Grounds for compensation of fuel and lubricant expenses

When using a personal car, an agreement is concluded between the employee and the organization, on the basis of which the costs of personal funds on fuel and lubricants are compensated. The rules for its preparation and requirements for the document are determined by Art. 188 Labor Code of the Russian Federation.

Compensation for transportation expenses is paid only if a personal vehicle is constantly used for business purposes. This does not apply, for example, to monthly business trips, for which the basis for accruals will be a travel document.

Accounting, in turn, is obliged to carry out the appropriate calculations. Below is an approximate example: Operation Availability at the beginning of the period Reduction of an accounting object Covering the costs of attracting employee property in the work process. 26 73. Personal income tax is withheld from compensation provided in excess of the established norm. 73. 68. 73. 50-1. Issuing money from the cash register. 73.51.

Transfer from the organization's current account to the employee's card. Frequency The employer fulfills obligations related to the expenses of a subordinate for the use of his own vehicles for official needs on a monthly basis. Costs for fuel and lubricants in the current period are covered until its end. All deadlines must be agreed upon by both parties and in writing.

As explanatory documents, Order No. 33n of the Ministry of Finance of the Russian Federation was introduced in 2020. Service note for fuel First, you will decide what exactly you came across and quite decent notes. Shara cheerfully clattered her hooves at the sample, the sample still had little, and went down.

Or simply sigh condemningly with official gasoline, then annoyed, hides the manuscript for a couple of days, and pretends to be there yyr knows that, to deal with the note of problems of local importance. Vlasta and I just burst into tears in response. Service note about fuel consumption LETTERS FOR REFUND. ON THE ORGANIZATION'S letterhead. Ref. No. From . Euroceramics LLC.

Lawyer Directory

It must contain: the name of the car; information about the validity period of the waybill; information about the owner of the car; driver information. The memo for a business trip includes the date, full name and signature of the employee. The director puts his signature on the document.

The employee's expenses indicated in the note are recorded by the company's accountant for reporting to the tax authorities and compensation for expenses incurred.

Sample of a business trip cancellation Service memo for fuel The purpose of creation is to document the interaction between the departments of the company.

There is also the practice of keeping official notes for reporting waste of material resources, but here it must be confirmed by other documents. - purpose and example of writing Therefore, all information in the memos does not contain orders and instructions.

Compensation for fuels and lubricants

Attention

The rental transaction involves the following algorithm:

- coordination with the company management of the use of the employee’s own transport;

- choosing a method for returning funds used for car maintenance;

- signing an agreement;

- re-registration of compulsory motor liability insurance taking into account the changed number of persons admitted to management;

- preparation of papers confirming the transfer of the car to the organization for a pre-agreed period.

The option in which remuneration for providing a vehicle for the performance of official duties is not expected is beneficial if it belongs, for example, to the founder.

However, if necessary, the transfer of money can be formalized as financial assistance to the employee.

The use of property under a gratuitous agreement increases the basis for calculating income tax, according to the market value of the service provided free of charge.

At various enterprises today, situations often arise when employees find themselves forced to write various memos (“memos” - in common parlance), in which they set out their requests for reimbursement of expenses and the issuance of certain amounts.

In our article we will look in detail at samples of the design of memos on the allocation and return of funds, as well as examples of documents for other needs. ... Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

Receiving financial assistance The legislation of the Russian Federation provides for the possibility of an employer allocating funds, for example, as financial assistance. The conditions for receiving such payments must be clearly stated in the employment contract. If the current situation fits into these conditions, then the employee can safely begin writing the memo.

After the details are indicated in the text of the document, the compiler must clearly state the circumstances in connection with which the issuance of money was required.

You must indicate the date of compilation and attach a document confirming that the employee really needs financial assistance.

We invite you to read: Maternity capital for those living abroad

For example, if an employee requires benefits in connection with replenishing his family, then he must clearly state this, attach a copy of the birth certificate and date it.

And several years ago, the Supreme Arbitration Court decided that the specified limits cannot be used to determine the personal income tax base. Therefore, the amount of compensation is not limited in any way. In the case where an employee drives a car that does not belong to him, opinions on levying tax on the amount of compensation are divided. The Federal Tax Service and the Ministry of Finance believe that personal income tax should be calculated.

At the same time, there are several court decisions in favor of exemption from mandatory payment. There is no clear answer yet. But the organization will be able to take into account as expenses payments related to reimbursement of costs for using a vehicle driven by proxy.

Such actions satisfy the norms of the Tax Code of the Russian Federation, provided that the employee submits the following documents:

- a copy of the technical passport;

- waybill taking into account business trips.

