basic information

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

For both individuals and legal entities, situations may arise when funds are needed to purchase a product or service. But when you need it urgently, and there is no money in your savings, you can take advantage of the offer from a microfinance organization to purchase goods on credit.

If an important contract is at risk, then any entrepreneur tries to get funds as quickly as possible. Accordingly, there is no time to wait for a decision from a banking-type credit institution. We need funds here and now. A microfinance organization has such an offer.

A commodity loan is the only opportunity to obtain a targeted loan with a reduced interest rate. But first you need to study the basic provisions and characteristics of the proposals.

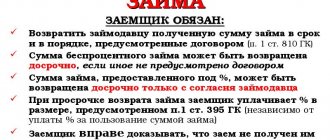

Debt repayment

The conditions for repayment of a commodity loan are fully specified in the relevant document.

At the request of the parties, the return of the borrowed property can be made:

- similar goods;

- a monetary amount equivalent to the value of the goods received.

The terms for the return of property or money are agreed upon at the stage of concluding a commodity contract. If this moment was missed for some reason, the borrower must repay the commodity loan within 30 days from the date the lender submits the corresponding request, drawn up in writing.

If the property or sum of money was not returned within the specified period or was returned, but in an improper form, then the borrower may be subject to penalties of a certain amount or in the form of penalties, calculated as a percentage of the market value of the specified goods.

It is advisable, when concluding a loan agreement, to pay attention to both the deadline for returning the goods and the amount of the penalty in the event of failure by the borrower to fulfill its obligations. These aspects will allow both parties entering into a commodity loan to minimize risks as much as possible.

The borrower can protect himself with a specific term for repayment of the loan (in this case, the lender has no right to demand the return of the property earlier than the specified period).

And the lender will insure itself by charging a certain amount of penalty if the borrower does not return the goods at the right time.

All disputes related to commodity loan agreements are resolved in the courts.

Concepts

A cash loan, like a trade loan, presupposes the possibility of receiving funds on the terms of repayment and payment in a short time. In this case, the loan can be both with accrual of value and without accrual for legal entities and individuals.

In accordance with current legislation, the borrower undertakes to return the funds taken from the lender in the original position or a similar product. After all, some lenders provide material assets rather than cash. In the case of analogues, the characteristics must be completely identical.

Return of a commodity loan

In accordance with a commodity loan agreement, the lender transfers ownership of property to the borrower, and he undertakes to return things in equal quantities of the same kind and quality.

The courts have repeatedly noted in their decisions that the return of a trade loan is possible only in goods and it is unacceptable to include a clause in the contract about the possibility of repaying it in cash. This situation makes it very difficult for organizations to obtain commodity loans from individuals, since they are forced to incur additional tax expenses.

It is worth knowing that if the returned goods cost the borrowing company more than what was received, then no changes in accounting will need to be made.

Legislation

The issue is regulated by Chapter 42 of the Civil Code of Russia, Articles 807, 808, 809, 810, 811, 812, 813, 814, 815, 816, 817, 818, 819, 820, 821.

Also, the Civil Code contains a lot of different information regarding the nuances of commodity borrowing.

The amount of payments and the frequency of their payment are stipulated in Federal Law No. 395–1 “On Banks and Banking Activities”.

Legislation on commodity loans

All relations between individuals and legal entities residing or registered on the territory of the Russian Federation are regulated by the Civil Code of the Russian Federation.

Chapter 42 of this document defines the concepts of loan and credit, and provides explanations for the conclusion of these agreements.

Article 822 defines the concept of trade credit. All trade credit agreements concluded between constituent entities of the Russian Federation must be based on this document.

In addition to these articles, the conclusion of a commodity loan agreement is subject to the rules of purchase and sale agreements (Chapter No. 30 of the Civil Code of the Russian Federation), which regulate the requirements for the transferred goods.

When concluding a commodity loan agreement, it is important to take into account all the nuances and reach a full agreement, which will avoid unnecessary disputes and litigation. The contract must be drawn up in accordance with all the rules and fully comply with the Civil Code of the Russian Federation.

