The procedure for writing off fixed assets and inventories

| The procedure for writing off fixed assets and inventories The main regulatory documents that should be followed when writing off fixed assets and inventories are the Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds , state academies of sciences, state (municipal) institutions, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n, and the Procedure for considering applications for approval of the write-off of property assigned to state institutions of the Moscow Department of Education system, approved by order of the Department of Education dated October 5, 2011 No. 720. |

- Write-off of fixed assets

- The grounds for writing off fixed assets are:

— unsuitability for further use due to physical wear and tear, obsolescence;

— gratuitous transfer, intradepartmental transfer;

— sale of fixed assets.

2. In accordance with Instruction 157n (clause 51),

write-off of fixed assets includes the following activities:

- determination of the technical condition of a fixed asset item;

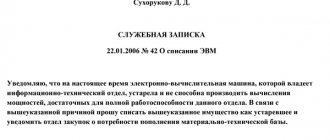

— preparation of the necessary documentation: conclusions on the technical condition of the object, issued by specialized organizations, confirming the unsuitability of the object for restoration and further use; act of decommissioning of the object;

— disposal of fixed assets and registration of materials received from their liquidation.

Depending on the type of fixed assets being written off, the following may be attached to the acts:

copies of the order of the head of the institution on the creation of a permanent commission of the institution for the receipt and disposal of assets;

copies of inventory cards for recording fixed assets;

conclusion on the technical condition of the object, issued by organizations that have licenses for this type of activity, confirming the unsuitability of the object for restoration and further use;

balance sheet statements on the value of fixed assets

and other documents.

3. Write-off of particularly valuable movable property

requires approval from the owner of the property, the act of writing off such fixed assets is accepted for accounting only if the specified approval is available.

4. In the system of the Moscow Department of Education, approval of the write-off of property,

accepted for accounting as fixed assets, on the grounds provided for by the legislation of the Russian Federation, including on the basis of moral and physical depreciation of property, inexpediency of further use of property, its unsuitability, impossibility or ineffectiveness of its restoration is

carried out in the Procedure approved by the order of the Department of October 5 2011 No. 720.

4.1. In accordance with the order:

District education departments are vested with the functions and powers of the founder of state institutions in terms of considering applications for approval of the write-off of property of subordinate state institutions. Currently, the Central Administrative District Office of Education is not subject to this provision of the order;

making decisions on the consideration of requests from city institutions of the Department of Education and institutions of the Central Educational Institution for approval of the write-off of property are entrusted to the City Commission on the implementation by the Department of Education of the functions and powers of the founder in relation to state budgetary institutions of the Department system.

4.2. Cases are defined in order

when approval of the write-off of movable and immovable property of state government, budgetary and autonomous institutions is carried out only by the Department of Education or the district education department and cases when the write-off of property requires the approval of the Department of City Property of the city of Moscow. There are also cases when the write-off of movable property of state budgetary institutions is carried out by the institution independently.

4.3. The package of documents is determined by the order,

which is required to be submitted for approval of the write-off of movable property, vehicles, real estate, unfinished construction projects, as well as a package of documents for approval of the write-off of fixed assets based on their disposal against the will of the state institution.

How to draw up an act on write-off of inventories in 2020

To write off debt, an order (instruction) is issued from the head of the organization (clause 77 of the Accounting Regulations).

How to write off overdue accounts receivable that are recognized as bad? The amount of such debt is written off from the reserve for doubtful debts. This operation is reflected in accounting with the following entries:

- D 63, K 62 (58-3, 76, 60...) – write-off of accounts receivable from the reserve;

- D 91-2, K 62 (58-3, 76, 60...) – write-off of accounts receivable if the formed reserve is insufficient (the difference is reflected).

Accounting for inventories by government agencies

If the list of documents stipulates that the institution must submit a copy of the document, then it must be certified by the signature of the head or the person performing his duties and the seal of the applicant.

5. In accordance with Order No. 720,

state institutions of city subordination and educational institutions of the Central Administrative District send documents for approval of the write-off of property to the Financial Control Service,

which checks the submitted documents for compliance with their composition, form and completeness of reflection of information with the requirements of the order, and also carries out, if necessary, on-site control activities.

Document verification is carried out by the SFK within 10 calendar days from the date of receipt and registration of documents.

