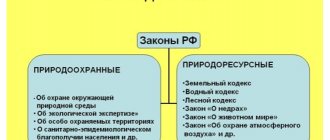

Definition and decoding of checkpoints

Knowledge of the checkpoint allows you to obtain a number of information confirming the integrity of the supplier and protect the organization from concluding a contract with a fly-by-night company. This code, in accordance with clause 5 of the appendix to order No. MMB-7-6/, consists of 9 numeric characters, which are a combination of 3 combinations, each of which carries certain information:

- the first four numbers indicate the code of the tax service that registered the legal entity and registered it (the first 2 digits in it correspond to the code assigned to the region in which the inspectorate is located, and the next 2 to the number of the specified government body);

- the following 2-digit combination indicates the reason why the taxpayer was registered;

- the last 3 digits are the number assigned to the unit when it was registered.

It is obvious that the checkpoints of separate divisions will not coincide even if they are located in the territory under the jurisdiction of one tax authority: due to the inclusion of the serial number of the registered division in the code, it becomes unique and simply cannot be assigned to another organization.

The abbreviation KPP stands for the reason for registration. It is provided to certain companies as a supplement to the TIN.

The provision of checkpoints is associated with the registration of the organization with government agencies responsible for taxation (in accordance with the address where the legal entity and its OP are registered).

Thus, using the checkpoint one can judge the reason for registration and the attitude of legal entities to specific tax authorities. In addition, any enterprise can have more than one checkpoint, since the organization’s activities can be carried out in several regions.

When issuing a certificate of registration, it also indicates the checkpoint, in addition, it appears in the certificates of registration of private enterprises, real estate and vehicles.

The checkpoint is a nine-digit number:

- the first four of them are the code of the tax department that was involved in registering this organization;

- the next two code the specific reason why there was a need for registration;

- the next three digits are the serial registration number in the territorial tax division.

KPP is one of the main details of any legal entity and appears in almost all accounting, tax or payment documentation.

How to quickly find out an organization's checkpoint

KPP – reason code for registration, which is given to a certain company as an addition to the TIN. This code is associated with the registration of an organization with state authorities involved in taxation (depending on the place of registration of this legal entity along with separate divisions and where it acts as the owner of the property).

- According to its location, along with the assignment of a TIN.

- By new location, when the address of the company changes, if this place is located in the territory that is under the jurisdiction of another tax authority.

- By location of each of the company's separate divisions.

- At the new location of a separate division, if this is a new address reporting to another tax authority.

- By location of its real estate and/or vehicles.

- For other reasons, which are reflected in the Tax Code.

A separate division - what is it? Separate division: form, form and accounting

How is a separate division reflected in 1C? Let's consider the accounting of a government agency. The program supports the reflection of two types of EP: allocated and not allocated to an independent balance sheet. Reporting on the former can be carried out both in a separate information base and in one with the main enterprise. Data is entered about both the main office and the OP. The balance sheet, general ledger and other registers, as well as regulated reports, can be generated consolidated for a certain group of institutions or separately for the main enterprise and separate divisions. If OPs are not allocated, then reporting on them is carried out in the same database as the main office. The corresponding data is entered into the Divisions directory with the assignment of the “Separated” category. Based on this parameter, the program will distinguish them from other additional offices.

Interesting: Filling out 3 personal income taxes when returning apartment tax 2020

In accordance with Art. 385 of the Tax Code, a company that accounts on its balance sheet for real estate located outside the location of its own or a designated OP, pays tax (advance amounts) to the budget in the territory where these objects are present. The amount of payments is determined as the product of the rate that is valid in a given region and the base (1/4 of the average value of real estate) established for the reporting/tax period according to the rules of Art. 376 NK. The calculation is carried out for each object separately. Thus, the main enterprise calculates, pays and declares tax at the location of the property, regardless of whether separate reporting will be provided for a separate division for the fixed assets that it uses.

Assigning a checkpoint to a separate unit

The basis for assigning a code to a separate division is its tax registration at its location. After registering the division, its head will be issued a corresponding paper certificate, which, in addition to the TIN, which matches the number of the parent organization, will indicate the checkpoint assigned to this particular branch or representative office.