Find out what conditions a perpetual loan agreement is concluded in from the article: perpetual loan agreement. See the table for which MFOs provide online loans to cards around the clock throughout Russia.

How to get a microloan online on a card with a bad credit history, read here.

Advantages and disadvantages

Any financial transaction has both positive and negative sides. That is why it is advisable for a potential borrower to study all these concepts in order to be prepared for the consequences.

Among the advantages of such a loan are:

- conclusion of an agreement between individuals and receipt of an object by an individual;

- absence of intermediaries;

- receipt of goods or other object;

- possibility of obtaining individual lending conditions.

A commodity loan also has several negative aspects. In particular, one main drawback can be highlighted here - the inconvenient repayment of loan obligations. After all, the return is carried out with a product of similar characteristics or the same without various deviations.

An agreement can be concluded between different categories of people in different statuses. If the loan is received in kind, then it must also be repaid. The characteristics of the natural form must coincide. But it is worth remembering that there is such a thing as taxation.

Accounting and taxation for an organization providing a loan in kind.

The amounts of borrowed funds provided by the organization, if all the required conditions established by PBU 19/02 are met, represent the organization’s financial investments. Consequently, an organization providing a loan in kind reflects it in accounting as a financial investment, taking into account the subaccount “Provided loans” in account 58 “Financial investments”.

When transferring, for example, goods to a borrower, an organization will record this operation in accounting as follows:

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 76 “Settlements with various debtors and creditors” subaccount “Settlements for commodity loans” | 41 "Products" | The cost of goods transferred under the loan agreement is written off |

| 58 “Financial investments” subaccount “Provided loans” | 76 “Settlements with various debtors and creditors” subaccount “Settlements for commodity loans” | The amount of the issued commodity loan is reflected |

Next, a question arises, which currently does not have a clear answer: is it necessary to charge VAT on the cost of goods, materials or raw materials transferred on loan? Some experts argue that VAT must be paid on the amount of the transferred loan in kind, while others put forward arguments using which the organization can avoid this. We will present both points of view, but which one to use is up to you.

Definitions

A microfinance organization is a legal entity with a license from the Central Bank of Russia to carry out lending and other practices regarding the issuance of funds.

A loan is material assets that can be transferred for temporary use to a potential borrower with the obligatory condition of repayment. In this case, a loan agreement must be drawn up. It is this that serves as the basis for return and regulation of a conflict situation.

Trade credit represents items or things that are purchased using funds issued or transferred to another person for specific periods. all objects must be united by specific generic characteristics.

A commodity loan agreement is a document that accompanies all actions related to the transfer of funds to the other party. It may indicate the name of things, characteristics and other features.

The legislative framework

When concluding a trade credit agreement, you need to take into account the norms of the Civil Code, namely its 42 chapter.

Article 807 states that when borrowing a non-monetary type, the lender must lend items that have common generic characteristics, and the borrower, under the terms of the agreement, undertakes to return the same items.

Generic characteristics are:

- product quality;

- quantity;

- assortment width;

- type of packaging or container.

When describing the proposed items that need to be borrowed, you need to rely on the usual rules that apply when concluding a purchase and sale agreement. Although it is possible that the parties to the contract may expand the list of characteristics.

Receipt procedure

Initially, each citizen needs to find a specific institution or person who can provide this type of offer. You can often view such information on the Internet. That is, suppliers or lenders place offers in advertisements.

A commodity loan from the founder of an organization is popular. Then the person can sign an agreement on the provision of a commodity loan, which contains all the necessary characteristics of the product and the terms of provision, as well as the cost of the product.

The contract can indicate the repayment of obligations - that is, in what form this can occur. That is, sometimes the creditor requests repayment in the form of another product or fuel. In terms of other characteristics, it is no different from standard borrowing and lending.

The loan can be interest-free or interest-bearing. All this is stipulated in the contract - sample:

The procedure for obtaining a loan according to the Civil Code of the Russian Federation

First, you need to find an organization, person or bank that can provide a commodity loan, usually this is done on Internet sites or in the advertisement section where lenders post offers.

A commodity loan from the company founder is also popular, if he can provide it.

