Making an order

For example:

1. Commercial Director I.I. Ivanov….

If an assignment is given to several executors who have the same position, then after the generalized name of the position, the surnames of the executors (in the dative case) and their initials are listed in parentheses. For example:

1. Heads of departments (Ivanov I.I., Petrov P.P., Sidorov S.S.)…

Only deputies of the first person or heads of structural divisions are indicated as executors in the order.

The prescribed action is expressed by a verb in an indefinite form, for example: prepare, provide / organize, develop and submit for consideration (if the project must be signed) or... for approval (if the document is subject to approval).

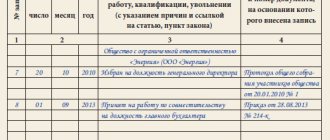

The execution date of the order is fixed only by three pairs of Arabic numerals. For example: Deadline 07/20/2010 or... until 07/20/201 0 or... by 07/20/2010.

A clause of an order can be divided into sub-clauses if: one executor is given several instructions; several performers have a common deadline for execution; an order given to several executors is formulated in the same way.

The last paragraph of the administrative part may contain information about the unit or official responsible for monitoring the execution of the order. For example:

3. Entrust control over the execution of the order to Deputy Director for Production Ivanov G.I.

or

3. I reserve control over the execution of the order.

Persons whose official rank is higher than the official rank of performers must be indicated as controllers.

If regulatory documents are approved or put into effect by order, then the administrative part may not indicate executors, deadlines and controllers. For example:

I ORDER:

- Approve the instructions for office work.

- The instructions will come into effect from 11/15/2010

If the executor is given a standing order, then instead of the deadline, indicate the frequency of its execution. For example:

1…. provide a weekly summary….

The order comes into force from the moment of signing.

The wording of the order must be completely precise, specific, and not subject to different interpretations. The use of verbs “increase”, “improve”, “activate”, “strengthen”, “pay attention”, the adjective “necessary” and language constructions such as “if..., then...”, “then when...” are not allowed.

As it is written, I reserve control over the execution of the order.

You look at the classification described above and begin to get confused. Which one is verbal, which one simply denotes an action, and which one is abstract? And the choice of design depends on this.

That is why today the idea of a strict distinction between the constructions of control over / for with these words can already be called into question. It can be said that control over/for tend to be used with all types of objects without the above conditions.

In general, in modern use the control .

Info

It displaces the previously dominant construct of control over . www.aif.ru

See also:

- Slides farewell to retirement Scenario Farewell to pensioners and head teachers. Meeting new employees Hurry up to take advantage of discounts of up to 50% on Infourok courses Farewell to pensioners and head teachers. Meeting new employees Preparing for the holiday The hall is decorated with flowers, balloons, [...]

- Something anything nothing rule Indefinite pronouns in English The use of Some and any denote a specific quantity and are used before plural nouns, as well as before uncountable nouns.

Moreover, some and his […]

- Order 25 Russian Railways ORDER of JSC Russian Railways dated December 25, 2007 N 2423r (as amended on February 4, 2010) “ON APPROVAL OF THE LIST OF TYPES OF LOCKING AND SEALING DEVICES USED FOR SEALING CARS AND CONTAINERS DURING TRANSPORTATION RUZOV, IMPLEMENTED BY JSC "Russian Railways" (as amended .[...]

- Order 345 of 1973 Order of the Ministry of Transport of the Russian Federation dated November 7, 2013 N 345 “On approval of Mandatory regulations in the seaport of Kandalaksha” Order of the Ministry of Transport of the Russian Federation dated November 7, 2013 N 345 “On approval of Mandatory regulations in […]

- The rule for subtracting numbers with different signs Subtracting negative numbers As you know, subtraction is the opposite of addition.

Control over the implementation of this order is assigned to the chief accountant

Changes in accounting policies

5. Entrust control over the implementation of this order to the chief accountant.

General Director of the company

Particular care must be taken in determining the date from which a new method is introduced into the accounting policy. Its introduction should not distort the financial result of the organization’s activities, complicate the accounting process or interfere with its normal course.

Theoretically, a new accounting method can be introduced from any date chosen by the organization. However, from a practical point of view, the most acceptable moment is January 1 (we are, of course, not talking about changing accounting policies in extraordinary situations).

