We draw up an act of writing off spare parts for a car - sample

Accounting documents Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media. networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > February 26, 2020 Documents and forms will help you: Certificate of write-off of spare parts for a car - a sample of this document due to lack Companies approve the unified form independently. What are the main nuances of its preparation? Enterprises that use cars regularly record transactions that reflect the turnover of spare parts for them.

In this case, it is assumed that the following basic operations with these materials are recorded:

- Write-off for repair.

- Posting.

- Moving from one division of the company to another.

Each case uses its own supporting documents.

If we talk about the 3rd operation, then as a corresponding document, many companies use an independently developed form of an act of writing off spare parts for a car, the main feature of which is the justification for the need to replace the corresponding spare part. This act can be used as an alternative to such unified forms as an invoice (drawn up according to the M-15 form) or a demand invoice (drawn up according to the M-11 form), which do not always meet the specifics of the movement of spare parts accepted in the organization when writing off for repairs.

Software for keeping track of spare parts in stock – RepairOnline

Do you need a program that not only records receipts, write-offs and movements of spare parts, but also stores the details of these transactions? Are you looking for a solution that allows you to control inventory, track parts shipments, and automate their pricing?

RepairOnline is a cloud service that can bring order to your warehouse.

Understanding the importance of keeping records in the workshop is a guarantee of the development of your business. The same reason that negatively affects the management of a repair company is the use of outdated accounting techniques.

RepairOnline is a cloud service that optimizes business processes and eliminates managerial headaches. The program fully automates the management of service centers and repair shops, as it has a number of useful features:

- use of individual forms when creating different types of orders;

- convenient and functional order table;

- control of work progress implemented using order statuses;

- retail sales management;

- accounting of enterprise income and expenses;

- invoicing;

- customer base with physical division and legal persons on customers and suppliers;

- generation of reports on salaries and cash flows;

- tracking profits from orders and sales;

- creating reports on accepted, closed and pending orders;

- automation of document printing;

- sending SMS and email notifications to clients and employees;

- full-fledged telephony designed for recording and recording conversations;

- keeping records of parts and spare parts in the warehouse;

- automation of the goods procurement process.

Keeping records of goods is the process we want to focus your attention on.

Keep records of spare parts in a separate warehouse

Create a virtual copy of your warehouse, and then transfer the database of repair parts there. Add spare parts to the global warehouse so that they are available in all workshops. Sell goods and accessories, and keep records of them in a separate warehouse. Create an unlimited number of warehouse spaces and control employee access to them.

Separate spare parts into different categories

Create categories of spare parts - groups of spare parts that have similar characteristics and are used to carry out the same type of repairs or repair specific models of devices. Sort products into categories and speed up various processes:

- adding material or spare parts to an order;

- selection of spare parts when selling them;

- search for spare parts in the warehouse;

- creating a report on the balances of spare parts belonging to a specific category.

Receive spare parts to the warehouse

Create detailed product cards: add images, indicate codes, articles, barcodes of spare parts, as well as the standard duration of the warranty period.

Perform capitalization, indicating suppliers' details, invoice numbers, as well as names, quantities and purchase prices of spare parts - store information about each batch received. Create price types with unique markup values, and receive a ready-made price list for a spare part when it is received. Add parts to the warehouse and immediately register their payment in the cash register.

Find postings made for any period of time, view their details. Print receipts or download them as Excel documents.

Write off spare parts from the warehouse

Use spare parts to fulfill orders, sell them in the store, and record each decommission from the warehouse. View details of charges made for any period of time. Print spare parts write-off reports directly from RepairOnline or download them as .xls documents.

Move spare parts between warehouses

Move parts between warehouses and store parts from those warehouse operations. View information about movements performed over a certain period of time. Print movement reports or export them as spreadsheets.

Control the availability of spare parts in stock

Create reports on inventory and monitor the fullness of warehouse space with spare parts. Specify the product category before creating reports and control the availability of specific spare parts and components. Print reports on balances directly from RepairOnline, and also download them in .xls format.

Create reports on spare parts write-offs

Create reports on write-offs from the warehouse, and determine the consumption of repair materials for the required period of time. Print parts write-off reports directly from your browser or download them as spreadsheets.

If you have any questions regarding keeping track of spare parts in RepairOnline, call one of the hotline numbers. Technical support specialists will definitely help you and, if you wish, tell you in detail about the main capabilities of RepairOnline.

Source: https://remonline.ru/features/programma-skladskogo-ucheta/program-for-accounting-of-spare-parts-in-warehouse/

Decommissioning a car, posting spare parts: taxes and accounting

During operation, fixed assets, and cars are no exception, gradually wear out and sooner or later fail.

The cost of fixed assets that are not capable of generating economic benefits (income) in the future, according to the norms of accounting legislation, is subject to write-off from accounting. The disposal of fixed assets is also reflected in the tax accounting of the organization. In the article we will tell you how the write-off of cars is taken into account in accounting and tax accounting, how to document write-off operations and how the accounting of spare parts identified during write-off is carried out. As you know, uniform accounting requirements have been established Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ) and Art.

