Filling rules

It is necessary to take full responsibility for the formation of the cash book in order to eliminate negative consequences from regulatory authorities.

Algorithm for designing a unified form:

The title page contains the required details:

- name of the organization, which must correspond to the constituent documents/last name, first name, patronymic of the individual entrepreneur;

- for what period was the cash book drawn up - month, quarter, year;

- name of the division - in the case where the enterprise has branches or separate divisions;

- OKPO - indicated on the basis of the All-Russian Classifier of Aggregate Legal Organizations and Enterprises.

The maximum period for which a cashier's book can be formed is one calendar year, regardless of the number of transactions performed during this period. If one journal is not enough, the next one is started and so on. Entries are made in chronological order and are not interrupted.

The order of cash books is determined based on the dates indicated on the title page.

An important point - on the first working day of the year you must:

- all pages of KO-4 are numbered and stitched;

- on the last page, make a note about the number of sheets of the journal, certify with the signature of the head and chief accountant of the institution, and put a stamp;

- The cashier's book is filled out daily as cash transactions are carried out. On days when there were no operations, f. There is no need to fill out KO-4.

https://youtu.be/szMChAkrf4s

https://youtu.be/USl0igaEJjQ

Basic rules for registering a cash book

- The cash book is started annually and is maintained from the beginning to the end of the year. If it ends before the end of the reporting period, a second cash book is drawn up, entries in which continue to be made in chronological order.

- You can fill it out either handwritten or on the computer. All information must be entered in order, without gaps.

- The cash book consists of two parts:

- title page where information about the company is entered,

- main pages where data on cash financial transactions carried out for each day is indicated.

- Each sheet has two copies, one of which, after filling out, must be left in the book, and the second must be cut off and handed over to the accounting department specialists. All sheets of the cash book should be numbered in the usual order and laced together. The number of sheets in the book should be written on the last page and this information must be certified by the signature of the chief accountant, the director of the enterprise and the seal (if any).

- It is impossible to make mistakes, blots and inaccuracies in the document, but if they do happen, you should cross out the incorrect information and carefully enter the correct information next to it. The correction must be certified by the signature of the cashier and the chief accountant. You can fill out the cash book only with a ballpoint pen (pencils are not allowed).

- The cash book must be maintained daily, but if no cash transactions were carried out on a particular day, there is no need to fill out the sheets. At the end of each work shift, the cashier is required to submit the document to the accounting department, along with the rest of the “primary” documents. After checking the information entered in it, the accountant signs the book and returns it to the cashier.

- One enterprise cannot have two cash books, except in cases where a legal entity has representative offices and branches - they must have their own similar documents (in this case, copies of the cash book and payment documents must be regularly transferred to the head office).

The procedure for maintaining a cash book in electronic form

There are some features of creating a cash register journal using software:

- Formation of a journal in electronic form is permitted when measures are taken to restrict access to financial documents;

- By the beginning of the current day, you need to create 2 identical printed forms: “Insert sheet” and “Cashier’s report”. Forms must reflect the required details and be numbered in order;

- The cashier's journal is formed for a specific period, which is determined by the accounting policy of the organization: month, quarter, year. The last insert should indicate the total number of pages for the period: “_______ sheets numbered and laced.” Please note: the bound book indicating the number of pages for the period is confirmed by the signature of the director and chief accountant of the institution.

The very principle of making entries in f. KO-4 is similar to the procedure for filling out the journal in handwriting.

The cashier is obliged:

- at the end of the current day, check the correctness of filling out the journal and certify it with your signature;

- draw up a cashier’s report with all supporting documents attached and ensure its transfer to the institution’s accounting department;

- ensure stitching and safety of loose-leaf forms.

How to stitch a cash book?

When maintaining a cash book, an important point is not only its correct filling, but also compliance with all requirements for registration of accounting documentation. First of all, this concerns stitching sheets and fastening them.

The order of stitching the sheets of the cash book also depends on how it is maintained:

1. A book purchased from a printing house is bound immediately. Before you start filling it out you must:

- number all sheets;

- sew all sheets;

- on the last page indicate the total number of sheets;

- put a seal (wax or mastic);

- sign (this must be done by the head of the enterprise and the chief accountant).

2. The book, printed on a computer, is stitched at the end of the year. During the year, the cashier or accountant fills out the printed sheets and stores them in a separate folder, and then staples them according to the same rules as the finished book (indicating the number of pages, the seal and signatures of the manager and chief accountant).

When maintaining and registering a cash book, it is worth remembering several important points:

- Having a book is necessary for those organizations and entrepreneurs who deal with cash in their activities.

- For use, you can either buy a ready-made cash book or print it yourself on your computer.

- A special responsible person is responsible for maintaining the cash book: the chief accountant or cashier.

- In the paper version, the book can be kept either by hand or using technical means (that is, filled out on a computer and printed).

