Form 2 Personal Income Tax is required for submission to the tax office. Some companies included a certificate in the documentation package, for example, an embassy for obtaining a visa, a banking organization for obtaining a mortgage. In each case, the counterparty independently determines the validity period of the personal income tax certificate in Form 2. Knowledge of these deadlines will prevent a possible refusal to accept business papers. In this review, we will consider the main nuances in each specific case when preparing and presenting a report.

How long does it take to obtain a 2nd personal income tax certificate according to the law?

If necessary, submit a 2nd personal income tax report to a third-party organization. the person submits a written application for the issuance of the form to the accounting department. Here they indicate how many copies to prepare and for what period. There is no need to indicate the location of the presentation.

According to Art. 62, the company has three working days to fill out the certificate. If these deadlines are violated, the employee has the right to file a complaint with the labor inspectorate. The management of the organization will be held administratively liable for violating the law.

Please be aware that the certificate is issued free of charge, regardless of the number of applications from the same person, and a number of forms are prepared upon request.

After receiving the declaration 2 personal income tax, physical. the person checks the presence of the signature of the authorized representative for the preparation, seal and registration.

How to prepare a certificate in form 2 personal income tax

Each bank independently develops a package of business papers for obtaining a loan or mortgage, and determines the validity period of the submitted 2 personal income tax certificates.

Declaration 2 of personal income tax is an official certificate signed by a trustee, which must contain reliable information about the employee’s earnings, applied deductions, calculated, withheld and transferred personal income tax to the treasury. Information is provided at the place of official employment or study. faces.

Based on this document, a bank’s solvency calculation is made, deductions are applied at the place of next employment, and the form is considered a reason for taxation. Therefore, to avoid mistakes and possible penalties, you should carefully check the submitted information.

How long is personal income tax certificate 2 valid for obtaining a bank loan?

Each bank independently develops a package of business papers for obtaining a loan or mortgage, and determines the validity period of the submitted 2 personal income tax certificates.

After contacting the physical person to a credit institution, a complete list of requirements for registration is issued, indicating the expiration date of each of them. For example, they will establish that the validity period of a certificate in Form 2 of personal income tax is 1 month from the date of registration.

Also, the bank considers income for the last six months or a year, in this case, they prepare a report for this period, but the validity period will still be 1 month. And if physical the person will contact the bank in a couple of months, the certificate will have to be updated.

Depending on the amount requested by the borrower, according to the bank’s requirements, the certificate contains income for a specified period:

- Loan amount 300 thousand rubles – income of the last 4 months;

- amount up to 1 million rubles - income is calculated for 8 months;

- loan over 1 million rubles - income statement for 3 years (the period is reduced at the discretion of the bank).

And the second question asked by the taxpayer is whether the bank checks the information in the report when applying for a loan. Without a doubt, every bank has a security service that monitors the legality of issuing such certificates. If false information is identified, physical a person or legal entity is subject to punishment.

This is interesting: For an external part-time employee, personal income tax deductions

What period should be indicated in the certificate?

If inaccuracies are discovered (during a tax or independent audit), the tax agent must provide an updated version of the certificate to the Federal Tax Service. And do this as soon as possible so as not to become liable for distortion of information submitted to the Federal Tax Service (Article 126.1 of the Tax Code of the Russian Federation). Corrections made before the violation is discovered by the tax authority will relieve liability.

In addition, the correct version of the certificate must be given to the employee.

Non-taxable income should not be included in the certificate. If a mistake was made when preparing the original certificate, the employer should correct this violation.

If the changes are related to the recalculation of personal income tax in the direction of increasing tax liabilities, then the amended certificate does not indicate the tax overpaid by the tax agent, but not withheld from the employee, since the Federal Tax Service of Russia does not consider such an overpayment as tax.

If the previous certificate indicated the tax withheld in excess from the employee, and it was subsequently returned to the individual, then the correct amount must be indicated in the new certificate. After discovering an error in the form of excessively withheld personal income tax, the refund must be made within 3 months.

For information on how refunds are made, read the article “How to return excessively withheld personal income tax to an employee.”

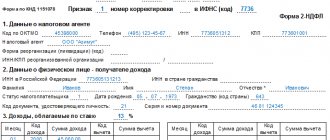

A certificate of income of an individual in form 2-NDFL must comply with the requirements of the Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected]

It must indicate the following:

- the period for which the certificate was provided;

- employer details (name, tax identification number, checkpoint, address and telephone number);

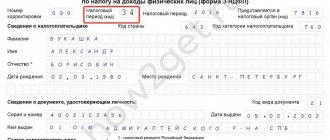

- information about the employee (full name, date of birth, citizenship, passport details);

- tax rate (personal income tax);

- information on income and deductions (by month);

- data on income, deductions and tax amount for the entire period.

