If a citizen wants to create his own business and obtain the status of a legal entity, then he must go through the state registration procedure. In addition, any legal entity to carry out activities on the territory of the Russian Federation must obtain a registration certificate and an extract from the Unified State Register of Legal Entities.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-56-12 (Moscow)

+7 (812) 317-50-97 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

These documents contain all the information about the legal entity itself. Only after entering data into the state register will the activity being carried out be considered legal. After the certificate is cancelled, extracts from state registers are issued.

What it is

A registration certificate is a document that was issued by the tax authorities before January 1, 2020, allowing the organization to carry out legal activities in Russia. It indicates the fact of making an entry in the Unified State Register, which contains information about all previously registered legal entities.

The certificate was replaced by two documents. The first is issued by the individual entrepreneur - an extract from the Unified State Register of Individual Entrepreneurs, the second document is the Unified State Register of Legal Entities, which applies to organizations and legal entities.

Thus, after the certificate was cancelled, the regulatory document became an extract containing all the necessary data. It is issued upon registration. In the future, when updating the data, you will also need to receive it.

The certificate was replaced by other documents for the transition to an electronic form of documentation, as well as for the full classification of business activities and their taxation.

All extracts and documents that replaced certificates can now be issued electronically and sent by email or through various online portals.

At the same time, a paper version of documents is also available if necessary. For example, if you need to collect a full package of paper documents, then it will include an extract from the Unified State Register of Legal Entities, instead of an outdated certificate.

You need to remember that if the certificate was issued before 2017, then it does not need to be changed, since the document has legal force. The only replacement option is the loss of relevance of any information.

Documents after LLC registration

- OGRN certificate

with the registration number assigned to the organization (as of January 1, 2019, it is no longer issued; the OGRN certificate replaces the Unified State Register of Legal Entities); - TIN/KPP certificate

with assigned taxpayer number; - Record sheet

with organization data; - Charter

with a mark and seal of the Federal Tax Service.

Read more: Application for the issuance of work-related documents

The procedure for state registration of a limited liability company has now become even simpler; prepare documents for LLC registration completely free of charge without leaving your home through the online service I have tested: “LLC registration for free in 15 minutes.” All documents comply with the current legislation of the Russian Federation.

What does a sample look like?

The certificate form is drawn up according to a specific sample No. P51001, approved by the tax authorities.

This form is used to register all legal entities operating on the territory of the Russian Federation, regardless of territorial affiliation. The certificate includes all the necessary information, which is almost identical to the document that replaced it - the registration sheet in the register (for legal entities this is strictly the Unified State Register of Legal Entities):

In fact, the information is identical, with the exception of a few points. In addition, the entry sheet regulates the place in the register for searching for the necessary information on an organization or any legal entity.

Unified State Register of Legal Entities

Until 2020, along with form No. P51003, a Unified State Register of Legal Entities record sheet was also issued according to form No. P50007 (Appendix No. 1 to the Order of the Federal Tax Service of Russia dated September 12, 2016 N ММВ-7-14 / [email protected] ), which can still be obtained today (clause 3, Article 11 of the Federal Law of 08.08.2001 N 129-FZ).

The registration sheet in the Unified State Register of Legal Entities is sent to the email specified in the Unified State Register of Legal Entities or in the application submitted for registration. You can obtain a paper document upon a separate request (clause 3 of Article 11 of the Federal Law of 08.08.2001 N 129-FZ).

The Federal Tax Service must send the registration sheet no later than the day following the day of making a positive decision on registration of the organization (clause 3, article 11 of the Federal Law of 08.08.2001 N 129-FZ).

The entry sheet in the Unified State Register of Legal Entities contains:

- OGRN;

- information about what the entry was made;

- date of entry;

- state registration number (SRN) of the record;

- contents of the entry (for example, information about the documents submitted to make this entry);

- name of the territorial body that made the entry.

The entry sheet has no expiration date. Also, it does not need to be re-registered if any changes are made to the Unified State Register of Legal Entities.

A record sheet is also issued when changes are made to information to be included in the Unified State Register of Legal Entities.

https://youtu.be/PBWe9sddO9M

What is contained in the document

The certificate itself contains information about:

- full name of the legal entity indicating the organizational and legal form;

- abbreviated name of the organization;

- date of entry of information into the register;

- a unique number assigned to the organization;

- name of the registering authority.

