From January 1, 2020, new innovations awaited us. The changes affected mainly labor legislation. But the innovations also affected drivers, people with disabilities, fish workers, pensioners and traders.

- Salary will be higher

- What awaits pensioners

- Innovations in concluding employment contracts

- Transfer of days off

- Migrants

- Vacation

- Clinical examination

- What other changes await employers and employees?

- Other changes

Fish lag

- Drivers

- Food embargo

- Consumers

- Disabled people

- Pensioners

Raising the minimum wage

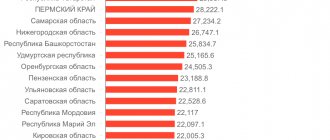

From May 1, 2020, the minimum wage was 11,163 rubles. In the current period, it increased by 1.05% and, therefore, now its value is 11,280 rubles. According to current legislation, the minimum wage should be equal to the subsistence minimum.

It is noteworthy that the administration of each region has the right to independently decide what the minimum wage will be. However, it cannot be less than the volume established at the federal level.

https://youtu.be/lcIHc8juYmU

New codes for salary slips are being introduced

New codes are being introduced for field 20 salary slips. Not filled in. To be filled out from June 1, 2020. Here it is clarified whether deductions can be made from this payment according to enforcement documents, taking into account the requirements of the legislation on enforcement proceedings. There are 2 code values:· 1 – deductions are possible, but only subject to restrictions. These are salaries, vacation pay, author rewards, etc.

· 2 – deductions are not allowed. These are the amounts of travel allowances, benefits and other payments according to stat. 99 No. 229-FZ dated 02.10.07

Draft instructions of the Central BankSalary will be higher

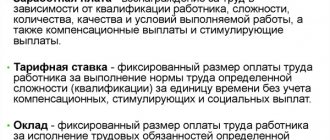

Since now an employee’s salary cannot be less than the subsistence minimum, personnel and accounting workers received an order to recalculate workers’ salaries. They must adjust the salaries of each employee and, if necessary, enter into additional contracts.

Don’t forget about the annual indexation of wages. The increase in the minimum wage also affects social contributions: sick leave, child and maternity benefits.

https://youtu.be/btGu74GMsa8

Reference! The calculation of new payments will now be made according to the new minimum wage indicators.

Child benefits will change

The period for payment of benefits for children (first and second) who were born after 01/01/2018 has been increased. Such benefits are assigned to parents until the children reach the age of 1.5 years. A mandatory condition for the issuance of funds is that the average family income (per person) should not be higher than 1.5 times the subsistence level for able-bodied citizens in the corresponding region. The indicator is taken for 2 quarters. previous year. And the amount of the benefit = the cost of living for children for the same period. Such benefits are assigned to parents until the children reach the age of 3 years. A mandatory condition for the issuance of funds is that the average family income (per person) should not be higher than 2 times the subsistence level for able-bodied citizens in the corresponding region.The indicator is taken for 2 quarters. previous year. And the amount of the benefit = the cost of living for children for the same period No. 305-FZ dated 08/02/19.

What awaits pensioners

From January 1, 2020, innovations in Russia will also affect pensioners. So, what awaits them:

- Gradual increase in non-working age. Growth will only end in 2023. Then the retirement age for men will be 65 years, for women - 60 years.

- Until the end of this time, the calculation of pension payments will be slightly different - not based on points, as in the past, but based on the amount of salary. It is planned that the pension amount will be 40% of wages.

- Thanks to indexation, the current values of pension payments will increase. According to plans, the increase will be 3%. In addition, indexation is also planned for April, provided that the federal pension fund has enough funds for this.

We would like to note that such innovations will affect only those pensioners who are not additionally employed anywhere. Changes to subsidies for working citizens are still under consideration.

