What bonuses are not subject to taxes?

Employers are required to charge income tax on employee bonuses and insurance premiums, because all remuneration - labor and non-productive - is the income of individuals and is subject to taxation on a general basis. For this reason, all incentive compensation is paid to employees minus personal income tax. Article 217, paragraph seven of the Tax Code of the Russian Federation provides for an exception. Income tax is not withheld from bonuses classified as budgetary:

- international;

- foreign;

- Russian national one.

Awarded for significant achievements in the field:

- Sciences;

- technology;

- education;

- culture;

- tourism;

- MASS MEDIA;

- literature and art.

The list of preferential bonuses is specified in the Decree of the Government of the Russian Federation dated February 6, 2001. Monetary rewards awarded by officials of constituent entities of the Russian Federation are not subject to income tax. At the regional level, a list of bonuses is compiled that are not subject to personal income tax.

Is the personal income tax premium in the amount of up to 4,000 rubles

The employer does not need to withhold personal income tax from the bonus if its amount is 4,000 rubles and two conditions are met:

- the entire amount is issued as a gift for the holiday;

- An agreement for donating funds to an employee has been drawn up and signed.

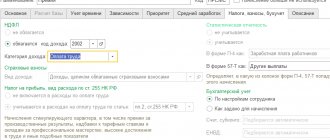

To avoid taxation, it is necessary to correctly display the remuneration in the reporting form 2-NDFL:

- the cash incentive paid is indicated by income code 2720 (gifts);

- code 501 (deductions from gifts) is entered next to the deduction amount, which is equal to the amount of the reward.

The procedure for calculating and withholding tax on personal income

When providing incentive compensation to employees, a legal entity or individual entrepreneur - agent has an obligation to calculate, withhold personal income tax from the bonus and transfer it to the budget. In 2020, there were changes in the procedure for paying income tax . There are differences in the calculation and withholding of personal income tax from labor bonuses and from non-production incentive payments.

Sources of bonus payments at the enterprise

A positive aspect of bonuses for employees is the ability to include the following as labor costs:

- the entire amount of incentive payments;

- insurance premiums accrued on remuneration.

It is not possible to reduce an organization’s profit by the amount of bonus payments and insurance contributions in accordance with the Tax Code in all cases. There are two options:

- Bonuses are given for labor achievements. The source of formation of such payments and accrued contributions is profit. It is worth taking care to document that incentive compensation is part of the remuneration system. The basis for calculation and the amount of payments must be specified in the employment contract and the Regulations on the bonus system.

- Non-production bonuses. According to the Tax Code, remuneration that is not related to the company's performance cannot increase its expenses. Payments made on grounds not prescribed in the employment contract do not reduce the profit tax base. Remunerations paid from targeted revenues or special funds cannot be included in expenses.

Tax rate

The tax rate depends on the status of the individual. For residents, the personal income tax withheld from the premium is 13%. The following options are available for non-residents:

- In the absence of special status, taxation is carried out at a rate of 30%.

- If you have a special status, the personal income tax on labor bonuses is 13%.

On a general basis - at a rate of 13%, the labor income of non-residents is taxed if they:

- carry out activities under a patent;

- are highly qualified specialists;

- are participants in the state program for resettlement in the Russian Federation;

- recognized as refugees from foreign countries;

- are members of the crews of ships that sail under the flags of the Russian Federation.

Payment deadlines

It is necessary to comply with the deadlines for paying personal income tax to the budget, because penalties will be applied in case of violation. According to the law, the withholding date is considered the day of actual payment of income, and funds must be transferred on the next business day. For non-payment or violation of the deadlines for transferring personal income tax, a fine is provided in the amount of 20 to 40% of the amount of arrears.

Accounting for bonuses

Barboy A. Ya. tax consultant, auditor, lecturer of professional seminars

As a rule, bonuses are the most effective tool for increasing employee motivation and thereby increasing their productivity. Therefore, employers willingly include this type of remuneration in their remuneration system and are willing to bear the additional costs associated with this. But not all types of bonuses can be included in expenses.

