Estimate

| Reviews: | 0 | Views: | 578 |

| Votes: | 0 | Updated: | n/a |

File type Text document

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

Form of the enterprise To the Department of Labor and Employment ______________________________ NOTICE I hereby notify that in connection with the decision of the general meeting _________________________ Minutes No. ______ dated “__”________ 20__ (shareholders/participants) on the liquidation of _______________________ joint-stock company (company (open/closed) limited liability _____________________________________ (name) starting from “__" ____________ 20__ ______________ (number) of our employees will be released enterprise. The list of redundant employees is given in the Appendix. Appendix: - minutes of the general meeting of shareholders (participants) No. _____ dated "__"___________ 20__, at which the decision to liquidate the enterprise was made; - information about the redundant employees. Chairman of the liquidation commission of the liquidated enterprise ________________________________ (full name, signature) M.P.

Download the document “Sample. Notification of the liquidation of the enterprise to the Department of Labor and Employment"

What is liquidation and who carries it out?

Proper documentation of dismissal

In case of liquidation of the organization, in accordance with clause 1, part 1, art. 81 of the Labor Code of the Russian Federation, the head of an enterprise has every right, without exception, to dismiss absolutely all employees, which include: pregnant women, employees who are on vacation or on sick leave, employees with children under 3 years of age, etc.

The procedure for dismissed employees, as a rule, begins with the fact that they are given a notice, necessarily in writing, against receipt, informing them of their upcoming dismissal. According to Part 2 of Art. 180 of the Labor Code of the Russian Federation, such notification must be issued at least 2 months before the date of dismissal.

This requirement applies equally to employees working at the enterprise in their main job, and to employees who work part-time at this enterprise. Below we provide a sample of such a notice.

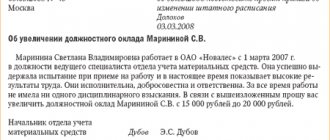

An example of a notice of future dismissal during liquidation of an enterprise

Limited Liability Company "Northern Lights"

Department of Information Technology and Advertising

about the upcoming dismissal due to the liquidation of the organization

Dear Dmitry Evgenievich!

We would like to inform you that, in accordance with the decision of the founders of Delta LLC dated September 1, 2012 No. 315, the enterprise will be liquidated. In this regard, the employment contract concluded between the administration and you is subject to early termination.

On November 30, 2012, at the end of the two-month period from the date of receipt of this notice, you, in accordance with paragraph 1 of part 1 of Article 81 of the Labor Code of the Russian Federation, will be dismissed with payment of severance pay.

General Director: Petrov A.P.

The notice has been reviewed by: Sidorov D.E.

September 14, 2012

After this, the employer keeps one copy of the document, on which the manager and employee have signed, and on which the current date is set, and gives the second to the employee. At the same time, if disagreements arise and the employee does not want to sign the notification, then based on his reluctance, an act is drawn up in which his refusal is recorded. This point must be certified by a representative of management and any other employee of the enterprise. Below is an example of an act.

An example of an act drawn up when an employee refuses to sign a notice

p align=»center»>about the employee’s refusal to sign a notice upon receipt of it in his hands about the upcoming dismissal due to the liquidation of the enterprise

September 14, 2012

I, head of the HR department V.A. Ivanova, prepared this act stating that in connection with the liquidation of Northern Lights LLC, employee A.A. Teapot, who currently holds the position of system administrator, was personally warned in writing about his upcoming dismissal on September 14, 2012.

He categorically refused to sign this notice and receive it in his hands.

This fact is confirmed by witnesses:

— Assistant HR Inspector L.L. Susanin

- accountant A.A. Monetary

- Head of HR Department R.O. Ivanova

After two months, an order of dismissal during liquidation is issued. After the employees familiarize themselves with the order and sign it, a corresponding entry is made in the labor book (work books) about dismissal due to liquidation and the employment contract is terminated on the basis of clause 1 of part 1 of Article 81 of the Labor Code.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Procedure

If a decision is made that the employing company is leaving the market, then its management begins to fire employees.

How to fire employees:

- The first step of the procedure: notification of the employment center and trade union.

- The second step of the procedure: all personnel must be notified (prepare written notices and plus dismissal orders).

- The final chord: settlement with employees and issuing completed work books to them.