At the end of the document, the signature of the head of the Federal Tax Service and a seal are placed, and the series and number of the certificate are also indicated.

The unique number received by the legal entity consists of 13 digits. Each of them contains certain information:

| 1 | about the number code |

| 2-3 | about the year in which registration was made |

| 4-5 | about the code of the subject in whose territory the organization is registered and will carry out its activities |

| 6-7 | about the code of the tax office that issued the certificate |

| 8-12 | about a unique cipher that is identical to that specified in the registry |

| 13 | is a control |

When registering, a citizen receives a sheet from the Unified State Register of Legal Entities, which contains the data entered in the unified register. However, these documents do not contain personal information concerning the citizen himself.

Also additionally issued: a certificate of tax registration at the place of registration of the organization, as well as a copy of the charter with the regulatory certification of the supervisory authority. Other documentation is issued only additionally if necessary.

In relation to the certificate, the documents now received in the aggregate have more information and allow more operations to be carried out based on the available data in the registry.

Registration authority

Documents for opening an LLC must be submitted to the registration tax office at the legal address of the future company or to the Multifunctional Center (MFC). An ordinary Federal Tax Service, where a limited liability company will be registered with the tax authorities, may not have special powers to issue.

Document form

Copies of the certificate are often requested by counterparties, banks, extra-budgetary funds, and other government bodies, so the original must be stored in conditions that ensure its safety. In case of loss or damage to the original, you must contact the registration authority to issue a duplicate. This is a government service for which a fee of 800 rubles is charged.

The applicant in this case is the head of the legal entity (CEO). If another person is engaged in the restoration of documents, the power of attorney on behalf of the executive body of the LLC must contain instructions both for a request to the Federal Tax Service and for receiving ready-made copies with a list of them.

Why is information needed?

A certificate of registration of a legal entity is primarily necessary to confirm the legality of the organization’s activities. This document must also be provided when registering with different funds, opening an account or ordering a company seal.

In addition, the certificate is used for:

- concluding contracts, regardless of their type;

- acquisition and registration of real estate, as well as vehicles;

- selling property and carrying out the procedure for registering transactions in Rosreestr or with a notary;

- drawing up agreements with a banking organization, including for obtaining a loan;

- obtaining property on lease;

- concluding a property insurance agreement;

- interaction with both individuals and legal entities to resolve issues regarding the implementation of the company’s activities.

In addition, using the information specified in the certificate, you can accurately find out all the information about the organization, including:

- on the legality of doing business;

- about the date of registration;

- about the activities carried out and the main participants.

This data allows other organizations to make the final decision on the implementation of any projects jointly.

The information provided in the certificate and similar documents is required for most procedures that may be related to both business activities and various organizational issues.

It is worth considering that all information must be provided to the tax authorities in a timely manner. Otherwise, sanctions will follow, including monetary ones.

OGRN verification

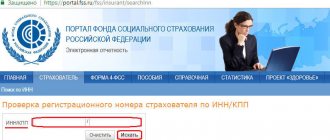

Similar to the TIN, OGRN is unique for each registered enterprise. This is the fundamental document that gives legal grounds to the organization's activities. Therefore, by checking the OGRN, the legality of the company’s existence is established. To establish the authenticity of the license plate, you must perform the following steps:

- Submit an official request to the tax office. In this situation, you must first pay the state fee;

- Go to the official website of the Federal Tax Service in the appropriate section;

- By calculating the control number.

Why was it cancelled?

The registration certificate was canceled in 2020. This was done in order to increase the efficiency of interaction between the interested party and the tax authority through the use of electronic systems. This allows you to reduce paperwork in authorities, simplifies and speeds up the procedure for obtaining the necessary documents.

The cancellation of certificates and the transition to registers began back in 2016. Registry databases made it possible to systematize information. In addition, this approach allowed all government bodies, if necessary, to receive all information on the organization and its activities in one place.

Among the advantages is also the ability to replace a paper document with an electronic one, which greatly facilitates sending data to the required authorities or organizations.

Another point was the entry of all information into the state register, from where any person can obtain data.

At the same time, obtaining personal data or personal important information is possible only with the consent of the owner. This approach has had an impact on tax regulation, as well as on the security of all data.

Why were the state registration certificates of legal entities and individual entrepreneurs canceled?

