- home

- Debts

A sample receipt for receipt of funds makes the task easier for both parties to the transaction. It is necessary both to ensure the rights of a citizen who does not give away his funds free of charge, and of a debtor at the end of his debt obligations. In some cases, a receipt is used in court proceedings to prove the rights of one of the parties to these legal relations. However, for this it must have legal force (notarization). Otherwise, proving the veracity of the words specified in it is postponed, for example, for handwriting examinations.

What is a receipt and why is it needed?

A receipt for receipt of money is required in many civil law situations. This may be the transfer of funds as a loan or their receipt through exchange transactions (even in a transaction for the purchase of real estate, concluded in a legal field, and with the participation of the banking system). The receipt acts as a kind of guarantor for the fulfillment of its obligations by the person who accepted the money.

The Civil Code of Russia in the second part has Federal Law No. 14 (from 1996), which confirms the possibility of taking a receipt from the borrower (although the person accepting the funds may not be the borrower, but the person who undertakes to carry out exchange transactions). It can even participate in the settlement system under a work contract (advance payment, main part or generalized payment), which is regulated by clause 8.1 in the Guide to Judicial Practice (Chapter No. 37 of the first paragraph).

Other situations for using a receipt for the transfer of funds:

- alimony payments (especially relevant in the case of transferring funds for alimony in person);

- lease agreements (including for a single prepayment);

- purchase of residential and non-residential properties;

- civil loan, etc. (as opposed to, for example, mortgages from financial institutions).

In this case, the purchase and sale report includes a receipt in the package of materials as a mandatory attachment. This is justified by the involvement of large sums of money. However, alleged child support payers may also accumulate large debts. The issuance of a receipt for the fulfillment of alimony obligations presupposes both the fact of receiving real money and the offset of property objects.

In accordance with the purposes of documenting the transaction, the debtor is supposed to subsequently return the funds in the same amount (or with the agreed interest) or transfer certain agreed upon material values / other assets. The sample acquires its significance when it thoroughly lists the rights and obligations of citizens to each other. The gratuitous procedure for transferring funds excludes the writing of the document under discussion.

promissory note

Do not hurry! You'll still have time. Competently and balanced. Carefully study the proposed material. Save time, nerves and good relationships with your loved ones!

“How can I get a receipt from a relative? He will immediately think that I am biased towards him and don’t trust him,” Misha will think, transferring 30 thousand to his brother, who is left without a job.

“Why draw up some kind of agreement, pile up a bunch of papers? - Masha speculates, borrowing 300 thousand from a friend, a manicurist with 20 years of experience, to open her own business. “She is a professional and an honest person.”

“Why the receipts, and especially the contracts, she will think that I have a bad attitude towards her family,” flashes through the mind of Maxim, who lends 1,000,000 rubles in cash to his wife’s brother.

In such a situation, it may seem that drawing up a loan agreement or receipt may simply offend someone close to you. Although it is quite logical that a respectable relative or friend in need of funds, based at least on ethical principles, should himself become the initiator of documenting the loan.

It is also worth understanding that the presence of a receipt of incomprehensible content does not at all guarantee a return of money, this is confirmed by a huge number of court decisions on such disputes.

Currently, the topic of loans is especially relevant, so today in our blog we will talk about how to lend correctly.

We advise you to lend only money that you are mentally prepared to lose.

Who writes the receipt

Writing is often done in a two-sided format. With this picture, two identical copies respectively remain in the custody of both participants in these legal relations (this is usually relevant when large sums of money are included in circulation or when transferring valuables on a large scale).

If it is not important for the party receiving the money to have a similar copy in their hands, then for the person issuing the money it is the only documentary guarantee for return. At the same time, at the end of the relationship, the debtor returning the money is recommended to request this receipt with a mark indicating that the money has been received and that there are no claims.

Putting a mark is necessary in order to avoid future problems with repeated requests for a refund. It is recommended to keep a copy with a mark affixed to the former debtor. This is sufficient evidence for the court to refute claims to re-collect funds.

In this case, this means both a receipt for the initial receipt of money in the form of a loan, and their return. In the first option, we mean the writing of a receipt by the person who received the money, and in the second, by the person issuing it. The lender (or, for example, the buyer/customer giving money) can, at the request of the former debtor, also issue him a receipt for receipt of funds according to the first sample.

Basic information

A receipt for receipt of money is a document that confirms the receipt of funds.

Often, receipts are drawn up when transferring money as a loan or receiving money when selling property. A correctly written receipt can be used in the future in case of litigation.

The main advantage of a receipt is that it is proof that the money was actually transferred. What legal force does the receipt have? If it is drawn up correctly, it has legal force even if it is not notarized. You can go to court with it and even win the case. So, in part 2 of Art. 808 of the Civil Code of the Russian Federation states that a document can be accepted as evidence confirming the transfer of a certain amount of money to the borrower or the person with whom the agreement was concluded.

It may happen that the court insists on conducting a graphological examination, which will require additional money and time. The plaintiff is required to pay for the examination, and its cost can reach 10,000 rubles.

In order not to overpay, you can draw up a receipt in the presence of a notary, who will then certify it. But it is worth noting that this step is optional.

Another option for obtaining additional guarantees is to involve witnesses who will be present during the preparation of the receipt. These should be people you trust, but who at the same time are not interested parties. Simply put, it shouldn't be your relatives. In the future, they can confirm the fact that the money was actually transferred to the person who issued the receipt. Witnesses must not only be present when the document is drawn up, but also sign on it themselves, leaving their data.

https://youtu.be/k8jqgYUXcTg

Do I need to get it certified by a notary?

