Primary documents: correction

Where you can and cannot make corrections

Corrections can be made to primary documents if this is not prohibited by laws or regulations in the field of accounting. For now, it is not possible to make corrections only to cash documents (PKO, RKO) and bank payment documents.

Corrections can and should be made to the remaining primary documents.

The rules for correcting the primary are quite simple, but their application in practice still raises questions.

For example, when making corrections to primary documents, we must indicate in the document itself the date of correction, and the correction must be certified by the signatures of the same persons who compiled this document. Naturally, with an indication of their surnames and initialsLaw “On Accounting” Article 9 7. Corrections are allowed in the primary accounting document, unless otherwise established by federal laws or regulatory legal acts of state accounting regulatory bodies. The correction in the primary accounting document must contain the date of the correction, as well as the signatures of the persons who compiled the document in which the correction was made, indicating their surnames and initials or other details necessary to identify these persons. Regulations, approved Ministry of Finance of the USSR 07/29/83 No. 105 4.2. Errors in primary documents created manually... are corrected as follows: the incorrect text or amounts are crossed out and the corrected text or amounts are written above the crossed out. Crossing out is done with one line so that the correction can be read. 4.3. Correction of an error in the primary document must be indicated by the inscription “corrected”, confirmed by the signature of the persons who signed the document, and the date of correction must be indicated. Directive of the Central Bank dated March 11, 2014 No. 3210-U 4.7. In documents drawn up on paper, with the exception of cash documents, corrections may be made containing the date of correction, surnames and initials, as well as the signatures of the persons who prepared the documents to which corrections were made. Regulations, approved Central Bank 06/19/2012 No. 383-P 2.4. Control of the integrity of the order on paper is carried out by the bank by checking the absence of changes (corrections) made in the order.

Accordingly, if representatives of several organizations participated in the preparation of the document, then all of them must certify the corrections with their signatures.

It is at this stage that difficulties usually arise, since it may happen that from the moment the document was drawn up until corrections were made to it, a lot of water has passed under the bridge and some of the people who compiled the document already occupy other positions or simply left the organization. And many accountants ask the question: is it possible to correct the document in this case? After all, when reading paragraph 7 of Article 9 of Law No. 402-FZ literally, it turns out that both positions and personal names must match. And. O. persons who initially signed the document and then certified the corrections with their signatures. But, you see, it would be strange if the dismissal of specific individuals who participated in the preparation of the primary document and made an error in it would become an obstacle to its correction.

However, how to do this? To answer this question, you need to consider ways to make corrections to the primary, of which there are only three.

How to correct by crossing out what is wrong

The first method of correction is traditional - when the incorrect text is crossed out, and the correct text is indicated above (below) it (or if there is not enough space, then in the free field of the document), after which a corrective inscription is made.

Example. Making corrections by crossing out incorrect amounts on a document

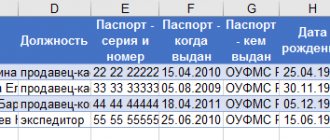

Invoice No. 48 dated 04/30/2015 FOR MATERIALS SUPPLY

Corrected on 05/15/2015 in line 1 of column 4 “6140.00” to “7140.00” believe.

| Head of warehouse | S.A. Ivanov |

| Storekeeper | V.Ya. Sokolov |

| Chief Accountant | L.Yu. Smirnova |

| Workshop master No. 2 | K.M. Pozdnyakov |

| Vacation allowed | warehouse manager position | signature | S.A. Ivanov decryption of signature | |

| Let go | storekeeper position | signature | V.Ya. Sokolov signature decoding | |

| Chief Accountant | signature | L.Yu. Smirnova decryption of signature | ||

| Received | workshop foreman no. 2 position | signature | K.M. Pozdnyakov decryption of signature | |

Can such a correction be signed by the person who took the position of the resigned employee who took part in the preparation of the document? Maybe, although it will look strange. After all, it turns out that a person who did not take part in the operation testifies that it was incorrectly reflected in the document drawn up at that time. In addition, the new employee can simply refuse to sign such corrections and will be within his rights.

