Pricing tasks

Pricing at an enterprise and in an organization pursues certain goals. To achieve them, certain tasks are set. They are decided during a certain option or direction of price behavior.

The list of tasks is usually common to any state. But it may vary. This depends on the stage of development of the economy, the types of processes that develop in it, etc. Before considering pricing formulas in foreign trade, in the domestic market, etc., you need to pay attention to the tasks of this process. In general they look like this:

- Covering production costs during the manufacturing process, as well as its sale. This allows you to ensure a profit, the size of which will be sufficient for the normal operation of the organization.

- Determining the degree of interchangeability of finished products in the process of cost formation.

- Solving social issues.

- Introduction of environmental methods in the process of creating the appropriate organizational policy.

- Resolving issues in the foreign policy sphere.

A feature of market development in the early stages was horizontal connections. They were established between consumers, producers, and intermediaries. During this process, the first two of these problems were solved. The rest of them face not only production, but also modern society as a whole.

In the conditions of market development, prices solve the following problems:

- Covering production costs, which ensures the company's profit. This is a requirement of both the manufacturer and the intermediary. Each of them must set a price in order to make a profit and for the enterprise to operate profitably. The more favorable the market environment, the higher the cost of production may be. As a result, the company receives greater profits.

- Carrying out accounting of the interchangeability of goods, works or services. If products with the same properties but different prices are on sale, the buyer will, of course, choose the cheapest option.

Other tasks arise purely in the conditions of the modern market. Therefore, pricing methods, the formulas of which will be discussed below, make it possible to move from a spontaneous, undeveloped market to its regulated form.

Stages

Before considering formulas for solving pricing problems, you need to pay attention to the stages of this process:

- Setting goals.

- Determining demand for products.

- Estimation of the amount of costs.

- Analysis of the cost of competitive products.

- Choosing a pricing method.

- Formation of product costs and rules for changing them.

- Taking into account government regulation measures in the field of price setting.

At the first stage, the economist must decide what problems the appropriate pricing policy will help solve. For example, a company can change the quantity of products manufactured or its structure, capture new markets, achieve a stable assortment, reduce costs, etc. There may also be a need to improve product quality or increase profit levels to maximum levels.

At the second stage, you need to analyze the demand for products. At the same time, it is important to determine how many products the organization can sell at a given price level. The maximum level of sales at the lowest prices does not always have a positive effect on the results of work, and vice versa.

Therefore, when determining pricing in trade, the formula for elasticity and the coefficient of supply and demand is necessarily determined. In this case, the following calculation is applied:

Ke = Increase in volume of demand, % / Decrease in prices, %, where Ke is the coefficient of elasticity of demand.

The supply and demand ratio is determined as follows:

KSP = Increase in supply volume, % / Increase in prices, %.

If demand is elastic, goods are highly dependent on the price level. Sales volume depends on this. If prices rise, customers will purchase items less frequently. Luxury goods are characterized by elastic demand. Some products are inelastic (for example, matches, salt, bread, etc.).

How to correctly calculate the maximum markup

Before setting a price, an entrepreneur must study the food market and competition. This is necessary to understand the demand for trade turnover and set the appropriate price.

Eg.

Loaf “Rizhsky”, wholesale cost 14 rubles, selling price 25. Demand for the loaf will increase if it is cut and sold like that, and along with the demand, the price also increases.

It is allowed to make a product popular by: changing packaging, flavors, and using various additives. The changes bring new positive dynamics in the sale of goods, due to which the seller can make the maximum markup.

Subsequent stages

Formulas for calculating pricing require cost calculations. With their help, the cost of production is determined. This allows us to consider the structure of this indicator and find reserves for its reduction.

At the fourth stage, an analysis of competitors' prices is carried out. This is a complex procedure, since the issue of pricing at the enterprise is a trade secret. However, such work still needs to be done. It is necessary to determine the indifference price at which the buyer will not care which manufacturer’s product he buys.

At the fifth stage, pricing methods are selected. Each of them has its own formulas. The most common methods are:

- Low sales and production costs.

- Adaptations.

- Uniqueness of product characteristics.

- Cost-marketing.

- Mixed.

After this, the final price is set. They also establish rules for changing it in the future. At this stage, two tasks are solved:

- We are creating our own discount system. You need to learn how to use it correctly.

- The price correction mechanism is determined. This takes into account the stage of the product life cycle. It is also necessary to determine inflationary processes.

At this stage, marketing and financial services must create an appropriate system of discounts and present them to customers. The degree of impact of discounts on sales policy must be determined.

After this, price regulation measures by the state are taken into account. It is necessary to predetermine how such actions will affect the level of product costs. The level of profitability may be limited by law. Subsidies are issued for some goods and tax sanctions are applied. In some cases, seasonal price reductions are carried out.