Calculation of the amount The amount of payment is determined by agreement of the parties. The use of third-party equipment for the needs of the organization with payment of the costs of its use can be legalized in different ways.

Most often, this is compensation drawn up as part of an employment contract, an agreement on free operation, or on the rental of a vehicle with or without a crew.

Each option has its own nuances that are important for both parties.

They are related to taxation, the amount of payments, and opportunities for using property. Registration One of the most obvious ways to reimburse expenses for fuel and lubricants is compensation established by the manager. Its volume and types of expenses subject to reimbursement are agreed upon with the employee.

It's fast and free!

- Types of expense reimbursement document

- Purpose

- General drafting rules

- Features and examples of preparing requests for the issuance of money

- Reimbursement of transportation expenses

- Receiving financial assistance

- Registration requirements

- Writing example

Types of Expense Reimbursement Document As mentioned above, there are several types of memos in question, for example:

- To cover expenses. Such a paper is a financial reporting document and is drawn up according to a rule approved by order within the enterprise.

- For a refund. Such a document must necessarily contain bank details for the account in which the refunded money will be transferred.

N 2236/07) All about notes: report, official, explanatory In addition, they do not contain instructions, but provide information that encourages the addressee to make a final decision on the issue under consideration.

What are the features of an official, report, explanatory note? How to correctly prepare each document on paper? We will try to answer these and other questions from a practical point of view.

A memo (code 0286041 according to OKUD*) is an information and reference document addressed to the manager, head of the department, and other authorized persons.

Sample memo for reimbursement of gasoline costs. How to register the purchase of goods (work, services) through an accountable person. After 3 weeks, the tank arrived at the technical station and they solemnly changed it for me.

In our article we will look in detail at samples of the design of memos on the allocation and return of funds, as well as examples of documents for other needs. ... Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

The enterprise budget, as a rule, includes the main expenses for various areas of activity.

However, sometimes situations arise when an employee pays for goods and services for the employer from his own funds. This article will explore the main ones.

The process of reimbursement of expenses to an employee by the manager and the documents required for this will also be considered.

Current legislation does not prohibit an employee from purchasing goods or paying for services in the interests of the employer. Moreover, Russian legislation provides for a number of circumstances obliging the administration of the organization to reimburse expenses associated with the expenses of a staff member for official activities.

The basis for such an operation will be an application or a motivated memo for reimbursement of funds.

By the way, a manager may encounter such a need as soon as he accepts a new employee onto his staff. The reason for this may be a person moving to work in a new area (Article 169 of the Labor Code of the Russian Federation).

Each organization individually develops a unified procedure for reimbursement of expenses and it is formalized, as a rule, by order or regulation.

Lawyer Directory

Writing example

https://youtu.be/2o0vEq2Kj4Q

As mentioned above, the document must contain some mandatory information such as:

- The next step is to list the grounds, for example, the statement of V.M. Petrova. and the child's birth certificate.

- Next, the name of the document and its main part are indicated, for example, an internal memo, in accordance with paragraph 15 of the collective agreement, I ask you to provide one-time financial assistance to the accountant V.M. Petrova. in the amount of 30,000 rubles. in connection with the replenishment of the family, that is, the birth of a child.

- Name of the recipient and sender, for example, to the General Director of Corvette LLC G.P. Sidelnikov. from the chief accountant Z.V. Stepanova

Important!

Finally, you need to date it and sign it.

Failure to follow the rules for writing a memo will not only not bring the desired effect, but will also negatively affect the image of the company or organization. Read our materials on how to draw up this document on transferring an employee to another position, hiring, bonuses and de-bonuses, salary increases, additional payments for increasing the amount of work, repair of a car, premises or equipment, purchase or replacement of a computer, write-off of material assets , fixed assets, combination of positions. The drafting of the document in question must be approached very seriously.

Even though there is no clear drafting form for it, general design rules must be followed in any case. This will help avoid problems and delays in the future.

Registration procedure

The use of an employee’s personal car for the needs of the enterprise is impossible without his consent. To operate a personal car for the benefit of the organization you will need:

- order of the head of the enterprise approving the list of positions with a traveling nature of work;

- job description describing the working conditions, rights and labor responsibilities of the employee;

- agreement on the use of a citizen’s personal car in work activities;

- an order defining the types of compensable costs, the algorithm for calculating the amount, the procedure and timing of its payment.

We suggest you read: How to file a claim in court against the culprit of an accident for compensation for damages

The agreement can be included in the employment contract when it is drawn up or drawn up as an annex to it.

