How to staple documents correctly

It is necessary to stitch documents to organize them. Companies and institutions stitch documents that need to be transferred to the archive. It is convenient to store bound documents and, if necessary, submit them to inspection authorities without worrying about their safety and the possibility of substitution. Contents of the article Theoretically, such a simple matter as binding documents is not regulated by regulations.

There are only instructions on how to do this:

- Methodological recommendations approved by the Order of the Federal Archive on December 23, 2009;

- GOST 51141 for office work;

- Also, office work rules containing requirements for filing documentation developed by industry departments (Central Bank of the Russian Federation, Ministry of Taxes and Duties, etc.).

In institutions and companies, documents are stitched by almost all structural divisions.

How to fill out a cash book in paper and electronic form

Compliance with the rules of cash discipline and maintaining a cash book is mandatory for all organizations and private entrepreneurs under any taxation system if they operate with cash when conducting business. Let's look at how to properly maintain a cash book.

The procedure for maintaining and registering a cash book

Based on the receipt and expense cash documents received, the cashier fills out the appropriate sections of the book. Each cash document corresponds to one entry in the cash book.

At the end of the working day, the cashier checks the cash order data with the cash book data, displays the final balance of funds and certifies this amount with his signature.

The cash balance in the cash book is reconciled with the actual cash balance in the cash register.

Attention!

The chief accountant checks the correctness of the reflection of incoming and outgoing amounts and the calculation of the balance at the end of the day, and signs the sheets of the cash book for the date being checked.

If no cash transactions were carried out during the day, the balance of funds in a constant amount is transferred to the next day.

When filling out the cash book, blots are not allowed; this is considered a violation of cash discipline.

The basics of cash discipline for LLCs and individual entrepreneurs are the preparation of a cash receipt order.

Read the article on how to connect a payment system to your online store.

How to staple documents for the tax office - examples, rules and requirements: https://bsnss.net/organizatsiya-biznesa/otchetnost/kak-pravilno-sshivat-dokumentyi.html

If an error was made when filling out the cash book, which does not affect the calculation of the cash balance, you should cross out the incorrect value with one line, write the correct version above or below it and certify it with the signatures of the cashier and the chief accountant. If an error has resulted in incorrect reflection of balances and turnover for a certain period, then it is allowed to single-cross out the erroneous pages with the mark “Canceled” and draw up new cash sheets with correct data.

In this case, the cashier must draw up a report addressed to the chief accountant about the discovery of an error. The chief accountant or director appoints a commission responsible for making adjustments to the cash book. After making corrections, the cashier draws up an accounting statement describing the error made and the corrections made.

Cash book cover page

On the title page of the cash book, the full name of the organization or full name of the entrepreneur is written, as well as the year for which the cash book is kept.

Cash book loose leaf

The cash book page consists of two identical parts - a loose leaf and a cashier's report. You can fill out a cash book on paper with or without carbon paper, duplicating the entries on the loose leaf in the cashier’s report. The insert sheet remains in the cash book, and the cashier's report is attached to the cash documents for the operating day.

Sample of filling out a cash book

Let's look at the rules on how to correctly format cash book fields.

- In the “Cash for” the date of the transactions is indicated. In the “Sheet” field, the serial number of the sheet of the cash book is indicated.

- In the “Document number” , the number of the corresponding incoming or outgoing order is indicated.

- In the column “From whom it was received or to whom it was issued” the initials of the individual or the name of the organization depositing or receiving funds, as well as the nature of the transaction, are written.

- In the column “Number of the corresponding account, sub-account” the number of the account corresponding to account 50 is indicated, indicating the method of receipt or expenditure of funds. Entrepreneurs do not fill out this column.

- In the line “Receipt” the amount of funds received under the PKO is entered.

- “Expense” line indicates the amount of money paid under cash settlement services.

- In the “Total for the day” , the total amounts of receipts and payments of funds are calculated.

