Business lawyer > Accounting > Remuneration > What is included in the daily allowance: explanations on all issues

A person sent to carry out a business trip is provided with a sum of money for various expenses. This type of cash payment has a peculiarity: in fact, it is not documented anywhere. Because of this, nuances arise that require clarification. This article provides detailed information regarding the regulation of payment and the amount of daily allowance. Information is current for 2020.

What is included in the concept of daily allowance and why are they needed?

Daily allowance is money given to an employee by an organization, the amount of which is calculated based on the estimated expenses per day. Per diems are part of travel expenses. The interpretation of the term is given and enshrined in the Supreme Court.

Business trip

The employer provides funding for additional expenses that an employee will need while on a business trip. Employees receive daily allowances for each business trip; this is regulated by law. Simply put, it is pocket money that is given to employees by their employer while they are on a business trip.

These additional costs include:

- purchasing tickets for public transport

- money to buy food

- other personal needs of the employee

What payment is guaranteed by law?

If an employee goes on a business trip, the employer, that is, the head of a budgetary institution, must provide such a specialist with compensation for his expenses. Such expenses are associated not only with the purchase of tickets or renting a hotel room. Additionally, the payment for a business trip includes expenses that are aimed at compensating for the inconveniences associated with living outside the place of the main residence, that is, daily allowances.

However, this is not a final list of guarantees. So, according to Art. 168 of the Labor Code of the Russian Federation, the employer must guarantee the preservation of the workplace and payment according to the average earnings of the business trip.

Types of daily allowances

Classification

The daily allowance will be received by the employee before the upcoming assignment on a business trip. The Labor Code obliges the employer to make daily allowance payments.

Daily allowances are paid:

- when sending your employees on a local or foreign business trip

- when constantly working on the road, during constant field trips, when equipping for an expedition or geological exploration

- when an employee is attending advanced training classes

Procedure for calculating and paying daily allowances

The exact amount of daily allowance is not reflected in the Labor Code and is calculated each time on an individual basis. The daily allowance varies on each business trip. All expenses of an employee who goes on a business trip are agreed upon in advance.

The law does not provide for a limit on establishing the maximum amount of daily allowance payments.

However:

- In Russia, the maximum daily allowance from which tax will not be collected is 700 rubles.

- For business trips abroad – 2500 rubles.

The amount of daily allowance will depend on the calculation of other expected expenses during the business trip. While the employee has not yet gone on a business trip, the number of days it will take to complete the business trip is calculated. The start of a business trip will be considered the departure from the place of work. The time spent on the way to the train station, airport, bus station is included in the travel allowance.

Per diem and accounting

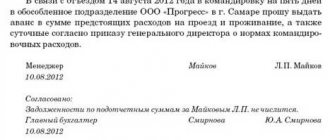

The duration of any business trip will be confirmed by travel documents, which are presented to accountants when the employee completes the trip and returns to his permanent place of work. In addition, the employee provides a report on the advance payment. The employee will not receive daily allowance until the employer issues an order for the employee to travel on a business trip.

Daily allowance accounting

Since 2015, the previous package of documents is no longer needed to confirm the business purpose of a future business trip. Now daily allowance payments are declared according to the company’s internal procedures and are prescribed only in the order to send an employee on a business trip.

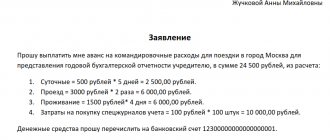

All expenses incurred from the daily allowances issued to employees are recorded in an advance report, which is filled out by an employee who has returned from a business trip. Before the trip, the employee fills out an application in which he requests funds for personal needs. Once completed, the application is submitted to the accounting department. The application must be signed by the chief accountant, the head of the organization and the employee being sent.

Daily allowance for trips abroad

The currency in which daily allowances are issued for a foreign travel assignment is determined by the employer himself. Daily allowances received in foreign currency are converted into the ruble equivalent of the Central Bank exchange rate (based on the last day of the month), in which the advance report is approved.