The right of employers to reward their employees is provided for in paragraph. 4 hours 1 tbsp. 22 Labor Code of the Russian Federation. However, this document does not define a specific list of types of incentive payments. So, in Art. 191 of the Labor Code of the Russian Federation lists only some types of incentives for employees who conscientiously perform their duties. Such payments include bonuses and gratitude; rewarding with a valuable gift or certificate of honor; The nomination for the title “Best in the Profession” has not been forgotten either. At the same time, there are other types of employee incentives that may be acceptable in each specific case. For example, these could be additional payments, bonuses, allowances for high qualifications, knowledge of foreign languages, length of service in the organization, etc. In a word, every employer has complete freedom in choosing incentive payments for their employees.

GOOD TO KNOW

The decision to pay a non-production bonus is made by the head of the organization.

Consequently, any payments of this nature can be established by an employment contract, collective agreement or other internal regulatory document. The most important thing is that these payments correspond to their intended purpose, helping to stimulate employees in terms of increasing their professionalism and conscientious attitude towards their duties, allowing employers to most effectively approach the attraction of the necessary highly qualified specialists, and minimizing staff turnover.

Let’s say right away that in practice, one of the most common aspects in organizing work on paying bonuses is documenting the reward system. In this case, the fundamental document is the Regulations on bonus payments to employees of the organization. This document refers to internal local regulations that establish the types of possible bonuses, the frequency and basis for their payment to employees and, of course, the calculation procedure.

GOOD TO KNOW

The possibility of paying non-production bonuses does not have to be reflected in the bonus regulations.

How to factor it into expenses?

An organization applying the simplified tax system, when paying bonuses to its employees, has the right to take them into account as expenses for tax purposes in accordance with paragraphs. 6 clause 1, clause 2 art. 346.16 Tax Code of the Russian Federation. Moreover, in paragraph 2 of Art. 255 of the Tax Code of the Russian Federation provides a list of some types of bonuses, which is open, which means that other remunerations can be taken into account on its basis. At the same time, it is important for tax purposes to take into account the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. In this regard, “simplified” companies must necessarily establish clear bonus conditions for each specific type of incentive. In addition, it is necessary to have documents confirming the actual fulfillment by employees of the organization of the conditions that require bonuses. Moreover, if a bonus is assigned and paid for production results, then for this the employer must fulfill a number of conditions. Let's name the main ones.

Firstly , it is necessary to develop an internal local regulatory document. Such a document may be the Regulations on bonuses or one of the clauses of the collective agreement. Bonus conditions can also be specified in the employment contract concluded with each employee upon hiring. In order to minimize claims from tax authorities, we recommend establishing the grounds for paying bonuses using indicators that can be realistically measured. For example, early fulfillment of the production plan, sales plan, overfulfillment of the scope of work with specific planned and actual indicators. It is important to avoid vague language. For example, such as “for high performance in work.” This document must also establish the sources of payment of the designated premiums, their sizes and calculation procedure.

Secondly , in accordance with Art. 252 of the Tax Code of the Russian Federation, documents confirming the employee’s fulfillment of the conditions for bonuses must be available. Such documents may include a memo or a petition with actual performance indicators of the employee, submitted by the immediate supervisor.

IMPORTANT IN WORK

If a bonus is awarded to employees on the occasion of a holiday, birthday, anniversary, etc., is one-time and non-productive in nature, then the costs of paying such a bonus should be classified as other expenses.

Thirdly , we should not forget about the list of expenses that are not accepted for tax purposes, which are named in Art. 270 Tax Code of the Russian Federation. This applies to bonuses paid to employees from net profits, special purpose funds and earmarked proceeds. In other words, even if the payment of such bonuses is provided for by the relevant internal local regulations, the organization still does not have the right to take them into account as expenses for tax purposes.

Fourthly , in order to generate a complete set of documents confirming the costs of assigning and paying bonuses, it is necessary to issue an appropriate order or instruction from the manager. To prepare this document, along with standard forms No. T-11 or No. T-11a (for bonuses for a group of employees), you can also use independently developed forms approved by the head of the organization.

