Let's consider issues related to payment of sick leaves for insured persons. At first glance, it seems like there might be questions here: “contributions to the Social Insurance Fund are transferred – if you get sick, you are required to pay sick leave.” However, everything is not always so simple and various unpleasant situations arise.

It is worth noting that the insured persons have the right to receive benefits due to temporary disability not only in the event of their own incapacity for work, but also in other cases provided for by law, including if it is necessary to care for a sick family member; if the insured person is in quarantine and in other cases.

ATTENTION : our labor dispute lawyer will achieve payment for sick leave: professionally, on favorable terms agreed with you and on time!!!

How is sick leave paid?

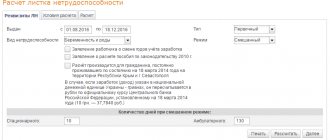

Let's start with the most important question: how is sick leave paid? So, in order for you to be paid for sick leave, you must provide your employer with a certificate of incapacity for work no later than six months after your sick leave was closed, that is, when you became able to work.

You must also provide a certificate of salary if during the billing period you worked officially for other employers who paid the corresponding contributions to the Social Insurance Fund of the Russian Federation (hereinafter referred to as the FSS) for you, and if you want this earnings to be taken into account when benefit calculation.

Next, the policyholder must assign you a benefit within 10 calendar days from the date of application.

As a general rule, for the first three days of temporary disability, benefits are paid at the expense of the employer, for the remaining days - at the expense of the Social Insurance Fund budget. In this case, the benefit is paid for all calendar days when the person was sick, including weekends and holidays.

If you are not eligible for benefits, seek legal advice from an attorney who can explain the law, your rights, and how to proceed.

USEFUL : watch also the video on how to protect the rights of an employee in a dispute with the employer, write your question in the comments of the video, read whether it is worth suing the employer at the link

https://youtu.be/CbnXvU_D-Zg

Who is not entitled to sick pay at all?

An employee should not count on payment for time off work if he cannot provide the document on the basis of which this is done, that is, the sick leave certificate itself. The law provides for refusal to issue a certificate for a number of reasons:

- the doctor, when contacting him for consultation, did not identify the disease as a result of the patient’s error or deliberate simulation;

- sanatorium treatment without appropriate medical direction;

- missed work due to short-term medical procedures performed one-time, such as vaccination, rinsing, inhalation, etc.;

- routine medical examination of employees, required by the requirements of this organization.

Some categories of health workers cannot issue the sheet, so it is pointless to contact them for sick leave:

- ambulance and emergency physicians;

- doctors at blood transfusion stations;

- emergency room doctors;

- workers of medical and preventive institutions.

NOTE! The law allows you to challenge the non-issuance of a sick leave certificate from a superior manager of the refusing doctor or from the Social Insurance Fund. But you need to be sure that your rights have been violated: a challenge will not always lead to the issuance of the desired certificate.

In a number of situations, even a correctly executed and issued sick leave is not “paid for” by the employer, and this is absolutely legal if it falls within the restrictions of Federal Law No. 255:

- Temporary removal from an employee of his duties. During the period when an employee is released from performing duties stipulated by the employment contract, the days of his illness are not subject to payment. Most often this occurs during unpaid leave, including for child care.

- Suspension without pay. Sometimes it is used if, for example, an employee for some reason cannot perform his previous duties, and there is currently no new suitable vacancy. Sick leave is not paid during this period.

- Under custody or arrest. If an employee is taken into custody or under administrative arrest and during this period he had health problems, then, naturally, he will not be paid for these sick leaves.

- Medical examination. When it is carried out, the employee is not guaranteed payment for disability.

- Illness after the start of downtime. An enterprise in idle mode does not pay sick leave to employees, but only “downtime” funds. If an employee fell ill while the enterprise was still operating, and then went into downtime, the “sick leave” money will be calculated for the days while the salary was still being accrued.

ATTENTION! If an employee has his normal annual leave ruined by sudden illness, those sick days must be paid.

We invite you to familiarize yourself with the percentage of enforcement fees of bailiffs

https://www.youtube.com/watch?v=ytdevru

Payments are also not due to the following leaflet holders:

- an employee who has become ill because he intentionally committed a crime;

- an employee who has caused conscious harm to his health.

In both cases, the court must confirm intent.

