Registration at a mass address is often associated with fly-by-night companies. And this has its own explanation.

In 2020, the Federal Tax Service noted a significant reduction in shell companies - up to 7.3%. Two years earlier, they accounted for 35.5% of the total number of registered companies. Experts explain these indicators not only by the introduction of automated control over VAT refunds, but also by amendments to Federal Law No. 129-FZ dated 08.08.2001, which opened up more opportunities for tax authorities to exclude organizations from the Unified State Register of Legal Entities.

The Letter of the Federal Tax Service of the Russian Federation dated February 11, 2010 No. 3-7-07/84 gives the following definition.

A company with a mark of unreliable data in the Unified State Register of Legal Entities is considered by tax authorities as a counterparty with whom it is dangerous to deal. Such a mark arises if a statement is submitted to the tax office about unreliable information by the head of the company or as a result of an inspection and identification by the Federal Tax Service of unreliable information - about the address, participants of the company, its director.

Mass address criteria

Order of the Federal Tax Service of the Russian Federation dated February 11, 2016 No. ММВ-7-14/ [email protected] provides that in order to recognize an address as a mass address, the fact of registration of five organizations at one address is sufficient. If such a fact is established by the tax authorities, then checking the information in the Unified State Register of Legal Entities for accuracy during the initial registration or change of address of a legal entity cannot be avoided.

The question often arises about registering an LLC or individual entrepreneur at the address of a large business center. Since it hosts many organizations, the address can be considered mass. The Letter of the Federal Tax Service of the Russian Federation dated January 31, 2014 N SA-4-14/ [email protected] contains a recommendation that details exactly how to register so as not to arouse suspicion.

Thus, in clause 14.2.05.60 of the Letter it is specified that in the documents submitted for state registration, when filling out the application, detailed elements of the address that is the location of the legal entity must be entered. We are talking about the address landmarks of the object: house (possession), building (building, etc.), apartment (office, etc.).

If the documents do not contain specific address elements, then this absence cannot indicate the presentation of documents reflecting the actual address of the company.

So, we can distinguish two key criteria for a mass address:

1. Many legal entities are registered at one address. At the same time, “many” can mean a different number, depending on the subject of the Russian Federation.

According to the Order of the Federal Tax Service of the Russian Federation dated December 29, 2006 N SAE-3-09/ [email protected] , each Department of the Federal Tax Service of Russia for a constituent entity of the Russian Federation issues its own minimum criterion for selecting a mass registration address. For this purpose, a corresponding administrative act is issued. For example, the same address is indicated during state registration as the last location of 10 or more legal entities, 5 or more legal entities, etc.

2. There is no connection with legal entities registered at the same address. This indicates that representatives of the legal entity are not located at a specific address, and correspondence is returned with the mark “the organization has left”, “after the expiration of the storage period” (Letters of the Ministry of Finance of the Russian Federation dated November 14, 2017 N 03-12-13/75024, N 03- 12-13/75027).

https://youtu.be/j7iIfeCe0DE

What you need to know

During its formation, the company must be registered at a specific address, which will indicate its location, and be displayed in the Unified State Register of Legal Entities.

According to tax legislation, the location of a legal entity is established at the locality level.

At the same time, the organization bears responsibility in several areas:

- in case of non-reception of messages that were sent to the address specified in the Unified State Register of Legal Entities;

- in case of absence of a legal entity at the address specified during registration.

It follows from this that only the real address (postal address) must be indicated in the Unified State Register of Legal Entities, since correspondence is received through it.

At the same time, the presence at the address of at least an authorized representative of the company, and better yet, management.

The data comes directly from the constituent documentation. It follows from this that they indicate the address from the Unified State Register of Legal Entities.

It must be remembered that the legislation of the Russian Federation does not require confirmation of the company’s relationship to a specific address during the registration procedure.

However, in case of detection of knowingly false data, the following is provided:

- criminal;

- and administrative responsibility.

During the formation of the constituent agreement, the legal entity being formed has the right to indicate the address as the address:

- the location of the real estate, which is entered into the organization’s Criminal Code as a contribution;

- rented premises where the company or part of it is located;

- place of residence or other property of the founder, if a specific region is sufficiently loyal to indicating such addresses;

- mass registration. It means a legal address at which no more than 10 companies are officially registered.

In the latter case, under such an address, for example, there may be:

| Business centers | Which were specially formed to accommodate offices and small companies |

| Industrial enterprise territory | Which rents out part of its not only premises, but also areas in particular |

At the same time, you need to understand that fictitious addresses are usually classified as:

- registration of a huge number of companies. with whom it is impossible to contact in reality;

- non-existent in fact;

- those that relate to unfinished or destroyed structures;

- in relation to which it is known regarding the owner's prohibition on registration.