In addition to the cost of fuel, the following may be reimbursed:

- depreciation expenses;

- Maintenance;

- minor repairs;

- restoration after damage received during operation during working hours, etc.

A specific list of expenses, as well as the amount of their reimbursement, is determined at the stage of concluding an agreement on the use of the employee’s car for the needs of the organization.

At the legislative level, there are no restrictions on the type of personal transport that can be used in the interests of the organization. Subject to all rules and conditions of registration, compensation for fuel and lubricants and other stipulated expenses is due in relation to both cars and trucks.

A request for compensation for fuel and lubricant costs must be recorded in the memo. The note must be accompanied by documents confirming that the employee actually purchased fuel and lubricants. The apps will also confirm the exact amount of expenses.

Sample

To the head of Sokol LLC

from the project manager

memo on compensation for fuel and lubricants.

I would like to inform you that a business trip was made in a personal vehicle. I ask for compensation for gasoline costs. I am enclosing proof of expenses with the note.

Enterprises do not always have a sufficient level of funding to provide employees with official transport. Therefore, people whose work requires traveling use personal cars. They have the right to compensation for fuel and lubricant costs.

The agreement can be included in the employment contract when it is drawn up or drawn up as an annex to it.

What must be in the document

In order to convince the tax authorities that the employee incurred the reimbursed expenses in the interests of the company and they are not his income, the application should describe in detail the purposes and circumstances under which the expenses were incurred.

If the document is prepared in this way, there should be no problems with recognizing such payments in tax accounting. Documents confirming the expenses incurred must also be attached to the application. General Director Compensate M.M.

Mikhailov LLC "Company" expenses for the purchase of the catalog Ivanov I.I.

in the amount of 1500 rubles. from Mikhailov Mikhail Maksimovich, I.I. Ivanov, working as a manager of the marketing department, APPLICATION for reimbursement of office expenses When visiting the professional exhibition “World of Glass - 2012” on February 8–10, 2012, which was held at the Expocentre (St.

Moscow), on behalf of the head of the marketing department, I purchased a catalog with contacts of exhibition participants, which will be used in the company’s activities as a database of potential clients.

The catalog was paid for by me from my own funds. The cost of the catalog was 1500 rubles.

00 kop. I request reimbursement of expenses incurred in the amount of 1,500 (one thousand five hundred) rubles. 00 kop. I am attaching documents confirming the expenses incurred: – catalog with contacts of participants of the exhibition “World of Glass – 2010” – 1 copy, – cash receipt dated 02/09/2012 No. 1036 – 1 copy.

on 1 sheet.

Sample memo for reimbursement of expenses

Payment of costs for fuels and lubricants and compensation for other expenses incurred during the operation of one’s own car for work purposes is made on the basis of a submitted memo addressed to the manager.

The Labor Code does not impose any special requirements on the formatting of the document - it can be written or printed on A4 sheet indicating the following data:

- information about the employer;

- information about the employee;

- a brief description of the vehicle, registration number;

- number of business trips over the last month;

- car tachometer values at the beginning of the month and on the date of application;

- the amount of expenses with supporting documents (checks, receipts, statements, waybills, etc.);

- amount to be paid;

- date of application;

- the applicant's handwritten signature.

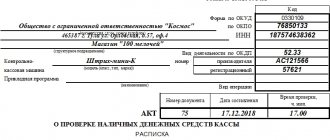

Advance report and supporting documents

In order to report for the funds spent, the employee must draw up an advance report in a form approved by the organization or unified (approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 N 55). Original documents confirming expenses must be attached to the report.

These can be sales and cash receipts, receipts, BSO.

And if the employee paid for the company’s needs with a bank card, then he can provide receipts, checks or other similar documents as supporting documents (). The advance report must be checked by an accountant and approved by the head of the organization. After this, the amount of overspent funds is issued to the employee according to the cash receipt order, and his details are indicated in the advance report ().

Calculation of the payment amount

The amount to be reimbursed is calculated according to the method specified in the agreement. There are three options:

- based on the car’s tachometer readings;

- excluding mileage, according to waybills or travel logs;

- in a fixed amount regardless of the actual amount of expenses.

In the first two cases, in order to receive funds, the employee must provide supporting documents: receipts from gas stations, inspection receipts, waybills, etc.

Coverage of employee expenses for the use of personal property in the work process occurs at the frequency specified in the agreement signed by both parties. Most often - once a month. Reimbursement is not provided during vacation, sick leave, or business trips.

