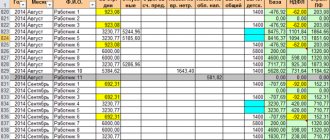

Basic cost accounting methods

The efficiency of a company's activities can be assessed through proper accounting of current costs. The choice of cost accounting method is carried out by the organization independently by fixing the method in the accounting policy, taking into account current legal requirements. When regulations change, the company's accountant needs to make appropriate changes to the accounting. The main methods used by company accountants in the Russian Federation are the following:

- Regulatory - widely used in enterprises with mass or serial production, in manufacturing industries, in light industry, and mechanical engineering. Based on the use of specified standards.

- Process-based - most often used at power plants, in the mining or chemical industries, that is, where the range of products is narrow and semi-finished production is completely absent or limited. Allows you to accurately calculate each individual process.

- Custom - used in small-scale, individual production of complex products; for repair and experimental services. For example, these are shipbuilding and machine-building enterprises. The cost of each product is calculated based on direct and indirect costs.

- Transverse - common in mass production, which is characterized by sequential multi-stage processing of materials and raw materials. For example, these are the textile industry, the metallurgical industry, as well as chemical and oil refining. Calculation is carried out using the non-semi-finished method or the semi-finished method, with the calculation of cost at each limit (stage) of production.

Cash method

The cash method in accounting implies recording (and subsequent reflection in reporting documents) income and expenses only based on the amounts that came to the company’s current account (or a transfer of funds to the counterparty’s account was completed in accordance with the agreement).

However, not everyone can use this approach. In accordance with the laws of the Russian Federation, this method is applicable only to those companies whose revenue for the previous 4 tax quarters amounted to no more than 1 million rubles. in each (excluding VAT payments). Also, companies operating under agreements establishing trust management of property, or agreements on joint activities, do not have the right to use the cash method.

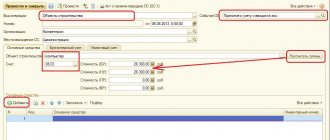

The accounting principles and methods that we described above can be used by businesses not only from the point of view of optimizing reporting to the Federal Tax Service. These tools are quite applicable as a way to increase production profitability by finding an optimal balance in the distribution of profits and expenses. Among the areas of financial and economic activity where the choice of the best accounting method can directly affect the efficiency of the business model is the depreciation policy. Let's consider its main features.

The essence of the standard method of accounting for production costs

The peculiarities and concept of the normative cost accounting method are that the formation of normative cost estimates for products is carried out on the basis of norms developed in advance and valid at the beginning of a given period (usually a year according to methodological recommendations). In this case, absolutely all types of existing costs are taken into account according to the given values. Deviations of actual costs from current standards are reflected separately - the reasons (justifications) for such discrepancies, places and culprits are necessarily given. This is done in order to make appropriate changes to the calculations and determine the impact of indicators on the final cost of production.

In the process of manufacturing GP, the standard method of accounting for production costs uses the following formula:

Actual costs = Costs according to standards + Deviations from standards + Changes in standards.

As is clear from the names of the values, in order to calculate the actual cost, it is necessary to sum up the costs according to the established standards with existing deviations (both in the form of savings and overruns) and changes in indicators made during the period. It should be taken into account that the standards are laid down at the beginning of the period, and the calculation of products during the period is carried out based on the approved values. But if changes are made for various reasons, such a difference is subject to special accounting, and recalculation can only be done as of the beginning of the next year. All standard values are approved by the head of the enterprise or an authorized responsible person.

Deviations are determined in terms of direct costs. These are raw materials, materials, wages, wear and tear, etc. As for other indirect costs, the amount of deviations for them at the end of the month is distributed among all types of products. The disadvantage of this method is the impossibility of ongoing monitoring of production costs.

Method Elements

Let us highlight the elements that form accounting methods:

- Observation. Relevant in relation to operations for the performance of functions by various departments. Observation ensures that forms are filled out correctly and that internal standards are followed.

- Measurement. The process reveals numerical values that relate to financial and business transactions. If observation takes into account compliance with standards, then in measurement the main indicator is numbers. The object in this case is monetary values.

- Generalization and detail. Procedures can be static or analytical. The choice of tool is determined by the company's objectives. Generalization and detailing can be used both in combination and separately.

All the elements under consideration can be applied comprehensively. However, as a rule, one of them is the main one.

Basics of applying the process method of cost accounting and calculation

The essence of the process-by-process method of cost accounting and product calculation is that the cost calculation in an organization is carried out without breaking down into types of products, that is, with the determination of costing for the entire production process as a whole. In this case, both direct and indirect costs are not subject to distribution and are written off against the entire output of GP (finished products) under the relevant items. The object of accounting is not a specific product, but a production process, hence the name of the method.