The patent purity of products is also assessed, especially when supplied abroad.

Costs per 1 ruble of products sold - formula

The amount of products sold equals the cost of products sold to the buyer. This amount can be found in the company's income statement in the "Revenue" line. To calculate the cost indicator per 1 ruble of products sold, it is necessary to divide the total cost of products sold by the amount of products sold.

To find out how the full cost is calculated, read the article “What costs does the commercial cost of production include?”

Comparison of pricing methods

There are different ways to calculate pricing. They have certain advantages and disadvantages. The main techniques used in carrying out such a process are as follows:

- Full cost method. It is also called “Cost Plus”. The advantage of this approach is to ensure full coverage of variable and fixed costs. This allows you to get the planned level of profit. The disadvantage of the method is the inability to take into account the elasticity of demand. There is also no sufficient incentive to reduce costs at the enterprise.

- Cost determination method based on reduced costs. Allows you to review the assortment structure by choosing the optimal product list. A special formula is used for the cost method of pricing. An additional list of costs is generated. The disadvantage of the methodology is the difficulty of allocating costs into fixed and variable ones according to the product range.

- Return on investment method. Allows you to take into account the cost of financial resources and credit funds. The disadvantage of this approach is high interest rates and their uncertainty, especially with high inflation.

- Return on assets method. The method makes it possible to take into account the effectiveness of the use of certain types of assets in accordance with the produced nomenclature. This ensures the required level of profitability of the enterprise's assets. The disadvantage of the methodology is the difficulty of determining the occupancy of certain types of property of the organization when using the nomenclature.

- Method of marketing assessments. Allows you to take into account market conditions, as well as determine the characteristics of buyer reactions to certain changes. The disadvantage of the methodology is that quantitative assessments are somewhat arbitrary.

Full cost method

Among the pricing formulas in manufacturing, the most common is calculation using the full cost method. To identify all the features of the presented approach, it needs to be considered with an example. For example, a company produces 10,000 units. products for the reporting period. Production and sales costs are as follows:

- Variable production costs (Rper) – 255 thousand rubles. (25.5 rubles per unit).

- Fixed general production expenses (Rototal) – 190 thousand rubles. (19 rubles per unit).

- Administrative, commercial costs (Rka) – 175 thousand rubles. (17.5 rubles per unit).

Total costs (Рtotal) are determined to be 620 thousand rubles. (62 rubles per unit). At the same time, the desired profit margin (Pzh) is 124 thousand rubles.

When calculating the price using the presented method, you need to add the required profitability indicator to the amount of total costs (variable and fixed). It covers the entire cost of manufacturing products and selling them. The organization also receives the desired profit. This technique is widely used in industries with a large product range.

The method involves calculating the rate of return:

R = Rw/Rfull * 100% = 124/620 * 100% = 20%.

This is the required level of profitability, on the basis of which the price of the product is calculated. In this case, the pricing formula based on the “Cost Plus” principle is calculated using the formula:

C = Rfull + Rfull * R/100.

You need to take into account these units of production:

C = 62 + 62 * 20/100 = 74.4 rubles.

You can then determine the cost of an individual product using the same method. The following formula is used for this:

C = P full. / 1 – R.

When using the presented pricing formula, the retail price will be the same (RUB 74.4).

Therefore, profitability includes a price that is acceptable to the organization. If for some reason it is impossible to present commercial products on the market at a given cost, you need to look for ways to reduce costs or provide for obtaining other profits.

Calculation example

To understand how to calculate the price of a product when importing, let’s analyze the sequence using an example. Since most goods from abroad are purchased with personal funds, price formation will be based on the purchase of a batch of goods by an average retail company, where:

- TC (customs value), cost $20 or 600 rubles (34 × 20, where 34 is the exchange rate);

- The state duty is 15% of the vehicle – 90 rubles (600 × 15 / 100);

- the quantity of the purchased batch is 500 pieces;

- the fees for registration of the entire batch amounted to one thousand rubles, that is, the amount of the vehicle for the entire batch is 3,000 rubles (600 × 500). It turns out that the fees for clearing one unit at customs amounted to two rubles (1000/500);

- estimated cost of production – 692 rubles (600 + 90 + 2);

- VAT – 20%;

- standard trade markup 25% – 173 rubles (692 × 25 / 100).

So, the company takes the estimated cost, which already includes the vehicle value of the goods, duty, and government fees. The estimated cost does not include VAT paid when goods pass through customs. Then a trade markup is added to this price and the retail price is obtained without VAT. VAT is added to the finished price and the final result is obtained.

As a result, the free retail value of imported goods imported into our country without VAT is 865 rubles. (692 + 173). VAT on it is 173 rubles (865 × 20 / 100). And the free cost including VAT for the entire shipment upon import is 1038 rubles (865 + 173). In this example, all the elements from which the price of an imported product can be calculated are clearly visible.

