Filling procedure

The declaration includes:

- title page;

- Section 1 “The amount of tax payable to the budget, according to the taxpayer”;

- Section 2 “Determination of the tax base and calculation of the amount of tax in relation to the taxable property of Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices”;

- Section 3 “Calculation of the amount of tax for the tax period on an object of real estate, the tax base in respect of which is recognized as the cadastral (inventory) value.”

An important detail: in the declaration that the organization submits at its location, there is no need to duplicate the data reflected in the declarations that the organization submits:

- by location of separate divisions that are allocated to a separate balance sheet;

- by location of geographically remote real estate objects.

Situation: what sections need to be filled out in property tax returns if an organization submits two declarations: for its location and for the location of geographically remote property, the tax base for which is the cadastral value?

Fill out two separate declarations: one for the organization, the other for remote property. In each report, indicate only the amount of tax that needs to be paid at the location of one or the other.

Let me explain. The organization is obliged to pay the tax on a geographically remote property to the budget of the region where this property is registered (Article 385 of the Tax Code of the Russian Federation). For the remaining property that is listed on the balance sheet, the tax must be transferred to the budget at the location of the organization itself (clause 2 of Article 383 of the Tax Code of the Russian Federation).

OKTMO in each declaration will be different. In one, put the code of the municipality subordinate to the inspectorate in which the organization is registered at its location. And in the other - according to the location of geographically distant property. This follows from the provisions of paragraphs 1.3, 1.6 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

How to fill out a declaration at the location of the organization

In such a declaration, reflect data on all property that is listed on the organization’s balance sheet, but without taking into account geographically remote real estate. Submit to the tax office as follows:

- title page;

- section 1;

- section 2. On line 270, reflect the residual value of all fixed assets as of December 31 (taking into account the geographically remote property);

- section 3. Since there is no data to fill out this section, put dashes in all cells (clause 2.3 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895).

How to fill out a declaration on the location of geographically remote property

In this report, reflect data about the deleted object. That is, without taking into account the rest of the property that is listed on the organization’s balance sheet. Submit a declaration to the tax office containing:

- title page;

- section 1;

- section 2. In all cells except line 270, put dashes. And only on line 270 reflect the residual value of all fixed assets as of December 31 (clause 2.3 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895);

- section 3.

https://youtu.be/f52e_e3Jwbg

Property tax in 2020

Organizations are required to pay property tax and submit declarations on it in 2020 if they have real estate (Articles 373-374 of the Tax Code of the Russian Federation). In this case, the obligation arises in cases where property arises on the basis of rights (Law dated September 29, 2019 No. 325-FZ):

- property;

- possessions;

- disposal and use.

The need to pay tax and submit a corporate property tax return in 2020 does not depend on the purpose of using this property. That is, even if a company has a building listed among its fixed assets that is not used in business activities, it will still have to pay tax.

Important! Since 2020, the obligation of taxpayers to submit quarterly calculations for advance payments of corporate property tax has been abolished (Law No. 63-FZ dated April 15, 2019).

General filling requirements

In each line in the corresponding column of the declaration, indicate only one indicator. If there is no data to fill out the indicator, then put dashes in all cells. For example, like this:

All values of the declaration’s cost indicators are indicated in full rubles. Indicator values are less than 50 kopecks. throw it away, and 50 kopecks. or more, round up to the full ruble.

Fill text indicators in cells from left to right in capital letters. Also fill in whole numeric indicators from left to right, with a dash in the last unfilled cells:

The return may not correct errors by corrective or other similar means.

This is all stated in paragraphs 1.1, 2.3–2.8 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Features of filling out a property tax return

The rules and requirements for filling out the declaration are contained in the Order of the Federal Tax Service dated August 14, 2019 No. SA-7-21 / [email protected] According to this regulatory document, when creating the calculation, the following points must be taken into account:

- if the declaration is filled out manually, you must use blue, purple or black ink;

- calculation pages must be numbered in order, starting with the title page;

- fields are filled in from left to right, starting from the leftmost cell;

- cost indicators must be rounded to the nearest whole value;

- double-sided printing of the document is prohibited;

- fastening sheets is not allowed;

- Errors in the declaration cannot be corrected using corrective means.