21 of this Law, documents in the field of accounting regulation include federal and industry standards, recommendations in the field of accounting, as well as standards of an economic entity. Before the approval of federal and industry standards provided for by Law N 402-FZ, the accounting rules approved before it comes into force, therefore, in order to organize the accounting of cars, we will be guided, in particular: - Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n (hereinafter - PBU 6/01); - Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003.

Write-off of spare parts in accounting

Contents Obtaining spare parts for the repair of vehicles on the balance sheet of the organization is included in the costs of maintaining and operating fixed assets.

Their actual cost is written off as part of other costs in the tax period in which they were incurred.

Instructions 1. Receive spare parts for cars received by the organization on the basis of a commodity-transport unprofitable invoice, if they were purchased by bank transfer, or on the basis of a sales receipt, if they were purchased in a store for cash. Draw up a receipt order in form M-4, signed by the storekeeper. In accounting, the posting for the posting of spare parts will be as follows: “Debit account 10-5 “Spare parts”, Loan account 60-1 “Settlements with contractors” (71 “Settlements with accountable persons”).”

2. Transfer spare parts for car repairs to the transport department.

In this case, the document must contain mandatory details that allow it to be recognized as primary.

The structure of the act for writing off car spare parts is as follows: Information about the owner Name of the organization, details, legal address Name of the document Registration number, date of preparation Details of the structural unit Write-off of spare parts Data on the types of spare parts to be written off, indicating their numbers according to the nomenclature Quantity and cost of Write-off spare parts Information about the accounts used to record the write-off of spare parts The drawn up act is signed by a representative

How to buy spare parts for a car?

There are several ways to purchase car parts. Today, more and more often, car enthusiasts order the necessary parts from online stores. One cannot but agree that this is very convenient, but there is a risk of purchasing low-quality products, since we see in front of us, at best, a picture and cannot familiarize ourselves with the part in more detail.

Therefore, purchasing auto parts from traditional stores is still very popular. However, you should be careful here too. Before making your final choice in favor of a particular spare part, ask the seller to tell you more about it. Often, stores that sell automotive products employ not very competent people. You don’t want to entrust your life to non-professionals, do you?

An excellent place to buy spare parts is FAVORIT MOTORS Group. The company's qualified specialists will help you choose the appropriate spare parts of exceptionally high quality.

Write-off of spare parts in accounting documents

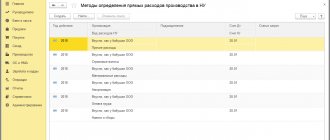

quoted1 > > One of them is taken away for use in the main production. Depending on the chosen policy, the write-off cost may be:

- the same as the first gearbox that arrived.

- average of the cost of all available gearboxes;

- the same as she was upon admission;

Wiring:

- debit 20, credit 10.5 – reflects the cost of the decommissioned gearbox.

If further use of the removed spare part is no longer possible, and its repair is impractical, it must be written off irrevocably.

However, it still has some material value: the price of scrap (salvage). The organization delivers metal or raw materials to specialized points, receiving a certain amount of money for it. These funds need to be capitalized.

EXAMPLE OF WIRING. An old car destroyed in an accident cannot be repaired.

Important It is necessary to use a sample act of writing off spare parts for car repairs. Spare parts are written off without confirmation of their installation on the car. Absence in the document Confirming the write-off of spare parts, the names of positions and surnames of the persons who signed the document. Write-off of purchased spare parts Without prior capitalization of them. As for the act of writing off spare parts for a car itself, then The validity of the document is recognized only if the basic requirements are met.

Such as the availability of mandatory details and accuracy of data.

We recommend reading: What date does the pension fund start working in January?

That is, all write-off parts must be identified in as much detail as possible in order to eliminate the possibility of erroneous write-off of other objects.

How are auto parts accounted for?

4181 Almost every organization has motor vehicles as part of its fixed assets, often more than one or two types. This means that it is necessary to periodically buy spare parts; in addition, they may appear as a result of disassembling a decommissioned car.

How to post these funds through accounting and reflect them on the balance sheet or off-balance sheet accounts? You can do this automatically through the 1-C program, you just need to remember the important nuances. If we are talking about transport of budgetary organizations, then the regulations for the supply of spare parts are written out in the following legislative acts:

- Federal Law No. 44 - for government institutions;

- Through subsidies or income from related activities (in accordance with the provisions of the above-mentioned Federal Laws) - for the public sector.

- Federal Law No. 223 - for autonomous organizations;

Depending on the volume of future orders, they can be made with a single supplier or with a group, which must be chosen freely or competitively (through a competition, auction, comparison of commercial offers, etc.).

Let's find out in the article. Since the maintenance of motor vehicles is a constant cost item, organizations enter into contracts for the supply of spare parts with one or more suppliers. Commercial organizations use conventional supply contracts.

IMPORTANT! From one supplier you can buy spare parts for a company in the amount of no more than 100 thousand or 5% of all purchases.

How to choose spare parts for a car?

The selection of spare parts must be carried out scrupulously and take into account many factors, such as workmanship, manufacturer, price. Based on the analysis of these three factors, you need to select the details. If you neglect to pay attention to their selection, you may encounter the following consequences of installing unsuitable spare parts:

- rapid destruction of the unit in which the part is placed;

- multiple increase in repair costs;

- a sharp decrease in travel safety;

- unsuitability of the car for long trips and driving at high speed.

