Numbering on invoices over several years leads to the fact that the numbers on the papers become larger and larger. This is not very convenient when keeping records, since you have to operate with large numbers. For this reason, some enterprises, usually large ones, start numbering from one every month, year or quarter. However, according to Letter of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427, the organization’s policy in this area has some nuances. The same document did not explain exactly how to carry out the numbering. For this reason, this operation still raises a lot of questions.

The legislative framework

Standard details of invoices for shipment, advances and adjustments are set out in paragraphs 5, 5.1 and 5.2 of the Tax Code of the Russian Federation. The serial number is also considered a property. However, there is no numbering order in the law. The features of this operation are spelled out in the Resolution of the Russian Federation dated December 26, 2011, number 1137. In particular, a reference to this normative act is contained in paragraph 8 of Article 169 of the Tax Code of the Russian Federation.

The numbering order has not been edited for many years. Some of the latest innovations were introduced in 2014: the resolution specified a separating symbol that is used when drawing up documentation. This law applies to the following structures:

- Separate divisions.

- Trust managers.

- Persons participating in the partnership.

In particular, you need to use the “/” sign for separation.

https://youtu.be/muJAw3MX8xw

Will it be a violation if the invoice is numbered out of order (not continuous)?

Violation of the numbering of invoices does not constitute a tax violation. The account serial number does not refer to details that affect the correct identification of a business entity by the Federal Tax Service in order to establish the right to deduct VAT.

Therefore, if it is discovered that invoices are numbered out of order, inspectors do not have the right to refuse a deduction (unless, of course, there are significant violations). This is confirmed by judicial practice (decision of the Arbitration Court of the Sverdlovsk Region dated July 20, 2011 No. A60-11248/2011). The Ministry of Finance itself agrees with this in letter dated January 12, 2017 No. 03-07-09/411.

The law does not provide for the application of any other sanctions, for example for gross accounting violations, in relation to companies that draw up invoices with out-of-order numbering.

However, it should be borne in mind that the number itself - established according to the rules for numbering invoices for 2020 that we reviewed or chosen according to another principle - must be indicated in the document (clause 5 of Article 169 of the Tax Code of the Russian Federation). Otherwise, there is a possibility that sanctions will follow for violation of accounting - in accordance with Art. 120 Tax Code of the Russian Federation.

Numbering rules

The main rule of numbering is assigning numbers in chronological order: numbers are indicated as they are assigned. Renewal of numbering is permitted. This is inevitable if a company has been in business for a long time. It is imperative to reflect renewal periods in the company's accounting policies. The period may be as follows:

- Month.

- Quarter.

- Year.

However, a government decree limits the resumption of numbering: it cannot be started from the beginning every day. This will be considered a violation.

The frequency of updates depends on the document flow of a particular enterprise. The more papers are filled out, the more often the numbers are renewed.

Adjustment invoices: features and procedure for issuing them

When does the need to issue an adjustment invoice arise? This occurs in a situation of a justified change in the cost of goods shipped, work performed or services provided (clause 5.2 of Article 169 of the Tax Code of the Russian Federation). If you adjusted the price or changed the quantity of goods shipped, you cannot do without an adjustment invoice.

The basic requirements for invoices (for filling out information about the parties to the transaction, completing signatures, etc.) are described in Art. 169 of the Tax Code of the Russian Federation. In addition, the adjustment invoice requires the following conditions to be met:

- The adjustment invoice must be preceded by the buyer’s consent to change the cost and/or quantity of goods shipped (Clause 10, Article 172 of the Tax Code of the Russian Federation).

- An adjustment invoice must be drawn up no later than 5 calendar days after the above consent is issued (clause 3 of Article 168 of the Tax Code of the Russian Federation).

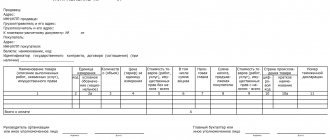

In addition, a special form is provided for the adjustment invoice. Its form is presented in Appendix 2 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Types of invoice numbers

The numbers can consist of both numbers and letters. Letter designations must be present when document flow is in the following structures:

- Separate units. After the number you need to indicate the index in numbers. Values are separated by slash (/). The index is determined by the company and prescribed under a specific contract.

- People in a partnership or trustee managers. The index separated by a slash must be specified in this case as well.

Compliance with rules is important not only for the implementation of regulations. Correct numbering ensures orderly document flow and prevents confusion.

What are the rules for numbering invoices?

