Concept and classification of inventories

Inventories

is part of the organization's assets:

- used as raw materials, materials, etc. in the production of products intended for sale, performance of work, provision of services;

- intended for sale;

- used for the management needs of the organization.

In accordance with PBU 5/01 “Accounting for inventories” (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n), inventories also include finished products and goods.

Inventory inventories are classified:

- by role and purpose in the production process;

- according to technical properties.

From the point of view of their role and purpose in the production process, inventories are divided into main and auxiliary.

Main production reserves

– these are the objects of labor that form the basis of manufactured products:

raw materials, products of the mining industry and agriculture;

basic materials, manufacturing products; purchased semi-finished materials that have undergone certain processing, but have not yet become finished products; components are material assets intended to complete the manufactured object. Auxiliary production inventories

– these are objects of labor that give the object certain properties and qualities (varnishes, paints, etc.) or are used to maintain labor tools (lubricating and wiping material).

Classification by technical properties is used in production technology and organization of analytical accounting:

- raw materials and supplies;

- purchased semi-finished products and components, structures and parts;

- fuel;

- containers and packaging materials;

- spare parts;

- other materials;

- building materials;

- materials transferred for processing to third parties.

Each of these groups is divided into subgroups, which contain a list of names of materials with a description of their technical characteristics. This classification is the basis for the development of nomenclature, i.e. a systematic list of all materials consumed in production. Each material is assigned a product number (code).

The accounting unit can be:

- nomenclature number of the material and production stock;

- the consignment;

- homogeneous group, etc.

An accountant may have the opinion that the item number should be considered as an object for accounting for inventories. Of course, this is not true. The nomenclature number is only a conventional (code) designation of a real existing object. Therefore, the inventory accounting unit can be a specific type (name) of inventory or a group (batch) of inventory, which is assigned the corresponding item number.

On the classification of reserves according to the law

When accounting for material inventories, it is necessary to rely on a document such as PBU 5/01 “Accounting for material and production assets.” Inventories are mainly items for production processes or other work functions. In one production cycle, the entire volume of inventory is consumed. The acquisition and use of materials results in costs, which are then transferred to sales value.

Legislative and regulatory regulation of inventory accounting in the Russian Federation

The following varieties can be distinguished depending on the role played by stocks at certain stages:

- Inventory units, accessories used on the farm.

- Spare parts and what is used in the packaging.

- Returnable types of waste or fuel.

- Semi-finished products purchased from others.

- Raw materials, main types of materials.

For accounting, the main unit of measurement becomes the nomenclature account, but not only this concept is used. These can be homogeneous groups, parties or other similar phenomena. Inventory in accounting are units that can be measured in different ways. The main thing is to choose a suitable unit so that it provides complete, reliable information regarding inventories and allows for control over the movement and availability of all necessary components.

Valuation of inventories upon receipt

In accounting, inventory is valued at actual cost. In current accounting, organizations can evaluate materials at the book price and separately take into account deviations of the actual cost of materials from the book price. In financial statements, materials are valued at actual cost.

The actual cost of inventories acquired for a fee is the amount of the organization's actual costs for their acquisition. VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation) are not included in the actual cost. Actual costs include:

- amounts paid in accordance with the agreement to the supplier (seller);

- expenses for information and consulting services related to the acquisition of inventories;

- customs duties;

- fees paid to the intermediary organization through which the supplies were purchased;

- costs for the procurement and delivery of inventories to the place of their use, including insurance costs;

- other costs directly related to the acquisition of inventories.

The actual cost of inventories received by an organization under a gift agreement or free of charge, as well as those remaining from the disposal of fixed assets and other property, is determined based on their current market value as of the date of acceptance for accounting. In this case, the actual cost includes the actual costs of the organization for the delivery of inventories and bringing them into a condition suitable for use.

The actual cost of inventories contributed as a contribution to the authorized (share) capital of the organization is determined based on their monetary value agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation. In this case, the actual cost also includes the actual costs of the organization for the delivery of inventories and bringing them into a condition suitable for use.