The year 2017 began with changes for everyone who wants to register their LLC or individual entrepreneur. The tax service no longer issues state registration certificates for legal entities and individual entrepreneurs, which have already become familiar - yellow, on official letterheads. These two documents were canceled completely. Below are all the details about how to now confirm the registration of an LLC or individual entrepreneur, as well as what documents replaced the old certificates of state registration of legal entities and individual entrepreneurs.

The tax service explains the reason for the innovations simply: “in order to increase the efficiency of electronic interaction between interested parties and tax authorities in the field of state registration of legal entities, individual entrepreneurs... and accounting of taxpayers.” This official reason is also indicated in the Order of the Federal Tax Service of Russia dated September 12, 2020.

https://www.youtube.com/watch?v=ytabouten-GB

In simple terms, the fewer documents are issued and the simpler these documents are, the easier and faster it will be possible to register new business entities. The abolition of strict reporting forms for registration certificates for legal entities and individuals is also a significant saving for the budget.

We invite you to familiarize yourself with: Power of attorney to receive maternity capital, sample

Certificate and OGRN: the same thing

OGRN is the main number that a citizen receives when going through the registration procedure as a legal entity. It is issued once after submitting an application and does not change during the entire period of the company’s activities. This number must be recorded in the registration certificate.

When registering from 2020, the OGRN is issued as a separate document in conjunction with other forms and the Unified State Register of Legal Entities. If necessary, it can be requested through government agencies or obtained through portals that provide services of this kind.

You need to remember that if you lose your OGRN, it will need to be restored at the place of registration of the organization, since it is needed for various procedures when conducting business.

Every citizen who decides to create his own organization is required to go through the registration procedure and receive the appropriate certificate.

Carrying out activities by a company without obtaining a certificate is illegal, which is why a legal entity can be brought not only to administrative, but also to criminal liability. This document was considered mandatory to obtain until 2020. At the moment it has been replaced by a recording sheet from the ERGUL.

https://youtu.be/pmoLxFY_v7s

In what form can I obtain a certificate of entry into the Unified State Register of Legal Entities in 2020?

Changes to information about the organization will now be indicated only in the Unified State Register of Legal Entities. The document was an addition to the certificate and was its integral part, carrying important information.

Since 2020, the form has been supplemented and redesigned. A new order has been issued to put into effect the Record Sheet for legal entities and individual entrepreneurs (ММВ7-14/ [email protected] dated 09/12/2016).

The document does not use the Federal Tax Service letterhead. The Unified State Register of Legal Entities is printed on plain paper without a security mark. In this case, the document can be received in electronic or paper form at the request of the head of the enterprise. The validity period is unlimited.

A copy of the recording sheet must be certified by a notary office. Otherwise, the document will not have legal force.

How to draw up a document

You can issue an extract yourself or contact a company that specializes in providing such a service. If the document is drawn up independently, then it is advisable to adhere to the following procedure:

- the cover is formed: on a sheet of A4 paper, the entry “Extract from the charter of the LLC” is made, where “LLC” is the name of the company;

- a duplicate of the title page of the statutory document is made, and, if necessary, a copy of its first page;

- paragraphs, sections and chapters of the charter are copied for extract;

- at the end a copy of the last page of the statutory papers is inserted;

- the extract is signed by the person who issued the document, the position of this employee is indicated and the date is indicated.

- the pages of the statement are stitched (the procedure is optional, but some companies and authorities requesting the document require it).

The extract can be issued on the company’s letterhead or indicate the name of the organization at the top of the document. The binding indicates the number of pages of the document, the entry “correct”, the date of formation, the employee’s signature and the company’s seal, if available. If the extract is not bound, then certification must be made on each page by affixing a signature and seal.

Extract from the charter of the municipality (sample)

Required documents and information

Before assigning a OGRN and receiving a confirmation form, you must register. It begins with collecting a package of documents. The list is quite modest:

- Founders' Protocol

- Certified version of the charter

- Application (Form N P11001)

- Original and copy of the applicant's passport

- Original form of receipt for payment of state duty.

The application must include information about the location of the organization, its name, information about the founders and authorized capital. This information is also found in the charter and cannot differ from what is provided in the application.

Read below about where and how to obtain a OGRN certificate for individual entrepreneurs and legal entities, including urgently.

Everything about opening an individual entrepreneur and limited liability partnership

When is it necessary to register as an individual entrepreneur or open a limited liability partnership?