In most cases, authorized representatives of the Federal Tax Service are aware of this.

The role of banks in the process of combating shell companies

Banks have also begun to check for signs of shell companies. Some even provide a service to verify the counterparty at the client bank. This option is usually a traffic light service that warns of the presence of suspicious information in red.

Since banks “joined” the practice of identifying shell companies, another threat has loomed over entrepreneurs and organizations - now their account may be blocked. For this, a sufficient reason is the transfer of money to dubious business partners who may be “located” in places of mass registration.

What are the dangers of registering at a mass address?

If a company chooses a place of mass registration, it may be denied state registration or (if it moves or changes the registration address) to update data in the Unified State Register of Legal Entities. This right of the tax authorities is confirmed by the Supreme Court in Ruling No. 306-KG17-21112 dated January 23, 2018: it is permissible to refuse registration of a company if the address of mass registration is indicated in the application for registration of changes in the constituent documents. The court believes that the location of the enterprise is very significant legally, since practically the place where duties are performed and taxes are paid, the identification of judicial authorities for resolving controversial issues depends on it, and in addition, the possibility of implementing the necessary control by the tax inspectorate is associated with it. Therefore, the court decided that filing an application containing deliberately false information should be equated to the complete absence of such an application.

Tax authorities may consider your transaction with an enterprise whose registered address is considered to be massive to be aimed at acquiring an unjustified tax benefit. However, Federal Tax Service employees do not use the very fact of registering a partner in a “mass” place as a separate basis for officially recognizing the unfoundedness of the benefit.

However, this fact is taken into account as an indicator of the company’s dishonesty in combination with other evidence: for example, the partner does not have an official website, no customer reviews, no sign on the building where he is registered, the partner is not advertised in any media, etc. d.

If the tax authorities can prove that your tax benefit is not justified, then you are threatened with very unpleasant sanctions:

- additional assessment of taxes and penalties, as well as a fine for non-payment of tax (Article 122 of the Tax Code of the Russian Federation)

- administrative fine (Article 15.11 Code of Administrative Offenses of the Russian Federation)

- criminal liability for significant amounts of arrears (Article 198, Article 199.1 of the Criminal Code of the Russian Federation)

Risks of working with a counterparty with a mass address

For legal entities themselves, the use of a mass registration address may result in refusal of state registration or in making changes to the Unified State Register of Legal Entities when changing location or address. The Supreme Court, in Ruling No. 306-KG17-21112 dated January 23, 2018, confirmed that if the address of mass registration is indicated in the application for registration of changes in the constituent documents, then the tax authorities may refuse registration. According to the court, the location of a legal entity has significant legal significance, since it actually determines the place of fulfillment of obligations, the place of payment of taxes, the jurisdiction of disputes, as well as the possibility of exercising proper tax control. Based on this, the court considers that filing an application prepared with knowingly false information is equivalent to failure to submit such a document.

A transaction with a counterparty registered at a mass address may be regarded by the tax authorities as an attempt to obtain an unjustified tax benefit. Although the registration of a counterparty at a “mass” address in itself is not used by tax authorities as an independent basis for recognizing a tax benefit as unjustified.

This fact becomes one of the proofs of the counterparty’s dishonesty, combined with such signs as the counterparty’s lack of an official website, customer reviews, advertising in the media, as well as signs at the counterparty’s place of registration, etc. For more information about the signs of the counterparty’s dishonesty, read the article “Unfair play: 15 signs that your counterparty is deceiving you.”

If it is proven that you received an unjustified tax benefit, you face the following consequences:

- additional assessment of tax, penalties, collection of a fine - for non-payment of tax under Art. 122 NK RF;

- administrative fine - for gross violation of accounting (Article 15.11 of the Code of Administrative Offenses of the Russian Federation);

- criminal liability - for a significant amount of arrears (Article 198, Article 199.1 of the Criminal Code of the Russian Federation).

Signs of mass participation

According to the Order of the Federal Tax Service of the Russian Federation dated February 11, 2016 No. ММВ-7-14/ [email protected] , an address is recognized as a mass address if at least 5 organizations are registered at it. When tax inspectors identify such facts, this is necessarily followed by a check for the accuracy of the address data specified in the Unified State Register of Legal Entities during the initial registration or change of the company's address.

Registration at the address of large business centers often raises questions: the address may be considered mass, since the offices of many companies are located in one such building. Letter of the Federal Tax Service of the Russian Federation dated January 31, 2014 N SA-4-14/ [email protected] contains detailed registration tips that should be followed to avoid unnecessary suspicions.

For example, clause 14.2.05.60 of this Letter states that when submitting documents for state registration, you should indicate in them all the details of the address where the company’s office is located. This means that you need to indicate not only the house (possession) and building (building, etc.), but also the number of the apartment or office.