IMPORTANT IN WORK

Premiums of a non-production nature are subject to insurance contributions for compulsory social insurance from NS and PZ.

Quite often, organizations also pay their employees bonuses based on work results for the calendar year - the so-called thirteenth salary. This bonus in its essence is also an incentive payment, since it is aimed at increasing the motivation of employees and encouraging them.

Based on the foregoing, we can conclude that, subject to the specified conditions, organizations using the simplified tax system have the right to take into account all types of production bonuses as part of their labor costs. In addition, in order to minimize the tax risks of the “simplified”, they must be economically justified and documented. Let us recall that in tax accounting under the simplified tax system such expenses are recognized in the reporting (tax) period when they were actually paid to employees (Article 347.17 of the Tax Code of the Russian Federation).

GOOD TO KNOW

Typically, bonuses are paid in cash in the month following the month in which they are accrued, often together with wages.

In what cases is a premium a guaranteed payment?

Thus, if the corresponding internal local regulatory document defines the regularity of bonus payment (once a month, quarterly, annually), then such a bonus is a guaranteed cash payment for employees. In this case, the employer does not have the right to evade such payment, since he voluntarily assumed such an obligation.

If in the above documents the condition for paying a bonus is formulated not as a direct obligation of the employer, but only mentions his right to accrue it in accordance with the organization’s remuneration system, then such wording relieves him of the obligation to regularly pay the bonus. Moreover, in case of payment, the execution of the corresponding order by the manager is also necessary.

As we can see, in order to avoid problems in the future, the employer should be extremely careful when drawing up not only an employment contract with an employee, but also other personnel documents. The following clause regarding bonuses can be stated in the employment contract:

GOOD TO KNOW

Any non-production bonuses, even if they are not provided for in the employment contract (or) collective agreement or local regulations, but are paid by order of the manager, are included in the base for calculating insurance premiums.

“Bonus payments to employees of Standard LLC are carried out in accordance with the current regulations on bonuses in the organization and in accordance with the order of the manager. Before concluding this agreement, the manager familiarizes the employee with the contents of this provision, with which the applicant expresses agreement with his signature.”

…..

The regulation on bonuses must have its own structure, determined by the employer, since there is no standard form for such a document. However, guided by established practice, we will point out certain mandatory points that are necessary in its content and that must be taken into account when compiling it. We will present the main recommendations for the preparation of this important document in a step-by-step format.

GOOD TO KNOW

Labor legislation directly provides for the payment of only bonuses for conscientious performance of labor duties.

Step 1. At this stage, the manager must establish to whom and for what to pay bonuses. In the regulations, it is desirable to show not only the maximum list of bonuses, but also the conditions for bonuses, indicate the categories of employees receiving bonuses, breaking them down by position or department. It is also necessary to indicate the types of bonuses: one-time (one-time) or periodic (monthly, quarterly, annual).

It would not be amiss to indicate in this document the conditions under which an employee can be deprived of a bonus. It is advisable to provide for appropriate document flow in this provision.

Step 2. At the second stage, you should decide on the amount of bonus payments. In this case, premiums can be either fixed or calculated with an established calculation algorithm. It is also advisable to stipulate in the regulations that the size of the bonus in each specific case is set by the head of the organization, defining its limit. For example, no more than the employee’s salary.

Step 3. Procedure for accounting for bonuses. At this stage, it is important to determine the period for paying bonuses, because when working on the simplified tax system, the organization uses the cash method of accounting for expenses in accordance with clause 2 of Art. 346.17 Tax Code of the Russian Federation.

Based on the foregoing, it is important to remember that bonuses reduce the tax base under the simplified tax system only if they are related to production results, since such a bonus is a component of wages. This is a requirement of Art. 255 of the Tax Code of the Russian Federation is mandatory for “simplified” residents on the basis of clause 2 of Art. 346.16 Tax Code of the Russian Federation.

GOOD TO KNOW

The types, sizes and other key points of the bonus procedure in an organization can be regulated by local regulations, for example, regulations on bonuses.

