Do you have questions or doubts about filling out the 6-NDFL report: how to reflect certain accruals, payments, for what period, should they be included in the report on a specific date, etc.? Go to our forum and ask them! For example, on this thread you can clarify the details of filling out 6-NDFL for the six months.

Location and explanation of page 070 in the 6-NDFL report

Point 1: tax rounding for entry in line 070

Nuance 2: when the personal income tax amount on line 070 is equal to the tax on line 040

Nuance 3: relationship between lines 070 and 080 of the 6-NDFL report

Results

Location and explanation of page 070 in the 6-NDFL report

In 6-NDFL, line 070 “Amount of tax withheld” is included in section 1. 15 cells are allocated for it, as for most of the total lines of this report.

The decoding of the contents of line 070 is given in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] It is prescribed:

- reflect in the specified line the total amount of personal income tax withheld;

- determine this amount on a cumulative basis from the beginning of the tax period.

The indicator in line 070 is combined, not only because the 6-NDFL report summarizes the indicators for all employees, but also because it must reflect all amounts of tax withheld upon payment. Let us remind you that the date of calculation and withholding of tax does not always coincide. For example, tax on wages is calculated on the last day of the month, and is withheld when it is actually issued. Including this can happen in parts if the payment is made in installments.

To calculate the figure reflected in line 070, you will need to sum up all the data included in line 140 of section 2 on a cumulative basis from the beginning of each reporting period. That is, for the report:

- for the 1st quarter, line 070 will consist of the amounts of lines 140 reflected in section 2 of the same report;

- half-year - from the amounts of lines 140 reflected in section 2 of the half-year report, and the amount shown in line 070 of the report for the 1st quarter;

- 9 months - from the amounts of lines 140 reflected in section 2 of the report for 9 months, and the amount shown in line 070 of the half-year report;

- year - from the amounts of lines 140 reflected in section 2 of the report for the year, and the amount shown in line 070 of the report for 9 months.

However, for data falling on the border of periods, the amount calculated in this way must be adjusted taking into account the fact that actual payments with tax withholding on them could have been made in one period, and the deadline established for paying tax on them, due to the coincidence with a weekend in the afternoon moves on to the next period. In such a situation, lines 020, 040 and 070 in section 1 must be filled out in the period of actual payment, and section 2 will contain data related to this operation in the next reporting period.

Read more about such situations in the publications:

- «6-NDFL and 2-NDFL: how to show January vacation pay issued on December 30?;

- «December sick leave in 6-NDFL: in what period should it be shown?.

Let us remind you that section 1 of the 6-NDFL report is filled out with a cumulative total, and section 2 contains data only for the last quarter of the reporting period.

Read about the principles of filling out 6-NDFL in the material “Report on Form 6-NDFL for the year - an example of filling out.”

For information on how to reflect bonuses, gifts, vacation pay and other various payments in the 6-NDFL calculation, see the Ready-made solution from ConsultantPlus.

ATTENTION! The deadline for submitting 6-NDFL for the year has been reduced by a month. You must report for 2020 no later than 03/02/2020, because 03/01/2020 - Sunday. For details, see the material “The deadline for issuing 6-NDFL and 2-NDFL has been shortened.”

https://youtu.be/-m0RgjUzafI

How to independently check that field 070 is filled out correctly

When preparing a report, you must be extremely careful. All lines in section 1 are filled in with a cumulative total, that is, data for the entire period from the beginning of the year is included there. One of the easiest ways to find out whether an error was made when filling out column 070 is to look at similar reports for the first, second and third quarters. The numbers should differ significantly (by several times) if the organization operated as usual.

The Federal Tax Service checks the correctness of filling out the entire form using field 070. In particular, the difference between the data indicated in columns 070 and 090 (the amount of tax returned by the tax agent) is compared. If the result is less than the figures from the budget settlement card, inspectors may suspect that the company has not transferred income tax to the budget in full.

You can fill out 6-NDFL in online services on the websites of accounting software developers: My Business, Kontur, Nebo and others. Some sites allow you to do this freely, but usually the services require a small fee (up to 1000 rubles).

This is important to know: Taxable income limit for personal income tax deductions in 2020 for children

Point 1: tax rounding for entry in line 070

Line 070 is filled in in full rubles and does not contain cells for recording the kopecks received when calculating the tax (as is provided for lines 020, 025, 030, 130). This circumstance is explained by the requirements of paragraph 6 of Art. 52 of the Tax Code of the Russian Federation, which prescribes rounding personal income tax when calculating to full rubles in compliance with the rule: you can discard kopecks only in 1 case: if their value is less than 50.

Based on this rule, the amount of tax withheld when paying income is calculated, falling into line 140 of section 2. That is, there it will already be shown in full rubles. Accordingly, when summing up such figures, the result will also be in full rubles.

Read more about the procedure for calculating personal income tax in the articles:

- “Calculation of personal income tax (personal income tax): procedure and formula”;

- “Personal income tax accrued (accounting entry)”.