TIN and checkpoint

On each sheet of the declaration, indicate the TIN and KPP of the organization. Fill out the cells provided for the Taxpayer Identification Number (TIN) from left to right. Since the organization’s TIN consists of 10 digits, put a dash in the last two cells that remain free:

Indicate another checkpoint (not the organization itself) in the following cases:

- when you submit a separate declaration at the location of a separate division with a separate balance sheet. Please indicate the checkpoint of this unit;

- if there is geographically remote real estate for which you submit a separate report. Enter the checkpoint that is assigned to the location of the property from which you pay property tax.

This is stated in paragraphs 2.7, 3.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

The largest taxpayers submit declarations only at the place of registration in this capacity. Even when you have to submit several declarations. At the same time, they indicate in the declaration the checkpoints assigned at their location:

- separate divisions with a separate balance sheet;

- geographically remote real estate objects (including real estate objects for which the tax base is the cadastral value).

This follows from the provisions of Articles 384–386 of the Tax Code of the Russian Federation, paragraphs 1.5, 3.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895, and is confirmed by letters of the Federal Tax Service of Russia dated July 18, 2014. No. BS-4-11/13894 and dated September 12, 2013 No. BS-4-11/16569.

Single declaration and choice of one inspection for reporting

Starting from the 2020 tax period, it will be possible to submit unified tax reporting on the property tax of organizations, which will be enshrined in clause 1.1 of Art. 386 Tax Code of the Russian Federation.

The innovation provides the following opportunities for the taxpayer: if he is registered with several tax authorities at the location of real estate objects owned by him, the tax base for which is determined as their average annual value, then he has the right to submit a tax return in respect of all such real estate objects in one from the specified tax authorities at its discretion. But he must inform the tax authority of the constituent entity of the Russian Federation about this desire.

It is worth noting that the presentation of unified tax reporting cannot be used if the law of the subject has introduced standards for deductions from the property tax of organizations to local budgets.

Submitting a single return is not an obligation, but a right of the taxpayer. Therefore, he can submit a property tax return to each tax authority with which he is registered at the location of the real estate.

How to notify the tax authority

A notice of the procedure for submitting a tax return is submitted annually before March 1 of the year, which is the tax period in which the procedure in question for submitting a tax return is applied. To do this, you need to use the form approved by Order of the Federal Tax Service of the Russian Federation dated June 19, 2019 N ММВ-7-21/ [email protected]

Since March 1, 2020 falls on a weekend, the deadline for submitting the notification is postponed to March 2, 2020. Thus, the taxpayer needs to meet the period from January 1 to March 2, 2020 in order to notify the tax authorities of his decision to submit a single declaration on the property tax of organizations, the tax base for which is determined as the average annual value.

During the tax period, the procedure for submitting the declaration cannot be changed.

Generate documents for paying taxes, receive notifications about requirements from the tax office.

To learn more

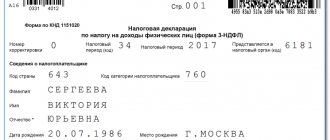

Title page

On the title page please indicate:

- adjustment number (for the primary declaration “0—”, for the updated declaration “1—”, “2—”, etc.);

- the reporting year for which the declaration is being submitted;

- tax office code;

- code of the place of reporting (in accordance with Appendix 3 to the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895);

- full name of the organization;

- code of the type of economic activity according to OKVED 2 or OKVED (Order of Rosstandart dated September 30, 2014 No. 1261-st);

- code of the reorganization form (in accordance with Appendix 2 to the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895) and TIN/KPP of the reorganized organization (in accordance with clause 2.8 and subclause 1 clause 3.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895), if a reorganization took place;

- contact phone number of the organization;

- the number of pages on which the declaration is drawn up;

- the number of sheets of supporting documents (copies thereof) attached to the declaration, including documents (copies thereof) certifying the authority of the representative of the organization who submits the declaration.