Next, you need to sign a commodity loan agreement, which contains the conditions for the provision of goods, its description and the interest rate that will be charged depending on the agreements between the parties.

For details of a loan without collateral, see the article: loan without collateral. How to urgently apply for a loan of 20,000 rubles, read here.

If it is permissible to provide a similar product, as is the case with seeds, fuel and other consumables, this is also indicated in the contract.

Otherwise, a commodity loan is similar to other types of loans, so the terms of the agreement and other provisions of this document are approximately similar.

Bank selection

The essence of a commodity loan, in contrast to a commercial one, lies precisely in the subject of lending. That is, the loan is issued not in cash, but in goods, and the established interest is also repaid in goods.

For example, the borrower asked the lender for a ton of land at 40%. At the end of the loan period, he undertook to return 1.4 tons of land to the lender.

Most often, commodity loans are concluded between two companies, which in most cases are partners. A sample trade credit agreement is available.

But since the loaned product is still used, money may be required to purchase a similar product or restore the original one to normal condition.

Then you can contact OTP Bank or another institution to receive a targeted loan for the purchase of goods for return.

| Bank | Loan amount | Loan terms | Interest rate (annual) | Application review period |

| Alfa Bank | up to 2 million rubles | up to 60 months | from 11.99% | within 2 days |

| VTB 24 | up to 3 million rubles | up to 60 months | from 15.5% | within 3 days |

| Raiffeisenbank | up to 1.5 million rubles | up to 60 months | from 12.9% | within 2 days |

| Citiban | up to 3 million rubles | up to 60 months | from 14% | within 3 days |

| Sovkomban | up to 1 million rubles | up to 60 months | from 12% | during the day |

If we are talking about an agricultural enterprise, some banks provide incentives for lending. But this must be clarified directly with the financial institution.

Make a deal

To enter into a commodity loan transaction, the parties prepare and mutually sign an agreement using an application provided by the borrower.

It indicates the passport details of the parties if they are individuals, or permission to conduct activities and registration data if one of the parties is a legal entity.

Next, the subject of the agreement is stated, which is usually contained in the specification application, as well as the targeted or non-targeted nature of the loan, and the requirements for the product (packaging and quality level).

The period within which the borrower must receive the goods and return it to the lender is also indicated. The interest rate and repayment schedule must be specified. Typically interest is refunded along with the entire item.

The contract also specifies all force majeure situations and other nuances that may seem important to both parties. It is not necessary to have this agreement certified by a notary, but it is advisable.

This will be useful if disputes arise that can only be resolved in court, and judicial practice has already considered such cases.

Terms of service

In most cases, the conditions for granting a commodity loan are quite vague and unclear. After all, such agreements are often concluded between familiar parties or enterprises.

And if a loan can only be issued by enterprises that are licensed by the Central Bank of the Russian Federation, then the loan is available for issuance and receipt by any companies and individuals.

Borrower's age

As for the age of the borrower, individuals must be 18 years old before applying for a commodity loan.

That is, only the age of the borrower is required, as in the case of all other loans. After all, such a requirement is spelled out in the legislation of the Russian Federation and an adult has such an inalienable right.

Loan period

Despite the fact that the loan period is not specified in the laws and is free, selected by agreement of the parties, the standard period is a year. This simplifies not only the calculation of interest, but also the calculation of VAT, which is charged if the borrower is an enterprise.

But at the same time, a loan can be concluded even for two weeks or ten years, because everything depends on the requirements of the lender and the convenience of both parties.

The main thing is to provide for a deferment, which is provided under a suspensive condition previously agreed upon by the parties.

Trade loan with bad credit history

To obtain a commodity loan, a bad credit history does not matter, since the lender simply does not have the opportunity to check such documents.

And since a commodity loan is most often secured by some kind of property, problems with the execution of the contract and receipt of the goods most likely will not arise.

But at the same time, if you take out a loan from a bank to purchase goods to repay the loan, a bad credit history will lead to a refusal to provide funds.

If the cost of the returned goods is low and is up to 30 thousand rubles, you can contact microfinance organizations, which most often do not check the client’s credit history and provide a loan online in any case.