Benefits

New regions in the FSS pilot project

Base:

| As it was | How did it happen | Pros/Cons | Expert commentary |

| In the regions that are included in the pilot project of the FSS of the Russian Federation, payments of sick leave, children's and other benefits are carried out directly by the territorial branches of the FSS. | From January 1, 2020, the FSS pilot project will expand to include the following regions:

| Pros. Authentication, no need to be reimbursed, the employer does not “credit” the Social Insurance Fund. Minuses. The process of interaction with the Social Insurance Fund is becoming more complicated, the time for “processing” sick leave and submitting data to the Social Insurance Fund is being reduced. | Let us remind you that in the pilot regions, workers receive social benefits directly from the Social Insurance Fund, and employers only prepare documents for benefits. If a region participates in a pilot project, the policyholder submits special documents to the Social Insurance Fund units depending on the type of benefit and other payments. |

Benefits can only be transferred to the Mir card

Base:

| As it was | How did it happen | Pros/Cons | Expert commentary |

| From May 1, 2019, all employers must pay benefits to the MIR card. This applies not only to government agencies, but to all employers: commercial and non-profit, organizations and individual entrepreneurs. | The list of payments that, in addition to those named in Federal Law No. 161-FZ of June 27, 2011, are required to be controlled by banks, should be transferred to the Mir card:

| Other payment options remain unchanged: cash at the cash desk, sending by mail, transfer to a “cardless” bank account. Recipients of payments will need to issue Mir cards before 07/01/2020 if they plan to receive benefits on a bank card | If on May 1, 2020, an employee received child benefits on a card of a payment system other than Mir, then nothing could be reissued until the card expired, but no later than July 1, 2020. And from this date, benefits can be transferred to the card only if it is a “Mir” card. |

The 50-ruble allowance for child care under three years of age is cancelled.

Base:

| As it was | How did it happen | Pros/Cons | Expert commentary |

| Presidential decree of 1994, according to which an allowance of 50 rubles is now paid. per month will become invalid. | Starting next year, employers will no longer be required to provide employees with compensation for caring for a child under three years of age (except in cases where the child was born before January 1, 2020). | Pros. The employer has less red tape with the preparation of personnel documents and the number of payments. There are no costs for transferring these amounts. | This does not apply to previously assigned benefits . They must continue to be paid after January 1, 2020 until the child reaches 3 years of age. |

Transfer of days off

According to the production calendar, due to the postponements, there will be more days off. The calendar of holidays, weekends and shortened days is given in the table below.

| Name of the month | Holidays | Weekend | Shortened days |

| January | 1, 2 | 2, 3, 4, 5, 6, 7, 8, 12, 13, 19, 20, 26, 27 | — |

| February | 23 | 2, 3, 9, 10, 16, 17, 24 | 22 |

| March | 8 | 2, 3, 9, 10, 16, 17, 23, 24, 30, 31 | 7 |

| April | — | 6, 7, 13, 14, 20, 21, 27, 28 | 30 |

| May | 1, 9 | 4, 5, 11. 12, 18, 19, 25, 26 | 8 |

| June | 12 | 1, 2, 8, 9, 15, 16, 22, 23, 29, 30 | 11 |

| July | — | 6, 7, 13, 14, 20, 21, 27, 28 | — |

| August | — | 3, 4, 10, 11, 17, 18, 24, 25, 31 | — |

| September | — | 1, 7, 8, 14, 15, 21, 22, 28, 29 | — |

| October | — | 5, 6, 12, 13, 19, 20, 26, 27 | — |

| November | 4 | 2, 3, 9, 10, 16, 17, 23, 24, 30 | — |

| December | — | 1, 7, 8, 14, 15, 21, 22, 28, 29 | 31 |

Changes in the labor code - what's new

Author: Eputaev Yan, head of personnel services

HR-Portal

Recently adopted changes to the Labor Code* have forced us to take a fresh look at this document. There are a lot of changes. In this article, we tried to highlight the most significant amendments to the labor code.