- In the column “Cash balance at the end of the day” the amount of the cash balance is calculated, obtained by adding the cash balance at the beginning of the day and the receipts for the day minus the amount of expenses incurred.

See also: What is synthetic and analytical accounting

How to stitch a cash book

The pages of the cash book are numbered consecutively. The entire book is laced and certified with the seal and signature of the director and chief accountant so that it is not possible to remove sheets from the book. On the last sheet of the cash book, the number of laced sheets of the book is indicated in numbers and in words.

Maintaining an electronic cash book

Attention!

You can prepare and download a cash book in online accounting. All you need is to register in the “My Business” online accounting service to work quickly, accurately and competently!

Try for free...

It is possible to register a cash book in electronic form. Using a special program, the sheets of the cash book are printed and stapled, and at the end of the year they are numbered and sealed with the signatures of the responsible persons. When registering a cash book electronically, the title page is printed at the end of the year and stapled to the loose leaves of the book. When maintaining a cash register in electronic form, it is possible to register a cash book quarterly, rather than annually.

Do you need a cash book for an individual entrepreneur?

Before the entry into force of the Procedure for Conducting Cash Operations, the legislation did not directly and unambiguously indicate the mandatory maintenance of a cash book by entrepreneurs. In Arbitration practice, there were also court decisions in favor of entrepreneurs who, when performing cash transactions, did not fill out the cash book.

https://www.youtube.com/watch?v=DEElwndhmGE

However, the Procedure applied since 2012 states that it is mandatory for entrepreneurs to maintain a cash book. Individual entrepreneurs carrying out cash transactions are required to maintain a cash book, regardless of the taxation system used. For incorrect maintenance of the cash book and violations of cash discipline identified during a tax audit, a fine may be imposed on the entrepreneur.

Source: https://bsnss.net/organizatsiya-biznesa/otchetnost/kassovaya-kniga.html

How to staple salary documents correctly

Shelf life is permanent.

- Employee applications for hiring, dismissal, provision of annual paid leave, provision of leave without pay.

The storage period for statements that are not included in the personal files of employees is 5 years.

The storage period for statements included in the personal files of employees is 75 years.

- Agreement on full financial liability (Article 243, Article 244 of the Labor Code of the Russian Federation).

It must be concluded with employees who have been hired for positions involving financial responsibility. The storage period is 5 years (after the dismissal of the financially responsible person).

- Registration log of inspections of regulatory services.

Keeping this journal is mandatory for all legal entities and individual entrepreneurs. All primary documents, accounting registers and accounting records must be stored for at least five years Art.

It does not correctly contain any exceptions for reorganized organizations.

Internal inventory of electronic documents and features of its preparation

GOST establishes a set of rules according to which ED (electronic document) is sent to the archive. It implies, for example, an annual examination, as a result of which ED with an expired shelf life is destroyed. Current EDs are entered into a new inventory, which is essentially an act of acceptance and transfer, and are left to be stored further.

The compilation of such an inventory is also regulated by rules, which, due to the elementary obsolescence of the described storage technology, are inapplicable for modern commercial organizations. For example, the inventory must be drawn up in two copies, its serial number must be entered in the archive, indicating the fund number, it must also describe the media on which the documentation is sent to the archive, etc. Considering that repositories today are high-tech data centers, It is difficult to imagine compliance with such rules.

How to hem documents with threads for 2, 3 and 4 holes, as well as on the corner

» » » »

Documents are stapled to ensure their integrity.

Sequential numbering, as well as fastening the sheets with lace or thread, completely solve this problem. Sometimes lacing is necessary according to the rules established by the organization, sometimes - according to the law. In this article we will look at how to properly flash documents in office work.

In office work, documentation is most often stapled in order to transfer it to the archive, or when submitting it to a bank and other financial institutions.

Also, document firmware is required when submitting reports to extra-budgetary funds and the Federal Tax Service. The document must not only be stitched, but also numbered.