Watch also the video on how to fill out the cash book correctly:

https://youtu.be/YePNtNjoPeo

0

Filling in the fields

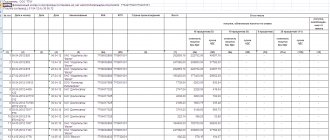

Step-by-step algorithm for forming f. KO-4:

- In the header you need to write the date, month, year. Check for journal page numbering;

- In the line “Balance at the beginning of the day”, enter in numbers (in rubles and kopecks) the amount of cash that is listed in the cash register at the beginning. This indicator must correspond to gr. “Balance at the end of the day” of the previous page. If this is the first page of a new calendar year - the last page for the past year;

- The column “Document number” contains data on the serial numbers of PKO and RKO;

- The column “From whom it was received or to whom it was issued” contains information about the direction in which cash is spent, as well as about the sources of its receipt. Example, refund of travel expenses from E.K. Petrov; issued for economic needs to T.P. Sokolov; salary payment;

- Column “Number of subaccount or corresponding account” - accounting entries: for account 50 - “Cash” in correspondence with other accounts. For example: 51 “Current account”, 62 “Buyers and customers”, 70 “Salaries”, 71 “Accountable amounts”, etc. Individual entrepreneurs do not fill in the specified column;

- The columns “Incoming” and “Output” reflect the amounts of funds that came in or went out during the operating day (in rubles and kopecks, separated by commas. Example: 523.64);

- “Transfer” line reflects the amounts in the income/expense columns, respectively;

- 2nd page: the line “Total for the day” summarizes the cost of all operations performed for the day separately by income and expense;

- “Balance at the end of the day” is calculated according to the algorithm below: Balance at the beginning + gr. 4 “Parish” – gr. 5 "Consumption". Reflected separated by commas in rubles. and cop. A separate line allocates the amount of cash for making wage payments and social benefits;

- It must be remembered that empty lines of the journal are crossed out with a “Z” so that there are no free fields left;

- At the final stage, you must indicate the full name of the cashier and accountant, the number (in words) of PKO and RKO.

Instructions for filling

As mentioned above, there is a prescribed form of cash book. Let's take a brief excursion into the method and form of filling out the cash book.

In order to correctly fill out the cash book, you need to know the algorithm:

- Every book starts with a cover. The cover is the face. General information is indicated on the cover, that is, the name of the enterprise or personal information of an individual entrepreneur (last name, first name and patronymic). If the book is filled out in a structural unit of the organization, then its name. Also, the title page must contain the reporting period for which the book is being opened.

- Next come the usual standard sheets of the cash book, which, in fact, reflect the transactions. Each sheet consists of two parts that are tear-off in nature. The date is indicated at the top, that is, the day for which the records are kept, as well as the sheet number. Next comes a table divided into 5 columns: document number;

- the subject (individual, enterprise, entrepreneur) from whom the amount was received or to whom the amount was issued;

- number of the corresponding account (c/s);

- income amount;

- amount of expense.

After these tables of contents, the amount at the beginning of the day (balance) is indicated, and then the table is filled in in accordance with the names of the columns.

If there are fewer transactions per day than there are lines in the table for filling in information, then the empty columns are filled in with the capital letter “Z” to avoid making additions and corrections. At the end of the table, the total amount is added, as well as the balance at the end of the day. If wages and social benefits were paid on that day, then the corresponding item in the table is filled in; if there are no such expenses, a dash is placed.

At the end, the document is signed by the cashier with a transcript of the signature and certified by the accountant with a note about receipt of the cash document in two copies.

Mandatory maintenance of a cash book

In accordance with the requirements of current legislation, all organizations are required to keep cash in a bank account, and the vast majority of payments between legal entities must be carried out exclusively by non-cash transaction.

Please note that when cash is not used to make payments, a ledger is not required. Thus, we can distinguish 3 categories of legal entities that are required to maintain CO-4:

- enterprises that operate using cash, despite having a bank account,

- enterprises that conduct non-cash payments but have cash in circulation,

- enterprises that do not use their income on bank cards, but use them.

Since June 2014, individual entrepreneurs have been exempted from the obligation to apply the Procedure for conducting cash transactions, on the basis of Central Bank Directives No. 3210-U dated March 11, 2014.

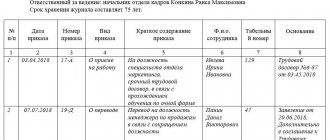

Who should keep the cash book?

Unified f. KO-4 is filled out:

- a cashier or another employee (accountant, deputy director) who is appointed by the general director from the staff of the enterprise;

- directly by the director of the institution;

- an individual entrepreneur or another employee from the company’s staff.

The employee responsible for carrying out monetary transactions is appointed on the basis of an order or instruction of the institution. An Agreement on full financial responsibility is concluded with him.

