Scope of application of cash register equipment

Cash register equipment (CCT) in accordance with Art. 1.1 Federal Law “On the Application...” of May 22, 2003 No. 54-FZ is:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- electronic computers;

- computer devices;

- their complexes,

which should provide:

- recording data to a fiscal drive;

- storing information in storage devices;

- formation of fiscal documents;

- transfer of such documents to the tax office with the help of fiscal data operators;

- printing of fiscal documents.

Important! A cash register used in our country must be included in the cash register register and registered with the tax authorities.

Cash register devices in Russia are allowed for use only if the model of the cash register and the fiscal drive used in it is included in a special register, and the device itself is registered with the tax authority.

CCP is not used when selling:

- paper periodicals of the media (newspapers, magazines);

- lottery tickets;

- securities, etc.

Note! For violation of legal requirements for the use of cash registers, liability is provided (Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

Who is required to register a cash register?

Each business entity that uses cash register systems in the process of conducting business is required to register it with the Federal Tax Service. Registration obligations apply to entrepreneurs and legal entities, regardless of their form of ownership. If you have registered an individual entrepreneur and trade in cash or accept payments by bank card, you are required to have a cash register officially registered with the tax authority. The same rule applies to enterprises and organizations, regardless of the area in which the legal entity operates. The main criterion that obliges an individual entrepreneur or company to register a cash register is that a person (individual or legal entity) conducts activities related to settlements (cash or non-cash) and acceptance of payments (both from legal entities and individual entrepreneurs or non-entrepreneurs).

However, there are exceptional cases in which you, as a business entity, can legally refuse to use a cash register, namely:

- Your activities are related to the provision of services to the population. In this case, an organization or individual entrepreneur is allowed not to use cash registers, but to formalize transactions using strict reporting forms (SSR);

- You are using an “imputed” taxation system, transactions within which do not require a cashier’s check.

The law also provides for certain types of activities that exempt individual entrepreneurs and legal entities from the obligation to purchase and register cash registers. You can familiarize yourself with them in Law No. 54-FZ of March 22, 2003.

Register of cash registers

The Register of Cash Register Equipment (RCCT) is a list of cash register models that is maintained and updated by an authorized government agency.

This responsibility is assigned to the Federal Tax Service (Resolution of the Government of the Russian Federation “On Amendments...” dated December 28, 2011 No. 1168).

The RCCT is compiled in the form of a table, which contains:

- name and tax identification number of the cash register manufacturer;

- CCT model;

- model version number;

- supported versions of document formats in accordance with the order of the Federal Tax Service of the Russian Federation dated March 21, 2017 No. ММВ-7-20/ [email protected] ;

- information about the possibilities of using CCP;

- model of the fiscal storage device used;

- date and number of issue of the expert opinion on the compliance of the cash register;

- name and TIN of the expert organization;

- date and reason for inclusion of the cash register model in the register;

- date and reason for removing the cash register from the register.

To include a cash register in the register, the manufacturer submits an application to the tax authorities, attaching copies of reports, extracts from them and other documents confirming the compliance of the cash register model with legal requirements. Read more in the article “Register of cash register equipment”.

Application on paper for filing with the Federal Tax Service

The application in form KND 1110061 is filled out on paper and submitted to the tax office. If the form is not provided by the director, issue a power of attorney to the authorized person and then he goes to the Federal Tax Service with his passport.

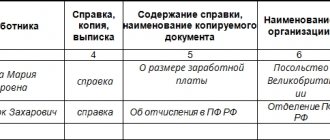

| Chapter | Filling procedure |

| 1st sheet | 1. We fill in the TIN, KPP of the organization, or its separate division, as well as OGRN 2.type of documents – 1 – registration 3. Name of the enterprise, then who is responsible for filling it out, usually the full name of the director, date, stamp, signature |

| 2nd sheet | To be completed if a person submits a notarized power of attorney |

| 3rd sheet, Section 1 | Data on cash register equipment: its serial number and FN, name of the manufacturer where it is installed |

| 4th sheet, Section 2 | The CCP functions are indicated by numbers |

| 5th sheet, Section 3 | Data about the fiscal data operator, his TIN |

Important! The third section may not be filled out if the client does not use the services of a fiscal data operator to transfer them to the tax office.

Registration of cash registers with the tax office

The procedure for registering a cash register with the Federal Tax Service and other actions (re-registration, deregistration) are defined in Art. 4.2 of Law No. 54-FZ.