How can an organization write off expenses for auto parts?

- 3.

- 5.

- 1.

- 2.

- 4.

Spare parts for a car are included in materials (Instructions for the chart of accounts).

rubles, if the purchased quantity is relatively small, less than 2 million rubles are spent on them during the year.

Therefore, the rules for recording transactions related to the receipt of spare parts in accounting are similar to the general procedure. For details of recording operations related to the replacement of car tires, see. The receipt, movement and disposal of spare parts for the car in accounting should be reflected in subaccount 10-5 “Spare parts” to account 10 “Materials”.

Typically, replacement of spare parts in a car occurs during its repair (current or major).

The procedure for writing off spare parts in accounting depends on how the car will be repaired - by the organization’s own resources or by a contractor. If an organization repairs a car on its own, and the repair department is located on its territory, then when writing off spare parts, fill out a demand invoice in form No. M-11.

If spare parts are transferred for repair to a department that is located outside the organization’s territory, or to a contractor, then issue a transfer of the invoice for the release of materials to the third party (Form No. M-15). Such rules are provided for in paragraph 100 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001.

No. 119n, and instructions for filling out forms No. M-11 and No. M-15, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. Situation: is it necessary to draw up a report in form No. OS-3 when replacing spare parts in a car? If the location of the car does not change when replacing spare parts, then there is no need to draw up a report.

Spare parts accounting: posting documentation and accounting

» » Almost every organization has motor transport as part of its fixed assets, often more than one or two types.

This means that it is necessary to periodically buy spare parts; in addition, they may appear as a result of disassembling a decommissioned car.

How to post these funds through accounting and reflect them on the balance sheet or off-balance sheet accounts? You can do this automatically through the 1-C program, you just need to remember the important nuances.

Let's find out in the article. Since the maintenance of motor vehicles is a constant cost item, organizations enter into contracts for the supply of spare parts with one or more suppliers. Commercial organizations use conventional supply contracts. If we are talking about transport of budgetary organizations, then the regulations for the supply of spare parts are written out in the following legislative acts:

- Federal Law No. 44 - for government institutions;

- Through subsidies or income from related activities (in accordance with the provisions of the above-mentioned Federal Laws) - for the public sector.

- Federal Law No. 223 - for autonomous organizations;

Depending on the volume of future orders, they can be made with a single supplier or with a group, which must be chosen freely or competitively (through a competition, auction, comparison of commercial offers, etc.).

IMPORTANT! You can buy spare parts for a company from one supplier for an amount of no more than 100 thousand rubles, if the quantity purchased is relatively small - less than 2 million rubles are spent on them during the year.

Types of machine parts

If you compare a car with the human body, then its auto parts will act as organs. We all take care of our health by eating something healthy, taking vitamins or playing sports. Let's see what needs to be done if one of the internal organs of the car begins to act up and needs replacement.

The modern auto market offers original products, non-original and used parts. There is no need to explain that there is nothing better than original parts, because they are very precisely designed for the parameters of a particular machine, experiments and strength tests are carried out on them. It is original spare parts that are used in extreme conditions and situations. And if your car needs to change an auto part, then with original spare parts you will not have any problems during installation. And with a new, original part, the car will serve you for a long time. The original part is produced at the same place as the car itself, and this speaks better than any words about the advantage of ordering original replacement parts.

It is not surprising that with all their advantages, original spare parts have one significant disadvantage - the price. The price sometimes discourages you from ordering an original part for a car. Also, many people do not like how long it takes to deliver original parts from the manufacturing plant. You can wait a week, a month, or even two for a new spare part.

Conclusion: advantages – durability, quality, manufacturer’s warranty; Cons: price, waiting for delivery.

Copies of original parts or duplicates are also produced in factories that have a license or patent for the production of auto parts from the original manufacturer's plant. It happens that a manufacturing plant is so busy with work that it does not have time to produce individual parts. Therefore, highly specialized enterprises that have a production license can produce certain spare parts.

But by buying duplicates, you risk purchasing parts made by craftsmen in garages. How do you know if you have purchased a quality item? Typically, manufacturers of duplicate auto parts under license accompany their products with a warranty. In this case, you can have no doubt about the quality of the products, since the manufacturer of original spare parts carefully checks their products. As a rule, factories receive a license to produce brake systems, suspension elements, batteries, and electrical equipment.

If your priority is money, then buying used spare parts would be a good option. The X-team online store offers spare parts from disassembly and there are a lot of such stores. The store provides a guarantee on the quality, originality of spare parts from disassembly and their performance. You can order the original engine, transmission, as well as wheels, tires and much more.

Write-off of spare parts for car repair documents

Contents A selection of the most important documents on request Certificate of write-off of spare parts (regulatory acts, forms, articles, expert consultations and much more).

“Instructions on the procedure for writing off fixed assets of enterprises and institutions of railway transport that have become unusable”

“Methodological recommendations for accounting of costs and output in dairy and beef cattle breeding” Question: An organization has on its balance sheet several cars that are used in activities aimed at generating income. As a rule, maintenance and repair of vehicles are carried out in a car service center on the basis of a contract.

