Deadlines for submitting declarations in 2020 to the tax office, funds and Rosstat

If you do not submit a declaration, tax calculation, personalized or statistical reporting, then the company, entrepreneur and even the director cannot do without financial losses.

You can fill out reports online and submit them via the Internet in the BukhSoft program. It transmits any form online automatically. You can send declarations and calculations to the tax service, social services. fear, Pension Fund, Rosstat and other government agencies. Before sending, any report is tested by all verification programs of the Federal Tax Service and the Pension Fund of Russia. Try it for free:

Fill out and submit reports online

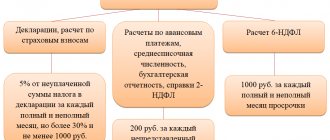

Read about sanctions against legal entities for late reporting in Table 1.

Table 1. Failure to meet deadlines for submitting declarations in 2020

| Reporting | Punishment |

| Tax declaration |

|

| Tax calculation | 200 rub. for each document |

| Tax calculation of contributions |

|

Fill out the calculation online

5% of arrears on contributions “for injuries”

Fill out the 4-FSS report online

Tables on deadlines for submitting declarations in 2020 are compiled according to the reporting of companies and entrepreneurs:

- applying a common tax system;

- using the simplified tax system;

- paying Unified Agricultural Tax or UTII.

Follow the link to read about the 2020 personal income tax payment order.

Mineral extraction tax rates in 2019-2020

All rates for calculating the mineral extraction tax, which is a federal-level tax, in 2019-2020 are reflected in the Tax Code of the Russian Federation (Article 342). They are divided into 2 types:

- expressed as a percentage;

- set in rubles.

Many of them provide for the use of coefficients that take into account:

- fluctuations in consumer prices;

- extraction method;

- characteristics of the territory of the developed field;

- fluctuations in world prices;

- mining difficulty level;

- degree of depletion of the deposit.

Some of the applied coefficients are relevant only to a certain type of fossil, others are valid for several types, and a number of coefficients for some of the fossils are applied in combination. The latter type of minerals includes oil and gas, which makes calculating taxes on them quite complex.

Odds may have a specific meaning or be calculated. However, the specific value may vary depending on the year the indicator was applied. The latter, for example, refers to the coefficient characterizing the export profitability of a unit of standard fuel and involved in gas calculations (Article 342.4 of the Tax Code of the Russian Federation).

In certain situations, taxpayers are entitled to rate reductions:

- by 30% if they carry out search and exploration of deposits at their own expense;

- by 40%, when mining minerals (but not hydrocarbons or common ones) in a special zone of the Magadan region.

To learn about the specifics of determining the object of taxation, read the article “What is the object of taxation under the mineral extraction tax?”

Mineral extraction tax calculation: instructions with examples

Mineral extraction tax is a federal-level tax. The Tax Code of the Russian Federation has established that the tax base for the subsoil use tax is the quantitative ratio of minerals.

These include oil, natural and associated gas, coal and gas condensate, and other minerals are determined only by the cost of the resource.

Therefore, without calculating the quantity and cost of extracted minerals, the total amount of tax cannot be determined.

Determination of the tax base

The procedure for calculating the amount of duty on extracted minerals begins with the calculation of the tax base (TB). The latter, in turn, is determined by the quantity and cost of extracted resources.

The tax base, or the number of minerals, is measured only in physical terms, and is calculated by two methods - direct and indirect. After choosing a method for determining the amount of extracted raw materials, it is fixed in the accounting policy. Taking into account these data, a declaration is filled out. Each option is used under individual circumstances.

Direct calculation formula

Losses count like this

The second component of NB is cost. To calculate the cost of extracted raw materials, the payer uses three methods:

- Based on the resulting estimated cost of the resource, excluding subsidiary investments.

- Taking into account the value relevant during the current tax period.

- Using the established estimated price of the extracted resource.

Method 1:

or

Method 2:

Method 3:

Mineral extraction tax calculation with examples

At the moment, it is impossible to calculate the mineral extraction tax and fill out a mineral extraction tax declaration in the 1C program for all types of natural resources. But with the release of a new version, the program will support the corresponding codes. The direct amount of subsoil use tax is calculated using an accounting calculator using the formula:

The above formula applies to all natural resources that taxpayers extract, but some minerals have a number of features when calculated.

