General concepts

If you plan to borrow a certain amount from your employer, you must comply with some requirements and take into account the nuances. These include:

- An interest-free loan agreement must be drawn up for an employee of the organization, on the basis of which a certain amount of funds is transferred to him;

- the borrower must repay the money within the established time frame;

- issuing such a loan is legal and therefore does not in any way contradict modern legislation;

- the agreement acquires legal force only after it is signed by both parties;

- the contract is drawn up exclusively in writing;

- Company employees who need funds to buy a home can receive a loan from the company, with the funds coming from the company's net profit after taxes.

Most often, such loans are offered to employees of the Ministry of Emergency Situations as incentives and support. Another purpose of issuing money is the ability to retain valuable employees.

An interest-free loan to an employee is represented by the issuance of a certain amount of money for various purposes without the need for the employee to pay interest for the use of borrowed funds. The features of such lending include:

- the employer can set low interest rates that do not exceed the inflation rate;

- all conditions must be agreed upon by the two participants in advance;

- Not only funds, but also property belonging to the company can be transferred for use;

- by law, the loan size cannot exceed 50 times the minimum wage;

- It is not allowed to use the received funds for commercial purposes;

- the employee can return the funds in parts or in full;

- it is allowed to repay the loan ahead of schedule;

- The recipient of the funds will have to pay taxes on the money received.

The company does not have to pay taxes on the funds returned by the employee, since the company does not have interest income.

Providing an interest-free loan to an employee is carried out through successive stages. For this, the following rules are taken into account:

- Initially, the employee draws up a special application addressed to the head of the company, where he asks to receive a certain amount;

- indicate the reasons why you need to apply for a loan at work;

- the exact amount of money that must be received from the employer is given;

- if management makes a positive decision, then the basic terms of the agreement are preliminarily agreed upon;

- then the employee prepares the necessary paperwork for processing the loan;

- a contract is formed directly, where personal information about the borrower and information about the company providing him with funds must be entered;

- the agreement is signed by the head of the company or a responsible person with appropriate authority;

- At the end the company seal of the organization is placed.

The procedure is considered quite simple, but the management of the company should be aimed at providing such loans to its employees.

Therefore, especially if the loan term is long enough, the amount of overpayment is very large.

The answer lies on the surface - the way out of this situation is an interest-free loan. But it is important to note that this can only be provided in some cases.

Accordingly, it is possible to designate such an offer as the most common interest-free loan. But it is important to consider that it has certain characteristics.

Accordingly, tax levies will not occur only if the conditions of the special provision are met. Otherwise, there is a material benefit - it is necessary to pay tax on it.

What it is

Separately, it is worth considering the question of what the term “material benefit” represents.

This benefit means that the borrower himself saves on interest - since there is no need to pay interest due to various reasons.

Accordingly, the borrower and the lender are obliged to comply with all provisions of a specific interest-free loan agreement. Today, the issue of drawing up such an agreement is determined by law.

You will need to understand all legal provisions in advance.

All controversial situations will need to be resolved in court.

It is also important to consider that material benefits do not arise only if certain basic conditions are met.

| Indicators | Description |

| If an interest-free loan is provided for the construction of a house | or purchasing an apartment or other residential real estate |

| The borrower has the right to receive a property deduction | and this fact is duly documented |

In all other cases that do not fall under the situations outlined above, you will need to pay a tax fee regarding material benefits.

This point is determined in each case strictly individually.

| Indicators | Description |

| If the borrower is a tax resident of the Russian Federation | the rate will be 35% according to clause 2 of article No. 224 of the Tax Code of the Russian Federation |

| If the borrower is not a tax resident of the Russian Federation | then the rate will be equal to 30% according to clause 3 of Article No. 224 of the Tax Code of the Russian Federation |

Accordingly, preliminary familiarization with all the terminology will allow you to avoid various kinds of difficulties and difficulties. First of all, familiarization will make it possible to prevent violation of your own rights.

It should be taken into account that all legal entities can provide a loan of this type.

| Indicators | Description |

| The citizen who is the borrower must be an adult | since, according to the Civil Code of the Russian Federation and other regulatory documents, participation in such relationships of citizens under the age of 18 is not allowed |

| Citizens must have full legal capacity | Participation in such relationships of citizens declared legally incompetent is not allowed |

At the same time, there are no requirements regarding the citizenship of a citizen entering into a corresponding type of agreement.

| Indicators | Description |

| Under threat of physical or psychological violence | — |

| In a state of intoxication of any type | drugs, alcohol, other |

Accordingly, if it is proven that the process of drawing up an interest-free or other loan agreement was signed in violation of the basic conditions, then it will be declared invalid in whole or in part.

It is best to work out this question in advance. There are many examples of such situations in judicial practice.

The situation is similar with a targeted loan for the construction of residential real estate or the acquisition of one. For example, a private house or housing.

Where to go

To avoid any tax consequences from an interest-free loan, it is worth getting advice in advance:

- From a qualified lawyer.

- At the tax office.

It is especially important to attend a legal consultation to draw up a direct loan agreement.

Since in the presence of a correctly drawn up agreement, the likelihood of various difficulties arising specifically with the return of funds is reduced to a minimum.

But you should remember some important features:

- first you must try to resolve the situation peacefully;

- It is necessary to go to court at the place of permanent residence of the defendant.

Sometimes a situation arises when you need to take out a loan from another individual. But at the same time, it is not possible to carry out such a procedure due to the lack of suitable acquaintances.

There are several special platforms on the Internet through which you can borrow funds from an individual.

But you should use the services of such sites with caution. Since there are a large number of different scammers.

https://youtu.be/uJD9r9SG4rw

Targeted loan

When specifying the purposes for obtaining a loan, the borrower may be exempt from personal income tax, but restrictions are imposed.

Such an agreement provides only for the intended use of funds, and it will be necessary to provide documents confirming compliance with the terms of the agreement.

Good to know: the borrower is exempt from personal income tax on material benefits only if he spends all borrowed funds on the construction of a new facility or the purchase of housing or its share in Russia.

Documents that need to be provided to be exempt from personal income tax:

- loan agreement;

- certificate 2-NDFL;

- documents certifying the expenditure of funds;

- when constructing buildings, purchasing land plots or apartments, provide property rights and a purchase and sale agreement;

- a letter confirming the right to a property tax deduction.

An interest-free loan was issued: accounting

An interest-free loan to an LLC employee can be provided in two ways:

- issuing cash from the organization's cash desk;

- transfer of money to a bank account.

If a company transfers salaries to specialists on cards, then usually loans are issued in non-cash form.

The organization issues an interest-free loan to an employee for specific purposes, which are specified in an application drawn up by a specialist addressed to the head of the company. Money is most often allocated for the following purposes:

- purchasing real estate or a car;

- holiday at sea or abroad;

- treatment of various diseases;

- studying at a university.

Often the contract directly states for what purposes the funds will be used. In this case, an interest-free loan is issued, which is targeted. Under such conditions, money must be used exclusively for the purposes specified in the application. If the employer receives information that the funds were spent on other needs, this may become grounds for early termination of the contract, so management will require the employee to return the funds.

If the head of the company makes a positive decision on the application, then an interest-free loan agreement is drawn up for the employee. For this purpose, a form specially developed by the company can be used. A distinctive feature of this document is the absence of interest accrual.

The following information must be included in this agreement:

- the subject of the contract, represented by the transfer of funds from the employer to the employee;

- the purpose for which the loan is issued;

- duration of the agreement;

- the rights and obligations of each party involved in the transaction;

- liability of the parties;

- grounds for terminating the contract before the end of its validity period;

- rules on the basis of which disputes arising between the borrower and the employer are resolved;

- force majeure situations that may affect the cooperation of the two parties.

Information about the borrower is required, including place of work, position held, passport details, place of residence and contact details. Information about the company is also entered, so its name, legal address, as well as other important details are indicated.

If the subject of the loan is not cash, but some property of the organization, then an act of acceptance and transfer of valuables is additionally formed. Often a payment schedule is drawn up containing information on what days the borrower must repay the funds to the company.

Particular attention is paid to the fines that the borrower will have to pay if he violates important terms of the contract for various reasons. They usually depend on the size of the loan and are calculated based on the Central Bank refinancing rate. A sample interest-free loan agreement with an employee can be viewed below.

The contract can be concluded for any period and for any amount. To complete it, the employee must contact the company management with a written application, drawn up in any form or in a form developed by the enterprise (there is no legally established form for this form). The application should indicate:

- purpose of the loan;

- the required amount;

- the period during which the employee undertakes to repay the debt;

- frequency of payments.

Having received the paper, the director examines it and makes his decision on the issuance of money or refusal. At the same time, he can independently choose the conditions for providing funds (amount and interest rate). Of course, the employer's requirements may not coincide with the employee's expectations. But no one will force him to sign an unprofitable contract.

As we noted above, the loan agreement with the employee must be in writing. Also, to confirm the transfer of money, a cash order can be drawn up (for cash withdrawals) or a receipt and payment order (for non-cash transfers).

When drawing up an agreement between an employee and an organization, you need to prepare:

- employee statement;

- employee passport;

- passport details of the guarantor (if there is one).

We draw up an agreement

In the contract, in addition to the borrower’s data and the details of the employer (lender), it is necessary to provide for the following points:

- the date on which the agreement comes into force is determined by the date of the actual transfer of money (clause 1 of Article 807 of the Civil Code of the Russian Federation);

- amount of credit. The full amount that the employer provides to the employee must be stated;

- interest rate. When setting interest, Art. 809 of the Civil Code of the Russian Federation. If the interest rate is not specified in the agreement, by default it is considered equal to the refinancing rate in effect at the time of repayment of the debt or part of it. This condition is stated in paragraph 1 of Art. 809 Civil Code of the Russian Federation;

- loan terms. The agreement must contain an explanation of when the principal amount and accrued interest will be returned. All terms must be agreed upon between the parties. If the parties have not specified the end date of the transaction, the lender may demand a refund at any time. According to Art. 810 of the Civil Code of the Russian Federation, the loan must be repaid 30 days from the date of presentation of the request for repayment;

- refund. It indicates how the employee must pay the debt: in installments every month or upon completion of the agreement. In this case, follow Art. 810 Civil Code of the Russian Federation;

- possibility of early repayment;

- consequences of violation of the contract by the borrower (when drawing up the clause, take into account Article 811 of the Civil Code of the Russian Federation).

An important point: each copy of the contract (and there should be two of them: for the employer and for the employee) is signed not only by the borrower and the lender, but also by the chief accountant of the enterprise. According to Art. 7 Federal Law “On Accounting”, any monetary or settlement transactions must be accompanied by the signature of the chief accountant. Without it, actions taken are considered invalid.

Application example

How does an employee submit an application to an employer for a loan?

The main part of the application contains the request itself, namely “I ask you to provide me with a loan in the amount of...” and you write down in numerical format the amount of money you want to ask for.

It would also be useful to indicate the purpose of the request and the period for concluding the contract (a year, one and a half, two or more).

More often in practice, partial collection of debt from an employee’s salary is used in the accounting department when forming the next monthly salary payment. At the end of the text, the date of the application is indicated at the bottom left and your signature with initials on the right. Then you need to register it with the secretary of the office. All that remains is to wait for a decision from management.

If an organization has issued an interest-free loan to an employee or the interest rate in the agreement is set to less than 2/3 of the refinancing rate, then the employee receives material benefits from saving on interest. The organization is obliged to withhold and transfer personal income tax to the budget. The tax rate for material benefits is:

- 35% - for residents;

- 30% - for non-residents.

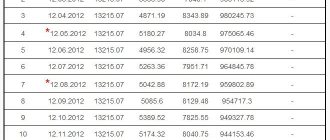

The calculation of material benefits and personal income tax on it must be made on the last day of each month for the entire duration of the lender’s use of borrowed funds. The refinancing rate is also taken into account, effective on the calculation date. From January 1, 2016, the refinancing rate is recognized as equal to the key rate. The indicator changes quite often. Changes must be monitored. So, in 2020, its meaning has already been revised twice.

Start date Refinancing rate

| 18.12.2017 | 7,75 |

| 12.02.2018 | 7,5 |

| 26.03.2018 | 7,25 |

The organization will be able to withhold personal income tax from the employee to whom the borrowed money is issued at the next payment of wages. Personal income tax must be transferred to the budget no later than the next day after the deduction.

To account for settlements with employees on borrowed money, the Chart of Accounts provides for the opening of a separate sub-account to account 73 “Settlements with personnel for other transactions”. When the accrual of interest and the issuance of a loan to an employee are reflected, entries are generated as a debit of the account. When returning funds - according to the account credit.

A loan was issued to an employee: transactions OperationDebitCredit

| Loans provided to an employee | 73-1 | 51 |

| Interest accrued for use | 73-1 | 91-1 |

| Personal income tax withheld from material benefits from interest savings | 70 | 68-1 |

| Personal income tax is transferred to the budget | 68-1 | 51 |

| Interest paid and borrowed funds returned | 51 | 73-1 |

In tax accounting, accrued interest is taken into account when calculating income tax as part of non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation).

Loan transactions are regulated by Chapter 42 of the Civil Code of the Russian Federation. The transfer of money into debt is formalized by a loan agreement in writing. By agreement of the parties, a document may be attached to the agreement that confirms the transfer of the loan (receipt, deed).

The agreement comes into force from the moment the money is transferred (clause 1 of Article 807 of the Civil Code of the Russian Federation).

The loan agreement must define the amount, procedure and terms of repayment, amount and procedure for paying interest. Particular attention should be paid to the interest rate. If your contract is free of charge, be sure to include this condition. In the absence of this information, the contract is considered to be interest-bearing by default (Article 809 of the Civil Code of the Russian Federation).

If the agreement does not establish the amount of interest, it is determined based on the refinancing rate on the day of payment of the loan or part thereof (clause 1 of Article 809 of the Civil Code of the Russian Federation).

An employee can only be given a loan in rubles (Article 9 of Federal Law No. 173-FZ of December 10, 2003 “On Currency Regulation and Currency Control”).

If the loan repayment period has not been determined, the employee is obliged to repay it at the request of the organization within 30 days (clause 1 of Article 810 of the Civil Code of the Russian Federation). The loan can be repaid ahead of schedule if this does not contradict the terms of the agreement (clause 2 of Article 810 of the Civil Code of the Russian Federation).

The employee can return the loan to the cash desk or to the organization's current account. Also, by agreement of the parties, the amount of debt can be deducted from wages. The amount of deductions cannot exceed 20% of the salary amount (Article 138 of the Labor Code of the Russian Federation).

- The decision of the meeting of LLC participants to issue an interest-free loan to the director, for example for 5 years.

- The loan agreement is signed.

- A loan is issued.

General aspects

Loan agreement is an agreement between the parties (lender and borrower) on the provision of services for the transfer of funds or property, according to generic characteristics.

The borrower undertakes to repay the debt within the agreed time frame. Can an organization issue an interest-free loan to an employee? Applying for an interest-free loan from a company is completely legal.

The agreement comes into force from the moment it is signed and the funds are transferred from hand to hand, unless otherwise agreed (Article 760 of the Civil Code of the Russian Federation). The agreement is drawn up only in writing.

Employees on the company's staff who require improved housing conditions have the right to receive a loan from the profits received by the company after deductions of all personal income taxes.

Interest-free loans are provided to employees of the Ministry of Emergency Situations by employers who want to support them or retain especially valuable specialists.

What it is

Interest-free loans are a widespread phenomenon recently. This type of loan is beneficial to the borrower because there is no interest on the use of funds.

The interest may be absent partially, that is, for a certain period, or completely, according to the agreement. An interest-free loan can be issued to an employee by his employer/founder, having agreed upon the terms of the transaction in advance.

In its own way, this is not beneficial for the founder, such a loan, but sometimes the manager makes compromises. A loan agreement can be considered interest-free if:

- It is not money that is transferred for use, but property based on family characteristics;

- the loan amount is no more than 50 times the minimum wage according to the legislation of the Russian Federation.

The loan issued is not related to the business activities of either party and does not concern commercial purposes.

Repayment of the debt in parts or in full, as well as early payment, is allowed. But the borrower will have to pay taxes.

The founder who issued a loan to an employee of the enterprise is not subject to taxes, since this type of loan does not generate income for him.

An organization can issue a loan to an employee in two ways:

- Providing to the account.

- In cash from the organization's cash desk.

Significance of the deal

A lending transaction is a manifestation of citizens’ actions aimed at establishing, changing, or terminating rights and obligations (Article 153 of the Civil Code of the Russian Federation).

Transactions can be concluded by both legal entities and individuals. Main features:

- legality;

- moral;

- manifestation of free will;

- purpose and motives of the transaction.

Divided into types:

- one-sided and two-sided;

- paid and gratuitous;

- real and consensual;

- causal and abstract.

It is difficult to say who exactly the deal is more profitable for. It all depends on the type of transaction and its composition.

But more often the benefit goes to the party that provides the services. In particular, this is well observed in lending and obtaining loans.

When a borrower, when paying off a debt, must pay interest on top of using the loan, and if the agreement is interest-free (for an employee, for example), then the employee is responsible for paying personal income tax.

The legislative framework

The interest-free loan agreement, which is concluded between the enterprise and the employee, is drawn up based on the requests of the Civil Code of the Russian Federation, namely Chapter 42 of this document.

Also, in the case of drawing up such an agreement, the Tax Code of the Russian Federation applies. The loan is considered interest-free according to the content of Art. 809 of the Civil Code of the Russian Federation.

As such, there are no restrictions or prohibitions in Russian legislation on interest-free loans from a company; it is only important that this is correctly and correctly indicated in the financial statements.

It is important that the contract is drawn up correctly, otherwise nuances may arise. First of all, it must be clearly stated that this type of loan is interest-free.

Thus, the responsibility for paying taxes is removed from the shoulders of the company/founder.

This is now the responsibility of the borrower and, if he does not make deductions for personal income tax, then the questions will concern him personally.

When purchasing a home using a loan, you will need to request a certificate from the tax service regarding the use of the tax deduction.

According to paragraph 1 of Art. 807 of the Civil Code of the Russian Federation - an organization has the right to issue a loan to its employee, both in cash and in goods.

According to Art. 812 of the Civil Code of the Russian Federation - the borrower has the right to challenge the agreement if funds or property were not properly transferred to him, not in the quantity previously agreed upon.

In this case, the contract is considered invalid. According to Art. 810 of the Civil Code of the Russian Federation - the borrower undertakes to repay the debt within the specified period and in the order specified in the agreement.

Legislative regulation

The procedure for concluding a transaction on the basis of which an interest-free loan is issued to an employee is regulated by the provisions of Chapter. 42 Civil Code. Additionally, the norms and requirements of the Tax Code are taken into account. Since the loan is interest-free, you should take into account the information available in Art. 809 Civil Code.

There are no legal restrictions on companies issuing interest-free loans. It is only important that this process is correctly recorded in the financial statements. Additionally, it is necessary to draw up the contract correctly and clearly indicate in it that the company does not receive profit in the form of interest. In this case, the company is exempt from taxation of the interest-free loan. The employee has to pay personal income tax.

If funds are used to purchase residential real estate, then a citizen can receive a property deduction from the Federal Tax Service or at the place of employment. Based on Art. 807 of the Civil Code, a company can provide employees not only with cash loans, but also with commodity loans. According to Art. 812 of the Civil Code, the agreement can be challenged by a specialist if there is evidence that he did not receive the amount of funds specified in the agreement, therefore, under such conditions, the document is invalid.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Loan Agreement (interest-free) with an employee”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Can a company write off debt?

The issuance of interest-free loans to employees is regulated by the Civil Code, namely the 1st paragraph of Chapter 42. The subject of the loan can be both money and things. In this case, an agreement must be concluded in writing between the employer and the employee (Article 808 of the Civil Code of the Russian Federation). The contract must state that the loan is interest-free.

- the agreement was concluded between citizens for an amount less than or equal to 50 minimum wages, not for business purposes;

- Things are given on loan.

In addition, the contract must specify the return period. If such a date is not specified, the borrower must be prepared to repay the debt within 30 days after receiving a request to do so. Also, at his discretion, an employee can repay an interest-free loan (hereinafter referred to as the LO) ahead of schedule.

| Description | Dt | CT | Documentation |

| Posting for issuing an interest-free loan to an employee in cash | 73.1 | 50 (51) | Expenditure cash order (payment order, bank statement) |

| Posting for repayment of cash balance by employee | 50 (51) | 73.1 | Receipt cash order (payment order, bank statement) |

The financial investment account is not used in transactions for interest-free loans issued to employees; this is indicated in the instructions for the chart of accounts for account 58. It is also necessary to pay attention to the reflection of transactions for personal income tax, which must be paid if the employer does not charge interest on the loan. Read more about personal income tax in the following sections.

| Description | Dt | CT | Documentation |

| Personal income tax withheld from income from non-payment of interest on the loan | 70 | 68 | Tax registers |

| Personal income tax is transferred to the budget | 68 | 51 | Payment order, bank statement |

MV = C × 2/3 × R / DG × D,

M is the size of the MV;

C - loan amount;

R is the refinancing rate on the date of receipt of the loan;

DG - number of days in a year;

D - number of days of the billing period.

How to determine the refinancing rate? Since this percentage changes periodically, it is necessary to determine the date of receipt of the CF. According to sub. 7 clause 1 art. 223 of the Tax Code of the Russian Federation, for a business history this date will be the last day of each month for the entire period of the business history. That is, personal income tax must be calculated every month. In this case, the number of days of the settlement period in our formula will concern only those days when the loan was valid. Thus, it can be either a full month or part of it if the loan was issued/repaid not on the first/last day of the month.

Example 1

03/09/2017 V. A. Sokolov received a salary from his employer in the amount of 120,000 rubles. Repaid the debt on 05/09/2017. The accountant calculates the MV every month.

As of 03/31/2017: 120,000 × 2/3 × 9.75% / 365 × 23 = 492 rubles.

As of 04/30/2017: 120,000 × 2/3 × 9.75% / 365 × 30 = 641 rubles.

As of 05/31/2017: 120,000 × 2/3 × 9.25% / 365 × 9 = 182 rubles.

Find more information about CF in the article “Art. 212 of the Tax Code of the Russian Federation (2017): questions and answers.”

The MV amount is the tax base for personal income tax (Article 210 of the Tax Code of the Russian Federation). The tax is calculated at a rate of 35% for residents and 30% for non-residents (clauses 2–3 of Article 224 of the Tax Code of the Russian Federation). Thus, from the employee’s income, which the employer pays him monthly, the corresponding percentage of personal income tax from his MV from the BZ must be withheld.

The amount of deduction cannot be more than 50% of income in cash, which is paid this month (clause 4 of article 226 of the Tax Code of the Russian Federation). If the withholding amount exceeds the maximum, the balance is carried over to the next month. If it was not possible to withhold personal income tax during the tax period, the employer must inform both the tax office and the employee about this by sending them a 2-NDFL certificate.

Example 1 (continued)

04/03/2017 (since 04/01/2017 is a day off): 492 rubles. × 35% = 172 rub.

05/01/2017: 641 rub. × 35% = 224 rub.

06/01/2017: 182 rub. × 35% = 64 rub.

Taxation of personal income tax for MV has exceptions specified in subsection. 1 clause 1 art. 212 of the Tax Code of the Russian Federation. One of them is that if the purpose of the BP is defined as the construction or acquisition of housing in our country, as well as land for its construction, then the MV for such BP is not recognized as income. In this case, the employee to whom such a work permit was issued must have the right to a property deduction.

Thus, until the employee brings the specified notice, the accountant withholds personal income tax from him every month from the MV according to the BZ. After confirmation of the right to a property deduction, personal income tax is not accrued, however, the employer cannot return previously withheld personal income tax amounts, since they are not considered excessively withheld in accordance with clause 1 of Art. 231 Tax Code of the Russian Federation.

An employee’s knowledge book can be issued to the company’s goods, materials, fixed assets, etc. The things transferred must be defined by generic characteristics, that is, they cannot be unique with specific characteristics that only they have. A non-monetary loan can be repaid in money or the same things.

When issuing this type of work permit, the employer must take into account some taxation nuances. As for income tax, the transfer of money or things as a loan is not considered an expense (clause 12 of Article 270 of the Tax Code of the Russian Federation), and repayment of the loan is not considered income (clause 10 of Article 251 of the Tax Code of the Russian Federation). Cash loans are not subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation).

Under a non-monetary loan agreement, the employer's property becomes the property of the employee. In paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale is equated to the transfer of ownership of things, and, according to subparagraph. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the sale is called an object for VAT. Therefore, the transfer of things under the BZ agreement is subject to VAT.

Example 2

01/01/2016В. A. Sokolov received as a BZ ceramic tiles produced at the Voskhod LLC enterprise, where he works. The cost of the tiles was 135,000 rubles. without VAT. The loan term is 1 year. The employer must pay VAT to the budget in the amount of 135,000 rubles. × 18% = 24,300 rub.

| Description | Dt | CT | Documentation |

| The book value of the property was written off when issuing a business license | 73.1 | 41 (01, 10…) | Transfer and acceptance certificate (invoice) |

| Income is reflected if the contract value is higher than the book value | 73.1 | 91.1 | Transfer and acceptance certificate (invoice) |

| An expense is reflected if the contract price is lower than the book value | 91.2 | 73.1 | Transfer and acceptance certificate (invoice) |

| VAT is charged on the amount of the loan issued by the property | 73.1 | 68 subaccount “VAT” | Invoice |

| Repayment of debt in kind with property or money | 41 (01, 10, 50, 51…) | 73.1 | Acceptance certificate (invoice), payment order, bank statement |

Example 2 (continued)

| Description | Dt | CT | Sum |

| The book value of the property was written off when issuing a business license | 73.1 | 41 | 105 000 |

| The excess of the contract value over the book value is reflected | 73.1 | 91.1 | 30 000 |

| VAT is charged on the amount of the loan issued by the property | 73.1 | 68 subaccount “VAT” | 24 300 |

| BZ extinguished | 41 | 73.1 | 159 300 |

| Personal income tax withheld from MV according to BZ | 70 | 68 subaccount “NDFL” | 3 345 |

| Personal income tax is transferred to the budget | 68 subaccount “NDFL” | 51 | 3 345 |

In practice, an employee often asks the organization in which he works to help him temporarily with funds to purchase housing or other property. This raises the following questions for accounting:

- Do companies have the right to issue loans to their employees?

- What requirements are imposed on the organization (availability of profit, etc.) and on the employee (length of his work in the company, etc.)?

- What is the maximum loan size and term?

- Should such loans be subject to interest?

- How is the issuance of loans to employees of an organization reflected in tax reporting?

- What taxes are subject to?

- What documents are required to obtain a loan?

1. Any commercial company has the right to issue loans to its employees

1) transactions with funds in cash: withdrawal from the account or crediting to the account of a legal entity of funds in cash in cases where this is not due to the nature of its economic activity;... 4) other transactions with movable property:... provision by legal entities, non-credit institutions, interest-free loans to individuals and (or) other legal entities, as well as receiving such a loan.”

Forgiveness

For the employee, the amount of the forgiven debt is economically beneficial. Moreover, at the time of identifying the tax base for personal income tax, it is necessary to pay attention to all the employee’s income that he received both in kind and in cash or which he did not have the right to dispose of. The Tax Code provided for this in paragraph 1 of Art. 210 Tax Code of the Russian Federation.

If the company decides to give an employee a certain amount of money, he is automatically relieved of the obligation to pay this debt, as a result of which he has a chance to use his money as he sees fit.

Consequently, the employee receives income in the amount of the forgiven loan provided by the company. This amount is also taxed at a rate of 13%.

Undoubtedly, an interest-free loan to a company employee has a huge list of advantages in comparison with classic bank lending. After all, it is much more profitable and comfortable to take out a loan from an employer. Thus, the employee can pay the debt to the best of his ability, without paying fines or paying interest.

MFO Borrow Simply is described in the article: Borrow Simply MFO. Reviews of a loan of 30,000 rubles online urgently to a card without refusal can be found on this page.

Read a sample loan agreement between individuals secured by a car here.

What conditions must be met?

Initially, you should decide whether the organization can issue an interest-free loan to an employee. The procedure can be implemented if certain conditions are met:

- the funds or goods received must be used by the employee for any purpose;

- it is required to return the money in the specified amount within a predetermined time frame;

- if a tangible item is provided, it must be returned in its original condition;

- the employer cannot require employees to pay any interest;

- the procedure for transferring money is fixed by drawing up a written agreement and receipt;

- If money is issued for specific purposes, then it is not allowed to direct it to other purposes, since this is a violation of the terms of the agreement.

The main terms of the agreement are negotiated between the two parties to the transaction, so they can make their own adjustments to this agreement, which should not contradict the requirements of the law.

Contract restrictions

A loan agreement for an employee in some cases requires the permission of the founders (owners) of the organization (when issuing borrowed funds). Certain restrictions appear, for example, when a loan agreement for an employee meets the criteria of a transaction in which there is an interest and a large transaction of a business company.

A transaction, in particular, in which there is an interest, will provide a loan to the head of the company, usually the general director). Note that the loan amount does not matter. A big deal is a loan, the amount of which is more than 25 percent of the value of the company’s assets as of the last reporting date.

In an LLC, the decision to carry out a major transaction is made by the general meeting of company participants. In the absence of this decision, the loan agreement for the employee may be invalidated. Requirements for approval procedures for such transactions are established by Article 45 and Article 46 of the Federal Law of 08.02.

A sample loan agreement for an employee (interest-free or interest-bearing) has the following attachments:

- Interest repayment schedule.

- Loan repayment schedule;

- Loan schedule;

We invite you to familiarize yourself with: Registration of a lease agreement for non-residential premises in 2020: procedure and terms.

A standard loan agreement for an employee has the accompanying documents:

- Protocol for reconciliation of disagreements.

- Protocol of disagreements;

- Additional agreement;

How is an application made?

Before drawing up an interest-free loan agreement, the employee is required to write an application addressed to the head of the company. When forming this document, the following rules are taken into account:

- the document is drawn up on a blank sheet of A4 format;

- the full name and position of the director is indicated in the upper right corner;

- Next, the full name and position of the company employee drawing up this document is written down;

- in the middle the name of the document submitted by the application is indicated;

- the main part contains a direct request to receive funds on loan from the company;

- the specific amount required by the citizen is given;

- the purposes for which the money will be spent are listed;

- it is indicated for what period it is advisable to draw up an agreement;

- the conditions under which the money will be returned are given, for example, will the entire amount be paid to the employer at the end of the term or will partial funds be transferred monthly;

- At the end of the document the date of drawing up the application, as well as the signature of the citizen, is indicated.

It is most convenient to use a scheme on the basis of which every month the employer independently withdraws from the employee’s salary a certain part of the funds used to pay off the debt. In this case, the employee will not face a serious credit load. A correctly drawn up application is registered in the company office, after which the employee should only wait for the decision of the enterprise management.

How to prepare a loan agreement with an employee{q}

Which is available to you right now, can be concluded upon provision of a minimum package of documents. You need to provide a passport; the management of the organization will register their details independently.

The agreement is drawn up in 3 copies;

It is necessary to affix the signatures of the borrower’s manager in accordance with the requirements of Art. 7 Federal Law – chief accountant.

Please note that without the signature of the chief accountant, the transaction will be considered invalid. Follow all formalities, this will allow you to avoid conflict situations and disputes.

A loan agreement with an employee of an enterprise, a sample of which is available to you right now, can be concluded upon provision of a minimum package of documents. You need to provide a passport; the management of the organization will register their details independently.

•The agreement is drawn up in 3 copies;

•It is obligatory to affix the signatures of the borrower’s manager in accordance with the requirements of Art. 7 Federal Law – chief accountant.

Please note that without the signature of the chief accountant, the transaction will be considered invalid. Follow all formalities, this will allow you to avoid conflict situations and disputes.

Reflection in accounting

When issuing loans to employees, it is necessary to correctly reflect this procedure in accounting. Therefore, the entries corresponding to this operation must be used for an interest-free loan to an employee. These include:

- D73.1 K50 – issuing money to an employee on the basis of a loan agreement;

- D73.1 To 91.1 - accrual of interest, which should not be higher than the refinancing rate, since otherwise the loan will not be interest-free;

- D50 or D51 K73.1 – loan repayment.

If a loan is actually provided by the company, then this indicates that the employee is responsible and serious. If the entries for an interest-free loan to an employee are incorrectly reflected, this may give rise to problems with the tax authorities. Therefore, even under an interest-free agreement, the company may need to pay taxes.

How to get an interest-free loan for an employee

Any borrower has the opportunity to receive an interest-free loan. The main thing is that the parties manage to achieve full agreement with the management. Companies also have no legal restrictions that affect the provision of credit.

A loan is issued for the purchase of housing on the basis of a standard loan agreement.

The document contains the following information:

- date and place of signing the agreement;

- full information of the parties to the agreement (company name, legal address, bank and passport details of the employee, address of his place of residence and registration);

- the size of the loan provided and the terms of its repayment;

- the responsibilities of the participants, their contractual obligations and duties;

- other terms of the contract that were reached as a result of negotiations between the participants;

- signatures of the participants and the seal of the company that provided the interest-free loan.

A payment schedule for debt obligations is attached to the agreement. This document is being developed for large debts, which makes it impossible to repay them in one payment. When developing a payment schedule, the loan term covered by the loan agreement is not affected.

The borrower can repay borrowed funds in one of the following ways:

- by money transfer of the amount or part thereof indicated in the schedule to the bank account of the enterprise. The account number and other necessary information are issued to the employee in advance at the time of execution of the transaction;

- payment to the company cash desk;

- withholding a sum of money from an employee's salary.

If the loan agreement clearly defines any option for paying the debt, then the lender does not have the right, on its own initiative, to collect currency in another way.

Thus, contracts often indicate a condition that the employee is obliged to repay the loan every month in small installments. Even if he violates the conditions, causing him to have several delays in a row, the employer does not have the right to withhold the corresponding amount from the employee’s salary.

Tax consequences

Many companies offer the opportunity to issue interest-free loans to employees. The tax consequences of such a decision are acceptable for any company, since no taxes are required. This is due to the fact that the company does not receive any profit in the form of interest from the employee.

At the same time, workers receive a certain income represented by savings on interest. Therefore, he has to pay a fee for the income received if the company provides an interest-free loan to an employee. Taxes in this case are represented by personal income tax. The fee is 13%, with the tax agent represented by the employer handling the withholding. The company withholds tax from the employee's salary, but such withholding cannot exceed 50% of the citizen's monthly income.

For what purposes?

The company can provide its employee with a loan on an individual program beneficial to both parties. The board of directors can approve an interest-free loan for a specific purpose or for personal needs. The legislation of our country does not provide for any restrictions on the use of money taken from the company.

The goals of this type of lending may be as follows:

- construction of a summer cottage or a country house;

- construction of a garage;

- purchasing a car;

- interest-free loan for construction or purchase of housing;

- loan for the purchase of equipment and other household items;

- money for rest and treatment.

In civil law, the time of repayment of the subject of the loan agreement and the time of its deferment are unlimited. Despite this, in most cases, the manager lends currency for a short period, no more than 1 year. However, he has the right to extend the duration of the contract for as long as he deems necessary.

To confirm that the currency received was spent for a specific purpose, and the borrower's salary should not be withheld for material benefits, the borrower must prepare a notice from the tax authority to his manager. But in order to receive it, the borrower will have to confirm the intended use of the money.

A 24-hour loan secured by a vehicle is described in the article: loan secured by a vehicle.

Read about loans secured by real estate here.

Underwater rocks

https://www.youtube.com/watch?v=ngoMPGIiTIk

The execution of such a transaction has nuances that must be taken into account by both parties. These include:

- the contract requires a detailed description of the subject of the transaction, since if it is impossible to identify it, problems may arise in court;

- it is required to clearly indicate in the contract that the loan is provided without the need for the employee to pay interest;

- the subject of the agreement may be not only a sum of money, but also the property of the company;

- when providing an interest-free loan, the company does not receive any material benefit, so it is not required to pay taxes;

- the borrower can receive a property deduction if he uses the funds received to purchase real estate;

- If housing is transferred for temporary use, the transaction will certainly be registered.

By law, it is not required to contact a notary to certify the contract, but many companies decide to use the services of this specialist, which significantly simplifies the process of concluding a transaction.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Loan Agreement (interest-free) with an employee” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!