About part-time drivers

Old edition:

Article 329 . Working time and rest time for employees whose work is directly related to the movement of vehicles

Employees whose work is directly related to the movement of vehicles are not allowed to work beyond the established working hours for them in a profession or position directly related to the movement of vehicles, as well as work under harmful and (or) dangerous working conditions. The list of professions (positions) and work directly related to the movement of vehicles is approved in the manner established by the Government of the Russian Federation.

Features of the regime of working time and rest time, working conditions of certain categories of workers, whose work is directly related to the movement of vehicles, are established by the federal body

executive power in the field of the relevant type of transport. These features cannot worsen the situation of workers in comparison with those established by this Code.

New edition:

part one should be stated as follows:

“Employees whose work is directly related to driving vehicles or controlling the movement of vehicles are not allowed to work part-time, directly related to driving vehicles or controlling the movement of vehicles. The list of jobs, professions, positions directly related to driving vehicles or controlling the movement of vehicles is approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.”

Now the employee must sign the employer’s contract, confirming that he received his copy of the contract

Old edition:

Article 67 . Employment contract form

The employment contract is concluded in writing, drawn up in two copies, each of which is signed by the parties. One copy of the employment contract is given to the employee, the other is kept by the employer.

<<…>>

New edition:

in article 67 :

part one should be supplemented with the following sentence: “The receipt by the employee of a copy of the employment contract must be confirmed by the employee’s signature on the copy of the employment contract kept by the employer.”

Now, before signing an employment contract, the employer is obliged to familiarize the future employee with PVTR, etc.

Old edition:

When hiring, the employer is obliged to familiarize the employee with the internal labor regulations in force in the organization, other local regulations related to the employee’s labor function, and the collective agreement.

New edition:

Part three should be stated as follows:

“When hiring (before signing an employment contract), the employer is obliged to familiarize the employee, against signature, with the internal labor regulations, other local regulations directly related to the employee’s work activity, and the collective agreement.”

About dismissal

Was:

Article 81 . Termination of an employment contract at the initiative of the employer

An employment contract can be terminated by the employer in the following cases:

1) liquidation of the organization or termination of activities by the employer - an individual;

2) reduction in the number or staff of the organization’s employees;

3) the employee’s inconsistency with the position held or the work performed due to:

a) health status in accordance with a medical report;

b) insufficient qualifications confirmed by certification results;

4) change of owner of the organization’s property (in relation to the head of the organization, his deputies and the chief accountant);

5) repeated failure by an employee to perform labor duties without good reason, if he has a disciplinary sanction;

6) a single gross violation by an employee of labor duties:

a) absenteeism (absence from the workplace without good reason for more than four hours in a row during the working day);

b) appearing at work in a state of alcohol, drug or other toxic intoxication;

c) disclosure of secrets protected by law (state, commercial, official and other) that became known to the employee in connection with the performance of his job duties;

d) committing at the place of work theft (including small) of someone else's property, embezzlement, intentional destruction or damage, established by a court verdict that has entered into legal force or a resolution of the body authorized to apply administrative penalties;

e) violation by an employee of labor protection requirements, if this violation entailed serious consequences (work accident, accident, catastrophe) or knowingly created a real threat of such consequences;

7) commission of guilty actions by an employee directly servicing monetary or commodity assets, if these actions give rise to a loss of confidence in him by the employer;

the commission by an employee performing educational functions of an immoral offense incompatible with the continuation of this work;

the commission by an employee performing educational functions of an immoral offense incompatible with the continuation of this work;

9) making an unjustified decision by the head of the organization (branch, representative office), his deputies and the chief accountant, which entailed a violation of the safety of property, its unlawful use or other damage to the property of the organization;

10) a single gross violation by the head of the organization (branch, representative office), his deputies of their labor duties;

11) the employee submits forged documents or knowingly false information to the employer when concluding an employment contract;

12) termination of access to state secrets if the work performed requires access to state secrets;

13) provided for in the employment contract with the head of the organization, members of the collegial executive body of the organization;

14) in other cases established by this Code and other federal laws.