The actual cost of inventories during their production by the organization itself is determined based on the actual costs associated with the production of these inventories. Accounting and formation of costs for the production of inventories is carried out by the organization in the manner established for determining the cost of relevant types of products.

The actual cost of inventories received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the cost of assets transferred or to be transferred by the organization. The value of such assets is established based on the price at which, in comparable circumstances, the entity would normally determine the value of similar assets.

Transport and other costs associated with the exchange are added to the cost of the received reserves directly or are preliminarily included in the composition of transport and procurement costs, unless otherwise provided by the legislation of the Russian Federation. If the barter agreement provides for the exchange of goods of unequal value, then the difference between them in monetary form is recorded by the party that transferred the goods of greater value in the debit of the settlement account. The resulting debt is repaid in the manner prescribed by the agreement.

The valuation of inventories that do not belong to this organization, but are in its use or disposal, is carried out in the amount stipulated in the contract, or in the amount agreed upon with their owner. If there is no price for the specified reserves in the contract or a price agreed with the owner, they can be accounted for at a conditional valuation.

The valuation of inventories, the cost of which is determined in foreign currency upon acquisition, is made in rubles by recalculating the amount in foreign currency at the exchange rate of the Central Bank of Russia effective on the date of acceptance of the inventories for accounting.

How are inventories accepted for accounting after the amendments made to PBU 5/01?

In connection with the innovations in PBU 5/01, effective from June 20, 2016 (Order of the Ministry of Finance of Russia dated May 16, 2016 No. 64), the assessment of inventories in simplified accounting can be carried out using one of the following methods for analyzing inventories:

- Purchased inventories are at the seller's price. Other costs for their purchase can be accepted in full during the period of their implementation as costs for ordinary activities (clause 13.1 of PBU 5/01).

- Inventory and equipment used in production - at the cost of their acquisition, as well as the amount of other production and other costs incurred in the process of preparing goods for sale. At the same time, the entire amount of such costs can be taken into account as they arise in expenses for ordinary activities. This option is applicable for microenterprises, as well as other economic entities that have insignificant balances of inventories (clause 13.2 of PBU 5/01).

- Inventory and equipment used for management purposes are fully included in costs as they are purchased (clause 13.3 of PBU 5/01).

In addition, for the economic entities in question, the obligation to reserve funds to reduce the cost of material assets has been canceled (clause 25 of PBU 5/01).

An aspect of accounting reporting is the assessment of inventories owned by the organization, but in transit, or transferred to the buyer, as of the reporting date are reflected at the contractual value with subsequent clarification of the actual cost (clause 26 of PBU 5/01).

Accounting for inventories

The basis for accepting materials for accounting are primary documents on receipt and issue of materials.

For materials received from outside, the organization receives:

- transport documents;

- invoice from the supplier;

- certificate and other documents in accordance with the terms of the purchase and sale agreement.

A receipt order is issued at the warehouse (standard interindustry form No. M-4, approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a). For bulk homogeneous cargo arriving several times during the day from the same supplier, it is allowed to draw up one receipt order for the whole day. During this day, entries are made on the back of the order for each receipt of material, which are calculated at the end of the day, and the total is recorded in the receipt order. Instead of a receipt order, the acceptance and posting of materials can be formalized by affixing a stamp on the supplier’s document (invoice, waybill, waybill), the imprint of which contains the same details as in the receipt order. In this case, fill in the details of the specified stamp and put the next receipt order number. Such a stamp is equivalent to a receipt order.

If the quantity and quality of materials arriving at the warehouse does not correspond to the supplier’s data, the materials are accepted by a commission and a materials acceptance report is drawn up (standard interindustry form No. M-7), which serves as the basis for filing a claim with the supplier or transport organization. In the case of drawing up an acceptance act, a receipt order is not issued.

Materials arriving from their production are issued with a consignment note for internal movement of materials.