Oil

The Federal Tax Service has established that the tax on mineral resources for March 2020 must be calculated taking into account the following information:

- the average monthly price of Urals oil on the oil market, which is $63.58 per barrel;

- The average exchange rate of the dollar currency against the ruble equivalent, which was established by the Central Bank of the Russian Federation, is 57.0344 rubles / 1 dollar. CC = 10.6158. The formula used here is:

- CC is an element that shows price jumps in the world for a product, determined by the formula: Average oil prices are published every 15th of the month in Rossiyskaya Gazeta.

- DM is a standard that reflects the characteristics of product extraction, defined as follows:

- EF is a component that reflects the level of production of subsoil used in production;

- KZ - an element showing reserves in this area;

- CD - the indicator reflects the complexity of resource extraction in this well;

- KDV - indicates the level of oil product production in this well;

- KKAN - indicates the immediate area of oil product production.

The mineral extraction tax coefficient is currently 559, while in 2020 it was 530.

An example of calculating the tax on black gold with real data for February 2020:

- the tax base is calculated in tons;

- tax tariff - 919 rubles/1 ton;

- CC = 8.5698;

- KNDPI = 559;

- CV = 0.3;

- KZ = 1;

- CCAN = 1;

- CD = 1;

- KDV = 1;

- CC = 306.

Conventionally, the organization received 10,000 tons of oil in February 2020. Using the formulas, we get:

10,000 * (919 * 8.5698 – 559 * 8.5698 * (1 – 0.3 * 1 * 1 * 1 * 1) – 306) = 42,162,835 rub.

This amount is the mineral extraction tax on oil production in a conditional example.

Coal

When calculating the mineral extraction tax, the organization takes into account the use of tax deductions, that is, whether the enterprise spends funds on employee safety and labor protection. The company makes these contributions in two ways: including it in the amount of other expenses or deducting it from the mineral extraction tax. When choosing one option or another, the organization consolidates it in the accounting policy of the enterprise and regularly uses the chosen method.

Without a tax deduction, the organization calculates the mineral extraction tax on coal according to the general rules:

- Determine the total amount of waste on safety and labor protection.

- The tax is calculated using the formula:

- Calculate the maximum amount of tax withheld:

- Compare the amount of actual costs for occupational safety and health. Sometimes expenses exceed the tax limit. In this case, it is included in the total amount of monthly deductions (up to 36 months).

Gas

Calculation formula:

When multiplying EUT, KS and TG, the result is a figure less than zero, then the rate will be zero. When calculating the EUT indicator, the monthly price tag and the coefficient reflecting the share of the extracted resource are taken into account.

Gas condensate

The mineral extraction tax for this condensate is calculated in the following way:

EUT and other data are calculated in the same way as gas indicators. The correction factor is calculated:

where KGP is an indicator that reflects income from gas exports.

Rate

Mineral extraction tax rates are set differentially depending on the type of resource, that is, each element has its own percentage. The mineral extraction tax rate for 2020 is divided into two types: percentage expression and in rubles.

Every year the tax rate undergoes changes, and each year the rate increases rather than decreases. But the reduced tariff, benefits and 0% rate make it easier to get busy.

- If the mineral extraction tax tariff on oil in 2020 was 857 rubles per ton, then in 2020 it increased to 919 rubles. At this time, the tariff has not increased further.

- The mineral extraction tax on gold in 2020 is 6%, and the tariff on other precious metals is 6.5%. According to Federal Law No. 41, the amount of tax on precious metals is calculated on the territory of the deposit.

- Gas and natural condensate is measured not only as a percentage, but also in rubles, which makes it more expensive: condensate - 42 rubles. for 1 thousand m3, 35 rubles. - natural fuel.

- The coal coefficient varies greatly between types of resource: the tariff for the extraction of brown coal is 11 rubles. per ton and 47 rubles. costs 1 ton of anthracite. The latter rate has been maintained since 2020.

Privileges

For some organizations, a reduction factor of 0.7 is provided. An enterprise uses it if it meets the requirements:

- before 07/01/2001, a company or individual entrepreneur paid OVMSB, but did not pay this duty for work on developed fields;

- the enterprise searched for and developed new deposits at its own expense, and government subsidies were compensated.