According to her:

- Registration of CCP is free of charge.

- The list of documents required for registering a cash register is exhaustive. It is prohibited to require documents from applicants that are not included in the list.

- The application is submitted at any tax office or through the cash register office, the rules of operation of which are prescribed in the order of the Federal Tax Service dated March 21, 2017 No. ММВ-7-20/ [email protected]

- No later than the next working day, the tax authority sends the registration number to the cash register user.

- The user enters this number, as well as his name and other data, into his cash register, generates a report and submits it to the tax office no later than the next working day after receiving the registration number.

- The report can be transmitted through the fiscal data operator or by posting it in the cash register account.

- After authenticating the user and the fiscal drive and checking the accuracy of the information provided, the tax authority makes an entry in the accounting journal and the cash register registration card. The date the card is generated is the date of registration of the cash register (Clause 7, Article 4.2 of Law No. 54-FZ). The tax authority is given 10 working days to generate and send it to the user.

- After 10 working days from the date of submission of the application, the registration card must be placed in the cash register account or transferred to the user through the fiscal operator.

Procedure for deregistration of cash registers

An application to deregister a cash register is submitted in a manner similar to registering or re-registering a cash register (Clause 1, Article 4.2 of Law No. 54-FZ).

At the same time, a cash register is subject to deregistration in the following cases:

- transferring it to another user;

- theft;

- losses;

- expiration of the fiscal attribute key.

Need an electronic signature? The GARANT certification center will help you select and purchase an electronic signature certificate for both a legal entity and an individual.

After transferring a cash register to another user, an application for deregistration is submitted to any territorial tax authority in person or through the cash register account on the website nalog.ru no later than one business day after the transfer. In case of theft or loss - no later than one business day from the date of discovery of the theft or loss.

However, if the fiscal attribute key in the FN expires, the cash register is deregistered unilaterally without the user’s application. At the same time, within one month from this date, the user must submit to the tax authorities all fiscal data that is stored in the FN used in the cash register at the time of its deregistration (clause 5, clause 16 of Article 4.2 of Law No. 54-FZ ).

A cash register registered before February 1, 2020 is applied, re-registered and deregistered in the same manner until July 1, 2020. And after July 1, when the old equipment can no longer be used, it will be deregistered without notifying the owners (letter Federal Tax Service of Russia dated December 30, 2020 No. ED-4-20/25616 “On consideration of the appeal”).

The application for deregistration of a cash register shall indicate the following information:

- full name of the user organization or last name, first name, patronymic of the individual entrepreneur;

- User's TIN;

- model name and serial number of the cash register copy registered with the tax authority;

- information about cases of theft or loss of cash registers (if such facts exist) (clause 6 of article 4.2 of Law No. 54-FZ).

Documents for registration of cash registers

To register a cash register, the applicant must submit an application showing:

- name or full name cash register user, his tax identification number;

- address, including website address and location of installation of the cash register;

- model and serial number of the cash register;

- name and number of the fiscal drive;

- number of the automatic device for calculations, if the cash register is used as part of it;

- information about the mode of use of cash register systems, for example, the equipment is used only for the provision of services or only for settlements using electronic means of payment on the Internet.

Tax authorities have the right to include additional information in the form.

Important! From 12/07/2018, a new application form is used, which can be downloaded on the official website of the Federal Tax Service, received in person at the territorial division of the Federal Tax Service, or downloaded here: application form for registering a cash register.

Registration process

Let us immediately note that the matter will not be limited to one trip to the Federal Tax Service - you will have to go twice . The procedure for registering a cash register consists of several stages:

- submission of documents for registration;

- fiscalization of the cash register;

- receiving a card.

The entire process can take up to 5 business days.

What do you need to go to the Federal Tax Service?

At the time of registration, the future user of the online cash register, in addition to the device itself with the fiscal drive, must have a formalized relationship with the OFD .

For registration you will need the following documents:

- KKT passport;

- FN passport;

- agreement with OFD;

- application for registering a cash register (see below for how to fill it out);

- if a representative will register the cash register - a notarized power of attorney.

If the package is incomplete, the tax office will not accept the documents. At the same time, inspectors cannot require any other documents to register a cash register.

The specified set of documents can be submitted to any tax office.