Materials received after the liquidation of a fixed asset are documented in an act on the recording of material assets received during the dismantling and dismantling of buildings and structures (standard interindustry form No. M-35).

If, in the interests of production, it is advisable to send materials directly to a division of the organization, bypassing the warehouse, such batches of materials are reflected in accounting as received at the warehouse and transferred to the division of the organization. At the same time, a note is made in the incoming and outgoing documents of the warehouse and the incoming documents of the organization’s division that the materials were received from the supplier and issued to the division without delivering them to the warehouse (in transit).

Acceptance acts and receipt orders are drawn up on the day the relevant materials are received at the warehouse or on other dates established by the organization, but not later than the deadlines established by regulations for the acceptance of incoming goods.

Materials received for safekeeping are recorded by the financially responsible person in a special book (card), stored separately in the warehouse and not consumed.

The posting of materials purchased by the accountable persons of the organization is carried out in the generally established manner on the basis of supporting documents confirming the purchase (invoices and store receipts, a receipt for a cash receipt order - when purchasing from another organization for cash, an act or certificate of purchase on the market or from the public ), which are attached to the advance report of the accountable person.

Based on primary documents, the acquisition of materials is reflected in the accounting records as follows:

- The debit of account 10 “Materials” is the amount of actual costs for the purchase of materials;

- Debit of account 19 “Value added tax on purchased assets” – VAT amounts on invoices of third-party organizations;

- Credit of settlement accounts: 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 76 “Settlements with various debtors and creditors”, etc.

VAT is claimed for reimbursement from the budget on capitalized and paid materials for production purposes and is reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of account 19.

Materials received from the founders as a contribution to the authorized capital are accepted for accounting at the cost agreed upon by the founders and are recorded as an accounting entry:

- Debit of account 10 Credit of account 75 “Settlements with founders.”

The actual costs of the organization for the delivery of inventories and bringing them into a condition suitable for use are reflected in the debit of account 10, VAT - in the debit of account 19 and the credit of accounts 60, 71, 76, etc.

Materials received under a gift agreement or free of charge are reflected in the valuation at market value on the date of acceptance for accounting:

- Debit of account 10 Credit of account 98 “Deferred income”, subaccount 2 “Gratuitous receipts”.

The actual costs of the organization for the delivery of inventories and bringing them into a condition suitable for use are reflected in the debit of account 10, VAT - in the debit of account 19 and the credit of accounts 60, 71, 76, etc.

Features of accounting and valuation of materials when using accounts 15 and 16. Valuation of materials in current accounting can be carried out at the accounting price, which can be the planned cost of procurement or the purchase price of materials. In this case, accounting is organized using accounts: 10 “Materials”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”.

The actual cost of purchased materials is reflected in accounting in the debit of account 15 and the credit of accounts 60, 71, 76, VAT - in the debit of account 19 and the credit of accounts 60, 71, 76. The accounting value of materials actually received is written off to the debit of account 10 from the credit of account 15 .

Thus, the debit of account 15 reflects the actual cost of materials, and the credit reflects their accounting price. The difference between the actual cost of received materials and their accounting price represents deviations of the actual cost from the accounting price, which are taken into account on account 16 “Deviation in the cost of material assets.” Deviations are written off from account 15 to account 16 as follows:

- Debit account 16 Credit account 15 – if the actual cost is higher than the book price;

- Debit account 15 Credit account 16 - if the actual cost is lower than the book price.

The debit balance of the final account 15 shows the actual cost of materials in transit.

Debit and credit deviations from accounting prices accumulated on account 16 are written off as the debit of production cost accounts, as a rule, in proportion to the cost of materials used in production (at prices):

- Debit accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General business expenses”, 28 “Defects in production”. If the accounting price of the materials consumed is lower than their actual cost, an additional entry is made to the credit of account 16;

- Debit accounts 20, 23, 25, 26, 28. An additional entry using the “red reversal” method is made to the credit of account 16 if the accounting price of the materials consumed is higher than their actual cost.