Let us consider the details of this procedure separately.

Social Security Notice

Territorial employment authorities

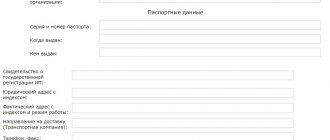

It must be prepared in writing and only if the company employed at least 15 people. The notification informs you that a decision has been made to liquidate the company and an order to dismiss employees has been approved (a list of all dismissed employees is attached). The document indicates not only the personal data of dismissed workers, but also their positions, as well as the amount of salary.

All this information is necessary so that the employment service can find new vacancies for them. The notice of dismissal is prepared by the employer's human resources department. If there is a mass dismissal of employees, the employment service is notified twice. The company is also required to submit Information about the dismissed employees, which indicates the salary and skill level of each.

The easiest way is to send the notification by registered or certified mail so that the shipping receipt is retained.

Trade union

The organization is notified of dismissal only if it exists (that is, only in large enterprises). The notification is sent by letter to avoid liability and payment of administrative fines. The purpose of the trade union organization is to protect the rights of dismissed employees.

The notice is given so that the union can act as a party to the case or as a witness in the event of class action or other legal actions against the organization. He may also take the initiative to reschedule or even cancel the dismissal procedure. Trade union notification period: no later than three months.

Notifying staff of upcoming closure

The obligation to notify personnel of dismissal is provided for by labor legislation. Notification shall also be made exclusively in writing. It is sent to both main employees and part-time employees.

The notice states:

Date of preparation;

- Document Number;

- name of the enterprise;

- Full name of the employee;

- reason for dismissal;

- date of termination of the contract.

The notification is prepared in two copies.

- The “header” contains the company name and details.

- In the middle is the title (notice of dismissal due to liquidation of the company).

- It further states that the employer notifies the employee that his employment contract is terminated on a certain date due to the liquidation of the enterprise.

One of the notification forms is given to the employee, the second remains with the company. For those who are on vacation or sick leave, a notification is sent by registered mail. The employee is required to sign the notice, so it is best to give it to him personally. At the end of the form there should be the phrase: “I have read the notification” and “I have received a copy of the notification.”

Responsibilities of the head of the enterprise before dismissal of employees

For employees who will be dismissed upon liquidation of the enterprise, employers are obliged to:

- pay wages for the days actually worked before the date of dismissal;

- pay compensation for unused vacation;

- issue severance pay;

- make an entry in the work book about dismissal due to liquidation.

This is important to know: Requirement for payment upon dismissal: sample 2020

Payments to retiring employees must be received on their last day of work. If the employee was absent from the workplace on this day for any reason, then the money is paid to him the next day after he applies for it, in accordance with part 1 of Article 140 of the Labor Code.

For unused vacation, the employee must be paid compensation. Compensation is paid both for unused annual basic leave and for additional leave, if it is provided for by labor legislation. In the event that an employee has not used his vacation for several years, compensation is paid to him for the entire period in accordance with Part 1 of Article 127 of the Labor Code. If an employee has worked for an organization for less than six months, compensation is paid to him in accordance with the general procedure.

To facilitate the calculation and accounting of wages due upon dismissal of an employee in connection with the liquidation of an organization or enterprise, a note is used - calculation for terminating an employment contract with a dismissed person in accordance with Form No. T-61, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Dismissal of an employee during the liquidation of an LLC (closing an individual entrepreneur)

Employees dismissed for other legal reasons (Article 80 of the Labor Code of the Russian Federation) are not paid severance pay and the average salary for the period of employment is not maintained.

And only if the position is replaced with a new one, the number of employees does not actually decrease. Notifying the employment service about a reduction in numbers or staff is a difficult moment when dismissing employees, because the preparation and transmission of the document involves bureaucratic formalities. You need to carefully fill out the documents and carry out the procedure.

Termination of an employment contract at the initiative of the employer in the event of a reduction in the number or staff of the organization's employees is carried out with the prior consent of the relevant trade union body in the manner prescribed by Art. 373 Labor Code of the Russian Federation.

Is it necessary to notify the employment center that this LLC is in the process of liquidation? Or is it necessary in advance, before the start of liquidation?

Who needs to be notified?

The following should be reported about the upcoming closure of a legal entity:

- tax authority;

- employees of the enterprise;

- creditors;

- Employment Center.