No special formulas are used in the calculations, and the average cost of one product is determined by dividing the total costs incurred during the period by the number of units produced. If production has a long cycle, calculations are performed for each month, and the final cost is determined upon completion of the process. Administrative costs and those attributable to auxiliary production are accounted for under general operating items.

The use of this method is justified in those organizations where there are no semi-finished products, that is, unfinished products; homogeneous products are mass produced; The technological process is characterized by a short period. The nuances of the calculation vary depending on how many product items exist in production. If only one type of product is produced, the cost of one unit is calculated by simply dividing the total costs by the number of units.

If several different types of products are produced, costing is determined item by item, broken down by product, and total costs are distributed according to the accepted methodology. If there is a work in progress in production, WIP balances are taken into account according to the company’s valuation method at the beginning and end of the period, and current expenses for the month are adjusted according to the balance of work in progress.

Calculation is

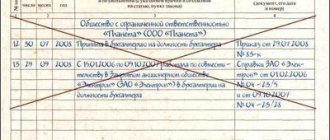

Example of transactions when using the accrual method

In March 2020, Alpha and Omega LLC shipped a batch of flour worth RUB 590,000 to Beta LLC. (including VAT - 90,000 rubles). Beta LLC transferred funds in April. Alpha and Omega LLC uses the accrual method (according to accounting policy).

The following entries are made in the accounting of Alpha and Omega LLC in March:

D62 K90 subaccount “Revenue” – 590,000 rubles. (proceeds from flour)

D90 sub-account “VAT” K68 sub-account “Calculations for VAT” – 90,000 rubles. (VAT is charged on sales).

And the income tax return for the first quarter of 2020 of Alpha and Omega LLC reflects income from the sale of flour in the amount of 500,000 rubles. (590000 – 90000).

Using the custom method

The custom method of cost accounting and calculation is used to accurately determine the cost of certain types of products, as well as when carrying out equipment repairs and auxiliary work. The object of accounting in this method is not the type of product, but the order itself for a specified quantity of goods. The scope of application of the custom cost accounting method is individual production or small-scale production, consisting of the same range of products. If large products are produced in a long cycle, order calculation is performed not for the entire object as a whole, but for its parts - components, assemblies and other completed structures.

Example of a custom cost accounting method

Let's assume that a furniture manufacturing enterprise has released 2 orders in a month: the first includes 5 cabinets, the second 7 tables. Direct costs are equal: for the first order - 120,000 rubles, for the second - 50,000 rubles; indirect = 70,000 rub. There is no work in progress, let’s do the calculations:

- Total cost of 1 order = 120,000 + (70,000 x 120,000 / 170,000) = 169,411.76 rubles.

- Total cost of 2 orders = 50,000 + (70,000 x 50,000 / 170,000) = 70,588.24 rubles.

In the above methodology, the production cost of products was calculated with the distribution of indirect costs to the base for which direct costs were taken. But a method is also allowed when individual types of production costs are taken into account evenly by dividing by the entire number of products produced. In this case, the distribution of indirect costs will be the same.

Simplified accounting

Some organizations have the right to use simplified accounting methods, including simplified accounting (financial) reporting. They can establish for themselves the following procedure for recognizing sales revenue: not as the rights of ownership, use and disposal for the delivered products/goods sold/work performed/services rendered are transferred, but after the receipt of money and other forms of payment.

In this case, expenses are recognized after the debt is repaid.

Also see “Accounting on the simplified tax system”.

Features of the incremental method of accounting for production costs

The incremental method of cost accounting is the calculation of costs not by product, but by redistribution. It is used in industries with homogeneous raw materials. The object of cost accounting in the cross-cutting method is not the unit of product, but the individual phases of processing materials. And redistribution in the complex use of raw materials is recognized as a set of working technological operations, as a result of which an intermediate semi-finished product or already a semi-finished product is produced.

The procedure for using this method may vary in each organization depending on the method of reflection. What is common is that direct costs are formed for each processing stage; within different stages, products (semi-finished or finished) are combined into appropriate groups according to the degree of homogeneity of the raw materials and the complexity of their processing, and indirect costs are distributed according to the chosen principle. A decision is made independently on which processing stages and stages of production the cost is calculated, as well as which product items are included in each phase.

The basis for applying the incremental cost accounting method are two common options - semi-finished and unfinished. The first is characterized by determining the cost of semi-finished products at each stage of processing, which allows for more economically accurate calculation and control of the cost of finished products. In the second case, calculation of semi-finished products is not carried out, the cost of production is determined after release from production, and the movement of such objects is carried out between workshops in kind without making entries on accounting accounts.