Dismissal on the grounds specified in paragraphs 2 and 3 of this article is permitted if it is impossible to transfer the employee with his consent to another job.

It is not allowed to dismiss an employee at the initiative of the employer (except in the case of liquidation of the organization or termination of activities by the employer - an individual) during the period of his temporary incapacity for work and while on vacation.

In the event of termination of the activities of a branch, representative office or other separate structural unit of an organization located in another locality, the termination of employment contracts with employees of these structural units is carried out according to the rules provided for cases of liquidation of the organization.

It became :

81) in article 81:

in part one:

in paragraph 1, the words “employer - individual” should be replaced with the words “individual entrepreneur”;

paragraph 2 should be supplemented with the words “individual entrepreneur”;

paragraph 3 should be stated as follows:

“3) the employee’s inconsistency with the position held or the work performed due to insufficient qualifications confirmed by certification results;”;

in paragraph 6:

in subparagraph “a” the words “(absence from the workplace without good reason for more than four hours in a row during the working day)” should be replaced with the words “, that is, absence from the workplace without good reason during the entire working day (shift) regardless of its ( its) duration, as well as in case of absence from the workplace without good reason for more than four hours in a row during a working day (shift)”;

subparagraph “b” should be stated as follows:

“b) the appearance of an employee at work (at his workplace or on the territory of an organization - employer or facility where, on behalf of the employer, the employee must perform a labor function) in a state of alcohol, narcotic or other toxic intoxication;";

subparagraph “c” should be supplemented with the words “including disclosure of personal data of another employee” (for us HR officers if we go to sell an employee); in subparagraph “d” the words “body authorized to apply administrative penalties” should be replaced with the words “judge, body, official authorized to consider cases of administrative offenses”;

in subparagraph “d” the words “violation of safety requirements by an employee” should be replaced with the words “violation of safety requirements by an employee established by the labor protection commission or the labor protection commissioner”;

in paragraph 11 the words “or knowingly false information” should be deleted;

paragraph 12 is declared invalid;

Parts two – four should be stated as follows:

“The procedure for certification (clause 3 of part one of this article) is established by labor legislation and other regulatory legal acts containing labor law norms, local regulations adopted taking into account the opinion of the representative body of workers.

Dismissal on the grounds provided for in paragraph 2 or 3 of part one of this article is permitted if it is impossible to transfer the employee with his written consent to another job available to the employer (both a vacant position or work corresponding to the employee’s qualifications, and a vacant lower position or lower-paid job) which the employee can perform taking into account his state of health. In this case, the employer is obliged to offer the employee all vacancies available in the given area that meet the specified requirements. The employer is obliged to offer vacancies in other localities if this is provided for by the collective agreement, agreements, or employment contract.

In the event of termination of the activities of a branch, representative office or other separate structural unit of an organization located in another locality, termination of employment contracts with employees of this unit is carried out according to the rules provided for cases of liquidation of the organization.”;

add parts five and six as follows:

“Dismissal of an employee on the grounds provided for in paragraph 7 or 8 of part one of this article, in cases where guilty actions giving grounds for loss of confidence, or, accordingly, an immoral offense were committed by the employee outside the place of work or at the place of work, but not in connection with his performance labor duties is not allowed later than one year from the date of discovery of the misconduct by the employer.

It is not allowed to dismiss an employee at the initiative of the employer (except in the case of liquidation of an organization or termination of activities by an individual entrepreneur) during the period of his temporary incapacity for work and while on vacation.”

The Labor Code established the need to pay piece workers extra for work on non-working holidays

New edition:

in article 112 :

Parts three and four should be stated as follows:

“Employees, with the exception of employees receiving a salary (official salary), are paid additional remuneration for non-working holidays on which they were not involved in work. The amount and procedure for payment of the specified remuneration are determined by the collective agreement, agreements, local regulations adopted taking into account the opinion of the elected body of the primary trade union organization, and an employment contract. Amounts of expenses for the payment of additional remuneration for non-working holidays are included in the full amount of labor costs.