Our recommendations

Filling out line 070 in 6 personal income tax in accordance with the instructions set out in the letter of the Ministry of Finance dated July 1, 2020 N BS-4-11/11886 will allow you to reduce the risks of desk audits and possibly on-site inspections by the Federal Tax Service.

You should pay serious attention to this issue and make a decision: to submit or not to submit the updated calculations for the first quarter and first half of the year. We recommend that you do as indicated in the written explanations and henceforth fill out line 070 in 6 personal income tax taking into account these instructions. Sources of information: Letter of the Ministry of Finance dated July 1, 2020 N BS-4-11/11886

Nuance 2: when the personal income tax amount on line 070 is equal to the tax on line 040

The data reflected in line 070 of 6-NDFL and line 040 (calculated personal income tax) coincide extremely rarely, since the main part of payments is salary, and it is accrued on the last day of the month (including the month ending the reporting period), and is usually paid in the next month (which for the accrual month that ended the reporting period will fall into the next quarter).

For example, report 6-NDFL for the year in line 040 contains data on wages accrued for December. The tax calculated from it will be included in line 070 only at the time of salary payment. For December earnings, this event will occur in the next month - January. For 6-NDFL this is a different reporting period.

The tax amounts reflected on lines 070 and 040 may be the same if, for example:

- earnings are regularly issued to employees on the last day of the month for which they are accrued, and the dates of accrual and payment of income/calculation, withholding and payment of personal income tax coincide;

- In the reporting period, only income accrued at the time of payment was paid, and there were no situations forcing the postponement of dates to another reporting period.

About the features of reflecting salary advances in 6-NDFL, read the material “How to correctly reflect an advance in the 6-NDFL form (nuances)?”

Line 070 for non-cash income

As for personal income tax on income in kind or in the form of material benefits, the tax is withheld from income paid in cash. Therefore, on line 070, such personal income tax will be reflected not at the time of receipt of income, but at the time of the subsequent cash payment, from which personal income tax was withheld taking into account the existing limit (50% of income) (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation).

According to the procedure for filling out form 6-NDFL in 2020, line 070 contains the amount of tax withheld for the reporting period. This line is filled in in total for all personal income tax rates.

Accountants can fill out all lines of 6-NDFL online for free in the Bukhsoft program. The program will distribute payments into sections in the required order, and will also check the report for errors, in particular, line 070.

Nuance 3: relationship between lines 070 and 080 of the 6-NDFL report

If during the year the tax agent was unable to withhold accrued personal income tax from income paid to an individual, then for such tax, instead of line 070 in the 6-NDFL report, line 080 will be used, intended to reflect the personal income tax not withheld by the tax agent.

The inability of a tax agent to withhold personal income tax from the income of individuals may arise, for example, in the following cases:

- The employee received in-kind income from the company and then quit. At the same time, the dismissal amount was not enough to withhold personal income tax from the value of natural income.

- Former retired employees were given anniversary gifts (worth more than 4,000 rubles). At the same time, no other monetary income was paid.

- A company employee received an interest-free loan, but is on long-term leave without pay. At the same time, he receives monthly income from interest savings (material benefits), with which the employer is unable to withhold personal income tax due to the lack of income paid to the employee.

For explanations from tax officials on filling out lines 070 and 080, see the publications:

- “Annual 6-NDFL will not agree with 2-NDFL certificates regarding the amount of tax withheld”;

- «New explanations from the Federal Tax Service to line 080 of form 6-NDFL".

Sample of filling out line 070 for different cases of receiving income in 2020

Let's look at a few examples. In the completed samples, we will make the following assumption: the above transactions are the only ones in the tax period.

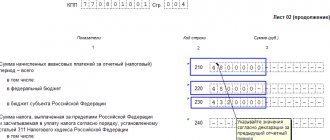

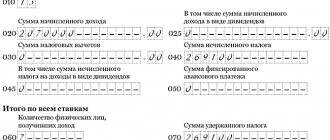

The salary for January 2020 was accrued in the amount of 100,000 rubles. Personal income tax to be withheld 13,000 rubles. The salary was paid in 2 stages: the advance was paid on 01/21/2019 and the final payment was made on 02/05/2019. Filling out the lines of the first section of form 6-NDFL for the 1st quarter of 2019 looks like this:

On March 20, 2020, an agreement was concluded with an individual for the renovation of office premises in the amount of 30,000 rubles. According to the terms of the agreement, payment is made in 2 stages: on March 21, 2020, the amount of the advance payment was 10,000 rubles. (minus the withheld personal income tax in the amount of 1,300 rubles), and on April 2, 2020, the final payment was made in the amount of 20,000 rubles. (minus withheld personal income tax in the amount of 2,600 rubles). The work completion certificate was signed by the parties on March 26, 2020. Filling out the lines of the first section of form 6-NDFL for the 1st quarter of 2019 looks like this:

The salary for December 2020 was accrued in the amount of 200,000 rubles. Personal income tax to be withheld 26,000 rubles. The salary was paid in 2 stages: the advance was paid on December 20, 2020 and the final payment was made on December 28, 2020. Filling out the lines of the first section of form 6-NDFL for 2020 looks like this:

The salary for December 2020 was accrued in the amount of 200,000 rubles. Personal income tax to be withheld 26,000 rubles. The salary was paid in 2 stages: on December 25, 2020, an advance was paid and on January 10, 2020, the final payment was made. Filling out the lines of the first section of form 6-NDFL for the 1st quarter of 2020 looks like this (the amount of personal income tax does not fall into line 070 of the report for 2018, but the salary itself does fall into line 020 and the amount of calculated tax into line 040):

The salary for March 2020 was accrued in the amount of 100,000 rubles. Personal income tax to be withheld 13,000 rubles. The salary was paid in 2 stages: an advance was paid on March 20, 2019 and the final payment was made on April 5, 2020. Filling out the lines of the first section of form 6-NDFL for the 1st quarter of 2019 looks like this:

Results

Line 070 in the 6-NDFL report is located in section 1 and is used to reflect the total amount of personal income tax withheld for the reporting period. This amount is calculated by summing the values that fell into line 140 of Section 2 for the entire reporting period, adjusting it for situations that arise at the border of periods (when payment of income and tax withholding fall into one period, and the deadline for paying personal income tax falls into another). If during the year it was not possible to withhold personal income tax from the income paid to an individual, then the amount of tax related to such income will go to line 080 instead of line 070.

Sources:

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Line 070 in control ratios

It is also necessary to pay attention to the letter dated March 10, 2020 No. BS-4-11 / [email protected] “On the direction of control ratios” of the Ministry of Finance and the Federal Tax Service.

If line 070 - line 090 is more than the personal income tax transferred from the beginning of the tax period, then the conclusion is that the amount of tax has not been transferred to the budget. Thus, the company attracts the attention of the Federal Tax Service. And this attention entails the following consequences:

- in accordance with paragraph 3 of Article 88 of the Tax Code of the Russian Federation, a written notification will be sent to the Federal Tax Service with a requirement to submit documents and explanations or submit appropriate corrections within five days.

- If the submitted documents and explanations are reviewed, a violation is established, an inspection report is generated in accordance with Article 100 of the Tax Code of the Russian Federation.

What are the errors when filling out field 070?

Often line 070 6-NDFL for withheld tax contains indicators that should not be there. This usually happens if wages are accrued and paid in different months.

If the company’s employees regularly receive money at the beginning of the next month, say on the 10th, the accountant, in order not to break the law, is obliged to indicate in the calculation that he paid wages, vacation pay and sick leave in the current month - on its last day. In this case, is it necessary to include in the total amount of tax withheld information about those funds that are yet to be withdrawn? The Federal Tax Service of Russia, in Letter No. BS-4-11/8609 dated May 16, 2016, explained that this is not necessary. After all, personal income tax is allowed to be withheld exclusively from the funds of the individual recipient directly upon payment.

Thus, if wages for December 2020 are issued in January 2020, field 070 should not contain data on tax on December wages. They should be reflected in another column - 040 (the amount of calculated personal income tax). This was indicated by the Federal Tax Service in Letter dated November 29, 2016 No. BS-4-11/

If, nevertheless, field 070 includes information about funds that were allegedly withheld from the December salary, the company may be suspected of non-payment of personal income tax. After the inspection, inspectors may punish for errors in the report and/or for failure to comply with the duties of the tax agent, if a violation actually occurred. However, given that section 1 is filled in with a cumulative total, extra indicators will still have to appear in the report. But already next year - for the first quarter of next year.

Withheld tax: how to reflect it in 6-NDFL

In Section 1 of Form 6-NDFL, all indicators are entered incrementally from the beginning of the year. Withheld tax is no exception; it is also indicated in an incremental manner: when filling out, for example, the Calculation for 9 months, in line 070 you need to show the tax withheld from January to September of the reporting year.

The amount of tax withheld in 6-NDFL is indicated without kopecks. This is obvious, because the cells allocated to reflect the amounts of income and tax deductions provide for the indication of rubles with kopecks, but for personal income tax amounts there are no “penny” cells, and they are indicated in full rubles.

Deadlines for filing 6-NDFL

The certificate must be submitted to the Federal Tax Service no later than the last day of the month following the reporting quarter. In 2020, for example, the following reporting deadlines are prescribed.

Table 1. Reporting deadlines in 2020

| Period | date |

| For 2020 | 03.04. 2017 |

| For 1 sq. 2020 | 02.05.2017 |

| In 6 months 2020 | 31.07. 2017 |

| In 9 months 2020 | 31.10.2017 |

| For 2020 | 02.04.2018 |

Since, for example, 04/01/2017 is a day off, the deadline for submitting 6-NDFL until 04/01/2107 provided for by the Tax Code of the Russian Federation is postponed to April 3. By the same principle, other submission deadlines are shifted if necessary.