For any company, notification to the registration authority, creditors and personnel is mandatory. You should notify the central employment center about the upcoming closure only if you plan to dismiss 15 or more employees (subparagraph “a” of paragraph 1 of the “Regulations on the organization of work to promote employment in conditions of mass layoffs”, approved by Decree of the Government of the Russian Federation of 02/05/1993 No. 99).

Is it necessary to notify the Social Insurance Fund about the liquidation of an LLC, as well as the Pension Fund and the Compulsory Medical Insurance Fund? Such an obligation existed previously, but in 2020, the tax inspectorate, having received information about the upcoming closure of a legal entity, reports this to the funds independently.

We warn employees

The company's personnel, regardless of its number, should be notified of the upcoming closure no later than 2 months in advance (Part 2 of Article 180 of the Labor Code of the Russian Federation). There is no official sample for notifying employees about the liquidation of an organization, so employees can be notified of dismissal in any form. We suggest using the following sample notification to employees about the liquidation of an enterprise:

Notice Rules

Notification of all listed participants in the process must be done at the appropriate time and in the prescribed manner.

Tax

This stage is the most important, and it should be completed no later than 3 days from the moment of signing the minutes of the founding meeting. For this, form P15001 is used. Such a statement will become the basis for making an entry in the Unified State Register of Legal Entities and issuing a corresponding extract to the owners. The company is liable in the form of penalties in the amount of 5,000 rubles for untimely compliance with this requirement.

Employees

Notification of employees must be carried out at least two months before the closure of the enterprise. Responsibility for failure to comply with the requirement includes penalties in the amount of 1,000 - 5,000 rubles for the manager and up to 30,000 rubles for the enterprise.

TsZN

It is necessary to notify 2 months in advance in any form, and the employees in the document should be listed by name, indicating basic information regarding position, education and experience.

Creditors

To notify creditors, you can use a free form of document, but it is important to give them the opportunity to make demands, for which creditors have 2 months.

We notify creditors

There is no mandatory form for written notification of creditors (Part 1 of Article 63 of the Civil Code of the Russian Federation), but it is obvious that this should be done as soon as possible - creditors have two months to submit claims from the date of publication of the announcement of the beginning of liquidation in the State Registration Bulletin "(Clause 1, Article 61 of the Civil Code of the Russian Federation). Please note that if an enterprise has arrears in insurance premiums, it is necessary to notify the FSS about the liquidation of the LLC as a creditor, and similarly - the Pension Fund and the tax office.

We suggest using the following sample:

The list of letters sent will need to be submitted to the tax authority to complete the liquidation procedure of the company.

Failure to personally notify creditors may result in the tax authority refusing to register the closure of the company, as well as claims by creditors.

Dismissal procedure

When an organization is liquidated, current legislation obliges employers to dismiss all employees, since a company that has ceased to exist cannot maintain a staff of employees. The dismissal procedure must be carried out in accordance with the standards provided for by the Labor Code of Russia. If they are violated, the employee will be able to defend his rights in court, which will lead to the application of sanctions against the employer. To prevent negative consequences, it is recommended to adhere to the following algorithm of actions:

- The manager must notify the employment center of his decision to close the enterprise and dismiss all employees. This must be done 2 months in advance for a regular layoff and 3 months in advance for a mass layoff by sending a notice drawn up in any form, indicating the full names of all employees, their positions, skill level and monthly wages;

- All employees of the organization are notified of dismissal within the same time frame. They are sent notifications in which they are required to indicate the reason for termination of the employment contract, as well as the exact date of termination of cooperation. The document must be drawn up in two copies - a copy with the employee’s signature remains with the director.

- after two (three) months, the director of the organization must order the issuance of a dismissal order;

- All necessary documents are prepared, including filling out a calculation note and making entries in the work book and personal cards of employees.

This is important to know: Additional compensation upon dismissal due to reduction

On the last working day, all employees are fully paid. They are given the required funds, as well as documents, including employment and a 2-NDFL certificate.

Notice to trade unions, authorities

The message must be sent not only to subordinates, but also to the authorities that are empowered to control this direction. The employment service is informed at least two months before the event. In this case, the document must contain:

- positions;

- professions;

- specialties;

- qualification requirements;

- wage conditions for everyone.

