How to fill out the 3-NDFL declaration for property deduction for 2020

Download the new 3-NDFL declaration form for 2020 when filing a declaration for 2017 in PDF format.

Download the new 3-NDFL declaration form in Excel format.

Title page

At the top of the sheet, the TIN code of the citizen who makes up the document and the serial number of the sheet are indicated.

Next, enter the correction number if this report is submitted to correct errors in the previous one. If the report is primary, then “0” is entered. Next, you need to indicate the period for which the document was compiled - “34” indicates the year, and the 4-digit year number.

The last step is to write down the Federal Tax Service code where the document will be sent.

The next step is to provide information about the applicant.

One by one, in the appropriate columns you need to indicate:

- country code - for Russia 643;

- Payer code - possible codes are indicated in Appendix 1 of the instructions; to receive a deduction for an ordinary citizen, 760 is usually entered here.

- Full name

- Date and place of birth.

Next, you need to write down the code of the identity document (for a Russian passport - 21) and information about it.

In the status column you need to enter:

- “1” – if the applicant is a resident of Russia;

- “2” – if a non-resident (stays in Russia less than 183 days a year).

Next, enter your contact phone number. After this, you need to indicate how many pages the document occupies (this is best entered after filling out all the necessary sheets), and how many pages the power of attorney occupies (if submitted by an authorized person).

Next, fill out the left side of the sheet. Here it is indicated who submits the form to the tax office “1” - the taxpayer personally and “2” - his representative. In the first case, you only need to put a date and sign. In the second, indicate information about the representative and the document giving him authority.

Section 1

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

The following are entered:

- Line 010 - code “2”, indicating tax refund;

- Line 020 - KBK code by which the tax was transferred (personal income tax code);

- line 030 - OKTMO code in which the tax was paid;

- “0” is entered in line 040, and in line 0505 - the amount of tax that is requested for refund.

The sheet must be signed and dated at the bottom.

Attention! If several sources of income are indicated, they must be reflected on separate sheets.

The second sheet will also need to be signed.

Section 2

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

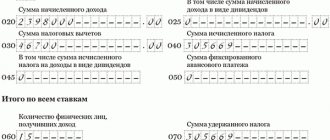

The following are entered:

- Line 001 - tax rate, usually 13%;

- Line 002 - for income from employment, enter “3”;

- Line 010 - total income for the year;

- Line 020 - income for some reason not taxed;

- Line 030 - difference between 010 and 020;

- Line 040 - the amount of requested deductions. Usually equal to the amount of income for the year;

- Line 050 - expenses accepted to reduce income. Usually there is “0”;

- Line 051 - income from participation in foreign companies.

- Line 060 - calculated using the formula 030+051-040-050

- Line 070 - the amount of tax to be paid, put “0”

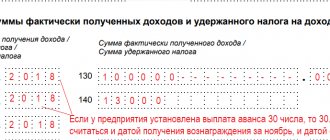

- Line 080-120 indicates the amounts of taxes withheld in various cases.

- Line 130 - the amount of tax to be paid, put “0”

- Line 140 is calculated using the formula 080+090+091+100+110+120-070

The sheet must be signed and dated at the bottom.

Sheet A

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

Next, enter information about income, calculated and withheld tax.

First, the tax rate is indicated - usually 13%. Next is the income code. All possible codes are written in Appendix 4 of the instructions, usually code 06 is entered here - income under an employment agreement.

Next, you need to provide information about the employer—TIN, KPP, OKTMO codes, and its name. Then the total amount of income subject to tax, calculated and withheld tax is indicated.

The sheet contains several blocks of this kind if income was received from different organizations or at different rates. If there is not enough space, you can add the required number of sheets A.

The sheet must be signed and dated at the bottom.

Sheet D1

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

Further on this sheet, full information about the purchased or constructed object is indicated.

The object code is indicated in accordance with Appendix 5 of the instructions. For an apartment “2” is written here, for a house – “1”, etc.

Next, the type of property is recorded, it can be

- “1” – individual;

- “2” fractional;

- “3” joint;

- “4” – the deduction is requested for the child.

You might be interested in:

How to obtain a TIN for an individual: where to apply, what documents are needed

The taxpayer's attribute is usually indicated as “1” – owner. All codes are listed in Appendix 6 of the instructions.

Next, you need to indicate whether the applicant is a pensioner “1” - yes, “2” - no.

The following specifies what is used as an identifier:

- “1” – cadastral number;

- “2” – conditional number;

- “3” inventory;

- “4” – no number.

The number itself is entered in the next column.

Then you need to write down the address where the property is located (if you indicate the cadastral number of the property, you do not need to enter information about the address).

Next, you need to enter the date of the transfer act, registration of ownership of the home or plot, etc.

Then the share is indicated if the object is in shared ownership.

Next, you need to enter the year from which the deduction begins.

Below in the columns the cost of the object, the amount of interest paid, the amount of deductions for the acquisition of real estate and interest provided in previous years are recorded.

Then you need to write down the size of the tax base for the period, the amount of confirmed expenses and interest (they together should not exceed the base). Next, the deduction amount is recorded, which is carried forward to subsequent years.

The sheet must be signed and dated at the bottom.

Declaration 3-NDFL: sample filling for individuals

The report form consists of several sections:

- Title page;

- Sections 1 and 2;

- Appendices 1-8.

It is filled out by hand. In this case, several rules are observed:

- there should be no corrections in the report;

- fastening sheets should not violate the bar coding on each sheet of the document;

- all data is written in printed letters;

- Each character has a separate cell.

The full list of rules can be found in Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] dated 10/03/2018.

What is indicated in each section of the 3-NDFL form:

- Title page. It reflects the taxpayer’s data, the code of the Federal Tax Service of the Russian Federation to which the report is submitted, the tax period code, the reporting year, the adjustment number and other necessary data.

- Section 1. It calculates the amount of tax that must be paid or paid additionally to the budget, returned from it.

- Section 2. It is intended to calculate the tax base and amounts of income that are taxed at different tax rates.

- Appendix 1. It reflects income received from sources in the Russian Federation. If there are several of them, fill out several sheets of the Appendix.

- Appendix 2. It is intended to reflect income received from sources outside the Russian Federation.

- Appendix 3. It is filled out by entrepreneurs and individuals who are engaged in private practice (lawyers, notaries, arbitration managers, heads of farms).

- Appendix 4. It calculates the amounts of income that are not subject to taxation.

- Appendix 5. It is used to calculate standard, social and property deductions.

- Appendix 6. It is intended for calculating property deductions for income from the sale of property.

- Appendix 7. It calculates property deductions when purchasing real estate or new construction of an object.

- Appendix 8. It calculates the tax base for transactions carried out with securities and derivative financial instruments.

The title page, Sections 1 and 2 are required to be filled out. The data in the Appendices is indicated depending on the purpose of submitting the report.

3-NDFL: sample filling when selling an apartment

In what cases is a declaration submitted?

Every citizen of the Russian Federation who has received income must fill out a declaration and send it to the tax authority in a timely manner. Let us consider several examples of making a profit.

when it is necessary to draw up a document.

Examples:

- sale of property, both residential and non-residential;

- receiving income from shares or other securities;

- winning the lottery;

- receiving a present or other income as a gift;

- receiving income from renting out a house, room, plot or garage.