If the documents are provided in full compliance with the requirements of Order No. 720, the SFK sends the documents with the draft order on approving the write-off of property to the responsible secretary of the City Commission on the implementation by the Education Department of the functions and powers of the founder in relation to state budgetary institutions of the Department system.

5.1. Secretary within 10 calendar days

carries out preparations for the meeting of the Commission.

5.2. Within 10 calendar days from the date of registration of the minutes of the Commission meeting

An order is issued by the Moscow Department of Education to approve the write-off of property, which

within 5 calendar days from the date of signing

.

If the documents do not comply with the requirements of the order

The SFK prepares a notification to the applicant about leaving documents without consideration, signed by the deputy head of the Department of Education.

Write-off (release) of inventories

(paragraphs 108, 111-113 of Instruction 157n) is carried out by institutions independently at the actual cost of each unit, or at the average actual cost.

The application of one of the specified methods for determining the value of inventories upon disposal by group (type) of inventories is carried out continuously throughout the financial year.

Disposal of inventories due to release to work.

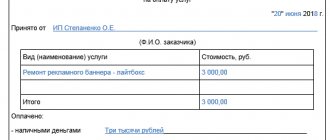

This operation is formalized by a primary (consolidated) accounting document (invoice, acceptance certificate, etc.).

Inventories are written off based on:

— Menu requirements for issuing food products

— Statements for the issuance of feed and fodder

- Statement of issuance of material assets for the needs of the institution - Waybill (used to write off all types of fuel);

— Act on write-off of inventories;

— Act on the write-off of soft and household equipment, used for the write-off of soft equipment and utensils. In this case, the dishes are written off on the basis of the data in the Book of Warehouse Registration.

Disposal of inventories in the amount of natural loss

is carried out on the basis of Acts on the write-off of inventories (f. 0504230), with reflection on expenses of the current financial year.

Disposal of inventories based on their write-off as a result of thefts, shortages, losses

is carried out on the basis of properly executed Acts on the write-off of inventories, reflecting the value of material assets to reduce the financial result of the current financial year, with the simultaneous presentation of the amounts of damage caused to the perpetrators.

Disposal of inventories based on their write-off as a result of losses of inventories under emergency circumstances

is carried out on the basis of properly executed acts, with the current financial result being allocated to extraordinary expenses.

Operations on receipt, internal movement, disposal

(including on the basis of write-off) of material inventories are documented in accounting records on the basis of properly executed primary (consolidated) accounting documents, in the manner prescribed by the Instructions (157n, 174n, 183n (for autonomous) on the use of Charts of Accounts.

The write-off of inventories is carried out according to an act, the form of which is approved by order of the Ministry of Finance of the Russian Federation dated December 15, 2010 No. 173n

“On approval of forms of primary accounting documents...” (“On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions ").

Commission on fixed assets

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Worn-out assets of the enterprise's fixed assets require write-off, since their further use will be costly, inappropriate, irrational and unprofitable. If expensive repairs are required, it is better to purchase new equipment and write off the old one. Note that fixed assets are also written off if their useful life has expired or they have completely depreciated their cost.

In order to determine the fixed assets that can be written off, it is necessary to create a special commission that will conduct an inventory and identify old, damaged objects, prepare the necessary documents and issue an act for writing off the enterprise's fixed assets.

The commission is formed by the heads of the company or enterprise. It consists of at least three people, from whom a chairman and a secretary are selected.

From experience, we will say that most often the commission includes representatives of the accounting department and a company employee who is financially responsible for the integrity and safety of the operating system.

The composition of the created commission is approved by order of the director.

We also invite you to download other sample orders:

- About the creation of an expert commission

- On the creation of a special commission to investigate accidents.

Introduction

In accordance with the Federal Law of 05/08/2010 No. 83-FZ “On amendments to certain legislative acts of the Russian Federation in connection with the improvement of the legal status of state (municipal) institutions”, from January 1, 2011, the types of state, municipal institutions are recognized as autonomous, budgetary and state-owned.