At the same time, the replacement of some failed parts is carried out on their own (by the driver, mechanic of the transport department).

Explain what documents need to be completed to confirm the costs of repairs in this case.

Question: What primary document confirms the fact of write-off of spare parts during warranty repairs of equipment? Is the claim act a mandatory document or is it possible to develop another one? The printed form of the Certificate for write-off of inventory items (spare parts) is intended for the configuration “1C: Enterprise Accounting 8, edition 2.0”.

We recommend reading: How to find out who lives at an address

The printed form of the Certificate for write-off of inventory items (spare parts) is intended for the 1C: Enterprise Accounting 8 configuration, edition 2.0.

This printed form is connected to the Request Invoice document through the mechanism of external printed forms, this allows you to use processing without making any changes to the standard configuration.

Separate spare parts into different categories

Create categories of spare parts - groups of spare parts that have similar characteristics and are used to carry out the same type of repairs or repair specific models of devices. Sort products into categories and speed up various processes:

- adding material or spare parts to an order;

- selection of spare parts when selling them;

- search for spare parts in the warehouse;

- creating a report on the balances of spare parts belonging to a specific category.

Spare parts accounting: postings, documentation and accounting

Author of the article Olga Evseeva 6 minutes to read 17,728 views Contents Equipment and vehicles on the balance sheet of the enterprise are subject to maintenance and replacement of parts to maintain working condition.

Accounting for spare parts requires careful documentation to confirm economically justified expenses. The installation of new parts, assemblies, and spare parts on a fixed asset (OS) is carried out to replace worn-out elements that have failed. When replacing spare parts, the OS characteristics remain unchanged, the cost does not increase.

The purpose of repair work is to eliminate malfunctions and carry out preventive measures to replace worn parts. Repair work is carried out on our own (self-employed) or with the involvement of contractors (service centers). Regardless of the method of carrying out repairs, a document flow must be developed at the enterprise. For each fixed asset, the procedure and frequency of carrying out are approved: (click to expand)

- Preventive measures.

- Major renovation.

- Routine maintenance.

- Medium repair (for vehicles).

Control over the condition of the operating system and repairs is carried out by a commission permanently operating at the enterprise. Enterprises that have not approved the list of spare parts to be replaced carry out repairs based on the defective list.

The document is used to write off parts and approve a repair plan.

Accounting for spare parts installed on vehicles

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

04/27/2010 subscribe to our channel

The program “1C: Accounting of a budgetary institution 8” provides for the automation of accounting for the full cycle of movement of spare parts - from receipt to write-off of worn-out ones.

The methodologists in this article provide the normative regulation of the issue and explain the procedure for reflecting the relevant operations in the program.

According to the Instructions for Budget Accounting (approved.

by order of the Ministry of Finance of Russia dated December 30, 2008 No. 148n, as amended. dated December 30, 2009 No. 152n, hereinafter referred to as Instruction No. 148n), material assets issued for vehicles to replace worn-out ones (batteries, tires and tires, etc.) in order to control their use are recorded on off-balance sheet account 09

“Spare parts for vehicles issued to replace worn-out ones”

.

Material assets are reflected in accounting at the time of their write-off for the purpose of repairing vehicles and are taken into account during the period of their operation (use) as part of the vehicle. The write-off of material assets from off-balance sheet accounting is carried out on the basis of an acceptance certificate for completed work, confirming their replacement.

Analytical accounting of the account is maintained in the Card of quantitative and total accounting (f. 0504041) in quantitative terms, indicating the position and surname of the recipient, date of receipt, serial number.

Car repair

Attention

Upon receipt of the purchased parts at the warehouse, on the basis of the received invoice, the materially responsible person is accounted for in the Book (card) of accounting for material assets (f. 0504042) by name and quantity. In accounting, spare parts are accounted for at their actual cost, taking into account VAT presented to the institution by the supplier, if the spare parts intended to be used in activities not subject to VAT. This is stated in paragraph 52 of the Instructions on Budget Accounting, approved by the Order of the Ministry of Finance of Russia dated December 30, 2008.

N 148n (hereinafter referred to as Instruction N 148n). The actual cost of inventories acquired for a fee includes, among other things, amounts paid to organizations for information and consulting services, as well as for the delivery of inventories to the place of their use.

Tip 1: How to write off spare parts

January 29, 2012 Author KakSimply!

The purchase of spare parts for the repair of vehicles on the balance sheet of the organization is included in the costs of maintaining and operating fixed assets. Their actual cost is written off as other expenses in the tax period in which they were incurred.

- How to write off fixed assets Question “How to fix engine malfunctions?” — 2 answers Instructions 1 Receive spare parts for cars received by the organization on the basis of a bill of lading, an invoice if they were purchased by bank transfer, or on the basis of a sales receipt if they were bought in a store for cash. Draw up a receipt order in form M-4, signed by the storekeeper. In accounting, the posting for the posting of spare parts will be as follows: “Debit to account 10-5 “Spare parts”, Credit to account 60-1 “Settlements with suppliers” (71 “Settlements with accountable persons”).”