How to fix it when creating a new document

The second way to correct a document is to draw up a new, correct document with the same details. In this case, we pretend that there was no document with errors at all. To apply this correction method, two conditions must be met:

1) all copies of the original document must be destroyed. Otherwise, one and the same fact of the organization’s economic life will be recorded in two papers with different content, and this can lead to confusion and disputes;

2) the new document must be signed by the same persons who drew up the original document.

How to correct by drawing up an adjustment document

Therefore, if a document is signed by persons who cannot take part in its correction, we will have to use the third method.

It consists of drawing up a corrective document, that is, a document in which we record that an error was made in the original document and indicate which information is correct. The closest analogy is making corrections or adjustments to invoices.

And since the corrective primary document is essentially a new document, it can be drawn up not by the people who compiled the original document, but by those who discovered an error in it.

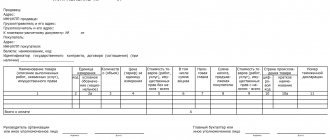

Example. Making corrections by creating an adjustment document

/ condition / In the originally issued invoice for materials release No. 35 dated March 10, 2015, the total amount including VAT was entered incorrectly: RUB 6,808.00 was indicated. instead of 6,608.00 rub.

By the date the error was identified and corrections made, June 23, 2015, chief accountant L.Yu. Smirnova resigned and a new employee, I.V., was hired for this position. Sergeev.

/ solution / An adjustment invoice for the issue of materials with the correct total amount included in it, including VAT, will look like this.

Invoice No. 35 dated March 10, 2015 FOR SUPPLY OF MATERIALS

Correction No. 1 dated 06/23/2015

| Vacation allowed | warehouse manager position | signature | S.A. Ivanov decryption of signature | |

| Let go | storekeeper position | signature | V.Ya. Sokolov signature decoding | |

| Chief Accountant | signature | L.Yu. Smirnova decryption of signature | ||

| Received | workshop foreman no. 2 position | signature | K.M. Pozdnyakov decryption of signature | |

By the way, a similar method was proposed by the Federal Tax Service, agreed with the Ministry of Finance and described in the Letter about the procedure for correcting the universal transfer document. It can be used regardless of how the document is compiled - paper or electronic. So, if errors are subsequently discovered in it for the originally drawn up primary document, you can issue an adjustment document. Or even several such documents, if there were several edits. Such adjustment documents must be sequentially numbered in strictly chronological order.

When we talk about making corrections to the primary document, we usually mean documents drawn up on paper. But Law No. 402-FZ equalized primary accounting documents on paper and documents compiled in electronic form, certified with an electronic signature.

How to correct an electronic document

At the same time, the Accounting Law does not differentiate the procedure for making corrections depending on what primary document we are dealing with: paper or electronic. It turns out that electronic documents can also be corrected. But it is impossible to correct such documents in the traditional way. Firstly, electronic document formats usually simply do not allow for corrections to be made to generated and signed documents. Secondly, in some cases, regulations directly prohibit making corrections to electronic documents. Thirdly, even if correction is possible, it actually leads to the destruction of the original document. Therefore, an electronic document can only be corrected by drawing up a new document. And only those people who work in the organization at the time the error is discovered and corrected will be able to sign it. Letter from the Federal Tax Service dated October 17, 2014 No. ММВ-20-15/ [email protected] 1.2. ...correction of UPD indicators filled in with errors is recommended to be done by compiling a new corrected copy of the UPD. The new copy of the UPD... indicates the serial number of the UPD correction and the date of correction. In this case, it is recommended to transfer all indicators from the copy compiled before the corrections to the new copy of the UPD, indicating new information (initially not filled out) or clarified (changed) for the corresponding positions of the primary accounting document that need correction. The specified method of making corrections complies with the legislation ... on accounting and the Tax Code of the Russian Federation and can be used to correct the indicators of the UPD as a primary accounting document in any part of it and regardless of whether the document is drawn up on paper or in electronic form. Directive of the Central Bank dated March 11, 2014 No. 3210-U 4.7. It is not allowed to make corrections to documents executed electronically after signing these documents.

