What it is?

In 1999, the Federal State Statistics Service, by Resolution No. 20, approved a package of primary documents necessary for carrying out accounting activities at an enterprise. One of these documents is an invoice in form MX-18 for the transfer of finished products to storage places.

All enterprises that carry out production activities are required to maintain a document flow that will provide the accounting service with all the necessary information.

Form MX-18 records the movement of products by production departments to warehouses. That is, this form is an internal document of the organization.

Accounting for the receipt of finished products at the warehouse and their evaluation

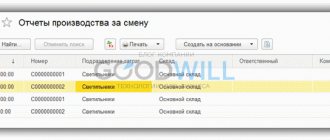

The release of finished products from production and their arrival at the warehouse is documented by the following primary accounting documents: delivery notes, specifications, acceptance certificates, statements of delivery of finished products from production to the warehouse, plans for delivery of finished products, etc.

These documents are usually filled out in three copies, are approved in the accounting policies of the organization and must contain mandatory details (name, document number, date and place of its preparation, content and basis for a business transaction, its measurement and assessment in natural, quantitative and monetary terms; positions of persons, surnames, initials and personal signatures of those responsible for carrying out a business transaction and the correctness of its execution).

Based on primary accounting documents, finished products are delivered to the warehouse for reporting to financially responsible persons (warehouse manager, storekeepers, etc.). If an organization produces products that cannot be stored due to technical characteristics (for example, large-sized products), then such products are accepted by the customer at the place of its location (manufacturing).

When finished products arrive at the warehouse, the storekeeper must check:

1) compliance of the actual quantity of incoming valuables with the data specified in the primary accounting documents;

2) the presence in the primary accounting documents of appropriate marks that confirm the quality control of the manufactured products.

After inspection, the storekeeper signs both copies of the primary accounting documents on the basis of which it is received, which indicates acceptance of the finished product. In this case, the first copy of the document is returned to the main production workshops as a basis for writing off products from production. The second copy remains in the sales department of the storekeeper along with the finished products.

In the event that the contract or delivery conditions provide for the acceptance of products at the production site by representatives of the customer, the products are considered ready if they are accepted by representatives of the customer and documented in an acceptance certificate.

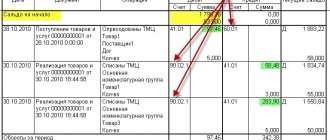

Based on the data from the delivery notes, the storekeeper records the number of incoming valuables in the finished product accounting cards. In addition to recording the receipt of finished products from production, the cards keep records of the transfer (shipment, sale) of products to buyers in accordance with primary documents and movement dates. After each operation, the balance of finished products must be displayed in the card. Analytical accounting of the movement of finished products in cards is carried out by their names, types, storage locations and materially responsible persons.

Based on the data recorded in the cards, turnover sheets of finished products or balance sheets of finished products are compiled in warehouses, which are transferred to the accounting department. Here they are necessary for maintaining quantitative and cost records of the movement of finished products in warehouses and organizing control over the safety of these values.

In automated warehouses, analytical accounting of the movement of finished products is carried out in machine diagrams of the movement of finished products through the warehouse, which have the same content as cards, but are compiled daily in the context of each item and type of finished product.

Primary accounting documents received at the warehouse, grouped by storage locations and types of finished products in accordance with the document flow schedule, are transferred to the accounting department, where they are checked and taxed. On their basis, the accounting department prepares a monthly release sheet of finished products, which is necessary for operational control of the daily implementation of the production plan by product names in quantitative and cost terms over one month on an accrual basis.

When generating accounting data for finished products (including analytical), it is not allowed to keep records only in quantitative terms, without a corresponding valuation. In this case, the following types of assessment can be used in accounting:

1) at actual cost;

2) at accounting prices (selling prices, planned cost, standard cost, etc.).

To reflect the receipt of finished products from production at accounting prices in the list of finished products, as a rule, the accounting prices of the price list item are used. At the end of the month, the calculated actual cost of finished products by type is also reflected in the list of finished products. At the same time, deviations of the actual production cost of products from their cost at accounting prices are separately identified. These deviations are taken into account for homogeneous groups of finished products.