Papers are sewn together either with thread or tape, or using special machines.

The following types of documentation are subject to firmware:

How to sew a cash book - sample?

Subscribe to our accounting channel Yandex.Zen

Subscribe

How to sew a cash book - a sample and generally accepted method for forming a book are given below. This article is relevant for almost all accountants who do not want to allow fines to be imposed for violating cash discipline.

How to file a cash book correctly

See also: If the debt was bought by collectors

How to lace a cash book: instructions

How to flash a cash book: photo

Results

How to file a cash book correctly

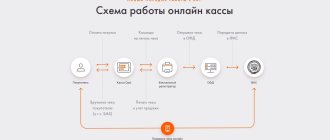

Despite the fact that most of the previously familiar cash documents have been canceled after the introduction of online cash registers, the cash book still remains a mandatory document for registration.

To learn more about which cash documents you don’t need to prepare now and why, read the material “Do I need a cash book to run an online cash register?”

There are a number of ways to maintain a cash book, and there are several options for how the cash book is filed. We will describe all known methods of binding a book.

As you know, the cash book must be kept in one copy at the enterprise. Usually it is started for a year, but other periods of using one cash book are also possible, for example, for a quarter or a month. It all depends on the number of cash turnovers of an organization or individual entrepreneur.

Before we learn how to file a cash book, let’s figure out why this needs to be done. This is due to the need to ensure the safety of information entered into the register. That is, the stitched and numbered pages of the cash book eliminate the possibility of manipulation of the records by the cashier. The stitched and counted sheets cannot be torn out and replaced with falsified ones.

Let's look at how to file a cash book.

1. If the cash book is a standard journal, printed in the KO-4 form (in accordance with Goskomstat Decree No. 88 of August 18, 1998, hereinafter referred to as Resolution No. 88), in which all pages are located horizontally, you should follow our instructions about , how to file a cash book (a sample in the photo and the instructions themselves are presented below).

The peculiarity of keeping such a book is that each sheet inside the magazine consists of 2 parts, one of which remains in the book, and the second is torn off and attached to the cashier’s report. Entries on both halves of the sheet are made identical using carbon paper. Accordingly, the page numbering on each half of the sheet is duplicated.

In this case, that part of the sheets that are located in the binding (fastened with a fastening staple or glued) is sewn together. When filling out such a book, a manual method of entering data is usually used. The pages in it are numbered, and it itself is stitched and printed at the very beginning of its establishment.

2. In the event that the cash book is filled out using a typewritten method, i.e., every day all information is entered by the cashier directly into an accounting program, for example, in “1C:Enterprise” or another (or if the book is maintained in an office program such as Excel), you should do this.

At the end of the day, when cash transactions have taken place, recorded in the cash book on the basis of incoming and outgoing cash orders, the cashier prints out the completed page/pages that were generated using the software. The pages are printed in 2 copies: 1 - loose leaf of the cash book, 2 - cashier's report.

Advice!

Loose sheets and cashier reports must be numbered. In this case, numbering begins from the beginning of the year (or month/quarter, depending on the volume of cash transactions). In addition, loose-leaf sheets and cashier reports duplicating them, filled out on separate unstitched sheets, can be maintained not only by typewriting, but also by hand. In this case, carbon paper should be placed between the sheets.

IMPORTANT! According to tradition, the book should be kept from the beginning of the year. All methods adopted by the company for maintaining and filling out the cash book must be reflected in the accounting policy approved by a separate order.

The nuances of documenting cash transactions are disclosed in this article.

At the end of the month/quarter, the cashier must indicate on the last loose sheet for this period how many total sheets from the cash book were compiled in this month/quarter. All loose-leaf sheets signed and checked by the cashier must be retained by him for a year. As they accumulate (or at the end of the year), the sheets are bound and stitched.

Find out what the fine is for not having a cash book by following the link.