Who benefits from taking it?

A commodity loan will be good and useful for certain categories of individuals and legal entities who are tied to the material and do not want to overpay for a bank loan.

Since when purchasing a product, a tax is paid, as well as considerable interest is paid to the bank. Therefore, for borrowers under a commodity contract, it is often preferable to pay only interest in goods.

For legal entities

Large loans in goods are popular among legal entities. For example, large volumes of fuel, cars, seeds, fertilizers and other goods necessary for conducting extensive activities may be provided.

At the same time, legal entities can often secure a loan with some kind of property, so even in the event of difficulties with repayment, fines rarely arise.

For an individual

Among individuals, loans for goods with a small monetary value are most often popular.

Such transactions can be concluded in the case of borrowing construction equipment, building materials for repairs and other household materials that are not used in large quantities.

At the same time, an individual often cannot secure a loan with any large property, so penalties are prescribed either in an increased amount, or other conditions are provided to guarantee a problem-free repayment.

Between individuals and legal entities

Legal entities rarely take out commodity loans from individuals, but the reverse version of borrowing is common.

A good example of taking a commodity loan from an individual from a legal entity may be the rental of cars or housing under a contract, but in these cases interest is paid and taxation is applied.

Return procedure

The detailed process for returning borrowed goods is described in the concluded agreement. Typically, repayment is made on the last day of the agreed loan term, and the interest due on a specific loan is also paid at the same time.

Find out how to urgently get a loan of 200,000 rubles from the article: loan for 200,000 rubles urgently. Is it possible to get a loan from Beeline? Read here. How to get a loan of 15 thousand on a card, see here.

Delivery of the goods back to the lender and its characteristics should be specified in the contract, because if for some situations pickup by the lender is preferable, in others there may only be delivery by the borrower or third-party companies.

But it is worth calculating the delivery time so that the goods are returned to the lender exactly on the last day.

How to choose a bank

In accordance with current legislation, a potential borrower can independently decide on the choice of a credit institution. Moreover, he pays not only for the banking product, but also for the cost of using it.

Commodity loans are most often concluded between legal entities. But if this is the purchase of a specific product, then you may also need money.

At the moment, many lenders are ready to provide such a program:

| Name | Credit limit | Time frame (months) | Cost (percent per year) | Review (days) |

| Alfa Bank | 2 000 000 | 60 | 11,99 | 2 |

| VTB 24 | 3 000 000 | 60 | 15,5 | 3 |

| Raiffeisenbank | 1 500 000 | 60 | 12,9 | 2 |

| Citibank | 3 000 000 | 60 | 14 | 3 |

| Sovcombank | 1 000 000 | 60 | 12 | 1 |

Position one: VAT must be accrued and paid to the budget.

From the definition of a loan agreement given by the Civil Code of the Russian Federation, namely paragraph 1 of Article 807 of the Civil Code of the Russian Federation, it follows that under a loan agreement, the lender transfers ownership of things to the borrower, that is, he loses all his rights to them. Indeed, the party receiving goods, raw materials or materials takes them for use in its activities, and naturally it will not be able to return these particular things, it will only return similar ones.

What does a transfer of ownership actually mean for tax purposes? In accordance with Article 39 of the Tax Code of the Russian Federation:

“The sale of goods, works or services by an organization or an individual entrepreneur is recognized, respectively, as the transfer on a paid basis (including the exchange of goods, works or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in the cases provided for by this Code, the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person - on a free basis.”

In other words, for tax purposes, sale means the transfer of ownership rights for a fee or free of charge.

VAT is regulated by Chapter 21 of the Tax Code of the Russian Federation in accordance with paragraph 1 of Article 146 of the Tax Code of the Russian Federation, which recognizes the following transactions as objects of taxation:

“1) sale of goods (work, services) on the territory of the Russian Federation, including the sale of collateral and transfer of goods (results of work performed, provision of services) under an agreement on the provision of compensation or novation, as well as the transfer of property rights.