Upon returning, the employee (no later than ten days after arrival) must present an advance report. The report must indicate the following:

Business trip abroad

- all documents that record the spending of issued money (checks, receipts, etc.)

- a report detailing all the activities involved in completing a travel assignment

- scanned page of a foreign passport with customs marks

The daily allowance is issued to the employee in the form of an advance, which is calculated according to the travel estimate. The amount of daily allowance issued by a commercial organization is determined by it itself, but in any case it will not be lower than the legally established minimum.

Daily allowances are accrued according to foreign standards immediately after departure from Russia. This formality also works in the opposite direction. The day the amount of money given as daily allowance changes is determined by the stamp in the passport at the border.

Unspent funds must be returned to the company's cash desk.

Daily allowance for one-day business trips

The issuance of daily allowances for trips of a day or less has not yet been fully regulated. An employer can give employees money for one-day business trips if this is confirmed and secured by a collective agreement. Then the daily allowance will be considered other expenses that the employer himself allowed.

Payment of daily allowances

If an employee, while on a one-day business trip, has the opportunity to come to his place of residence every day, the employer has a legal basis not to pay the daily allowance. This nuance is regulated by Regulation No. 749. But if the employee and the employer agree, the daily allowance can be paid in a smaller amount or even replaced with a one-time salary increase.

The employer may consider the amount of the daily allowance payment to be insignificant and retroactively include it in other travel expenses. In the event of a controversial situation, the employer may justify non-payment of daily allowances for business trips of less than 24 hours by the fact that the employee does not need to pay for housing.

For one-day business trips or work trips to another country, the employee will receive a daily allowance in the amount of 50% of the amount reflected in the internal regulations of the organization. The payment is made in the currency of the country where the employee is sent.

Per diems for day trips are still controversial. An employer often tries to withhold daily allowances and deprive employees of them, motivating this in different ways. Employees' knowledge of the relevant chapters of the Labor Code will help them solve this problem to their advantage.

Daily allowances on weekends and non-working days

Daily allowances are also accrued for weekends that fall during a business trip. The employee will receive them in any case, even if he does not work on a business trip. Although such payments are regulated by labor legislation, the size and timing of accrual can be regulated within the enterprise, in accordance with its internal regulations.

Weekend work

Payment will apply not only to work and leisure during the weekend spent on a business trip. An employee receives benefits when going on a business trip on weekends, including non-working days:

- daily allowance payments are made at double rate

- For each day off or non-working day spent without accrual of daily allowance, the employee deserves an extraordinary day off paid by the employer

Daily allowances for weekends can also provoke a conflict situation with management. But here the situation is resolved more simply, because the law will be on the employee’s side. An exception may be the payment of daily allowances on non-working days designated by the company’s internal regulations. This could be a day off due to a holiday for one of the employees, the head of the company, the anniversary of the founding of the company and other similar occasions. If the issuance of daily allowances on such days is not agreed upon by the company’s regulations, then an arbitration court will help resolve the situation.

FAQ

Question No. 1 What is daily expenses?

Answer: Daily expenses are additional expenses of an employee, which are intended to pay for housing and food outside the place of residence.

Question No. 2 What is the amount of daily expenses for a business trip in Russia and abroad?

Answer: According to the law, the amount of daily expenses is not established. Each enterprise independently sets the amount of daily allowance in its internal documents. But there are minimum amounts from which personal income tax will not be paid. These amounts are: daily allowance in Russia - 700 rubles, daily allowance abroad - 2500 rubles. If the company has established more than this amount, then it must pay personal income tax on the amount that exceeds the minimum. For example, an enterprise has set 3,000 rubles for traveling abroad, then from 300 rubles it is necessary to pay 13% personal income tax.

Question No. 3 What can be included in daily expenses?

Answer: Typically, daily expenses include: transportation costs; living expenses; food expenses; expenses for business calls, Internet, banking or postal services, etc. In general, a posted worker can spend his daily allowance on whatever he wants and is not required to report on it.