Bonus after dismissal

We consider it necessary to indicate that the bonus is paid only to those employees who are in an employment relationship at the time the bonus is awarded. The employer has every right to do this. This means that the organization has the right not to pay bonuses to resigned employees. Such a condition, prescribed in the relevant internal local regulatory act, cannot be considered as infringing on the rights of employees.

If desired, the employer can also do otherwise, i.e., pay bonuses to resigned employees, and establish as the basis for paying the bonus that at the time the bonus is calculated, the employment relationship is considered to be ongoing.

POSITION OF THE MINISTRY OF FINANCE

A reference in an employment contract to the employer’s local regulations means that the corresponding payments are provided for in the contract.

Employees, having become familiar with this condition by signing an employment contract or having read the relevant internal local regulations of the employer, have the right to decide on the beginning (continuation) or termination of employment relations with this employer. If they disagree with the decision made by the employer and quit early, before the bonus is calculated, they thereby agree with not receiving it, without even confirming their opinion with a signature.

Example from practice.

Excerpt from the Regulations on bonuses approved by the General Director of Standard LLC: “The bonus is provided for an employee who has worked in the organization for more than one month in the reporting year.” The employee quit before the order was issued to pay the bonus under clause 3 of Art. 77 of the Labor Code of the Russian Federation on an application for dismissal (at one’s own request).

A dispute arose between the manager and the employee, the decision of which was made in court. The court took into account the fact that at the time of issuing the order to pay the bonus for 2013, there were no labor relations between the parties, which gave grounds for the court to make a decision not in favor of the resigned employee.

GOOD TO KNOW

The wage relationship can be considered established if, from the terms of the employment contract, it is possible to reliably determine what amount of wages is due to him for the amount of work actually performed.

Bonus by decision of the director

It often happens in practice that the decision on bonuses is made by the general director based on his subjective judgments. In addition, these payments are sometimes not supported by any calculations. In this case, for the purpose of taxation by the simplified tax system, these payments are not accepted, because they are unfounded, not documented, and therefore do not satisfy paragraph 1 of Art. 252, Art. 255, 346.16 of the Tax Code of the Russian Federation, even if they are of a production nature.

ORIGINAL SOURCE

Labor costs include incentive accruals, including bonuses for production results, bonuses to tariff rates and salaries for professional excellence, high achievements in work and other similar indicators.

Clause 2 of Art. 255 Tax Code of the Russian Federation.

Awards for the holiday

The question immediately arises: is it possible for “simplified” tax purposes to include as expenses bonuses to employees of an organization paid in connection with professional holidays, significant dates, personal anniversaries, as well as incentives for employees for success in sports, etc.? According to financiers and regulatory authorities, these bonuses cannot be classified as expenses for tax purposes, because these payments do not depend on the results of the work performed (see letters of the Ministry of Finance of Russia dated November 22, 2012 No. 03-04-06/6-329, dated May 28. 2012 No. 03-03-06/1/281, dated 04/23/2012 No. 03-03-06/2/42). The arbitrators also accept the position of financiers and regulatory authorities and indicate that such payments are not related to specific results of work and are one-time in nature, and therefore cannot be taken into account as expenses (Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 2, 2012 No. A74-2038 /201).

- Back

- Forward

How is tax on employee bonuses reflected in reporting?

The procedure for including bonus income depends on its type. The following nuances must be taken into account:

- The date of receipt of monthly incentive payments is considered to be the last day of the month for which the employee received bonuses.

- Quarterly and annual bonuses are included on the last day of the month in which the order is issued.

- Non-productive income paid on holidays, anniversaries, and professional holidays must be taken into account on the day of actual payment.

This is important to know: 2 personal income tax 2020: sample filling out for employees using the new form

Form 2-NDFL

A certificate in form 2-NDFL contains data on the income of an individual for the reporting period. It includes the following sections:

- Agent details.

- Information about the individual.

