Before determining whether per diem is subject to insurance premiums, here are some key points to remember about business travel.

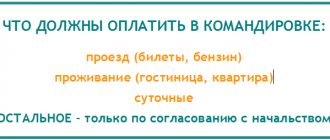

The employer is obliged to pay the posted employee:

- travel to and from your destination;

- accommodation (housing rental);

- expenses related to the performance of labor duties;

- costs that compensate for the inconveniences associated with living outside the place of residence, or CP.

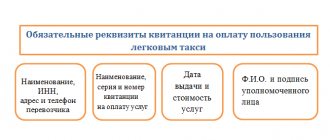

Travel and accommodation costs are determined based on actual expenses incurred. Moreover, such expenses will have to be documented. That is, provide checks, tickets or receipts. With SR the situation is different. It is quite problematic to document such expenses. Therefore, it is necessary to set a limit for SR - a specific amount of money that will be given to the employee for one day of stay on a business trip.

Determining limits

So, the current legislation does not establish a maximum size of SR. However, officials have determined a certain limit, above which daily allowances in excess of the norm are subject to insurance premiums (2018).

Article 217 of the Tax Code establishes that excess daily allowances are subject to insurance contributions (2018). Also, personal income tax will have to be withheld from amounts exceeding the limit. The limits are set as follows:

- for trips within Russia - 700 rubles per day;

- for foreign business trips - 2500 rubles per day.

In other words, if an institution has established large values for this type of expense, then the amount exceeding the limit is subject to taxation (personal income tax and personal income tax). Please note that this limit only applies to taxation. The company has the right to establish a CP greater than specified in Art. 217 Tax Code of the Russian Federation.

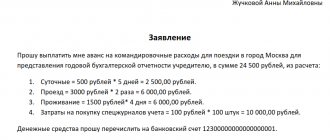

Using a specific example, we will determine whether daily allowances are subject to personal income tax and insurance premiums.

Primerov Ivan Andreevich was sent to Moscow for 10 calendar days. 43,000 rubles were allocated for travel expenses, including:

- 5000 rub. - to pay for travel;

- 18,000 rub. — for rental housing (payment for a hotel room);

- 20,000 rub. - SR (2000 rubles per day, therefore, daily allowances over 700 rubles, insurance premiums will have to be charged).

Amounts allocated for travel and accommodation are not subject to taxes. But above-limit daily allowances are subject to insurance premiums. Let's do the calculation:

- We determine the amount of excess (2000 rubles – 700 rubles) × 10 days. = 13,000 rub.

- We calculate personal income tax: 13,000 × 13% = 1,690 rubles.

- We determine the amount of SV: 13,000 × 30.2% (OPS - 22%, compulsory medical insurance - 5.1%, VNIM - 2.9%, NS and PZ - 0.2%) = 3926 rubles.

Consequently, Examples will receive 41,310 (5000 + 18,000 + (20,000 – 1690)) rubles. And the company’s expenses will amount to 46,926 (43,000 + 3926) rubles.

Please note that one-day business trips and daily allowances (insurance contributions) are no exception. You will still have to withhold personal income tax on the excess and pay the contribution tax to the budget.

Accounting entries when reflecting daily allowances for business trips

These are the company's expenses normalized in tax accounting, by which it can reduce profits. For business trips in Russia, this norm is 700 rubles. per day, abroad – 2100 rubles. If you give an employee amounts exceeding these limits, you will have to withhold personal income tax. Example of postings Example: An employee is sent on a business trip for 6 days.

Info

The tickets were purchased by the organization from the airline. Their cost is 31,270 rubles. Expenses on a business trip to pay for hotels amounted to 13,000 rubles.

( VAT 1983 rubles), for the use of public transport - 250 rubles, entertainment expenses - 3000 rubles. Daily allowances were issued in the amount of 4,200 rubles. and travel allowances in the amount of 12,000 rubles.

https://youtu.be/BmkqLD0kHIY

How are daily personal income tax and insurance premiums assessed?