Adjustment of accounting policies from the beginning of a new reporting year ensures the consistency of the accounting process throughout the entire reporting year and greater representativeness of the indicators formed in accounting. [1, pp.86-87]

3.2. Disclosure of accounting policies in reporting.

The accounting policies adopted by the organization must be disclosed (made public) to external users of financial information. [8, p.182] In this case we are talking about disclosing in the financial statements the most important methods of accounting. To analyze the state of an organization based on its financial (accounting) statements, you need to know how certain indicators were formed, which reflects their change: a real improvement (worsening) of affairs or an adjustment in the methods for calculating these indicators. In other words, an interested user of financial statements must be able to understand and evaluate certain data included in it.

Typically, not all components of accounting policies must be described in a published report, but only those that significantly affect the understanding of the financial position of the organization, its cash flow or results of its operations, as well as those that significantly affect or may affect the interpretation of the data. Accounting methods should be disclosed, without knowledge of the application of which users of financial statements will not be able to draw useful conclusions on them. Obviously, this mainly relates to methodological methods of accounting. As for the technical and organizational aspects of the accounting system, since their knowledge is not decisive for users of the statements, they may not be described in the report. [1, pp.87-88]

In addition to provisions different from generally accepted ones, disclosed information about accounting policies must contain information about the provisions formed by the organization: as a result of a choice made from several acceptable options; based on the industry sector of the organization; as a result of non-traditional application of permissible options, including industry ones. In this case, we are talking about information such as: depreciation policy in relation to fixed assets; the procedure for calculating depreciation on intangible assets; method of valuing raw materials, materials and similar values; created reserves for upcoming expenses; method of profit recognition under long-term contracts; method of reporting received loans, etc.

Particular attention should be paid to the description of changes in the accounting organization that occurred both during the reporting year and at the beginning of it, compared with the year preceding the reporting one and significantly influencing (substantively and quantitatively) the assessments and decisions of users of financial statements. We are talking about reporting for both the reporting period and subsequent periods. Disclosure of these cases makes it possible to assess the nature of fluctuations in certain reporting indicators. The description must be accompanied by a disclosure of the reasons for the changes and an assessment of their consequences in order to provide complete clarity to the question of how changes in accounting policies affected the financial condition and financial performance of the organization.

Information on accounting policies must also contain an indication of what new accounting rules (standards) the organization began to use in the reporting period. Such information will allow interested parties to get an idea of the range of regulations that the organization is guided by when maintaining records and reporting, as well as assess the degree of “modernity” of financial data. [1, pp.88-89]

Thus, in the process of functioning of the organization, the need arises to make changes to the selected accounting policy. The consequences of such changes can be assessed: 1) as the difference in the value of assets for which new valuation methods are used, before and after making these changes; 2) as the outstanding amount of the initial cost of assets. If there is a change in accounting policies, the organization must determine the procedure for managing differences that arise during the transition to using new accounting methods. In addition, the accounting policies adopted by the organization must be disclosed to external users of financial information.

Conclusion

The accounting policy of the enterprise assumes openness to external users of accounting information reflected in the financial statements. According to the financial statements, the property and financial position of the enterprise, its solvency, basic business provisions, trends in the improvement (deterioration) of the enterprise’s activities and other indicators are established.

The accounting policy of an enterprise is based on a certain set of generally accepted rules, which is especially important when strengthening the role and importance of accounting in a market economy. Accounting information must be complete and reliable, accessible and understandable to a wide range of interested users.

Along with the order (instruction) on accounting policies, the following are also approved:

· a working chart of accounts, containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

· forms of primary accounting documents used for registration of business transactions, for which standard forms of primary accounting documents are not provided, as well as forms of documents for internal accounting reporting;

· the procedure for conducting an inventory and methods for assessing types of property and liabilities;

· rules of document flow and technology for processing accounting information;

· the procedure for monitoring business transactions, as well as other decisions necessary for organizing accounting. [4, pp.45-46]

Today, accounting is the language of business and entrepreneurship, capable of uniting business people. In addition, accounting is considered as an important component of the national system for the formation of macroeconomic indicators, which means that each enterprise, when preparing the information necessary to calculate such indicators, must adhere to uniform approaches and rules. These rules establish those starting points in building an accounting system at an enterprise that must be observed when choosing accounting procedures and developing an accounting process. They are the foundation for building an accounting system at an enterprise, the purpose of which is to provide access to comparable information and provide reliable information about the financial position and results of operations. [8, p. 182]

Bibliography

1. Accounting: Textbook ./ A.S. Bakaev, P.S. Bezrukikh, N.D. Vrublevsky and others; Ed. P.S. Armless.-5th ed., revised. and additional – M.: Accounting, 2004.-736 p.