- The amount of income for the month and the corresponding code are entered line by line. Production bonus payments are accounted for under code 2002, and non-production bonuses are recorded separately under code 2003. They are displayed for the month in which the employee received income.

- Social, standard, property, investment deductions. The appropriate fields are filled in if the individual has such grounds.

- The total amount of income paid: accrued, withheld, transferred by personal income tax (the last figures must be the same).

Help on form 6-NDFL

This type of reporting is intended to display the total amounts of income paid, withheld from them and transferred to personal income tax. Help contains topics:

- The first section contains generalized data on income (column 020), personal income tax (column 040), which are displayed on an accrual basis for the reporting period. Column 060 indicates the total number of individuals who received payments.

- The second section provides data on the amount of income paid and personal income tax withheld by date.

Monthly bonuses that the employee received along with his salary are displayed as a single block with salary income. In all other cases they are shown as a separate block. In the second section on bonus payments, fill in the following columns:

- 100 – indicates the last day of the month for which the monthly premium is accrued; the last day of the month in which the order to assign a quarterly or annual bonus was issued; date of issue of non-production cash incentives;

- 110 – date of actual payment of remuneration and withholding of personal income tax;

- 120 – date of tax transfer, the next business day after the date of receipt of payment;

- 130 – amount of incentive compensation paid;

- 140 – the amount of personal income tax withheld and transferred.

Deadline for transferring personal income tax from the annual bonus

How to reflect the bonus paid in the year in 6-NDFL? See how filling out 6-NDFL affects the type, timing and frequency of payment of bonuses. And also download detailed examples of filling out 6-NDFL for different types of payments - one-time, quarterly and annual bonuses. Activate trial access to the RNA magazine or subscribe at a discount. All bonuses in the year are divided into production and non-production. Production bonuses are bonuses that are related to the results of an employee’s work for a certain period of time, a month, a quarter, a year, or any other period determined by the employer.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

WATCH THE VIDEO ON THE TOPIC: On what income can you NOT pay taxes?

Sample payment slip for payment of personal income tax on premiums

But for the payment of personal income tax on a bonus in 2020, the income code depends on the situation in which it is paid. In our example, the bonus was paid at the end of the year, which means for the production result, which corresponds to code 2000 (remuneration for performing job duties).

The calculation of personal income tax on one-time production bonuses, in turn, depends on the period for which they are accrued. It could be:

- month;

- quarter;

- year;

- upon the occurrence of a specific event (for example, a one-time bonus for the successful completion of a project). One-time production bonuses paid upon the occurrence of a specific event should be included in the personal income tax tax base at the time of payment to the employee (subclause

1 clause 1 art. 223 of the Tax Code of the Russian Federation).

How to reflect the bonus in the calculation of 6 personal income taxes in 2020

How to reflect the bonus paid in the year in 6-NDFL? See how filling out 6-NDFL affects the type, timing and frequency of payment of bonuses.

And also download detailed examples of filling out 6-NDFL for different types of payments - one-time, quarterly and annual bonuses. Activate trial access to the RNA magazine or subscribe at a discount. All bonuses in the year are divided into production and non-production. Production bonuses are bonuses that are related to the results of an employee’s work for a certain period of time, a month, a quarter, a year, or any other period determined by the employer. Non-production bonuses are bonuses that are paid at the discretion of the company, for example, for holidays or anniversaries.

However, these terms are not strictly established and the employer has the right to choose other periods for which bonuses are calculated. An employee is required to pay personal income tax for each bonus, regardless of whether it is based on production or non-production. And since in 6-NDFL the accountant shows all payments from which tax is calculated and withheld, any bonus will be included in the report. Such payments must be reflected in section 2, so below we will consider the procedure for filling out only this section.

The rest of these forms are filled out as usual, regardless of whether there are incentive payments or not. Let's look at the filling procedure in detail, and then look at examples for each individual case. If the production bonus is monthly, then the date of actual receipt of income will be the last day of the month. For example, for May of the year - In this case, the procedure for filling out section 2 of form 6-NDFL will be similar to the procedure for filling out the same section for payment of wages.