The chief accountant and the head of the organization in which you work must sign the certificate.

Important for the bank:

- information about the employer;

- amount of income (total and by month);

- amount of deductions (for example, alimony);

- the total amount of all tax withholdings and deductions.

No regulatory act specifies what period should be indicated in the personal income tax certificate. Everything will depend on the purpose of its registration and the requirements of the recipient. A standard personal income tax certificate, which, for example, is provided upon dismissal, is issued for the previous two years.

If a document is requested to apply for a mortgage loan, you need to focus on the requirements of the lender. As a rule, this is one year.

Bank requirements

There is no uniform standard for banks that request a certificate of income. They have the right to request a document for the last six months and for the last six years. Therefore, such nuances must be clarified in advance with the lender.

Most banks require proof of income for one year prior to applying for a loan. Less often they ask for two years.

How long is personal income tax certificate 2 valid for submission to the tax office?

Since the Federal Tax Service is a government agency, where work is regulated by municipal acts and norms. Therefore, there are strict validity periods for each certificate, including the 2nd personal income tax declaration. This norm is defined by Art. 230 tax legislation.

Each business entity is required to submit declarations for employees no later than April 1 of the year following the reporting period. The declarations reflect information for the calendar year, and the form itself is filled out separately for each employee. It follows that the deadline for submitting 2 personal income taxes to the tax authority after signing is no later than April 1.

In 2020, reports are submitted starting from 2020; certificates for 2014 are no longer valid. But during this period, the information from the certificate is valid, in addition, it is not limited in time; if you fill out the declaration on time, you can submit it within 3 years, the main thing is not to miss this period. This norm is regulated by Articles 230, paragraph 2, and 226, paragraph 5.

Example 1

An individual contacted the Federal Tax Service with an application asking for a property deduction for 2013. According to Article 78, paragraph 7, this is not possible, since the statute of limitations for registration has expired. The individual was refused.

Deadlines for issuing certificate 2-NDFL

Certificates are provided by the head of the company in three cases.

- The form must be submitted to the tax office for each individual employee with information about the withholding of funds. This procedure must be carried out annually before April 1.

- Certificates in the absence of withheld funds in the form of attribute 2 should be submitted before March 1.

- The document is issued at the request of the employee any number of times. The manager does not have the right to refuse such treatment to his employee. In some cases, an individual makes a request for several certificates at the same time.

Requesting a tax form is not required. Some managers issue certificates at the employee’s verbal request. Without reminders, the document is prepared for an individual upon his dismissal.

If management decided to issue 2 personal income taxes only after receiving an application from an employee, it is filled out randomly.

When contacting your superiors, you must indicate:

- personal data;

- the period for which the report must be submitted (within the last three years).

Employer's refusal to issue a form

Situations when the heads of an organization refuse their employees to obtain a certificate are a rare occurrence. More often than not, the reason for this is a problem with tax accounting. To obtain a document, the employee must act in accordance with laws and regulations.

It is necessary to send a request to receive 2-NDFL to the employer by valuable letter. If, after the three-day period, the form is not issued, the employee has the right to write a complaint to the labor inspectorate, where he points out the inaction of his boss.

Unemployed people and pensioners must contact the employment center to obtain a certificate of income. If more than three years have passed since the last employment, Form 2-NDFL is not required, another document is issued.

For what period is the 2-NDFL certificate issued?

Related publications

In certain situations, government agencies, commercial banks and other structures, along with the necessary documents, ask citizens to provide a certificate in form 2-NDFL for a certain period. The certificate contains information about the individual’s income, accrued, withheld and transferred tax. For a certificate, an employee turns to his employer (individual entrepreneur or organization), and he, in turn, is obliged to prepare and issue it.

This is interesting: Line 120 in 6 personal income tax how to fill out

Tax period for personal income tax Art. 216 of the Tax Code of the Russian Federation recognizes the calendar year. It is for a full year that certificates are submitted to the tax office, and for what periods can an employer issue a 2-NDFL certificate at the request of an employee?

Where is it usually provided?

In most cases, a certificate in form 2-NDFL is requested by banks and other credit organizations. The data reflected in the document allows you to make a positive or negative decision on the issue of granting a loan.

For large amounts of lending, in particular mortgages, the provision of a tax certificate of income is a fundamental and mandatory condition for concluding a loan agreement.

In addition to credit institutions, a unified form of certificate can be requested by:

- Federal Tax Service for calculating tax deductions.

- Pension Fund when assigning and calculating pensions.

- Guardianship authorities for the adoption of children.

- Social protection authorities for processing benefits for low-income citizens.

- Judicial authorities to approve the legality and calculation of alimony amounts.

- TsN for assigning and establishing the amount of unemployment benefits.

- Embassy when applying for a visa.

In addition, the need for a 2-NDFL certificate arises when:

- 3-NDFL reporting is filled out;

- a former employee gets a new job.

For what period is a 2-NDFL certificate required?

Certificate 2-NDFL is issued upon application of the employee in accordance with clause 3 of Art. 230 of the Tax Code of the Russian Federation, but the Tax Code does not specify for what period it should be issued - only for a year or for any time period. By letter dated February 24, 2011 No. 20-14/3/16873, the Moscow Federal Tax Service explained that the refusal to issue a 2-NDFL certificate was unlawful. This means that an individual can apply for a certificate of income for any required period, and the employer is obliged to issue such a certificate.

© photobank Lori

You can contact your employer with an application for a certificate either orally or in writing, if such a procedure is established at the enterprise. At the same time, it is necessary to indicate for which year, quarter, or for how many months the 2-NDFL certificate should be drawn up. According to the norms of the Labor Code of the Russian Federation (Article 62; 84.1), the employer must issue a certificate within three days, and in case of dismissal - on the last day of work. Violation of these deadlines may result in a complaint from the employee to the labor inspectorate and a fine for the enterprise or individual entrepreneur.

Statement

2-NDFL is issued by a tax agent (employer or state) to an individual (employee).

In this case, the employer may not be a legal entity, but is still obliged to issue the employee the required certificate, which will have legal significance equivalent to a certificate issued by a legal entity. A detailed description of tax agents is provided in Art. 230 Tax Code of the Russian Federation. The basis for issuance is the employee’s statement. Its sample is not established, the form can be arbitrary, in some cases an oral statement is sufficient.

In writing, the employee indicates correct information about himself and the period for which the certificate is needed, in years.

2-personal income tax for the quarter

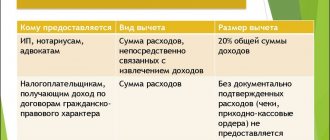

As already mentioned, an employee can request to prepare a certificate of income for any period he needs, including a quarter. Such certificates may be required, for example, by a bank to apply for a short-term loan.

Before ordering a 2-NDFL certificate from the accounting department, it is better to check with the requesting organization in what form the required quarter should be reflected in the certificate: the entire year, including the required period, or exclusively the required quarter.

Even if the current year has not yet ended, and therefore the tax period for submitting the 2-NDFL report to the tax office has not yet expired, a certificate can be issued to an employee for any quarter of the current year, this is not a violation.

In practice, employees often request certificates for a period covering part of the current and past tax periods, for example, from September 2020 to June 2020. In this case, two certificates must be issued: one for 2020, the other for the period from January to June 2020 of the year.

If there is a delay in payment of wages

Due to the fact that in accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, accrued personal income tax cannot be withheld until the employee’s salary is paid; there are particular difficulties with entering data related to accrued but not yet paid income into the 2-NDFL certificate.

According to the tax authorities, voiced in the letter of the Federal Tax Service dated October 7, 2013 No. BS-4-11 / [email protected] , if income for the previous tax period at the time of drawing up the certificate has not yet been paid, then they, as well as the withholding of taxes from them, are 2- Personal income tax should not be reflected. True, according to the letter of the law, the date of actual receipt of income in the form of wages is the last day of the month for which this income was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Help 2-NDFL: for what period is it done?

The certificate is generated by the tax agent for submission to the territorial divisions of the Federal Tax Service on the employee’s accrued income, deductions, transfers and deductions. The reporting period is a calendar year (stat. 216 of the Tax Code). An employer (legal entity or entrepreneur) acts as a tax agent and pays wages and other types of remuneration to personnel within the framework of labor relations.

Important! For military personnel, the tax agent is the state. You can obtain a 2-NDFL certificate for previous years and current ones at the Unified Center of the Ministry of Defense of the Russian Federation.

Employed citizens are familiar with situations where various organizations and government agencies are asked to provide 2-personal income tax. For example, such a document is required when approving a mortgage or other loan; in the process of obtaining a tax deduction; when applying for a Schengen visa, etc. At the employee’s request, the employer is obliged to provide him with a duly certified certificate for the required period of time. The reporting period of the Tax Code is not limited - from a month or quarter to six months or a year.

Where and when is 2-NDFL compiled:

- Every year at the Federal Tax Service at the place of registration of the company - data is generated for the previous calendar year by April 30 of the current one. Information is provided for each employee separately. If an individual was employed simultaneously in several divisions of the company, when filling out the certificate, one should be guided by the explanations of the Ministry of Finance on separate divisions (Letter No. 03-02-08/28888 dated July 23, 2013).

- An unlimited number of times at the request of an enterprise employee - data is generated for the required period of time, the number of certificates in the original is not limited by law.

Note! If an employee asks for a 2-NDFL certificate, how many months in advance is it legal to generate it? After all, sometimes the calendar year has not yet ended, but data is needed during the period. In this regard, the Tax Code of the Russian Federation does not contain restrictions and a certificate can be issued for the period of time that is relevant to the citizen.

Special cases

Military personnel receive a 2-NDFL certificate at the Unified Settlement Center of the Ministry of Defense of the Russian Federation, since in this case the employer is the state. This is possible because the military service contract is technically between the service member and the government.

If during the reporting period an employee received wages in several divisions of the same company, then the sample certificate is different; the form is filled out in accordance with the recommendations given in the letter of the Ministry of Finance of the Russian Federation No. 03-02-08/28888.

2-NDFL for 2020 - for which tax periods to issue

The current reporting form for 2020 was approved by Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated October 30. 2020. For 2020, 2020, 2020 you need to report on this document form. If it is necessary to obtain 2-personal income tax from an employee for earlier periods, it should be remembered that stat. 23 of the Tax Code of the Russian Federation, namely sub. 8, paragraph 1, obliges employers to ensure that tax documentation is stored for at least 4 years. And according to archival requirements (the List is approved by the Ministry of Culture by Order No. 558 of August 25, 2010) - 5 years. And if the specified deadlines are exceeded, the enterprise has the right to refuse the citizen to draw up a certificate. The reason is the expiration of the period of limitation for storing documents.

This is interesting: How to return personal income tax from contributions to welfare

2-personal income tax for the quarter

According to stat. 230 of the Tax Code of the Russian Federation, individuals can receive 2-NDFL from their tax agent, that is, their employer, upon a written application. Banks often ask to confirm the level of solvency and solvency of a citizen 2-NDFL for a mortgage; for what period it is better to check with the financial institution. Tax agent authorized persons do not have the right to refuse an employee to prepare a form for an incomplete reporting period, for example, 6 months (Letter of the Federal Tax Service of Russia for Moscow No. 20-14/3/16873 dated February 24, 2011).

Important! Stat. 230, namely clause 3, does not contain clear explanations regarding the period for which the 2-NDFL certificate is issued. The generation of data can be carried out both for the reporting year as a whole, and for shorter periods. Consequently, the employee can request a certificate for the period that he needs.

When an individual may need 2-NDFL:

- When filling out 3-NDFL to receive deductions.

- When applying for loans of various types.

- When changing place of employment to confirm the amount of income.

- When applying for social benefits, pensions, state assistance.

- Upon receipt of a visa.

- In other cases.

How long does it take to get a 2-NDFL certificate?

The Tax Code of the Russian Federation does not establish regulatory standards establishing deadlines for issuing a certificate. But according to the Labor Code (Article 62 and upon dismissal, Article 84.1), wage documentation is issued within 3 days from the date of written application; upon termination of an employment contract with an individual - on the day of payment and dismissal. All documentation is provided free of charge in a form certified in accordance with the official procedure.

Note! Violation of the established deadlines for settlements with personnel threatens the employer with “labor” fines under stat. 5.27 Code of Administrative Offenses of the Russian Federation.

freedom of choice

Based on Article 230 of the Tax Code of the Russian Federation, the employer, in fact being the tax agent of his subordinate, is obliged, upon his request, to issue him a 2-NDFL certificate. Which, in turn, is an official document confirming his solvency and some solvency, since it reflects data on the income received by the citizen and the tax deducted from him to the budget.

Sometimes the question remains unclear: for what period is this certificate issued? The answer is simple. It all depends on the purpose and place of presentation of this document. An employee may ask to be given a certificate confirming his income for the last six months or only for the last quarter. Or he may need all the data contained in the certificate for several years.

An employer does not have the right to refuse an employee’s request. Even if he asks for a certificate for the current year, which has not yet actually been completed for reporting to the tax authorities.