The taxation procedure for SRs exceeding those established in Art. 217 of the Tax Code of the Russian Federation, the general one applies. For personal income tax, the rate is set at 13%. Let us remind you that not the entire amount is taxed, but only the difference exceeding the permissible limit.

For example, a company operates in the field of IT technologies and has the right to reduced insurance rates:

According to the conditions of the example given above, the company will pay to the budget not 3,926 rubles (13,000 × 30.2%), but only 1,846 rubles (13,000 × 14.2% (8% + 4% + 2% + 0.2% Therefore, insurance premiums for excess daily allowances are calculated and paid at preferential rates if the company has a legal right to them.

Daily allowances based on insurance premiums 2020

Many accountants wonder whether per diem is correctly reflected in the calculation of insurance premiums? Tax officials gave an official explanation that not only SR, but also all amounts of travel expenses should be included in the calculation of SV.

So, when filling out the report, indicate the entire amount that was accrued to the posted employee. Don't forget to include travel, accommodation and other expenses. Enter travel expenses in line 030 of subsection number 1.1 of Appendix No. 1 to Section No. 1 of the SV report.

The amount that is not subject to taxation is indicated in line 040 of subsection 1.1, Appendix No. 1 of the first section.

Therefore, line 050 will indicate the taxable difference.

Lines 030, 040 and 050 of subsection 1.2 of Appendix No. 1 of the first section should be completed in the same way. And also lines 020 and 030 of Appendix No. 2 to the first section. Such recommendations are presented in the Letter of the Federal Tax Service dated 08.08.2017 No. GD-4-11/15569.

The information will also have to be detailed in the third section of the DAM. Namely, in part 3.2.1 of the third section, reflect the daily allowance in the report on insurance premiums as follows:

Let's sum it up

So, we have identified the following important points:

- The CP limit is set by the organization independently.

- The norms must be enshrined in the order.

- If the CP per day exceeds 700 rubles. for trips around Russia and 2500 rubles. per day for business trips abroad, then amounts exceeding the daily allowance for business trips are subject to insurance contributions.

- All travel expenses should be included in reporting, namely in the DAM.

Please note that if a company does not include travel expenses in the DAM report, then tax authorities do not have the right to issue a fine. However, this only applies to non-taxable amounts. It should also be noted that if the company has not included non-taxable business trips in the DAM, then it is advisable to provide an adjusting report. But if the adjustment is not provided, then the tax authorities cannot fine the company, since the tax base is not underestimated.

What expenses are reimbursed to a posted worker?

There are often cases when employers are forced to send their employees outside the location of the organization to resolve official issues. Trips for a certain period of time, on a specific official assignment from a manager, to another locality or abroad are called business trips.

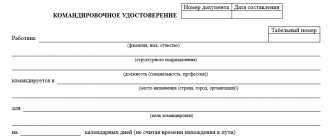

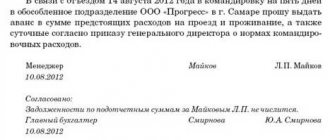

Before the start of a business trip, the employer must:

- establish the amount and procedure for paying travel expenses to an employee;

- prepare the documents necessary to send an employee on a business trip.

In accordance with the Labor Code of the Russian Federation, the employee is reimbursed for the following business trip expenses:

- for travel;

- rental of residential premises;

- additional living expenses (per diem);

- other expenses for the performance of official tasks (with the permission of the manager).

As a rule, an organization develops internal documents or a collective agreement that defines the procedure and amount of reimbursement for these expenses.

The procedure for reimbursement of business trip expenses to employees of various federal government bodies, institutions and funds, as well as municipal institutions is determined by regulatory legal acts of the government of the Russian Federation, local governments, and state authorities of the constituent entities of the Russian Federation (Part 2 of Article 168 of the Labor Code of the Russian Federation).

The concept of “per diem”

In situations where a company employee goes on a business trip in Russia or abroad, the employer undertakes to pay him a certain monetary remuneration, which is calculated per day - these are the so-called daily allowances. At the same time, there are only 3 main situations in which the employer is obliged to pay per diem. Firstly, these are business trips themselves. Secondly, business trips of employees in situations where the work is traveling in nature or occurs directly on the road. And thirdly, during expeditionary type work or in field conditions.