On the back of the last sheet, the thread with which the sheets were stitched is sealed with a seal indicating the number of sheets sewn. All this is certified by the signatures of the head and chief accountant of the company. A seal impression is placed, which partially covers the seal, and partially remains on the last stitched sheet.

3. A cash book produced in electronic form does not require printing or stapling. It is issued using technical means that prevent unauthorized access to it. As a result, it is signed with electronic digital signatures (of the manager, chief accountant).

How to flash a cash book will be discussed in detail in the next part of the article.

How to lace a cash book: instructions

Let's look at how to sew a cash book step by step. The described example of firmware for this accounting register is suitable for books designed in the form of a magazine with horizontally arranged pages, in which one part of the sheet is tear-off.

Step-by-step instruction:

- Before sewing a cash book, you need to number all the pages. This should be done with a ballpoint pen. Page numbering is continuous, starting from page 1. The number of each page must be duplicated on the tear-off and stapled sheet.

- A blank book is stitched together, in which there are no entries yet. For stitching, a thick needle or awl threaded with coarse thread is usually used.

- The book is opened, and only those sheets on which records will be kept are stitched, i.e. excluding the cover and title page.

- It is necessary to sew so that the loop (double) is free. The knot is tied so that the pages of the book can open freely.

- The two ends of the thread after the knot are placed on a cardboard cover and glued to it using a small sheet of white paper (usually 5 × 10 cm in size). This sheet is the seal.

- The sealing sheet must be well glued so that the ends of the thread are tightly attached to it and cannot be pulled out later to replace sheets in the cash book.

- On the seal, a handwritten inscription is made (or pre-printed) of the following type: “In this cash book, ____ sheets are numbered and laced together” (in accordance with Resolution No. 88). The number of stitched sheets is also written down by hand. Below should be the signatures of the director and chief accountant of the enterprise.

Source: https://nalog-nalog.ru/kkt_kkm_kassa/kak_pravilno_sshit_kassovuyu_knigu_obrazec/

Systematization of accounting

12/21/2018 Contents The issue of storing documents relates to the document flow regulations that the organization develops and approves in its accounting policies.

Each chief accountant of the organization decides for himself how to store documents. This depends on the size of the enterprise, the types of activities, and the method of organizing accounting.

There are several forms of accounting: journal-order; memorial warrant; simplified form for small businesses. You will need

- — folders-registrators,

- — Folders,

- - source documents.

Instructions The journal-order accounting system is the most common.

How to staple documents

Any organization must ensure systematization, integrity, safety of documents and convenient access to them.

It is typically used in accounting automation programs. For each order journal, keep 1 folder for the financial year. In journal order No. 1 “Cash”, include the results of business transactions for account 50 “cash”.

Basic rules governing the process of document stapling:

- Methodological recommendations approved by Order of the Federal Archive of December 23, 2009 No. 76;

- GOST R 51141 - 98 “Office management and archiving”;

- Recordkeeping requirements developed by industry departments.

We recommend reading: Application for registration at the place of residence of public services

You have to stitch documents and copies of documents that consist of two or more sheets:

- acts of completed work;

- orders of personal and general personnel;

- expense reports;

- staffing schedule;

- statements

- invoices;

- cash book;

- waybills;

- invoices;

Stitching process

When starting to staple a document, you need to make sure that you have everything you need at hand. In addition to the work itself, you will need special threads and a needle, as well as an awl. Straight threads, bank twine or stitching threads LSh-210 are used . The latter are the most frequently used in office work.

To begin, remove all paper clips or other metal objects from the document and fold the file into an even pile. On the left side of the margin you need to make 3 holes using an awl or needle. It is best to make holes in half of the free margin of the left indent - approximately 1.5 cm. This is important, since the document must remain readable after flashing. You can use a hole punch to ensure that all the holes have straight edges, but be careful as it will not be able to make holes on a large number of sheets.

