What is batch accounting?

Batch accounting is product accounting in which each batch is taken into account. A product label is attached to each batch. Subsequently, the corresponding numbers are entered into the consumable papers. Product labels must contain document numbers, as well as the number of products sold.

A separate analytical account is created for each batch. It is needed to make movement records. Every month, based on the established analytical accounting, a turnover sheet is formed. It contains the batch number for each product group, as well as the amount and number of containers for each of them.

General provisions

Methods of accounting are specified in the Methodological Instructions approved by Order of the Ministry of Finance No. 119n dated December 28, 2001. In essence, the only difference between the varietal method and the batch method is accounting for each batch of products.

A batch is a homogeneous product that came from one supplier. The goods can be delivered on the basis of one or several documents. However, these conditions must be met:

- Delivery on the same date.

- Transportation by the same type of transport.

The method under consideration is relevant for both accounting and warehouses. Here are its main features:

- Accounting is carried out on batch cards. They are documents for recording the receipts and expenses of products from a single batch. The card form was assigned the number MX-10 on the basis of Resolution of the State Statistics Committee No. 66 of August 9, 1999. Cards are issued in two copies: one remains in the warehouse, and the other is sent to the accounting department. They are compiled by the financially responsible employee. The card must be registered. It is designated by the batch number. The document contains this information: details of the recipient and supplier, acceptance certificate, product characteristics.

- The batch of products is sent to a warehouse separately from other facilities.

- In the primary documentation regarding the release of valuables, the number of the consignment card is indicated.

- If the documented batch has left the warehouse in full, an inventory is carried out.

Accounting rules not specified in laws can be formulated independently. For this purpose, the relevant provisions are specified in regulations.

IMPORTANT! After the entire batch has been eliminated, the card is closed. Then an act of depletion of reserves is drawn up. All related documents are sent to the accounting department.

Indication of batch in transactions

If, after enabling batch accounting, you look at the postings (in the case of accounting), you can see that the third subaccount “Batch” has appeared in the documents:

If you enabled accounting by batches after the start of accounting, it is better to repost the receipt and write-off documents. This can be done using special processing.

Based on materials from: programmist1s.ru

Setting up accounting parameters in 1C 8.3 is one of the first actions you must take before starting full-time work in the program. The correct operation of your program, the availability of various functionality and accounting rules depend on them.

Starting with version 1C:Accounting 3.0.43.162, the interface for setting up accounting parameters has changed. Also, some parameters began to be configured separately.

Go to the "Administration" menu and select "Accounting Settings".

This settings section consists of six items. Next we will look at each of them. All of them allow you to influence the composition of subaccounts for certain accounts and subaccounts.

Initially, we already have flags set in two items that cannot be edited. You can also additionally enable maintenance by accounting methods.

This setting was also completed. The item “By item” cannot be used, but other settings can be edited if necessary. The list of accounts and subaccounts that are affected by these settings is shown in the figure below.

Here the management of subaccounts 41.12 and 42.02 takes place. By default, only warehouse accounting was installed. It is predefined and we cannot edit it. In addition, this type of accounting can be maintained according to the nomenclature and VAT rates.

Cash flow accounting

This type of accounting will necessarily be carried out according to the account. It is also recommended to additionally take into account in 1C 8.3 the movements of DS according to their items for additional analytics on management accounting.

You can keep records of this type of settlement both for employees as a whole, and for each individual. These settings have a direct impact on subaccounts 70, 76.04 and 97.01.

Cost accounting will necessarily be carried out by item groups. If you need to prepare audited statements in IFRS, it is advisable to also keep records of cost elements and items.

Types of batch accounting

Batch accounting is divided into these types:

- FIFO and LIFO. These are automatic methods. That is, they function without user participation.

- Manual. Assumes manual accounting.

- Combined. For the most part, automated accounting is performed. However, the user can make manual adjustments.

The FIFO method is the most common. Its main feature is the write-off of batches in accordance with the capitalization procedure. Under FIFO, you can enter information retroactively. LIFO assumes priority write-off of lots that were capitalized later. This is a favorable method within the framework of inflation. This is due to the fact that if the purchase price increases, it is possible to reduce the markup, profit and VAT. However, it is not possible to enter information retroactively in this case.

Which form of accounting to choose?

If you choose the manual method, you need to consider the following disadvantages:

- Mistakes made due to negligence.

- Intentional mistakes made for the purpose of theft or deception.

- Inconsistency in the work of specialists.

- A lot of time is spent moving documents between the warehouse and the accounting department.

- The need for frequent control of warehouses.

Due to all the disadvantages of the manual system, the automated system is the most common.