The presence of non-working holidays in a calendar month is not a basis for reducing wages for employees receiving a salary (official salary).”;

part five should be supplemented with the following sentences: “In this case, the regulatory legal act of the Government of the Russian Federation on the transfer of days off to other days in the next calendar year is subject to official publication no later than a month before the start of the corresponding calendar year. The adoption of normative legal acts on the transfer of days off to other days during the calendar year is permitted subject to the official publication of these acts no later than two months before the calendar date of the established day off.”

If you did not pay the employee for vacation on time or did not warn him, then he has the right to demand a postponement of vacation

Old edition:

Article 124 . Extension or transfer of annual paid leave

part two:

Annual paid leave by agreement between the employee and the employer is postponed to another period if the employee was not paid in a timely manner during this leave or the employee was notified about the start time of the leave later than two weeks before it began.

New edition:

part two should be stated as follows:

“If the employee was not paid in a timely manner for the period of annual paid leave or the employee was warned about the start time of this leave later than two weeks before its start, then the employer, upon the written application of the employee, is obliged to postpone the annual paid leave to another date agreed with the employee. »

Now the employer must wait 2 days for a written explanation from the employee when imposing a disciplinary sanction and only after that draw up a report

Old edition:

Article 193 . Procedure for applying disciplinary sanctions

Before imposing disciplinary action, the employer must request a written explanation from the employee. If the employee refuses to give the specified explanation, a corresponding act is drawn up.

An employee’s refusal to provide an explanation is not an obstacle to applying disciplinary action.

Disciplinary action is applied no later than one month from the date of discovery of the misconduct, not counting the time of illness of the employee, his stay on vacation, as well as the time necessary to take into account the opinion of the representative body of employees.

A disciplinary sanction cannot be applied later than six months from the date of commission of the offense, and based on the results of an audit, inspection of financial and economic activities or an audit - later than two years from the date of its commission. The specified time limits do not include the time of criminal proceedings.

For each disciplinary offense, only one disciplinary sanction can be applied.

The employer's order (instruction) to apply a disciplinary sanction is announced to the employee against signature within three working days from the date of its publication. If the employee refuses to sign the specified order (instruction), a corresponding act is drawn up.

A disciplinary sanction can be appealed by an employee to state labor inspectorates or bodies for the consideration of individual labor disputes.

New:

in article 193 :

part one should be stated as follows:

“Before imposing a disciplinary sanction, the employer must request a written explanation from the employee. If after two working days the employee does not provide the specified explanation, then a corresponding act is drawn up.”

in part two, the words “Refusal of the employee to give an explanation” should be replaced with the words “Failure of the employee to provide an explanation”;

in part six, the word “receipt” is replaced with the word “signature”, after the words “from the date of its issue” the words “except for the time the employee is absent from work” are added, the words “If the employee refuses to sign the specified order (instruction)” are replaced with the words “ If the employee refuses to familiarize himself with the specified order (instruction) against signature, then”;

in part seven, the words “state inspections” are replaced with the words “state inspection”, the word “or” is replaced with the words “and (or)”

It is now clearly stated that an employee in the event of dismissal without registration. reasons is obliged to pay training costs only in proportion to the time not worked

New:

“ARTICLE 249. Reimbursement of costs associated with employee training

In the event of dismissal without good reason before the expiration of the period stipulated by the employment contract or agreement on training at the expense of the employer, the employee is obliged to reimburse the costs incurred by the employer for his training, calculated in proportion to the time actually not worked after completion of training, unless otherwise provided by the employment contract or training agreement."