If you are carrying out business activities:

- use hired labor on a permanent basis; and/or

- have a total annual income from business activities exceeding 12 times the minimum wage (from January 1, 2020 - an amount of 293,508 tenge); and/or

- If you sell agricultural products on the territory of trade markets (this norm came into force on January 1, 2020 and is valid until December 31, 2020), then you must register your business activity, otherwise illegal business will face an administrative fine or even criminal liability.

What is an IP?

Individual entrepreneurship (hereinafter - IP ) is an initiative activity of private business entities aimed at generating income, based on the property of private business entities themselves and carried out on behalf of private business entities at their risk and under their property responsibility. The law classifies individual entrepreneurs (hereinafter referred to as individual entrepreneurs), with an average annual number of employees of no more than 100 people and an average annual income of no more than 300,000 MCI (680,700,000 tenge for 2020) as small businesses, among which, from 2020, the Law has identified a separate category Individual entrepreneurs who are micro-enterprises. with an average annual number of individual entrepreneurs of no more than twenty-five people or an average annual income of no more than 30,000 MCI (68,070,000 tenge for 2020), classifying them as micro-business entities. At the same time, small and micro-business entities cannot be individual entrepreneurs who:

- activities related to the trafficking of narcotic drugs, psychotropic substances and precursors;

- production and (or) wholesale sale of excisable products;

- grain storage activities at grain collection points;

- holding a lottery;

- activities in the field of gambling and show business;

- activities for the extraction, processing and sale of oil, petroleum products, gas, electrical and thermal energy;

- activities related to the circulation of radioactive materials;

- banking activities (or certain types of banking operations) and activities in the insurance market (except for the activities of an insurance agent);

- auditing activities;

- professional activity in the securities market;

- activities of credit bureaus.

List of documents for individual entrepreneur registration*

- tax application in the established form ();

- a copy of an identification document (the original to identify the identity of the service recipient);

- a document confirming the right of ownership and use of real estate or an address certificate;

- consent of legal representatives, and in the absence of such consent - a copy of the marriage certificate or a copy of the decision of the guardianship and trusteeship authority or a copy of the court decision declaring the minor fully capable - when applying to a service recipient who has not reached the age of majority.

Note* Documents for registration as an individual entrepreneur in the form of personal entrepreneurship are submitted personally by an individual registering as an individual entrepreneur; in the form of a joint individual entrepreneurship, they are submitted by a person authorized to represent interests in relations with third parties and government bodies.

How to get the service online

- Log in to the portal and click on the “Order a service online” button.

- Fill out the application and sign it with an electronic signature (electronic digital signature).

- In your personal account (in the “History of receiving services”), read the notification about the processing of your application, which will arrive within the specified time.

* To register, the applicant must not have previously been registered as an individual entrepreneur, private notary, private bailiff, lawyer, professional. mediator. The code of the State Revenue Authority is selected from a directory according to the registration address at the place of residence and at the place of registration of the Applicant’s real estate (for individual entrepreneurs).

How to obtain a service from a government agency (required documents):

- a copy of an identification document (the original to identify the identity of the service recipient); IMPORTANT! A certificate of state registration of individual entrepreneurs is not issued from January 1, 2020.

Individual entrepreneur registration procedure

The individual applicant submits the above documents to the State Revenue Committee or through the “electronic government” portal of the State Corporation “Government for Citizens.” Within 1 (one) working day from the date of submission of the above documents, the registration authority carries out state registration of the individual entrepreneur or refuses such registration. When registering as an individual entrepreneur through the “electronic government” web portal in the “Business Registration” section, you must fill out an electronic application, and within one day you will receive a response in your personal account in the form of an electronic certificate of state registration or refusal.

What is a LLP?

An LLP is a legal entity, a type of commercial organization, which is created to carry out business activities by combining the capital of its founders - individuals and legal entities. An LLP can be established by several persons or by one person. Restriction: An LLP cannot have another business partnership consisting of one person as its sole participant (Clause 1, Article 10 of the Law on LLP). List of documents for LLP registration

- For founders - individuals:

- copy of ID;

- address certificate.

- For founders – legal entities:

- a copy of the certificate (certificate) of state registration of a legal entity;

- copy of the charter;

- Bank details;

- decision of the body authorized by the charter of a legal entity on participation in the creation of a registered legal entity.