Methodology for analysis and organization of accounting of inventories before the 2020 amendments

Before the above amendments, persons with simplified accounting accepted inventories at actual cost (clause 5 of PBU 5/01). The exception was trade organizations that account for inventories at the cost of their acquisition or, for retail, at the cost of sales adjusted for the markup (clause 13 of PBU 5/01).

Let us recall that the composition of the actual cost depends on the method of obtaining materials:

- purchased;

- produced;

- received as a contribution to the authorized capital;

- transferred under a gift agreement or free of charge;

- purchased under an agreement, payment for which will be made in non-cash.

For information on inventory accounting, see the article “What transactions reflect transportation costs?”

Accounting for release of inventories

The release of materials for production needs for systemic consumption is carried out on the basis of pre-established limits. The supply department sets a limit for the release of materials for production, based on approved standards for material consumption. Limited release of materials from the warehouse is documented using limit cards (standard interindustry form No. M-8). Materials released irregularly are documented with a demand invoice (standard interindustry form No. M-11).

The movement of materials from one warehouse to another is documented with an invoice for internal movement of materials.

The issue of materials is reflected in the accounting department on the basis of documents on the issue of materials on the credit of account 10 in correspondence with the debit of accounts 20, 23, 25, etc.

Valuation of inventories during release for the needs of the organization. In accordance with PBU 5/01, organizations have the right, when releasing materials into production and other disposal, to evaluate them in one of the following ways:

- at the cost of each unit;

- at average cost;

- at the cost of the first materials acquired in time - the FIFO method;

- at the cost of the most recent acquisition of materials - the LIFO method.

The chosen valuation method must be fixed in the accounting policies of the organization.

Estimation at the cost of each unit can be used in enterprises with a small range of products that carry out special orders, when it is possible to monitor the use of materials in production and organize such accounting.

When valuing production inventories at average cost, it is customary to determine the average unit cost for each type (group) of inventories by dividing the total cost of the type (group) of inventories by their quantity.

With the FIFO method, the actual cost of written-off inventories is determined as the cost of materials purchased first, taking into account the cost of inventories listed at the beginning of the month, i.e., at the cost of the first purchases.

The LIFO method is based on the assumption that inventories that are the first to enter production should be valued at the cost of the last purchases.

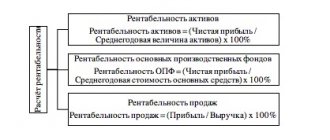

The amount of production inventory - calculation formula and indicators used

To determine the volume in monetary terms of inventories, the following formula is used:

MPz = Tz + Pz + Sz,

Where:

MPz - the amount of inventories;

Тз - current;

Pz - preparatory;

Sz - insurance.

The company's main potential is formed from current reserves to meet production needs and uninterrupted production of products. Within the current stocks there is a gradation into normalized and non-standardized.

Preparatory stocks are formed for a maximum of 2–3 days.

Safety stocks are created in case new circumstances arise that require a rapid increase in production volume with a sharp increase in demand or the resumption of an interrupted cycle due to force majeure.

Accounting for disposal of inventories

To account for the sale and other disposal of inventory items, operational account 91 “Other income and expenses” is intended.

Disposal of materials as a contribution to the authorized (share) capital of other organizations is accounted for as long-term investments. The actual cost of materials transferred is reflected in the credit of account 10 “Materials” and the debit of account 58 “Financial investments”. The difference between the actual cost and the agreed estimate of the transferred materials is written off:

- to the debit of account 91-2 “Other expenses” from the credit of account 58 - if the agreed cost is lower than the book value of materials;

- debit account 58 and credit account 91-1 “Other income” - if the agreed cost is higher than the actual cost of materials.

