Internal movement of fixed assets - document flow

In total, Resolution No. 7 approved 14 forms of primary documents, including the Invoice for the internal movement of fixed assets (Form No. OS-2).

According to the Instructions for the use and completion of primary accounting documentation forms for accounting for fixed assets, form N OS-2 is used to register and record the movement of fixed assets within an organization from one structural unit (workshop, department, site, etc.) to another. The invoice is issued by the structural unit that transfers the fixed asset, that is, it is the deliverer.

Three copies of the invoice are drawn up: the first copy is transferred to the accounting department of the organization, the second copy remains with the person responsible for the safety of the fixed assets of the delivery unit, and the third copy is intended for the unit receiving the fixed asset. Each of the three copies must be signed by the responsible persons of the delivering unit and the receiving unit.

The accounting unit for fixed assets, as you know, is an inventory item. In accordance with clause 11 of Methodological Instructions N 91n, each inventory item is assigned a corresponding inventory number. During the period that the fixed asset is in the organization, the inventory number assigned to the object is retained.

When fixed assets are received by the organization, an inventory card (book) is opened for each inventory item. The basis for filling out the card are, in particular, acts of acceptance and transfer of fixed assets (forms NN OS-1, OS-1a, OS-1b). The movement of fixed assets within the organization is also reflected in the inventory card (book) for accounting for fixed assets (forms NN OS-6, OS-6a, OS-6b).

In the inventory card for recording a fixed asset object (Form N OS-6), internal movement is reflected in section. 4 “Information on acceptance, internal movements, disposal (write-off) of fixed assets.” In the tabular part of Sect. 4 indicates the date and number of the document on the basis of which the entry is made, the type of transaction, the name of the structural unit, the residual value of the object, as well as the surname and initials of the person responsible for storage.

So, let's look at the order in which the Invoice for the internal movement of fixed assets should be filled out (Form N OS-2). The invoice indicates the OKUD form code. According to the All-Russian Classifier of Management Documentation OK 011-93, approved by the Resolution of the State Standard of the Russian Federation of December 30, 1993.

N 299, form N OS-2 corresponds to code 0306032. Then the name of the organization, its OKPO code assigned by the territorial body of state statistics, as well as the name of the structural unit-deliver and recipient are indicated. Please note that the Procedure for the use of unified forms of primary accounting documentation, approved by the Resolution of the State Statistics Committee of Russia dated March 24, 1999

N 20, it is determined that all details of the unified forms must remain unchanged (including codes). Removing individual details from unified forms is not allowed. Next, you should indicate the document number and the date of its preparation. Documents must be numbered in chronological order and numbers must not be repeated during the reporting year.

If an organization keeps records using computer technology, then a number is assigned to the document when it is compiled, which avoids repetition. If an organization has a large number of divisions, it is possible to provide for the numbering of documents separately for each such division.

In this case, all departments should be assigned a digital or letter code, which will be indicated in the document. According to paragraph 4 of Art. 9 of the Law “On Accounting”, the primary accounting document must be drawn up at the time of the transaction. If this is not possible, then the document is drawn up immediately after its completion.

Persons drawing up and signing primary documents must ensure timely and high-quality execution of documents, the reliability of the data contained in the documents, as well as their transfer within the established time frame to the accounting department to reflect transactions in accounting. After filling out the details already mentioned, you can begin filling out the tabular form of the invoice.

It indicates the name of the transferred fixed asset object, the date of its acquisition (year of manufacture, construction), as well as the inventory number assigned to the object. The number of objects being transferred, the unit cost and the total cost are also indicated. In the case of simultaneous transfer of several names of fixed asset objects, information about each object is entered in a separate line indicating its number.

In the unfilled terms of the invoice, dashes should be added. On the reverse side of Form N OS-2, in the “Note” section, a brief description of the technical condition of the fixed asset object is indicated, as well as the positions and personnel numbers of the persons handing over and accepting the valuables. It also contains transcripts of the signatures of these persons indicating the date of signing the document. The chief accountant makes a note that the movement of the fixed asset item is noted in the inventory card (book).

So, the invoice must be properly executed, that is, all the necessary details must be filled out in the document and the document must have the appropriate signatures, as established by clause 7 of Methodological Instructions No. 91n.

Note! According to clause 82 of Methodological Instructions No. 91n, the movement of a fixed asset item between structural divisions of an organization is not recognized as a disposal of a fixed asset item.

The organization's costs associated with moving an object within the organization, that is, transportation and other costs, according to paragraph.

74 of Guidelines No. 91n relate to production costs (selling costs).

It is necessary to recall that assets in respect of which the conditions provided for in clause 4 of PBU 6/01 are met, and with a value within the limit established by the organization’s accounting policy, but not more than 20,000 rubles.

per unit, can be reflected in accounting and reporting as part of inventories. To ensure the safety of these objects, the organization should organize control over the movement of such objects. In the Letter of the Ministry of Finance of Russia dated May 30, 2006.

N 03-03-04/4/98 it is noted that if an organization decides to account for such objects as part of inventories, it must maintain appropriate accounting cards for them - a receipt order in the form N M-4, a demand invoice in the form N M-11, materials accounting card in form N M-17 and other primary documents.

The named forms of primary accounting documents are approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction” .

A few words should be said about how the transfer of property from one division to another is reflected in the accounting records of an organization. In addition to the fact that an organization can have various workshops, departments, sites, production and other divisions in its structure, it can also have representative offices and branches.

Representation according to Art. 55 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them. A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office. Clause 3 of Art.

55 of the Civil Code of the Russian Federation establishes that representative offices and branches are not legal entities and are vested with property by the legal entity that created them. Accounting in an organization that transfers fixed assets to its branches will depend on whether or not the branch is allocated to a separate balance sheet. If the branch is not allocated to a separate balance sheet, then the operations carried out by the branch, as well as its property and liabilities, are accounted for by the main organization in the corresponding sub-accounts opened to the accounting accounts.

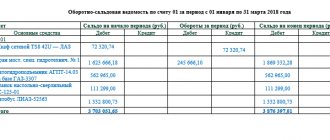

According to the Chart of Accounts for accounting financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts), an account is intended to summarize information on the availability and movement of fixed assets in an organization 01 “Fixed assets”.

On account 01 “Fixed Assets”, analytical accounting should be maintained for individual inventory items, while the construction of analytical accounting should provide the ability to obtain data on the availability and movement of fixed assets necessary for the preparation of financial statements (by type, location, and so on).

For account 01 “Fixed assets” you can open, for example, the following subaccounts: 01-1 “Fixed assets in operation of the parent organization”; 01-2 “Fixed assets in the operation of the branch.” Then the transfer of a fixed asset item to the branch will be reflected in the accounting record as a debit entry in account 01-2 “Fixed assets in operation of the branch” in correspondence with the credit of account 01-1 “Fixed assets in operation of the parent organization”.

The corresponding sub-accounts must be opened for the depreciation account for fixed assets (account 02 “Depreciation of fixed assets”), as well as for other accounts. If a branch of an organization is allocated to a separate balance sheet, accounting in the main organization will be slightly different. The chart of accounts for summarizing information on all types of settlements with branches, representative offices, departments and other separate divisions of the organization, allocated to separate balance sheets, is account 79 “Intra-business settlements”.

It is recommended to open a subaccount 79-1 “Settlements for allocated property” for account 79 “On-farm settlements”. This sub-account takes into account the status of settlements with branches, representative offices, departments and other separate divisions of the organization, allocated to separate balance sheets, for non-current and current assets transferred to them.

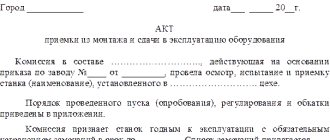

Sample of registration of the act of acceptance and transfer of fixed assets

You can fill out the document manually or on a computer. It should not contain corrections or blots. If it was not possible to avoid the error, then the entry “Believe the corrected” is made. But it is better to fill out a new document to avoid unnecessary disputes with regulatory authorities.

The act must contain information that must be displayed:

- date and number of compilation;

- full name of the object;

- place where operating systems are accepted;

- inventory and serial numbers;

- depreciation group to which the fixed asset is assigned;

- manufacturer or supplier;

- the presence of precious stones and metals in the object;

- specifications.

The act is considered fully completed only after it is signed by all members of the commission that accepted the object.

https://youtu.be/rCUKirlJspI

Invoice for internal movement of fixed assets (form No. os-2)

It is used to register and record the movement of fixed assets within an organization from one structural unit (workshop, department, section, etc.) to another.

Issued by the transferring party (deliverer) in three copies, signed by the responsible persons of the structural divisions of the recipient and the deliveryr.

Data on the movement of fixed assets is entered into the inventory card (book) for recording fixed assets (forms No. OS-6, No. OS-6a, No. OS-6b).

It is used for registration and accounting of acceptance and delivery of fixed assets from repair, reconstruction, modernization.

Signed by members of the acceptance committee or a person authorized to accept fixed assets, as well as by a representative of the organization (structural unit) that carried out repairs, reconstruction, and modernization. It is approved by the head of the organization or a person authorized by him and submitted to the accounting department.

If repairs, reconstruction and modernization are carried out by a third-party organization, the act is drawn up in two copies. The first copy remains in the organization, the second copy is transferred to the organization that carried out the repair, reconstruction, and modernization.

Data about repairs, reconstruction, and modernization are entered into the inventory card for recording the fixed assets object (Form No. OS-6).

Act on write-off of fixed assets (except for vehicles) (Form No. OS-4)

Act on write-off of motor vehicles (form No. OS-4a)

Act on write-off of groups of fixed assets (except for vehicles) (Form No. OS-4b)

Used for registration and accounting of write-offs that have fallen into disrepair:

- object of fixed assets - according to form No. OS-4;

- motor vehicles - according to form No. OS-4a;

- groups of fixed assets - according to form No. OS-4b.

They are drawn up in two copies, signed by members of the commission appointed by the head of the organization, and approved by the head or his authorized person.

The first copy is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets, and is the basis for delivery to the warehouse and sale of material assets and scrap metal remaining as a result of write-off.

In the indicators, the column “Initial cost as of the date of acceptance for accounting or replacement cost”:

- for fixed assets that have undergone revaluation, the replacement cost is indicated based on the results of the last revaluation;

- for objects that have not been revalued - the original cost as of the date of acceptance for accounting.

In the indicators, the column “Amount of accrued depreciation (wear)” indicates the amount of accrued depreciation (wear) from the beginning of operation.

The costs of writing off fixed assets, as well as the cost of material assets received from dismantling fixed assets, are reflected:

- in section 3 “Information on the costs associated with the write-off of fixed assets from accounting, and on the receipt of material assets from their write-off” (form No. OS-4);

- in section 5 “Information on the costs associated with the write-off of vehicles from accounting, and on the receipt of material assets from their write-off” (form No. OS-4a);

- in section 2 “Information on the receipt of material assets from the write-off of fixed assets” (form No. OS-4b).

The data from the write-off results are entered into the inventory card (book) of accounting for the object, objects and group accounting of fixed assets (forms No. OS-6, No. OS-6a, No. OS-6b).

Inventory card for accounting of fixed assets (form No. OS-6)

Inventory card for group accounting of fixed assets (form No. OS-6a)

Inventory book for accounting of fixed assets (form No. OS-6b)

They are used to account for the availability of fixed assets, as well as to account for its movement within the organization. Maintained in the accounting department in one copy: for each object - according to form No. OS-6, for a group of objects - according to form No. OS-6a, for fixed assets of small enterprises - according to form No. OS-6b.

Entries during acceptance and transfer are made on the basis of acts of acceptance and transfer of fixed assets (forms No. OS-1, No. OS-1a, No. OS-1b) and accompanying documents (technical passports of manufacturing plants, etc.).

Reception and movement of fixed assets within the organization, including reconstruction, modernization, major repairs, as well as their disposal or write-off are reflected in the inventory card (book) on the basis of relevant documents.

Certificate of acceptance of fixed assets (receipt of fixed assets)

The document is used to include individual objects received in the organization by:

- Purchases for a fee from other organizations.

- Construction by contract or economic method.

- Receipt from other organizations and individuals for free use.

- Contribution by the founders towards their contributions to the authorized capital.

- Receipt into economic management or operational management.

- Transfers in exchange for other property.

The document is drawn up in one copy for each inventory item. Drawing up a general act formalizing the acceptance of several OS objects is allowed only when taking into account production and household equipment. Tools, equipment, etc., if these objects are of the same type, have the same cost and were accepted in the same calendar month.

In this document we use the reference book “Fixed Assets”.

The fixed assets are entered into the accounting circuit as the debit of the account in correspondence with the account. In addition, it is necessary to indicate the account for attributing depreciation to fixed assets (, , , , etc.).

The procedure for issuing an acceptance certificate for fixed assets is as follows:

- Formation of a commission to commission the operating system.

- Drawing up an Acceptance Certificate. The act is drawn up in one copy.

- Signing of the Acceptance Certificate by members of the commission.

- Approval of the Acceptance Certificate by the head of the organization.

- Accounting registration – acceptance for accounting.

When registering the internal movement of fixed assets, the act (invoice) is written out in two copies by an employee of the structural unit of the donating organization. The first copy with the receipt of the recipient and the deliverer is transferred to the accounting department, the second - to the structural unit of the delivery organization.

| Top of page |

When is it issued?

When moving a fixed asset within an organization from one division to another. For example, such an act is drawn up:

- transfer of equipment from one workshop to another for permanent use;

- transfer of equipment from one workshop to another for temporary use (for example, for temporary replacement of broken equipment);

- transfer of equipment to a repair shop for repair, reconstruction, modernization on our own.

The invoice is issued on the day of transfer of the fixed asset.

Procedure for filling out an invoice for internal movement

Sometimes a company needs to move goods or material assets from one structure to another, but even such minor movements must be kept in the documents in order not to damage the reporting.

In any case, for internal movements, a document is drawn up that serves as a guarantee that the goods have been transferred and accepted by the other party. Depending on the goods being transferred, there are different forms of invoices. Let's take a closer look at this issue.

Internal movement is the movement of certain goods or services that occurs within a single legal entity. It can be carried out between various financially responsible persons or structural divisions.

Goods, materials, core values, etc. can be transferred.

But regardless of what exactly is being transferred, it is necessary to fill out a certain unified form, which serves as reporting for warehouses and accounting.

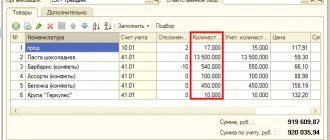

Depending on the goods, there are forms TORG-13 and OS-2. In addition, data on internal movements is entered into the documents of the organization itself.

To track the movement of goods, materials and fixed assets within an organization, there are special invoices that must be issued during the transfer of goods. This document is proof that material assets were transferred and accepted.

After the goods have been accounted for on both sides, the invoice must be submitted to the accounting department for a full report on the movement. It is also worth noting that only financially responsible persons can sign the document.

Depending on what kind of goods or valuables you are transferring, there are two unified forms: TORG-13 and OS-2. So, the first is used when we are talking about ordinary goods or materials of the company. OS-2 is used when it is necessary to transfer an item of fixed assets.

In order to draw up a document for the transfer of fixed assets of a company, you will need to refer to form OS-2; the document should be drawn up in triplicate.

The first one will remain with the one who provides the object, and in the future it will serve to write it off from the warehouse. The second document goes to the person to whom you transferred the object - it also serves for reporting and confirmation of how much of the product was transferred and what it was.

The third copy should remain with the person who entered the data in this form.

The TORG-13 invoice requires two copies and a less strict form of completion. It can only be used when it comes to goods, containers and materials. It also applies when it comes to transportation by the organization’s transport. The document will be effective when transferred between any materially responsible persons (MRP) or departments:

- main and separate;

- separate divisions;

- workshops or responsible persons.

The form should be filled out in two copies, and this is usually done by the financially responsible person for this product or warehouse, division, etc. The form serves as a guarantee that he has transferred the goods to another person. Typically, such a document is completed before the transfer or during, if any questions arise.

Completed decision of the commission and signatures of the parties

The third page is filled out exclusively by the commission that accepted the object. Information is indicated whether the OS complies or does not meet the technical specifications. If additional work is required, this must be noted.

Members of the commission submit their signatures. At the very bottom of the document, the accounting specialist indicates information about entering data about the object into the inventory card. If we are talking about a sale or purchase or another type of alienation transaction, then the transferring party puts a mark that the OS is deregistered.

Third page of OS-1 form

https://youtu.be/T3wcKNOND3k

Why do you need accounting?

Act OS-2 allows you to control the movement of fixed assets within the organization.

If a fixed asset is transferred to another department for permanent use, on the basis of the OS-2 act, the fixed asset is written off from the account of one financially responsible person and assigned to another employee.

Information about the movement of fixed assets is entered into inventory cards for recording fixed assets in the form OS-6, OS-6a or into the inventory book OS-6b (for small enterprises).

How to fill out the front side

The front side of the OS-2 form is filled out in the following order:

- Organization name – the name of the company that owns the moved OS object;

- Names of the structural divisions of the company between which the fixed assets are transferred;

- The invoice number, as well as the date of its generation;

- Information about the OS being moved - its full name; the date it was built or purchased; its inventory number and price.

Each completed line of the table must be accompanied by a serial number.