- Copy of ID, manager's address;

- Company name (must be original, having no analogues in the Republic of Kazakhstan);

- List of activities;

- Legal address;

- The size of the authorized capital and the composition of deposits;

- Distribution of shares in the authorized capital between the founders (if there are several founders);

- Name of the bank in which the accounts will be opened and account currencies;

- Cash register (if necessary);

LLP registration procedure

The establishment of a LLP with a single participant is carried out on the basis of a decision made by him alone. In this case, the constituent agreement is not drawn up. An LLP is considered created from the moment of its state registration. All LLPs created on the territory of the Republic of Kazakhstan are subject to state registration, regardless of the purposes of their creation, the type and nature of their activities, and the composition of participants (members).

Where and how is an LLP registered?

- On the “electronic government” web portal;

- Through the State Corporation “Government for Citizens”, appearance procedure

Exception: registration of a LLP created through reorganization is carried out in the State Corporation “Government for Citizens” at the place of formation of the registered LLP. According to subparagraph 1-1 of Article 457 of the Tax Code of the Republic of Kazakhstan, SMP LLPs are exempt from paying the registration fee for state registration, that is, LLP registration is free of charge.

LLP - For registration in the Public Service Center are provided:

- A completed application for state registration in the prescribed form. Application form - Appendix 1 or Appendix 2 (for LLPs operating under the Model Charter) to the Instructions on state registration of legal entities and accounting registration of branches and representative offices, approved by Order of the Minister of Justice of the Republic of Kazakhstan dated April 12, 2007 No. 112 ()

- Completed notification of the start of business activities in the established form. Notification form - Appendix 18 to the Instructions on state registration of legal entities and accounting registration of branches and representative offices, approved by Order of the Minister of Justice of the Republic of Kazakhstan dated April 12, 2007 No. 112 ()

- A receipt or other document confirming payment of the registration fee to the budget (except for medium-sized businesses).

To register online you must complete the following steps*:

- Log in to the “electronic government” web portal and click on the “Order a service online” button;

- Select the type of registration of a legal entity;

- Fill out the application depending on the chosen type. In the application, indicate address information, name, director and information about the founders.

- Sign the application with an electronic digital signature (EDS). If an LLP is created by several founders, it is additionally required that the application be signed with an electronic signature by each of the founders.

- In your personal account (in the “History of receiving services”), read the notification about the processing of the application, which will arrive within the specified time.

As a result, the LLP must have:

- Certificate of state registration with justice authorities.

- Charter and memorandum of association.

- Decision (protocol) on the creation of a legal entity.

- Printing (manual or automatic).

- Extract from the statistical business register.

- VAT payer certificate (if necessary).

- Bank details and current account agreement.

- Registration as a participant in foreign economic activity (if necessary).

- Documents on registration of the cash register (if necessary).

It is also useful to know when registering a legal entity

- If you choose a type of activity that is subject to licensing, you must obtain a license to carry out this activity;

- In case of proposed non-cash payments, it is necessary to open a bank account;

- If the amount of turnover during a calendar year exceeds 30,000 times the MCI, register for VAT;

- If the activity involves accepting cash, it is necessary to register a cash register.

- In order to submit tax reports via the Internet, obtain an electronic digital signature (EDS);

- Order yourself a stamp, which is not required.

When are duplicates of constituent documents needed?

An organization may need to obtain duplicates of basic documents confirming the legitimacy of a legal entity only if it is not possible to use the original documents. The impossibility of using constituent documents may occur if:

- loss of official forms;

- damage to documents: flooding with water;

- part of the document is cut off;

- burnt paper.

Without the availability of basic documents in perfect condition, the organization cannot actually carry out any actions with its partners (conclude contracts, establish contacts, order goods, etc.). The only way out in such a situation is to obtain duplicates of the constituent documents.

Read below about how to obtain duplicates of constituent documents from the tax office.

Terms of issue

It is important to know that during the entire operation of the organization, its state number remains unchanged. For legal entities, it consists of 13 numbers and does not change when changing types of activity. Data about it are indicated in financial statements, contracts and documents for all government funds.

The conditions for the initial issuance of OGRN are simple - the number will be issued upon registration. However, there is no opportunity to get a special number. The numbers are not chosen at random; the OGRN contains encrypted data about the tax office itself, the year of registration and other information. Walkthrough? Previously, when registering, a company was required to confirm the existence of an authorized capital at the time of submitting documents; now this can be done within the next 4 months.

Sometimes it is necessary to re-issue the form with the main registration number. After applying to the tax office and paying the state fee, a document will be issued indicating the same number as before.