For the purposes of this chapter, the transfer of ownership of goods, results of work performed, and the provision of services free of charge is recognized as the sale of goods (work, preferential” Article 149 of the Tax Code of the Russian Federation, which lists transactions exempt from taxation.

So, according to this position, VAT arises, at what point should it be charged?

Before January 1, 2006, the answer to this question depended on the moment chosen by the taxpayer to determine the tax base for the sale (transfer) of goods (work, services). Let us recall that before January 1, 2006, for taxpayers who approved in their accounting policies for tax purposes the moment of determining the tax base upon shipment and presentation of settlement documents to the buyer, this was the day of shipment (transfer) of goods (work, services), and as funds were received , — the day of payment for goods shipped (work performed, services rendered).

In accordance with the amendments made to Article 167 of the Tax Code of the Russian Federation by Law No. 119-FZ, from January 1, 2006, for the purposes of Chapter 21 of the Tax Code of the Russian Federation, the moment of determining the tax base, unless otherwise provided by the items listed in Article 167 of the Tax Code of the Russian Federation, is the earliest of the following dates:

1) the day of shipment (transfer) of goods (work, services), property rights;

2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Thus, if an organization provides a loan in kind, then it will have to charge VAT in the tax period in which the transfer of goods, materials or raw materials to the borrower was made.

Example 1.

Let us assume that the organization Raduga LLC entered into a loan agreement with Katyusha CJSC in the 4th quarter of 2005, according to which Raduga LLC transfers 2 tons of 1st grade flour to Katyusha CJSC at a price of 12.10 rubles, including VAT 10%. The actual cost of flour is 11 rubles per 1 kg.

For the purposes of VAT taxation, the accounting policy of the organization in 2005 approved the moment for determining the tax base as shipment proceeds, the tax period for VAT is a quarter.

In accounting, the accountant of Raduga LLC made the following entries:

| Account correspondence | Amount, rubles | Contents of operations | |

| Debit | Credit | ||

| 76 subaccount “Commodity loan settlements” | 41 "Products" | 22 000 | The cost of flour transferred under the loan agreement was written off (11 rubles x 2000 kg) |

| 58 “Financial investments” subaccount “Provided loans” | 76 subaccount “Commodity loan settlements” | 24 200 | The amount of the issued commodity loan is reflected |

| 76 subaccount “Commodity loan settlements” | 68 “Calculations for taxes and fees” sub-account “VAT” | 2 200 | VAT was charged on the issued commodity loan (RUB 24,200 x 10% / 110%) |

The accountant reflected this tax amount in the VAT return for the 4th quarter of 2005, and Raduga LLC is obliged to pay this amount by January 20, 2006.

Under contracts starting from January 1, 2006, in connection with changes made to Article 167 of the Tax Code of the Russian Federation, an organization providing a non-cash loan will have to charge VAT in the tax period in which the transfer of goods, materials or raw materials to the borrower was made.

The term for repayment of the loan amount by the borrower is usually stipulated by the parties in the text of the agreement. If the agreement does not contain such a provision, then the borrower is obliged to repay the amount borrowed within 30 days from the moment the lender demanded repayment of the debt. We remind you that in accordance with civil law, the borrower can repay the debt before the due date only if an interest-free loan is concluded between the parties. If the loan provided involves the payment of interest, then the borrower has no right to repay the principal debt early.

Example 2.

In December 2005, Raduga LLC transferred 100 cans of paint to ZAO Katyusha under a loan agreement at a price of 70.80 rubles (including VAT) per 1 can. The actual cost of 1 can of paint is 60.00 rubles. The loan agreement stipulates that Katyusha CJSC will return the paint in January 2006.

In the accounting policy of Raduga LLC in 2005, for the purposes of VAT taxation, the moment of determining the tax base as of shipment was approved, the tax period is a month.

To simplify the example, we will not consider the calculation and payment of interest.