* - These changes were adopted by Federal Law N 90-ФЗ dated June 30, 2006 N 90-ФЗ On introducing amendments to the Labor Code of the Russian Federation, recognizing certain normative legal acts of the USSR as invalid on the territory of the Russian Federation and invalidating some legislative acts (provisions) legislative acts) of the Russian Federation.

Published on July 7, 2006 in the Russian newspaper changes in the labor code

Migrants

Now responsibility for visiting workers will fall entirely on their employers. They will be the ones who will have to ensure that the mercenaries carry out their immediate duties and also cross the border of the Russian Federation on time.

For failure to comply with the requirements specified in Federal Laws No. 216-FZ and No. 215-FZ, the employer faces a fine of 400 to 500 thousand rubles, if it is an organization. And up to 50 thousand rubles, if the employer is an individual entrepreneur.

SPECIAL ASSESSMENT OF WORKING CONDITIONS

Part 6 art. 27 of the Federal Law of December 28, 2013 No. 426-FZ “On special assessment of working conditions” (as amended on July 19, 2018)

Will come into force - 01/01/2019

Before the beginning of January 2020, employers must conduct a special assessment of working conditions (hereinafter referred to as SOUT).

Since the deadline for conducting a special assessment expires on December 31, 2020, for those employers whose workplace certification was completed in December 2013, these employers are also required to conduct a special assessment.

In accordance with Part 2 of Art. 5.27.1 of the Code of Administrative Offenses of the Russian Federation for violation by the employer of the established procedure for conducting special labor safety measures at workplaces or failure to carry it out, liability is provided in the form of:

• warning or fine from 5,000 to 10,000 rubles. — for an official (for example, the head of an organization);

• a fine from 5,000 to 10,000 rubles. — for an individual entrepreneur;

• a fine from 60,000 to 80,000 rubles. - for the organization.

Vacation

The changes will also affect furloughs. Now parents with many children are a priority - persons whose dependents are 3 or more children under the age of 12 have the right to independently choose the time of guaranteed leave.

As before, the following conditions must remain:

- Dependents must be under 12 years of age at the time of leave, not at the time of scheduling.

- To receive leave, the employee’s work experience must not be less than six months. Otherwise, the provision of rest will be carried out only at the initiative of the lessor.

Changes to vacations from 2020

The timing of the issuance of vacation pay will change. Payment of vacation pay to the employee is made at least 3 calendar (!!!) days before the start of the vacation. For example, a specialist goes on vacation on Monday (November 18th). Funds must be issued no later than the previous Thursday, that is, November 14 (Part 9 of Article 136 of the Labor Code). Payments to the employee for vacation pay are made at least 3 working (!!!) days before the start of the vacation. For example, a specialist goes on vacation on Monday (November 18th). Then the funds must be issued no later than the previous Tuesday, that is, November 12th. Bill No. 88941 Separately, the deadlines for issuing funds for unscheduled leave will be established. No special rules for calculations for unscheduled leave have been approved. Employers issue funds 3 days (calendar) before the start of the vacation. For unscheduled vacation, a special payment procedure applies. If a specialist submits an application for vacation outside the schedule, vacation pay must be paid within 3 days from the date of receipt of the request. Only working days are taken into account.For example, a specialist goes on vacation on Monday (November 18th), but submitted the application on Friday (November 15th). Funds must be issued no later than next Tuesday, that is, November 19th Bill No. 88941

Clinical examination

Now the days that the employee spends undergoing medical examination will be paid. The amount of payment will be calculated in the same way as regular vacation pay - based on the average wage of a hired worker.

Slightly different changes will also affect citizens of retirement age. If ordinary employees can count on only one day off every three years, then this category of workers is entitled to two days off annually. Employees of pre-retirement age will have to confirm their right to time off. The personnel department will receive such information from the pension fund.

Reference! Employees of pre-retirement age are those citizens who have 5 or less years left before retirement.

Fines for employers for military registration will increase

If employers, for one reason or another, do not report employees who have not registered with the military, they will have to pay a fine of 5,000 rubles.