On January 1, 2011, new regulatory documents on budget classification, accounting and reporting of state and municipal institutions came into force:

- Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n “On approval of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, State Academies of Sciences, state (municipal) institutions and Instructions for its application" (registered with the Ministry of Justice of Russia on December 30, 2010, No. 19452);

- Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n “On approval of the Chart of Accounts for Budget Accounting and Instructions for its Application” (registered with the Ministry of Justice of the Russian Federation on January 27, 2011 No. 19593) and letters of the Ministry of Finance of Russia dated December 29, 2010 No. 02-06-07 /5396 “Table of correspondence of Charts of Accounts for budgetary accounting used in 2010 and 2011”;

— order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n “On approval of forms of primary accounting documents and accounting registers used by government bodies (state bodies), local governments, management bodies of state extra-budgetary funds, State Academies of Sciences, state (municipal) institutions and Methodological guidelines for their application" (registered with the Ministry of Justice of the Russian Federation on February 1, 2011 No. 19658);

— Order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n “On approval of the Chart of Accounts for accounting of budgetary institutions and Instructions for its application” (registered with the Ministry of Justice of the Russian Federation on February 2, 2011 No. 19669);

— Order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n “On approval of the Chart of Accounts for accounting of autonomous institutions and Instructions for its application” (registered with the Ministry of Justice of the Russian Federation on February 4, 2011 No. 19713);

— Order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n “On approval of the Instructions on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation” (registered with the Ministry of Justice of the Russian Federation on February 3, 2011 No. 19693);

— Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 No. 33n “On approval of the Instructions on the procedure for drawing up and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions.”

Write-off of material assets as a natural process of production

Writing off valuables during the production process is a natural process. It is impossible to make a product without using up certain materials. It does not matter what type of final product is manufactured - write-off of raw materials is inevitable. Its quantity and types depend on the complexity and composition of the final product.

The main feature of this write-off process is its regularity. Raw materials and materials are written off at the enterprise according to reporting periods (daily, ten-day, monthly, quarterly). The accuracy of accounting information depends on the timeliness of write-off of raw materials and materials:

- about the cost of products (semi-finished products, work in progress, etc.);

- about the stock balances in the warehouse at the current (reporting) point in time.

The process of writing off material assets for production needs is organized taking into account the Guidelines for accounting of inventories, approved. by order of the Ministry of Finance dated December 28, 2001 No. 119n.

Inventory accounting

From January 1, 2011, budgetary institutions apply the relevant provisions of instructions N 157n*(1) and 174n*(2) regarding inventory accounting. Instruction No. 157n provides general rules for accounting for these assets (composition, formation of actual value, rules for disposal, receipt, internal movement, grouping and analytical accounting of inventories). Instruction No. 174n provides a specific list of inventories accounts and a methodology for reflecting transactions with inventories.

Why is it important to study the Guidelines now?

There are still 4 months before the Federal Standard “Reserves” is applied. It would seem, why now turn to its provisions and consider the Methodological recommendations for its application, communicated by letter of the Ministry of Finance of Russia dated 08/01/2019 No. 02-07-07/58075? Public sector accountants already have enough regulatory issues that need to be resolved. At a minimum, you need to delve into the nuances of the Procedure for applying KOSGU dated November 12, 2017 No. 209n.

The methodological recommendations that we will talk about today will help solve many pressing problems. As experts from the financial department note, the Federal Standard “Inventories” does not establish a ban on the earlier application of its provisions by decision of accounting entities, subject to the disclosure of relevant information in the accounting (financial) statements (letter of the Ministry of Finance of Russia dated March 25, 2019 No. 02-07-05/ 20028). That is, some provisions by agreement can be used now. In turn, the Methodological Recommendations touch upon interesting issues of writing off inventories in terms of accounting records, which are intertwined with the provisions of Procedure No. 209n.

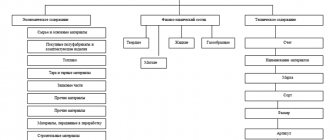

Material assets included in inventories

In accordance with paragraph 99 of Instruction No. 157n, inventories can be divided into four groups:

– items used in the activities of the institution for a period not exceeding 12 months, regardless of their cost;

– goods intended for sale;

– material assets, regardless of their cost and service life, according to the closed list given in clause 99 of Instruction No. 157n.

It is noteworthy that part of the list of material assets classified as inventories, regardless of their cost and service life, is familiar to accountants of budgetary institutions, since it was given in paragraph.

Accounting for inventories in a budgetary institution

51 Instructions No. 148n. To be fair, it is worth noting that Instruction No. 148n did not contain such a group of material reserves as material assets, regardless of cost and service life. The mentioned part of the list was represented by independent positions. Let's look at the items first named as inventories:

– forest roads subject to reclamation;

– sportswear and shoes;

– building structures and parts ready for installation;

– equipment requiring installation and intended for installation;

– disabled equipment and means of transportation for disabled people;

– precious and other metals for prosthetics;

– special equipment for research and development work before its transfer to the scientific department;

– special-purpose material assets.

