Who files the 12-F report?

This form is intended for all legal entities that produce goods and services for sale. A single form is valid for both commercial and non-profit companies. Representative offices, branches and divisions of foreign companies also report on it.

Exceptions from the list of respondents were:

- small businesses;

- government agencies;

- credit organizations;

- non-credit financial organizations (Article 76.1 of the Federal Law of July 10, 2002 No. 86-FZ).

In general, organizations that are undergoing bankruptcy proceedings, payers of the single tax of the simplified tax system and those subordinate to the Russian Ministry of Defense must report.

About the OP-12 form

This form is unified. It was put into effect by Decree of the State Statistics Committee No. 132 on December 25, 1998. The form has ceased to be mandatory for use since January 2013. From that moment on, companies could develop their own forms and use them in their work - the form became only a recommended one.

Important! When using your own forms, you need to remember that the documents must have all the necessary details. You can learn about them from paragraph 2 of Art. 9 Federal Law No. 402 of December 6, 2011. In addition, your choice must be consolidated in the accounting policies of the organization. This also applies to unified forms.

Although business entities have received such freedom in choosing forms for primary accounting documents, many companies prefer the old, proven forms. The advantage of this choice is the absence of complaints from inspection authorities, since they are accustomed to standard forms.

Zero form 12-F

If throughout 2020 the respondent’s activities did not show a single indicator studied according to the form, then he can submit a zero report or send a letter to Rosstat.

Blank (zero) report - in which only the title page is filled out and all the necessary signatures are affixed. In other sections you cannot put zeros or dashes; leave them blank.

In the official information letter, you need to explain that during the reporting period you did not have any events observed in the form. Send it to the same Rosstat body to which you submit reports.

Migrant statistical registration sheet sample to fill out

Registration at the previous place of residence of citizens transferred to the reserve after completing military service by conscription is carried out upon submission of an application for registration at the place of residence in the established form and an identification document, in other cases on a general basis. For these citizens, statistical registration sheets in form N 12P and in form N 12B are drawn up only if they come to live in settlements where they did not live before being called up for military service. Registration at the previous place of residence of citizens who were transferred to the reserve after completing military service in connection with conscription should be carried out after a corresponding application is submitted to the government authorities with a request for registration of registration, as well as an identification document, Otherwise, this procedure will be carried out on a general basis. For these citizens, statistical registration sheets are issued only if, after completing their service, they are sent for permanent residence to a city in which they have not previously lived. Citizens who arrive to perform services on the territory of monasteries, churches or any other religious buildings must be registered in the specified territory in accordance with the standard procedure prescribed in the Regulations.

Movements associated with military service or imprisonment are subject to statistical recording if, after completing military service or being released from prison, such migrants are registered at a new place of residence in which they did not reside before being called up for service. or until conviction. In the sheets of statistical registration of arrivals, in the paragraph on the last place of residence, the address of the place of residence before conscription or before conviction must be indicated.

- when registering military personnel who were transferred to the reserve and returned to the address where they lived before the moment of conscription;

- in the process of moving to another locality, if the old and new places of residence are located within the boundaries of the same administrative district;

- within a populated area that is not divided into several districts;

- within a certain locality.

Deadlines and procedure for delivery

Organizations submit a report on Form 12-F every year. Deadline: April 1 after the reporting year. So, for example, the report for 2020 must be submitted by April 1, 2020. And the report for 2020 must be submitted by April 1, 2021.

It is worth considering that the report must be submitted on a working day, therefore, if April 1 was a holiday or day off, the report can be submitted later. In 2020, the entire month of April was declared a non-working day. On this occasion, Rosstat allowed the report to be submitted later. The maximum delay is 8 days, that is, until April 8. This is written on the official website of the FSGS in the “Respondents” section.

The form can be submitted either on paper or electronically. The place of delivery is the territorial body of the statistics service at the location of the organization.

An additional rule is provided for legal entities that have separate divisions, allocated to a separate balance sheet and keeping records of sales revenue and expenses. For each such person, a separate form is submitted - at the location of the unit or at the place of actual work, if they do not match. In this case, the form for the legal entity is presented separately, without summary data.

The report can be completed and submitted by a person authorized by the manager, for example the chief accountant or a specialist from the company’s statistical department.

Blanker. at

Why is it needed? If a citizen stays on the territory of the Russian Federation for more than 90 days, he must obtain temporary registration. In this case, the location can be anything, from rented apartments and hotels to sanatoriums and hospitals. To achieve this, the Federal Migration Service has established a procedure that takes into account all actions of citizens and representatives of the migration service. If a person is registered in the same locality, but lives at a different address, he also requires temporary registration. One of the documents required for registration is the arrival address sheet Form 2 (you will find the form below).

It was established by FMS Order No. 288 dated September 11, 2012 and is needed to simplify the process if the duration of stay is known and determined. The period of stay at the place of temporary registration must be at least six months.

Filling out Form 12-F

Form 12-F in the latest version was approved by Rosstat Order No. 421 dated July 24, 2019 in Appendix No. 3, OKUD code 0608011. Information about respondents, the procedure for submitting and filling out the form is also provided there. The form consists of a title page and a large information plate, which contains all the information about expenses.

First, let's deal with two questions: where to get the data to fill out Form 12-F and whether VAT needs to be taken into account when filling it out. Even organizations on OSNO do not need to indicate VAT. And basic information about the use of funds can be obtained from financial statements, contracts, primary documents, etc. — sources differ for individual indicators.

Let's look at the procedure for generating a report.

Title page

Fill out the title page in the standard manner. Indicate the reporting year, name of the enterprise, postal address with zip code and OKPO code of the reporting organization or identification number for a separate division and the head division of the legal entity.

Form of statistical arrival sheet according to form 12p

IMPORTANT! A static arrival record sheet can also be confused with an address sheet. The main difference between them is that the latter is filled out and attached to the documents when a person plans to temporarily register at the place of stay for a period of more than 9 months.

Who fills out The document forms are filled out by the employee of the budget organization responsible for registration. However, it often happens that they are filled out by citizens themselves who apply to the passport office.

Forms are issued free of charge and are not subject to state duty. The document is prepared in three copies, and in the centers of the constituent entities of the Russian Federation - in two, and submitted to the OUFMS (clause 17 of Resolution No. 713 of July 17, 1995).

conclusions

The “Information on the use of funds” form is a way to collect information about business entities of territorial statistical bodies and includes information about the organization’s expenses, that is, for what purposes the enterprise’s funds were spent. The form is submitted annually and can be submitted in written or electronic form with the obligatory signing of the form with an electronic digital signature. For failure to submit this report, the organization may be subject to an administrative penalty in the form of a fine.

How to fill out a temporary arrival form

The document is drawn up when planning to stay at a specific address for no more than 90 days. For this purpose, temporary registration at the place of residence is carried out. The following places of residence are considered:

The places of residence of a Russian or foreign citizen are established:

- residential premises owned or leased;

- hotels, hostels;

- sanitary-resort treatment institutions;

- hospitals, city, municipal or private foundation.

Sample form

How to register using the arrival sheet

The procedure for issuing an arrival slip is established by the Department of the Federal Migration Service of the Russian Federation. It regulates in detail the requirements for filling out the document and notifying authorized bodies.

Important: If a citizen has permanent registration at one address, but is temporarily in another premises, then he requires registration, which is recorded on the arrival sheet. The form is established in the order of the Federal Migration Service of the Russian Federation No. 288 dated September 11, 2012. The approved form is used if the period of stay at a certain address is unknown or in case of a short stay at the address. The period should not exceed 6 months of actual residence at the address.

Expert opinion

The employing company is responsible for notifying the migration service of a change of place of residence of a foreigner or Russian employed. In case of untimely notification of the authorized body, administrative responsibility will be borne by the administration of the organization.

Ilyichenko R.N., senior lawyer of the Federal Migration Service of the Russian Federation for the Sverdlovsk region

Features of working with a document

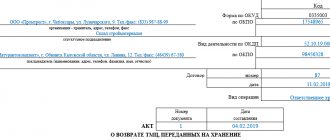

So, the form must be filled out daily based on cash receipts. It is needed to certify business transactions that the accountant will display in the company’s accounting records, as well as write off the amounts noted in the act.

The document is signed by members of a special commission who compare the data of checks with those deposited, a cashier, an accountant who must check the document after drawing up, and the head of the organization - he approves the document with his signature.

For your information! The commission must include the production manager.

The act must indicate dishes by type. For example: general meals, take-home meals, custom meals, etc. The completed document must be attached to the statement in form OP-14 (recording record of the movement of products and containers in the kitchen).

Instructions for filling

The form is filled out manually, in block letters. You can view a completed sample of the arrival address sheet, form 2, below, but for now we’ll look at the procedure for filling it out point by point.

pp. 1-3 - here indicate the last name, first name and patronymic of the applicant in the nominative case.

Item 4 – day, month, year of birth of the applicant (in full).

P. 5 - by highlighting the correct option, the gender is noted.

P. 6 - place of birth (first the country, then the region, region, city and, finally, the locality).

P. 7 - do you have citizenship of the Russian Federation?

P. 8 - date and place where the citizen is permanently registered.

Item 9 is the government body that registered the residence permit (indicated in the passport).

Item 10 - passport details (series, number, by whom and when issued).

Item 11 - place of departure of the person (from where he arrived) indicating the region, district, city or locality, street, house, building (if any), apartment.