To study the issue more accurately, let’s look at how the law interprets business trips. A business trip is a business trip, the terms and conditions of which are determined by the employer. In this case, the place where the work will be carried out must be remote from the established one.

Per diems are not part of the housing payment when working remotely and are taken into account as additional expenses for the employee’s daily needs. As a rule, the further away the remote work location is, the greater the amount the employer pays.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Which travel expenses are subject to personal income tax?

Daily allowances are partially subject to personal income tax - they are exempt from tax only within the limits established by the Tax Code of the Russian Federation (clause 3 of Article 217 of the Tax Code of the Russian Federation).

If the manager decides to reimburse the posted employee for expenses in excess of the norm, then this difference is subject to personal income tax.

Clause 3 Art. 217 of the Tax Code of the Russian Federation establishes the following daily allowance rates:

- when a seconded employee is in the Russian Federation - 700 rubles. in a day;

- if a posted employee is located outside the territory of the Russian Federation—RUB 2,500. in a day.

Consequently, personal income tax on business trips will be calculated from the amount of 500 rubles. for each day you are on a business trip, i.e. from the difference between the daily allowance paid and the non-taxable rate established by law (1200 - 700 rubles).

What travel expenses are not subject to personal income tax?

The Tax Code of the Russian Federation stipulates what is not included in the employee’s income subject to income tax. This includes, among other things, compensation by the employer for the following expenses (clause 3 of Article 217 of the Tax Code of the Russian Federation):

- the cost of travel to the place of performance of the official assignment (regardless of the place of departure for the business trip) and back, including the cost of services in luxury cars;

- commission for airport services;

- the cost of travel to the place of departure (train station, airport), destination or transfers;

- baggage transportation.

Compensation for these expenses is not subject to personal income tax if the expenses are documented. If such documents are missing, the compensation paid is exempt from personal income tax only within the established norms (clause 3 of Article 217 of the Tax Code of the Russian Federation).

In addition, the employee must be reimbursed for the costs of renting housing on a business trip (paragraph 3, part 1, article 168 of the Tax Code of the Russian Federation). If the employee submits supporting documents, then such expenses will be compensated in full and are not subject to personal income tax. In the absence of documents, income tax will not be imposed on the amount within the limits specified in paragraph. 10 clause 3 art. 217 Tax Code of the Russian Federation.

Results

Compensation for travel expenses is not subject to personal income tax if these expenses are documented. As for the taxation of daily allowances, they are not subject to personal income tax only within the limits of the norms.

Starting from 2020, insurance premiums are not subject to daily allowances in the amount established by the Tax Code. Daily allowances in excess of this limit, even if their amount is specified in the company’s local regulations, are subject to both contributions and personal income tax.

When sent on a business trip, the employee is guaranteed reimbursement of expenses associated with the business trip, including additional expenses for living outside his permanent place of residence (per diems) (Articles 167, 168 of the Labor Code of the Russian Federation).

If sent on a business trip, the employer is obliged to reimburse the employee for travel and rental expenses, additional expenses associated with living outside the place of permanent residence (per diems), and other expenses incurred by the employee with the permission and knowledge of the employer.

The procedure and amount of reimbursement of expenses related to business trips are established in the collective agreement or local regulations of the company.

What norms are provided by law?

The issue of excess daily allowances is regulated by two main legislative documents - the Labor and Tax Codes.

The Labor Code regulates the following aspects:

- Article 168 obliges the employer to reimburse expenses of employees associated with living outside their permanent place of residence;

- the amount of daily allowance can be determined by the employer independently, and it must be fixed in a local regulatory document or collective agreement;

- The trip of an employee whose work officially involves the implementation of field activities is not considered a business trip;

- when a person is on a business trip, his salary must be accrued to him in the established amount, and his job must also be retained.

Article 168. Amount of tax presented by the seller to the buyer

The Tax Code establishes the following standards:

- the fact that daily allowances higher than the norm established by the Russian Government do not reduce the income tax base (Article 264);

- Article 217 limits the amount of daily payments that are not subject to taxation;

- The procedure according to which personal income tax is withheld is determined by Article 226.