Grounds for refusal to register a cash register

Note! Tax inspectors do not have the right to refuse to accept documents, but they can refuse to register cash register equipment in the following cases:

- in the submitted application for registration of the cash register, the user provided false information;

- The user did not provide complete information in the application.

Important! Tax authorities do not have the right to refuse registration of cash register equipment in other cases. This rule is enshrined in paragraph 17 of Art. 4.2. Law No. 54-FZ.

The same cases of refusal are provided for when submitting an application for re-registration of cash register equipment or deregistration of equipment.

What is meant by online cash register?

The new cash registers differ from the previous ones in that instead of memory, the EKLZ now has a fiscal drive that accumulates data on goods sold, and through the fiscal data operator they go to the tax office. Its validity period is usually 13 months, a month before the end, the data stops leaving and this is recorded on the receipt. To do this, you will have to update the fiscal document, paying about 12 thousand rubles. And also if we go to our personal account on the OFD platform, we will not see receipts, since the information will not be transmitted. If this continues for more than thirty days, the cash register will be blocked.

So, the differences between the old cash register and the new one:

| Old | New |

| EKLZ - a memory drive that stores information on the operation of a cash register | Fiscal storage |

| The data did not go to the tax office | Now all checks go to the tax office through the fiscal data operator, business has become more transparent |

| ECLZ from 2020 not used | Fiscal registrar is valid for 13 months |

| For old cash registers it was necessary to issue a refund on the same day or the next | The online cash register allows you to return money to the buyer at any time by providing a check and passport and drawing up an application addressed to the head of the enterprise |

| Previously, the cashier was required to fill out a lot of paperwork, such as a cashier report, a certificate - calculation | At the online cash register you only need to submit a final report for the shift, for cash and non-cash |

Application form for registration of cash register equipment

The application form for registering a cash register was approved by Order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20/ [email protected] as amended by the Order of the Federal Tax Service dated September 7, 2018 No. ММВ-7-20/ [email protected]

Note! For each case, the application indicates its own type of document. In this case, 1 is entered when registering a cash register, and 2 - when re-registering. When submitting an application for registration of a cash register, the column “Registration reason code” is not filled in.

All other fields of the form are intuitive to fill out:

- FULL NAME. individual entrepreneur or full name of the organization;

- OGRN, INN, KPP of the user is indicated on each page of the document;

- number of sheets in the application;

- FULL NAME. the head of the legal entity submitting the application or other representative;

- date of document preparation;

- information about the cash register and fiscal drive model, their serial numbers;

- address where the cash register will be installed;

- date, signature of the applicant on each page.

A sample application form can be found here.

How to fill out an application for registration of a cash register (KND Form 1110021).

The application form (KND 1110021) is universal and is filled out in cases of registration, deregistration, re-registration (replacement of EKLZ, replacement of FP, change in the installation location of the cash register, etc.). When filling, black, blue or purple ink is used. Double-sided printing of the application is not permitted.

The application consists of three sheets and is filled out as follows:

Page 1

1. At the top of the page, fill in the TIN of the organization (individual entrepreneur) submitting the application.

2. Then the checkpoint of the organization or a separate division is indicated (in the case of registering a cash register for a separate division); if the application is submitted by an individual entrepreneur, then this field is not filled in.

3. In the column “provided to the tax authority” you should indicate the inspection code, which consists of the region code and the inspection number (for Moscow: 77XX, where XX is the two-digit inspection number).

4. In the “Type of document” column, the first box indicates the reason code for the application, where:

- “1” – Registration;

- “2” - Re-registration (also indicated when replacing EKLZ);

- “3” - Deregistration;

If the reason code is “2” (re-registration), then in the remaining five boxes you must indicate the reason for re-registration; there may be several of them. Each square corresponds to a reason; you must indicate “1” (yes) or “2” (no).

- “1” - Changing the installation location of the cash register

- “2” - Change of central service center

- “3” - Replacement of ECLZ

- “4” — Replacing the FP unit

- “5” - For other reasons

Thus, the corresponding column looks like this:

- 2 / 2 2 1 2 2 — when replacing ECLZ

- 2 / 1 2 1 2 2 — when replacing the ECLZ and changing the installation location of the cash register

- 1 / 2 2 2 2 2 - upon registration

- 3 / 2 2 2 2 2 — when deregistering cash register

5. In the “user name” column the full name of the organization or individual entrepreneur is indicated.

6. Next, OKVED (main type of activity) is indicated.

7. Who submitted the application?

8. Contact phone number (mobile phone is possible).

9. In the column “on pages” the number of pages is indicated – “3”

10. In the section “I confirm the accuracy and completeness of the information specified in this application,” select the user or representative, indicate his full name, line by line, signature, date of signing and seal (for individual entrepreneurs, the seal is not required). If the application specifies a representative of the user, then in the column “name of the document confirming the authority of the representative” the power of attorney, its number, and date of issue are indicated. If a user was specified, the corresponding field is not filled in.