Inventory accounts

Objects of material inventories on account 105 00 “Material inventories” by analytical groups of the synthetic account of the accounting object:

– 30 “Other movable property of the institution”;

– 40 “Property – leased items.”

At the same time, objects of material reserves - other movable property of the institution are recorded on accounts containing an analytical code of the type of synthetic account of accounting objects (23rd category of the account) from 1 to 9. Objects of material reserves - leased items are recorded on accounts containing in the 23rd category account codes 4, 6.

Inventory accounts used by budgetary

Return to Material Assets

The procedure for writing off material assets is not fully regulated by accounting instructions. Therefore, writing off inventory items causes disagreements and difficulties. Especially many questions arise regarding the write-off of office equipment. The write-off of inventory items was analyzed by an expert from the journal “Accounting in Budgetary Institutions.”

Write-off of material assets: reasons and procedure

The procedure for writing off material assets is not fully regulated by accounting instructions. Therefore, writing off inventory items causes disagreements and difficulties. Especially many questions arise regarding the write-off of office equipment. The write-off of inventory items was analyzed by an expert from the journal “Accounting in Budgetary Institutions.”

As a rule, fixed assets in state (municipal) institutions are written off in accordance with instructions (provisions) for the write-off of inventory assets developed and approved by ministries and departments, as well as municipal authorities in charge of the institutions. The write-off of inventory items in institutions is carried out according to principles largely similar to the principles for the write-off of federal property.

The Regulations on the specifics of writing off federal property (hereinafter referred to as the Regulations) were approved by Decree of the Government of the Russian Federation No. 834.

According to this document, write-off of material assets is defined as a set of actions related to the recognition of inventory items:

• unsuitable for further use for its intended purpose due to complete or partial loss of consumer properties of the property, including physical or moral wear and tear; • lost (retired) due to death or destruction, including against the will of the owner, as well as due to the impossibility of establishing its location (clauses 2, 3 of the Regulations).

The procedure for writing off material assets is as follows:

1. determination of the technical condition of each item of inventory; 2. preparation of the necessary documentation; 3. obtaining permission to write off material assets; 4. dismantling, dismantling of property; 5. disposal of objects and registration of materials received from their liquidation; 6. deregistration.

The decision to write off material assets

Budgetary educational institutions independently decide on the write-off of inventory and materials in accordance with paragraphs 4 and 4 of the Regulations. An exception is cases of write-off of material assets that relate to especially valuable movable property assigned to federal budgetary institutions by the founder or acquired with funds allocated for this by the founder. Then the decision to write off inventory items is made by budgetary institutions in agreement with the founder.

To prepare a decision on writing off inventory items, it is necessary to carry out a number of activities. They are implemented by a permanent commission created in the institution for the receipt and disposal of non-financial assets.

Write-off of material assets: actions of the commission

The regulations on the commission for writing off material assets and its composition are approved by order of the head of the institution. The composition of the commission for writing off material assets performs the following functions (clause 6 of the Regulations):

Examples and accounting entries

Accounting operations in the process of writing off inventory items are as follows.

- Dt 20 Kt 10. Release of materials into the main production process. In this case, the consumption of materials in the main production is taken into account. The posting is made for the cost of materials (this is its amount). A limit fence card and a demand invoice are used as the basis document for the operation.

- Dt 23 Kt 10. Issue of materials to auxiliary production and accounting of consumption. The amount is the same and equal to the cost of materials. The basis documents are the same papers as in the first case.

- Dt 25 Kt 10. Issue of materials for general production needs, taking into account consumption. The amount is the same, the documentation is the same.

- Dt 26 Kt 10. Issue of materials for general business purposes. The consumption of materials is recorded. The documentation on the basis of which the posting is made is similar.

- Dt 10 Kt 10. Issue of materials to warehouses and storerooms of workshop departments. An invoice for internal movement is considered a document-evidence.

Thus, there are quite a lot of transactions confirming the operation.

Account 105 Material reserves in a budgetary institution

Material reserves of a budgetary institution are a significant part of the organization’s non-financial assets. These include:

- items whose useful life does not exceed 12 months;

- finished products;

- goods intended for sale.