Moreover, if the dates of payment of salaries and bonuses coincide, then these amounts do not need to be separated: indicate information on them in the lines - using single indicators:. If the salary and bonus payment dates are different, you will have to separate the data. In this case, the monthly bonus should be reflected in section 2 of form 6-NDFL as follows: Below we will look at a detailed example with a sample of filling out 6-NDFL in case of payment of monthly bonuses.

For quarterly and annual bonuses, the same rules apply for reflecting them in section 2 of the form. The company may also provide one-time production incentive payments, for example, for the performance of certain work by an employee.

In this case, the order of filling out section 2 will be as follows:. There are incentive payments that are not related to the employee’s work duties, for example, holidays or anniversaries.

In this case, the report must be completed after the fact, regardless of the date of the manager’s order: Next, we will look at detailed examples of filling out section 2 of form 6-NDFL when paying different types of bonuses. The payment deadline is the 10th of every month. The salary and bonus were paid together on June 10 of the year. The tax is transferred on June 11. The salary payment deadline is the 10th of each month. The deadline for bonus payment is the 15th of each month. The salary was paid on June 10, personal income tax was transferred on June 11. The bonus was paid on June 14, since June 15 is a day off, personal income tax was transferred on June 17 of the year.

The bonus was paid on April 23 of the year. The tax was withheld on the same day and transferred to the budget on April 24 of the year. This premium will be reflected in form 6-NFDL for the 2nd quarter of the year and section 2 in this case will be filled out in the following order:.

This is important to know: Deadline for submitting 6 personal income tax

The bonus was paid on March 20 of the year. The tax was withheld on the same day and transferred to the budget on March 21 of the year. The tax was withheld on June 18 of the year and transferred to the budget on June 19 of the year. The date of payment of the bonus is June 5 of the year, the tax is withheld on the same day, transferred to the budget on June 6 of the year. This is possible due to the fact that the date of accrual of the monthly bonus and salary coincides - the last day of the corresponding month, and when these amounts are paid on the same day, other dates reflected in section 2 of form 6-NFDL also coincide.

See Example 1 above in this article for more details. When paying other types of bonuses, production and non-production, it will not be possible to reflect the bonus and salary as a single amount, even if they were paid on the same day: the dates of actual receipt of income will differ.

The difference in at least one date provides grounds for filling out a separate block of lines. If the monthly bonus is paid separately from wages on another day, then it must be reflected in a separate block of data.

For more information on the procedure for filling out section 2 in this case, see example 2 of this article. All other bonuses are shown in a separate block from the salary data in section 2 of form 6-NFDL, regardless of the date of payment of such a bonus. This is due to the fact that the date of actual receipt of income for any bonus other than a monthly one will be the payment date, and for wages this date is the last day of the corresponding month. Personal income tax on bonuses must be withheld by the employer in the usual manner - at the time of actual payment and transferred to the budget no later than the next working day.

Recommendations on the topic. Articles on the topic. Sample of filling out 6-NDFL for the 2nd quarter of the year. Filling out 6-NDFL for the 1st quarter of the year - sample. Line in 6-NDFL: filling out in the year.

News on the topic. Accountants face a new fine for 6-NDFL. How to correctly reflect non-taxable payments in the calculation of contributions. Questions on the topic. How to reflect income received in kind in the calculation of 6-NDFL. What is the statute of limitations for bringing liability for late filing of 6-NDFL.

How to fill out 6-NDFL if an employee is fired and a settlement has been made with him. Filling out section 1 of the 6-NDFL calculation. How to fill out 6-NDFL if during the reporting period an employee went on vacation and received an advance payment that was more than the salary for the time actually worked.

Your colleagues are now reading: Classifier of fixed assets by depreciation groups Fuel consumption standards for the year Ministry of Transport of the Russian Federation, latest edition Accounting policies for the year download a free sample for OSNO minimum wage from January 1 of the year in Russia table by region Profit tax rate per year for legal entities.