The sale of materials to third parties is reflected in accounting upon the transfer of materials and the signing of acceptance documents, unless the agreement provides for a different procedure for the transfer of ownership to the buyer. For the total amount of the buyer's debt, an entry is made in the debit of account 62 “Settlements with buyers and customers” and the credit of account 91-1. Expenses associated with sales are reflected in the debit of account 91-2 and the credit of expense and settlement accounts: 44 “Sales expenses”, 60 “Settlements with suppliers and contractors”, 70 “Settlements with personnel for wages”, 76 “Settlements with various debtors and creditors”, etc. VAT on the sale of materials is accrued on the debit of account 91-2 and the credit of account 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”. The actual cost of materials is written off to the debit of account 912 and the credit of account 10.

When materials are disposed of due to gratuitous transfer, the actual cost is written off to the debit of account 91-2 and the credit of account 10. The loss from gratuitous transfer is written off from own sources to the debit of account 99 “Profits and losses” and the credit of account 91-9 “Balance of other income and expenses." When transferring materials free of charge, VAT is paid by the transferring party. The amount of accrued VAT is reflected in the debit of account 91-2 and the credit of account 68, subaccount “Calculations for VAT”.

The write-off of material assets lost as a result of natural disasters and other emergency situations requires the availability of a certificate of emergency. The loss in this case is attributed to the financial result and is reflected in the debit of account 94 “Shortages and losses from damage to valuables” and the credit of account 10 “Materials”, and then written off to the debit of account 99 “Profits and losses” from the credit of account 94.

11.5. Inventory of inventories and reflection of its results on accounting accounts

In order to ensure the reliability of accounting and reporting data, enterprises conduct an inventory of material assets at least once a year and no earlier than the first of October.

The inventory is carried out by a commission appointed by order of the head of the organization, in the presence of the financially responsible person, from whom a receipt has been received stating that all valuables have been capitalized and the documents have been submitted to the accounting department. Warehouses are sealed before inventory.

Material assets received at the warehouse and issued from the warehouse during the inventory period are subject to registration in a special statement under the heading “Received (issued) from the warehouse during the inventory period.”

Inventory is carried out by weighing, measuring, measuring material assets for each storage location. Identified values are entered into an inventory list, according to which matching statements are compiled.

As a result of the inventory, the following can be identified:

- Surplus valuables that are subject to capitalization and assessed at market value. This records the following:

Dt sch. 10 "Materials"

K-t sch. 91/1 “Other income and expenses.”

Shortage of material assets, which is written off to account 94 “Shortages and losses from damage to assets.” The shortage of materials within the limits of natural loss norms is written off as expenses by writing:

Dt sch. 25.26

K-t sch. 94 “Shortages and losses from damage to valuables.”

Shortages due to the fault of the financially responsible person are written off from account 94 “Shortages and losses from damage to valuables” to the debit of account 73/2 “Calculations for compensation of material damage.”

Compensation for the shortage by the financially responsible person is carried out at market prices. In this case, the difference between the cost of materials at market prices and their actual cost until reimbursement is taken into account in account 9 8/4 “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables.”

For the amount of the difference to be reimbursed by the financially responsible person, account 73/2 “Calculations for compensation of material damage” is debited and account 9 8/4 “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables” is credited.

When compensating for the shortfall, the guilty party makes the following entries:

- Dt sch. 50 "Cashier"

K-t sch. 73/2 “Calculations for compensation for material damage.”

Dt sch. 9 8/4 “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables”

K-t sch. 91/1 “Other income and expenses.”

Typical accounting entries for materials accounting are presented in table. 11.2.

Table 11.2

Typical accounting entries for accounting for materials in organizations

Inventories are assets used as raw materials, materials, etc. in the production of products intended for construction work. . They are entirely consumed in each production cycle and fully transfer their cost to the cost of construction and installation work performed.For the proper organization of material accounting, their classification, evaluation and choice of accounting unit are of great importance.

Depending on the role played by various industrial reserves in the construction process, they are divided into the following groups: • basic building materials; • purchased semi-finished products; • designs, products and parts; • auxiliary materials: fuel, containers, spare parts.

Basic building materials are those materials that are materially included in manufactured products, forming their material basis (cement, brick, metal, clay, timber, etc.).