Question No. 4 In what currency will daily allowances be paid when traveling abroad?

Answer: The enterprise independently determines in its regulations in what currency to pay travel allowances. The daily allowance that is paid to an employee during a business trip in foreign currency must be converted into ruble equivalent at the Central Bank exchange rate on the last day of the month in which the advance report is approved.

Per diem and taxation

On daily allowances the amount of which exceeds the undeclared amount of 700 and 2,500 rubles (for local and foreign trips, respectively), personal income tax payments are paid. Per diem cannot be considered employee income. For this reason, daily allowances cannot be considered income taxable under personal income tax. Payments for daily allowances in excess of the duty-free allowance will be taken into account when the tax base is determined.

Taxes

Payments issued instead of daily allowances are also not subject to tax within the limits of the law. For example, during a one-day one-time business trip, the employer can pay employees a monetary remuneration instead of daily allowance.

When compiling the tax base, you need to remember that daily allowances paid to employees for any needs are an accountable amount. Until the manager's final approval of the expense report, per diem is not an expense of the employer. Accordingly, until the report is signed, tax payment for excess daily allowance cannot be made.

Personal income tax payments from overtime daily allowance cannot be recovered from the employee. All unspent money is given back to the cash desk of the organization that issued it.

Many organizations, when sending their employees on a foreign business trip, give other monetary compensations instead of daily allowances. At the same time, personal income tax is withheld in full from the entire amount, not only in regulatory norms. This is a risky approach for the employer and is recommended to be used as rarely as possible. During a tax audit, this will be noted as a violation and a fine will be issued. The fact is that Government Decree No. 749 directly states that it is necessary to give the employee daily allowances.

Cost estimate for a business trip abroad

The travel allowance estimate for foreign trips may differ from that calculated for business trips within the country. Firstly, the amount of daily allowance in this case is much higher. Secondly, compensation will be an order of magnitude greater due to the issuance of more expensive tickets, visas, and sometimes even a foreign passport.

On average, expenses will be 3.5 and sometimes 5 times more than for regular business trips around Russia. The formula for calculating daily allowances is also different. They can also be paid for one-day trips (fly to a meeting in the morning, negotiate and return in the evening). It’s just that in this case only half of the daily allowance is paid - not 2500, but 1250 rubles.

Free 24/7 legal support by phone:

- daily allowance in foreign currency;

- currency exchange costs;

- consular fees when applying for a visa;

- state duty when obtaining a foreign passport or expenses for intermediary services;

- accommodation, travel, food at higher prices than in Russia;

- entertainment expenses (restaurant or meeting room, etc.);

- services of a translator or other consultants;

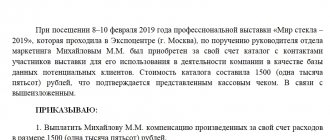

- payment for participation in a conference, master class, exhibition;

- baggage storage, airport and other fees;

- payment for courier and baggage carrier services;

- mobile, Internet, scanning, photocopying.

In this case, the calculation of travel allowances can be carried out in foreign currency, which sometimes presents certain difficulties. Currency accounting is carried out in rubles at the current exchange rate. If the advance was issued in rubles, then foreign currency expenses are recalculated at the exchange rate on the date of payment. The minimum amount of daily allowance, which is not subject to tax and social security contributions, is 2,500 rubles. It also happens that for the day of entry the daily allowance is accrued in national currency, and for the day of departure - in foreign currency.

https://youtu.be/v8A5MPmdkmU

Filling out an advance report

When filling out an advance report, the employee will be required to have documents with him that confirm the expenditure of the daily allowance. The advance report is a completed form No. AO-1.

Procedure for filling out an advance report:

Compilation of a report

- The first paragraph of the advance report is the name of the organization

- Report date and number

- The position of the posted employee and the work unit

- The reason for drawing up the report is indicated (business trip)

- The report includes all actual expenses incurred during the trip.