The main (and only) rule is that numbers are assigned in chronological order as invoices are compiled/issued (subparagraph “a” of paragraph 1 of the rules for filling out an invoice, subparagraph “a” of paragraph 1 of the rules for filling out an adjustment invoice) .

An organization can set the numbering renewal period independently in its accounting policies, depending on the number of documents it prepares. For example, you can resume numbering from the beginning of the next year, quarter, month. The only thing that officials spoke out against was the daily numbering of invoices from the first number (letter of the Ministry of Finance of Russia dated October 11, 2013 No. 03-07-09/42466).

Invoice numbers may not only consist of numbers: the use of letter prefixes and digital indices is allowed. The latter must be included in invoices:

- separate divisions (the document number separated by a slash is supplemented by the digital index of the OP, fixed in the accounting policy);

- participants of partnerships or trustees (the company’s transaction index for a specific agreement is also indicated through a slash).

Read more about invoice details and their significance for this document in this article .

Features of putting down letter values

Some enterprises number advance and adjustment documents using different letters and numbers. For example, advance invoices are assigned the letter A, and adjustment invoices are assigned the letter B. This measure allows you to quickly find the necessary documents. However, it is not recommended to use the method in question, since there are no permissions for this in the law.

There is a risk that the buyer, upon discovering the letter designation, will require correction of the papers. A person’s motivation is to prevent problems from arising during a tax audit.

ATTENTION! There is a compromise method.

You can assign both an official and an auxiliary number to an invoice. This measure will not be considered a violation. You can indicate the auxiliary number not only in the accounting program, but also in the document itself. However, the additional value does not need to be mentioned in the Number column. It is indicated after all the details in the “For reference” column. Permission to use additional numbers is given in letters from the Ministry of Finance.

Invoice number

In other cases, you cannot split the invoice number.

In practice, companies number invoices as convenient for them, for example, they put the month or year after the number (23/5 or 23/12).

Officials believe this could confuse inspectors. After all, it will not be clear what follows the fraction: the unit number or something else. Allegedly, this will prevent the seller from being identified, which means the buyer may lose the deduction. We believe that the Ministry of Finance's conclusion is unlawful. Resolution No. 1137 does not prohibit placing separating marks in the invoice number.

The main thing is to follow the chronology of the numbers.

And even if you put two numbers separated by a line or a fraction, this will not prevent the tax authorities from identifying the seller.

Meanwhile, inspectors will probably use the new clarifications of the Ministry of Finance as a reason to refuse the deduction.

This means that, if possible, it is safer to avoid using unnecessary characters in numbers. If the buyer has already received such a document, then it should be corrected.

Is it allowed to put separate numbers on different invoices?

Is it permissible to put numbers separately on advance or adjustment invoices? The need for a unified chronology is established by the Decree of the Russian Federation of December 26, 2011, number 1137. Until this year, such a norm did not exist, and therefore accountants often put different numbering on invoices for shipments and prepayments. This procedure was considered the simplest, but is now prohibited. Otherwise, violations may be revealed during verification.

Separate numbering is also clearly prohibited by Letter of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427. If you want to highlight advance invoices, you can use a letter value. The letters must correspond to a single chronology, for example, these could be the values “A”, “AB”.

There are also separate standards for filling out adjustment tax forms. They must be listed in chronological order.

General requirements

The numbering for invoices should be:

- continuous;

- sequential in chronological order;

- non-repeating - each document must be assigned its own unique number (Order of the Ministry of Finance of the Russian Federation No. 119n of 2001 and Filling Out Rules).

The chronological order requirements apply to both master and adjustment invoices.

In all other respects, the organization is free to choose a numbering system for primary accounting documents .

Reference. If the numbers increase in chronological order, there should be no reason for claims from the Federal Tax Service of the Russian Federation. The main thing is to correctly fill out the remaining columns of the invoice form.

Regulatory acts allow for the possibility of separate numbering for invoices. But this opportunity, according to the Filling Rules, can only be used:

- for organizations operating through branches or representative offices;

- for participants of the partnership;

- for trustees.

In this case, the serial number is divided into two parts:

- Shared room.

- Through a slash - a digital index of a subdivision or an index of an agreement between comrades.

In general, we can conclude: the organization has the right to adopt its own accounting policy regarding invoices, indicating numbering rules in them. The main thing is that the numbers go in ascending order. At the same time, separate numbering for special types of invoices (for example, only for advance invoices) at the enterprise is not provided for by law - but it is not prohibited either. The main thing is to avoid situations in which the same number can be assigned to different documents relating to different counterparties and different obligations.

Omissions in invoice numbers are not a significant violation, and such documents must be accepted by tax authorities for VAT deduction.