2. Accounting: Textbook for universities / Ed. prof. Yu.A. Babaeva.-M.: UNITY-DANA, 2002.-476 p.

3. Vasilyeva N.A. Accounting policy of the organization//Accounting.-2003.-No. 24.-p. 31-35.

4. Veshchunova N.L., Fomina L.F. Accounting: Textbook.-2nd ed., revised. and additional – M.: Finance and Statistics, 2004.-560.: ill.

5. Vlasova V.M. Primary documents are the basis of financial statements.-3rd ed., revised. and additional – M.: Finance and Statistics, 2003.-400 p.

6. Guseva T.M., Sheina T.N. Fundamentals of accounting: theory, practice, tests: Proc. manual.-4th ed., revised. and additional – M.: Finance and Statistics, 2004.- 368.: ill.

7. Zhukov V.N. Formation of an organization’s accounting policy // Accounting.-2002.- No. 1.-p. 42-50.

8. Kiryanova Z.V. Accounting Theory: Textbook. - M.: Finance and Statistics, 1996.-192 pp.: ill.

9. Kondrakov N.P. Accounting: Textbook - M.: INFRA-M, 1996, - 550 p.

10. Pyatov M.L. Development of elements of an organization’s accounting policy // Accounting.-2002.- No. 5.- p. 15-18.

Changes in accounting policies

Information about the work “Accounting Policy”

Section: Accounting and Auditing Number of characters with spaces: 56618 Number of tables: 2 Number of images: 3

Similar works

Accounting policy of the organization and its formation at OJSC "Caustic"

102628

4

0

... 1/98, regardless of organizational and legal forms. The formation of an accounting policy is understood, according to the Regulations, as its choice and justification. When forming an organization’s accounting policy for a specific area of maintaining and organizing accounting, one method is selected from several allowed by legislation and regulations on accounting. If...

Accounting policy. Organization and forms of accounting in small businesses

82013

0

0

… 5. Cashier’s report (tear-off sheet of the cash book) 6. L/O No. 1 statement No. 1 7. General ledger 8. Balance sheet At small businesses, accounting is kept in the book of the cashier of the operator and the statement of accounts for d/s and funds (form B4 ) On account 50/1, funds in the organization’s cash desk are taken into account. At 50/2, the availability and movement of cash registers at the ticket offices of commodity offices, ticket and baggage offices of ports and stations, ...

The accounting policy of the organization, its basic principles and content

120359

9

0

... of their production and economic activities, independently form their accounting policies based on the structure, industry affiliation and other features of their activities. The accounting policy of an organization is the main document regulating accounting and taxation procedures. As we have already noted, the organization must approve two accounting policies: for ...

Accounting policy of NKMZ JSC

46542

6

0

...) accounting No. 17 “Income tax” at the time of preparation of annual financial statements in the case when the income tax determined in accordance with the accounting policy of the enterprise according to accounting data is less than the income tax determined for taxation purposes. 21. Receivables are recognized as an asset if there is a likelihood that the enterprise will receive future...

Requirements for the execution of order forms

But before unifying the document, let's consider what elements it consists of, in other words, consider the requirements for the execution of an order and the composition of its details. The “favorite” GOST R 6.30-2003 will help us with this.

In accordance with his recommendations, orders are issued on special forms, which are called forms for a specific type of document, because the name of the type of document (ORDER) is printed on them, then it will no longer be possible to issue a document of another type (for example, ACT) on this form.

Now let’s look at samples of the form for a specific type of document, as well as the instructions regarding the composition of its details:

GOST R 6.30-2003 “Unified documentation systems. Unified system of organizational and administrative documentation.

Change of status

In order for an official document to be classified as executed, it is necessary to actually fulfill all the instructions that are written in its text. Execution must be confirmed in documentary, official form. The official appointed as the executor on the paper is obliged to report to management on the results of the work performed. In addition, reports must be provided to higher organizations, authorities, and individuals if they are interested in receiving information. In some cases, the official receives revisions to the project or is faced with additional instructions. In this situation, it is too early to talk about the execution of documentation. If a document has been transferred for execution from one official to another, the importance of its control does not decrease; the office work service in any case must monitor compliance with deadlines, as well as control the transfer of such, if necessary. The service responsible for monitoring work on documents may consider that what the official prepared in form, essence, and content does not correspond to the assignment issued by management. In such a situation, the documentation is sent to the contractor for processing without shifting the time frame.