- Sheet number 2 lists all expenditure documents on which each expenditure of the money issued is recorded.

- Then the report is approved by the accounting department, where the debit and credit numbers are written down

- The completed expense report is submitted to the manager, he approves and signs

How does the online travel allowance calculator work?

Step 1. In the first column of the calculator, indicate the employee’s total earnings for the billing period. You can calculate the amount for more than a month; in this case, do not forget to sum up the salary and other payments to the employee.

Step 2. Indicate in days how many days the employee worked during the pay period and how long he was on a business trip.

Step 3. Enter the amount of daily allowance that is established in the organization. This amount must be established by a local act.

Step 4. Click on the Calculate button.

Step 5: The result will be displayed in the table below. In addition to the amount of travel allowances, the calculator will calculate the average daily earnings and the amount of daily allowance.

Cancellation of daily allowances in Russia

Conversations that daily allowances will finally be completely abolished and they will no longer be paid for business trips in Russia have been going on for a long time. But the Ministry of Finance’s resolution number 749 seems to put an end to this story. The daily allowance remains only for trips abroad. Budgetary organizations will be able to cut costs and save money, because previously they always had to pay daily allowances to everyone.

The attitude of workers and management to this news is ambiguous. On the one hand, the daily allowance could already be replaced with other monetary compensation, and the employee would not be left without money at all. On the other hand, in companies where this point is quite clearly stated in the regulations, the employee is completely deprived of his daily allowance. Rewriting regulations to accommodate a new regulation will take time and cost.

Top

Write your question in the form below

How much is the employee reimbursed?

It often happens that the purchase of tickets and booking a hotel room is handled directly by the company administration, which means that the employee does not receive money for this. And there are no questions with them. But if money for travel expenses is given to a person, then you need to understand what standards are used to reimburse them.

By law, travel expenses allow an employee to get to their destination, buy food, pay for accommodation, and afford other things previously agreed upon with the head of the company. And since the person went to perform an official assignment, he should be compensated for all expenses incurred and agreed upon with his superiors, and not consider the amount issued as income. That is, neither income tax nor insurance premiums are withheld from them. But this is provided that the company has approved a regulatory document (regulations on business trips), which provides for compensation standards, as well as the procedure for this procedure.

The only expense item that is standardized at the legislative level is the amount of daily allowance. In particular, the Tax Code of the Russian Federation states that daily allowances issued in the following amounts are not subject to personal income tax and insurance contributions:

- 700 rubles - per day of travel around the country;

- 2500 rubles - per day of a business trip abroad.

This does not mean that the employer cannot pay more. Maybe. But in this case, the company will have to withhold income tax and insurance premiums from the excess amount.

We also note that the subordinate is not required to report on what he spent the daily allowance on and whether he spent it at all. This is the item of travel expenses that is taken into account when taxing company profits without documents confirming that the money was spent.

What documents will be needed to confirm travel expenses?

No later than three days after returning from a trip, the employee is required to report on the amounts spent. Please note that all expenses must be documented and be reasonable. Otherwise, the employer may refuse to compensate them.

Documents confirming travel expenses include:

- travel certificate with notes on departure and arrival, if it was issued at the beginning of the trip;

- travel tickets, including those issued via the Internet;

- any receipts and invoices for accommodation, rental vehicles, services received or goods purchased that were purchased to perform a work assignment;

- an advance report indicating the costs, as well as the amount paid to the employee. If more was spent on a business trip than the amount of the advance payment issued, an additional payment is made. If according to the documents there is still money left, it must be returned to the cashier. Or the employer will independently deduct the required amount from wages (Article 137 of the Labor Code of the Russian Federation).

Also an important document is a report (memo) on the completion of a work assignment during a trip. Otherwise, the feasibility of travel expenses will not be proven. Note that such a report can also become a source of information about the duration of a business trip if the employee traveled to the destination by personal or official transport.