The law regulates the grounds for partial reduction of sick leave payments in certain cases. This is not a refusal, but a justified reduction in the amount of accrued payments, and, unfortunately, all the situations provided for are of a negative nature:

- the patient did not comply with the treatment procedure (taking medications, procedures, adherence to the regimen) prescribed by the doctor without a good reason;

- illness or injury was the result of a person’s inadequate state as a result of taking alcohol or narcotic or toxic substances;

- the patient did not show up at the agreed time to see the doctor or did not undergo the prescribed medical examination.

These cases provide for a reduction in the amount of sick leave pay to the level of the federal or regional minimum wage based on a monthly calculation (sick leave will be calculated not according to real wages, but according to the minimum wage adopted by the state or regional authorities).

In such dire situations, the patient may receive a smaller amount not for the entire period of illness, but for a certain part of it, allocated depending on the basis. For example:

- in case of violation of the treatment regimen, payment is reduced from the date of recording deviations from the doctor’s instructions;

- in case of failure to show up for an appointment or medical examination, the days starting from the date when the patient did not come where it was necessary are subject to reduction;

- alcohol and drugs, as the cause of illness, inexorably reduce pay for the entire period of incapacity.

The doctor must provide assistance to the patient even if he was intoxicated at the time of visiting the hospital or was injured in a similar state. But the medical worker is obliged to record all violations of the regime on the sick leave. In this case, a special note is made about non-compliance with the treatment regimen (a specific code is set).

The accounting department, having received such a sheet, is obliged to accrue and pay benefits, but taking into account reducing factors. Since in such cases the social insurance fund obliges to reduce the amount of temporary disability benefits (Article 8 of Law No. 255-FZ).

Sick leave payment deadline

You handed over a certificate of incapacity for work, the insurer assigned you benefits. When should sick pay be paid?

There is no specific deadline for payment established by law. However, a rule has been established. according to which the payment of benefits must be made by the policyholder on the next payday after the assignment of benefits.

If the deadlines for paying sick leave are violated, you have the right to demand compensation for violation of the deadlines. A lawyer specializing in labor disputes can explain how to do this correctly.

Features of registration of a sick leave for a disabled person

In this case, citizens may face several situations.

Let's find out what the law says:

- Patients with chronic diseases in remission, as well as if they are undergoing a medical examination or undergoing treatment procedures in an outpatient setting, are not issued a sick leave certificate. In such situations, citizens can ask the doctor to make an extract from the outpatient card (clause 26 of the Procedure);

- for a person, the certificate of incapacity for work will be closed on the last day before official registration with the bureau of medical and social examination for assignment of a disability group (Article 28 of the Procedure).

Attention! If a person has been assigned a disability group that allows him to work, then upon the onset of illness, medical workers must issue a certificate of incapacity for work on a general basis.

When a severe pathology is detected, doctors already assume that the disease cannot be cured. Therefore, in the initial stages, a cancer patient is issued a sick leave certificate, but after four months he must be sent for a medical and social examination to register his disability.

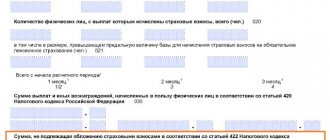

Amount of temporary disability benefit

How much sick leave you will be paid if you, as an insured person, get sick depends on your work experience. We are talking about paying for a certificate of incapacity for work for a working insured person.

- If you have insurance coverage of up to 5 years , you should be paid sick leave in the amount of 60% of average earnings. With 5 to 8 years of experience, sick leave is payable in the amount of 80% of average earnings. If your work experience is 8 years or more, then sick leave is paid in the amount of 100% of average earnings.

- If your child falls ill and it is necessary to care for him, the benefit for outpatient treatment for the first 10 calendar days is accrued according to the rules reflected in the above paragraph, starting from the 11th day - in the amount of 50% of average earnings.

- If a child is being treated in an inpatient setting , then the benefit is calculated taking into account your work experience, regardless of the number of days of sick leave.

- If you need to care for a sick family member (with the exception of a child) who is undergoing treatment on an outpatient basis, benefits are also paid depending on your work experience.

PLEASE NOTE : Average earnings are calculated for the two calendar years that preceded the onset of temporary disability; read what payments are due at the birth of a child at the link.

Any issue has its own nuances, this issue is no exception. There are times when it is necessary to replace the years of the billing period; some payments may not be taken into account when calculating average earnings and other situations. A lawyer can help you understand all the nuances, namely, taking into account the documents and information provided, check the possibility of changing the years of the billing period, check the correctness of the calculation of average earnings.