If specific address details are missing from the documents, this indicates that management has presented documents that do not reflect the actual address of the organization.

There are 2 main features of mass addresses:

- A large number of companies have a common registered address. What specific quantity should be considered suspicious depends on the subject of the federation.

The Order of the Federal Tax Service of the Russian Federation dated December 29, 2006 N SAE-3-09 / [email protected] states that each Department of the Federal Tax Service of Russia for a constituent entity of the Russian Federation determines its own indicator that determines mass registration addresses. For this purpose, a special administrative act is issued. Let’s say a specific address is declared during state registration as the last location of no less than 10 organizations, no less than 6 organizations, etc.

- It is impossible to contact businesses that are registered at a suspicious address. Letters are returned with an o or “beyond the expiration of the retention period.” It follows from this that there are actually no company employees at this address. (Letters of the Ministry of Finance of the Russian Federation dated November 14, 2017 N 03-12-13/75024, N 03-12-13/75027).

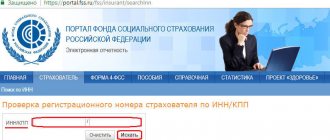

How to check an address for mass availability

You can check the address of the counterparty on the tax website, as well as using the Transparent Business service. The system searches by entered details (region, district, city, locality, street, house) and provides information about persons registered at the address.

You can also find out how many companies are registered at the counterparty’s address using the Kontur.Focus service. The check will also determine whether the director or founder is . Just enter the address in the search bar of the service.

What risks does an organization registered at a mass registration address bear?

When purchasing a “mass address,” there is a risk of ending up on a special list of the Federal Tax Service, which is secretly called the “black list of addresses” or “list of mass registration addresses.” In this case, the tax authority may refuse to register the company.

If during an inspection by the Federal Tax Service or a bank it turns out that the executive body of the company is not located at its legal address, then the following negative consequences will occur:

- an administrative protocol is drawn up against the manager with the further imposition of an administrative fine of 5,000 rubles;

- the bank may block the current account;

- the company may be forced into liquidation;

- the company risks not receiving legally significant correspondence.

You should know! Owners of premises were required to submit lists of tenant companies to the Federal Tax Service. Since 2020, the automatic VAT control system allows the tax authority to analyze landlords' sales books. Based on this information, a database of organizations renting premises at the address, information about which is included in the Unified State Register of Legal Entities, is formed.

Limit number of companies at one legal address

Since neither the definition of a legal address nor the term mass are official and are not mentioned in any legislative documents, it turns out that there is no limit on the number of organizations registered at one legal address indicated anywhere. There is only a recommendation from the Federal Tax Service that is not very adequate to reality, as well as the opportunity to attract negative attention from the tax service with an address where more than one hundred companies are listed.

conclusions

Therefore, there are some concerns regarding the mass registration address. But you should not write down all addresses that have more than 10 registered companies as mass and dubious. In fact, it is worth paying attention to the area of the premises and its other characteristics: for a business center, for example, the norm may be about 100 registered organizations, and for premises of a smaller area, 20-30 legal entities. Accordingly, you should avoid addresses with a number of companies on them that exceeds adequate numbers.

How to check a legal address for mass registration?

If the address is included in the list of mass registration addresses, the Federal Tax Service may refuse to register the company. Therefore, when purchasing a legal address, we recommend checking it for several points:

- whether the address is included in the list of addresses with mass registration - through the Federal Tax Service website;

- where the proposed registration address is located - inspect the premises;

- Find out from the owner who else is renting the premises.

It is important to sign a lease agreement with the owner of the premises, or a sublease agreement. If desired, you can provide in the contract a condition prohibiting sublease to other persons. Additionally, postal and secretarial services should be provided so that the company receives correspondence from government agencies, banks and counterparties in a timely manner.

The Lagans group of companies provides legal addresses not included in the list of mass registration addresses. We cooperate with reliable owners who guarantee address confirmation.

To purchase a legal address, request a call back or fill out the order form and our specialists will contact you as soon as possible.

Bulk addresses and company registration

When registering a legal entity, the decisive factor is the confirmation by the owner of his contractual relationship with the tenant organization, and not the number of companies registered at this address. The factor of mass participation can have a noticeable impact in the subsequent activities of the organization.

A strict selection of premises and owners is carried out before it includes this offer in its catalogue. We guarantee cooperation with responsible owners who are ready to confirm the presence of the company in this premises. Clients can also buy a legal address with a certain number of “neighbors”: automatic monitoring allows us to guarantee that there are less than 10, less than 20 or less than 50 legal entities at a given address. Use the appropriate selections if this parameter for selling a legal address is important for the activities of your company.