Zero rate

The 0% tariff rate is regulated by Art. 342 of the Tax Code of the Russian Federation, which contains information about natural resources that are not subject to duty. Mineral extraction tax is not paid in the following cases:

- in case of standard losses of obtained fossil raw materials during the work process;

- during the production of sand, associated, natural gas, its condensate, very thick oil;

- during the production of qualified associated tin ores;

- when receiving groundwater that contains minerals;

- when processing residues after the extraction of a natural resource;

- during the extraction of medicinal waters;

- when extracting water for agriculture. needs.

Also in paragraph 21 of Art. 342 of the Tax Code of the Russian Federation indicates specific geographical zones where extraction of natural resources is carried out free of mineral extraction tax.

Ad valorem

Ad valorem tariff indicators are used as a percentage of the cost of the extracted resource. According to Art. 342 of the Tax Code of the Russian Federation they vary between 0–8%.

In 2020, the Tax Code of the Russian Federation introduced a number of changes and innovations to the section on mineral extraction tax. Not only the indicators have changed and the coefficients have increased, but also the calculation formulas. They are relevant in this article.

Source: https://NalogObzor.info/publ/rascet-ndpi-instrukcia

Coefficients for calculating oil tax

When calculating the mineral extraction tax on oil in 2019-2020, the following special (related only to this fossil) indicators are used:

- taking into account fluctuations in world prices and determined monthly by the Government of the Russian Federation or by independent calculation (clause 3 of Article 342 of the Tax Code of the Russian Federation);

- characterizing the degree of complexity of production and taking on a certain value depending on the specific characteristics of the deposit and the year of development (clauses 1, 2 of Article 342.2 of the Tax Code of the Russian Federation);

- reflecting the degree of depletion of the field; depending on the value of the previous coefficient, it can take either a specific value or become a calculated one (clauses 3, 6 of Article 342.2 of the Tax Code of the Russian Federation);

- characterizing the characteristics of oil production and calculated using a formula that includes several coefficients, both calculated and taking a certain digital value depending on the year of application (Article 342.5 of the Tax Code of the Russian Federation).

Deadlines for payments and reports on mineral extraction tax

The deadlines established for paying taxes and submitting reports on them are tied to the end of the tax period. Such a period is a month (Article 341 of the Tax Code of the Russian Federation). That is, you must pay tax and submit a tax return every month in the month following the reporting month.

The deadlines for this are defined in the Tax Code of the Russian Federation and correspond to:

- for payments - on the 25th (Article 344);

- for the report - the last day of the month (clause 2 of Article 345).

The established dates are subject to the general rule of transferring days that fall on weekends to the next weekday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Subject to the above, the expiration dates applicable to tax for the remainder of 2020 and in 2020 will be:

Payment and reporting period

Deadline for payment of mineral extraction tax in 2019-2020

Deadline for submitting the mineral extraction tax declaration in 2019-2020

Section updated October 3, 2020

| Calculation of 6-NDFL |

|

| Calculation 4-FSS | |

| Form SZV-M and form SZV-STAZH | 500 rub. for each person |

| Accounting reports | 200 rub. for each overdue or unsubmitted document |

| Statistical reports |

|

| The due date expired on February 28, 2020. |

Set due date

Actual date of submission of the declaration (calculation)

The amount of tax reflected in the declaration (calculation) and not paid within the period established by law

General tax provisions

Features of the application of federal tax, rates, benefits, deadlines for submitting mineral extraction tax in 2020 are regulated in Chapter 26 of the Tax Code of the Russian Federation.

In addition to the Tax Code of the Russian Federation, key conditions are presented in the Law of the Russian Federation of February 21, 1992 No. 2395-1 “On Subsoil”. According to these regulations, taxpayers are recognized as all economic entities that are officially recognized as users of subsoil. Moreover, companies located in Crimea and Sevastopol are also classified as taxpayers of mineral extraction tax.

The tax base is recognized as minerals that:

- mined in Russia;

- received outside the Russian Federation, in territories leased under international treaties (contracts, agreements);

- extracted from some type of waste, which are subject to separate licensing.

IMPORTANT!

The company is required to register within 30 calendar days from the date of receipt of official permission (license). In other words, the organization has one calendar month to register. Otherwise, penalties will be applied to the company.