Responsibility

The person responsible for paying sick leave is the employer. Responsibility arises if an inspection carried out by the State Labor Inspectorate reveals the illegality of the actions of representatives of the organization in relation to their employee on the issue of payments related to his temporary disability.

Depending on the nature of the detected violations, it is possible to bring to material, administrative and criminal liability (in accordance with Article 419 of the Labor Code of the Russian Federation).

Labor Code of the Russian Federation Article 419. Types of liability for violation of labor legislation and other acts containing labor law norms

Persons guilty of violating labor legislation and other acts containing labor law norms are brought to disciplinary and financial liability in the manner established by this Code and other federal laws, and are also brought to civil, administrative and criminal liability in the manner established by federal laws. laws.

Fine and other forms of punishment for late payment

In accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation, fines may be imposed on an organization that violates labor legislation.

- If the violation is committed for the first time, fines for organizations (legal entities) vary from 30 to 50 thousand rubles.

- In case of repeated commission of similar violations, the fine will be from 50 to 70 thousand rubles.

- For organizations operating without forming a legal entity, in case of a primary violation a penalty is imposed in the amount of 1 to 5 thousand rubles, in case of a repeated violation - from 10 to 20 thousand rubles.

- Punishment for officials who violate labor laws for the first time may be limited to a warning or payment of a penalty ranging from 1 to 5 thousand rubles.

- An official found guilty of repeated misconduct before the law may be subject to a fine of 10 to 20 thousand rubles, or temporary suspension from his position for a period of 1 to 3 years.

Federal Law No. 382-FZ of December 23, 2010 provides for criminal liability and large penalties for the guilty party, depending on whether the non-payment was full or partial, and the period of its delay. Punishment in this case can be expressed as a fine from 100 to 500 thousand rubles, deprivation of the right to work in a certain position for a period of 1 to 3 years, or imprisonment for a similar period.

Article 236 of the Labor Code of the Russian Federation provides for financial liability that the employer bears in case of delay in payments. It is expressed in the fact that interest is accrued daily on the amount of debt of at least 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay. If the payment was not made in full, the amount of monetary compensation is calculated based on the amounts that were not paid on time.

If the employer violates the terms of payments under the certificate of incapacity for work, you should not sit idly by. If you are confident that you are right and consider his actions unlawful, then you should first try to resolve the problem amicably. If contacting the HR and accounting departments, as well as directly to the manager, does not have a positive effect, you can safely contact higher authorities to protect your rights.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

The procedure for paying for sick time is strictly regulated by law and is subject to compliance by all companies without exception. If the employer does not pay for sick leave, he violated labor law and infringed on the rights of the employee, leaving him without a livelihood after illness. An employee in such a situation has the right to seek justice by any legal means, since all currently valid legal norms are on his side.

Where can I complain if I don’t get paid sick leave?

If your employer does not pay you for sick leave, you can contact the Social Insurance Fund directly about this matter, that is, the insurer, which is obliged to protect the rights of the insured to receive guaranteed benefits. The Social Insurance Fund will represent the interests of the employee on controversial issues that arise with the employer. In this situation, the insurer is obliged to take all possible measures to accrue and pay appropriate benefits to the insured person.

- Also, the insured person can file a complaint with the labor inspectorate or the prosecutor's office.

- But before filing a complaint, you should still contact your employer’s accounting department and try to find out the reason why sick leave is not paid (this procedure is called pre-trial dispute resolution and is recommended to everyone without exception by our labor lawyer).

- You also have the right to seek judicial protection of your rights.

Our labor lawyer can provide assistance in preparing a complaint or statement of claim. In addition, a lawyer can be your representative in resolving issues related to non-payment of sick leave to you, as well as in a legal dispute with the Social Insurance Fund regarding the issue of payments.

USEFUL : Watch a video with advice from an employment lawyer on how to file a grievance

If the disease is longer than the leaf

An employee will receive an incomplete amount even for a completely correctly and legally issued sick leave in another special case, provided for in Art. 6 Federal Law No. 255. The fact is that sometimes the course of the disease turns out to be unpredictable and exceeds the maximum allowed time for payment of compensation for temporary disability. Payments in this case depend on a number of nuances.