At large enterprises, control over the correctness of filing. KO-4, as a rule, is assigned to the chief accountant. When an institution has several cash employees, a senior cashier is appointed who is responsible for maintaining financial discipline.

All entries in financial documents are made by the cashier. He issues cash from the institution's cash desk and confirms these transactions with an entry on the form. It is the cashier who personally certifies each completed page of the journal, confirming his responsibility for the transactions performed.

The chief accountant or senior cashier checks the correctness of registration of the form every day at the end of the current day. KO-4.

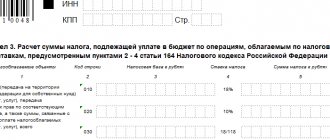

Requirements for individual entrepreneurs and LLCs

By letter No. ED-4-2/13338 dated July 09, 2014, the tax service provided recommendations on the application of the requirements of Regulation No. 373-P. You need to pay attention to the following points:

- Individual entrepreneurs who keep tax records under special taxation regimes: Unified Agricultural Tax, Unified Internal Income Tax, simplified taxation system and patent taxation system - have the opportunity not to fill out cash documents and the unified KO-4 form. Please note: this is a right, not an obligation!

- Small businesses are required to fill out the form and complete all necessary primary documents. This provision is mandatory!

If an open joint-stock company has separate divisions in its structure, where cash transactions are also carried out, it is necessary to issue a KO-4 for each such division.

In order to summarize information about financial transactions throughout the enterprise, it is necessary to establish in the accounting policy the procedure for compiling and transmitting data on transactions performed to the head accounting department of the LLC.

Based on Regulation No. 373-P, the transfer of the cashier’s report after the expiration of the reporting period by separate branches can be carried out in two ways:

- electronic,

- on paper.

Features of the cash book for individual entrepreneurs and LLCs

For individual entrepreneurs there is no obligation to maintain a cash book. But at the same time, entrepreneurs must still keep records of income in it. However, if an entrepreneur already keeps or wants to keep a cash book, no one limits him, this is his right.

If an individual entrepreneur keeps a cash book, then the nuances of filling out will concern only the internal sheets. Thus, in the plate indicated on the sheets of the book, the column indicating the corresponding account is not filled in, unlike in organizations. Entrepreneurs do not indicate a cash balance limit.

It is also noteworthy that individual entrepreneurs do not issue so-called consumables - cash orders.

As for limited liability companies, the procedure is also slightly simplified; the following is not specified:

- correspondent account;

- there is no column defined as “sub-account”;

- analyst codes;

- special purpose.

However, the cash limit is still indicated.

Formats for maintaining a cash book

There are 2 options for forming KO-4:

- on paper;

- using special software.

A unified standard form can be purchased in a store or produced by printing. The magazine usually contains 50 or 100 sheets.

When using the software it is important:

- organize protection against third-party penetration into the financial documentation of the enterprise;

- eliminate loss, entry of incorrect data, duplication of operations;

- ensure archiving of the software base and formation of backup copies.

Cash book firmware

To do this you need:

- Determine the period for which the book is bound, check the presence and correctness of all pages;

- Number all sheets;

- Using a thread and a needle, sew the book so that the knots at the ends of the threads are at the back of the book. Small rectangles cut from clean paper should be glued onto the knots of thread;

- A paper is glued to the book, which should indicate in numbers and in words how many pages are numbered and laced, as well as how many sheets are certified with a seal. The director and accountant sign and stamp the same paper.

How to stitch

The year-end book should be numbered and bound:

- the book is stitched with special threads so that the ends of the thread after tying are on the back of the book;

- a special paper is glued to the knot formed by the thread, on which the number of stitched and numbered sheets is indicated;

- such firmware is certified by the seal of the organization, individual entrepreneur, and signed by the manager.

https://youtu.be/7ci2P5kvw0A

Corrections

The new procedure 373-P allows you to make corrections to the cash register. In this case, the following requirements must be met: the date the correction was made, the full name and signature of the person responsible for issuing the document must be indicated.

Sequence of actions when an error is detected:

- Draw up a memo addressed to the chief accountant about the identified error;

- By order of the director, a commission is appointed whose powers include monitoring the introduction of corrections;

- When the error does not distort the cash balance indicators, the incorrect data is carefully crossed out and the correct information is entered. The corrections made are certified by two signatures - the cashier and the chief accountant. Important: if several corrections are made, each one is certified;

- In the event that an error entails corrections in the balances at the beginning or end of the day and it is not possible to correct it by crossing out, then the entire page is crossed out and a note “cancelled” is made. Next, a new sheet is drawn up with the correct data. Remember: pages cannot be torn out.

Important! Corrections are prohibited:

- in the unified form KO-4, issued in electronic form;

- in receipt and expenditure orders.

https://youtu.be/ugQAiSAQeKg