Article 264. Other expenses associated with production and (or) sales

Article 217. Income not subject to taxation (exempt from taxation)

Article 226 Peculiarities of calculation and payment of tax by tax agents when carrying out transactions with securities

Important regulatory documents are decrees of the Russian government, which address the problem of paying daily allowances to employees. In the first document, number 93, you can find information about the daily allowance standards that can be paid. The second, numbered 729, displays the amount of reimbursement for expenses incurred during a business trip, which should guide budget structures.

Insurance premiums based on daily allowance

Since 2020, the Federal Tax Service of Russia has been administering the procedure for calculating and paying insurance premiums to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund of Russia (with the exception of contributions for injuries). In this regard, the Tax Code has been supplemented with a new chapter 34 “Insurance premiums”. It sets out the rules for calculating and paying contributions.

Thus, it has been established that daily allowances in the amount of:

no more than 700 rubles for each day of a business trip in the Russian Federation;

no more than 2,500 rubles for each day of being on a business trip abroad (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

Until 2020, daily allowances were not subject to insurance premiums within the limits established by the company itself in its local regulations.

Thus, from 2020, daily allowances in excess of these standards should be subject to contributions, regardless of whether the excess amounts are prescribed in local regulations or not.

As a general rule, the date of payments is determined as the day they are accrued (clause 1 of Article 424 of the Tax Code of the Russian Federation). The date the employee receives income in the form of excess daily allowance is the day the advance report is approved.

This means that daily allowances that exceed the norm are included in the base for calculating insurance premiums in the calendar month in which the employee’s advance report is approved.

Let us remind you that upon returning from a business trip, the employee is obliged to submit an advance report on the amounts spent in connection with the business trip, including daily allowances, within three working days, and make a final payment on the cash advance issued to him before leaving for the business trip for travel expenses (clause 26 Regulations on business trips, approved by the Government of the Russian Federation of October 13, 2008 No. 749).

Please note that daily allowances are not subject to insurance premiums for injuries (Clause 2, Article 20.2 of Federal Law No. 125-FZ of July 24, 1998). In this case, the amount of daily allowance does not matter.

What to look for in 2019

In 2020, it makes sense for accountants to be more careful regarding excess daily allowances: insurance premiums will have to be charged on them. And the main thing here is not to get confused. After all, earlier, in 2016 and earlier, any amount of daily allowance was free from contributions. The main guarantee was that their maximum values were specified:

- in a collective agreement;

- regulations on business trips or other internal acts.

However, in 2020, insurance premiums from daily allowances in excess of the norm will have to be paid to the treasury. At the same time, the daily allowance standards remained at the same level (clause 2 of Article 422 of the Tax Code of the Russian Federation):

- for business trips in Russia – up to 700 rubles;

- for foreign business trips – up to 2.5 thousand rubles.

Thus, daily allowances in 2020 are subject to insurance premiums if they exceed these values.

According to the law, daily allowances are additional costs in connection with staying in a place other than your permanent residence (see 168 of the Labor Code of the Russian Federation).

As you can see, legislators have equated the daily allowance standards that have long been in effect in relation to income tax. Therefore, from the specified norm of the head of the Tax Code of the Russian Federation on insurance premiums, a direct reference is given to the third paragraph of Article 217 of the Tax Code of the Russian Federation.

Also see “Excess Per Diem Rules.”

Personal income tax on daily allowances

Excessive daily allowances are also subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Calculation of personal income tax on excess daily allowances is made on the last day of the month in which the advance report is approved. And the calculated tax is withheld, for example, from the salary amount. The withheld personal income tax must be transferred to the budget no later than the day following the day of payment of income (subparagraph 6, paragraph 1, article 223, paragraphs 3, 6, article 226 of the Tax Code of the Russian Federation).

Income in the form of daily allowances exceeding the standards established by law, when filling out section 3 of the certificate in form 2-NDFL, is reflected under income code 4800 “Other income” in the month of approval of the advance report (letter of the Ministry of Finance of Russia dated June 21, 2016 No. 03-04-06/36099 , dated 06.10.2009 No. 03-04-06-01/256, Federal Tax Service of Russia dated 19.09.2016 No. BS-4-11/17537). But daily allowances within the norms are not subject to personal income tax and are not reflected in the 2-personal income tax certificate.