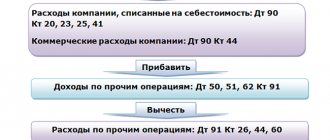

Accounting for the availability and movement of finished products is carried out on active account 43 “Finished Products” at the actual production cost. The debit of account 43 “Finished products” reflects the receipt of finished products at the warehouse, and the credit reflects their write-off (sales).

When applying accounting prices, organizations can stipulate in their accounting policies the use of subaccounts to account 43 “Finished products”: 43-1 “Finished products at accounting prices”; 43-2 “Deviations of the actual cost of finished products from the accounting value.”

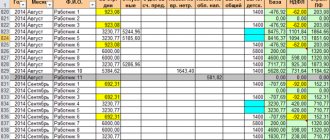

Business transactions related to the reflection of the receipt of finished products at the warehouse when using various types of valuation in accounting are presented in Table 10.2.

Table 10.2 – Typical invoice correspondence associated with recording the receipt of finished products at the warehouse

| Account correspondence | Business transactions |

| 1 Accounting for finished products is carried out at actual cost | |

| The actual cost of manufactured products is reflected | |

| 2 Accounting for finished products is carried out at accounting prices | |

| 43-1 | Finished products received during the month at discounted prices are reflected |

| 43-2 | The deviation of the actual cost of finished products received at the warehouse from its cost at accounting prices (overexpenditure) is reflected. |

| (additional entry) | |

| 43-2 | The deviation of the actual cost of finished products received at the warehouse from its cost at accounting prices is reflected (savings) |

| (reversal entry) |

Analytical accounting for account 43 “Finished products” is carried out both by storage location and by individual types of finished products.

Date added: 2015-10-22; ; Does the published material violate copyright? | Personal data protection |

Didn't find what you were looking for? Use the search:

What is it used for?

Form MX-18 is usually used in production , since trade organizations, as well as those working in the service sector, do not need such a document - the invoice is used to move manufactured products.

A manufacturing enterprise is required to confirm all its business transactions with primary accounting records, and the goods it produces go through many stages before ending up in the warehouse.

At the moment when the products are produced and can be moved within the enterprise, for example, to other divisions, or to warehouses for further sale, the document in question is drawn up.

In what form is it compiled?

The MX-18 form is unified, that is, standard and complies with all legal requirements. The form has OKUD code 0335018 .

However, since 2013, unified forms are not mandatory; each enterprise has the right to independently choose the form of the invoice, but it must meet all the necessary requirements.

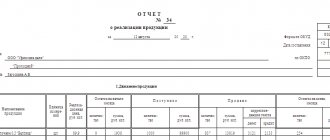

The document used to transfer finished products must contain the following columns:

- Date and document number.

- Sender - the department that transfers the products.

- Recipient - the department receiving the products.

- Corresponding account.

- A tabular section with the name, quantity and other characteristics of the transferred products.

- Signatures of the transmitting and receiving parties.

Compilation and design

Responsible person

It is necessary to draw up a document in form MX-18 to the person responsible for the transfer of products in the transferring unit, that is, the financially responsible person.

How many copies do you need?

The invoice for the transfer of finished products must be drawn up in two copies:

- one copy remains in the department from which the products will be transferred, after which the accounting department will write off;

- the second is transferred to the department receiving the products, where the receipt is posted.

Filling

The header states:

- Full name of the enterprise.

- Information about the organization.

- OKPO.

- OKDP.

- Number and date.

The following is a tabular section containing information such as:

- Name of the transmitting unit with OKDP code.

- Name of the receiving unit with OKDP code.

- Accounting entries: subaccount and analytics code.

- Product characteristics:

- Product name.

- Product characteristics.

- The units in which products are measured, as well as the OKEI code.

- Type of packaging.

- Number of products.

- Weight of transferred products.

- Registration prices for products - both per unit of goods and the total amount.

- Quantity and cost of products in words.

- All necessary signatures.

Particular attention should be paid to the header of the document, the name and quantity of products, as well as the signatures of the responsible persons.

If the document is not filled out completely, you may encounter problems during fiscal audits.

Signing the document

The invoice in the MX-18 form must be signed on both sides : by the financially responsible person of the department transferring the product, and by the financially responsible person of the department receiving the product.