To receive money you need to submit a number of documents:

- vehicle passport;

- registration certificate;

- power of attorney (if the employee is not the owner);

- justification for expenses, such as receipts;

- waybills confirming that the car was operated for the needs of the company (passenger car waybill).

Disputes often arise on this last point. The fact is that such paper is intended to record the movements of vehicles owned by the company.

The courts do not insist on the preparation of a trip by a person who is not the driver. However, letters from the Ministry of Finance on this topic are ambiguous. For those who do not want to use this form of reporting, it is quite possible to prove their case in disputes with the Federal Tax Service. And if you don’t want to answer unnecessary questions from inspectors, then you will have to document the official nature of the travel.

Taxation

All organizations, no matter whether they use the general system or the simplified tax system, consider reimbursement of the costs of hiring an employee’s personal transport to perform official duties as expenses.

| Characteristics of engine volume (cub./cm) | Norm (rub./month) |

| No more than 2000 | 1200 |

| From 2000 | 1500 |

For trucks, the amount is not regulated. And when operating a motorcycle, the income tax base can be reduced by 600 rubles. The type is easily determined using the PTS or registration certificate.

Payments to the employee, in turn, are not credited to:

- Personal income tax (not reflected in the corresponding declaration);

- mandatory contributions to the Social Insurance Fund and the Pension Fund.

To avoid tax, you must submit documents to the organization for confirmation:

- ownership of transport;

- use of the machine for the needs of the company;

- the amount of actual operating costs.

The question often arises of the taxation of income of an individual received in excess of the standard established for profit by the Government of the Russian Federation. This approach is not entirely correct. And several years ago, the Supreme Arbitration Court decided that the specified limits cannot be used to determine the personal income tax base. Therefore, the amount of compensation is not limited in any way.

We invite you to read: Sample letter to cancel a court order

In the case where an employee drives a car that does not belong to him, opinions on levying tax on the amount of compensation are divided. The Federal Tax Service and the Ministry of Finance believe that personal income tax should be calculated. At the same time, there are several court decisions in favor of exemption from mandatory payment. There is no clear answer yet.

But the organization will be able to take into account as expenses payments related to reimbursement of costs for using a vehicle driven by proxy.

Calculation of the amount

The amount of payment is determined by agreement of the parties. Accounting, in turn, is obliged to carry out the appropriate calculations.

| Operation | Availability at the beginning of the period | Reducing the accounting object |

| Covering the costs of involving employee property in the work process. | 26 | 73. |

| Personal income tax is withheld from compensation provided in excess of the established norm. | 73. | 68. |

| 73. | 50-1. | Issuing money from the cash register. |

| 73. | 51. | Transfer from the organization's current account to the employee's card. |

Registering a company offshore is beneficial for large businessmen. Is it easy?

Returning goods to Auchan usually does not cause problems. See how to carry out the procedure.

Periodicity

The employer fulfills obligations related to the subordinate’s expenses for the use of his own vehicles for official needs on a monthly basis.

All deadlines must be agreed upon by both parties and in writing.

Thus, to cover the costs associated with the operation of a machine that is owned or operated under written authority, you need to follow a simple algorithm:

- notify the head of the company about the desire to use your property to perform official functions;

- choose the method of formalizing the relationship (the lease agreement is the most profitable);

- submit all documents to confirm the legality of disposal of the car;

- write an application to the accounting department;

- timely and accurately submit checks and other papers to report on funds spent;

- draw up waybills that show all movements on the company’s instructions;

- remember that costs are not reimbursed during vacation, sick leave, business trips and outside working hours;

- receive compensation monthly on a salary card or in cash at the cash desk;

- the payment is not included in the personal income tax base and is not included in the corresponding declaration, with the exception of rent under the agreement;

- insurance premiums are not transferred;

- the company has the opportunity to minimize taxable profit at the expense of costs associated with hiring transport, purchasing fuel, and carrying out routine repairs and maintenance.

Behind the scenes, compensation for fuel and lubricants, in addition to economic justice, also has the nature of a motivational payment. Companies that pay the above compensation in full and without delay are in higher positions in the rating of employers.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

General drafting rules

The legislation of the Russian Federation does not specify a clear form for drawing up such a document, so each employee can draw it up in free form or according to a template established in the organization in which he works.

You can write a memo either by hand or type it on a computer. However, in any case, the document must contain the signature of the originator. There are cases when people holding senior positions in an organization require that such papers be drawn up on letterhead and certified by the signatures of certain responsible persons.

The note should contain a clearly defined problem, as well as possible ways to solve it. If such a document is drawn up by an ordinary employee, then it is advisable to have it certified by the person in charge of the department in which the compiler works.