On the title page, indicate the date the report was completed. It is also mandatory that the person who certifies the declaration and the completeness of the information in it affixes his signature. A stamp can be affixed if the organization has one.

If this is the head of the organization, indicate his last name, first name and patronymic. In this case, in the section of the title page “I confirm the accuracy and completeness of the information specified in this Declaration”, put “1”.

In the section of the title page “I confirm the accuracy and completeness of the information specified in this Declaration,” put “2” if the report is certified by a representative of the organization:

- employee or outsider. Then indicate his last name, first name and patronymic, as well as a document that confirms his authority, for example, a power of attorney. In this case, the declaration is signed by a representative;

- outside organization. In this case, indicate the name of such a representative organization, as well as the last name, first name and patronymic of the employee who is authorized to certify the report on its behalf. He also certifies the declaration with his personal signature. The seal is affixed by the representative organization. In addition, documents confirming the authority of the representative organization are indicated. It could be a contract.

Here, for example, is how to fill out information about a representative - an employee of an organization:

This procedure is provided for in Section III of the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Section 1

In section 1 please indicate:

- on line 010 – OKTMO code according to the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st. If the OKTMO code value is less than the number of cells allocated for it, put dashes in the empty cells;

- on line 020 – BCC for property tax;

- on line 030 - the amount of tax payable to the budget according to the codes KBK and OKTMO, indicated on lines 010–020 of the corresponding block. The procedure for calculating this indicator is given in subclause 3 of clause 4.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895. If the resulting value is negative, put a dash on line 030;

- on line 040 – the amount of tax to be reduced based on the results of the tax period. This figure represents the difference between the tax for the year and the accrued advance payments. From these amounts, subtract the tax that was paid abroad on the property of a Russian organization located on the territory of another state. If the resulting value is negative, enter it without the minus sign. And when it is positive, then enter zero.

Fill out separate sections 1 for all cases when you pay tax by location:

- a Russian organization or a place where a foreign organization operates through a permanent representative office;

- a separate division with property allocated to a separate balance sheet;

- real estate taking into account the peculiarities of the budget structure of the regions.

Each Section 1 must be signed by the head of the organization or other authorized representative. Don’t forget to include the date you made the declaration:

This procedure is provided for in clause 2.4 and section IV of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Situation: which OKTMO code – 8-digit or 11-digit – should I indicate in my property tax return?

It all depends on how the tax is distributed between budgets of different levels in a particular region.

The explanation is simple. Despite the fact that the declaration itself has 11 cells for filling out OKTMO, you must indicate the code that corresponds to the final recipient of the tax. That is, OKTMO budgets of municipalities (8 characters) or smaller territorial associations (11 characters). Therefore, there are two options.

Option 1. The property tax can be sent entirely to the regional budget or distributed in whole or in part between municipalities of a constituent entity of the Russian Federation. In this case, indicate OKTMO of eight characters in the declaration.

Option 2. As a result, property taxes can also be redistributed to the budgets of smaller territorial associations that are part of municipalities. For example, various settlements, towns, districts, villages, uluses, etc. Then the 11-digit OKTMO must be entered in the declaration.

This procedure follows from paragraph 1.6 of Appendix 3 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 and the order of Rosstandart dated June 14, 2013 No. 159-ST.

How is the tax distributed?

The decision on how to distribute property taxes between budgets of different levels is made by regional authorities. Therefore, you can find out this procedure in a particular region from local regulatory documents. Or check with your tax office. Typically, such information can be found on inspection information boards.

How to fill out OKTMO in the declaration

Regardless of how many characters must be indicated in section 1 of the declaration, fill out the line “OKTMO Code” from left to right. If you enter an 8-digit code, put dashes in the cells left empty.