To conclude the topic of making corrections to primary documents, I will note that, in the opinion of the Ministry of Finance, if errors are insignificant, then they do not need to be corrected, since this does not make the document defective for tax purposes. The Ministry of Finance classifies as non-essential errors those that do not interfere with the identification of the seller, the buyer, the name of goods (work, services), their cost and other circumstances of the documented fact of economic life, which are associated with the application of a certain taxation procedure. As you can see, the approach to minor errors in documents confirming expenses is similar to the approach to errors in invoices. Moreover, the Letter of the Ministry of Finance, which expressed this position, is posted on the official website of the Federal Tax Service as an explanation, mandatory for use by tax authorities. Letter of the Ministry of Finance dated 02/04/2015 No. 03-03-10/4547 (sent by the Letter of the Federal Tax Service dated 02/12/2015 No. GD-4- 3/ [email protected] ) Errors in primary accounting documents that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their cost and others during a tax audit. circumstances of a documented fact of economic life that determine the application of the appropriate taxation procedure are not grounds for refusing to accept the corresponding expenses to reduce the tax base for income tax..

We have more or less figured out the rules for preparing and correcting the primary document; it’s time to talk about the actual document flow.

How to correct an electronic document?

If the primary document, compiled in the form of an electronic document signed with an electronic signature, contains errors, then a new electronic document is created. An erroneous electronic primary may be recalled. The specific procedure for making corrections to an electronic source document will depend on the operator through which the electronic documents are exchanged.

Quite often questions arise about how to correctly make corrections to primary documents, and how such corrections are reflected in accounting and reporting. We will talk about this in this article.

In accordance with clause 7 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ), corrections are allowed in the primary accounting document, unless otherwise established by federal laws or regulations acts of state accounting regulatory bodies. The correction in the primary accounting document must contain the date of the correction, as well as the signatures of the persons who compiled the document in which the correction was made, indicating their surnames and initials or other details necessary to identify these persons.

Errors in primary accounting documents are corrected as follows: the incorrect text or amounts are crossed out and the corrected text or amounts are written above the crossed out. Crossing out is done with one line so that the correction can be read. In this case, the correction of an error in the primary document must be indicated by the inscription “corrected” (clause 4 of the Regulations on Documents and Document Flow in Accounting, approved by the Ministry of Finance of the USSR on July 29, 1983 No. 105).

Thus, the mechanism for making corrections to primary accounting documents, set out in paragraph 7 of Art. 9 of Law No. 402-FZ is not strictly regulated. These provisions of Law No. 402-FZ establish only the minimum requirements for the content of the corrected primary accounting document: mandatory indication of the date the corrections were made, as well as identifying information about the persons who made the correction.

However, in practice, correction of incorrectly completed primary documents is also used by completely replacing them with new documents with the same details, indicating the date of the corrections.

It should be noted that current legislation and regulations do not prohibit the use of such a correction procedure. At the same time, the legality of such a procedure for correcting primary accounting documents, including for tax purposes, is also confirmed in private clarifications of the Ministry of Finance of the Russian Federation, for example, based on Letter No. 07-01-09/2235 dated January 22, 2016, it follows that, on the one hand On the other hand, Law No. 402-FZ does not provide for the replacement of a primary accounting document previously accepted for accounting with a new document if errors are detected in it. On the other hand, taking into account parts 2 - 4 art. 8 of Law No. 402-FZ, as well as the Accounting Regulations PBU 1/2008 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n, the organization has the right to independently develop ways of making corrections to the primary accounting documents compiled on on paper and in the form of an electronic document, based on the requirements established by Law No. 402-FZ, regulatory legal acts on accounting, and taking into account the peculiarities of document flow.

Currently, arbitration practice has developed in similar situations, according to which the legislation of the Russian Federation does not prohibit making changes to primary accounting documents, including by replacing them with properly executed ones, without changing indicators affecting the volume and content of business transactions (for example, Resolution FAS Moscow District dated May 21, 2008 N KA-A41/4238-08 in case No. A41-K2-14877/07, Resolution of the Ninth Arbitration Court of Appeal dated October 7, 2009 in case No. A40-51820/08-14-203 (FAS Resolution Moscow District dated January 15, 2010, this Resolution was left unchanged), the Resolution of the Fourteenth Arbitration Court of Appeal dated March 28, 2013 in case No. A13-9242/2012, which stated that, as well as the Resolution of the Nineteenth Arbitration Court of Appeal dated February 21, 2013 in case No. A64-3569/2012).

Taking into account the above, as well as the established arbitration practice, it seems possible to draw the following conclusion.

Correction of primary accounting documents is allowed both by making changes to existing documents and by issuing new ones in the above order - i.e. with the same date under the same number, indicating in the source document (or in the accompanying letter) the date of the correction. At the same time, the implementation of the first of these correction methods is associated with lower tax risks.

It is not allowed to make unilateral changes to primary accounting documents. In this case, one should take into account the established arbitration practice, for example, Resolution of the Tenth Arbitration Court of Appeal dated January 16, 2015 No. 10AP-14763/2014 in case No. A41-53651/14, according to which unilateral change of information in primary documents without the mutual will of the parties is contrary to the law and does not entail legal consequences, as well as the Resolution of the First Arbitration Court of Appeal dated June 30, 2015 in case No. A43-27322/2014.

The procedure for correcting errors in accounting and reporting is regulated by Order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n “On approval of the Accounting Regulations “Correcting Errors in Accounting and Reporting” (PBU 22/2010)” (hereinafter referred to as PBU 22/2010) and depends on the significance of the error and the moment it was discovered.

The organization determines the criteria for the materiality of an error independently, taking into account clause 3 of PBU 22/2010.

We will consider the most difficult case from the point of view of making corrections - the discovery of an error after the presentation of financial statements and after their approval.

In accordance with paragraphs. 1 clause 9 PBU 22/2010 a significant error of the previous reporting year, identified after the approval of the financial statements for this year, is corrected by entries in the corresponding accounting accounts in the current reporting period. In this case, the corresponding account in the records is the account for retained earnings (uncovered loss).

According to paragraphs. 2 clause 9 PBU 22/2010, when correcting a significant error of the previous reporting year, identified after the approval of the financial statements for this year, in addition to making corrections to the accounting, the comparative indicators of the financial statements for the reporting periods reflected in the financial statements of the organization for the current reporting year are adjusted. Restatement of comparative financial statements is carried out by correcting the financial statements as if the error of the previous reporting period had never been made (retrospective restatement). Retrospective restatement is carried out in relation to comparative indicators starting from the previous reporting period presented in the financial statements for the current reporting year in which the corresponding error was made.

At the same time, clause 10 of PBU 22/2010 provides that in the event of correction of a significant error of the previous reporting year, identified after the approval of the financial statements, the approved financial statements for the previous reporting periods are not subject to revision, replacement and re-presentation to users of the financial statements.

In accordance with paragraph 14 of PBU 22/2010, an error of the previous reporting year that is not significant, discovered after the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts in the month of the reporting year in which the error was identified. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Is it possible by law to make corrections to cash documents - rules and cases of making changes

Cash transaction accountants sometimes wonder whether errors, inaccuracies and corresponding adjustments are allowed in cash transactions.

The exact answer is determined by the type of document being corrected and the significance of the detected defect.

Some clerical errors or misprints lead to obvious distortions in financial and tax reporting, others can have the most unfavorable impact on the tax obligations of a business entity, and some simply are not detected during an audit and subsequently go unnoticed.

Is it even possible to correct any cash register papers?

How can changes be made to such documentation correctly if this is not prohibited by current legislation?

Ways to fix account errors

In general, in accounting there are the following methods for correcting errors:

- proofreading method;

- additional wiring;

- “Red reversal” (method of negative numbers).

The method chosen in a given situation is determined by the nature of the mistake made.

The correct way to fix errors

It is used in cases where no errors were made in the correspondence of accounts, or the error was discovered in a timely manner, errors of a given reporting period. The corrective method is used in the following cases:

- making mistakes;

- errors when calculating results;

- entering data into the wrong accounting register.

Corrections are made as follows: erroneous data is crossed out so that it is visible (with one line), a correct entry is made next to it with a reflection of the date, confirmation with the phrase “Believe the corrected” and a signature.

Example:

D 20 K 10/1 -– 5,000 rub.

D 20 K 10/1 – 5,100 rub. “Believe the Corrected” 01/18/18 Vlasova A.N.

Correcting errors using additional wiring

The additional posting (recording) method is used in the case when the correspondence of accounts reflected in the accounting record is correct, but the amount is indicated below the actual one. In order for the record to be correct, an additional posting with the same account correspondence, and the amount is determined as the difference between the actual amount and the amount entered in the previous posting. This method is used in organizations, also when making adjustment entries at the end of the reporting year, if the planned cost of production received during the year of production turned out to be lower than the actual amount of costs (i.e., in case of overruns).

Example:

An error was made in recording the amount; the correct amount is 6,500 rubles.

D 10/10 K 60 – 5,850 rub.

Additional entry.

D 10/10 K 60 – 650 rub.

“Red reversal” as one of the ways to correct it

The use of the “red reversal” method is most often relevant when correcting errors related to the correspondence of accounts or when the error relates to the reporting period for which the balance has already been drawn up. This method is also used if the accounting entry reflects an amount greater than it should actually be.

An erroneous entry is canceled by reversing the entry. A reversal entry is an entry with a negative number, and it is written in red ink (paste) or highlighted in red in accounting applications.

Example:

Construction materials were received from suppliers in the amount of 6,100 rubles.

D 10/4 K 60 – 6,100 rub.

D 10/4 K 60 – 6,100 rub.

Now it is spelled correctly.

D 10/8 K 60 – 6,100 rub.

Is it possible to deposit?

The absence of any adjustments in the cash transaction registers is the main requirement when a business entity prepares cash documentation.

In other words, there should be no errors, blots or corrections in the cash register papers. However, in practice, various types of amendments are still made to documents certifying the execution of cash transactions.

Sometimes for these purposes, employees of the organization use correction fluids, which is generally not acceptable.

Adjustments to PKO and RKO

If the contractor made a mistake or made a blot when filling out a cash receipt/expense order, it is strictly prohibited to make any corrections to such papers.

In RKO/PKO, the presence of any painting, crossing out or other adjustments is not allowed.

The only solution to this problem is to cross out the damaged order and issue a new document.

The crossed out (rejected) cash order should, however, be attached to the cash report generated at the end of the corresponding day.

A rejected or damaged document cannot be used to perform an outgoing/receiving transaction with cash.

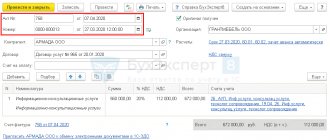

Can consolidated accounting registers be changed?

By the instruction of the Central Bank of the Russian Federation, registered on March 11, 2014 under number 3210-U, it is strictly prohibited to correct information already entered in cash papers - completed RKO/PKO forms.

However, the same regulatory act allows for proper changes to be made to the payroll, cash register/pko register journal and, of course, the cash book.

What amendments are allowed?

Adjustment of primary accounting papers is regulated by the Law of the Russian Federation “On Accounting”, registered under number 402-FZ. Specific requirements are prescribed by Article 9 (clause 7) of this regulatory act.

Thus, it is allowed to use the following methods for correcting accounting documents:

- The first method is that the correct information is entered directly into the original (original) version of the erroneous document. Incorrect values are crossed out with a single line (the corrected value must then be read). The correct number or correct text is indicated above the crossed out value. Next to the change made, the wording “Corrected” is written, which is signed (certified) by authorized entities. Signatures are decrypted. The date of the completed adjustment is indicated.

- The second method is to draw up a corrective (corrective) document on a principle similar to the formation of an invoice for adjustment purposes.

- The third method is to cancel documents posted earlier, you should use the red reversal method.