Batch information

Information on batches in 1C 8.3 can be viewed in the Account balance sheet report from the Reports section – Account balance sheet:

In order for batches to be reflected in the report, you need to check the Batch checkbox in the settings of the 1C 8.3 program:

You can figure out where which documents and reference books are located, what actions the program takes automatically and which you will have to do yourself, how to customize the program “for yourself,” what order of paperwork and regulatory reporting applies in the program - you can learn all this from. For more information about the course, watch the following video:

Please rate this article:

How to enter accounting of goods balances by receipt batches in the 1C 8.3 Accounting program?

In 1C 8.3 programs related to warehouse accounting, it is possible to keep track of product balances by receipt batches. This opportunity is realized by specifying a variant of the batch write-off method in 1C.

Tasks of batch accounting

Let's consider all the tasks of the above method:

- Displaying the date of purchase, supplier, actual volume of products placed in the warehouse. The information provided is a tool that may be useful in future purchases and sales. Based on the information, you can understand what and in what quantities should be purchased.

- Conducting analysis of turnover and profit from sales of products from various suppliers. As part of accounting, the batch is linked to a specific supplier, which allows the manager to receive all the necessary information.

- Determination of the cost of write-off of products. However, to obtain up-to-date information, one condition must be met: timely entry of data on receipts and write-offs.

This is an incomplete list of tasks facing batch accounting.

When is the batch method suitable or not suitable?

Let's consider cases in which batch accounting should be used:

- The company is engaged in the sale of mass products. This includes medicines, components, and food products.

- This is the optimal method for organizations with intensive trading.

- Inability to quickly track the number of balances for the required products.

- The company specializes in selling products with a short shelf life. The method allows you to track goods that are about to expire. This allows you to take appropriate measures in a timely manner. A quick response reduces and prevents financial loss.

Batch accounting is not suitable when selling unique products. For example, an organization sells cars. In this case, the varietal method is chosen. This is due to the fact that when selling such goods, only one document is drawn up - the receipt and expense document.

Business process “Blotting acceptance of alcohol (ATN)”

Applicable only to work with branded products that were produced or imported after July 1, 2020 (new brand).

You can scan only those stamps that are indicated in the TTN.

As a result of the acceptance carried out on the TSD, a document is generated in 1C that contains a list of brands of each bottle (an example of a table from the “Retail 2.2” configuration after filling with data from the TSD).

Continue reading “The principle of online exchange of documents and reference books” →

Features of accounting organization

For batch accounting, you need to build an appropriate algorithm. It is formed based on accounting tasks and the characteristics of the organization’s activities. The algorithm can be either simple or complex. As a rule, it is compiled by the company representatives themselves. However, you can also use the algorithm that is given on the Internet. The method can be organized along these lines:

- Formation of a register of balances for batches and warehouses in a separate manner.

- Formation of a register that includes sections by batches and warehouses.

When organizing accounting, you need to choose what exactly is its object: the product itself or its delivery. A combined option is possible.

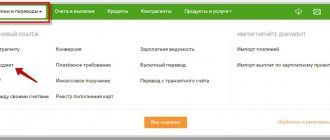

Setting up batch accounting in 1C 8.3

To set up batch accounting in 1C 8.3 you need to:

1. In the accounting parameters settings: Administration – Accounting parameters – Setting up a chart of accounts, in Inventory accounting, check the box By batches (receipt documents):

2. In the accounting policy settings: Main – Accounting policy, on the Inventory tab, set the method of estimating inventory – by FIFO. This method assumes that goods are received in separate batches and each batch of one product is accounted for separately:

After these settings, a new Batch subaccount appears in the inventory accounts:

Important! When specifying the VAT rate of 0% and Without VAT in receipt and sales documents, as well as when using a simplified taxation system in the 1C 8.3 Accounting program, batch accounting is maintained, regardless of the program settings.

Advantages and disadvantages of batch accounting

Let's look at the main advantages of the batch method:

- You can track expiration dates.

- Ability to control the expiration of certificates.

- Assistance in the correct formation of mark-ups on products.

- Facilitate the return of products to the supplier.

- Ensuring “transparent” payments to suppliers.

- Correctly entering information about transactions into accounting programs.

- Drawing up analytical reports in the context of cost characteristics (this is VAT, income, etc.).

- Strict control over residues.

- Reducing losses.

- Reducing the number of losses.

Batch accounting is used in most cases by food manufacturing enterprises. However, this method is not without its disadvantages:

- Irrational exploitation of space.

- It is impossible to maintain operational records by item. This is explained by the fact that accounting is carried out using different batch cards.

IMPORTANT! The selected accounting method must be specified in the accounting policy.