Purchased semi-finished products - components, structures and parts, materials that have undergone certain stages of processing and packaging, but are not yet finished construction products, purchased by the enterprise. In the manufacture of construction products, they play the same role as the main building materials, that is, they constitute its material basis.

Structures, products and parts include reinforced concrete, concrete, metal, wood, plastic structures and products, joinery, embedded parts, sanitary and electrical products, rails, sleepers, pipes, etc.

From the group of auxiliary materials, fuel, packaging and container materials, and spare parts are separately distinguished due to the specific use. Fuel is divided into technological (for technological purposes), motor (fuel) and economic (for heating).

Containers and container materials are assets used for packaging, transportation, storage of various materials and products (bags, boxes, boxes). Spare parts are used to repair and replace worn parts of construction machines, mechanisms and equipment.

The specified classification of inventories is used to construct synthetic and analytical accounting.

Construction organizations carry out inventory accounting in accordance with PBU 5/01 (30) at actual cost. The actual cost of inventories purchased for a fee is the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation). The actual costs of purchasing inventories include: amounts paid in accordance with the contract to the supplier (seller); amounts paid to organizations for information and consulting services related to the acquisition of inventories; customs duties; non-refundable taxes paid in connection with the acquisition of a unit of inventory; remunerations paid to the intermediary organization through which inventories were acquired; costs for the procurement and delivery of inventories to the place of their use, including insurance costs. These costs include, in particular, costs for the procurement and delivery of inventories; costs of maintaining the procurement and warehouse division of the organization, costs of transport services for the delivery of inventories to the place of their use, if they are not included in the price of inventories established by the contract; accrued interest on loans provided by suppliers (commercial loan); interest accrued on borrowed funds before accepting inventory for accounting, if they were raised to purchase these inventories; costs of bringing inventories to a state in which they are suitable for use for the intended purposes. These costs include the organization’s costs of processing, sorting, packaging and improving the technical characteristics of received stocks, not related to the production of products, performance of work and provision of services; other costs directly related to the acquisition of inventories. General and other similar expenses are not included in the actual costs of purchasing inventories, except when they are directly related to the acquisition of inventories.

To account for materials, the account is used: 10 “Materials”. The purchase of materials can be made using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets”. Materials that do not belong to the organization by right of ownership are recorded in off-balance sheet accounts 002 “Inventory assets accepted for safekeeping” and 003 “Materials accepted for processing.” Inventories that are obsolete, have completely or partially lost their original quality, or the current market value, the selling price of which has decreased, are reflected in the balance sheet at the end of the reporting year minus a reserve for a decrease in the value of material assets. The reserve for reducing the value of material assets is formed at the expense of the organization’s financial results by the amount of the difference between the current market value and the actual cost of inventories, if the latter is higher than the current market value (clause 25 of PBU5/01 (30)). To account for the reserve, account 14 “Reserves for reducing the value of material assets” is intended. Contracting construction and installation organizations account for basic building materials, structures and parts according to the Chart of Accounts (22) on account 10 “Materials”, subaccount 1 “Raw materials and materials”. It is necessary to pay attention to the fact that developer enterprises use subaccount 8 “Building materials” of account 10.

If, under the terms of a construction contract, the contractor assumes responsibilities for providing construction equipment, such equipment is accounted for in a separate subaccount of account 10, opened in accordance with the right to introduce additional subaccounts provided for in the Chart of Accounts (22).

Inventories are accepted for accounting at the actual cost, which consists of the actual costs of their acquisition (except for the amount of value added tax and other refundable taxes, except for cases provided for by the legislation of the Russian Federation). The actual cost of inventories, in which they are accepted for accounting, is not subject to change, except in cases established by the legislation of the Russian Federation and provided for by PBU 5/01 (30).

In accordance with clause 15 of PBU 5/01 (30), when materials are released into production and otherwise disposed of, they are assessed in one of the following ways:

• at the cost of a unit of inventory; • at average cost; • at the cost of the first acquisitions (FIFO).