Item 12 is completed during temporary registration in the same locality where the person has a residence permit.

Item 13 is completed when the last name or other personal data is changed.

If there is any important information that needs to be indicated, it is entered in clause 14.

Item 15 – date of completion and signature.

The remaining items are filled out by employees of the government agency.

Also, the arrival address sheet, form 2, sample filling, can be viewed directly at the OUFMS.

Concept of form, who passes

Form 12-F is a document that every organization must submit to the state statistics agency according to the region in which the enterprise operates. To be fair, it should be noted that there are so-called exceptions to the rule.

The following types of business entities are not required to submit this form:

- Small businesses. Let me remind you that small enterprises include enterprises with no more than one hundred employees, with annual revenue of no more than 800 million and with a limited share of participation in such an enterprise by other persons.

- Non-state pension funds;

- Banks and other credit organizations;

- State and municipal institutions;

- Insurance companies.

Important! If an enterprise has separate divisions - branches or representative offices, then such divisions must submit this report at the place of business activity.

Enter the site

RSS Print

Category : Statistical reporting Replies : 169

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. 6 Next → Last (17) »

| govoratiabelka [email hidden] Wrote 10 messages Write a private message Reputation: | #51[25626] February 25, 2014, 15:31 |

Notification is being sent...

| Eugene [email hidden] Belarus Wrote 446 messages Write a private message Reputation: | #52[25627] February 25, 2014, 16:48 |

Notification is being sent...

| govoratiabelka [email hidden] Wrote 10 messages Write a private message Reputation: | #53[25635] February 27, 2014, 17:50 |

Notification is being sent...

| Ta-Nyusha [email hidden] Wrote 276 messages Write a private message Reputation: | #54[25638] February 28, 2014, 8:35 |

Notification is being sent...

| govoratiabelka [email hidden] Wrote 10 messages Write a private message Reputation: | #55[25639] February 28, 2014, 9:52 |

Notification is being sent...

| Ta-Nyusha [email hidden] Wrote 276 messages Write a private message Reputation: | #56[25644] February 28, 2014, 1:37 pm |

COMMENTARY to the resolution of the National Statistical Committee of the Republic of Belarus dated August 4, 2011 No. 219 “On approval of the state statistical reporting form 12 “Labor Report” and instructions for its completion.” Labor statistics: explanations on the most problematic issues (in questions and answers) State statistical reporting in form 12 “Labor Report” (hereinafter referred to as form 12-t) was approved by Belstat Resolution No. 219 dated 08/04/2011 (with amendments and additions) . Often respondents make mistakes due to inattentive study of the Instructions for filling out statistical indicators on labor in the forms of state statistical observations, approved by Resolution of the Ministry of Statistics of the Republic of Belarus dated July 29, 2008 No. 92 (with amendments and additions) (hereinafter referred to as the Instructions on Labor), as well as Instructions on filling out form 12-t. From the editor: From January 15, 2014, you should be guided by the new state statistical reporting form 12 “Labor Report” and the Instructions for filling out the state statistical reporting form 12 “Labor Report”, approved by Belstat Resolution No. 163 of August 19, 2013 The form comes into effect starting with the report for January 2014. Let's consider the problematic issues that respondents most often encounter when filling out form 12-t. Question: Are employees who have committed absenteeism included in the average number of employees? Answer: To answer this question, “truant workers” should be divided into categories: • workers who committed absenteeism and were fired for absenteeism are excluded from the payroll (and, accordingly, from the average payroll) from the first day of absence from work (subclause 6.9 clause 6 and subclause 27.3 clause 27 of the Labor Instructions); • workers who committed absenteeism and were not fired for absenteeism are not excluded from the payroll (as well as from the average number of employees) for the days of absenteeism they committed (this conclusion follows from subclause 10.1 of clause 10 of the Labor Instructions). Question: Are donor employees taken into account in the average number of employees for the days they donate blood and its components, as well as for the additional days of rest provided after that? Answer: Donor employees for the days of donating blood and its components are not taken into account in the average number of employees (subclause 10.1.7, clause 10 of the Labor Instructions). Question: How is the number and payroll of an external part-time worker who simultaneously performs work in the organization under a civil contract reflected? Answer: If an organization additionally enters into a contract with an external part-time worker within the same organization, then work under a civil contract should be considered as additional. Such employees are reflected only in the indicator “Average number of external part-time workers” (section II, gr. 5 and 6, section V, gr. 13 and 14 of form 12-t). When calculating the number of external part-time workers, all man-hours worked by the employee are taken into account, both at the rate of the external part-time worker and under the contract, but the number of employees should not exceed “1”. Data on the wage fund of such an employee must be summarized and reflected in the report in section I on page 03 “Wage fund of external part-time workers”, and in section V should be included in column 5-8 “Wage fund of payroll employees and external part-time workers (without citizens who performed work under civil contracts).” Question: A civil contract has been concluded with an employee on the payroll. Should this employee be taken into account in the average number of citizens who performed work under civil contracts? Answer: The average number of citizens who performed work under civil contracts does not take into account employees who are on the payroll of an organization (including separate divisions) and who entered into a civil contract to perform work in the same organization (including separate divisions) (clause. 12 Labor Instructions). Question: Should financial assistance provided to individual employees upon their personal application be included in the wage fund, if the application states “due to difficult financial situation” without specifying a specific reason? Answer: In this case, a difficult financial situation is equated to negative family circumstances (natural disaster, fire, injury, serious illness, etc.). This kind of financial assistance provided to individual employees upon application should not be included in the wage fund when reporting on Form 12-t. It is taken into account in other payments and expenses that are not reflected in the wage fund (subclause 70.21, clause 70 of the Labor Instructions). Question: How to correctly reflect in a report on Form 12 financial assistance provided to employees: on the wedding day; to internationalist soldiers (on the Day of Remembrance of the Internationalist Warrior); liquidators of the consequences at the Chernobyl nuclear power plant (on the Day of the Chernobyl tragedy); in connection with the birth of a child; for parents with student children to prepare for the start of the school year; due to the death of close relatives? Answer: Financial assistance for the wedding day is equivalent to the payment issued to the employee in connection with the special event. It must be included in the wage fund (subclause 63.2.5 clause 63 of the Labor Instructions). The wage fund does not include: • amounts of social payments accrued to employees of the organization for memorable dates: internationalist soldiers (on the Day of Remembrance of the Internationalist Soldier), participants in the liquidation of the consequences of the disaster at the Chernobyl nuclear power plant (on the Day of the Chernobyl Tragedy) (subclause 70.4 clause 70 of the Labor Instructions); • financial assistance provided to parents at the birth of a child (subclause 70.4 clause 70 of the Labor Instructions); • financial assistance to parents with student children to prepare for the start of the school year (subclause 70.6, clause 70 of the Labor Instructions); • financial assistance provided to individual employees in connection with the death of close relatives (subclause 70.21, clause 70 of the Labor Instructions). Question: If one employee carries out several types of economic activity during the reporting period, what type of economic activity should he be classified as when filling out Section V “Number and wage fund of employees by type of economic activity” of Form 12-t? Answer: If the same employees of the organization were engaged in several types of economic activities in the reporting period, classified into different groupings of the national classifier of the Republic of Belarus OKRB 005-2006 “Types of economic activity”, approved by Resolution of the State Standard of the Republic of Belarus dated December 28, 2006 No. 65, then the data on These workers should be recorded according to the type of economic activity in which they were employed for the majority of their working time in the reporting period. Important! This methodology can be used when filling out statistical indicators in all forms of state statistical observations on labor. Instructions for filling out labor statistics in state statistical observation forms, forms for state statistical observations and instructions for filling them out, as well as various summary statistical information can be found on the official website of the National Statistical Committee of the Republic of Belarus - www.belstat.gov.by. 01/05/2013 Natalya Voevodina, Chief Economist of the Labor Statistics Department of the National Statistical Committee of the Republic of Belarus

I want to draw the moderator's attention to this message because:Notification is being sent...

| govoratiabelka [email hidden] Wrote 10 messages Write a private message Reputation: | #57[25645] February 28, 2014, 13:56 |

Notification is being sent...

| Ta-Nyusha [email hidden] Wrote 276 messages Write a private message Reputation: | #58[25646] February 28, 2014, 13:58 |

Notification is being sent...

| Ta-Nyusha [email hidden] Wrote 276 messages Write a private message Reputation: | #59[25744] March 21, 2014, 10:50 |

Notification is being sent...

| mari [email hidden] Belarus Wrote 1 message Write a private message Reputation: | #60[25802] April 14, 2014, 12:07 |

Notification is being sent...

« First ← Prev. 6 Next → Last (17) »

In order to reply to this topic, you must log in or register.

Who rents

The new report form states on the title page who submits Form 1-T (working conditions) at the end of the year. The completed statistical data form must be submitted to the territorial body of Rosstat by legal entities of all forms of ownership carrying out, in accordance with the classification according to OKVED (All-Russian Classifier of Types of Economic Activities), the following activities:

- on mining;

- in manufacturing industries;

- for the production and distribution of electricity, gas and water;

- in construction;

- in transport and communications;

- in the field of agriculture, forestry, and fisheries.

Branches, representative offices, and divisions of companies are required to submit reports for the annual period.

An exception is made for legal entities classified as small businesses. They are exempt from the obligation to report in Form 1-T.