11. The section “Information on registration of cash register equipment with the tax authority” must be filled out by the tax inspector, but in practice this does not always happen. Therefore, if possible, it is better to fill it out too (except for the last line “position, full name, signature”). The registration number of the cash register can be found in the registration card, and in the “date” column the date of registration of the cash register is entered, which is also indicated in the registration card. The registration number of the EKLZ and the date (the date of its activation) are known after the activation of this unit (at the second stage of replacing the EKLZ block) and this information can be found in an additional sheet, in the EKLZ passport or on the receipt for the activation of the unit. When submitting an application for registration, this data is not yet known to the user, so the field is not filled in.

Page 2

1. As on the first page, the TIN and KPP are filled in at the top, and in the “Page” field. put “2” (page number).

2. Line code 010 indicates the model of the cash register (the model of the device is indicated in the version passport, in the registration card, on the nameplate of the device itself, etc.).

3. Using line code 020 , the serial number of the cash register is indicated (indicated in the version passport, in the registration card, on the nameplate of the device itself, etc.).

4. Line code 030 indicates the year of manufacture of the cash register (indicated in the form, in the version passport, in the registration card, on the nameplate of the device itself, etc.).

5. Line code 040 indicates the CCP version number (indicated in the version passport).

6. Line code 050 indicates the series and account number of the cash register identification mark (indicated in the form and on the device itself).

7. Line code 060 indicates the cash register passport number (indicated on the passport itself).

8. Line code 070 indicates the serial number of the EKLZ (indicated in the EKLZ passport).

9. Using line code 080 , the EKLZ registration number is indicated (indicated in the receipt after activation of the EKLZ (registration), sometimes indicated in an additional sheet to the version passport). When filling out an application for registration, the line may not be filled out.

10. Line code 090 indicates information about the installation of the cash register in the payment terminal (enter “1” if installed in the payment terminal and “2” if not installed).

11. Line code 100 indicates the registration number of the payment acceptance point ( if the cash register is not part of the payment terminal, then this line is not filled in

).

12. Line code 110 indicates the number of the payment terminal (if the cash register is not part of the payment terminal, then this line is not filled in

).

13. Line code 120 indicates the access code to enter the tax inspector mode ( if the cash register is not included in the payment terminal, then this line is not filled in

).

14. Line code 130 indicates the name of the central service center.

15. Line code 140 indicates the TIN of the service center.

16. Line code 150 indicates the number, start and end date of the agreement with the central service center.

17. Using line code 160 , the registration and individual number of the seal brand is indicated (the number located at the top of the seal is entered in the first part of the field, and after the fraction (in the second part of the field), the number located at the bottom of the seal is entered)

18. Line code 170 indicates the number and year of issue of the ICS (indicated on the ICS itself, which are pasted on the cash register and in the cash register form).

19. Signature and date are placed at the bottom of the page.

Page 3

1. As on previous pages, the TIN and checkpoint are indicated at the top. In the "Page" field put “3” (page number).

2. Next, fill out the section “Information about the address of the installation location of the cash register applied for registration (re-registration or deregistration) with the tax authority.” In the column “Name of the location where the cash register is installed,” the type of retail outlet (office, workshop, store, pavilion, kiosk, etc.) and, if available, its name are indicated.

3. In the column “Name of the organization (full name of an individual entrepreneur, individual) that provided the premises in which the cash register is installed for use (rent)” we indicate the lessor.

4. We indicate the tax identification number of the landlord who provided the premises in which the cash register is installed, as well as the number and date of the lease agreement.

5. Signature and date are placed at the bottom of the page.

Application for registration of cash registers: selected issues

The procedure for filling out the application was also approved by order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20/ [email protected] Below are the main requirements:

- the application must be filled out by hand using blue or black paste or using a stamp;

- It is not allowed to use correctors;

- each page must be printed separately; double-sided printing of the document is prohibited;

- name of the organization or full name the entrepreneur is indicated in full, without abbreviations;

- if the organization has several cash desks, then the application must be filled out for each separately;

- When registering a cash register belonging to a separate division of a legal entity, the checkpoint is affixed not to the parent organization, but to this division.