You will learn more about filling out the fields in the invoice in this article.

Penalty for incorrect numbering

Errors often occur when assigning invoice numbers. The most common ones are:

- Skipping numbers.

- Ignoring the need for chronology.

- Assigning the same number to the same document.

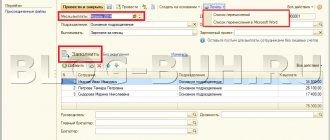

The last mistake is quite rare, since most accountants use special programs. The software prevents bifurcation.

Violation of the numbering order is the most difficult case. To correct the violation you will have to spend a lot of time and effort. An error in the chronology of one number leads to the fact that other numbers “creep”. It turns out that the invoices already sent to the buyer contain incorrect numbers.

Do the numbering need to be corrected? This measure makes sense if an error was made in the last number of the document, which has not yet been transferred to the buyer. If the error concerns a late number, it is not necessary to correct it. The seller does not bear any penalties for this violation.

ATTENTION! Article 120 of the Tax Code of the Russian Federation states that the absence of invoices for completed transactions entails a fine. These penalties do not apply to incorrect numbers. However, correct numbering is important in any case. This is taken into account during inspections.

It became clear how to number invoices

Sometimes suppliers make numbering mistakes and may assign the same number to two different invoices from different dates.

In this case, the buyer has the right to claim a deduction, confirms Elena Vikhlyaeva. An error in the invoice number does not interfere with identifying the parties to the transaction, the name and cost of goods, the rate and amount of VAT. This means that there are no grounds for refusing a deduction (clause

2 tbsp. 169 of the Tax Code of the Russian Federation). Commentary "UNP" In practice, inspectors sometimes refuse to deduct VAT due to the same numbers in different invoices of the same supplier.

But the judges are on the side of the companies (resolution of the Federal Arbitration Court of the Moscow District dated May 30, 2013 No. A40-38596/12-107-204). It is possible to protect the deduction even if the supplier completely forgot to put the serial number on the invoice (resolution of the Federal Arbitration Court of the Central District dated 04/08/13 No. A14-7612/2011).

How does incorrect numbering affect the buyer?

In most cases, incorrect numbering does not have any impact on the buyer. Errors don't bother you:

- identification of the parties to the contract;

- name of GWS, their cost;

- rate and total VAT.

That is, the buyer will not be denied a deduction, as stated in paragraph 2 of Article 169 of the Tax Code of the Russian Federation. If the controller makes his claims, they can be challenged, as evidenced by judicial practice. Based on court decisions, we can conclude that even the complete absence of numbering cannot be a basis for deducting VAT.

General Audit Department regarding violation of the numbering order in invoices

Answer

In accordance with subparagraph a) of paragraph 1 of the Rules for filling out an invoice[1], if an organization sells goods (work, services), property rights through separate divisions, when such separate divisions draw up invoices, the serial number of the invoice is separated by a dividing mark “/” (dividing line) is supplemented with a digital index of a separate division established by the organization in the order on accounting policies for tax purposes.

Therefore, the invoice number issued by a separate division must contain the index of this separate division, separated by a dividing line.

We note that the norms of the Tax Code of the Russian Federation do not provide for the seller’s liability for issuing an invoice with errors.

In accordance with paragraph 2 of paragraph 2 of Article 169 of the Tax Code of the Russian Federation, errors in invoices and adjustment invoices that do not prevent the tax authorities from identifying the seller, buyer of goods (work, services), property rights, name of goods (work, services) during a tax audit ), property rights, their value, as well as the tax rate and the amount of tax presented to the buyer, are not grounds for refusing to accept tax amounts for deduction.

The Letter of the Ministry of Finance of the Russian Federation dated May 14, 2012 No. 03-07-09/50 contains the following explanation:

“The lists of details that must be indicated in invoices and adjustment invoices are established in paragraphs 5, 5.1, 5.2 and 6 of Art. 169 of the Tax Code of the Russian Federation (hereinafter referred to as the Code). These clauses provide for the indication of their serial numbers in issued invoices and adjustment invoices.

Based on the rules for filling out invoices and adjustment invoices approved by the above-mentioned Decree of the Government of the Russian Federation, applied when calculating value added tax, in cases where the organization does not sell goods (works, services) through separate divisions or is not a member of the partnership or trustees acting as value added tax taxpayers, no dividing line is placed in the serial numbers of invoices and adjustment invoices issued by this organization.