2 Hand over spare parts for car repairs to the transport department. Complete the demand invoice in form M-11.The document must be signed by the storekeeper and the site mechanic, who at the end of the month is required to draw up a material report on the use of materials and a vehicle repair report.

The report indicates which vehicle the spare parts were used for.

- How to write off spare parts

- How to account for car expenses

| ATTENTION! The material was updated as of 01/01/2019. Read more here |

REPAIR OF A CAR RECEIVED UNDER A FREE USE AGREEMENT: TAX AND ACCOUNTING OF COSTS

| Situation An organization under a free use agreement uses a passenger car for office maintenance. In accounting, it is recorded in off-balance sheet account 001 “Leased fixed assets.” Under the terms of the contract, the maintenance and servicing of the vehicle is carried out by the user organization. The user organization had a need to repair this vehicle. The repair will be carried out by a third party, but using customer spare parts. In this regard, questions arose: • can car repair costs be considered expenses taken into account for tax purposes; • how to document and record the transfer of spare parts to a repair organization and their write-off; • how to record car repair services? |

Legislative regulation of free use of property

Under an agreement for gratuitous use, one party (the lender) undertakes to transfer or transfers an item for gratuitous temporary use to the other party (the borrower), and the latter must return the same item in the condition in which it received it, taking into account normal wear and tear (clause 1 of Art. .643 of the Civil Code of the Republic of Belarus (hereinafter referred to as the Civil Code)).

The borrower is obliged to maintain the thing received for gratuitous use in good condition, carry out current and major repairs and bear all expenses for its maintenance, unless otherwise provided by the agreement of gratuitous use (Article 649 of the Civil Code).

Thus, the borrower must carry out maintenance of the car and technical care for it, bear the costs associated with its maintenance: the purchase of spare parts, parts, etc.

Accounting for repair costs when taxing profits

| From the editors of "Business-Info" The material refers to the Tax Code of the Republic of Belarus as amended before January 1, 2020. From January 1, 2020, the above-mentioned Code is set out in a new edition by the Law of the Republic of Belarus dated December 30, 2018 No. 159-Z. Regarding taxation, the material is relevant as of the date of its writing. |

Costs of production and sale of goods (work, services), property rights, taken into account for taxation, represent the valuation of goods (work, services), property rights of natural resources, raw materials, materials, fuel, energy, basic materials used in the process of production and sale of goods (work, services), property rights. funds, intangible assets, labor resources and other expenses for their production and sale, reflected in accounting (part one, paragraph 1, article 130 of the Tax Code of the Republic of Belarus; hereinafter referred to as the Tax Code).

Costs for the production and sale of goods (work, services) are determined on the basis of accounting documents and are reflected in the tax period to which they relate, regardless of the time (term) of payment (preliminary or subsequent) (clause 2 of Article 130 of the Tax Code) .

Since a car received by an organization for free use is used in production activities to service the office, the costs of its repair and maintenance can be included in the costs taken into account when taxing profits. At the same time, the fact that the car is not the property of the organization does not matter, since the obligation to keep the property used in the property is not established.

Accounting and documentation of the transfer of spare parts for repairs

Under a contract for the provision of services for a fee, one party (the contractor) undertakes, on the instructions of the other party (the customer), to provide services (perform certain actions or carry out certain activities), and the customer undertakes to pay for these services (clause 1 of Article 733 of the Civil Code).

General contract provisions established by Article 656-682 of the Civil Code (Article 737 of the Civil Code) apply to contracts for the provision of paid services for car repairs.

Car repair services can be provided either using the contractor’s own materials or using the customer’s materials (Articles 658 and 667 of the Civil Code).

When a repair organization accepts a vehicle for repair, it issues a work order (another document), which indicates the list and cost of repair services, as well as the materials and spare parts required for this.

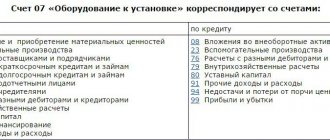

To account for the availability and movement of spare parts used to replace worn parts of machines, equipment, vehicles, etc., subaccount 10-5 “Spare parts” is intended for account 10 “Materials” (part seven of clause 16 of the Instructions on the procedure for application standard chart of accounts for accounting, approved by Decree of the Ministry of Finance of the Republic of Belarus dated June 29, 2011 No. 50; hereinafter referred to as Instruction No. 50).

Spare parts are accepted for accounting at the actual purchase price (clause 7 of the Inventory Accounting Instructions, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated November 12, 2010 No. 133).

To write off inventory items (hereinafter referred to as goods) from the consignor and (or) take them into account from the consignee, when moving goods within an organization between storage and (or) production sites located at different addresses (except for moving goods within the same building ) organizations use invoice TTN-1 and invoice TN-2 (part two of clause 1 of the Instructions on the procedure for filling out the consignment note and consignment note, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 30, 2016 No. 58; hereinafter referred to as Instruction No. 58).

| From the editors of "Business-Info" From January 1, 2020, you should be guided by clause 1 of Instruction No. 58, taking into account the changes made by the Decree of the Ministry of Finance of the Republic of Belarus dated 08.10.2018 No. 58. For a comment, see here . |

When carrying out intra-republican road transport for one’s own needs, a TTN-1 consignment note is issued. Invoice TN-2 is issued when transferring goods without the participation of road transport and in other cases established by the legislation of the Republic of Belarus (part four, paragraph 1 of Instruction No. 58).