Legal basis. Tax Code Civil Code. Poll of the week. Do you conduct an annual inventory? No, this is an unnecessary procedure. No, there is not enough time for this. Partner products and services. E-mail address.

I give my consent to the processing of my personal data. Subscribe to us on VKontakte. Official representatives Feedback Advertisers. Personal data processing policy. We are in social networks. Register or log in via social media. I have a password. Password has been sent to your email Enter. Enter email Wrong login or password. Incorrect password. Enter password.

This is my first time here. Please register on the site and download the file! They allow you to get to know you and receive information about your user experience. This is necessary to improve the site. By visiting the site and providing your information, you allow us to provide it to third party partners. If you agree, continue to use the site.

If not, set special settings in your browser or contact technical support. The last day of the month for which the bonus is accrued. Payment date. No later than the next business day.

Reflection of the bonus in personal income tax

When filling out reporting documents, you should take into account the types of bonuses that were paid to the employee, the period of their accrual, as well as some nuances that distinguish the following features of bonuses:

- a one-time payment cannot be defined by the concept (wages), since this type is not systematic and refers to non-labor incentives; in the 2-NDFL certificate it is reflected in a separate code, as a payment made from the profit of the organization or revenues of a targeted nature.

In 6-NDFL it should be written as a separate block from the salary, and the date of tax withdrawal must coincide with the date of direct payment of the bonus or dated the next day after the money is transferred to the person, but no later - order of the Federal Tax Service of the Russian Federation MMV-7-11/450 (more on that , how to reflect the bonus in 6-NDFL separately from the salary, read in a separate material). - In the middle of the month - in certificate 2 it is written with a code based on the direction of the payment and its relation to wages; in calculation 6 it is recorded in the same way as a one-time payment, that is, taking into account the date of payment.

- The monthly bonus is a systematic payment and is fixed in the employment agreement in the form of a monthly bonus payment, therefore it is classified as wages and is written in 2-NDFL under a code that corresponds to payments from the main accounts, not the target ones.

Important! In 6-NDFL it does not need to be written in a separate block (it is written together with the salary); such a bonus is dated, like the salary, on the date of the last working day of the month.When entering salary into calculation 6, the date of salary payment and tax calculation is considered to be the last day of the month, because according to the law, taxes are not calculated from an advance payment, the same rule applies to the monthly bonus.

- At the end of the month - it is reflected in the reporting documents, depending on the direction of payment, because such a bonus can be either monthly (being remuneration), or one-time or periodic (for special merits, etc.), therefore it is recorded in certificate 2 with a code corresponding to the purpose of the money paid.

In calculation 6, if the bonus received at the end of the month is monthly and is included in wages, it is recorded and deducted in trade union organizations no later than the last day of the month (along with the salary).And if this incentive is not included in the payment of labor under an employment contract, then the procedure is prescribed in a separate block, and it is fixed if you transfer personal income tax when the payment of money is withheld, on the same day we record the deduction of the tax and the next day (no later) we record the date of transfer of the tax to budget.

- The annual and quarterly bonus is included in the report in accordance with the nuances provided for by the letter of the Federal Tax Service dated January 24, 2017 No. BS-4-11/1139; here, when filling out 2-NDFL, the same code is used as for the monthly bonus.

Workers employed under an employment contract receive not only a salary, but also bonuses. However, here there is an interaction between labor and tax laws. Read our articles about whether such incentives are taxable, as well as how director bonuses are paid and what documents are needed for this.

The annual bonus in 6-NDFL is indicated as actually received on the day of its payment

Calculate employee benefits online. In practice, the question may arise - when to pay personal income tax on bonuses in the year. You will find the answer to this popular question below in the article. Regardless of the taxation system that the organization uses, personal income tax subp. This rule applies regardless of whether the bonus is provided for in the employment contract or not. Premium tax must be withheld when paying income sub. The answer to this question is below. Personal income tax must be transferred no later than the next business day after payment of income.

How to withhold personal income tax from quarterly and annual bonuses, according to tax authorities

A question immediately arises here. Monthly bonuses are usually calculated and paid along with your salary. That is, employees receive them after the expiration of the billing period, when income has already been accrued.