Reduced Cost Method

You should continue to look at examples of pricing calculations. One of the most common is the reduced cost method. In this case, the level of required profitability is added to variable costs. This figure should cover all fixed costs. By including such profitability in the price of products, the company can make a profit.

This method is widely used today in many industries. Especially in those organizations where the direct costing system is used. In this case, costs are divided into variable and fixed. The second category includes, for example, depreciation, rent, interest on loan funds, etc.

Variable costs change proportionately with production volume. They are calculated per unit of production. They represent the costs of raw materials, wages of employees involved in production, etc.

To determine the cost of products, you need to calculate the level of profitability:

P = ((Pzh + Rtotal + Rka)/Rper) * 100%.

P = ((124 + 190 + 175)/255) * 100% = 191.8%.

Next, the cost is determined using the following formula for the cost method of pricing:

C = Rfull. + Rfull * R/100.

C = (25.5 + 25.5 * 191.8/100) = 74.4 rub.

The price is calculated per unit of production. This method allows you to get the same result as using the full cost method. This is explained by the fact that the same source data is used. If the information is different, then per unit of production this difference is compensated by the different level of profitability.

What price will be more tempting for the client?

The pricing policy depends on the store owner and his expectations.

Determining the cost of goods depends on:

- What target audience is the store aimed at (economy, medium, business);

- Average salary of the expected flow of clients;

- Locations;

- Popularity of the sales network.

For example:

At the end of the month, on average, a person has 7,000 left; it is based on this indicator that prices should be oriented for greater affordability.

When calculating the markup on a product, the main thing is to correctly compare the price-quality criteria. The cost largely depends on the location, class, and service of the point.

In order to cover all expenses as clearly as possible, it is important to correctly calculate the cost of the markup. There is no need to be afraid to sell at an inflated price; if the consumer purchases the product at this price, then it should be so. You should not sell goods at cost; this can lead to bankruptcy.

Marketing assessment method

Other pricing formulas apply. One approach that is suitable in different circumstances is the marketing evaluation method. It involves using information about past auctions and competitions. The winner is the manufacturer whose bid price can guarantee acceptable deadlines for completing the upcoming work, as well as the quality of the finished product. A reasonable price in this case ensures profit.

This technique is used if it is necessary to select contractors for government orders or in the process of socially significant work. Another approach may be used, for example, return on sales. The price in this case is determined by drawing up an estimate of total costs. Profitability is calculated using the formula:

R = Pzh / Rfull * 100%.

You can also formulate prices using gross profit information. In this case, the full cost method is used. The profitability included in the cost of products is calculated as follows:

P = (Pzh + Rka)/Roln * 100%.

Relangi method

When studying pricing formulas, it is worth paying attention to the relangi technique. It is often used in chemical, light and other individual industries. In this case, the product life cycle is planned. Based on the actual timing of such a cycle, the price of a unit of production is also formed.

It is necessary to use this method if you need to observe and constantly monitor the presence of commercial products on the market. To do this, the ratio of price and demand is taken into account and even sometimes changes. The use of the presented methodology provides a number of possibilities:

- Changes in the physical characteristics of commercial products.

- Changes in operational performance.

- Perform minor feature changes.

- Supplement the product with some special services, for example, consultations, expansion of maintenance and service, etc.

- Product update.

At the same time, one must take into account the fact that when producing long-lasting products, their service life is artificially shortened. To do this, the design simply changes. At the same time, the range of finished products is expanding, and the filling of the retail network with the organization’s products is expanding.

Costs per 1 ruble of commercial products - formula

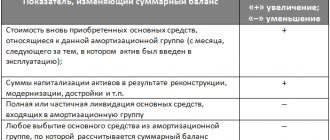

Marketable products are the cost of products that have been manufactured over a certain period and are ready for sale to third parties. Commodity products are measured in prices for buyers - selling prices. The relationship between sold and commercial products is determined by the formula:

RP = GP1 + TP – GP2,

Where:

RP - the amount of products sold,

TP - the amount of marketable products in sales prices,

GP1 - the amount of finished products in the warehouse at the beginning of the period in sales prices,

GP2 - the amount of finished products in the warehouse at the end of the period in sales prices.

To calculate the cost indicator for 1 ruble of commercial products, it is necessary to divide the total cost of commercial products by the amount of commercial products.

Consumer effect method

This approach involves taking the effect of using new products as a basis when calculating prices. It arises in the area of consumer demand. The pricing formula in this case will be as follows:

C = Cbi + E * Kt, where:

- Cbi - the cost of the basic product that was produced earlier;

- E – consumer effect when replacing an old product with a new one;

- Kt – coefficient of braking, obsolescence of the product.