The legislation does not have clear requirements related to the sending of papers to trade union organizations. Three months before the event, a message is sent if the dismissal falls under the concept of “mass”.

There is no need to report the incident again if the tax office refused to register the notices. So the liquidation decision itself is enough for dismissals.

Sample order

Until 2014, the labor legislation of the Russian Federation obligated employers to use the unified form T-8 or T-8a when drawing up dismissal orders. At the moment, this requirement has lost its relevance, which allows the organization to develop its own order form or use the old form. Despite the lack of a uniform template, the document must necessarily contain the following information:

- about the exact name of the organization, which must be presented without abbreviations;

- about the OKPO code of the enterprise;

- about the exact name of the document - “Order ...”;

- about the date and number assigned to the order;

- about the date of conclusion and number of the employment contract that is subject to termination;

- about the exact date of dismissal;

- about the employee’s full name, personnel number assigned upon employment, structural unit and position held;

- on the basis for termination of cooperation - is indicated in accordance with the Labor Code of the Russian Federation, and a reference is also made to the relevant article, for example, termination of an employment contract at the initiative of the employer, clause 1 of Art. 81 Labor Code of Russia;

- on the basis for dismissal - the data of the regulatory document on the basis of which the employment contract is terminated is indicated.

At the end of the document, the position of the head of the organization must be indicated, as well as his signature with a transcript, without which the document has no legal force.

After drawing up the order, it must be given to the employee for review and signature. If an employee refuses to sign a document or is unable to familiarize himself with the order, the head of the organization is obliged to draw up an appropriate act, which must be attached to the document.

Liquidation: what is it, who is responsible for carrying it out?

During the liquidation of an enterprise, all activities cease. Managers are deprived of the rights and responsibilities associated with their work. After completing this procedure, even creditors do not have the right to make any additional demands. Therefore, all calculations must be completed before the liquidation comes to an end. This also applies to employees who have been laid off.

This procedure is carried out by a special commission. Its composition is appointed by legal entities or bodies that made decisions on the liquidation itself. The initial responsibility of the commission is to draw up a liquidation plan. The document must consist of several items:

- Order of dismissal.

- Reconciliation with counterparties and tax authorities.

- Inventory of property.

- Calculation of preliminary balance.

Nuances

In the event of liquidation of an organization, the manager is obliged to dismiss all employees. Termination of employment contracts is also carried out with protected categories of citizens, for example, pregnant workers, single mothers or maternity leavers. In addition, on the basis of clause 1 of Art. 81 of the Labor Code of Russia, cooperation can be terminated with citizens who, at the time of dismissal, were on vacation or on sick leave due to temporary disability.

It is worth considering that current legislation allows employees to terminate their employment contract early. To do this, you need to submit a corresponding application to the head of the organization. If approved, the person is dismissed before two (three) months. In such a situation, he is paid the monetary compensation required by law, as well as wages for the period that he could have worked if not for the early dismissal.

At the legislative level, there is no unified sample of a dismissal order due to the closure of an enterprise. In such a situation, the manager can use a form specially developed in the organization or the previously developed T-8 form, which was mandatory for use until 2014. The order must fully comply with all standards for this type of document. If there are errors, omissions or inaccuracies, it is considered invalid.

What payments are due?

Upon dismissal the following is paid:

- wage arrears;

- compensation for unused vacation (if applicable);

- severance pay in the amount of one month's salary.

If dismissal occurs early, then additional compensation is paid in the amount of salary accrued in proportion to the remaining time until the end of work.

In addition, the following may be paid:

- all bonuses accrued for this period;

- paid sick leave;

- commissions, monetary incentives (bonuses, etc.).

If an employee does not find a job within two months after leaving, he has the right to claim two more salaries. When registering with the employment service, it is possible to receive a third salary in full.

Payments are calculated on the last day of dismissal. But if the employee was absent on that day, the money must be paid no later than the next day after the claim is made. In the event that there are disagreements regarding payments, it is necessary to make a settlement on the undisputed amounts.

If payment is delayed, administrative liability arises for the employer. When resigning, it is better to immediately ask the accounting department to issue a certificate for you in form 2-NDFL and about your salary for the last year, six months. This will be useful for applying for benefits, as well as for other purposes.