All 3 holes are located symmetrically in height, the distance between them is about 3 cm. The middle hole should be in the middle of the sheet.

Sometimes it is recommended, in order to prevent the case from “falling apart” and the title page from being damaged, to glue strips of cardboard in the stitching area on the front and back. The thread will pass through these strips. The length of the thread depends on the stack, the standard size is about 70 cm.

Firmware algorithm for 3 holes:

- Pass the needle through the middle hole, leaving the end of the thread on the back side.

- Now we thread the thread into the top hole. Both ends of the thread ended up on the other side of the case.

- We pass the needle through the lower hole, bringing the thread to the title side.

- We put the thread into the middle hole again.

- The thread has passed through all the holes, now you can tie a strong knot from the two ends of the thread on the back of the document. You need to leave 5-6 cm. A certification inscription is glued to the knot. We will look at how to do it in the next section of the article.

This is interesting: Independent assessment: features of the conduct + review of the best expert companies (+ video)

You can stitch a document using 4 holes. This is done quite simply. Punch 4 symmetrical holes on one vertical axis. We sew with stitches from the first hole, leaving a piece of thread on the back side. A knot is tied in the same way as the previous method.

The document should be stitched twice to ensure its reliability and safety.

You can watch the process of filing an archive folder in the following video:

What salary documents need to be printed and stored?

The question of using unified or independently developed forms in the field of labor relations still remains open, so it is recommended to adhere to specially developed forms back in 2004.

To do this, the documents are stitched. This activity requires accuracy and attentiveness. and what is needed for this - we will tell you in our article.

T-12 - Form “Sheet for recording working hours and calculating wages”; T-13 The form is called “Working Time Sheet”; T-49 The form is called “Payment Sheet”; T-51 The form is called “Payment Sheet”; T-53 “Payroll” form; T-53a Form “Payroll Registration Journal”; T-54 “Personal Account” form; T-60 Form “Calculation notes on granting leave to an employee”; T-61 Form “Calculation notes upon termination (termination) of an employment contract with an employee”; T-73 Form “Act of acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific work.”

Therefore, it is most appropriate to consider the main documents on payroll accounting in force at Russian enterprises in the light of Resolution No. 1 of January 5, 2004 of the State Statistics Committee of Russia.

How to file accounting documents

September 2, 2011 Author KakSimply!

The issue of storing documents relates to the document flow regulations that the organization develops and approves in its accounting policies. Each chief accountant of the organization decides for himself how to store documents. This depends on the size of the enterprise, the types of activities, and the method of organizing accounting.

There are several forms of accounting: journal-order; memorial warrant; simplified form for small businesses.

- How to file invoices Question “How to find a job in the IT field without specialized education” - 3 answers You will need

- How to file documents

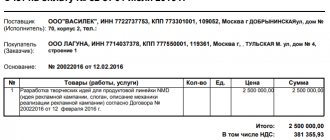

Dates of issuance and receipt

According to clause 1.10 of the Procedure, the date of issuing an electronic invoice is considered to be the date of receipt of the invoice file from the seller to the operator, indicated in the operator’s official document.

In accordance with clause 1.11 of the Procedure, the date of receipt is the date of sending the invoice file to the buyer, also indicated in a special official document of the EDF operator.

The operator records all dates without fail. If disagreements arise between counterparties, the operator can act as a third independent party and always confirm the fact and time of document transfer.

Viewing the invoice date in Synerdocs:

Viewing the dispatch date through the Document Flow functionality:

How to stitch documents correctly with thread so that everything is in accordance with GOST?

The main function of any organization's library is to provide convenient and easy access to stored documents. Another important role is to maintain papers within the time limit established by law.

The form of document storage is also strictly regulated and is of key importance for the successful functioning of each enterprise. In other words, the documents must be correctly and reliably stitched by hand: First, incorrect stitching of the papers will most likely cause the regulatory authorities to refuse to accept the documents.