Some MC listed in clause 99 of Instruction 157n should be classified as material reserves, regardless of the period of use. Such MH includes equipment that requires installation, containers, bedding and accessories, clothing and footwear, including special ones and uniforms, young animals and others.

To account for the Ministry of Health in budgetary institutions, the main regulations are:

According to clause 98, clause 99 and clause 117 of Instruction 157n, inventories in institutions of the public sector of the economy are accounted for in account 105 00 and, in accordance with the analytical code of the type of accounting object (position 23 in the 26-digit account number) are divided into the following types:

- 105 01 – medicines and dressings;

- 105 02 – food products;

- 105 03 – fuels and lubricants;

- 105 04 – building materials;

- 105 05 – soft equipment;

- 105 06 – other MH;

- 105 07 – goods;

- 105 08 – finished products;

- 105 09 – markup on goods.

Accounting for receipt of materials in a budgetary institution

In budgetary organizations, there are three possible ways to receive money:

- acquisition from suppliers under government contracts;

- receiving free of charge under agreements of gift or donation;

- recording of inventories generated as a result of the activities of the institution.

When purchasing materials from suppliers, the grounds for reflection in accounting are: delivery notes, invoices, universal transfer documents, acceptance certificates, etc. Materials are received at actual cost, which consists of:

- the amount paid to the supplier under the contract;

- the cost of related services (consulting, information, intermediary, etc.);

- expenses for procurement, delivery, sorting, part-time work, packaging, improvement of technical characteristics of the medical equipment;

- other costs associated with the acquisition.

The value formed upon receipt of inventory does not change throughout the entire period of use, unless revaluation is made. The table shows transactions reflecting the purchase of MH.

First option: the price takes into account only the costs under the supply contract

Receipt of materials from the supplier (commercial non-financial organization)

Second option: the price takes into account additional costs

Receipt of materials from the supplier (commercial non-financial organization)

Received an invoice from the transport organization for delivery

Material reserves can be transferred to a budgetary institution by legal entities or individuals free of charge under gift or donation agreements. These relationships are regulated according to Art. 572 and art. 582 of the Civil Code of the Russian Federation. A donation agreement can be concluded orally with citizens for any amount, and with legal entities - for no more than 3 thousand rubles. If the transferring party submits primary documents, the initial cost of the MH is formed in the same way as when purchasing under a supply agreement.

note

, in 2020, the procedure for recording strict reporting forms has changed significantly. BSO is reflected under subarticle KOSGU 349. But in which account should the forms be taken into account: 105 00 “Inventory” or 03 “Strict reporting forms”? See the response from the Ministry of Finance

In the absence of primary documents, an assessment is made at fair value (Chapter V of the Conceptual Framework standard). In this case, the basis for reflecting the received MH in accounting is the receipt order for the acceptance of material assets, f. 0504207 (Order of the Ministry of Finance 52n). The table shows the transactions that are made when accepted for accounting.

Free non-cash receipts of a current nature from organizations (except for the public sector)

Free non-cash receipts of a current nature from individuals

If MH are intended for capital investments, KOSGU are applied:

- 196 – for organizations, with the exception of the public sector;

- 197 – for individuals.

The posting of inventories received from public sector organizations is formalized by notice f.0504805 (Order of the Ministry of Finance 52n). In accounting, based on this document, the entries shown in the table are made.

Free non-monetary receipt from the head office or a separate division within the framework of intradepartmental settlements

Free non-monetary receipts of a current nature from government agencies and authorities

Free non-cash capital receipts from government agencies and authorities

In the course of the activities of a budgetary institution, MH may be formed, for the capitalization of which the following entries are used.

For MZ manufactured in the institution

For MH received as a result of dismantling and liquidation of decommissioned assets. If the fixed asset was listed in storage, at the same time the off-balance sheet account 02 should be reduced by this amount

For MH received:

- after repair work, write-off of non-material items (rags, scrap metal, waste paper, spare parts, firewood, etc.);

- as a result of identifying unaccounted surpluses during the inventory;

- as a result of accepting special equipment onto the balance sheet after completion of work (if provided for in the contract);

- as a result of taking into account young animals obtained as offspring.

For Ministry of Health received in kind from the guilty person as compensation for damage.

In these cases, the capitalization of the Ministry of Health is carried out on the basis of relevant acts, the forms of which are in the order of the Ministry of Finance or are developed by the institution independently.