There is no need to submit an application for the formation of a checkpoint for a new unit - the code will be generated automatically. After the registration procedure for the unit is completed, the inspector of the territorial branch of the Federal Tax Service transfers all the necessary information (including checkpoints) to the tax service with which the parent organization is registered.

IMPORTANT! The checkpoint of a unit can be changed if it changes its legal address and moves to the territory under the jurisdiction of another inspection. All banking organizations that provide services to the unit, as well as counterparties, must be notified of such changes.

How to find out the OKPO of a separate division (representative office, branch)

The OKPO code, like the KPP, is unique for each separate division of the enterprise. In order to find out this code, you can use the service offered by Rosstat at the address: statreg.gks.ru. In the window that opens, you will need to enter the TIN of the parent company and click the “Search” button. As a result, the system will generate a table that will indicate the names of all representative offices and branches, as well as the OKPO codes assigned to each of them.

So, the registration code is one of the details of any organization that has the status of a legal entity. If a company has separate divisions, the checkpoint of each of them (as opposed to the Taxpayer Identification Number) will be different. It is quite difficult to find out the code of such a division if you have a TIN, since the service developed by the tax service for determining the details of a legal entity provides information related to the parent organization, and not to its branches and representative offices. Nevertheless, it is still possible to independently find out such a checkpoint by ordering an extract from the Unified State Register of Legal Entities or by studying the information reflected in the invoice issued by a separate division.

How can I find out the checkpoint of an organization?

The checkpoint stands for the reason for registration. Approved by Order of the Interregional Tax Service of the Russian Federation No. BG-3-09/178 dated March 3, 2004. It goes as an additional detail to the TIN at a non-primary (not main) place of registration.

This code is also indicated on payments, as well as in accounting reports and documents.

This code is located in the certificate of delivery for registration of the organization, as well as in the notification of registration in the case of registration of a subdivision/branch, real estate or car.

Decoding

The checkpoint is a 9-digit code indicating:

- tax code where the organization/division/branch was registered (first 4 digits);

- the reason why the organization/division/branch was registered (the next 2 characters), the reason code for a company of the Russian Federation from 1 to 50, for a non-resident company - from 50 to 99;

- tax registration number, which indicates the number of times the company has been registered for this reason (last 3 digits).

How and where to find out

How and where to find out

There are two options for searching for a checkpoint of a partner company:

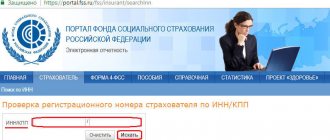

Free. The easiest way to find out the checkpoint of an organization without additional payment is on the official website of the Federal Tax Service nalog.ru. There you need to go to the “Electronic Services” section and select the “Check yourself and counterparty” item. A window will appear in which you must enter the name of the partner or his TIN (depending on what you know). The name must be entered without quotation marks, without indicating the legal form. Despite the lack of payment, the company data here is always up to date.

Paid. There are also paid sites and services where you can find out much more information about partners, such as financial status, founders, partner structure, etc.

- SPARK spark-interfax.ru/Front/Index.aspx is a service that analyzes the financial condition of companies. Before deciding to use this service, you have the opportunity to get a demo version of it or order a presentation of it to your office.

- Kontur.Focus focus.kontur.ru – using this service, any organization can be easily checked. There is also access to a demo version and the opportunity to use the service for a month for a small fee.

How to find a checkpoint in documents (for example, an invoice) of a separate division

An invoice is one of the most important tax documents, which certifies the fact of shipment of goods (provision of services), and also contains information about its cost. It contains information about the name and details of both parties to the concluded agreement, so it will not be difficult to find the checkpoint of a separate unit in this document.

In accordance with the explanations given by the Ministry of Finance of the Russian Federation in the letter “On the preparation of invoices...” dated 04/03/2012 No. 03-07-09/32, when forming this document by separate divisions, the checkpoint of the division, and not the parent organization, is indicated in line 26. This means that you can obtain the most relevant and factual information by reading the invoice issued by the department of interest.

Peculiarities

Companies, in accordance with the Civil Code of the Russian Federation, can be created to conduct business activities in general or perform certain tasks. In this they are no different from other entities engaged in economic activities.

A legal entity has the opportunity to open its own separate divisions (hereinafter also referred to as OP). This right is enshrined in Art. 55 of the Civil Code. Let us clarify that merchants are formally deprived of this opportunity.