It should be taken into account here that each such failure will lead to additional loss of time and material costs. But this is not the only consequence. Second, careless stapling of an organization’s financial documents can open an easy path for unscrupulous individuals to gain access to important papers.

Reporting and primary documents can be expanded, and their internal information adjusted.

How to staple accounting documents correctly?

Before you start working with documents, you need to carefully read the relevant instructions on office work and document flow.

These are very complex standards containing many small nuances and details.

It would seem that it could be simpler than stitching a document by hand and handing it over to the archives.

But in practice this is absolutely not the case. The archive often does not accept a document if any rule of record keeping is violated. We have to do everything again.

If you are familiar with a similar situation, then our article will help you figure it out.

We will consider in detail all issues related to the procedure for stitching a document: from GOSTs regulating this process to the design of the cover and stitching with 3 or 4 holes.

We recommend reading: When does a child need to apply for a personal insurance policy?

How to correctly flash documents before submitting them to the archives or the tax office

There are no unified instructions for binding documents.

Contents of the article The procedure is regulated by several instructions: Firstly, these are Methodological recommendations for office work, approved by order of the Federal Archive of December 23, 2009. Secondly, the corresponding GOST R 51141, called “Office work and archiving.

But recommendations for filing files are contained in the Methodological Recommendations of the Federal Archive, Order No. 536 of the Ministry of Culture of Russia for 2005, the instructions of the Central Bank on document management and GOST 51141, which regulate the rules for storing documents.

Let's look at the basic principles of proper stitching of various documents. Before filing the documents, you should think about a cardboard cover for each folder. They are:

Standard.

They measure 22.9 x 32.4 cm and are needed to sew together standard size sheets of paper. Non-standard. They are needed if the size of the papers differs from the usual A4 format, in which case the shape and proportions of the cover correlate with the format of the paper being filed. For long-term storage. They have a random format, but are made of especially hard cardboard.

Designing the cover

As you know, theater begins with the wardrobe, and business begins with the cover. The first thing to do is choose a cardboard cover for the case. Although at first glance it seems that they are all the same, this is not entirely true. There are three types: standard, non-standard and cover for long-term storage :

- Standard ones are most common; their size is 229x324 millimeters. They are used when the sheets have a regular, standard size.

- Non-standard differs in size and is needed when a document for some reason has a specific, non-standard size.

- And the last type is a document that, according to legal regulations, must be stored in an archive for more than 25 years. It requires a hard cardboard cover. Since the storage period is quite long, care should be taken to ensure that the document is in proper form and is suitable for use after such a period of time. Acid-free cardboard covers are used for those documents that are subject to submission to the state archive.

You can view the rules and a sample of filling out a payroll slip using the T-49 form in this article.

If you are interested in what OKATO is, check out this material.

How to file documents correctly in accounting

Before you start working with documents, you need to carefully read the relevant instructions on office work and document flow.

These are very complex standards containing many small nuances and details. It would seem that it could be simpler than stitching a document by hand and handing it over to the archives.

But in practice this is absolutely not the case. The archive often does not accept a document if any rule of record keeping is violated. You have to do everything all over again. If you are familiar with a similar situation, then our article will help you figure it out.

We will consider in detail all the issues related to the procedure for stitching a document: from GOSTs regulating this process to the design of the cover and stitching with 3 or 4 holes. The procedure is regulated by several instructions: Firstly, these are Methodological recommendations for office work, approved by order of the Federal Archive of Russia from December 23, 2009. Secondly, the corresponding GOST R 51141, called “Office management and archiving.

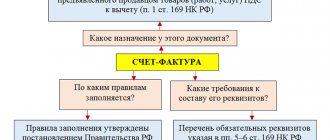

Exchange of electronic invoices

The exchange procedure is regulated by law and approved by Order of the Ministry of Finance of Russia dated April 25, 2011 N 50n (hereinafter referred to as the Procedure).