Therefore, the transfer of spare parts to a repair organization for repairs should be issued with an invoice of the appropriate form.

Spare parts transferred for repair in accounting on the basis of an invoice are reflected in subaccount 10-7 “Materials transferred for external processing” (part ten, paragraph 16 of Instruction No. 50).

Accounting for car repair costs

Each business transaction is subject to registration with a primary accounting document (Clause 1 of Article 10 of the Law of the Republic of Belarus dated July 12, 2013 No. 57-Z “On Accounting and Reporting”; hereinafter referred to as Law No. 57-Z).

Primary accounting documents, unless otherwise established by the President of the Republic of Belarus, must contain the information listed in paragraph 2 of Article 10 of Law No. 57-Z.

The transferred spare parts until the completion of the organization's repair work continue to be included in the organization's reserves in subaccount 10-7.

The basis for writing off spare parts transferred for repair as costs, as well as the cost of repair services, will be a work order (another primary accounting document) for car repairs issued by a repair organization.

To summarize information about the costs associated with managing an organization, account 26 “General business expenses” is intended. This account reflects accrued depreciation and repair costs of fixed assets for management and general business purposes.

, costs of maintaining management personnel, costs of information, audit and other services, other costs similar in purpose (part one of clause 28 of Instruction No. 50).

Administrative expenses related to the management of the organization and accounted for on account 26 are included in the expenses for the current activities of the organization (clauses of the Instructions for accounting of income and expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated September 30, 2011 No. 102).

Transactions on the acquisition, transfer and write-off of spare parts in the accounting accounts are reflected by the following entries:

| Contents of operation | Primary accounting document, basis | Debit | Credit | Rationale for entry |

| Accepted for accounting of purchased spare parts (excluding VAT) | Supplier's invoice TTN-1, TN-2 (clause 1 of Instruction No. 58) | 10-5 | Parts seven, seventeen, clause 16, part three, clause 47 of Instruction No. 50 | |

| VAT presented by the spare parts supplier is reflected | Supplier's invoice TTN-1, TN-2 (paragraph 3 of part twelfth clause 3 of Instruction No. 58), ESChF (clause 31 of Article 105 of the Tax Code) | 60 | Part two, paragraph 21 of Instruction No. 50 | |

| The transfer of spare parts to a repair organization is reflected | Consignment note TTN-1, TN-2 (clause 1 of Instruction No. 58) | 10-7 | 10-5 | Part ten, paragraph 16 of Instruction No. 50 |

| The cost of car repairs performed by a repair organization is reflected, excluding VAT. | Work order (another primary accounting document issued by a repair organization) (Clause 1, Article 10 of Law No. 57-Z) | 60 | Part two, paragraph 28 of Instruction No. 50 | |

| VAT claimed by the repair organization is reflected | Work order (another primary accounting document issued by a repair organization), ESChF (clause 31, Article 105 of the Tax Code) | 18 | 60 | Part two, paragraph 21 of Instruction No. 50 |

| Own spare parts used in repairs were written off | Work order (another primary accounting document issued by a repair organization, indicating the customer’s spare parts used during repairs) (Clause 1 of Article 10 of Law No. 57-Z) | 26 | 10-7 | Part eighteen clause 16, part two clause 28 of Instruction No. 50 |

| Payment for repair services reflected | Payment instruction (clause 3 of the Instruction on bank transfer, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 29, 2001 No. 66). From the editors of "Business-Info" From July 4, 2020, clause 3 of Instruction No. 66 on the basis of Resolution of the Board of the National Bank of the Republic of Belarus dated 02.21.2017 No. 73 is set out in a new edition | 60 | Part two, paragraph 40 of Instruction No. 50 |

15.11.2016

Anna Andreeva, economist

Write-off of spare parts what documents are needed in the budget

Free consultation by phone: +7 (499) 495-49-41 Contents Analytical accounting of the account is maintained in the Quantitative and Total Accounting Card (f.

0504041) in quantitative terms, indicating the position and surname of the recipient, date of receipt, serial number.

The decision of the developers of the “1C: Accounting for Budgetary Institutions” program to keep analytical records for account 09 “Spare parts for vehicles issued to replace worn-out ones” in the context of the range of spare parts (sub-account “Nomenclature”), centers of liability, in the author’s opinion, is optimal , since with such an organization of accounting for each spare part it is always known which car it was written off for. This allows you to track the write-off of spare parts and establishes control over their consumption.

For example, in the tabular part of the document “Write-off of MH” spare parts and the corresponding vehicles on which they should be installed are indicated. Important Instruction No. 148n was amended, according to which, including in the off-balance sheet account 09 “Spare parts for vehicles funds issued to replace worn-out ones”, additions were made to the account description.

This account records the material assets issued to vehicles to replace worn-out ones (engines, batteries, tires, etc.) to control their use.