Voluntary and forced liquidation of an enterprise: what is it?

Liquidation of an enterprise can be either voluntary or forced.

In the first case, such a decision is made by the owners (founders). Then the whole process looks like this:

- a decision on liquidation is made;

- a liquidation commission is created;

- if necessary, a message about liquidation is published in the media;

- an audit is carried out by tax authorities;

- draws up a liquidation balance sheet, which must be submitted to the tax office;

- approval of this balance;

- an application is submitted to the tax office to close the organization or terminate the activities of an individual entrepreneur;

- making entries in the state register of legal entities and individual entrepreneurs.

The company can be forcibly liquidated by a court decision. After the relevant decision is made, the same procedure is carried out as in the case of voluntary liquidation.

If the organization ceases its activities, then all employees are subject to dismissal.

Before serving the employee’s notice of liquidation of the enterprise

Liquidation of an organization includes several procedures. This includes the organizational component (the adoption of an appropriate decision by an authorized person or persons, the preparation of documents with the tax office), the economic component (liquidation balance sheet, etc.), and the dismissal of personnel.

Liquidation is carried out by a special body - the liquidation commission. Its members are appointed by the employer. A plan is being developed that includes items on drawing up an interim balance, inventory of funds, as well as dismissal of the company’s personnel.

Documentation of reduction during liquidation: step-by-step instructions

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

First of all, the management of the enterprise must notify its employees of the upcoming dismissal. Employees must review the notices and sign.

If for some reason the employee did not receive the notification, then in the future he has the right to go to court - such dismissal will be declared illegal. In the event that a person is absent and it is not possible to give him a notice in person, it must be sent by mail in a letter with an inventory and notification.

When the period specified in the notice expires, the organization must issue an order of dismissal. All employees must be familiar with it. Confirmation of this fact is the personal signature of the employee.

Similar to the situation with notifications, if it is impossible to familiarize a member of the work collective in person, a copy of the order must be sent to him by mail. In case of disagreement with the notification or order, it is necessary to draw up acts of refusal to sign the document.

This is important to know: When the length of service is interrupted after dismissal in 2020

On the day of dismissal, the company pays the dismissed all payments and compensations due to them by law, and makes entries in their work books. Employees are given completed employment forms and certificates of average monthly earnings.

If it is not possible to hand over the book to a person in person, it must be sent by a certified letter to his home address.

Employee notification periods

The notice period for dismissal due to liquidation of an enterprise is standard - 2 or 3 months, depending on whether the dismissal is considered mass.

If the organization has seasonal workers, then they must be notified at least 7 days before dismissal; those working on fixed-term contracts (up to 2 months) - 3 days before.

Sample notice of liquidation

notifications to employees about the liquidation of the enterprise can be found here.

Sample dismissal order

An order of dismissal due to liquidation is drawn up in form T-8:

An order for dismissal upon liquidation of an enterprise can be found here.

Notifying social security authorities

You can notify the employment service about staff reductions by following this link.

The liquidated enterprise must notify the employment center about this. It must indicate detailed details of the organization and the reason why it is being liquidated.

The content of the document requires a list of all dismissed employees, indicating their positions, professions, and qualification requirements for each position.

It is also mandatory to indicate the salary amount of each employee.

Recording in labor

When an employee is dismissed due to liquidation, the following entry must be made in his work book:

“Dismissed due to the liquidation of the organization, paragraph 2 of part one of Article 81 of the Labor Code of the Russian Federation.”

Proper formatting of notifications

The law does not establish strict requirements for such notifications for employees. But it is advisable to record the following information:

- The admissibility of dismissal during vacations and periods of incapacity for work.

- Listing of guarantees and compensation if the dismissal is related to the relevant grounds.

- Date of acquaintance with the document.

- A specific date or period during which the dismissal will take place.

The notification itself is drawn up in two copies - one is sent to the subordinate, the second is kept by the manager. If there is only one copy, a copy is given to the other party.

An act of refusal with familiarization is drawn up if the corresponding decision is made by subordinates. It is imperative to describe the compiler and invite at least two witnesses. You can read the contents of the document out loud, which is also recorded.

Who is entitled to payments upon liquidation?