Previously, managers had to pay fines from 300 to 1000 rubles.

We remind you that clauses on military registration are recommended to be included in the employment contract.

Organizations that employ young people of pre-conscription age are required to report on employees who are:

- 15 or 16 years old – until October 1.

- 17 years old – until November 1.

When the bill on increasing fines for draft evaders No. 620700-7 comes into force, the manager will pay a fine of 3,000 thousand for failure to submit such lists.

What other changes await employers and employees?

A number of minor innovations await employees and employers. The changes will affect the salary bank, electronic work books, the amount of the withheld part of the salary to cover debts, and a fine for late payment.

The complete list is as follows:

- Previously, the maximum amount that could be withheld from an employee’s salary to offset debts was 25 thousand rubles. Now it has been increased to 100 thousand rubles. After all penalty write-offs, the mercenary’s account must remain in an amount of at least one minimum wage established in the region.

- Now the employee can choose the bank in which he will be serviced. And if previously the employer could refuse a request without explaining the reasons, now he faces a fine for this.

- In order to facilitate document flow, electronic work books will be introduced.

- The fine for late wages will also increase. If previously its volume was 1/100 of the key rate of the Central Bank for each unpaid day, now it will be increased to 1/150.

Increasing the minimum wage in 2020

From January 1, 2020, Federal Law No. 481-FZ dated December 25, 2020 approved a new minimum wage. Now it is 11,280 rubles, in 2020 it was equal to 11,162 rubles . According to the law, employers cannot pay their employees wages that are less than the specified amount, that is, less than 11,280 rubles. Exceptions include part-time and part-time employees. These rules do not apply to them. If employers do not comply with the requirements of the law, they face a fine of 30,000 to 50,000 rubles (repeated violation - 70,000 rubles).

Accordingly, from January 1, 2020, the wages of public sector employees will increase.

Other changes

Changes in legislation will not be limited to labor relations. Innovations await fishermen, drivers, people with disabilities, consumers and pensioners.

Fish lag

According to the innovations, all fish producers fishing on the shores of the Barents, Baltic, Azov and Black Seas are required to supply the catch, as well as products from it, to the territory of Russia.

Drivers

Motorists can expect the following changes in legislation:

- Now administrative liability for drunk driving occurs if 0.3 ppm of alcohol is detected in the driver’s body.

- Before July 1 of this year, every owner of a vehicle of category M2 and M3 must install a tachograph on it.

- Now MTPL insurance policies will be equipped with a QR code as an additional measure of protection against document forgery.

Food embargo

Restrictions for manufacturers in the following countries will continue until the end of this year:

- USA.

- EU.

- Canada.

- Australia.

- Liechtenstein.

- Norway.

- Ukraine.

- Iceland.

- Albania.

- Montenegro.

Consumers

The following changes will affect consumers:

- Now cash receipts must contain an additional column - “Product code”. It will be possible to track the belonging of the product to the category.

- Now the following groups of goods will be subject to mandatory labeling: tobacco products, perfumes and eau de toilette, shoes and clothing, tires, bed linen, and complex equipment.

- Buyers of online stores have the right to demand a refund of the deposit amount within 10 days from the date of purchase.

- The sale of tickets to entertainment events without a cash register is now prohibited.

- The list of goods subject to excise duty has been expanded. Now these also include dark marine fuel and petroleum raw materials.

Disabled people

Starting from 2020, the employment service must hire a specialist whose responsibilities will include the employment of disabled people, taking into account the characteristics of their health. He must also regulate the applicant’s work schedule and adapt the disabled person’s route to his place of work.

Reference! This year the Government plans to increase the percentage of employed disabled people from 32% to 50%.

Pensioners

The implementation of a new pension reform will begin this year. And at the same time, an additional payment to pensions will be introduced. At the moment, its size is 1000 rubles.