At the same time, in accordance with paragraph. 2 p. 2 art. 169 of the Code, errors in invoices and adjustment invoices that do not prevent the tax authorities, when conducting a tax audit, from identifying the seller, buyer of goods (work, services), property rights, the name of the goods (work, services), property rights, their value, and Also, the tax rate and the amount of tax presented to the buyer are not grounds for refusing to accept amounts of value added tax for deduction.

Thus, if putting a dividing line in the invoice number does not prevent the tax authorities from identifying the above information during a tax audit, then such an invoice is not a basis for refusing to accept tax amounts for deduction.”[2]

Thus, since the presence (absence) of a dividing line in the invoice does not prevent the tax authorities from identifying the information specified in paragraph 2 of paragraph 2 of Article 169 of the Tax Code of the Russian Federation, the buyer does not have the risk of making claims from the tax authorities.

At the same time, in our opinion, in the case of shipment of goods from the warehouse of another structural unit (head unit), the invoice should include the index of the structural unit that actually concluded the supply agreement. Indirectly, this conclusion is confirmed by the following.

In accordance with subparagraph e) of paragraph 1 of the Rules for filling out an invoice, line 2b indicates the taxpayer identification number and the reason code for registering the taxpayer-seller.

The Letter of the Ministry of Finance of the Russian Federation dated May 30, 2016 No. 03-07-09/31053 states:

“In accordance with subparagraph “e” of paragraph 1 of the Rules for filling out an invoice used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137, in line 2b “TIN/KPP of the seller” the identification number is indicated taxpayer number and reason code for registering the taxpayer-seller. Therefore, if an organization sells goods through its separate divisions, line 2b of the invoice indicates the reason code for registering the taxpayer-seller of the corresponding separate division.”[3]

At the same time, the Letter of the Ministry of Finance of the Russian Federation dated July 21, 2017 No. 03-07-09/46548 contains an explanation:

“According to paragraph 1 of the Rules for filling out an invoice used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137, line 3 indicates the full or abbreviated name of the shipper in accordance with the constituent documents. If the seller and the shipper are the same person, the entry “same” is entered. If the seller and the shipper are not the same person, the shipper's mailing address is provided.

In order to match the information specified in the invoice and the primary accounting document drawn up during the shipment of goods, filling out line 3 of the invoice is possible on the basis of a similar indicator in the invoice.”

Thus, in our opinion, by analogy with indicating the checkpoint of a separate division, the invoice should indicate the index of the separate division with which the agreement was signed. In this case, in the shipper column, you must indicate the address of the parent organization (another structural unit carrying out the shipment).

In addition, we draw your attention to Letter of the Ministry of Finance of the Russian Federation dated January 12, 2017 No. 03-07-09/411:

“According to paragraphs 1 and 2 of Article 171 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), when calculating the amount of value added tax payable to the budget, the taxpayer has the right to reduce the total amount of tax calculated for transactions recognized as objects of taxation by the amount of tax on goods (works, services), property rights acquired to carry out transactions subject to value added tax.

In accordance with paragraph 1 of Article 172 of the Code, deductions of amounts of value added tax presented by sellers to the taxpayer when purchasing goods (work, services), property rights are made on the basis of invoices after registration of these goods (work, services), property rights and in the presence of relevant primary documents.

Based on paragraph 2 of Article 169 of the Code, invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by paragraphs 5, 5.1 and 6 of said Article 169 of the Code are met.

According to subparagraph 1 of paragraph 5 of Article 169 of the Code, the invoice issued for the sale of goods (work, services), transfer of property rights must indicate the serial number and date of the invoice.

Thus, the right to apply deductions for value added tax is not made dependent on the procedure for generating serial numbers of invoices issued by the seller when selling goods (works, services).

At the same time, we inform you that, in accordance with paragraph two of paragraph 2 of Article 169 of the Code, errors in invoices and adjustment invoices do not prevent the tax authorities, when conducting a tax audit, from identifying the seller, buyer of goods (work, services), property rights, name of goods (work, services), property rights, their value, as well as the tax rate and the amount of tax presented to the buyer, are not grounds for refusing to accept tax amounts for deduction.”

College of Tax Consultants, February 15, 2020

[1] Section II of the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”, hereinafter referred to as Rules for filling out an invoice

[2] Similar explanations are set out in Letters of the Ministry of Finance of the Russian Federation dated 05.22.12 No. 03-07-09/59, dated 05.15.12 No. 03-07-09/52, dated 05.15.12 N 03-07-09/53

[3] Similar explanations are contained in the Letter of the Federal Tax Service of the Russian Federation dated 07/08/14 No. GD-4-3/ [email protected]

Back to section