Otherwise, if a controversial situation arises, there will be no person who can be held responsible for what happened.

Some organizations also have a person assigned supervisory responsibilities for such transactions. In such cases, this employee also leaves his signature on the document.

The signature is made in the form: indication of position, signature and transcript of the signature. Please note that an invoice without all the required signatures is considered invalid .

Placing stamps

Since 2020, affixing stamps on the primary document is an optional feature. And if with an external transfer/sale it is better to play it safe and affix stamps, then there is no need to do this in internal documents, such as MX-18.

In what cases is a report drawn up based on the results of an inspection?

You will find the forms of verification acts and the procedure for carrying out activities by public authorities in departmental orders, as well as the norms of the Federal Law of December 26, 2008 No. 294-FZ “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control "

The procedure for appealing such documents is set out in orders (administrative regulations). Recommendations for drawing up an administrative claim to challenge a decision of an authority are posted on our website.

If you need to draw up an act of checking the employee’s activities, then you need to refer to the norms of the Labor Code of the Russian Federation. Most acts regarding employees are drawn up as part of internal inspections in compliance with the requirements of Art. 193 Labor Code of the Russian Federation.

Please also note that the inventory act and the act of writing off material assets have a form strictly regulated by the legislation of the Russian Federation (information on the preparation of such documents is also available on the website). In all other cases, when it is necessary to record the fact of an inspection of a particular circumstance, document the results and conclusions of the commission, draw up an inspection report.

What legislation provides for inspection reports?

- Law on the protection of the rights of individual entrepreneurs and legal entities under state or municipal supervision;

- Tax Code, as well as acts of the Ministry of Finance regulating the conduct of audits based on tax codes;

- The Law on the Central Bank provides the right to inspect and control certain organizations. Instructions have been developed for conducting inspections.

Features of audits

The Audit Law gives an organization the right to hire auditors to check the compliance of reporting and other documentation with legal requirements. If the auditors made a mistake in some way and did not notice the customer’s violation, then the customer has the right to later demand payment of the losses that he suffered because of this.

For example, the tax service collected unpaid tax and ordered a fine to be paid after an audit carried out by an auditor. If the auditor refuses to pay, the victim has the right to go to court.

How long to store?

MX-18 is primary accounting documentation , according to this, like all other primary documents, it should be stored for at least five years.

There are different types of invoices for accounting; we suggest you learn about goods invoices, demand invoices, transport, consignment notes, expenditure and receipts, expenditure and receipts, returns and for the release of goods.

Form MX-18 is the easiest and most accurate way to reflect the movement of finished products within the organization. Filling it out is not difficult, however, it, like filling out any primary documentation, should be treated responsibly in order to avoid further problems.

If you find an error, please select a piece of text and press Ctrl+Enter.

Primary documents for accounting of finished products

—————————————————————————————————————————— ¦Division¦ Products¦ Composition ¦ Implemented ¦ Issue ¦ ————- ———- —————- —————————— ———————————————— ¦ ¦ ¦Cost,¦ VAT ¦ ¦ Cost in ¦Cost in ¦Constant¦ ¦ ¦Quantity¦ rub.

¦ incl. “Quantity” of accounting tax differences, rub. ¦accounting, rub.¦ ¦ —————————————— ———- ———- ——— ———- ————- ———— ———- ¦ Total ¦ 443,000 ¦ 29,220.00 ¦ 4,457.38 ¦ 443,000 ¦ 6,591.57 ¦ 6,591.57 ¦ ¦ ——————————————————————— —— ———- ————- ———— ———- ¦Canteen ¦ 431,000 ¦ 28,380.00 ¦ 4,329.22 ¦ 431,000 ¦ 6,399.45 ¦ 6,399.45 ¦ ¦ ——— ——————————— ———- ———- ——— ———- ————- ———— ———- ¦ ¦Drinks ¦ 431,000 ¦ 28,380.00¦ 4,329.22¦ 431,000 ¦ 6,399.45 ¦ 6,399.45 ¦ ————- ————————— ———- ———- ——— ———— ——— —- ———— ———- ¦ ¦Espresso Coffee ¦ 179,000 ¦ 10,740.00¦ 1,638.36¦ 179,000 ¦ 2,007.57 ¦ 2,007.57 ¦ ¦ ————- ————— ———— ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Bean coffee, ¦ ¦ ¦ ¦ 1,253 ¦ 1 165.29 ¦ 1 165.29 ¦ ¦ ¦ ¦ ¦kg ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ——— —- ———— ———- ¦ ¦ ¦Water ¦ ¦ ¦ ¦ 13.425 ¦ 72.44 ¦ 72.44 ¦ ¦ ¦ ¦ ¦bottled, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦ Sugar ¦ ¦ ¦ ¦ 358,000 ¦ 257.11 ¦ 257.11 ¦ ¦ ¦ ¦ ¦packaged ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦5 g, pcs.

¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ——— - ¦ ¦ ¦Cup ¦ ¦ ¦ ¦ 179,000 ¦ 285,20 ¦ 285,20 ¦ ¦ ¦ ¦ ¦disposable, pcs¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Cover to ¦ ¦ ¦ 179,000 ¦ 227.53 ¦ 227.53 ¦ ¦ ¦ ¦ glass, pcs.

¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ——— - ¦ ¦Coffee Cappuccino ¦ 252,000 ¦ 17,640.00¦ 2,690.86¦ 252,000 ¦ 4,391.88 ¦ 4,391.88 ¦ ¦ ————- ————————— ———- — ——- ——— ———- ————- ———— ———- ¦ ¦ ¦Coffee ¦ ¦ ¦ ¦ 0.756 ¦ 2,003.40 ¦ 2,003.40 ¦ ¦ ¦ ¦ ¦sublimated,¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦kg ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- — ———- ———— ———- ¦ ¦ ¦Milk formula ¦ ¦ ¦ ¦ 1,260 ¦ 1,100.76 ¦ 1,100.76 ¦ ¦ ¦ ¦ ¦dry, kg ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —— ——- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Water ¦ ¦ ¦ ¦ 37,800 ¦ 203.92 ¦ 203.92 ¦ ¦ ¦ ¦ ¦bottled, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦l ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Sugar ¦ ¦ ¦ 504,000 ¦ 361.98 ¦ 361.98 ¦ ¦ ¦ ¦ ¦ packaged ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦5 g, pcs.

¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ——— - ¦ ¦ ¦Cup ¦ ¦ ¦ ¦ 252,000 ¦ 401,51 ¦ 401,51 ¦ ¦ ¦ ¦ ¦disposable, pcs¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Cover to ¦ ¦ ¦ 251,000 ¦ 320.31 ¦ 320.31 ¦ ¦ ¦ ¦ glass, pcs.

¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ——— - ¦Buffet ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —————————————— ———- ———- ——— ———- ————— ———— ——- ¦ ¦Hot chocolate ¦ 12,000 ¦ 840.00¦ 128.16¦ 12,000 ¦ 192.12 ¦ 192.12 ¦ ¦ ————- ————————— ———- ——— - ——— ———- ————- ———— ———- ¦ ¦ ¦Cocoa drink, ¦ ¦ ¦ ¦ 0.240 ¦ 130.80 ¦ 130.80 ¦ ¦ ¦ ¦ ¦ kg ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦ Water ¦ ¦ ¦ ¦ 1,800 ¦ 9.72 ¦ 9.72 ¦ ¦ ¦ ¦ ¦ BUSTICE, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ———————————— - —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Sugar ¦ ¦ ¦ ¦ 24,000 ¦ 17.24 ¦ 17 ,24 ¦ ¦ ¦ ¦ ¦packaged ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦5 g, pcs.

Find out what: Sample application for renunciation of inheritance

¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ——— - ¦ ¦ ¦Cup ¦ ¦ ¦ ¦ 12,000 ¦ 19.12 ¦ 19.12 ¦ ¦ ¦ ¦ ¦ disposable, pcs.¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- ———- —————- ———- ———- ——— ———- ————- ———— ———- ¦ ¦ ¦Cover to ¦ ¦ ¦ 12,000 ¦ 19.12 ¦ 19.12 ¦ ¦ ¦ ¦ glass, pcs. ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————— ———- —————- ———- ———- ——— ———- ————- ———— ——— —

Source - “Accounting in Agriculture”, 2011, No. 1

Search Lectures