Difference between semi-finished and semi-finished cost accounting methods

In accounting, the unfinished method of cost accounting is distinguished by the fact that products that have not undergone full technological processing, released from one stage, but used in the further production of GP, are not reflected in account 21, but are included in the work in progress in the account. 20. The internal movement of semi-finished products between workshops is controlled using data in physical terms, which are recorded by responsibility centers. During the calculation process, the cost of production is determined based on the total costs at all stages (redistributions) of production.

In contrast to the non-semi-finished method in accounting, the semi-finished method of cost accounting involves the initial entry of manufactured semi-finished products into the organization's warehouse and the subsequent write-off (transfer) of objects to other workshops for further use in the production of state enterprises. An account is used to reflect transactions. 21, and calculating the cost at each stage separately is necessary for the correct release of products. There are different options for calculating the unit cost - by the cost of inventories, by direct costs, by standard or actual, as well as accounting price. The optimal methodology is selected by the enterprise and enshrined in the accounting policy.

General characteristics of the accounting method

The accounting method is a set of methods and techniques that ensure an inextricable, continuous, documented and interconnected reflection in the monetary valuation of the activities of enterprises, organizations and institutions

.

The accounting method includes the following elements: documentation and inventory, valuation and calculation, accounts and the dual reflection of business transactions in them, balance sheet summary and reporting

.

In accounting, the registration of business transactions begins with the preparation of documents. Each business transaction must be formalized with an appropriate document, which is the only basis for its reflection in accounting. The documents provide the content of a business transaction in quantitative (material values) and monetary terms. Drawing up documents is called documentation

. Timely documentation of business transactions is of great importance in ensuring the objectivity and accuracy of accounting data, as well as in ensuring the safety of recorded objects. Inventory plays an important role in this.

Inventory

is a method of determining the actual availability of property and financial obligations (accounts receivable and payable, bank loans, loans and reserves) of an organization and comparing the data obtained about them with accounting data in order to establish the reliability of accounting indicators and clarify them in case of discrepancies.

Based on the completeness of cost accounting, the following methods are distinguished:

- Direct costing – in this method, costs are divided into fixed and variable. The cost price of a GP includes only variable costs - materials, raw materials, wages and general production variables (utilities, equipment maintenance costs, salaries of general shop personnel, etc.). Fixed costs not related to the production process are attributed directly to the financial result. The marginal method of cost accounting is used to regulate the volume of product output, analyze the workload of equipment, calculate sales prices and determine the minimum volume of GP output to cover current costs.

- The full cost accounting method consists of assigning all current production costs to the cost of products. With this method, direct and general production costs are directly written off to cost, and general operating costs are charged to costs without dividing them into types of products.

Current methods for calculating products were gradually developed and implemented at enterprises. The ancestor of modern calculations can be called the boiler method of cost accounting, which consists of summing up all costs incurred during a period into a common boiler. At the same time, neither the types of products produced nor the places where costs occurred were taken into account, which did not make it possible to determine the cost correctly and taking into account the characteristics of the manufactured products. Currently, this technique continues to operate only at those enterprises where one type of GP is produced and there is no need to calculate the exact cost.

The ABC cost accounting method is not widespread in Russia and is used mainly not for calculating costs, but for the purpose of financial analysis of the success of an enterprise. This method consists of calculating individual types of work (functions) with subsequent partial attribution to the price of the product. In this case, the entire technological process is divided into simple components with calculation of the consumed resources. Based on the results, all expended resources determine the final cost of the GP.

Transverse

The cross-cutting method is used in enterprises with homogeneous raw materials, materials and the nature of the production of mass products, in the production of which physical and chemical production processes predominate with the transformation of raw materials into finished products under the following conditions:

- continuous technological process;

- a number of sequential production processes, each of which or a group of which constitutes separate independent stages.

With this method, production costs are taken into account by workshops (processing stages, phases, stages) and expense items.

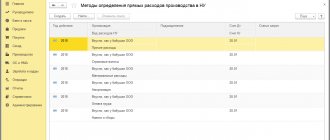

Standard costing method

This method is widespread in Western countries, and is now successfully used in Russia. It is mainly used in industries where prices for the resources used are relatively stable and products do not change for a long time. The method is similar to calculating standard cost.

The basis of this system is the following principles:

- preliminary standardization of costs by elements, as well as cost items;

- drawing up standard cost estimates for the product and its individual parts;

- separate accounting of costs and standard deviations;

- deviation analysis;

- making adjustments to calculations when standards change.

Cost rates are pre-calculated by expense items:

- basic materials;

- remuneration of production workers;

- general production expenses;

- business expenses.