Features of the application of legislative norms regarding the mineral extraction tax are in a separate material “MET”.

Composition of the mineral extraction tax declaration

The declaration consists of:

- title page;

- Section 1 “Amount of tax to be paid to the budget”;

- Section 2 “Data serving as the basis for the calculation and payment of tax for the production of dehydrated, desalted and stabilized oil, with the exception of production at a new offshore hydrocarbon field”;

- Section 3 “Data serving as the basis for the calculation and payment of tax for the production of combustible natural gas and gas condensate, with the exception of production at a new offshore hydrocarbon field”;

- Section 4 “Data serving as the basis for the calculation and payment of tax when extracting hydrocarbons from a new offshore hydrocarbon field”;

- section “Data serving as the basis for the calculation and payment of tax, with the exception of hydrocarbons (except associated gas) and coal”;

- Section 6 “Determination of the cost of a unit of extracted mineral resources based on the estimated cost.” It is included in the declaration only if the value of any mineral is assessed based on the estimated cost;

- Section 7 “Data serving as the basis for the calculation and payment of tax when mining coal on a subsoil site.” It must be filled out when calculating the amount of tax and using the tax deduction for coal mining by the payer. Otherwise, section 7 does not need to be included in the declaration.

MET: filling out the declaration

Let's talk about the main points of the procedure for filling out the mineral extraction tax declaration:

- The pages are numbered starting from the Title Page - it is assigned the number “00001” (clause 2.2 of the Procedure, approved by Order of the Federal Tax Service dated May 14, 2015 N ММВ-7-3/ [email protected] (hereinafter referred to as the Procedure)).

- The declaration must be filled out in black, blue or purple ink (clause 2.2 of the Procedure).

- The text fields of the declaration are filled in printed capital letters (clause 2.3 of the Procedure).

- Errors in the declaration cannot be corrected using a corrective or other similar means (clause 2.2 of the Procedure).

- You cannot print the declaration double-sided (clause 2.2 of the Procedure).

- Stapling declaration sheets, leading to damage to the paper, is unacceptable (clause 2.2 of the Procedure).

- If an organization/individual entrepreneur submits a primary declaration, then in the “Adjustment number” field you must indicate “0—”. When submitting the first updated declaration, “1—” is indicated, the second – “2—”, etc. (clause 2 clause 3.2 of the Procedure).

- On the title page you must indicate the code corresponding to the period for which the declaration is being submitted (clause 3, clause 3.2 of the Procedure):

| Period for which the mineral extraction tax declaration is submitted | Code corresponding to the period |

| For January | 01 |

| For February | 02 |

| For March | 03 |

| For April | 05 |

| For May | 05 |

| For June | 06 |

| For July | 07 |

| For August | 08 |

| For September | 09 |

| For October | 10 |

| For November | 11 |

| For December | 12 |

| For January during reorganization/liquidation of the organization | 71 |

| For February during reorganization/liquidation of the organization | 72 |

| For March during reorganization/liquidation of the organization | 72 |

| For April during reorganization/liquidation of the organization | 74 |

| For May during reorganization/liquidation of the organization | 75 |

| For June during reorganization/liquidation of the organization | 76 |

| For July during reorganization/liquidation of the organization | 77 |

| For August during the reorganization/liquidation of the organization | 78 |

| For September during reorganization/liquidation of the organization | 79 |

| For October during reorganization/liquidation of the organization | 80 |

| For November during reorganization/liquidation of the organization | 81 |

| For December during reorganization/liquidation of the organization | 82 |

You can learn more about the rules for filling out a mineral extraction tax declaration in the above-mentioned Procedure.

Where to take it

Taxpayers submit a declaration on the use of subsoil to the territorial offices of the tax inspectorate. Here's where to submit your mineral extraction tax declaration in 2020:

- for institutions that are large taxpayers (code 213 on the title page) - to the interdistrict tax office;

- for other taxpayers (code 214 on the title page) - to the Federal Tax Service at the place of registration;

- for foreign enterprises operating through Russian representative offices - at the place of operation.

A number of organizations enter into production sharing agreements. Participants in such an agreement are not provided with the opportunity to submit a mineral extraction tax declaration.