- The employee was ill longer than the law provides for sick leave, but the loan fully restored his ability to work and returned to work. In this case, only the maximum permitted period will be paid - a month or its legally authorized extension for another 3 months. Days. Anything beyond this period will not be paid.

- The disease has progressed, the employee has been absent from work for more than 4 months. Such diseases require the assignment of a disability group. The Social Insurance Fund will pay for only 4 working months in a row, and during the year - no more than 5 months.

- The employer himself wants to compensate the employee for sick days. This, although rare, does happen. The employer has the right to pay for sickness periods exceeding the legal maximum, but is not obliged to do so. If this is his good will, he should take funds for this from the property of the organization, and not from funds. Such accruals must be secured by a special order or local regulation.

Does the employer have the right not to pay sick leave or reduce the amount of benefits?

Many are convinced that an employer is obliged to pay sick leave to its employees at all times and in full. However, this is not always the case.

► The benefit amount may be reduced:

- if, without good reason, while on sick leave, you violated the regime established by the attending physician. The benefit will be paid in an amount not exceeding the minimum wage for a full calendar month from the day the violation was committed.

- if you fail to appear without good reason at the appointed time for examination by a doctor. The benefit will be paid in an amount not exceeding the minimum wage for a full calendar month from the day the violation was committed.

- if your illness or injury occurred due to alcohol, drug or toxic intoxication, or related to these actions. The benefit will be paid in an amount not exceeding the minimum wage for a full calendar month, and for the entire period of incapacity.

► The benefit will not be paid if the employee fell ill while he was released from work, for example, on leave at his own expense or on maternity leave. This situation does not include the time an employee is on annual paid leave.

- During the downtime period, no benefits are also paid. BUT, if you fell ill before the downtime period and were disabled for the entire corresponding period, the employer is obliged to pay you sick leave.

- Also, sick leave is not paid if the person was in custody or administrative arrest, and for the period of a forensic medical examination.

► Benefits will be denied if temporary disability occurs due to the insured person intentionally causing harm to his health or attempting suicide, and these facts are established by the court.

- If the disability occurs due to the commission of an intentional crime by the relevant person, payment of benefits will also be denied.

- An employer may refuse to pay sick leave if it is not properly completed.

Normative base

Every citizen should know their rights, this also applies to situations with sick leave.

Therefore, a person can independently study the procedure for issuing sick leave certificates (SL), approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n (hereinafter referred to as the Procedure). The document approves an exhaustive list of cases when medical workers can refuse to issue sick leave on legal grounds. First, let’s find out under what conditions a person can count on receiving a certificate of incapacity for work.

| Criterion | Description |

| A citizen must have the right to BL | Such persons include insured citizens, including foreigners, specified in clause 1 of the List and in Art. 2 of the Law of December 29, 2006 No. 255-FZ. |

| A medical worker is authorized to issue BC | The list of such employees is limited; it is approved by Part 2 of Art. 59 of the Law of November 21, 2011 No. 323-FZ and clause 2 of the Procedure. In particular these include: · doctors treating sick citizens; · paramedics and dentists of a medical institution; · doctors of scientific and technical institutes treating patients. |

| The medical institution has the appropriate license | This norm is prescribed in clause 46, part 1, art. 12 of the Law of 04.05.2011 No. 99-FZ; para. 1 clause 2 of the Order. Indeed, the documents determine that not all medical institutions can issue certificates of incapacity for work. Clause 3 of the Procedure contains a complete list of organizations that are not authorized to issue sick leave, even if the first two conditions are met. These include: · emergency medical aid stations; · blood transfusion points; · hospital emergency room; · mud baths; · special category institutions (centers for disaster medicine and medical prevention, as well as forensic medical examination departments); · health authorities to protect the well-being of citizens. |

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Therefore, there is no need to require doctors who are not on the approved list to issue a BL. They will not break the law, especially since the leaflet turns out to be invalid.

Important! When receiving the certificate, the citizen must present an identification document (clause 4 of the Procedure).

What is the penalty for falsifying a sick leave certificate?

There are situations when employees can issue themselves what is called a “fake sick leave”. Before taking such a step, you should think about whether you need this, since your actions can be qualified as “using a knowingly forged document”, as “fraud in receiving payments”, these acts are criminally punishable. You may also be subject to disciplinary or financial liability.

The employer has the opportunity on the website of the Social Insurance Fund of the Russian Federation to check the sick leave by identification number, where you can see information about invalid sick leave forms and stolen (lost) sick leave forms.

