mother receives a certificate in form No. 2 (formerly form No. 25), confirming her single status.

You might be interested ==> Fine for an unregistered individual entrepreneur in 2021

Keeping a baby and providing him with the most necessary items of clothing, quality food and, if necessary, medications is an expensive and troublesome task. Life in the Russian Federation is becoming more expensive, and prices are rising higher due to inflation.

How is family income calculated?

Before applying, it would be a good idea to find out how government officials will calculate your family's income. To do this, you need to know who is considered a family member.

Family composition

The family composition taken into account when calculating the average per capita family income includes:

- parent (including adoptive parent);

- guardian;

- spouse;

- minor children.

Not taken into account:

- persons serving a sentence of imprisonment;

- persons against whom a preventive measure in the form of detention was applied;

- persons undergoing compulsory treatment by court decision;

- persons deprived of parental rights;

- persons who are fully supported by the state.

Types of income

When calculating the average per capita family income, the following types of family income are taken into account:

received in cash:

- remuneration for the performance of labor or other duties, including compensation and incentive payments, remuneration for work performed, service rendered, action performed in the Russian Federation. At the same time, remuneration of directors and other similar payments received by members of the management body of an organization (board of directors or other similar body) - a tax resident of the Russian Federation, the location (management) of which is the Russian Federation, are considered as income received from sources in the Russian Federation, regardless from the place where the management responsibilities assigned to these persons were actually performed or from where the payments of these remunerations were made;

- pensions, benefits, scholarships and other similar payments received by a citizen in accordance with the legislation of the Russian Federation and (or) the legislation of a constituent entity of the Russian Federation or received from a foreign organization in connection with the activities of its separate division in the Russian Federation;

- payments to successors of deceased insured persons in cases provided for by the legislation of the Russian Federation on compulsory pension insurance;

- compensation paid by a state body or public association for the performance of state or public duties;

- monetary allowance (salary) of military personnel, employees of internal affairs bodies of the Russian Federation, institutions and bodies of the penal system, compulsory enforcement bodies of the Russian Federation, customs authorities of the Russian Federation and other bodies in which the legislation of the Russian Federation provides for the passage of federal public service related to law enforcement activities, as well as additional payments of a permanent nature, and food provision (monetary compensation in exchange for food rations), established by the legislation of the Russian Federation.

Average per capita family income is calculated based on the sum of the income of all family members over the last 12 calendar months

(including in the case of submitting information on family income for a period of less than 12 calendar months)

preceding 6 calendar months before the month of filing the application

for a monthly payment, by dividing one twelfth of the income of all family members for the billing period by the number of family members.

Could it be simpler?

Certainly. So, for clarity, let’s consider the different composition of a family in the Tula region and its maximum total income per month, which will allow you to count on receiving the monthly payment in question.

- Family of two - total monthly income should be lower 47 688 ₽

; - Family of three - total monthly income should be lower 71 532 ₽

; - Family of four - total monthly income should be lower 95 376 ₽

; - Family of five - total monthly income should be lower 119 220 ₽

;

We continue to be boring

The amount of remuneration for the performance of labor or other duties, including compensation and incentive payments, provided for by the remuneration system and paid based on the results of work for the month, is taken into account in the family income in the month of its actual receipt, which falls on the billing period.

If there are other established deadlines for the calculation and payment of wages, including compensation and incentive payments, the amount of wages received, including compensation and incentive payments, is divided by the number of months for which it was accrued and taken into account in family income for those months that fall for the billing period.

The amounts of income received from the execution of civil contracts, as well as income from business activities and from private practice, are divided by the number of months for which they are accrued and are taken into account in family income for those months that fall within the billing period.

When calculating the average per capita family income, the following are not taken into account:

- historical monthly payments covered here;

- the amount of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation, local budgets and other sources in connection with a natural disaster or other emergency circumstances, as well as in connection with a terrorist act;

The income of each family member is taken into account before taxes in accordance with the legislation of the Russian Federation.

Family income received in foreign currency is converted into rubles at the exchange rate of the Central Bank of the Russian Federation established on the date of actual receipt of this income.

Benefits in Tula and the Tula region for pregnancy

Providing free vacation vouchers, opportunities for nutritious nutrition for pregnant and nursing mothers, as well as children in the first years of life. 2021 will not be an exception in this sense. Stimulating the birth rate, without a doubt, should be helped by an impressive payment to expectant mothers who register with a medical institution on time. Treatment, recreation, housing - nothing goes unnoticed by local authorities, which cannot but please future parents and those who have already known the joys of motherhood and fatherhood.

You might be interested ==> Amendments to parole under Article 228 in 2021 will be

Benefits for children under 1.5 years old

There are over 20 types of cash payments, and among them are regional (in Tula and the Tula region) and federal child benefits. Help is constantly provided to large families and families who have adopted a foster child.

- work book with a record of dismissal from the last place of work;

- a certificate of family composition to confirm the fact of cohabitation;

- a salary certificate for the previous year or a document confirming the lack of income.

Previously, it was assumed that for this group of recipients an additional payment in the amount of 2 living wages would be established. But so far the initiative of representatives of the NRC (the interregional public movement “National Parents Committee”) remains unanswered.

What payments are due to single mothers in 2021?

The state provides active support to families with children, including women raising a child on their own. The list of benefits in 2021 for single mothers is enshrined in the legislation of the Russian Federation, as well as regulatory legal acts of the constituent entities of the Federation.

- the country has benefits due to all single mothers, approved at the federal level;

- there are regional ones, differing in size and purpose depending on the place of residence of the single mother;

- there are one-time subsidies that are intended to be accrued in strictly defined cases;

- monthly benefits are paid until the child reaches a certain age;

- It is impossible not to mention targeted assistance, which is paid at the local level, on the basis of the transfer of such powers by the federal authorities to the local administration.

Termination of payment

Payment stops in the following cases:

- when the child reaches the age of three years - from the day following the day the child turns three years old;

- in the case of a citizen receiving the specified payment moving to a permanent place of residence in another subject of the Russian Federation - from the 1st day of the month following the month in which the executive authorities of the subject of the Russian Federation exercising powers in the field of social protection of the population, and (or ) the territorial bodies of the Pension Fund of the Russian Federation have been notified of the change of residence;

- in case of refusal to receive the specified payment - from the 1st day of the month following the month in which the executive body of the constituent entity of the Russian Federation exercising powers in the field of social protection of the population and (or) the territorial body of the Pension Fund of the Russian Federation who appointed the payment received relevant statement;

- in the event of the death of a child, with the birth (adoption) of which the citizen has the right to receive the specified payment - from the 1st day of the month following the month in which the child’s death occurred;

- in the event of the death of a citizen receiving the specified payment, declaring him dead in the manner established by the legislation of the Russian Federation or recognizing him as missing, as well as in the event of depriving a citizen receiving the specified payment of parental rights - from the 1st day of the month following the month, in in which the death of this citizen has occurred or a court decision has entered into legal force to declare him dead, or to recognize him as missing, or to deprive him of parental rights;

- in the case of using maternal (family) capital in full.

Payments can be resumed if:

- cancellation of a court decision to declare a citizen receiving the specified payment dead, or to recognize him as missing, or to deprive him of parental rights - from the 1st day of the month following the month in which the court decision entered into legal force;

- filing an application for the renewal of the specified payment by a citizen who refused to receive it - from the 1st day of the month following the month in which the executive body of the constituent entity of the Russian Federation exercising powers in the field of social protection of the population is responsible for assigning the specified payment, and (or ) the territorial body of the Pension Fund of the Russian Federation received a corresponding application.