When materials are received, account 10 is debited and credited: • account 60 “Settlements with suppliers and contractors” - for the cost of received materials at suppliers’ prices with transportation and procurement costs reflected in suppliers’ accounts, • account 76 “Settlements with various debtors and creditors” - on the cost of intermediary services; • account 71 “Settlements with accountable persons” - for the cost of materials paid from accountable amounts; • account 23 “Auxiliary production” - for the costs of delivering materials by own transport and for the actual cost of materials of own production; • account 20 “Main production” - for the cost of returnable waste.

If synthetic accounting of material assets is carried out at discount prices, in addition to account 10, all enterprises use accounts 15 and 16. The debit of account 15 includes the purchase value of material assets for which the construction enterprise received settlement documents from the supplier, and other expenses for the purchase of materials on credit accounts 60, 23, 71, depending on where they came from, the nature of the costs of procurement and their delivery to the enterprise. Material assets actually received by the enterprise are written off at accounting prices from the credit of account 15 to the debit of account 10.

The amount of the difference in the cost of acquired material assets, calculated in the actual cost of acquisition and accounting prices, is written off from account 15 to the debit of account 16. The balance on account 15 at the end of the month shows the availability of materials in transit.

It is possible to account for the procurement of material assets without a balance on account 15. In this case, at the end of the month, the debit of account 10 and the credit of account 15 reflect the cost of materials remaining in transit at the end of the month or not removed from the supplier’s warehouse (without taking into account materials in the warehouse recipient). At the beginning of the next month, these amounts are reversed, and they are recorded as the debit of account 15. The balance on account 15 revealed at the end of the month is written off to account 16, and account 15 has no balance.

Consumed or sold material assets are written off to the accounts of production and sales costs from the credit of material accounts at accounting prices. Account 16 is intended to account for the difference in the cost of purchased materials, calculated in the actual cost of acquisition and accounting prices. This option is used only if on account 10 synthetic accounting is carried out at discount prices.

The differences accumulated on account 16 between the actual cost of acquired material assets and their cost at accounting prices are written off from the credit of account 16 to the debit of production cost accounts or other accounts in proportion to the cost of consumed material assets at accounting prices. Analytical accounting for account 16 is carried out by groups of material assets with approximately the same level of these deviations.

Materials accepted for processing as customer-supplied raw materials, but not paid for by the contractor, are accounted for in his off-balance sheet account 003 “Materials accepted for processing” at the prices stipulated in the contract without value added tax.

A peculiarity of construction is that when carrying out construction and installation work, contractors use temporary (non-title) structures, fixtures and devices, which we mentioned when considering the structure of fixed assets. Let us note once again that in the case of the construction (purchase) of temporary buildings, structures and fixtures at the expense of the contractor, they are considered non-title.

The list of works and costs related to non-title temporary buildings and structures is established by the Methodological Guidelines for Determining the Cost of Construction Products (37). Non-title temporary buildings and structures include on-site offices and storerooms for superintendents and craftsmen, warehouses and sheds at the construction site, floorings, stepladders, stairs, walkways, walking boards, temporary wiring from main and distribution networks of electricity, water, steam, gas and air within the work area and other auxiliary items included in the list of overhead items. Expenses for the construction of temporary (non-title) structures are written off directly to the debit of account 26 “General business expenses”. Expenses for the liquidation of temporary (non-title) structures are also written off to the debit of account 26. The cost of materials received from the dismantling of temporary (non-title) structures, based on the KS-9 form, is reflected in the debit of account 10 in correspondence with account 91 “Other income and expenses”, subaccount 1 “Other income”.

In this case, the following entries are made in accounting: Debit 23 Credit 10, 70, 69 - expenses associated with the construction of temporary (non-title) structures are written off; Debit 10.9 Credit 23 - acceptance of materials for accounting on the basis of an act in form KS-8; Debit 26 Credit 10.9 - when transferring temporary (non-title) structures into operation on the basis of an act or invoice.