Over-limit daily allowances are also subject to reflection in section 2 of the calculation in form 6-NDFL (approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ).

The daily allowance for a business trip in Russia was paid on March 13, 2017. Their size is established in local regulations in the amount of 1000 rubles. per day. The advance report on the results of the business trip was approved on 03/25/2017, the salary for March was paid on 04/05/2017. Personal income tax transfer was made on 04/06/2017.

Section 2 of the calculation in form 6-NDFL for the half year 2020 should be completed as follows:

- line 100 “Date of actual receipt of income” - the last day of the month in which the advance report was approved - 03/31/2017;

- line 110 “Date of tax withholding” - date of payment of the next salary - 04/05/2017;

- line 120 “Tax payment deadline” - 04/06/2017;

- line 130 “Amount of income actually received” - the amount of excess daily allowance;

- line 140 “Amount of withheld tax” - withheld personal income tax (letter of the Federal Tax Service of Russia dated April 27, 2016 No. BS-4-11/7663).

Display in accounting

Payment of excess daily allowances must be reflected in the financial statements. The documents must reflect both direct daily allowance payments and withheld insurance premiums, as well as personal income tax.

For example, an employee is sent by the employer on a business trip within Russia for 7 days. His daily allowance is 1,200 rubles, which is 500 rubles higher than the established norm. For the days allotted for a business trip, the employee will be paid an amount of 8,400 rubles.

In the calculation table it looks like this:

| No. | Debit/Credit | Sum | Operation | date |

| 1 | 208.12; 201.34 | 8400 | An amount was issued from the organization's cash desk for daily expenses | Date on which the daily allowance was paid |

| 2 | 401.20; 208.12 | 8400 | The daily payment by the date of approval of the advance report is shown in expenses | Date when the expense report was approved |

| 3 | 302.11; 303.01 | 455 | Personal income tax is withheld from the employee’s salary (8400 – 700*7)*0.13=455 | The date of the next salary payment |

Similar rules for indicating payments and expenses are contained in the Instructions for the use of budget accounting plans of accounts, approved by the Ministry of Finance of the Russian Federation in 2010.

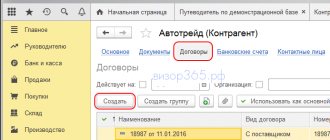

The question often arises, which 1C income code should be used when it comes to excess daily allowances. In this case, code 4800 is used; it is intended for other expenses for which personal codification is not provided.

Daily allowance and income tax

In 2020, when calculating income tax, daily allowances do not need to be normalized. The company has the right to write them off in the amount provided for by internal documents: collective agreement, regulations on business trips and other regulations of the company.

Travel expenses, including daily allowances, are taken into account as other expenses associated with production and sales. They are recognized on the date of approval of the advance report. This rule applies to both the accrual method and the cash method (subclause 12, clause 1, article 264, subclause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

Insurance premiums calculated from the amount of excess daily allowance are included in other expenses associated with production and sales on the date of accrual (subclause 1, clause 1, article 264, subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

When is the daily allowance excessive?

The concept of excess daily allowance comes into play when the employer pays to an employee an amount of daily allowance that exceeds the norm established by law. Separately, you should pay attention to those expenses that are not considered daily subsistence allowance, but must also be paid by the employer:

- Travel expenses using any transport (car, bus, train, plane, etc.).

- Accommodation costs for the entire period of the business trip (hotels, guest houses, hostels, rental housing, etc.).

- Other types of expenses related to needs and arising as a result of the employee living away from home.

Any other expenses are called daily allowances, which must be paid by the employer. If necessary, these daily allowances can be increased by the employer himself, and in situations where the amount paid exceeds the permissible norm, they will be considered excess. Excessive daily payments, as a rule, should be subject to tax contributions established by the legislative framework. If taxes are not made, the matter could take a serious turn, even leading to trial.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |