The act of recording material assets in form M-35 is used to document inventory and materials received during the demolition and dismantling of buildings and structures. Through it, they can be classified as the organization’s fixed assets and used in its economic activities.

FILES

The document must be drawn up by a specially created commission. Moreover, there must be at least three people in total. Naturally, it should include both representatives of the customer and representatives of the contractor. The presence of signatures of representatives is in the interests of each organization. Without them, the act will not have legal force.

Is this form required?

Since 2013, all unified forms have lost paramount importance. They remained mandatory for use only in exceptional cases provided for by law. But the M-35 form does not apply to these exceptions. An act on the recording of material assets after the demolition of a building can be drawn up in any form convenient for the organization.

The only fundamental point remains the nuance that any form created personally must be entered into the company’s accounting policy by a separate order from the manager. Therefore, if such a process occurs for the first time in a company, it is necessary to ensure that by the time of signing the act is already listed in the accounting policies as a developed document.

Moreover, you can use both a unified and your own form of the form. The slightest changes and additions to the unified form make it independently developed.

https://youtu.be/QdjTK5-_f4E

Commission for write-off of material assets

| when used in the company's activities |

| in case of damage and detection of defects in which the asset cannot be used |

| when selling goods |

| when a shortage is identified after an inventory |

Write-off can be initiated by a specialized commission or the direct MOL, which is responsible for the asset. A write-off act is used to confirm the procedure.

The material assets of the organization include:

- raw materials;

- stocks;

- unfinished production;

- finished products.

We invite you to familiarize yourself with a sample of a supply agreement

Write-off of material assets refers to the documented removal of material assets from the organization’s records.

The need to write off inventories most often arises due to the following circumstances:

- putting raw materials into production;

- end of service life;

- wear;

- breaking;

- loss of quality as a result, for example, of a flood or fire;

- incurring losses in connection with the maintenance of material assets.

These circumstances are usually identified by persons responsible for material assets in the organization. In all cases, accounting for such material assets is unprofitable for the organization and entails additional costs. In addition, failure to write off material assets may become the basis for abuse by persons directly working with material assets.

However, in order to directly carry out actions to write off material assets, it is necessary to issue a special act from the manager - an order to write off material assets.

Before the manager makes a decision on write-off, a special commission performs its work. Its composition is approved by order of management and includes, as a rule, the chief accountant, financially responsible persons and other specialists if the write-off requires special knowledge in a certain area.

The tasks of the commission include:

- inspection of materials;

- establishing the reasons for their unsuitability for use;

- identification of the perpetrators;

- determining the future fate of discarded materials;

- drawing up an act for writing off materials;

- submitting the act for approval to an authorized person;

- estimating the cost of materials;

- control over the disposal of materials.

Based on the decision of the commission, an act on the write-off of material assets is drawn up, which indicates all the assets subject to write-off and the reasons for the write-off. The act is signed by members of the write-off commission and the financially responsible person and must be approved by the order of the manager on the write-off of materiel.

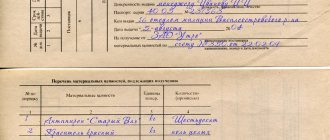

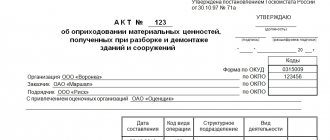

Sample of filling out form M-35

The document consists of several separate elements:

- Hats.

- Two tables in the main part.

- Conclusions in the form of a conclusion to the second table and signatures of the members of the convened commission.

At the top there is a little space left for the visa of the head of the organization, who certifies the paper. After filling out the document, his signature with a transcript and position should appear in the required columns. If the organization has a seal, then its imprint is placed here.

Sales of scrap ferrous metals

Is VAT subject?

Current tax legislation exempts

enterprises from paying value added tax when delivering scrap metal only if it was generated

in the course of

the company’s activities.

Decommissioned operating systems can be sold to specialized companies

without state VAT collection.

This type of transaction does not require the seller to have any other permits.

Below is a sample acceptance certificate,

which can be filled in when selling (purchasing) scrap ferrous metals:

All acts of scrap metal write-off are then entered into the Book of Acceptance and Delivery Acts.

Tenders

Auctions are an effective means of obtaining the maximum possible profit

from the sale of scrap ferrous metals obtained as a result of the liquidation of fixed assets.

A tender is justified if the object of sale is of significant material value

and arouses interest among a potential buyer. For the sake of two tons of scrap metal, this procedure is not worth undertaking.

The auction begins with the preparation of tender documentation

.

For this purpose, design organizations may be involved. The composition of the document package may vary, but usually it contains the following elements:

- invitation to bidders;

- information about the auction item: in the context of scrap - this is its weight, class, chemical composition, dimensions;

- application forms and instructions to offerors;

- rules and procedure for holding a tender;

- draft agreement with the winner.

Export of ferrous metal scrap

Selling scrap for export is quite difficult

procedure from the point of view of customs legislation.

implement

it you will need:

- Calculate customs duties.

- Obtain radiation control and explosion safety

. - Create conditions for inspection

in the form of a temporary customs control zone. - Provide the opportunity for inspectors to conduct customs inspections.

- Select samples for testing in the laboratory

for chemical composition. - Prepare an evidence base to confirm the declared value

of the goods.

In addition, the following documents will be needed to present to inspectors:

- contract

with the buyer; if the amount of the supply agreement is more than fifty thousand dollars, a transaction passport will also be needed; - constituent

documents; - invoice

or

invoice; - waybills

- you will need a TTN, CMR or bill of lading depending on the selected type of transportation; - confirmation of the classification code according to the Commodity Nomenclature of Foreign Economic Activity;

- packing

list; - payment

documents confirming payment for goods; - checks

confirming payment of customs duties; - If there are benefits

, their confirmation will also be required.

Contacting a specialized organization that provides customs brokerage services will significantly simplify

registration procedure, but will also require additional

costs.

Introductory part of the act

After the name of the document and its number in the middle of the sheet there are sequential columns in which, when filling out, indicate:

- Name of the compiler's organization.

- Name of the customer organization.

- Contractor company name.

- Name of the appraisal organization or several. Only those who were directly involved in the process of assessing material assets obtained during disassembly are indicated.

Separately on the right in the attached form of the act there is a small table. It already contains the OKUD form number. If at least one column in the act is changed, then this number will need to be removed. This requirement is related to the rules for the use of unified forms of documentation.

In addition to the OKUD code, the attached act has columns for indicating OKPO. In the smaller of the three tables, it is also necessary to fill in the columns: “Date of compilation”, “Operation type code”, “Name of the structural unit” and “Type of activity”. Not all of them are required to be filled out. For example, if there are no structural divisions in the organization, then the entire corresponding column can be left blank. This is not forbidden.

Receipt of materials from supplier

This operation is located in the “Purchases” section and is almost no different from the operation of purchasing goods.

Let's look at the receipt of materials in 1C 8.3 using a real example. We go to the “Purchases” section, then follow the link “Receipts (acts, invoices)” to the list of receipt documents. In the list window, click the “Receipt” button. A drop-down list will appear, in it select “Products (invoice)”:

A window for creating a new document will open. Fill in the details of the document header and tabular section. Of course, we add the materials we need to the tabular part. Here is an example of a document taken from the 1C demo database that comes with the program:

Let's look at the postings that the document generates:

The main and, perhaps, the only difference between the receipt of materials and the receipt of goods is the accounting account. Materials are accounted for on account 10.01. Otherwise everything is the same. A debt to the supplier also arises (loan account 60.01), and an entry is created in the VAT register for entries in the purchase book.

In order for an accounting account for materials to be set automatically, it must be configured for the item group in which the materials are located. This is done in the “ ” register from the “Nomenclature” directory.

Get 267 video lessons on 1C for free:

If the same item can be both a product and a material, you must set the accounting account in the document manually.

Main part

For convenience, the description of material assets obtained during the dismantling of buildings and structures is presented in the form of a lengthy table with separately labeled columns. They should include information regarding:

- Corresponding account. This column is divided into two: the first part indicates the subaccount, and the second - the analytical accounting code. This data is filled in by the accountant.

- The nature of the remaining material assets. Their name, variety or brand are indicated, as well as, if the organization has adopted such a system, the nomenclature number.

- Units of measurement of goods and materials, its code.

- The quantities of the specified material resource.

- The suitability coefficient of the material obtained during disassembly.

- How much of the material received was transferred to another company for reuse.

- Prices and total amount of materials that are transferred to the organization.

The table is placed on two sheets. In the vast majority of cases, this space is sufficient for a detailed description of the categories of material assets obtained during analysis. And also their quantities and prices.

At the end of the table, the results are summed up, and it is also indicated that the inventory items have been accepted, are subject to capitalization, and that some of them (or all) are transferred to the contractor for reuse.

As a sign that the data indicated in the table is correct, all members of the commission put their signatures at the end of the act. If necessary, the participants in the process leave notes and draw up applications.

Moreover, the contractor’s representatives sign on the right side, and the customer’s representatives sign on the left. Both sides of the conclusion of the act on the posting of material assets in form M-35 must be completed. Without this, the document will not have legal force.

The act of recording material assets is

The act of recording material assets in form M-35 is used to document inventory and materials received during the demolition and dismantling of buildings and structures. Through it, they can be classified as the organization’s fixed assets and used in its economic activities.

The document must be drawn up by a specially created commission. Moreover, there must be at least three people in total. Naturally, it should include both representatives of the customer and representatives of the contractor. The presence of signatures of representatives is in the interests of each organization. Without them, the act will not have legal force.

M-35. Act on the recording of material assets received during the dismantling and dismantling of buildings and structures

Fill out the form without errors in 1 minute!

Free program for automatically filling out all documents for trade and warehouse. Find out more >>

- invoices for payment

- invoices

- invoices

- waybills

- powers of attorney

- acceptance certificates

- certificates of completed work

- inventory acts

- commercial offers

- cash orders

Class365 – fast and convenient filling out all primary documents

Source: https://mpo-kamena.ru/akt-ob-oprihodovanii-materialnyh-ce-/2104/

Answers to frequently asked questions

Question N1: Good afternoon! Our organization needed to dismantle the television mast. As a result of disassembly, scrap ferrous metal was left behind. Can form M-35 be the basis for recording such material? Or do we need to register the posting in some other way?

Answer: Hello! Materials obtained as a result of dismantling fixed assets that are not real estate should be formalized with a demand invoice in form M-11. Form M-35 is used when capitalizing inventory items remaining after the dismantling of buildings and structures. In your case, it is advisable to convert the document into a demand invoice in form M-11 or use your own form developed at the enterprise.

Question N2: Good afternoon! The contractor and I had a dispute about who was required to fill out the M-35 form, due to which the materials obtained as a result of dismantling the building were not properly processed. Please allow it.

Answer: Hello! It was already said earlier that filling out the posting act is the work of a specially assembled commission, which includes both the customer’s employees and the contractor’s employees. To prepare the document, assemble a commission that will consist of at least three people and let it evaluate the received material, on the basis of which it will fill out Act M-35.

The act of recording material assets in form M-35 is used to document inventory and materials received during the demolition and dismantling of buildings and structures. Through it, they can be classified as the organization’s fixed assets and used in its economic activities.

FILES

The document must be drawn up by a specially created commission. Moreover, there must be at least three people in total. Naturally, it should include both representatives of the customer and representatives of the contractor. The presence of signatures of representatives is in the interests of each organization. Without them, the act will not have legal force.