Opening an OP does not entail the creation of a separate legal entity. It is part of an already registered organization, which means it does not have the same scope of legal rights and obligations.

The Tax Code contains clear features that must necessarily be inherent in “separateness”:

- availability of stationary workplaces;

- different addresses for the head office and the OP.

The absence of at least one of these signs means that there are insufficient grounds for opening a new structure in the OP status. The creation of a “separateness” in this case will contradict Article 11 of the Tax Code. This means that there will not be a separate checkpoint of a separate unit.

The Civil Code mentions only two forms of OP:

- branch;

- representation.

At the same time, Art. 55 of the Tax Code of the Russian Federation provides another type of separate unit - equipped working positions.

The opening of branches and representative offices implies the appearance of data about them in the Unified State Register of Legal Entities (in the case of equipped workplaces with the status of EP, this does not happen). To do this, you must first fill out an application (there are approved forms) and send it to the tax authorities.

In this section we will tell you where the checkpoint is indicated and where you can look at this code, how to find it out online through Internet resources, knowing the organization’s tax identification number.

We will also consider such an important nuance as the possibility of assigning several codes to an organization from the point of view of legislative regulation.

The checkpoint must be indicated as part of the official details of the legal entity on all official documentation and letterheads of the company.

How to draw up a vehicle purchase and sale agreement, see the article:

vehicle purchase and sale agreement

.

Read the procedure for calculating car tax online here.

The checkpoint can also be found in contracts and agreements, various official letters and powers of attorney.

There is a list of documents where checkpoint is a mandatory requirement. For example, it must be indicated in the invoices of the division and branch.

| The first 4 digits indicate the tax office code | Which assigned to a separate division of the checkpoint |

| Fifth and sixth digits | They directly indicate the basis for registering a division for tax purposes |

| Three last signs | Means the serial code for registering a branch or representative office for tax purposes |

How to find out online

An application for current company details can be sent to the tax office, from where you will receive an extract from the Unified State Register of Legal Entities.

You can fill out an application online to find out this information on the tax service website, after which you will promptly receive an extract in electronic form, certified by a digital signature.

To submit an application online on the Federal Tax Service portal, you must register and log into your personal account.

Registration of the extract is paid, you will need to pay 200 rubles for the service, for an urgent request it will cost 400 rubles.

You can also find out the unit’s checkpoints on information portals on the Internet and in enterprise databases.

There are many such portals that contain up-to-date and reliable information. To find out the checkpoint, you will need to enter the company's TIN in the search bar.

How to find out the organization code by TIN

By TIN, you can find out the checkpoint on the website of the Federal Tax Service, in the information located in the Unified State Register of Legal Entities, in the unified federal register of information on the activities of legal entities, in the database of companies, and also, as mentioned above, in various search services.

On both paid and free services, having the TIN of the company you are interested in, you can find out the checkpoint and other information of interest.

In addition to the above services, there are some more:

- www.prima-inform.ru/cases/uznat-ogrn

- 1eb.ru/proverka_kontragenta.html

- online.igk-group.ru/ru/home

- egrul.nalog.ru

Sometimes a situation arises when you need to find a missing partner company, but this cannot always be done as easily as we would like. Unfortunately, in practice there are enterprises that conduct their activities in bad faith, as well as those that do not have their own website, or the company may simply move and not inform partners about it.

Any company may encounter an unscrupulous partner, and searching for details can turn into a long search process. In such cases, it is advisable to contact a law firm that has experience in such searches.

The main reasons for registering using a checkpoint code

Also, specific data in the checkpoint indicate the following signs:

- state the fact that the organization has its main place of accounting;

- 05 and 31-32 - indicates the presence of structural divisions and their legal form;

- availability of property in a specific territory;

- 10-29 – registered vehicles;

- 30 – the organization was not registered as an existing taxpayer;

- over 51 are large companies, including foreign ones.

Thus, the reasons that allow the organization to register are confirmed by the corresponding code.

We can summarize the following reasons for obtaining a code when registering:

- Confirmation of registration of a legal entity and its location.

- Due to a change in tax authority and registration address.

- Opening of other divisions of the company.