Sometimes there are inventories on the balance sheet that are no longer valuable to the institution or cannot be used for their intended purpose. What to do with them: leave them on the balance sheet, transfer them to an off-balance sheet account, or write them off altogether? The Ministry of Finance has not issued any clarification on this matter. But we have figured out this issue and offer you an algorithm of actions

Reasons for write-off

The procedure for writing off fixed assets from the balance sheet implies, first of all, identifying the reasons why the property should be removed from the institution’s accounting records. Situations in which write-off from accounting is required:

- complete or partial loss of useful properties of an object, in which the OS cannot function properly;

- physical loss or damage to an object, these include: breakdown, destruction, damage, loss, liquidation;

- moral or technical obsolescence of the OS, in which the modernization of property is economically unjustified;

- loss of property assets due to emergencies or natural disasters.

Write off assets that have become obsolete during the construction, reconstruction, modernization and technical re-equipment of the enterprise as a whole or its individual structural divisions.

Write-offs are also carried out in cases where it is impossible to restore an asset or it requires significant financial costs, which will be regarded as inappropriate, irrational and inappropriate use of budget funds.

More on the topic Modern self-service devices: what is the difference between a terminal and an ATM?

What other grounds are there for writing off fixed assets from accounting:

- if an institution decides to sell a non-financial asset to a third-party company or individual, then the object must be written off from the register;

- if the property is transferred into the ownership of third parties under an exchange agreement or free of charge;

- if NFA is transferred to a third party as a contribution to the authorized capital, then the asset is subject to write-off;

- if it is decided to rent or lease the object, provided that the property will be taken into account by the tenant (lessee).

Objects that are temporarily mothballed, for example, those that are not currently used in the production cycle, are not subject to write-off. Also, NFAs that are undergoing reconstruction and modernization, and whose operation is temporarily suspended, are not written off.

If property is transferred from one structural unit to another, the movement is reflected by internal movement. The NFA acceptance and transfer certificate is filled out. If an object is transferred from one separate division to another or to the head office, provided that the divisions are allocated to a separate balance sheet, then the procedure for the gratuitous transfer of fixed assets is observed.

The end of the useful life of an asset is not a basis for writing it off from accounting.

Accounting for write-offs of materials in a budgetary institution

In a budgetary institution, MH can be written off at the actual cost of one item (accounting unit) or at the average cost. Both methods are legal; the procedure for writing off inventories in budgetary institutions must be established in the Accounting Policy and followed consistently throughout the calendar year. Different write-off methods may be adopted for different groups of MH.

To determine the average price on the write-off date, you need to add up the amount of inventory of a certain type at the beginning of the month and their receipt in the current period. Similarly, the cost of balances at the beginning of the month is added up with the cost of received cash. The resulting amount is divided by the quantity and the average price per unit is obtained. Write-off at the actual cost of one item is possible if each delivery at a different price is reflected separately in accounting. For some groups of the Ministry of Health, such accounting and write-off are mandatory, for example, for potent medications.

Sometimes there are inventories on the balance sheet that are no longer valuable to the institution or cannot be used for their intended purpose. What to do with them: leave them on the balance sheet, transfer them to an off-balance sheet account, or write them off altogether? Detailed algorithm

The following documents, the unified forms of which are approved in Order 52n, may be the basis for recording the disposal of metallurgical equipment in the accounting records, download them:

- menu requirement for issuing food products – f.0504202;

- act on write-off of inventories - f.0504230;

- act on write-off of soft and household equipment - f.0504143;

- statement for the issuance of material assets for the needs of the institution - f.0504210;

- statement for the issuance of feed and fodder - f.0504203.

The write-off of fuel and lubricants in budgetary institutions can be carried out on the basis of waybills approved by Resolution of the State Statistics Committee of the Russian Federation No. 78 of November 28, 1997, or developed independently and recorded in the Accounting Policy.

The transactions that are used to reflect the write-off of inventory from account 105 in a budget institution are shown in the table.

Sep 10, 2019adminlawsexp

Contents of the order

As noted above, the commission for writing off inventory items is formed on the basis of an order, by which the manager gives instructions on:

- composition of the commission;

- conducting audits and technical expertise (if required);

- drawing up an act and reflecting the write-off of inventory items in accounting;

- the exact dates of the events, as well as the persons responsible for the events.

The order must contain both the director’s order and the organizational features of the process.