Procedure for registering new cash registers

- In order to register an online cash register with the inspectorate, there are two ways:

1. Register in your personal account, to do this you need to go to the inspection website, fill out all the data for your legal entity, and also have a strengthened qualified signature, through which you can perform any manipulations

2.submit on paper through an operator

This procedure does not require additional costs and is quite feasible to carry out independently, but it is possible to contact an intermediary who, for a fee, will prepare documents and register the cash register.

Initially the process went like this:

- Conclude an agreement with a technical service center

- Submit documents to the tax office

- If you decide on your own, bring the cash register for inspection and fiscalization - installation of the drive

- Receive a statement about the installation of a cash register

- Conclude an agreement to register a cash register on the OFD platform.

Now the procedure has been simplified: - There is no longer any need to conclude an agreement with the central service center in advance.

- You can submit an application while sitting at home through your personal account.

- No need to carry the cash register anywhere

- A notice of placement is printed from your personal account

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Advantages of the new procedure for registering cash registers

Note! As a result of changes made to Law No. 54-FZ, the procedure for registering cash registers has been simplified:

- All registration is carried out electronically. A visit to the Federal Tax Service for this purpose is possible only at the stage of filing an application.

- A new tool for exchanging electronic documents is being used - the cash register office. In it, tax inspectorates place such documents as: registration (deregistration) card of a cash register, requests from authorities sent to the user of a cash register or the operator of fiscal data, protocols and resolutions on administrative cases, documents on the inclusion (exclusion) of equipment in the register of cash registers, etc.

- Having a contract for the maintenance of cash registers has become optional, but you will need to formalize a relationship with the fiscal data operator.

***

Thus, the cash register system used by economic entities must be indicated in the RCT list and registered with the Federal Tax Service.

Registration of a cash register with the tax service is carried out free of charge within 5 working days on the basis of an application and report generated in the cash register after receiving the registration number. To carry out the registration procedure, it is not necessary to visit the tax office; it will be enough to use the services of a fiscal data operator or a cash register office.

Documents for deregistration and re-registration of cash registers

If you do not plan to use the cash register, then you must deregister it. To do this, similar to the registration procedure, you will need to submit an application, passport and cash register registration card to the Federal Tax Service. After a fiscal service employee checks the device and takes control readings, the cash register will be deregistered, and a corresponding note will be made on the card.

A procedure for re-registration of devices is provided for owners of cash register systems. You are required to come to the tax office to re-register your equipment if:

- Your company has undergone reorganization;

- the location of the legal entity user of the device has changed (for example, the parent organization transferred the cash register for use to a branch). A similar requirement applies to individual entrepreneurs who have changed their registration;

- You purchased a used device. In this case, you need to re-register the equipment to yourself.

The list of documents required for re-registration does not differ from the main package of documents - to go to the tax office you will need an application, a passport and a cash register card. After accepting the documents and checking the equipment, the Federal Tax Service specialist will enter new credentials into the cash register card and passport.

Fiscalization of cash registers

The essence of fiscalization is the activation of the fiscal drive, the key technological component of the online cash register. To carry it out you need (let’s agree that CCP registration is carried out online):

- Open a program from the online cash register manufacturer - designed specifically for fiscalization.

For example, for cash registers from ATOL, the EcrRegistration.exe program is used.

- Using the program, synchronize the time at the checkout and on the PC (which by that time should be precisely set - in accordance with the local time zone).

- Indicate information about the business entity in the program. Typically these include:

- name of shop;

- address of the retail outlet;

- TIN of the business entity;

- registration number of the cash desk with the Federal Tax Service (indicated on the page that we leave open after completing the online application).

We still don't close that page.

- Choose a tax system.

- Perform fiscalization - that is, activation of the fiscal drive.

Upon completion of fiscalization, the cash register will print a test receipt. It must be carefully torn off from the tape (if it was not cut off with an automatic cutter) and kept at hand.

The most important nuance: if some information about the cash register user is indicated incorrectly during fiscalization (for example, TIN), then upon completion of the procedure it will not be possible to change it (they are recorded in the fiscal drive once). You will have to incur additional expenses - buy a new FN and indicate the correct data in it.