For example, in Moscow property taxes are distributed at the level of municipal districts. In most cases, they correspond to 8-digit OKTMO. And this is what the code entry will look like in the property tax return in Novogireevo:

Situation: how to correctly indicate the amount of tax in section 1 of the property tax return. Is the tax calculated at the end of the year less than the advance payments? The organization does not have property in other countries.

Indicate the tax on line 040 of section 1 of the declaration. There is no need to put a minus sign or fill out line 030.

This is exactly the procedure established by subclause 4 of clause 4.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

An example of filling out section 1 of a property tax return. The tax calculated at the end of the year is less than the amount of accrued advance payments. The organization does not have any property located in other states

The amount of the organization’s property tax for 2020 is 166 rubles. The amount of advance payments for property tax accrued to the budget for the nine months of 2020 is 175 rubles.

The amount of tax to be reduced is: 166 rubles. – 175 rub. = 9 rub.

The organization's accountant reflected this amount on line 040 of section 1 of the property tax return. In line 030 of the declaration, the accountant added dashes.

Section 2

Section 2 is completed and submitted by:

- Russian organizations;

- foreign organizations that have permanent representative offices in Russia.

Section 2 should be completed separately regarding:

- property, the tax on which is paid at the location of the Russian organization or permanent representative office of a foreign one (property type code – 3);

- property of each separate division of a Russian organization with a separate balance sheet (property type code – 3);

- geographically remote real estate (property type code – 3);

- property for the taxation of which different tax rates are applied (property type code – 3);

- real estate included in the Unified Gas Supply System (property type code – 1);

- each property that is simultaneously located on the territory of different constituent entities of the Russian Federation (property type code – 2);

- each property that is simultaneously located on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation, the continental shelf or the exclusive economic zone of the Russian Federation (property type code – 2);

- own property of a Russian organization, if it is located on the territory of another state where the tax on it has already been transferred (property type code – 4);

- property for which a special tax benefit is provided. In addition to those benefits that completely exempt you from paying tax, as well as those that reduce the tax rate;

- property of a resident of the Special Economic Zone in the Kaliningrad Region, which he created or acquired during the implementation of an investment project (property type code - 5);

- public railway tracks, main pipelines, energy transmission lines, as well as structures that are an integral technological part of these facilities (property type code – 6).

In section 2 on lines 020–140 in columns 3–4, indicate the residual value of fixed assets for the reporting period, including preferential property. Include in the declaration only information about objects subject to property tax. Do not include information about all other property and other assets in the declaration.

Indicate the residual value of the property at the end of the year separately, in line 141:

On line 150, indicate the average annual value of property for the tax period, determined by dividing the sum of lines 020–140, column 3 by 13. Read in more detail how the average value of property for the reporting period is determined.

If the organization uses a benefit, then on line 160 indicate the benefit code given in Appendix 6 to the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Attention: starting from 2020, two new property tax benefits are in effect:

- for movable property that the organization registered after December 31, 2012 (clause 25 of Article 381 of the Tax Code of the Russian Federation);

- for any property of participants in the free economic zone in Crimea and Sevastopol (clause 26 of article 381 of the Tax Code of the Russian Federation).

There are no codes for these benefits yet (Appendix 6 to the Procedure for filling out a property tax return, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895). Before making changes to the order, indicate the following codes in the declaration:

- code 2010257 - for movable property that the organization registered on January 1, 2013;

- code 2010258 – for the property of participants in the free economic zone in Crimea and Sevastopol.

This was stated in the letter of the Federal Tax Service of Russia dated December 12, 2014 No. BS-4-11/25774.

On line 270, reflect the residual value of all fixed assets that are listed on the organization’s balance sheet as of December 31 of the reporting year. The exception is fixed assets that are not recognized as objects of taxation in accordance with subparagraphs 1–7 of paragraph 4 of Article 374 of the Tax Code of the Russian Federation. There is no need to indicate their residual value on line 270. The cost of fixed assets specified in subclause 8 of clause 4 of Article 374 of the Tax Code of the Russian Federation should not be excluded from the calculation.

This is stated in paragraphs 5.1–5.3 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Please note: from January 1, 2020, the content of subparagraph 8 of paragraph 4 of Article 374 of the Tax Code of the Russian Federation has changed. Previously, it talked about movable fixed assets registered after December 31, 2012. Now this subparagraph refers to any fixed assets that are included in the first or second depreciation group according to the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1.

The procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895, does not take these changes into account. Fixed assets included in the first or second depreciation group are not recognized as an object of taxation, regardless of when they were registered. However, when filling out the declaration for 2020, data on their residual value must be included in the indicator on line 270. This is stated in the letter of the Federal Tax Service of Russia dated August 7, 2020 No. BS-4-11/13906.

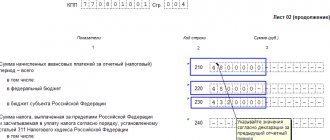

Here, for example, is what a completed Section 2 tax calculation will look like:

Situation: is it necessary to reflect the value of the land plot, which is listed on the organization’s balance sheet, in section 2 of the property tax declaration?

No no need.

After all, land plots are not subject to property tax. Property tax reporting reflects only fixed assets - objects of taxation. Therefore, there is no need to show information about land plots in the declaration. This follows from subparagraph 1 of paragraph 4 of Article 374 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated December 8, 2014 No. 03-05-06-02/62855.

Situation: how to reflect the value of preferential property in the property tax return? The organization lost the right to the benefit in the middle of the year.

There is no need to completely exclude such property from the declaration. But fix its cost - on the date when the benefit ended.

The residual value of the preferential property is reflected in section 2: on lines 020–141 in column 4 (clause 5.3 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895).

How to fill out these lines if you lost your right to benefits in the middle of the year? In this case, when calculating the average value of the preferential property, you need to take into account its residual value on the 1st day:

- each month in which you use the benefit;

- the month from which you stop using the benefit.

This is explained by the fact that to calculate the tax, the residual value of the property is fixed as of the beginning of the day. That is, as of 0 o'clock on the 1st day of the month. For example, to calculate the average value of property for the first quarter, you need to take its residual value as of four dates, including April 1, and divide by 4.

This follows from the provisions of paragraph 4 of Article 376 of the Tax Code of the Russian Federation, subparagraphs 3 and 4 of paragraph 5.3 of the Procedure for filling out the declaration, subparagraphs 3 and 4 of paragraph 5.3 of the Procedure for filling out the calculation, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 , as well as from the letter of the Ministry of Finance of Russia dated July 14, 2010 No. 03-05-05-01/26.

An example of filling out section 2 of calculating advance payments for property tax. The organization lost its right to benefits in May

Alpha LLC enjoyed the benefit until May 1, 2020. The property that Alpha acquired for an investment project was exempt from tax (clause 3 of article 2 of the Law of the Udmurt Republic of November 27, 2003 No. 55-RZ).

The accountant reflected the value of the preferential property in a separate section 2 of the calculation of advance payments for property tax for the six months.

When calculating the average value of preferential property, the accountant divided the total residual value by seven months:

(RUB 1,785,310 + RUB 1,652,131 + RUB 1,518,952 + RUB 1,839,471 + RUB 1,512,808): 7 = RUB 1,186,953

The average value of all property for six months is:

(RUB 67,650,000 + RUB 66,547,913 + RUB 65,445,826 + RUB 68,789,432 + RUB 65,207,261 + RUB 61,625,090 + RUB 58,042,919): 7 = RUB 64,758,346 .

The property tax rate is 2.2 percent.

The advance payment for property tax for the six months is:

(RUB 64,758,346 – RUB 1,186,953) × 2.2%: 4 = RUB 349,643