If an organization is liquidated or an individual entrepreneur ceases its activities, then all employees must receive the following benefits and compensation:

- wages for hours actually worked in the month preceding dismissal;

- compensation for unused vacation days;

- payments for business trips, sick leave, compensation for other expenses provided by the enterprise;

- a benefit in the amount of one average monthly salary, issued on the day of dismissal;

- benefits in the same amount for the second month: paid if the employee does not find a new job within 2 months.

Some employees are not entitled to full payments. These include part-time workers who are paid only benefits (average monthly earnings). If an employee resigns before the expiration of the notice period, then all payments required by law are retained.

Procedure for terminating an employment contract before the expiration of the notice period

Employees may be dismissed before the expiration of the notice period for the upcoming dismissal (earlier than two months). The basis for dismissal in this case will depend on the reason that the employee indicates in his application.

The employer, with the written consent of the employee, may terminate the contract with him before the expiration of the working period due to liquidation.

In this case, he is obliged to pay additional compensation in the amount of the employee’s salary, accrued in proportion to the time remaining until the expected date of dismissal.

We invite you to read: Is it possible to fire an employee who is on vacation?

Step-by-step procedure for early termination of an employment contract:

- Notifying an employee of dismissal.

- Issuance of a dismissal order.

- Submission of an application by an employee for early dismissal.

- Issuance of a new order.

- Dismissal of an employee and payment on the last day.

Documentation

To resign early, an employee must write an application addressed to the director or head of the liquidation commission. He can choose any reason for dismissal, including agreement of the parties or leaving at his own request. But in order to receive benefits, it is better to leave the previous grounds for terminating the contract. In the header of the application you will need to indicate the name of the company and management information. The new date for leaving must also be indicated in the document.

Features of the procedure

The process of dismissal due to liquidation may vary depending on the category of employee.

Is it possible to fire everyone at the same time?

If we are talking about ordinary employees, then the dates of their dismissal can be any. This issue remains at the discretion of management and the liquidation commission. It is not prohibited to terminate employment contracts at the same time.

Dismissal of a manager

The last day of work of the manager is considered to be the date of the decision regarding the liquidation of the enterprise. In the future, until the complete cessation of the organization’s activities, his place is taken by the chairman of the established liquidation commission. If a director of an enterprise is appointed to this position, then his powers as a manager will still terminate on the specified date, and from the next day he will begin work as the head of the commission.

Pregnant women and women on maternity leave

These categories of employees are dismissed in accordance with the general procedure upon liquidation of the enterprise. In this situation, the law does not provide for special rights under which their job can be retained.

Pensioners, part-time workers and seasonal workers

Documentation of the dismissal of such employees is carried out in accordance with the general procedure. The only difference is the amount of severance pay:

- for part-time workers - one average monthly salary;

- for seasonal workers - average earnings for 2 weeks (14 average daily payments);

- for pensioners - two average monthly salaries.

For such workers, a different period is established during which their average monthly earnings are retained. It is 3 or 6 months, as specified in Art. 178 Labor Code of the Russian Federation. This is explained by the fact that in such areas it is more difficult to find a new job. At the same time, the employee must register with the employment center within a month, not two weeks.

Notification of Rosstat about the liquidation of an organization

The processed personal data is subject to destruction or depersonalization upon achievement of the processing goals or in the event of loss of the need to achieve these goals, unless otherwise provided by federal law.

Using the example of Article 5 of Federal Law No. 14-FZ dated 02/08/1998, it follows that a branch and representative office can be opened only by decision of the general meeting of LLC participants.

The form for notification of dismissal on this basis is not established by the legislation of the Russian Federation, therefore the employee is notified of the liquidation of the organization using a form developed by the company independently. The employee's notice of upcoming dismissal must contain the expiration date of the contract and the grounds for its termination.

Accordingly, to close them, a decision is needed to close a separate division. A sample of such a decision, documented in the minutes of the general meeting of participants, can be downloaded from the link below. It should be taken into account that the procedure for closing a separate division differs from the liquidation of an enterprise.

The form for notification of dismissal on this basis is not established by the legislation of the Russian Federation, therefore the employee is notified of the liquidation of the organization using a form developed by the company independently. The employee's notice of upcoming dismissal must contain the expiration date of the contract and the grounds for its termination.

Notification to the employment center about employees being released due to the liquidation of the organization (filling sample) / changed in September 2020