Application procedure

Correction fluid is definitely not allowed to be used to make any changes to already compiled cash register papers.

Only corrections that are performed as follows are allowed:

- The inscription that was entered incorrectly is crossed out. However, it should be crossed out so that it is clearly legible later.

- The necessary correction is made directly above the crossed out (erroneous) inscription. Such an adjustment involves writing the correct text or the correct amount.

- On the unoccupied fields of the document being corrected or directly next to the corrected inscription, the text designation “Corrected” should be written. Responsible entities authorized to draw up cash documentation must sign this designation.

- A mandatory decoding of all affixed signatures is made, indicating the actual date of making the corresponding adjustment.

- All copies of the corrected paper are subject to similar adjustments.

Basic design requirements

Due to the fact that the approved and mentioned above design documentation differ from each other, let us consider the rules for drawing up each.

Design features of the PKO:

- the essence of the operation is entered in the line “Base”;

- the total amount of VAT is entered in the line “Incl.” in digital terms. This line cannot be empty. If tax is not applied, enter the phrase “without (VAT)”;

- data on additional supporting documents (if any) are entered into the PQR in the “Appendix” line.

When filling out the cash register, you must take into account the following nuances::

- the presence of additional documents (for example, a power of attorney) is entered in the “Appendix” line with the obligatory indication of the date and number;

- the line “Base” suggests reflecting the content of the expense transaction;

- the signature of the manager is not necessary if it is present on the attached document. For example, if the signature of the director of the enterprise is present on the order along with the resolution “I authorize” or “Agreed,” then the RKO can be accepted for work without his signature.

We will separately consider the issue of requirements for affixing stamps to RKO and PKO. According to the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 on the conduct of cash transactions, there are no mandatory requirements for stamp imprinting, as was the case before 2014. Previously, the stamps “Paid” were used on the incoming order and “Repaid” on the outgoing order. The current rules only imply the mandatory affixing of a stamp on the tear-off receipt for the PKO. Thus, the “Paid” stamp can be affixed to the receipt for the PKO. The presence of the “Paid” stamp is confirmation of the actual deposit of money and its posting.

As for the “Redeemed” stamp:

- it is placed on statements, for example, when issuing salaries to employees;

- can be used instead of “Paid”, for example, if the stamp is lost or missing for another reason.

There are 3 basic rules for registering a CC:

- Sew.

- Number. The bottom line: each sheet is numbered (consecutive number).

- Seal. The bottom line: you need to indicate how many sheets are contained in the CC according to the numbering and certify this inscription. This inscription is placed at the end of the book and is considered certified if there are signatures of the director and chief accountant.

The QC form assumes the presence of 2 parts. Moreover, the second part is detachable. It serves as the cashier's report at the end of the day and can only be torn off after all transactions have been completed.

Journal of registration of incoming and outgoing cash documents

The name itself answers the question of what this form is intended for, namely the assignment of serial registration numbers to cash documents.

Involves filling out such information:

- No. PKO/RKO, date and amount in Russian rubles in digital terms;

- The “Note” columns are filled in if necessary.

Filling out the KVD is justified if the organization has several cashier positions on its staff, including a senior one.

Features of the design of the KVD:

- the amount transferred by the senior cashier to the subordinate employee is reflected in the line “Issued” or “Transferred”;

- It is mandatory to put the signatures of both persons in the lines “Money received”.

https://youtu.be/szMChAkrf4s

What mandatory rules and requirements must be followed when drawing up primary CDs:

- Signatures of the chief accountant and cashier are mandatory.

- The mandatory stamp on the tear-off receipt is “Paid.”

- A seal (stamp) is not affixed to the cash register, but the recipient’s signature is required.

- The design documentation can be completed on paper or electronically.

- The electronic version of the document is prepared using special equipment (computer, printer).

- The paper version is filled out manually with a ballpoint pen, ink or using a typewriter.

- Blank lines that do not contain information are marked with a dash.

The chief accountant is the responsible person in the matter of drawing up the design documentation. In his absence, the manager becomes the person responsible for the preparation of cash documents, which is carried out under his control.