New requirement for insurance companies

From June 1, 2020, new requirements appear that determine the activities of insurance companies that issue MTPL policies. The main innovation concerns the impossibility for an insurance company to arbitrarily stop issuing MTPL insurance policies without reason. You can stop issuing policies only for several reasons:

in case the insurance company's relevant license is revoked

in a situation where the limit of insurance policies sold has been reached

The insurance company must also notify visitors to its official website that it is impossible to issue new MTPL policies by closing sections on the website through which it was previously possible to issue a new policy.

Pivot table

Let's summarize the changes in legislation from January 1, 2019 in a summary table.

| Sphere | Current standards | Changes | Bill |

| Pension reform | Previously, the age of incapacity for work was 60 for men and 55 for women. | In the current changes, the age of incapacity for work for men is 65 years, for women - 60 | Federal Law No. 350 |

| Working with migrants | Previously, the fine for employers for the illegal presence of a migrant in the country was 4 thousand rubles | According to the changes, the fine for organizations will increase to 500 thousand, for individual entrepreneurs - up to 50 thousand, for an official - up to 40 thousand | Federal Law No. 216, Federal Law No. 215 |

| Salary | Previously, for late payment of wages, the employer could limit himself to a warning | According to the amendment, the fine will be from 30 to 50 thousand rubles | Federal Law No. 473887-7 |

| Employment of pensioners | Previously, an employer could refuse employment to a citizen of pre-retirement age | Now an illegal refusal to hire or illegal dismissal threatens the employer with criminal liability | Criminal Code of the Russian Federation Article No. 1441 |

| Additional day off | – | Each employee has the right to an additional day off once every 3 years to undergo medical examination | Federal Law No. 353 |

| Disabled people | – | Starting this year, the work activity of a disabled person will be monitored by a special employee | Federal Law No. 476 |

| Salary amount | Previously, the minimum wage was 11,163 rubles | Now the minimum wage is 11,280 rubles | Order of the Ministry of Labor No. 550n |

| Transportation of employees | Previously, no documents were required to transport employees | Now, for this, the employer will need to obtain a license. Exceptions include the Ministry of Internal Affairs, ambulance officers, firefighters, and the Russian Armed Forces. Lack of a license threatens the employer with a fine of up to 400 thousand rubles | Federal Law No. 386 |

This is what the changes look like in 2020. Some of the innovations can already be observed now. Others will come into force only during the entire period.

Article Rating

Reporting

New report to the Pension Fund of Russia in the form SZV-TD

Base:

| As it was | How did it happen | Pros/Cons | Expert commentary |

| Previously, information was submitted to the Pension Fund once a year. | All employers will submit a new report to the Pension Fund. It will contain information about the work activities of the insured persons who are in an employment relationship with them. Therefore, if you have concluded at least one employment contract, you are required to submit a new SZV-TD report from 2020. It must include every insured person with whom you are in an employment relationship. The fact is that from 2021, employers will begin making entries in paper books only if the employee submits an application before the end of 2020. And the Pension Fund of Russia will maintain electronic books. But in order for the Pension Fund to have all the necessary information and the fund to personalize it, employers must submit a new monthly SZV-TD report starting from 2020. | Pros. The first stage of the transition to electronic document management with the Pension Fund has begun. Soon, employers will no longer need to ensure the maintenance and safety of employees’ work records. Minuses. Labor costs for preparing additional reporting forms will increase. Additional risk of receiving fines for non-provision or late provision. | Information on the SZV-TD form will need to be submitted monthly from 2020. The deadline is no later than the 15th of the next month. Thus, for the first time you will submit a new report for January 2020 no later than February 17, 2020 (February 15 is a day off, Saturday). From January 1, 2021, you will submit reports for each case of personnel changes. That is, when hiring or dismissing, information in the SZV-TD form will need to be submitted no later than the working day following the day the order on hiring or dismissal is issued. The report should include the following information:

|