In accounting, the accountant of Raduga LLC made the following entries:

| Account correspondence | Amount, rubles | Contents of operations | |

| Debit | Credit | ||

| In December 2005 | |||

| 76 subaccount “Commodity loan settlements” | 41 "Products" | 6 000 | The cost of paint transferred under the loan agreement was written off (60 rubles x 100 b.) |

| 58 “Financial investments” subaccount “Provided loans” | 76 subaccount “Commodity loan settlements” | 7 080 | The amount of the issued commodity loan is reflected |

| 76 subaccount “Commodity loan settlements” | 76 subaccount “Calculations for unpaid VAT” | 1 080 | VAT was charged on the issued commodity loan (RUB 7,080 x 18%/118%) |

| In January 2006 | |||

| 41 "Products" | 76 “Settlements with various debtors and creditors” subaccount “Settlements for commodity loans” | 6 000 | Paint returned by the borrowing organization was accepted for accounting (60 rubles x 100 b.) |

| 19 “Value added tax on material assets” | 76 subaccount “Commodity loan settlements” | 1 080 | VAT on paint included |

| 76 subaccount “Commodity loan settlements” | 58 “Financial investments” subaccount “Provided loans” | 7 080 | Commodity loan repaid |

| 76 subaccount “Calculations for unpaid VAT” | 68 “Calculations for taxes and fees” sub-account “VAT” | 1 080 | VAT accrued for payment to the budget |

| 68 “Calculations for taxes and fees” sub-account “VAT” | 19 “Value added tax on material assets” | 1 080 | VAT credited on paint received to repay the loan |

This amount will be reflected in the VAT return for January 2006 and is subject to payment to the budget by February 20, 2006.

We remind you that from January 1, 2006, in accordance with the new edition of Article 167 of the Tax Code of the Russian Federation, for organizations the moment of determining the tax base for VAT, unless otherwise provided by paragraphs 3, 7 - 11, 13 - 15 of the said Article 167 of the Tax Code of the Russian Federation, is the most the earliest of the following dates:

1) the day of shipment (transfer) of goods (work, services), property rights;

2) the day of payment for goods (work performed, services rendered), transfer of property rights.

When shipping (transferring) goods (work, services) or property rights under a non-monetary loan agreement with the lending organization, the moment of determining the tax base for VAT will be the day of shipment (transfer) of the goods (work, services) or property rights specified in the contract.

Under what conditions is it provided?

Each lender can independently determine the terms of provision. There are no such provisions in the law.

Only organizations that have a license to operate from the Central Bank of Russia can issue such a loan.

Age restrictions

Only adult citizens can receive a cash loan.

Age must be confirmed by providing a passport in accordance with current legislation.

Deadlines

Regardless of the fact that loan terms are not specified in current legislation, the standard period becomes a year. This allows you to correctly calculate the tax base and VAT.

Taxation is paid and a loan is issued for a period of 2 weeks, 10 years, depending on the agreement. It is also worth considering a delay if necessary.

Bad credit history

A bad credit history is not a reason to be upset. As a rule, the lender does not request information from the Credit History Bureau, which allows you to receive financial obligations in a short time.

If checked by the lender, the percentage increases slightly.

Important points

When providing a trade loan, you need to pay attention to important details:

- legitimacy of the contract - all clauses of the document must comply with the norms of current legislation so that no problems arise;

- oral agreements are necessarily transferred to paper, and this should not depend on the personal acquaintance of the lender and the borrower, their relationship and other extraneous factors;

- deadlines for returning products, the procedure for calculating penalties in case of violation of the established time period, etc.;

- the most complete information about the products that are the subject of the contract, all existing technical characteristics that are of any importance when concluding the relevant contract.

For whom is it beneficial?

This product is beneficial for both legal entities and individuals.

But each individual case has its own nuances.

Entity

This is an advantageous position for those who provide vehicles, fuel and seeds.

In this case, such a person can ensure repayment using the collateral property.

Individual

For individuals, this is beneficial only in monetary terms. For example, if equipment or other services are needed for repairs.

An individual can also provide repayment.

Legal and individual

Such interactions occur quite often. For example, when renting real estate or a vehicle.

This type of activity is subject to tax.

Founder

It happens that the founder acts as a creditor. Then an agreement is concluded that stipulates repayment and payment terms.

As a rule, such a condition may be prescribed in the company’s charter.