All information (both about the process of document control and its results) must be strictly recorded in the accounting system. From time to time, information is brought together, analyzed, and submitted to the manager for review. The most common practice is monthly reports on the work of the office management service. The document is sent to the manager in the form of a summary. Its structure is usually established in the production instructions; from month to month, papers are received, formatted according to the same template. This makes it easier to compare results over different times. The results of the analysis help to understand what measures should be taken to improve the efficiency of the work process and speed up the processing of documentation. Specific officials are responsible for formulating proposals for optimizing work, and managers decide which of these should be implemented and in what time frame the work must be completed.

Design features

Control over the execution of documents requires the correct execution of all stages of working with official paper. At the moment when the documentation is registered and put under control, the responsible employee makes the appropriate marks on top of the empty field (19th detail). A similar note should be indicated on the registration form. If the task is complex, it is quite possible that the deadline will be long – months, or even a year. This forces us to divide the work into stages and formulate individual deadlines for each of them, which will have to be tracked in the future. In any of the options, the very moment of control is the reporting point, after which responsible persons must monitor the document. The clerk (or another employee whose responsibilities include this) sends the paper to the executor, recording this moment in the accounting book. The controlling official or body responsible for control will check the timeliness of receipt of documentation directly to the contractor.

Monitoring the execution of documents involves conducting checks to monitor all steps of preliminary work to prepare a response. The results of intermediate stages must be recorded in the registration card of the official paper or in the control system. Executor is an official responsible for providing information in a timely, accurate manner, in accordance with the real state of affairs. You can organize written checks, sometimes oral checks are sufficient. The control service may regularly send written notifications to responsible persons, which contain references to all documents currently under control. You can regularly send reminders about the documentation that is simultaneously being worked on by several departments of the enterprise at once. This helps to more effectively coordinate the activities of structures.

Errors when issuing orders

* Organization of office work. Types of documents * Regulatory documents on office work * Approximate composition of documents of the personnel service * Orders on personnel * Grounds for orders on personnel - reports and explanatory notes, presentations, minutes, acts * Orders on core activities, having a free form - Regulatory framework - Typical errors in orders - Options for orders to cancel previously issued orders * Military registration documents * Documents for the Pension Fund * Notices, notifications, directions, certificates * Samples of orders issued by the personnel service for all other occasions * Save time when creating a document

Typical errors in orders.

Preamble (statement part) of the order of the organization “On the creation of a Commission for the transition to a new wage system”

In accordance with the Regulations on the establishment of remuneration systems for employees of federal budgetary institutions, approved by Decree of the Government of the Russian Federation of August 5, 2008 No. 583, I order.

Where is the mistake? In this case, the justification is a reference to a regulatory legal act issued by the Government of the Russian Federation. When referring to documents in the preamble to the order, it is necessary to provide the full output data of the document: name of the type of document, name of the body that issued the document, date, registration number of the document, title to the text. If a reference is given to a document approved by any body, indicate the type of document, the body by which it was approved, and the date of approval. It should also be borne in mind that there is no official abbreviation of the words “Russian Federation” in the form of “RF”.

Thus, according to the Dictionary of Difficulties of the Russian Language, the word “control” is used with the following prepositions:

- control over what and over what - with verbal nouns, that is, formed from verbs: control over / over the spending of funds (spending from spending); control over the execution of the order (execution from execution);

- control over what - with nouns denoting an action or attribute: control over the operation of the machine (action); control over the quality of work (sign); installation control (action); environmental control (quality; monitoring the state and changes in the characteristics of landscape components that are especially important for humans and biota); shipment control (action); control over the production (= process) of containers;

- control over someone or something - with abstract nouns and with animate nouns: control over production (= organization); control over young specialists (animate nouns);

- control of what - in official and vocational speech: control of the activities of elected bodies; control of finished products; control of commercial conditions.

Thus, the phrases “monitoring the work of employees”, “monitoring the execution of orders” and the like are correct and recorded in dictionaries.

www.ekburg.ru