The exchange of invoices is possible only through a trusted operator of the Federal Tax Service of Russia, in other words, an EDI operator on the basis of clause 1.3 of the Procedure.

EDF operator is an organization that provides services for the exchange of electronic documents between companies.

The list of operators included in the Trust Network of the Federal Tax Service of the Russian Federation is posted on the official website of the service. The procedure for joining the Network is determined by Order of the Federal Tax Service of the Russian Federation dated April 20, 2012 N ММВ-7-6/ [email protected]

Topic: How to staple accounting documents correctly

Accountants constantly have the need to flash documents.

Almost all documents are stitched, these are advance reports, invoices for writing off materials, cash register, bank, invoices for goods received, sales documents, invoices, wage documents and many others. The law does not provide precise instructions and regulations that would explain how to correctly file accounting documents. There are a number of requirements from various authorities, for example, general recommendations for binding documents in A4 format can be read in the Methodological Recommendations for the development of instructions for office work in federal executive authorities, approved.

By order of the Federal Archive of December 23, 2009 No. 76 and from GOST R 51141-98 “Office work and archiving.” Numbering of sheets Numbering of sheets in files is necessary to fix the order of documents after flashing to ensure their safety.

Sheet numbering

Fold the case in the required sequence, then start numbering it. It is done with a simple pencil .

The basic rule is that it is not the pages that are numbered, but the sheets of the document . The number is placed in the upper right corner of each sheet using Arabic numerals. The numbers should not touch the text. In this case, the inventory is not included in the general numbering of sheets.

Let's look at some numbering points:

- If the document being filed contains letters, then the envelope itself is numbered first, then all the sheets enclosed in the envelope.

- If the document is quite large (more than 250 sheets), then it is divided into appropriate volumes. Each new volume has its own numbering.

- The file may contain documents that have their own page numbering, such as periodicals, etc. Despite this, they are also numbered in a general order.

- The larger sheet is unfolded and numbered in the upper right corner. It needs to be hemmed at one edge so that you can easily unfold and read the text of the document.

- Regarding sheets on which other fragments are glued and which cannot be separated, such sheets are numbered as one. But in this case, you need to make an inventory of the glued fragments in the free space or on the back. When compiling a general inventory, it is indicated in the notes or in the certification inscription that a document (its name) is pasted on such and such a sheet, about which the inventory is drawn up on the sheet. This can usually be photographs, receipts or clippings. If such a document is stapled or glued at one edge, then it is numbered in the same way as all the others. Information about this is not indicated in the inventory.

- Specific documents, for example, drawings, photographs, diagrams, occupying the entire sheet, are numbered on the back of the sheet in the upper left corner.

- Maps or diagrams can be glued together from several sheets, they have one number, but in the notes it is necessary to write the number of sheets in such a glued together.

This is interesting: The concept of nominal and real wages in Russia

If minor errors were identified during the numbering, that is, one or two sheets were missed, then letter designations can be used instead of renumbering all the sheets. For example, instead of the missing sheet 12, following the eleventh, put the number 11a. Other sheets do not change their number. Errors can be corrected in this way only by agreeing on this correction with an archive employee.

If there are gross errors, the document must be renumbered. The previous number is carefully crossed out and a new one is added. A certification note must also be made for the new numbering. The old inscription remains, but it should be crossed out.

How to file documents correctly in accounting

Contents It is customary for any enterprise to publish documents and contain a huge number of papers that are related to the activities carried out.

All these documents need strict systematization, otherwise all the documents will be mixed up, and confusion will arise in the enterprise. Usually, HR specialists staple documents so that the sheets are not lost and the document is a single whole.

There are many options for flashing documents, and there is also a certain procedure for flashing, which every clerk must know. How to flash documents correctly, what is required for this and what should be followed?

Let's look at these questions below. Not all documents need to be flashed, and for this reason it is very important to understand which of them are suitable for such a procedure.