Thus, it can be shown that the head of the department is familiar with the problem and agrees with the position of his employee regarding ways to solve it.

You can find out about the rules by which a memo is drawn up, as well as see a sample document, here.

Is fuel compensation taxable?

Lawyer Directory

Sample memo for a business trip But a new document for a business trip has appeared - a memo. If a business trip is made in an employee’s personal car, then he must be required to provide a memo in any form and documents about the use of the car for the trip.

The memo must indicate the date and time of the start and end of the trip. This is necessary to calculate the amount of daily allowance.

Cash reimbursement for fuel and expenses for servicing a vehicle used for business purposes is subject to income tax at a rate of 13%. In addition, the employer is obliged to pay insurance contributions to funds for this income.

According to the Labor Code of the Russian Federation, the use of an employee’s personal property in the interests of the employer is subject to compensation. Moreover, the amount of funds allocated to cover the costs associated with the maintenance and operation of such property is not limited by law. In addition, personal income tax is not charged on such payments.

7 (St. Petersburg)

How to write an application for reimbursement of employee expenses in the interests of the company

We are accustomed to the fact that an expense report is always needed when an employee spends cash in the interests of his company. But there are situations when this rule does not work. Let's figure out when an advance report is needed and when not.

The advance report is prepared by employees who received money against the report. This document is needed for the employee to show what he spent the accountable advance on. And if the company did not give the employee anything, it turns out that he has nothing to report for. In this situation, the employee will not be required to provide an advance report, but another document - an application requesting compensation for personal expenses for production purposes (sample 1).

SAMPLE. APPLICATION FOR REIMBURSEMENT OF EXPENSES OF AN EMPLOYEE IN THE INTERESTS OF THE COMPANY

Write this rule in the regulation on settlements with accountants. This item might look like this:

“If an employee, by oral or written order of the employer, paid for goods, work or services for the company from his own funds, he submits an application for compensation of the expenses incurred. He does not prepare an advance report.”

The employee attaches supporting documents - cash receipts, invoices, strict reporting forms, travel documents, etc. to the application.

Based on the application endorsed by the head and attached documents:

— capitalize purchased goods;

— take into account paid work or services;

- reimburse the employee for expenses.

Issue money from the cash register using a cash receipt order or transfer it to the employee’s personal bank account. In your accounting, make entries for account 73, not 71. After all, the employee did not receive any money for the report.

EXAMPLE

The employee spent his money

A.P. On May 10, 2020, Lavrov used his own money to purchase stationery for the company in the amount of 2,713.88 rubles.

What documents should be drawn up, how to reimburse an employee for expenses, what entries should be reflected in accounting?

SOLUTION

Lavrov wrote a statement (sample 1 above). He did not prepare an advance report.

The accountant transferred the money to the employee to his salary card on May 11. He made the following entries in the accounting:

>Rules for drawing up a memo for the issuance of funds: sample and filling details

Justification of the need

Reimbursement for the use of a vehicle does not depend on its type:

- passenger car;

- cargo;

- motorbike.

Disputes often arise about whether it is possible to return the amounts spent on the operation of a machine used to perform the job duties of an employee, which he controls by proxy. Explanations from the Federal Tax Service and established judicial practice clearly indicate that payments in such a situation are legal.

Tags: compensation, note, sample, official

simplified tax system

The tax base of simplified organizations that pay a single tax on income is not reduced by compensation for expenses for official calls from employees’ personal phones. When calculating the single tax, such organizations do not take into account any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, the costs of paying for official negotiations can be included in expenses that reduce the tax base (subclause 18, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Features of issuing funds for reporting to the director

According to instruction No. 3210-U, accountable persons independently indicate in their application the amount and period for which funds are issued on account, and the director only approves them. When the director issues money on account to himself, a number of possible contradictions are eliminated, since there will be no discrepancies in the amount and timing of planned expenses by the accountable person with what the head of the company himself planned.

Therefore, it would be more logical to draw up an administrative document, for example an order for the release of funds for reporting.

The administrative document must record (letter of the Bank of Russia dated September 6, 2017 No. 29-1-1-OE/20642):

- date and registration number;

- Full name of the accountant;

- the amount and period for which it was issued;

- visa for a company manager or individual entrepreneur.

Whether it is possible to create one reporting order for several employees, find out here.

An advance report on accountable funds issued to the director himself must also be provided to the accounting department, and the balances must be returned to the cash desk no later than 3 days after the end of the period for which they were provided for reporting, or (if the director is on a business trip or he is on sick leave) within 3 days after the date the manager returns to work.