An employer has the right to contact law enforcement agencies regarding the issue of an employee providing a fake sick leave certificate.

If it is established that the sick leave certificate is fake, the employer has every reason to bring the employee to disciplinary liability and dismiss him for absenteeism.

In case of payment to an employee on a fake sick leave, the employer has the right to demand from the employee the return of the amounts paid; in case of refusal, the employer has the right to withhold the paid amount from the employee’s salary in the manner and within the limits established by law (no more than 20% of the monthly salary boards). If the employer incurs other losses associated with the provision of a fake sick leave certificate, they can also be recovered from the employee in court.

If the matter has reached law enforcement agencies, you will need the help of a lawyer in resolving this situation. At the stage of the preliminary investigation, not just a person with a legal education, but a person who is a lawyer can participate as your defense attorney. Forgery of a sick leave certificate falls under the crime provided for in Art. 327 of the Criminal Code of the Russian Federation.

The lawyer will be able to correctly assess the situation, including whether there are grounds for releasing the offender from criminal liability, explain how to avoid punishment for forgery of documents, or select criteria for reducing the punishment.

https://youtu.be/wS4qOZKnLLg

Who is not entitled to sick pay at all?

A certificate of temporary incapacity for work – in common parlance “sick leave” – is issued not only to provide it to the employer for the purpose of calculating payments. In a number of cases provided for by regulations, the days indicated on such a sheet cannot be paid at all, because its holder does not have the right to do so.

According to the legislation of the Russian Federation, a temporary work permit issued by:

- employees working not under an employment contract, but under a civil law one;

- officially unemployed citizens of the Russian Federation;

- with errors and inaccuracies in filling out (only doctors who signed the form can make corrections);

- unlawfully, that is, falsified or invalid, for example, of the old type, with forged signatures, seals (for such management has the right to be held accountable).

FOR YOUR INFORMATION! An overdue sick leave certificate will not be paid - it can only be presented within six months after the date indicated on it as the day of return to work.

The law provides for several cases when, despite the fact that the employee’s health was damaged and he was provided with medical care, he is not entitled to sick leave. The fact is that the law directly prohibits granting benefits under it in the following situations:

- the disability occurred because the employee committed a crime and suffered as a result;

- the employee intentionally caused harm to his own health.

If the facts of malicious intent are confirmed in court, temporary disability benefits should not be assigned and paid (Part 2 of Article 9 of Federal Law No. 255 of December 29, 2006).

How does the Social Insurance Fund pay for sick leave?

When an insured person (lawyers, individual entrepreneurs, etc.) applies, in cases established by law, directly to the Social Insurance Fund for payment of benefits, the said body assigns and pays the appropriate benefit within 10 calendar days from the day the application and necessary documents were received.

When sick leave is paid by the employer to pay insurance premiums, the amount of insurance contributions to the Social Insurance Fund is subject to reduction by the amount of paid sick leave.

If insurance premiums are not enough to pay benefits, the employer applies to the Social Insurance Fund with an application for reimbursement of the costs of paying benefits.

The FSS must allocate funds to the policyholder for payment of insurance coverage within 10 calendar days, when the policyholder provides all documents.

The FSS may refuse to allocate the appropriate funds to the policyholder by making a decision. In this case, the policyholder may appeal such a decision to a higher authority or to court. To draw up a complaint or application to the court, the policyholder has the right to contact a lawyer, including to represent the interests of the policyholder in the Social Insurance Fund or in court.

What to do if there are problems with accrual?

Many people think that if a person gets sick on weekends or holidays, then sick leave is not required. This is not true; there are a number of cases when doctors are required to issue a certificate. Let's find out under what conditions it is issued:

- a person falls ill or is injured at work;

- treatment must be carried out in an outpatient setting.

Therefore, people who apply are issued a sick leave certificate on the day the illness is recorded, even if this date falls on a weekend or holiday (clause 14 of the Procedure).

Important: payment of temporary disability benefits is accrued to the bearer of the sick leave certificate within 10 days after it is submitted to the employer.

If all the deadlines have passed and you still haven’t received the money, first of all you should ask the appropriate question in the accounting department or the human resources department. Perhaps, for objective reasons, the required amount has not yet reached the recipient.

The next method is to contact the director of the organization with a request to receive a written justification for the refusal of payments. If these actions do not lead to resolution of the conflict situation, proceed to the next step.