Replacement of car body parts

What body parts do we replace?

The service is equipped with equipment for replacing any body parts. The craftsmen working for us have the appropriate qualifications to perform work in the following areas:

- Replacement of the power elements of the supporting body or frame - spars, cross beams, floor and roof reinforcements, racks. Please note that independent replacement leads to unreasonable strengthening or weakening of the body, which causes a redistribution of loads. As a result, the overall service life of the vehicle is reduced and the safety of the driver and passengers is significantly reduced. Work in this category should only be performed by a specialist with appropriate experience and qualifications.

- Replacement of removable body elements - doors, trunk lid and hood. When installing new components, we pay special attention to precise adjustment of the gaps, ensuring the safety of the paintwork and the correct operation of the locks.

- Replacement of tail elements and body kits - bumpers, wings, spoilers, parts that improve the aerodynamics of the car.

- Replacement of additional components - mounted roof racks, tow hitches with selection of elements with the required load-bearing capacity.

- Replacement of the main sheet body parts - roof, interior floor and trunk with additional reinforcement and anti-corrosion treatment.

- Replacement of interior elements - headliner and pillars, front panel, door cards, seats.

- Replacement of body panels - sidewalls, front and rear of the car, quarter body.

We work with removable and non-removable parts, taking into account the peculiarities of fastening elements made of various materials. We change body elements:

- Plastic - these are mainly parts of aerodynamic body kits and bumpers, wings. The material has a certain elasticity, so when working, reliable fixation is required using various types of detachable fasteners - bolts, clips, self-tapping screws.

- Aluminum - the material is increasingly used in cars in the expensive price segment. The main advantage is resistance to corrosion, but parts made of this metal are difficult to restore in shape. Therefore, replacement is one of the main ways to restore aluminum bodies. Particularly difficult is the connection with plastic and steel body elements, for which we use special welding technologies, including gas-shielded welding, gluing and riveted fasteners.

- Steel is the most common type of body parts. Working with thin sheet steel requires the use of resistance spot welding, which allows for a reliable connection without local overheating of the metal, causing deformation.

We have developed the technology for replacing any body parts from small items to large-scale panels. Contact us, we will help in any case.

What components do we work with?

We provide a full range of auto services, starting from the search and purchase of components, including body parts. We will help you purchase parts in various price categories. We work with suppliers of the following classes of components:

- Original parts corresponding to the factory (original) ones in shape, metal thickness, protective coatings, mounting holes. We recommend this choice when repairing expensive foreign cars and restoring the bodies of new cars. When installing original body components, it is almost impossible to establish the fact of replacement.

- Contract elements are original, dismantled from used machines. The quality of the part is confirmed by the supplier company with relevant documents. By purchasing a body part of this class, you receive a guarantee that it is not broken or painted, and corresponds to all the characteristics of the factory product. In this area we mainly work with foreign companies, so the option is suitable for the entire range of foreign cars.

- Analogues are cheaper components produced by third-party companies, and not by the automaker. The main suppliers are China, Taiwan, other Asian countries and Russian private companies. The quality may be inferior to the original; sometimes there are problems with matching the shape, the configuration of the stampings, and the location of the fasteners. We recommend only trusted suppliers and manufacturers with whom we already have experience of cooperation. When purchasing on your own, there is a high chance of acquiring items of poor quality or simply not suitable for your car.

- Body parts from domestic salvage yards are the most cost-effective option, allowing you to significantly save on components. You can find any parts for most popular cars of Russian and foreign assembly. In most cases, additional preparation or partial repair of parts in this category is required, but it is quite possible to choose an option that is not inferior in quality to contract components. In addition to the low cost, we also note the minimum waiting time for delivery, which is especially important if it is necessary to urgently restore the machine.

In addition, when replacing, we also use custom-made parts that differ from factory items. Most often this concerns the installation of aerodynamic body kits, bumpers, wings, carried out with the aim of changing the appearance of the car during styling and tuning.

By purchasing body parts yourself, you run the risk of buying elements that are not suitable for your car due to some characteristics. This will lead to the need for additional adjustment and alteration, and in some cases replacement will be impossible in principle. By entrusting the search and purchase to us, you relieve yourself of all such risks. We will find exactly what is required in each individual case, and we will do it much faster. We would like to separately note that we sell all components at the purchase price without additional markups, that is, you also do not lose on price.

Based on what we decide on the need for replacement

The main indication for replacement is the technical impossibility of restoring the integrity of the part or its shape, as well as the high cost of repair work, exceeding the price of new components. We make a decision on the need for replacement only on the basis of detailed diagnostics and drawing up a defect report.

If both repair and replacement are possible, we will offer you all available options with justification of the estimated cost of the work. The decision in this case is up to you, but we recommend listening to the advice of a specialist, because his experience will allow you to choose the optimal solution not only in terms of cost, but also technical characteristics.

Thanks to this we will reduce the replacement period

The average replacement time for body parts depends on the scale of the reinforcement work, the need for related repairs and the time it takes to purchase components. But, even with complex large-scale body repairs, the time required to complete the work does not exceed one week from the moment the car is put into the box.