- Finding the office or real estate of the organization with its documentary evidence.

These are the most common reasons, but they are not the only ones. A full list of reasons for obtaining a checkpoint is discussed in the Tax Code of the Russian Federation.

The procedure for changing one checkpoint to another occurs if the company changes its main place of business. In this case, the TIN will remain unchanged, but the code will correspond to the new region at the location of the tax authority.

When changing the main legal address, in order to officially and correctly change the checkpoint code, you should perform a series of sequential actions:

- submit the necessary documents to the registration authority at the location of the company;

- notarize documents containing signatures of the manager;

- pick up a copy of the company's Articles of Association with the appropriate marks from the tax office, as well as a certificate of relevant changes.

Then, within five working days, the organization must receive:

- notice from the Statistical Register of the Federal State Statistics Service or view the new OKTMO code on their official website;

- notification of deregistration with the Pension Fund and the Social Insurance Fund.

Then all banks and counterparties are sent a corresponding notification about the change of legal address. The tax service must promptly notify other registration authorities of a change in the company's legal address, but it would be useful to monitor this process independently.

Any legal entity has its own registration data necessary to determine the place of registration with the tax office and display other individual data. Each number has its own meaning, which will help you understand many issues. The company has the right to open many additional offices and each division is registered with the tax authority and assigned a checkpoint. However, there may be many reasons for this, as well as the procedure for changing the code, its determination and identification in other tax offices.

When the registration of an OP has occurred, it may be assigned special codes. But the parent organization and all its divisions will still have the same TIN. This is due to the fact that the OP is not a legal entity.

Thus, you can find out the checkpoint of a separate division using the TIN of the main enterprise by applying for an extract from the Unified State Register of Legal Entities.

The judgment that there is no need to obtain a separate TIN is based on an analysis of the regulatory document regulating the procedure for obtaining, using and changing the TIN (approved by order of the Ministry of Taxes of Russia dated 03.03.2004 No. BG-3-09/178). And it is valid only when registering or deregistering legal entities and individuals.

How to find out the checkpoint of an organization - the main reasons for registration

The reason for assigning a code to one or another organization on the territory of the Russian Federation is registration with the tax authorities in accordance with:

- its location, and a TIN is assigned;

- new location (the address of the organization changes, and it geographically begins to belong to a different tax division);

- with the address of each of the OPs that relate to the organization;

- with the new address of one of the OPs, if it has become part of a different tax division;

- with the location of its movable and immovable property;

- with grounds of a different kind noted in the Tax Code.

For foreign companies, the assignment of a code occurs simultaneously with the registration of the organization with the tax authorities and in accordance with:

- the location of each of the OPs belonging to the organization;

- the new location of the OP, if it begins to belong to a different tax division;

- where the movable and immovable property belonging to her is located;

- other reasons specified in the Tax Code.

Absolutely any business entity receives certain codes, as stated in the law. They are needed for the following purposes:

- identification in classification systems according to various criteria (territory, industry, etc.);

- maintaining records of subjects (for the purposes of taxes and insurance premiums, statistics, etc.).

And if for the main organization codes are an integral attribute, then separate divisions may have their own or coincide with the codes of the main organization.

Any organization must register with the tax service before starting its activities. This is enshrined in paragraph 1 of Article 83 of the Tax Code of the Russian Federation. But not everyone understands which inspectorate they need to contact in order to register. Belonging to the Federal Tax Service can be determined:

- the address of the organization itself (for an individual entrepreneur - the address of his permanent registration);

- the location of its real estate;

- OP's address.

The company must inform the tax authorities about the opening of a separate division. After this, it is registered.

Despite the fact that the parent organization and all its separate divisions have one TIN, KPP is assigned to each of them. This will happen even if the organization does not submit an application to the checkpoint of a separate unit.

Then information about the checkpoint of a separate division is sent from the local tax office to the one where the parent company is registered.

The Tax Code of the Russian Federation offers its own approach to the concept of “separate division”. A separate subdivision is understood as any territorially separate subdivision from the parent organization, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month (Article 11 of the Tax Code of the Russian Federation).

However, if an organization has created a separate division that is not a branch or representative office, and is not indicated as such in the organization’s constituent documents, then such an organization has the right to apply a simplified taxation system.