But the bonus for a longer period can be paid in the month when the order is issued. For example, company management may decide to pay an annual bonus on March 1 of the following year and actually pay it on March 10.

If in this case we are guided by the position of the tax authorities, at the time of payment of the bonus the employees had not yet received income from the point of view of calculating personal income tax. Therefore, the organization has no reason to withhold income tax on the date of issuing incentives to employees.

In unofficial explanations, Federal Tax Service specialists said that in this case the premium must be paid in full without tax withholding. In this case, the “premium” personal income tax should be withheld from the first payment of the next month - from the salary.

Thus, in the case discussed above, personal income tax on bonuses accrued to employees at the end of the year must be withheld in April, on the date of payment of salaries for March, and transferred to the budget on the day following salary.

What the Ministry of Finance thinks about this and when, in the end, it is necessary to withhold income tax from incentive payments, we will consider in the next section.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

How to correctly reflect a one-time bonus in 6-NDFL (nuances)?

Many companies, after summing up the financial results of the year, decide to pay bonuses to employees for production results. We will tell you how such a payment is reflected for tax purposes, as well as what points an accountant should pay special attention to. Bonus systems in the company are established by collective agreements, agreements, local regulations of the organization Art. At the same time, the bonus payment system adopted by the company should provide for the payment of bonuses to a certain circle of people based on pre-established specific indicators and bonus conditions.

There are different types of awards

Thus, a bonus to an employee can be defined as an incentive payment. She can:

- enter the wage system (Article 135 of the Labor Code of the Russian Federation);

- not be part of the wage system (Article 191 of the Labor Code of the Russian Federation) - indeed, incentives for work and remuneration for this work are two different things.

In order for bonuses to be considered payments included in the remuneration system, they must be provided for by relevant documents - collective agreements, agreements, local regulations (for example, Regulations on bonuses), an employment contract with the employee - or at least an employment contract agreement (Article 57 of the Labor Code of the Russian Federation).

Bonuses not included in this system (incentive payments) are usually timed to coincide with some date or event: the birthday of the employee, the company, February 23; the completion of a significant project, etc. Such bonuses must be documented by local regulations of the company - as a rule, by orders of the manager.

Bonus and personal income tax: when to calculate and pay

Personal income tax on a monthly bonus paid after the end of the month for which it was accrued must be paid to the budget no later than the day following the day of payment. Source: Letter from the Ministry of Finance from The fact is that the date of actual receipt of income in the form of monthly bonuses, which are an integral part of remuneration and paid in accordance with the employment contract and the remuneration system adopted by the company, is determined in the same manner as for the payment of wages. Accordingly, in the case when a bonus for March of the year is paid, for example, A must transfer personal income tax from the bonus amount no later than Please note that if the bonus is paid based on the results of the quarter or year, then the date of its actual receipt is considered the day of its payment. Used for salary indexation.

This is important to know: What is the difference between VAT and personal income tax: example

How to correctly calculate the date of personal income tax withholding?

The calculation of the tax date on the premium directly depends on its type and the principle of payment. If this incentive is money of a systematic nature, as specified in the labor contract, then the date of actual payment and withholding of personal income tax will be considered the last day of the month, and the day of crediting the money to the state budget will be fixed as the next one.

When to withhold personal income tax from the premium? If the bonus payment is of an anniversary, holiday nature, or is paid for certain merits of the employee, then the dates of actual receipt and withholding of tax will be considered the day when the money arrived in the person’s account (for cases where the bonus was transferred to a bank account).

Reference! If the financial award is given in cash, then the day of actual receipt and deduction of the tax will be the date when the cash was taken from the bank, and the date of entry into the state budget should be fixed the next day after the person received the bonus (in both cases).

Annual or quarterly incentives, as already described above, are dated differently: the date of actual receipt should be written as the last day of the month in which the person received the bonus; the date of deduction of personal income tax should be considered the number indicated in the order for calculating the bonus as the date of payment, and the day of transfer to the budget will be the next number.