Storing invoices: new rules for 2017

From July 2020, new rules for storing invoices come into force. We'll tell you more about the new rules, as well as some reasons why you should keep invoices, in this article.

Document

: letter of the Federal Tax Service of Russia dated July 19, 2017 No. SD-4-3/14079

Consequences

: they will be fined less often for documents

There may be chronological gaps in the invoice file if you issue both paper and electronic invoices.

This was confirmed by the Federal Tax Service of Russia in a letter dated July 19, 2017 No. SD-4-3/14079. The company has the right to issue invoices on paper and electronically (paragraph 2, clause 1, article 169 of the Tax Code of the Russian Federation). But electronic and paper documents have different storage rules.

The company stores paper invoices in chronological order as they are issued or corrected (clause 14 of the Rules, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). In practice, companies staple invoices in chronological order along with delivery notes.

The company stores electronic invoices without printing them. This follows from paragraph 1.13 of the Procedure, approved by order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n. Electronic confirmations from the electronic document management operator and notifications to customers about receipt of an invoice are stored in the same way.

The Ministry of Finance believes that these rules cannot be violated (letter dated May 30, 2017 No. 03-07-09/33048). For example, store paper invoices electronically.

But when a company issues some invoices on paper and some electronically, there will be chronological gaps in the paper invoice files.

This is natural, since you do not print electronic invoices for storage. The Federal Tax Service clarified that such omissions are not violations.

There is no need to specifically record them in paper invoices.

Why should you keep invoices?

When a company discovers that an employee has caused property damage, immediately document the facts that relate to it. Get everything in writing.

These can be official memos, witness statements, invoices, invoices, checks. Describe the circumstances in detail, indicate the time, date, who was present, what the employee did and what the consequences of his actions were.

Also find out whether he fulfilled his official duties, etc.

Request a written explanation from the employee who caused material damage to the company (sample below). This is a mandatory requirement (part two of Article 247 of the Labor Code of the Russian Federation). The Labor Code does not determine whether to request explanations orally or in writing.

But to confirm that the employer has fulfilled its obligation, do it in writing, with a separate request. In response, the employee can state everything in free form, for example in the form of an explanatory note. If the employee refused to comment on the incident in writing, draw up a report.

Without an explanation from the employee, the employer can still hold the perpetrator financially liable.

>>>

On October 16, 2020, at 10:00, the senior ferryman was loading a Ford Focus freight car from the terminal and discovered damage on it. He wrote about this in a memo to his manager. Based on CCTV cameras, it was established that on October 10, 2017.

at 11.30, driver Ivan Petrovich Samoilov was moving a car from one storage area to another at the warehouse for storing freight vehicles. When I drove into the storage row and was reversing, I did not notice another car nearby and damaged both vehicles.

The manager outlined in a memo everything that he knew and asked for an explanation from the distiller Samoilov. In the explanatory note, he wrote that he did not know about the damaged commercial vehicles.

How invoices are used in the event of property damage

In order for an employee to compensate the company for damage, the employer is obliged to conduct an inspection and establish the amount and cause of the damage. To carry out the inspection, the employer can create a commission of specialists from different departments. Such a commission can operate either on an ongoing basis or be collected by the employer for each specific case.

Issue an order on the main activity, which determines the composition of the commission, its purpose and responsibilities (sample below). Set deadlines and in what form the inspection materials should be submitted.

If you create a separate commission to check each case, then in the order specify the offense that the employee committed, the circumstances, the time and moment when the incident was discovered, invoices and other documents and grounds that confirm this.

>>>

The employer has the right not to collect a commission if the amount of material damage can be determined on the basis of invoices and other documents. For example, if an accident occurs due to the fault of an employee, the employer will determine the damage using documents from the insurance company that repaired the vehicle.

Source: https://www.sekretariat.ru/article/211144-hranenie-schetov-faktur-17-m11