We were able to reduce the average time a vehicle spent in service due to the following factors:

- We work with trusted components suppliers. For most of the most common brands and models of cars in the capital, body parts are almost always in stock, so the waiting period for purchases will be minimal.

- If necessary, we attract a number of specialists that allows us to carry out work in several directions simultaneously - disassembly, preparation of the donor and body for installation. This approach provides the greatest time savings when replacing a set of parts, for example, wings, lockers.

- Work in each area is carried out only by a specialist with the appropriate qualifications - a mechanic, a welder, a painter, an auto electrician who connects and disconnects electrical equipment.

The service is equipped with professional equipment necessary to perform various types of work:

- Welding machines of various types, including spot welding, laser welding, shielded gas welding, equipment for working with plastic and aluminum.

- Tools and devices for drilling weld points, rivets, pullers necessary for dismantling various equipment during disassembly.

- Professional painting booth with a set of pneumatic and electrical equipment for priming, painting, applying protective anti-gravel and anti-corrosion coatings.

- Stacking stands with a computerized system for checking body geometry at factory control points.

Thanks to this, we replace the main part of the body elements within one day, subject to all technological requirements.

What is the work pattern?

To ensure quality control and compliance with the technology for replacing body elements made of various materials, to guarantee the protection of installed parts from corrosion, and to reduce the cost of repairs, we practice the following scheme of work:

- We carry out comprehensive diagnostics with the preparation of troubleshooting, which includes the entire list of detected damages and a list of elements that will need to be replaced. We can pre-order components based on an analysis of the appearance or an assessment of damage from a photograph.

- Once we receive all the components needed for replacement, we will agree on a repair time that is convenient for you.

- We carry out reinforcement work, carry out related repairs, restoring damaged body parts, remove rust, and carry out anti-corrosion treatment.

- At the same time, we are preparing the purchased elements for installation. The largest volume of such work occurs on parts purchased from disassembly sites. In this case, it is often necessary to restore the plane by straightening, leveling with polyester putties, and priming.

- Installation of new body elements, adjusting the shape if necessary, checking standard gaps with other parts, welding or fastening by other detachable and permanent methods.

- Cleaning and sealing welds, preparing the car for paintwork, painting, varnishing and polishing surfaces.

- Reassembly, checking the functionality of components and assemblies that were removed before replacement.

As a result, you will receive a serviceable car with a body restored and painted in the required color.

Key technological points when replacing body parts

The main task during replacement is not only the need to restore the appearance of the machine, but also to implement measures for anti-corrosion protection and ensure the safety of the structure. Let us note only the main nuances that we pay special attention to:

- Unauthorized changes in welding technology when installing non-removable elements are not allowed. If the technology requires spot welding, technology with continuous seams cannot be used, this will lead to a redistribution of loads that can shorten the service life of the body and reduce the safety of the structure.

- Replacement of the main power elements is allowed only if the manufacturer's recommendations are followed. For example, it is not allowed to dismantle parts of the side members with cutting in arbitrary zones or with unreasonable reinforcement. A change in the strength characteristics of a part leads to a deterioration in the ability to absorb loads arising during accidents. Replacement is possible only completely or in segments recommended by the manufacturers.

- Installation of new elements with fastening to body elements damaged by rust is not allowed. If necessary, we carry out related repairs including replacing metal and removing areas with pockets of corrosion.

- When performing welding work, the metal must be protected using special conductive primers. Such compounds prevent corrosion without disrupting the conditions necessary for the formation of a strong weld seam or points.

- When installing components that arrived with coatings made from transport primer, complete stripping to metal and repriming using epoxy-based compounds is required. It is impossible to paint on transport primer, such paintwork will be short-lived.

- Additional protection of overhead welds using polyurethane-based sealants is required. Poor-quality processing leads to the appearance of rust; these areas are considered the most dangerous; corrosion in such areas appears first.

- When installing new parts, it is necessary to control the geometry and size of the gaps between body elements. If necessary, the body is stretched on a slipway before welding.

- It is possible to paint only the installed parts with an exact color selection. But in most cases, painting is used with a transition to adjacent body elements, which allows you to visually smooth out the difference.

We guarantee quality control and compliance with technological requirements at all stages of replacing body parts, regardless of the volume and complexity of the work.

Why you will benefit from using our services

We practice an integrated approach to solving problems of replacing any body elements, that is, we will take on all stages from sourcing components to painting. At the same time, we offer quality comparable to work performed in branded dealership centers, but on more favorable terms.

By contacting us, you receive:

- Possibility to choose body parts in different price categories.

- Compliance with all technological requirements and recommendations of the car manufacturer.

- The minimum possible time for a machine to be in service and a reduction in the waiting time for the delivery of components.

- Official guarantee for all work performed.

- Clear replacement cost in accordance with the current price list without imposing additional services.

You yourself determine the amount of work acceptable to you based on the possible cost, and we will introduce you to all possible options for solving the problems of restoring the car body.

To use our service for replacing any body parts, just call us or leave a request on the website. We will coordinate a convenient time for you to visit the service, taking into account the workload of our specialists. We can replace single simple parts without waiting in line.