Certification of many civil legal acts is not an obligation, but only a recommendation for those involved. Accordingly, at their voluntary request, such paper is allowed to be certified in a notary office by affixing a signature and seal by a specialist. You can compose the text yourself or apply for this service to a notary of your choice.

Article 263 of the Civil Code of the Russian Federation declares that notarization of a transaction means giving it reliability and legality. In some cases, a transaction that is not notarized is characterized as void. However, this does not apply to the cases under consideration. It is worth considering that under this article it is allowed to replace the notary with another official authorized to perform such actions by an official from the government apparatus.

Specific documentary samples are not provided for by law in this case either. The legal field implies compliance with the adequacy of the stated terms of the transaction, as well as the correct writing of the parties’ details. Such a receipt does not require anything more. The expanded content is only the initiative of the parties signing this sample document.

The price for the services provided by a notary will vary depending on their composition: wording of content and certification (which does not occur in conjunction with the first point). In addition, pricing depends on the region of activity of the notary’s office and the individual tariff of the notary (taking into account his professional qualities).

Are witnesses needed?

Certification of a transaction can occur not only with the participation of a notary, but also of third parties - witnesses. This condition is not mandatory. It only adds significance to the document. Therefore, this decision must be made by citizens independently. Such fixation of the transaction will not be superfluous.

Third parties included in the contents of the receipt must be identified by last name, first name and patronymic. It would be best to provide their contact information as well. These witnesses may be called to court to give evidence. Therefore, it is better to indicate not only their telephone numbers, but also their address, as well as passport information (individual numbering, date and place, as well as issue code and registration).

How to write a receipt for receiving money

There are no standardized samples from the government apparatus. However, there is a common form of receipt with standardized wording. It is worth considering that the specifics of the content in any case depend on the specifics of the situation - the purpose of issuing the receipt.

Approximate contents of a sample receipt upon receipt of funds:

- A name where the specifics of the document can be displayed (for example, a loan and promissory note).

- Presentation of the participants.

- Description of the purpose of the receipt and characteristics of the obligations.

- Signing of the document: the debtor, the lender (or simply the person transferring funds in exchange for services) and, possibly, witnesses.

It is recommended that the latter be processed using their passports, ultimately certifying the entire document with dates and signatures. A common rule is to write a receipt for funds manually, rather than typing the text on a computer and then verifying it.

An important rule when writing its text is a complete presentation of information. That is, the digital value of the transferred volume of funds, as well as the statement of the amount in words (in parentheses after the written digital value), the place of drawing up and signing, as well as the terms and conditions of debt repayment (the latter means, for example, the accrual of independently determined interest and a payment schedule ).

Receipt for home purchase

It is much less common to issue a receipt when purchasing an apartment on behalf of the purchaser, although it may be required in some cases. So, if the buyer soon decides to sell the property, then the settlement document will need to be attached to the tax return when selling the apartment (together with the purchase and sale agreement and the transfer and acceptance certificate) for subsequent calculation and minimization of the tax on the income received from the property transaction. In the sample receipt for an apartment, the data of the parties is swapped (in the example - I am Petrov Petrovich), instead of “received” it is written “transferred”, and instead of “sold” - “bought”. A certificate is unnecessary in this case.

Sample and form of receipt for receipt of money

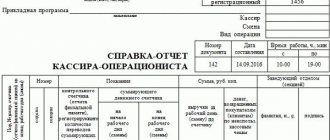

The form of the receipt in all life episodes assumes its voluntary and handwritten nature. If a legal entity uses receipts for the disbursement of funds, their sample will most likely have some form standardized for a specific organization (or individual entrepreneur).

If the user desires such a receipt, he should carefully study its contents and make the necessary adjustments in accordance with the current situation. It is not forbidden to add to the document other information required in the opinion of the compiler. However, the description of the obligations of the second participant in the relationship should in no way contradict his civil rights.

An abbreviated sample about the transfer or return of funds may consist of only one paragraph. After listing the parties and their information, you can, for example, register the fact of taking funds in a specific amount for a certain period. Below it is recommended to write down the idea of voluntarily and personally writing a receipt.

A description of obligations incommensurate with the amount taken may become the basis for challenging the receipt in court. Such a fact may indicate the mental incapacity of the person who received (or allegedly received the funds) or the forced way of writing it, etc. Therefore, the person taking the receipt should pay attention not only to the structure of the sample, but also to its content.

Pledge

It would be quite reasonable and advisable to require the borrower to secure the loan with his property as collateral. This is your insurance in case of any unforeseen circumstances. In this case, the borrower does not lose anything; he conscientiously fulfills his obligations to repay the loan, and you, in turn, return the collateral. If he reacts negatively to your request for collateral, think about why then you should respond positively to his request for a loan. For a conscientious person who really needs money at the moment, this will not be something “supernatural”.

We recommend using liquid items as collateral that do not lose their value over time and are easy to store.

This could be: items made of gold and silver (jewelry, etc.), expensive men's and women's watches (original packaging and documents are highly desirable); premium bags in excellent condition; antiques and art objects.

Before accepting the collateral, we recommend that you evaluate it first at a specialized pawnshop. We recommend that you proceed from this assessment by writing in the receipt that the collateral is valued by the parties at a certain amount. Indicate that the collateral will be kept by the lender; he will not assume the risk of loss.

... a decent borrower must offer collateral himself, this is the norm.

We strongly do not recommend accepting cars and other vehicles subject to registration as collateral: they are difficult to store and sell if necessary.

You cannot accept weapons as collateral (even if the borrower has permission to store and carry them), state awards (medals and orders).

If the loan is not repaid, consider at least part of it to be compensated.